Time-to-market acceleration is a critical advantage facilitated by semiconductor IP, offering pre-designed and pre-verified functional blocks that seamlessly integrate into custom designs. By leveraging existing IP, designers can sidestep the intricacies of starting from scratch, streamlining the development of intricate semiconductor components. This reduces the design cycle and enables companies to respond to market demands for advanced electronic devices swiftly. The importance lies in staying ahead in the highly competitive technology landscape by swiftly bringing innovative products to market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/north-america-semiconductor-ip-market

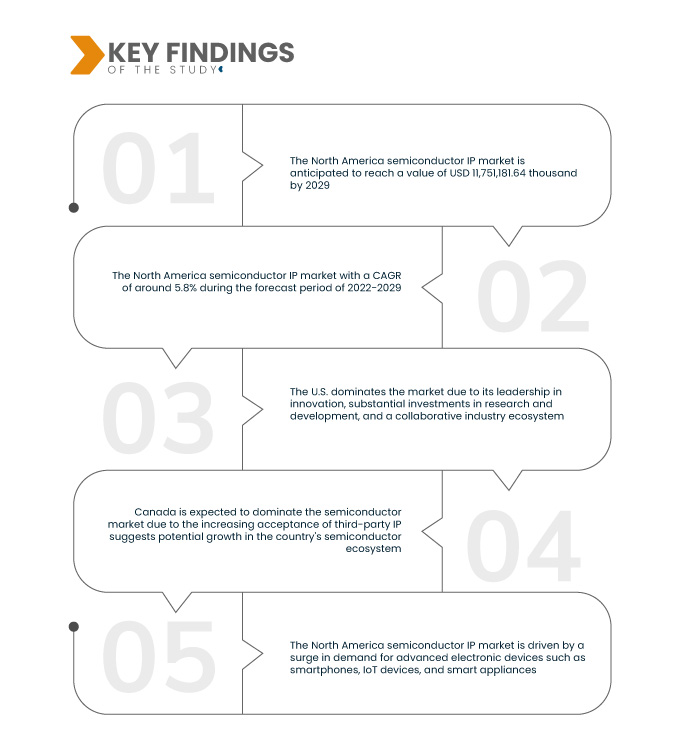

Data Bridge Market Research analyses the North America Semiconductor IP Market is expected to reach the value of USD 1,751,181.64 thousand by 2029, which was USD 1,115,439 thousand in 2021, at a CAGR of 5.8% during the forecast period of 2022-2029. The increasing complexity of semiconductor designs in North America, fueled by the demand for greater functionality and performance in electronic devices, is a key driver for the semiconductor IP market.

Key Findings of the Study

Increasing focus on automotive electronics is expected to drive the market's growth rate

The increasing focus on automotive electronics has emerged as a significant driver for the North America semiconductor IP market. The automotive industry's rapid integration of electronic components, driven by trends such as electric vehicles and advanced driver-assistance systems (ADAS), has elevated the demand for specialized semiconductor IP solutions. These solutions cater to the unique requirements of automotive applications, including safety-critical functionalities and in-vehicle connectivity. As vehicles become more technologically advanced, semiconductor IP providers are responding with innovations tailored to the automotive sector, contributing to the growth and dynamism of the North America semiconductor IP market.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

Quantitative Units

|

Revenue in USD Thousand, Pricing in USD, Volume in Units

|

Segments Covered

|

Type (CPU SIP, Wired SIP, GPU SIP, Memory SIP, DSP SIP, Library SIP, Infrastructure SIP, Digital SIP, Analog SIP, Wireless SIP and Others), Form (Soft Form, Hard Form), IP Source (Licensing, Royalty), Channel (Direct Sources, Internet Catalogue), End User (Automotive, Telecom, Consumer Electronics, Industrial, Defense, Commercial, Medical, Others)

|

Countries Covered

|

U.S., Canada, Mexico in North America

|

Market Players Covered

|

Rambus.com(미국), Dolphin Design SAS(프랑스), Xilinx(미국), Arm Limited(SoftBank Group Corp.의 자회사)(영국), Cadence Design Systems, Inc.(미국), Siemens(독일), eMemory Technology Inc.(대만), Wave Computing, Inc.(미국), Lattice Semiconductor(미국), VeriSilicon(중국), Digital Core Design(폴란드), Dream Chip Technologies GmbH(독일), Achronix Semiconductor Corporation(미국), Faraday Technology Corporation(대만), Synopsys, Inc.(미국), CEVA, Inc.(미국)

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위, 주요 기업 등 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 자세하고 업데이트된 가격 추세 분석, 공급망 및 수요에 대한 부족 분석이 포함됩니다.

|

세그먼트 분석:

북미 반도체 IP 시장은 유형, 형태, IP 출처, 채널 및 최종 사용자를 기준으로 세분화됩니다.

- 북미 반도체 IP 시장은 유형별로 CPU SIP, 유선 SIP, GPU SIP, 메모리 SIP, DSP SIP, 라이브러리 SIP, 인프라 SIP, 디지털 SIP, 아날로그 SIP, 무선 SIP 등으로 구분됩니다.

- 북미 반도체 IP 시장은 형태에 따라 소프트 형태와 하드 형태로 구분됩니다.

- IP 소스를 기준으로 북미 반도체 IP 시장은 라이선싱과 로열티로 구분됩니다.

- 채널 기준으로 북미 반도체 IP 시장은 직접 공급원과 인터넷 카탈로그로 구분됩니다.

- 최종 사용자를 기준으로 북미 반도체 IP 시장은 자동차, 통신, 가전제품, 산업, 방위, 상업, 의료 및 기타로 세분화됩니다.

주요 플레이어

Data Bridge Market Research는 북미 반도체 IP 시장의 주요 기업으로 Rambus.com(미국), Dolphin Design SAS(프랑스), Xilinx(미국), Arm Limited(SoftBank Group Corp.의 자회사)(영국), Cadence Design Systems, Inc.(미국), Siemens(독일), eMemory Technology Inc.(대만), Wave Computing, Inc.(미국)를 꼽았습니다.

시장 개발

- 2023년 5월, CEVA Inc.는 VisiSonicsCorporation으로부터 RealSpace 3D Spatial Audio 사업부, 기술 및 특허 인수를 발표하며 전략적 행보를 보였습니다. 이 인수는 특히 VisiSonics의 공간 오디오 R&D 팀과 소프트웨어를 CEVA의 센서 융합 R&D 개발 센터와 가까운 메릴랜드 소재 CEVA에 통합하는 것을 의미했기 때문에 주목할 만합니다. VisiSonics의 공간 오디오 기능 추가로 CEVA의 임베디드 시스템용 애플리케이션 소프트웨어 포트폴리오가 확장되었습니다. 이러한 움직임은 공간 오디오가 필수적이 된 웨어러블 기기 시장에서 CEVA의 입지를 강화했습니다. 이 전략적 인수는 기술 역량과 시장 입지를 강화함으로써 CEVA의 성장에 기여할 것으로 예상됩니다.

- 2023년 3월, 전자 설계 자동화(EDA) 분야의 선도 기업인 시놉시스(Synopsys)는 Synopsys.ai 제품군이라는 AI 기반 툴셋을 출시했습니다. 이 제품군은 아키텍처부터 제조까지 칩 설계 프로세스 전반을 포괄합니다. Synopsys.ai 제품군은 개발 시간을 크게 단축하고, 비용을 절감하며, 성능을 향상시키고, 수율을 개선할 수 있는 잠재력을 제공함으로써 칩 설계에 혁신을 가져오는 것을 목표로 했습니다. 이 툴셋은 5nm, 3nm, 2nm급 등 첨단 노드를 타겟으로 하는 칩 설계에 특히 유용했습니다. 시놉시스의 혁신적인 접근 방식은 EDA(전자 설계 자동화) 환경을 혁신하고 업계의 효율성과 효과성에 대한 새로운 기준을 제시할 것으로 기대됩니다.

- 2021년 11월, 지멘스는 삼성 파운드리와 협력하여 다양한 IC 설계 솔루션을 개발했습니다. 이 협력은 패키징, 정전기 방전, 집적 회로 등 설계 프로세스의 핵심 측면을 다루었습니다. 삼성 파운드리와의 전략적 파트너십을 통해 지멘스는 매출 성장을 가속화하고 수익을 증대할 수 있는 기반을 마련했습니다. 지멘스와 삼성 파운드리는 서로의 전문 지식을 활용하여 IC 설계 솔루션의 발전에 기여하고 반도체 산업의 혁신을 촉진하고자 했습니다.

- 2021년 4월, Rambus.com과 Lattice Semiconductor는 Rambus의 기술을 보안 솔루션에 활용하기 위한 전략적 협력을 체결했습니다. 이 협력을 통해 새로운 보안 솔루션을 통합하여 Rambus의 제품 기술을 향상시킬 것으로 기대되었습니다. Lattice Semiconductor의 기술 도입을 통해 Rambus는 고객에게 더욱 개선되고 안전한 솔루션을 제공할 수 있게 되었습니다. 이 파트너십은 기술 발전을 선도함으로써 Rambus.com과 Lattice Semiconductor 모두 신규 고객을 유치하고 매출 성장을 가속화하는 것을 목표로 했습니다.

지역 분석

지리적으로 북미 반도체 IP 시장 보고서에서 다루는 국가는 북미의 미국, 캐나다, 멕시코입니다.

Data Bridge Market Research 분석에 따르면:

미국은 2022-2029년 예측 기간 동안 북미 반도체 IP 시장 에서 지배적인 국가입니다 .

미국은 여러 요인이 복합적으로 작용하여 반도체 시장을 장악하고 있습니다. 혁신에 대한 미국의 헌신과 연구 개발에 대한 막대한 투자는 미국 기업들이 기술 선도 기업으로서의 입지를 유지할 수 있도록 해주었습니다. 탄탄한 생태계와 협력적인 환경은 업계의 강점을 더욱 강화합니다. 사물 인터넷(IoT), 5G, 스마트 기술 등의 트렌드로 촉발된 커넥티드 기기에 대한 전 세계적인 수요 증가는 이러한 추세에 중요한 역할을 합니다. 인텔, 엔비디아, 퀄컴, AMD와 같은 거대 기업을 거느린 미국 반도체 기업들은 이러한 수요에 대응할 수 있는 유리한 입지를 갖추고 있으며, 이는 미국의 시장 지배력 강화에 기여하고 있습니다.

캐나다는 2022-2029년 예측 기간 동안 북미 반도체 IP 시장 에서 가장 빠르게 성장하는 국가로 추산됩니다.

캐나다는 제3자 지식재산권(IP)에 대한 수용도가 높아짐에 따라 시장을 주도할 것으로 예상됩니다. 캐나다의 강점은 지식재산권 보호를 위한 탄탄한 법적 체계, 활발한 혁신 생태계, 그리고 연구 개발을 지원하는 정부에 있습니다. 기술 부문이 상당한 성장을 이룬다면 제3자 지식재산권 솔루션에 대한 수요를 촉진할 수 있습니다. 기업 친화적인 정책, 글로벌 협력, 기술에 정통한 인구, 그리고 자금 조달의 용이성은 캐나다의 잠재적 시장 지배력에 더욱 기여할 것입니다.

북미 반도체 IP 시장 보고서 에 대한 자세한 내용을 보려면 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/north-america-semiconductor-ip-market