North America Electrical Steel Market

시장 규모 (USD 10억)

연평균 성장률 :

%

| 2024 –2031 | |

| USD 3.97 Billion | |

| USD 6.46 Billion | |

|

|

|

|

북미 전기강 시장, 유형별(비곡물 방향성 전기강 및 곡물 방향성 전기강), 두께(0.23mm, 0.27mm, 0.30mm, 0.35mm, 0.5mm, 0.65mm 및 기타), 철심 손실(0.9W/KG 미만, 0.90W/KG~0.99W/KG, 1.00W/KG~1.29W/KG, 1.30W/KG~1.39W/KG 및 1.39W/KG 초과), 자속 밀도(1.76테슬라 초과, 1.73테슬라~1.76테슬라, 1.69테슬라~1.73테슬라, 1.65테슬라~1.69테슬라, 1.65테슬라 미만), 응용 분야(모터, 변압기, 발전기, 인덕터, 전기적 안정기, 배터리, 컨버터, 션트 리액터, 권선 코어 및 기타), 최종 사용자(에너지 및 전력, 엔지니어링, 자동차, 건물 및 건설, 가전 제품 및 기타) - 업계 동향 및 2031년까지의 예측.

북미 전기강철 시장 분석 및 규모

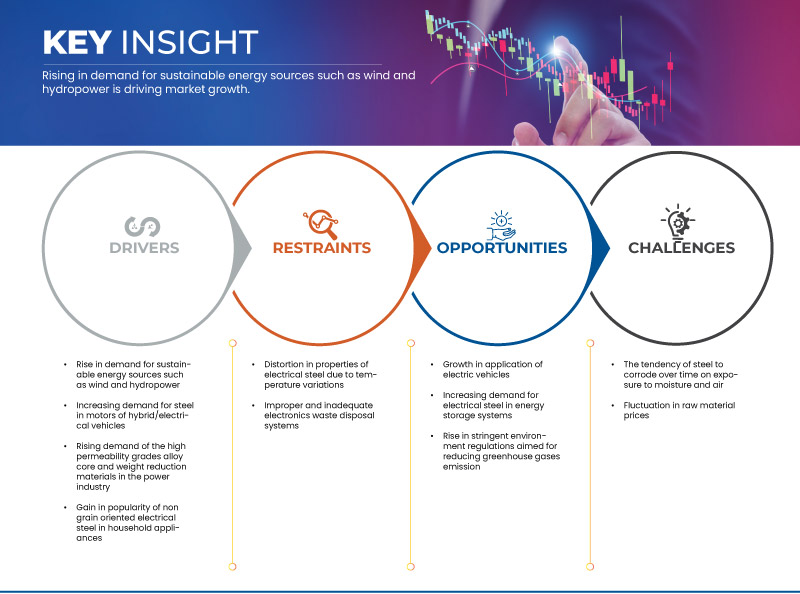

자동차 산업의 경량 부품에 대한 수요 증가와 전력 산업의 고투과성 등급 합금 코어 및 중량 감소 재료에 대한 수요 증가가 시장 성장을 견인하고 있습니다. 온도 변화로 인한 전기강의 특성 왜곡과 부적절하고 불충분한 전자 폐기물 처리 시스템이 시장을 제한하고 있습니다.

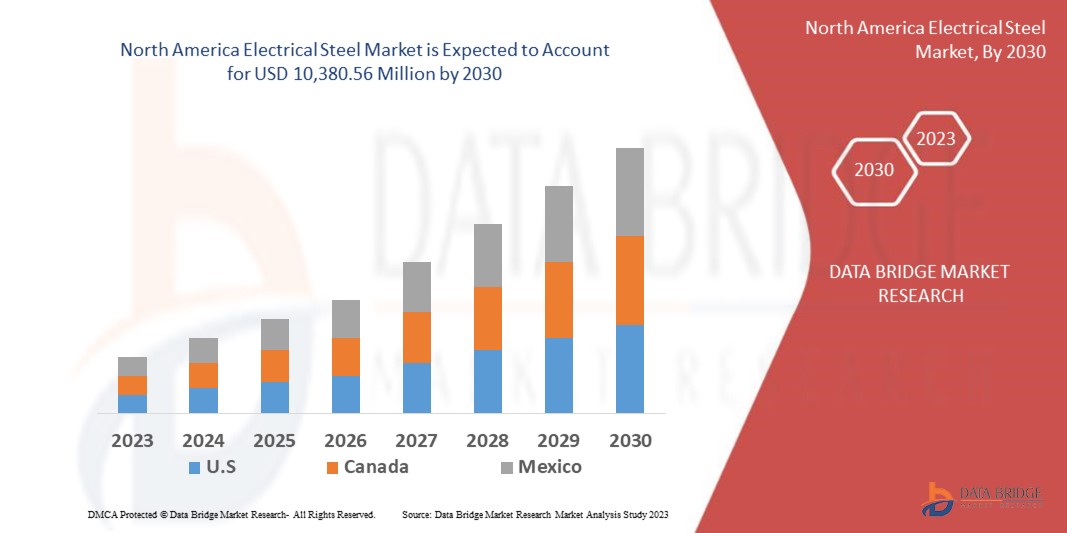

Data Bridge Market Research에 따르면 북미 전기강판 시장은 2023년 39억 7천만 달러에서 2031년 64억 6천만 달러로 성장할 것으로 예상되며, 2024년에서 2031년까지의 예측 기간 동안 연평균 성장률 6.4%로 성장할 것으로 예상됩니다.

북미 전기강철 시장 보고서는 시장 점유율, 새로운 개발, 국내 및 지역 시장 참여자의 영향에 대한 세부 정보를 제공하고, 새로운 수익 창출, 시장 규정의 변화, 제품 승인, 전략적 결정, 제품 출시, 지리적 확장, 시장의 기술 혁신 측면에서 기회를 분석합니다. 분석과 시장 시나리오를 이해하려면 당사에 연락하여 분석가 브리핑을 받으세요. 당사 팀은 원하는 목표를 달성하기 위한 수익 영향 솔루션을 만드는 데 도움을 드립니다.

|

보고서 메트릭 |

세부 |

|

예측 기간 |

2024년부터 2031년까지 |

|

기준 연도 |

2023 |

|

역사적 연도 |

2022 (2016-2021년까지 사용자 정의 가능) |

|

양적 단위 |

매출 (USD) 10억 |

|

다루는 세그먼트 |

유형(무방향성 전기강판 및 방향성 전기강판 ), 두께(0.23 MM, 0.27 MM, 0.30 MM, 0.35 MM, 0.5 MM, 0.65 MM 및 기타), 철손(0.9 W/KG 미만, 0.90 W/KG ~ 0.99 W/KG, 1.00 W/KG ~ 1.29 W/KG, 1.30 W/KG ~ 1.39 W/KG 및 1.39 W/KG 초과), 자속 밀도(1.76 테슬라 초과, 1.73 테슬라 ~ 1.76 테슬라, 1.69 테슬라 ~ 1.73 테슬라, 1.65 테슬라 ~ 1.69 테슬라, 1.65 테슬라 미만), 용도(모터, 변압기, 발전기, 인덕터, 전기 안정기, 배터리, 변환기, 션트 리액터, 권선 코어 및 기타), 최종 사용자(에너지 및 전력, 엔지니어링, 자동차, 건물 및 건설, 가전제품 및 기타) |

|

적용 국가 |

미국, 캐나다, 멕시코 |

|

Market Players Covered |

Cleveland-Cliffs Inc., JFE Steel Corporation., ArcelorMittal, voestalpine AG, thyssenkrupp AG, Baosteel Co.,Ltd., C.D. Wälzholz GmbH & Co. KG, NIPPON STEEL CORPORATION, POSCO, TC Metal, Tempel (A subsidiary of Worthington Steel) and among others |

Market Definition

Electrical steel, also known as silicon steel or transformer steel, is a type of specialty steel optimized for electrical applications. It has specific magnetic properties, including low core loss and high permeability, which make it ideal for use in transformers, inductors, electric motors, and generators. The steel is typically alloyed with silicon to enhance its electrical resistivity and reduce energy losses. Electrical steel is produced in various grades, tailored to meet specific requirements of the electrical industry, contributing significantly to energy efficiency in power distribution and electric devices.

North America Electrical Steel Market Dynamics:

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

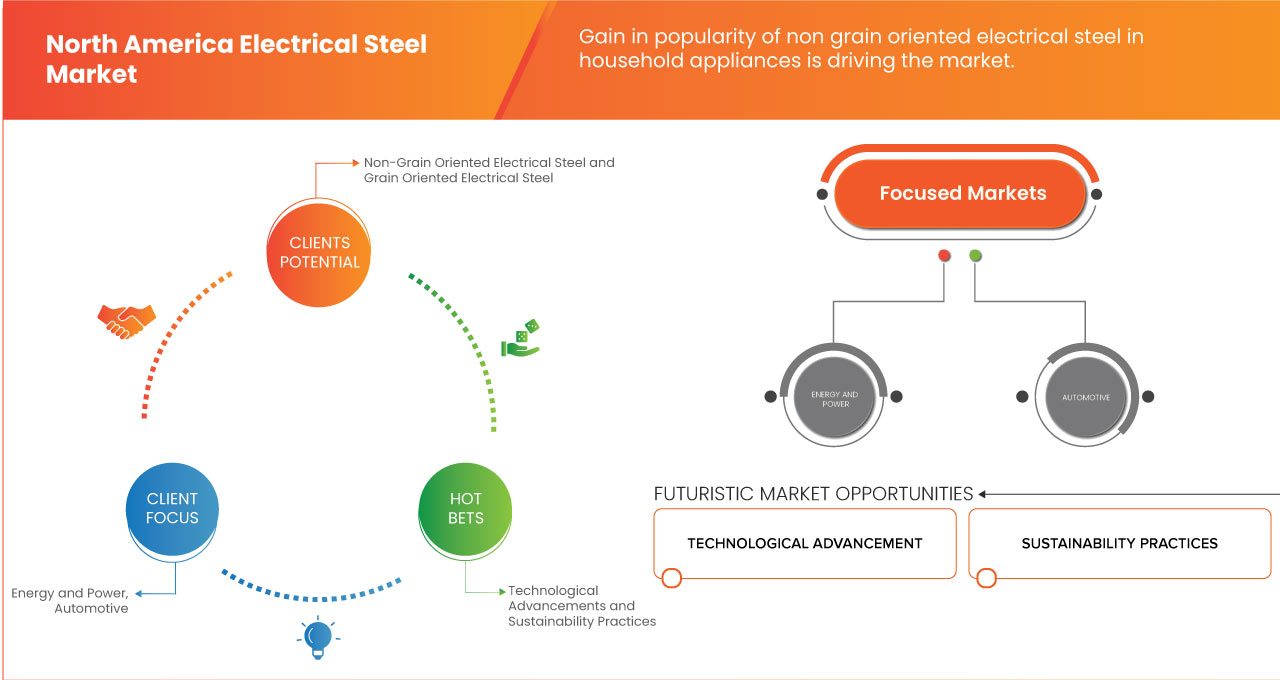

Drivers

- Rise in Demand for Sustainable Energy Sources Such as Wind and Hydropower

The demand for sustainable sources of energy such as wind and hydro prover, among others due to changing environmental scenarios is a major driver for the North America electrical steel market since non-grain oriented electrical steel finds applications in most of the turbines and motors used in such forms of sustainable energy.

Since, the respective initiative requires building new windmills that require turbines and motors that utilizes non-grain oriented electrical steel and since the U.S. is the most major economy in North America, such initiatives from the U.S. government that promotes the demand for sustainable energy sources such as wind and hydropower acts as a major market driver for North America electrical steel market and escalates the demand side of the respective market.

- Gain in Popularity of Non Grain Oriented Electrical Steel in Household Appliances

The overall demand for household appliances, particularly, cooling appliances, is growing drastically as a majority of people are still confined within their houses due to the COVID-19 pandemic. The growing popularity of non-grain oriented steel in household appliances is a major driver for the North America non-grain oriented electrical steel market as a major landslide in demand for non-grain oriented electrical steel would be created by the growing demand for household appliances that uses non-grain oriented electrical steel.

The demand for household appliances particularly cooling appliances that utilize non-grain oriented electrical steel is being scaled up. Since such scale-up in demand for household appliances is boosting the demand and consumption of non-grain oriented electrical steel, the respective parameter is considered as a major market driver or the North America electrical steel market.

Opportunities

- Growth in Application of Electric Vehicles

Since the environmental impact of fossil fuels is gaining popularity, the demand for electric vehicles is growing throughout the world. Since non-grain oriented electrical steel finds application in the manufacture of various parts that are vital for the working of electric vehicles, the growth in the application of electric vehicles is considered as a major market opportunity for the North America electrical steel market capable of boosting the sales and market demand.

In conclusion, due to the growing environmental concerns, electric vehicles have started to widely replace, the normal vehicles that run on fossil fuels. However, since many of the parts present in such electrical vehicles are comprised of various parts made from non-grain oriented electrical steel, the growing demand for electrical vehicles acts as an excellent opportunity that could boost the demand and production of non-grain oriented electrical steel in the North America electrical steel market.

Restraints/Challenges

- The Tendency of Steel to Corrode Over Time on Exposure to Moisture and Air

Since steel is an alloy of iron, the fact that it is susceptible to rust that arises due to moisture as well as air. Nonetheless, the tendency of steel to undergo corrosion over time on exposure to moisture and air pose a major challenge to North America electrical steel market as corrosion could damage the physical and chemical properties of steel, making it extremely debilitated for its industrial applications, thereby reducing the market demand.

Nonetheless, as such large-scale replacements of steel due to corrosive characteristics diminishes the overall market demand and sales of the non-grain oriented electrical steel, the tendency of steel to corrode over time on exposure to moisture and air acts as a challenge to the North America non-grain oriented electrical steel market

- Fluctuation in Raw Material Prices

Fluctuation in the raw material prices will affect the production cost of the electrical steel products. The change in the production cost will change the revenue for the manufacturers. The raw material which is used for the production of the electrical steel products is mixed with other components for the production of electrical steel in different grades for different applications in the industries.

The raw material is available in different quality and at different rates due to which production of the electrical steel products is very difficult for the manufacturers. Highly fluctuating raw material costs and ineffective price management can greatly endanger a manufacturer in the market. Due to the fluctuation in the raw material prices, the manufacturer is now able to fix the cost of the product which further resulted in a loss to manufacturers.

Recent Developments

- In April 2024, POSCO at the World Steel Association's semi-annual member meeting in London, it was named the Sustainability Champion for the third consecutive year. This recognition highlights POSCO's ongoing efforts to transition to a low-carbon system, including the introduction of electric arc furnaces and the operation of a sustainability management council

- In January 2024, Tempel, a Worthington Steel Company and a global leader in high-precision electrical steel laminations for motors, generators, and transformers, proudly announces receiving the Zero PPM (Parts per Million) award from Mahle Electric Drives India Pvt. This award recognizes Tempel's unwavering commitment to manufacturing excellence and quality assurance. MAHLE is a prominent international development partner and supplier in the automotive industry, pioneering electrification, thermal management, and clean combustion engines

- In 2024, Nippon Steel Corporation ("Nippon Steel") participated in the Offshore Technology Conference (OTC) in Houston, USA, from May 6 to May 9. OTC is a prominent exhibition that attracts offshore-related companies and organizations globally, featuring over 1,300 exhibitors and drawing around 30,000 attendees annually

- In December 2023, NIPPON STEEL CORPORATION (NSC) announced today its decision to acquire United States Steel Corporation (U. S. Steel), an integrated blast furnace and electric arc furnace steel manufacturer in the U.S., through its wholly-owned subsidiary, NIPPON STEEL NORTH AMERICA, INC. (NSNA). This acquisition follows the decision by NSC's Representative Director, mandated by the Board of Directors' resolutions on November 30, 2023, December 15, 2023, and December 18, 2023

- In May 2023, POSCO became the first global steelmaker to win three awards in the Technology Category at the worldstainless-27 conference, held in Brussels, Belgium. The company received Gold, Silver, and Bronze Awards for its innovations, including high-strength steel for large-scale premium home appliances, non-magnetic steel for mobile devices, and low-cost brazing filler metal. Lee Kyung-jin, Head of Office Stainless Steel Marketing at POSCO, stated, "They will lead the global market and supply the highest quality products to their customers based on the stainless steel material development technologies." This achievement marks yet another global recognition of POSCO's technical prowess, following their Gold Award in the same category at the 26th conference last year

North America Electrical Steel Market Scope

North America electrical steel market is segmented into six notable segments based on type, thickness, application, core losses, flux density, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Non-Grain Oriented Electrical Steel

- Grain Oriented Electrical Steel

On the basis of type, the market is segmented into non-grain oriented electrical steel and grain oriented electrical steel.

Thickness

- 0.23 MM

- 0.27 MM

- 0.30 MM

- 0.35 MM

- 0.5 MM

- 0.65 MM

- Others

On the basis of thickness, the market is segmented into 0.23 MM, 0.27 MM, 0.30 MM, 0.35 MM, 0.5 MM, 0.65 MM, and others.

Core Losses

- Less than 0.9 W/KG

- 0.90 W/KG to 0.99 W/KG

- 1.00 W/KG to 1.29 W/KG

- 1.30 W/KG to 1.39 W/KG

- Above 1.39 W/KG

On the basis of core losses, the market is segmented into less than 0.9 W/KG, 0.90 W/KG to 0.99 W/KG, 1.00 W/KG to 1.29 W/KG, 1.30 W/KG to 1.39 W/KG, and above 1.39 W/KG.

Flux Density

- Above 1.76 Tesla

- 1.73 Tesla to 1.76 Tesla

- 1.69 Tesla to 1.73 Tesla

- 1.65 Tesla to 1.69 Tesla

- Less than 1.65 Tesla

On the basis of flux density, the market is segmented above 1.76 tesla, 1.73 tesla to 1.76 tesla, 1.69 tesla to 1.73 tesla, 1.65 tesla to 1.69 tesla, less than 1.65 tesla.

Application

- Motors

- Transformers

- Power Generators

- Inductors

- Electrical Ballasts

- Battery

- Convertors

- Shunt Reactors

- Wound Cores

- Others

On the basis of application, the market is segmented into motors, transformers, power generators, inductors, electrical ballasts, battery, convertors, shunt reactors, wound cores, and others.

End-User

- Energy and Power

- Engineering

- Automotive

- Building and Construction

- Household Appliances

- Others

On the basis of end-user, the market is segmented into energy and power, engineering, automotive, building and construction, household appliances, and others.

North America Electrical Steel Market Regional Analysis/Insights

North America electrical steel market is segmented into six notable segments based on type, thickness, application, core losses, flux density, and end-use.

The countries covered in the North America electrical steel market are U.S., Canada, and Mexico.

The U.S. is the highest growing country in the North America electrical steel market due to gain in popularity of non-grain oriented electrical steel in household appliances.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Electrical Steel Market Share Analysis

북미 전기강철 시장 경쟁 구도는 경쟁사별 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 생산 현장 및 시설, 회사의 강점과 약점, 제품 출시, 제품 시험 파이프라인, 제품 승인, 특허, 제품 폭과 폭, 응용 분야 우세, 기술 수명선 곡선입니다. 위에 제공된 데이터 포인트는 북미 전기강철 시장과 관련된 회사의 초점에만 관련이 있습니다.

북미 전기강판 시장의 주요 참여 기업으로는 Cleveland-Cliffs Inc., JFE Steel Corporation, ArcelorMittal, voestalpine AG, thyssenkrupp AG, Baosteel Co.,Ltd., CD Wälzholz GmbH & Co.KG, NIPPON STEEL CORPORATION, POSCO, TC Metal, Tempel(Worthington Steel의 자회사) 등이 있습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA ELECTRICAL STEEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 MARKET APPLICATION COVERAGE GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS:

4.1.2 ECONOMIC FACTORS:

4.1.3 SOCIAL FACTORS:

4.1.4 TECHNOLOGICAL FACTORS:

4.1.5 LEGAL FACTORS:

4.1.6 ENVIRONMENTAL FACTORS:

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS (LOW)

4.2.2 THREAT OF SUBSTITUTES (MODERATE)

4.2.3 BARGAINING POWER OF BUYERS (HIGH)

4.2.4 BARGAINING POWER OF SUPPLIERS (MODERATE)

4.2.5 COMPETITIVE RIVALRY (HIGH)

4.3 VENDOR SELECTION CRITERIA

4.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.4.1 HIGH-PERMEABILITY GRADES:

4.4.2 NANO-CRYSTALLINE AND AMORPHOUS ALLOYS:

4.4.3 LASER SCRIBING TECHNOLOGY:

4.4.4 ADVANCED COATING TECHNIQUES:

4.4.5 3D PRINTING AND ADDITIVE MANUFACTURING:

4.4.6 DIGITAL TWIN TECHNOLOGY:

4.4.7 AI AND MACHINE LEARNING IN QUALITY CONTROL:

4.4.8 IMPROVED RECYCLING PROCESSES:

4.5 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR SUSTAINABLE ENERGY SOURCES SUCH AS WIND AND HYDROPOWER

6.1.2 INCREASING DEMAND FOR STEEL IN MOTORS OF HYBRID/ELECTRICAL VEHICLES

6.1.3 RISING DEMAND OF THE HIGH PERMEABILITY GRADES ALLOY CORE AND WEIGHT REDUCTION MATERIALS IN THE POWER INDUSTRY

6.1.4 GAIN IN POPULARITY OF NON GRAIN ORIENTED ELECTRICAL STEEL IN HOUSEHOLD APPLIANCES

6.2 RESTRAINTS

6.2.1 DISTORTION IN PROPERTIES OF ELECTRICAL STEEL DUE TO TEMPERATURE VARIATIONS

6.2.2 IMPROPER AND INADEQUATE ELECTRONICS WASTE DISPOSAL SYSTEMS

6.3 OPPORTUNITIES

6.3.1 GROWTH IN APPLICATION OF ELECTRIC VEHICLES

6.3.2 INCREASING DEMAND FOR ELECTRICAL STEEL IN ENERGY STORAGE SYSTEMS

6.3.3 RISE IN STRINGENT ENVIRONMENT REGULATIONS AIMED FOR REDUCING GREENHOUSE GASES EMISSION

6.4 CHALLENGES

6.4.1 THE TENDENCY OF STEEL TO CORRODE OVER TIME ON EXPOSURE TO MOISTURE AND AIR

6.4.2 FLUCTUATION IN RAW MATERIAL PRICES

7 NORTH AMERICA ELECTRICAL STEEL MARKET, BY TYPE

7.1 OVERVIEW

7.2 NON-GRAIN ORIENTED ELECTRICAL STEEL

7.2.1 NON-GRAIN ORIENTED ELECTRICAL STEEL, BY TYPE

7.2.2 NON-GRAIN ORIENTED ELECTRICAL STEEL, BY CATEGORY

7.3 GRAIN ORIENTED ELECTRICAL STEEL

7.3.1 GRAIN ORIENTED ELECTRICAL STEEL, BY TYPE

8 NORTH AMERICA ELECTRICAL STEEL MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 0.23 MM

8.3 0.27 MM

8.4 0.30 MM

8.5 0.35 MM

8.6 0.5 MM

8.7 0.65 MM

8.8 OTHERS

9 NORTH AMERICA ELECTRICAL STEEL MARKET, BY CORE LOSSES

9.1 OVERVIEW

9.2 LESS THAN 0.9 W/KG

9.3 0.90 W/KG TO 0.99 W/KG

9.4 1.00 W/KG TO 1.29 W/KG

9.5 1.30 W/KG TO 1.39 W/KG

9.6 ABOVE 1.39 W/KG

10 NORTH AMERICA ELECTRICAL STEEL MARKET, BY FLUX DENSITY

10.1 OVERVIEW

10.2 ABOVE 1.76 TESLA

10.3 1.73 TESLA TO 1.76 TESLA

10.4 1.69 TESLA TO 1.73 TESLA

10.5 1.65 TESLA TO 1.69 TESLA

10.6 LESS THAN 1.65 TESLA

11 NORTH AMERICA ELECTRICAL STEEL MARKET, BY END-USER

11.1 OVERVIEW

11.2 ENERGY AND POWER

11.3 ENGINEERING

11.4 AUTOMOTIVE

11.5 BUILDING AND CONSTRUCTION

11.6 HOUSEHOLD APPLIANCES

11.7 OTHERS

12 NORTH AMERICA ELECTRICAL STEEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 MOTORS

12.2.1 MOTORS, BY PRODUCT TYPE

12.2.2 MOTORS, BY CATEGORY

12.3 TRANSFORMERS

12.3.1 TRANSFORMERS, BY PRODUCT TYPE

12.3.2 TRANSFORMERS, BY APPLICATION

12.4 POWER GENERATORS

12.4.1 POWER GENERATORS, BY PRODUCT TYPE

12.4.2 POWER GENERATORS, BY APPLICATION

12.5 INDUCTORS

12.5.1 INDUCTORS, BY PRODUCT TYPE

12.6 ELECTRICAL BALLASTS

12.6.1 ELECTRICAL BALLASTS, BY PRODUCT TYPE

12.7 BATTERY

12.7.1 BATTERY, BY PRODUCT TYPE

12.8 CONVERTORS

12.8.1 CONVERTORS, BY PRODUCT TYPE

12.9 SHUNT REACTORS

12.9.1 SHUNT REACTORS, BY PRODUCT TYPE

12.1 WOUND CORES

12.10.1 WOUND CORES, BY PRODUCT TYPE

12.11 OTHERS

12.11.1 OTHERS, BY PRODUCT TYPE

13 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA ELECTRICAL STEEL MARKET : COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 CLEVELAND-CLIFFS INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 JFE STEEL CORPORATION.

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENTS

16.3 ARCELORMITTAL

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 1.3.3RECENT DEVELOPMENTS

16.4 VOESTALPINE AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 THYSSENKRUPP AG

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 BAOSTEEL CO., LTD.

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 C.D. WÄLZHOLZ GMBH & CO. KG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 NIPPON STEEL CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 POSCO

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 TC METAL

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO.

16.10.3 RECENT DEVELOPMENTS

16.11 TEMPEL (A SUBSIDIARY OF WORTHINGTON STEEL )

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

표 목록

TABLE 1 REGULATION COVERAGE

TABLE 2 NEW MODEL ANNOUNCEMENT OF ELECTRICAL CARS

TABLE 3 NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 4 NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 5 NORTH AMERICA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 6 NORTH AMERICA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 7 NORTH AMERICA GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 8 NORTH AMERICA ELECTRICAL STEEL MARKET, BY THCIKNESS, 2022-2031 (USD MILLION)

TABLE 9 NORTH AMERICA ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 10 NORTH AMERICA ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 11 NORTH AMERICA ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 12 NORTH AMERICA ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 13 NORTH AMERICA MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 14 NORTH AMERICA MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031, (USD MILLION)

TABLE 15 NORTH AMERICA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 16 NORTH AMERICA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031, (USD MILLION)

TABLE 17 NORTH AMERICA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 18 NORTH AMERICA POWER GENERATORSIN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 19 NORTH AMERICA INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 21 NORTH AMERICA BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 22 NORTH AMERICA CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 23 NORTH AMERICA SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 24 NORTH AMERICA WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031, (USD MILLION)

TABLE 26 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY, 2022-2031 (USD MILLION)

TABLE 27 NORTH AMERICA ELECTRICAL STEEL MARKET, BY COUNTRY, 2022-2031 (MILLION TONS)

TABLE 28 U.S. ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 29 U.S. ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 30 U.S. NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 31 U.S. NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 32 U.S. GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 33 U.S. ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 34 U.S. ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 35 U.S. ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 36 U.S. ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 37 U.S. MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 38 U.S. MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 39 U.S. TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 40 U.S. TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 41 U.S. POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 42 U.S. POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 43 U.S. INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 44 U.S. ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 45 U.S. BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 46 U.S. CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 47 U.S. SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 48 U.S. WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 49 U.S. OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 50 U.S. ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 51 CANADA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 52 CANADA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 53 CANADA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 54 CANADA NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 55 CANADA GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 56 CANADA ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 57 CANADA ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 58 CANADA ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 59 CANADA ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 60 CANADA MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 61 CANADA MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 62 CANADA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 63 CANADA TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 64 CANADA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 65 CANADA POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 66 CANADA INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 67 CANADA ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 68 CANADA BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 69 CANADA CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 70 CANADA SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 71 CANADA WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 72 CANADA OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 73 CANADA ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

TABLE 74 MEXICO ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 75 MEXICO ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (MILLION TONS)

TABLE 76 MEXICO NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 77 MEXICO NON-GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 78 MEXICO GRAIN ORIENTED ELECTRICAL STEEL IN ELECTRICAL STEEL MARKET, BY TYPE, 2022-2031 (USD MILLION)

TABLE 79 MEXICO ELECTRICAL STEEL MARKET, BY THICKNESS, 2022-2031 (USD MILLION)

TABLE 80 MEXICO ELECTRICAL STEEL MARKET, BY CORE LOSSES, 2022-2031 (USD MILLION)

TABLE 81 MEXICO ELECTRICAL STEEL MARKET, BY FLUX DENSITY, 2022-2031 (USD MILLION)

TABLE 82 MEXICO ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 83 MEXICO MOTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 84 MEXICO MOTORS IN ELECTRICAL STEEL MARKET, BY CATEGORY, 2022-2031 (USD MILLION)

TABLE 85 MEXICO TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 86 MEXICO TRANSFORMERS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 87 MEXICO POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 88 MEXICO POWER GENERATORS IN ELECTRICAL STEEL MARKET, BY APPLICATION, 2022-2031 (USD MILLION)

TABLE 89 MEXICO INDUCTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 90 MEXICO ELECTRICAL BALLASTS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 91 MEXICO BATTERY IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 92 MEXICO CONVERTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 93 MEXICO SHUNT REACTORS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 94 MEXICO WOUND CORES IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 95 MEXICO OTHERS IN ELECTRICAL STEEL MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

TABLE 96 MEXICO ELECTRICAL STEEL MARKET, BY END-USER, 2022-2031 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA ELECTRICAL STEEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRICAL STEEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRICAL STEEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRICAL STEEL MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRICAL STEEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRICAL STEEL MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA ELECTRICAL STEEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA ELECTRICAL STEEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA ELECTRICAL STEEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA ELECTRICAL STEEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA ELECTICAL STEEL MARKET: SEGMENTATION

FIGURE 12 TWO SEGMENTS COMPRISE THE NORTH AMERICA ELECTRICAL STEEL MARKET, BY PRODUCT TYPE

FIGURE 13 EXECUTIVE SUMMARY : NORTH AMERICAL ELECTRICAL STEEL MARKET

FIGURE 14 INCREASING DEMAND FOR STEEL IN MOTORS OF HYBRID/ELECTRICAL VEHICLES IS THE KEY DRIVER FOR THE NORTH ELECTRICAL STEEL MARKET IN THE FORECAST PERIOD OF 2024 TO 2031

FIGURE 15 NON-GRAIN ORIENTED ELECTRICAL STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRICAL STEEL MARKET IN 2024 AND 2031

FIGURE 16 STRATEGIC DECISIONS

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF THE NORTH AMERICA ELECTRICAL STEEL MARKET

FIGURE 20 STEEL PRICE (2020) (USD DOLLAR/METRIC TON)

FIGURE 21 NORTH AMERICA ELECTRICAL STEEL MARKET: BY PRODUCT TYPE, 2023

FIGURE 22 NORTH AMERICA ELECTRICAL STEEL MARKET: BY THICKNESS, 2023

FIGURE 23 NORTH AMERICA ELECTRICAL STEEL MARKET: BY CORE LOSSES, 2023

FIGURE 24 NORTH AMERICA ELECTRICAL STEEL MARKET: BY FLUX DENSITY, 2023

FIGURE 25 NORTH AMERICA ELECTRICAL STEEL MARKET: BY END-USER, 2023

FIGURE 26 NORTH AMERICA ELECTRICAL STEEL MARKET: BY APPLICATION, 2023

FIGURE 27 NORTH AMERICA ELECTRICAL STEEL MARKET: SNAPSHOT (2023)

FIGURE 28 NORTH AMERICA ELECTRICAL STEEL MARKET COMPANY SHARE 2023 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.