Global Medical Device Warehouse And Logistics Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

43.03 Billion

USD

62.13 Billion

2024

2032

USD

43.03 Billion

USD

62.13 Billion

2024

2032

| 2025 –2032 | |

| USD 43.03 Billion | |

| USD 62.13 Billion | |

|

|

|

|

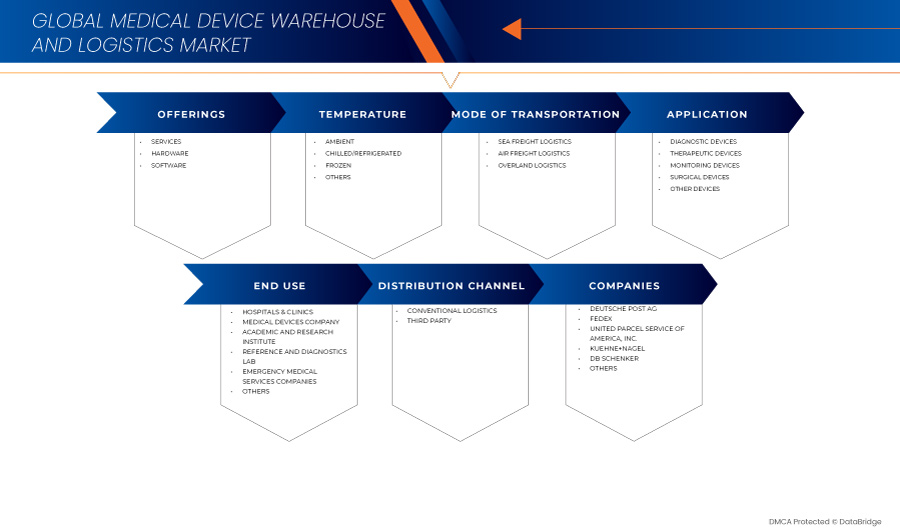

Global Medical Device Warehouse and Logistics Market Segmentation, By Offerings (Services, Hardware, and Software) Temperature (Ambient, Chilled/Refrigerated, Frozen, and Others), Mode of Transportation (Sea Freight Logistics, Air Freight Logistics, and Overland Logistics), Application (Diagnostic Devices, Therapeutic Devices, Monitoring Devices, Surgical Devices, and Other Devices), End Use (Hospitals & Clinics, Medical Devices Companies, Academic & Research Institute, Reference & Diagnostics Laboratories, Emergency Medical Services Companies, and Others), Distribution Channel (Conventional Logistics and Third Party) – Industry Trends and Forecast to 2031

Medical Device Warehouse and Logistics Market Analysis

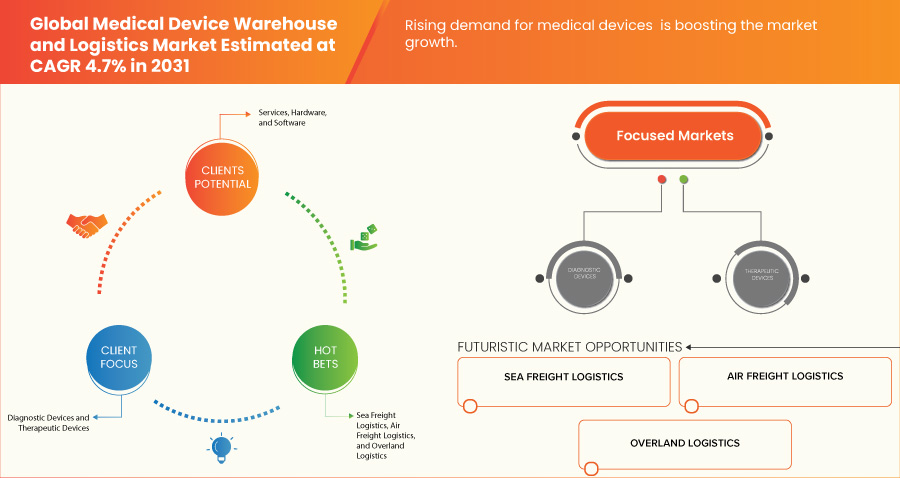

The medical device warehouse and logistics market is experiencing robust growth, driven by rising demand for medical devices. As the global healthcare industry continues to expand, the need for efficient storage, handling, and distribution of medical devices has grown exponentially. adoption of advanced technologies in logistics management and strategic partnerships and mergers between medical device manufacturers and logistics and e-commerce companies are enhancing performance and expanding their applications. Market dynamics are also influenced by fluctuations in raw material prices and geopolitical factors affecting supply chains. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Medical Device Warehouse and Logistics Market Size

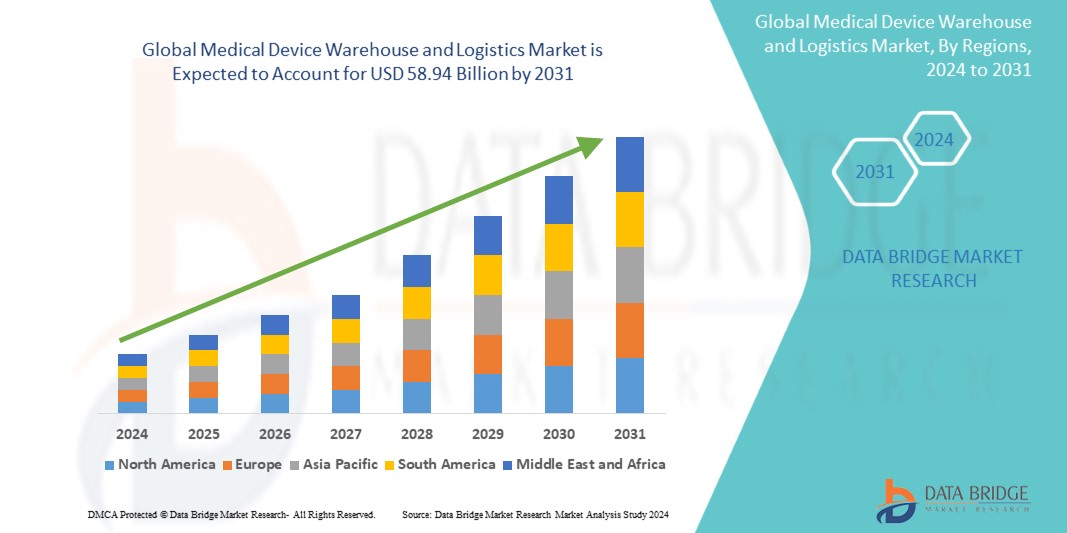

Global medical device warehouse and logistics market size was valued at USD 41.10 billion in 2023 and is projected to reach USD 58.94 billion by 2031, with a CAGR of 4.7% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Medical Device Warehouse and Logistics Market Trends

“Technological Advancements and Innovations in Medical Technology”

Technological advancements and innovations in medical technology are the key trend of the medical device warehouse and logistics market, reshaping how medical devices are stored, handled, and distributed. As medical devices become more sophisticated and require greater precision, the logistics infrastructure supporting their delivery must evolve to meet these advanced needs. The increasing complexity and sensitivity of devices, such as robotic surgical systems, implantable devices, diagnostic equipment, and wearable health tech, demand specialized warehousing solutions that ensure the safety, efficacy, and compliance of these products.

In addition, IoT integration in warehouses has enabled real-time inventory tracking, allowing logistics providers to monitor device conditions during transport and storage. 3D printing technology is also revolutionizing medical device manufacturing, leading to the production of customized implants, prosthetics, and surgical tools. These bespoke devices require efficient and rapid distribution to healthcare facilities. As a result, logistics providers are investing in agile warehousing systems that can manage the growing demand for just-in-time delivery, reducing lead times and ensuring that custom-made devices reach their destinations quickly. These advancements ensure the safe delivery of sensitive medical products, driving demand for cold storage warehouses with cutting-edge capabilities.

Report Scope and Medical Device Warehouse and Logistics Market Segmentation

|

Attributes |

Medical Device Warehouse and Logistics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Switzerland, Netherlands, Russia, Belgium, Finland, Denmark, Poland, Norway, Sweden, Hungary, rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, New Zealand, Vietnam, Taiwan, rest of Asia-Pacific, Brazil, Argentina, rest of South America, South Africa, Saudi Arabia, U.A.E., Israel, Egypt, Kuwait, Oman, Bahrain, and rest of Middle East and Africa |

|

Key Market Players |

Deutsche Post AG (Germany), FedEx (U.S.), United Parcel Service of America, Inc. (U.S.), Kuehne+Nagel (U.K), DB SCHENKER (Germany), Alloga (U.K.), AWL India Private Limited (India), C.H. Robinson Worldwide, Inc. (U.S.), CAVALIER LOGISTICS (U.S.), CEVA (France), Crown LSP Group (U.S.), Dimerco (Taiwan), DSV (Denmark), FM Logistic (France), Hansa International (China), Hellmann Worldwide Logistics SE & Co. KG (Germany), Imperial (South Africa), Mercury Business Services (U.S.), Movianto (Netherlands), Murphy Logistics (U.S.), OIA Global (U.S.), Omni Logistics, LLC (U.S.), puracon Gmbh (Germany), Rhenus Group (Germany), SEKO (U.S.), TIBA (Spain), Toll Holdings Limited (Australia), Warehouse Anywhere (U.S.), and XPO, Inc. (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Medical Device Warehouse and Logistics Market Definition

Medical device warehouse and logistics refers to the specialized processes and systems involved in the storage, management, and distribution of medical devices within the healthcare supply chain. This includes the warehousing of various medical products—such as surgical instruments, diagnostic equipment, and implants— while ensuring compliance with stringent regulatory standards for safety and efficacy. Logistics encompasses the planning and execution of transportation, inventory management, and order fulfillment to ensure timely delivery to healthcare providers and patients. Effective warehouse and logistics operations are critical for maintaining product availability, minimizing delays, and optimizing costs, ultimately supporting better patient care and outcomes in the healthcare ecosystem.

Medical Device Warehouse and Logistics Market Dynamics

Drivers

- Rising Demand for Medical Devices

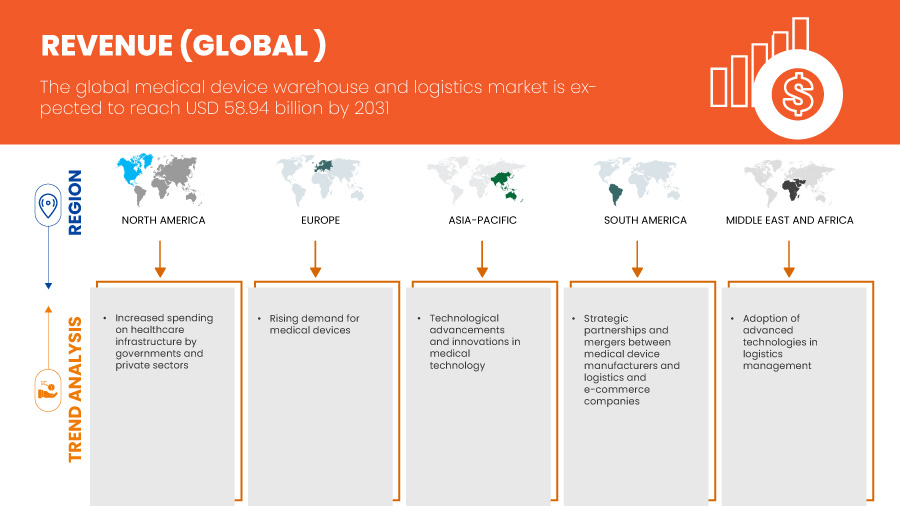

The rising demand for medical devices is a significant driver of the global medical device warehouse and logistics market. As the global healthcare industry continues to expand, the need for efficient storage, handling, and distribution of medical devices has grown exponentially. This surge is driven by several factors, including the increasing prevalence of chronic diseases, advancements in medical technology, an aging population, and the growing demand for healthcare services across both developed and developing markets. As medical devices become more sophisticated and diverse, the logistics and warehousing requirements to support their distribution become more critical.

In addition, as the medical device industry becomes more globalized, companies are outsourcing their logistics and warehousing needs to third-party logistics providers (3PLs) that specialize in handling healthcare products. These 3PLs offer value-added services such as inventory management, cold chain logistics, and last-mile delivery solutions that are tailored to the specific requirements of medical devices. By leveraging the expertise of these logistics providers, medical device companies can streamline their supply chains, reduce costs, and ensure compliance with international regulations.

For instance,

In September 2023, according to an article published by Rapid Medtech Communications Ltd, the demand for medical devices has been on the rise due to an aging global population and increasing prevalence of chronic diseases. The ongoing shift towards minimally invasive procedures and personalized medicine has also spurred the need for specialized medical devices, contributing to the expansion.

- Increased Spending on Healthcare Infrastructure by Governments and Private Sectors

Government and private sector increased spending on healthcare infrastructure is a significant driver for the medical device warehouse and logistics market. As countries invest heavily in upgrading healthcare facilities, expanding services, and integrating advanced medical technologies, the demand for medical devices and the associated logistics infrastructure is surging.

Governments worldwide are allocating substantial budgets toward building new hospitals, expanding existing facilities, and upgrading outdated equipment. Countries such as India and Brazil have announced significant investments in healthcare infrastructure to ensure better access to medical services for their populations. This push toward modernization necessitates a comprehensive supply chain strategy for medical devices, from manufacturing and storage to distribution and delivery. As healthcare facilities grow, the need for efficient warehousing and logistics solutions to manage increased inventory levels becomes paramount. Private sector investments in healthcare are equally noteworthy.

In addition, the global emphasis on preparedness for future health crises is prompting governments and organizations to stockpile essential medical devices and supplies. This proactive approach increases demand for warehouses capable of storing large quantities of medical devices, with robust logistics systems to facilitate rapid deployment in emergencies.

For instance,

In January 2024, according to an article published on the Invest India website, India’s National Health Mission saw significant funding for improving healthcare infrastructure, particularly in rural areas. The government’s investment in upgrading hospitals and healthcare centers has led to increased demand for medical devices, necessitating the expansion of warehousing and logistics operations.

Opportunities

- Adoption of Advanced Technologies in Logistics Management

The adoption of advanced technologies in logistics management is transforming the medical device warehouse and logistics market, creating significant opportunities for growth and efficiency. As the healthcare sector increasingly demands precision and speed, the integration of technologies such as IoT, AI, and blockchain is revolutionizing how medical devices are stored, tracked, and distributed.

Advanced technologies enable real-time tracking of medical devices throughout the supply chain. IoT devices can provide continuous monitoring of environmental conditions (such as temperature and humidity) critical for sensitive medical products. This visibility not only ensures compliance with regulatory standards but also enhances inventory management, reducing the risk of overstocking or stockouts. Automation in warehousing operations, through robotics and AI-driven systems, streamlines the picking, packing, and shipping processes. This leads to reduced labor costs and increased speed in order fulfillment. Automated systems can optimize storage solutions, ensuring that medical devices are readily accessible while maximizing space utilization.

For instance,

In 2021, according to an article published by Elsevier B.V., the increasing importance of logistics centers in supply chains is evident as they navigate a competitive market and rising customer expectations. This situation compels these centers to adopt various technological solutions to enhance service quality. This article aims to explore the current development stage of modern technologies in logistics centers and to identify the associated benefits and challenges. A case study of logistics centers in Poland was conducted using a questionnaire survey. Results indicate that while these centers are evolving, there remains a significant need for further technological advancement.

- Strategic Partnerships and Mergers Between Medical Device Manufacturers and Logistics and E-Commerce Companies

Strategic partnerships and mergers between medical device manufacturers and logistics and e-commerce companies present significant opportunities for the medical device warehouse and logistics market. As the demand for medical devices continues to surge, driven by technological advancements and an aging population, collaboration across sectors is crucial for improving efficiency and expanding market reach.

By partnering with logistics and e-commerce firms, medical device manufacturers can leverage established distribution networks. These partnerships enable manufacturers to access advanced logistics capabilities, including faster shipping, improved last-mile delivery, and broader geographic coverage. This is particularly important in an industry where timely delivery of products can impact patient care. Mergers between medical device companies and logistics providers can lead to streamlined operations. Shared expertise allows for better alignment of production and distribution processes, reducing lead times and costs. Integrated supply chain management can enhance inventory control and minimize wastage, which is critical in managing sensitive medical products.

Collaborating with e-commerce companies allows medical device manufacturers to adopt innovative technologies more rapidly. These partnerships can facilitate the integration of digital tools such as AI-driven demand forecasting, data analytics, and automated warehousing solutions. Such technologies improve efficiency and accuracy in inventory management and order fulfillment. Strategic alliances can also open new market segments for medical device manufacturers. E-commerce platforms provide an avenue to reach smaller healthcare providers and consumers directly, bypassing traditional distribution barriers. This democratization of access not only increases sales opportunities but also enhances patient accessibility to essential medical products.

For instance,

In January 2023, according to an article published by ResearchGate GmbH, the global supply chain is crucial for the development and distribution of medical devices used in diagnosing and treating health conditions. This paper explores how global supply chains affect the medical device industry, focusing on production centers and transportation challenges. It highlights how disruptions—stemming from trade law changes, transportation issues, and geopolitical tensions—lead to shortages and delays. The analysis includes financial impacts, cost structure variables such as raw material prices and labor costs, and the influence of supply chain consolidation on pricing and competition. Finally, it suggests strategies such as localized production and digitization to enhance resilience.

Restraints/Challenges

- Supply Chain Disruptions

Supply chain disruptions pose a significant restraint to the medical device warehouse and logistics market, undermining its efficiency, profitability, and ability to meet rising demand. As the medical device industry relies on the seamless flow of goods, any breakdown in the supply chain can have severe consequences, delaying the delivery of critical products and creating bottlenecks that are difficult to overcome. These disruptions often stem from a range of issues, including geopolitical tensions, global pandemics, natural disasters, and regulatory changes, all of which can affect the sourcing, manufacturing, and distribution of medical devices.

One of the primary challenges is the shortage of raw materials and components essential for the production of medical devices. Many medical device manufacturers source parts and materials from multiple global suppliers. However, when a supplier faces delays due to factors like port closures, transportation delays, or labor shortages, it directly impacts production timelines. This ripple effect slows down the manufacturing process, delaying deliveries to warehouses and, subsequently to healthcare facilities, further straining the logistics chain. This not only increases lead times but also creates backlogs in inventory management. Another critical factor is the complexity of global regulatory compliance. Different countries have varying regulatory frameworks governing the import and export of medical devices. Changes in trade policies, such as new tariffs or restrictions, can disrupt established supply routes and force companies to reconfigure their logistics strategies. This leads to higher operational costs and delays, further hindering market growth.

For instance,

In July 2024, according to an article published by Forbes, the global chip shortage heavily impacted technology and service companies, hindering production and delaying deliveries. The semiconductor supply chain disruptions caused by the pandemic and geopolitical tensions have forced businesses to rethink strategies, with many companies now facing challenges in meeting consumer demand. Many advanced medical devices, such as diagnostic equipment and imaging machines, rely on semiconductors. This global semiconductor shortage that began in 2020 has affected the production and delivery of these medical devices. Manufacturers were unable to meet production deadlines, leading to delays in shipments. Warehouses had to adjust their inventory management systems to cope with uncertain supply schedules, further straining the medical device logistics network.

- Complex Regulatory Requirements for Logistics Providers to Ensure Compliance

The medical device warehouse and logistics market faces significant challenges due to complex regulatory requirements. These regulations are essential for ensuring patient safety and product efficacy, but they also impose substantial burdens on logistics providers. Navigating this intricate landscape can hinder operational efficiency and increase costs.

Regulations require logistics providers to implement rigorous quality control measures. This includes monitoring environmental conditions for sensitive medical devices, such as temperature and humidity. Ensuring compliance with these quality standards adds layers of complexity to logistics operations, requiring investment in technology and training that can strain resources. To comply with regulatory standards, logistics providers must invest in ongoing training for their staff. This is essential to keep employees informed about current regulations, best practices, and compliance procedures. The need for specialized knowledge can result in higher operational costs and may lead to staffing challenges, particularly in regions with a limited pool of trained professionals.

For instance,

In February 2024, according to an article published by AltexSoft, healthcare logistics involves managing the flow of medical supplies, pharmaceuticals, and devices to ensure timely and safe delivery. With strict regulations governing handling, temperature control, and expiration management, efficient logistics is crucial for patient care. Technology plays a key role in addressing these challenges. IoT devices enable real-time monitoring of conditions, while inventory management software automates expiry tracking. Telemetry systems offer precise shipment tracking, and quality management software ensures regulatory compliance. Companies such as Pfizer, Eli Lilly, and Novartis are leveraging advanced technologies to optimize their supply chains and enhance operational efficiency.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research는 시장에 대한 고수준 분석을 제공하고 원자재 부족과 운송 지연의 영향과 현재 시장 환경을 고려하여 정보를 제공합니다. 이는 전략적 가능성을 평가하고, 효과적인 행동 계획을 수립하고, 기업이 중요한 결정을 내리는 데 도움을 주는 것으로 해석됩니다.

표준 보고서 외에도 예상 배송 지연 등의 조달 수준에 대한 심층 분석, 지역별 유통업체 매핑, 상품 분석, 생산 분석, 가격 매핑 추세, 소싱, 카테고리 성과 분석, 공급망 위험 관리 솔루션, 고급 벤치마킹 및 조달 및 전략적 지원을 위한 기타 서비스를 제공합니다.

경제 침체가 제품 가격 및 가용성에 미치는 영향 예상

경제 활동이 둔화되면 산업이 어려움을 겪기 시작합니다. 경기 침체가 제품의 가격 책정 및 접근성에 미치는 예상 효과는 DBMR에서 제공하는 시장 통찰력 보고서 및 인텔리전스 서비스에서 고려됩니다. 이를 통해 고객은 일반적으로 경쟁사보다 한 발 앞서 나가고, 매출과 수익을 예측하고, 손익 지출을 추정할 수 있습니다.

의료 기기 창고 및 물류 시장 범위

시장은 제공, 온도, 운송 수단, 응용 프로그램, 최종 용도 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

제공 사항

- 서비스

- 기호 논리학

- 물류, 유형별

- 비냉장 체인

- 콜드 체인

- 콜드 체인, 온도 유형별

- 온도 조절

- 온도 조절 불가

- 물류, 유형별

- 보관 및 창고

- 저장 및 창고, 장치 유형별

- 진단 장치

- 치료 장치

- 모니터링 장치

- 수술 장비

- 기타 장치

- 보관 및 창고, 유형별

- 현장

- 오프사이트

- 저장 및 창고, 장치 유형별

- 포장

- 패키징, 장치 유형별

- 진단 장치

- 치료 장치

- 모니터링 장치

- 수술 장비

- 기타 장치

- 패키징, 장치 유형별

- 모니터링 서비스

- 기타

- 기호 논리학

- 하드웨어

- RFID 장치

- 바코드

- 사물인터넷 센서

- 기타

- 소프트웨어

- 통합

- 독립형

온도

- 주변환경

- 냉장/냉장

- 언

- 기타

교통수단

- 해상 운송 물류

- 비냉장 체인

- 콜드 체인

- 콜드 체인, 온도 유형별

- 온도 조절

- 온도 조절 불가

- 콜드 체인, 온도 유형별

- 항공화물 물류

- 비냉장 체인

- 콜드 체인

- 콜드 체인, 온도 유형별

- 온도 조절

- 온도 조절 불가

- 콜드 체인, 온도 유형별

- 오버랜드 물류

- 비냉장 체인

- 콜드 체인

- 콜드 체인, 온도 유형별

- 온도 조절

- 온도 조절 불가

- 콜드 체인, 온도 유형별

애플리케이션

- 진단 장치

- 치료 장치

- 모니터링 장치

- 수술 장비

- 기타 장치

최종 사용

- 병원 및 진료소

- 의료 기기 회사

- 학술 및 연구 기관

- 참조 및 진단 연구실

- 응급 의료 서비스 회사

- 기타

유통 채널

- 기존 물류

- 제3자

의료 기기 창고 및 물류 시장 지역 분석

위에 언급된 대로, 제공 품목, 온도, 운송 수단, 응용 분야, 최종 용도, 유통 채널별로 시장을 분석하고 시장 규모에 대한 통찰력과 추세를 제공합니다.

이 시장에서 다루는 국가는 미국, 캐나다, 멕시코, 독일, 영국, 프랑스, 이탈리아, 스페인, 스위스, 네덜란드, 러시아, 벨기에, 핀란드, 덴마크, 폴란드, 노르웨이, 스웨덴, 헝가리, 기타 유럽, 중국, 일본, 인도, 한국, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 뉴질랜드, 베트남, 대만, 기타 아시아 태평양, 브라질, 아르헨티나, 기타 남미, 남아프리카, 사우디 아라비아, UAE, 이스라엘, 이집트, 쿠웨이트, 오만, 바레인, 기타 중동 및 아프리카입니다.

북미 지역이 병원 및 진료소에서 의료 기기에 대한 수요가 증가하고 전 세계적으로 진단 기기 사용이 증가함에 따라 시장을 주도할 것으로 예상됩니다.

아시아 태평양 지역은 의료 기술의 발전과 혁신으로 인해 시장이 성장하고 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 트렌드 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 글로벌 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향은 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

의료기기 창고 및 물류 시장 점유율

시장 경쟁 구도는 경쟁자에 대한 세부 정보를 제공합니다. 포함된 세부 정보는 회사 개요, 회사 재무, 창출된 수익, 시장 잠재력, 연구 개발 투자, 새로운 시장 이니셔티브, 글로벌 입지, 생산 현장 및 시설, 생산 용량, 회사의 강점과 약점, 제품 출시, 제품 폭과 범위, 애플리케이션 우세입니다. 위에 제공된 데이터 포인트는 시장과 관련된 회사의 초점에만 관련이 있습니다.

시장에서 운영되는 의료 기기 창고 및 물류 시장 리더는 다음과 같습니다.

- Deutsche Post AG(독일)

- 페덱스(미국)

- United Parcel Service of America, Inc.(미국)

- Kuehne+Nagel(영국)

- DB SCHENKER(독일)

- 알로가(영국)

- AWL India Private Limited(인도)

- CH 로빈슨 월드와이드, Inc. (미국)

- CAVALIER LOGISTICS(미국)

- CEVA(프랑스)

- 크라운 LSP 그룹(미국)

- 디메르코(대만)

- DSV(덴마크)

- FM 로지스틱(프랑스)

- 한자 인터내셔널(중국)

- Hellmann Worldwide Logistics SE & Co. KG(독일)

- 임페리얼(남아프리카)

- 머큐리 비즈니스 서비스(미국)

- 모비안토(네덜란드)

- 머피 로지스틱스(미국)

- OIA 글로벌(미국)

- 옴니 로지스틱스, LLC (미국)

- puracon Gmbh (독일)

- 레누스 그룹(독일)

- 세코(미국)

- 티바(스페인)

- Toll Holdings Limited(호주)

- 창고 Anywhere (US)

- XPO, Inc. (미국)

의료 기기 창고 및 물류 시장의 최신 동향

- 2023년 11월, DHL Express는 홍콩에 확장된 중앙아시아 허브를 공식적으로 개장하여 글로벌 무역이 성장하는 가운데 역량을 강화하기 위해 5억 6,200만 유로를 투자했습니다. 아시아와 세계를 연결하는 데 중요한 이 허브는 최대 선적 처리 용량을 거의 70% 늘렸으며, 2004년 설립 이래로 6배 더 많은 양을 처리할 수 있습니다. 이 확장은 고객의 성장을 지원하고 홍콩을 주요 국제 항공 허브로 자리매김하려는 DHL의 의지를 강조합니다.

- 2022년 12월, DHL Supply Chain은 북부 대만의 창고 역량을 확장하기 위해 1,093만 달러를 투자한다고 발표했으며, 특히 반도체, 생명 과학 및 의료 분야에 집중했습니다. 새로 오픈한 타오위안 유통 센터-젠궈는 타오위안의 DHL 총 창고 공간에 10,000제곱미터를 추가하여 37,000제곱미터로 늘렸습니다. 이 시설은 효율적인 물류 운영을 위한 연결성을 강화하고 2027년까지 대만의 총 면적을 200,000제곱미터로 늘리겠다는 회사의 목표를 지원합니다.

- 2024년 9월, FedEx는 미국 기업에서 현재 사용할 수 있는 데이터 기반 상거래 솔루션인 fdx 플랫폼을 출시했습니다. 이 플랫폼은 FedEx의 네트워크를 활용하여 수요 증가, 전환율 및 이행 최적화를 개선하여 고객 경험을 향상시킵니다. 주목할 만한 기능으로는 예측 배송 추정, 지속 가능성 통찰력, 브랜드 주문 추적 및 간소화된 반품 프로세스가 있습니다. FedEx CEO인 Raj Subramaniam은 Dreamforce 2024 행사에서 보다 스마트한 공급망에서 플랫폼의 역할을 강조했습니다.

- 2024년 3월 UPS Healthcare는 다양한 운영 시스템의 의료 공급망 데이터를 통합하고 관리하도록 설계된 클라우드 기반 플랫폼인 UPS Supply Chain Symphony R을 출시했습니다. 이 도구는 의료 고객에게 물류에 대한 완전한 가시성을 제공하여 정보에 입각한 의사 결정을 내리고, 계획을 개선하고, 정확하게 예측할 수 있도록 지원합니다. 이 플랫폼은 제어, 효율성 및 투명성을 향상시킴으로써 의료 분야에서 간소화된 공급망에 대한 중요한 필요성을 지원합니다. Kate Gutmann은 글로벌 운영 및 환자 치료를 최적화하는 데 있어 혁신적인 잠재력을 강조했습니다.

- 2024년 9월, 선도적인 물류 공급업체인 Kuehne+Nagel은 토론토에서 불과 50km 떨어진 온타리오주 밀턴에 Medtronic을 위한 새로운 온도 조절형 이행 센터를 열었습니다. 25,000제곱미터 규모의 이 시설은 병원에 의료 기기를 유통하고 Medtronic의 장비에 대한 서비스, 수리 및 예방 유지 관리 센터를 수용할 것입니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.