Europe Surface Disinfectants Market, By Composition (Alcohols, Chlorine, Quaternary Ammonium, Aldehydes, Peroxides, Biodisinfectants), Type (Liquid, Sprays, Wipes), Application (Surface Disinfection, Instrument Disinfection, And Other Applications), End User (Hospitals, Diagnostic and Research Laboratories, Pharmaceutical and Biotechnology Companies, Food & Beverage and Residential), Industry Trends and Forecast to 2029

Market Analysis and Insights

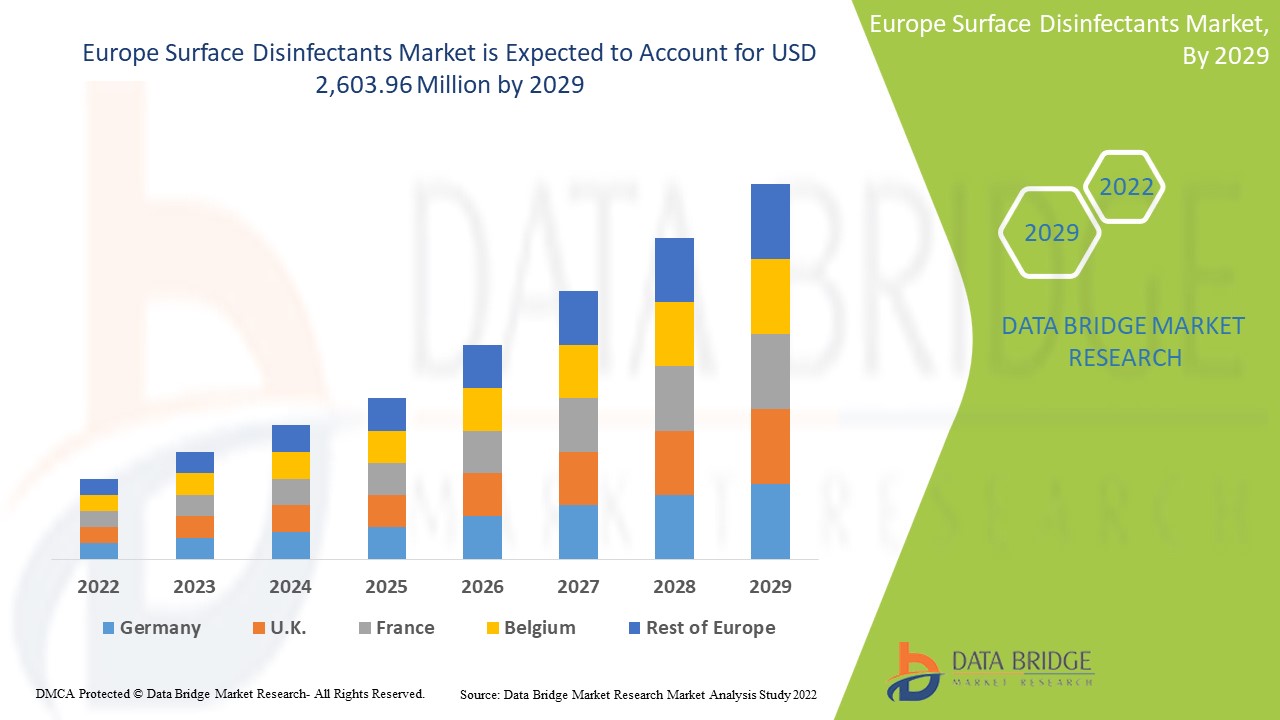

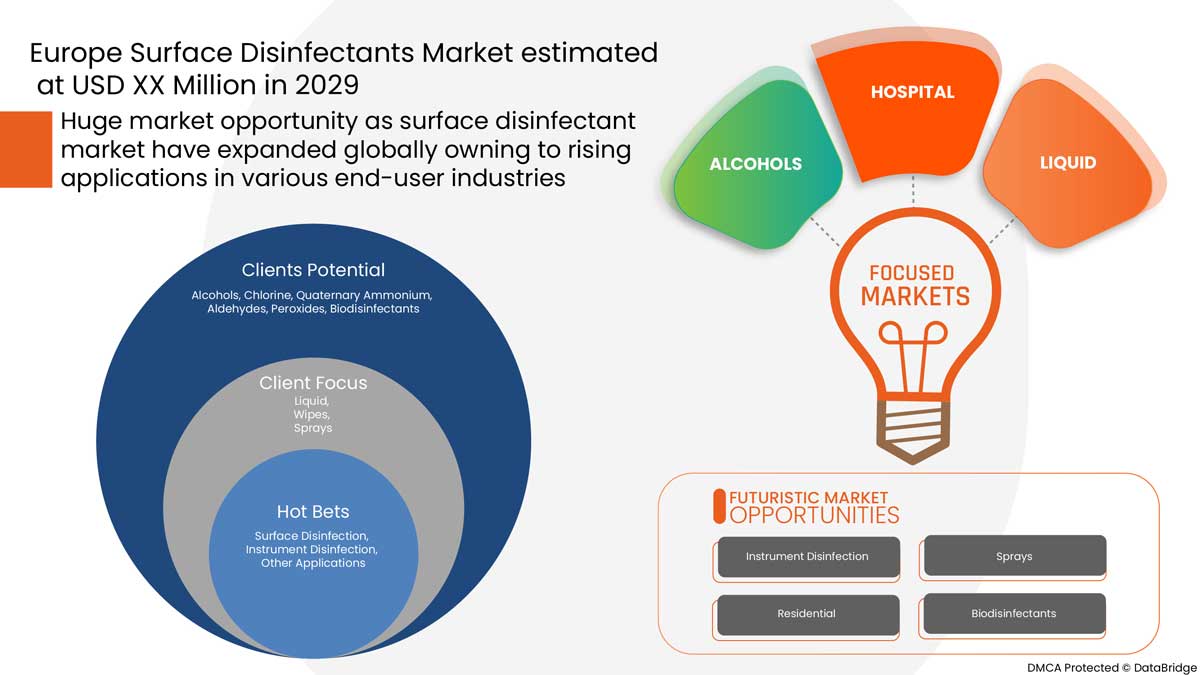

The Europe surface disinfectants market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 6.4% in the forecast period of 2022 to 2029 and is expected to reach USD 2,603.96 million by 2029. The primary factor driving the growth of the surface disinfectants market is the increasing demand from healthcare facilities, rise in occurrences of chronic disorders, rising product demand after Covid-19, and shifting consumers' preference toward the use of bio-based and nature-friendly disinfectants.

Disinfectants are the antimicrobials used to kill harmful bacteria, germs, and other microorganisms present on various surfaces and therefore are most usually used to disinfect floors, washrooms, tiles, furniture, and instruments.

A surface disinfectant is a chemical compound used to kill or inactivate microorganisms, usually on a solid surface. These disinfectants can be found in various chemical compounds and work in various pathways to destroy microorganisms. They can be incorporated in different forms, such as liquids, wipes, and sprays. The outbreak of COVID-19 increased the need for surface disinfection and cleaning practices significantly. All the known measures are being taken to curb the spread of the deadly virus, including disinfection and cleaning of surfaces. This increased the demand for the surface disinfectant to multiple folds.

The Europe surface disinfectants market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volume in Kilograms, Pricing in USD |

|

Segments Covered |

구성(알코올, 염소, 4차 암모늄, 알데히드, 과산화물, 생물 살균제), 유형(액체, 스프레이, 물티슈), 응용 분야(표면 살균, 기구 살균 및 기타 응용 분야), 최종 사용자(병원, 진단 및 연구 실험실, 제약 및 생명 공학 회사, 식품 및 음료, 주거) |

|

적용 국가 |

영국, 러시아, 프랑스, 스페인, 이탈리아, 독일, 터키, 네덜란드, 스위스, 벨기에, 기타 유럽 |

|

시장 참여자 포함 |

3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc., GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG, Diversey Holdings LTD. |

시장 정의

의료 시설의 수요 증가, 만성 질환 증가, 소비자의 바이오 기반 및 자연 친화적 살균제 선호도 변화로 인해 유럽 표면 살균제 시장이 성장할 것으로 예상됩니다. 대중의 인식 증가와 연구 개발(R&D) 이니셔티브에 대한 집중 증가로 인해 유럽 표면 살균제 시장에서 기회가 제공될 것입니다. 그러나 살균제와 관련된 환경 및 건강 위험은 표면 살균제 시장 성장에 도전할 것으로 예상됩니다.

유럽 표면 살균제 시장 동향

운전자

- 의료 시설의 수요 증가

병원에서 시행하는 수술이 증가함에 따라 감염을 피하고 양질의 환자 관리와 위생 유지를 제공하기 위해 수술 과정에서 점점 더 많은 소독제가 사용되고 있습니다. 내시경과 같은 재사용 가능한 의료 기구, 의료 장비의 부적절한 살균, 불충분한 고수준 소독과 같은 다양한 표면을 소독하기 위해 소독제를 사용하는 것이 증가하면 환자에게 심각하고 부정적인 영향을 미칠 수 있습니다.

- 만성 질환 발생 증가

노령 환자 인구가 증가함에 따라 의료 서비스 제공 및 작업 시스템이 바뀌고 표면 소독제 시장이 커질 것으로 예상되는데, 노령 인구는 병원 감염(HAI)에 걸리기 쉽기 때문입니다. 또한 심혈관 질환과 같은 만성 질환이 증가함에 따라 병원에 오래 머물러야 합니다. 따라서 이러한 입원 기간 동안 병원 감염 사례가 증가합니다.

- 코로나19 발병 이후 제품 수요 증가

팬데믹은 병원에 환자가 급증하면서 전 세계적으로 모든 의료 시스템을 혼란에 빠뜨렸습니다. 또한 질병 발생률이 증가함에 따라 이를 통제하기 위해 여러 임시 병원도 설립되었습니다. 따라서 COVID-19의 확산으로 안전, 위생 및 건강에 대한 인식이 높아짐에 따라 세척 및 소독 제품에 대한 수요가 급증했습니다. 따라서 의료비 지출이 증가하고 임시 병원이 늘어나면서 표면 소독제 수요도 증가하고 있습니다. 또한 병상과 ICU에 대한 수요 증가, 격리 시설 수 증가와 같은 요인으로 인해 표면 소독제 수요가 크게 증가했습니다.

- 소비자들의 선호도를 생물기반, 자연친화적 소독제 사용으로 전환

생물 기반 표면 소독제는 환경 친화적인 제품과 건강과 주변 환경에 독성 효과가 없는 제품을 사용하려는 경향이 증가함에 따라 소비자들에게 널리 선호되고 있습니다. 게다가 화학 물질의 과도한 사용에 대한 엄격한 규제로 인해 수년에 걸쳐 생물 기반 소독제의 성장이 촉진되었습니다. 생물 기반 표면 소독제는 또한 매우 효과적입니다. 독성 화학 잔여물을 남기지 않고 세균을 죽이고 피부, 눈, 호흡기에 유해한 영향을 제거합니다. 이러한 이점은 생물 기반 표면 소독제 제품에 대한 소비자의 관심을 끌었습니다. 또한 표면 소독제 제조업체가 새로운 생물 기반 제형을 개발하기 위한 연구 개발에 투자하고 화학 기반 제품의 대안으로 생물 기반 표면 소독제 사용을 늘리는 데 중점을 두는 것도 시장 성장을 촉진하고 있습니다.

기회

- 인구의 상당수에서 인식이 높아지고 있습니다.

세계보건기구와 같은 정부 및 비정부 기구도 소비자들에게 건강과 위생에 대한 인식을 확산하고 각자의 장소에서 소독제를 적절히 사용하는 것과 관련된 인식 프로그램과 지침을 시작했습니다. 이 모든 것이 유럽 표면 소독제 시장의 성장과 발전을 위한 많은 기회를 제공할 것으로 기대됩니다.

- 연구 개발(R&D) 이니셔티브에 대한 집중도 증가

표면 소독제 시장의 제조업체들은 또한 새로운 코로나바이러스 발병으로 인한 소독제 수요 증가에 대응하기 위해 생산 시설을 업그레이드하고 있으며, 다양한 표면의 세균과 박테리아를 효과적으로 죽이는 새로운 제형의 제품을 출시하고 있습니다. 따라서 연구 개발 이니셔티브에 대한 집중과 개발이 증가함에 따라 유럽 표면 소독제 시장의 성장을 활용할 수 있는 기회가 생길 것입니다.

제약/도전

- 최종 사용자의 표준 소독 관행 사용에 대한 이해 부족

환경 및 의료 시설에서 청소는 다차원적 접근 방식을 필요로 하는 복잡한 감염 예방 및 통제 개입입니다. 여기에는 교육, 적절한 모니터링, 정기적인 감사 및 피드백, 알림 및 주요 영역에 SOP 표시가 포함됩니다. 청소 직원 교육은 의료 시설의 정책 및 SOP와 해당 지역의 국가 지침에 따라야 합니다.

- 시장에서 대체 제품 및 기술의 가용성

소독 기술에는 자외선과 증기가 포함됩니다. 고온, 저습 또는 건조 증기의 증기는 잔류물이나 화학 필름을 남기지 않습니다. 이것은 매우 효과적이며 많은 표면에 적합합니다. UV-C 조명은 특정 소독 응용 분야에 적합합니다. 비어 있는 의료실과 첨단 전자 기기를 소독할 수 있으며 공기 덕트 내부에서 공기를 소독하는 데 사용할 수 있습니다. 또한 에어로졸 및 증발 과산화수소, 지속적인 자외선(UV-C)을 방출하는 모바일 장치, 고강도 좁은 스펙트럼(405nm) 빛을 포함하여 최신의 비접촉 및 자동 오염 제거 기술이 채택되었습니다. 이러한 기술은 표면의 박테리아 오염을 줄이는 것으로 나타났습니다. 따라서 시장에서 표면 소독제에 대한 광범위한 대체 제품 및 기술의 가용성은 유럽 표면 소독제 시장의 성장을 제한하고 개발을 제한하는 요소입니다.

- 소독제 사용과 관련된 환경 및 건강 위험

많은 표면 소독제는 더 독성이 강하고 지속적이며 생물 축적성이 강한 화학 물질로 천천히 또는 생분해되어 수생 생물을 위협합니다. 인이나 질소와 같은 성분은 수역의 영양소 부하에 기여하여 수질과 수생 생물에 부정적인 영향을 미칩니다. 게다가 세척 제품의 휘발성 유기 화합물(VOC)은 실내 공기 질에 영향을 미치고 실외 공기의 스모그 형성에 기여할 수도 있습니다. 표면 소독제와 관련된 다양한 부작용과 위험이 있으며, 이는 가까운 미래에 유럽 표면 소독제 시장이 성장하는 데 심각한 과제로 작용합니다.

- 생물 기반 소독제에 비해 화학 기반 표면 소독제의 가격이 더 높습니다.

화학 기반 표면 소독제는 병원, 진료소, 산업 및 공공 장소와 같은 다양한 시설에서 광범위하게 적용되기 때문에 유럽 표면 소독제 시장에서 큰 점유율을 차지합니다. 따라서 높은 가격은 시장에 부정적인 영향을 미치고 유럽 표면 소독제 시장에 도전이 될 것입니다.

COVID-19는 유럽 표면 살균제 시장에 최소한의 영향을 미쳤습니다.

COVID-19는 2020-2021년에 다양한 제조 산업에 영향을 미쳐 작업장 폐쇄, 공급망 중단, 운송 제한으로 이어졌습니다. 그러나 표면 소독제 시장에 상당한 영향이 나타났습니다. 여러 제조 시설을 갖춘 표면 소독제 운영 및 공급망은 여전히 이 지역에서 운영되고 있었습니다. 서비스 제공업체는 COVID 이후 시나리오에서 위생 및 안전 조치에 따라 표면 소독제를 계속 제공했습니다.

최근 개발

- 2022년 5월, BETCO는 일반 소독 및 시설별 소독에 대한 귀중한 정보 공유를 지원하기 위해 두 개의 새로운 주문형 모듈을 출시했습니다. 이 모듈은 소독제와 소독제 유형, 그리고 가장 효과적인 소독제를 추천하거나 선택하는 방법을 다룹니다.

유럽 표면 살균제 시장 범위

유럽 표면 살균제 시장은 구성, 유형, 응용 분야 및 최종 사용자를 기준으로 분류됩니다. 이러한 세그먼트 간의 성장은 주요 산업 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 분야를 식별하기 위한 전략적 결정을 내릴 수 있는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

구성

- 알코올

- 염소

- 4차 암모늄

- 알데히드

- 과산화물

- 생물소독제

유럽 표면 소독제 시장은 구성에 따라 알코올, 염소, 4차 암모늄, 알데히드, 과산화물, 생물 소독제의 6가지 부문으로 분류됩니다.

유형

- 액체

- 물티슈

- 스프레이

유럽 표면 소독제 시장은 유형에 따라 액상, 물티슈, 스프레이의 세 가지 부문으로 분류됩니다.

애플리케이션

- 표면소독

- 기구소독

- 다른 응용 프로그램

유럽 표면 소독제 시장은 응용 분야를 기준으로 표면 소독, 기구 소독 및 기타 응용 분야로 구분됩니다.

최종 사용자

- 병원

- 진단 및 연구 실험실

- 제약 및 생명공학 회사

- 음식 & 음료

- 주거용

유럽 표면 소독제 시장은 최종 사용자를 기준으로 병원, 진단 및 연구 실험실, 제약 및 생명 공학 회사, 식품 및 음료, 주거용으로 구분됩니다.

유럽 표면 살균제 시장 지역 분석/통찰력

의료 산업의 유럽 표면 소독제 시장은 구성, 유형, 용도 및 최종 사용자를 기준으로 세분화됩니다.

유럽 표면 소독제 시장 국가는 영국, 러시아, 프랑스, 스페인, 이탈리아, 독일, 터키, 네덜란드, 스위스, 벨기에와 기타 유럽 국가입니다.

독일은 시장 점유율과 시장 수익 측면에서 유럽 표면 살균제 시장을 지배하고 있으며 예측 기간 동안에도 지배력을 계속 유지할 것입니다. 이는 병원과 진단 센터의 방문객 증가 때문입니다.

보고서의 국가 섹션은 또한 현재 및 미래 시장 추세에 영향을 미치는 개별 시장 영향 요인과 시장 규제의 변화를 제공합니다. 하류 및 상류 가치 사슬 분석, 기술 추세, 포터의 5가지 힘 분석 및 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 유럽 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

경쟁 환경 및 유럽 표면 살균제 시장 점유율 분석

유럽 표면 살균제 시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보에는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선이 있습니다. 위의 데이터 포인트는 유럽 표면 살균제 시장에 대한 회사의 초점과만 관련이 있습니다.

유럽 표면 소독제 시장에서 활동하는 대표적인 기업으로는 3M, Ecolab, Gesco Healthcare Pvt. Ltd., Contec, Inc., BETCO, CARROLLCLEAN, Cetylite, Inc, GOJO Industries, Inc., Medalkan, Medline Industries, LP., Metrex Research, LLC., Spartan Chemical Company, Inc., RUHOF, ZEP Inc., KINNOS INC, PDI, Inc, Pal International, OXY PHARM, Reckitt Benckiser Group PLC., PurposeBuilt Brands, SC Johnson & Son Inc., Brulin, MEDIVATORS Inc, Pharmax Limited, Whiteley, Procter & Gamble, STERIS, The Clorox Company, PAUL HARTMANN AG, Diversey Holdings LTD 등이 있습니다.

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석 및 추정됩니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 기본(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 회사 시장 점유율 분석, 측정 표준, 유럽 대 지역 및 공급업체 점유율 분석이 포함됩니다. 추가 문의 사항이 있는 경우 분석가에게 전화를 요청하십시오.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE SURFACE DISINFECTANTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPOSITION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 U.S SURFACE DISINFECTANT ANALYSIS

4.2 EPIDEMIOLOGY

4.2.1 INCIDENCE

4.2.2 TREATMENT RATE

4.2.3 MORTALITY RATE

4.2.4 PATIENT TREATMENT SUCCESS RATE

4.3 INDUSTRIAL INSIGHTS:

4.3.1 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

4.3.2 KEY PRICING STRATEGIES

4.3.2.1 PRICES OF RAW MATERIALS:

4.3.2.2 FLUCTUATION IN DEMAND AND SUPPLY

4.3.2.3 LEVELS OF DISINFECTION

4.3.3 QUALITY:

4.3.4 KEY CONSUMER ENROLLMENT STRATEGIES

4.3.5 INTERVIEWS WITH DISINFECTION PRODUCT MANUFACTURERS

4.3.6 INTERVIEWS WITH INFECTIOUS DISEASE SCIENTISTS

4.4 PESTLE ANALYSIS

4.4.1 POLITICAL FACTORS

4.4.2 ECONOMIC FACTORS

4.4.3 SOCIAL FACTORS

4.4.4 TECHNOLOGICAL FACTORS

4.4.5 LEGAL FACTORS

4.4.6 ENVIRONMENTAL FACTORS

4.5 PORTER’S FIVE FORCES:

4.5.1 THREAT OF NEW ENTRANTS:

4.5.2 THREAT OF SUBSTITUTES:

4.5.3 CUSTOMER BARGAINING POWER:

4.5.4 SUPPLIER BARGAINING POWER:

4.5.5 INTERNAL COMPETITION (RIVALRY):

5 EUROPE SURFACE DISINFECTANT MARKET: REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FROM HEALTHCARE FACILITIES

6.1.2 RISE IN OCCURRENCES OF CHRONIC DISORDERS

6.1.3 RISING PRODUCT DEMAND POST THE OUTBREAK OF COVID-19

6.1.4 SHIFTING CONSUMERS' PREFERENCE TOWARD USE OF BIO-BASED AND NATURE-FRIENDLY DISINFECTANTS

6.2 RESTRAINTS

6.2.1 LACK OF UNDERSTANDING REGARDING THE USE OF STANDARD DISINFECTION PRACTICES BY END-USERS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS AND TECHNOLOGIES IN THE MARKET

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS AMONG A LARGE PERCENTAGE OF POPULATION

6.3.2 INCREASING FOCUS ON RESEARCH AND DEVELOPMENT (R&D) INITIATIVES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL & HEALTH HAZARDS ASSOCIATED WITH THE USE OF DISINFECTANTS

6.4.2 HIGHER PRICE OF CHEMICAL-BASED SURFACE DISINFECTANTS COMPARED TO BIO-BASED DISINFECTANTS

7 EUROPE SURFACE DISINFECTANTS MARKET, COMPOSITION

7.1 OVERVIEW

7.2 ALCOHOLS

7.3 CHLORINE

7.4 QUATENARY AMMONIUM

7.5 ALDEHYDES

7.6 PEROXIDES

7.7 BIO DISINFECTANTS

8 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE

8.1 OVERVIEW

8.2 LIQUID

8.3 WIPES

8.4 SPRAYS

9 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SURFACE DISINFECTION

9.3 INSTRUMENT DISINFECTION

9.4 OTHER APPLICATIONS

10 EUROPE SURFACE DISINFECTANTS MARKET, END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 DIAGNOSTIC AND RESEARCH LABORATORIES

10.4 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.5 FOOD & BEVERAGES

10.6 RESIDENTIAL

11 EUROPE SURFACE DISINFECTANTS MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 NETHERLANDS

11.1.8 SWITZERLAND

11.1.9 BELGIUM

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE SURFACE DISINFECTANT MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

12.1.1 COLLABORATION

12.1.2 PRODUCT LAUNCHES

12.1.3 PARTNERSHIP

12.1.4 EVENT

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 THE CLOROX COMPANY

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT UPDATE

14.2 PAUL HARTMANN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT UPDATES

14.3 PROCTER & GAMBLE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT UPDATE

14.4 DIVERSEY HOLDINGS LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT UPDATE

14.5 RECKITT BENCKISER GROUP PLC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT UPDATES

14.6 BETCO

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT UPDATE

14.7 BRULIN

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT UPDATE

14.8 CARROLLCLEAN

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT UPDATES

14.9 CETYLITE, INC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT UPDATE

14.1 CONTEC, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT UPDATES

14.11 ECOLAB

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT UPDATES

14.12 GESCO HEALTHCARE PVT. LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT UPDATE

14.13 GOJO INDUSTRIES, INC.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT UPDATE

14.14 KINNOS INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT UPDATES

14.15 MEDALKAN

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT UPDATES

14.16 MEDIVATORS, INC

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT UPDATE

14.17 MEDLINE INSUSTRIES, LP.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT UPDATES

14.18 METREX RESEARCH, LLC

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT UPDATES

14.19 OXY PHARM

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT UPDATES

14.2 PAL INTERNATIONAL

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT UPDATES

14.21 PDI, INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 PRODUCT PORTFOLIO

14.21.3 RECENT UPDATES

14.22 PHARMAX LIMITED

14.22.1 COMPANY SNAPSHOT

14.22.2 PRODUCT PORTFOLIO

14.22.3 RECENT UPDATES

14.23 PURPOSEBUILT BRANDS

14.23.1 COMPANY SNAPSHOT

14.23.2 RECENT UPDATE

14.24 RUHOF

14.24.1 COMPANY SNAPSHOT

14.24.2 PRODUCT PORTFOLIO

14.24.3 RECENT UPDATE

14.25 S.C. JOHNSON & SON INC.

14.25.1 COMPANY SNAPSHOT

14.25.2 PRODUCT PORTFOLIO

14.25.3 RECENT UPDATES

14.26 SPARTAN CHEMICAL COMPANY, INC.

14.26.1 COMPANY SNAPSHOT

14.26.2 PRODUCT PORTFOLIO

14.26.3 RECENT UPDATES

14.27 STERIS

14.27.1 COMPANY SNAPSHOT

14.27.2 REVENUE ANALYSIS

14.27.3 PRODUCT PORTFOLIO

14.27.4 RECENT UPDATES

14.28 WHITELEY

14.28.1 COMPANY SNAPSHOT

14.28.2 PRODUCT PORTFOLIO

14.28.3 RECENT UPDATES

14.29 ZEP INC.

14.29.1 COMPANY SNAPSHOT

14.29.2 PRODUCT PORTFOLIO

14.29.3 RECENT UPDATES

14.3 3M

14.30.1 COMPANY SNAPSHOT

14.30.2 REVENUE ANALYSIS

14.30.3 PRODUCT PORTFOLIO

14.30.4 RECENT UPDATES

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 IMPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 2 EXPORT DATA OF DISINFECTANTS, PUT UP IN FORMS OR PACKINGS FOR RETAIL SALE OR AS PREPARATIONS OR ARTICLES; HS CODE – 380894 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE ALCOHOLS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE CHLORINE IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE QUATERNARY AMMONIUM IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ALDEHYDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PEROXIDES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BIO DISINFECTANTS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 13 EUROPE LIQUID IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE WIPES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE SPRAYS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE INSTRUMENT DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE OTHER APPLICATIONS IN SURFACE DISINFECTION IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 EUROPE HOSPITALS IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE DIAGNOSTIC AND RESEARCH LABORATORIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE PHARMACEUTICAL AND BIOTECHNOLOGIES COMPANIES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE FOOD & BEVERAGES IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE RESIDENTIAL IN SURFACE DISINFECTANTS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE SURFACE DISINFECTANTS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 30 EUROPE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 GERMANY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 33 GERMANY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 GERMANY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 35 GERMANY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 GERMANY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 U.K. SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 38 U.K. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.K. SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 40 U.K. SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 U.K. SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 FRANCE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 43 FRANCE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 FRANCE SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 45 FRANCE SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 FRANCE SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 ITALY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 48 ITALY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 ITALY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 50 ITALY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 ITALY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 SPAIN SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 53 SPAIN SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 SPAIN SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 55 SPAIN SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SPAIN SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 RUSSIA SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 RUSSIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 RUSSIA SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 60 RUSSIA SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 RUSSIA SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 62 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 63 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 65 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NETHERLANDS SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 68 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 70 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 SWITZERLAND SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 72 BELGIUM SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 73 BELGIUM SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 75 BELGIUM SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 TURKEY SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 78 TURKEY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 TURKEY SURFACE DISINFECTANTS MARKET, BY TYPE, 2020-2029 (KILOGRAM)

TABLE 80 TURKEY SURFACE DISINFECTANTS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 81 TURKEY SURFACE DISINFECTANTS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 82 REST OF EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 EUROPE SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 2 EUROPE SURFACE DISINFECTANTS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE SURFACE DISINFECTANTS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE SURFACE DISINFECTANTS MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE SURFACE DISINFECTANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE SURFACE DISINFECTANTS MARKET: COMPOSITION LIFE LINE CURVE

FIGURE 7 EUROPE SURFACE DISINFECTANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE SURFACE DISINFECTANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE SURFACE DISINFECTANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE SURFACE DISINFECTANTS MARKET: END USER COVERAGE GRID

FIGURE 11 EUROPE SURFACE DISINFECTANTS MARKET: CHALLENGE MATRIX

FIGURE 12 EUROPE SURFACE DISINFECTANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE SURFACE DISINFECTANTS MARKET: SEGMENTATION

FIGURE 14 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE SURFACE DISINFECTANTS MARKET, WHILE NORTH AMERICA IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 15 INCREASING DEMAND FROM HEALTH CARE FACILITIES IS EXPECTED TO DRIVE THE EUROPE SURFACE DISINFECTANTS MARKET IN THE FORECAST PERIOD

FIGURE 16 ALCOHOLS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE SURFACE DISINFECTANTS MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE SURFACE DISINFECTANTS MARKET

FIGURE 18 EUROPE SURFACE DISINFECTANTS MARKET, BY COMPOSITION, 2021

FIGURE 19 EUROPE SURFACE DISINFECTANTS MARKET, BY TYPE, 2021

FIGURE 20 EUROPE SURFACE DISINFECTANTS MARKET, APPLICATION, 2021

FIGURE 21 EUROPE SURFACE DISINFECTANTS MARKET, END USER, 2021

FIGURE 22 EUROPE SURFACE DISINFECTANTS MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE SURFACE DISINFECTANTS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE SURFACE DISINFECTANTS MARKET: BY COMPOSITION (2022 - 2029)

FIGURE 27 EUROPE SURFACE DISINFECTANT MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.