아라미드 허니콤 코어 소재는 극한의 압력과 힘을 견딜 수 있어 항공우주 및 해양 산업 등 다양한 산업에서 수요가 높습니다. 무게가 가볍고 내열성 페놀 수지로 코팅되어 열적 특성이 우수합니다. 따라서 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장은 가까운 미래에 빠르게 성장할 것으로 예상됩니다.

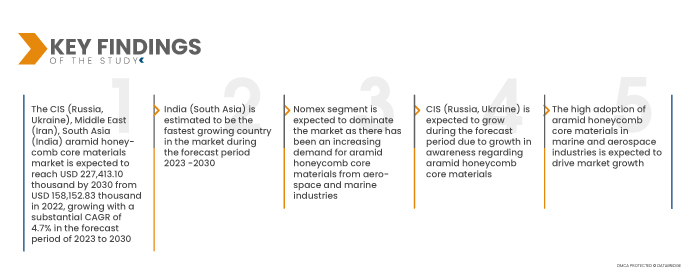

Data Bridge Market Research에 따르면 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장은 2023년부터 2030년까지의 예측 기간 동안 연평균 성장률 4.7%로 성장하여 2030년에는 2억 2,741만 3,100달러에 이를 것으로 예상됩니다. 해양 및 항공우주 산업에서 아라미드 허니콤 코어 소재의 채택이 높기 때문에 시장 성장이 촉진될 것으로 예상됩니다.

항공우주 및 해양 산업에서 아라미드 허니콤 코어 소재의 사용이 증가함에 따라 시장 성장이 촉진될 것으로 예상됩니다.

항공우주 허니콤 코어는 경량, 높은 강도 대 중량비, 감쇠력, 그리고 치수 안정성이 핵심 특성인 다양한 항공우주 응용 분야에 사용되며, 구조, 조종면, 그리고 내부 부품에 사용됩니다. 플라스코어(Plascore)의 통기성 금속 코어는 위성 제작에 이상적입니다. 허니콤의 주요 용도는 구조용입니다. 허니콤 샌드위치 패널은 강성 대 중량비와 강도 대 중량비 측면에서 매우 효율적이기 때문입니다. 경량성이 중요할 때 허니콤 샌드위치 구조는 최고의 선택입니다. 무게 감소는 설계자들에게 항상 어려운 과제였습니다. 노멕스(Nomex)는 뛰어난 강도 대 중량비로 높은 평가를 받으며, 에너지 절감 및 탑재량 증가와 같은 주요 비용 효율적인 이점에 기여합니다. 견고하면서도 가벼운 허니콤 샌드위치는 바닥 패널, 내부 벽, 수납 공간, 외부 조종면, 엔진 나셀, 헬리콥터 블레이드, 테일 붐과 같은 항공기 부품에 단단하고 얇은 노멕스 판 구조를 사용하여 제작됩니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2023년부터 2030년까지

|

기준 연도

|

2022

|

역사적인 해

|

2021 (2015년~2020년까지 맞춤 설정 가능)

|

양적 단위

|

매출(USD 천), 볼륨(세제곱밀리미터 단위), 가격(USD)

|

다루는 세그먼트

|

재료별(노멕스 및 노멕스 외), 아라미드 종류별(메타 아라미드 및 파라 아라미드), 크기별(24인치 * 48인치, 48인치 * 48인치, 48인치 * 96인치 및 기타), 두께별(.060인치, .125인치, .250인치, .500인치 및 기타), 용도별(외장 및 내장), 등급별(항공우주 및 상업용), 유틸리티별(지붕, 문, 바닥, 항공기 날개, 항공 패널, 테일붐, 보트 선체, 보트 객실, 데크, 화물 라이닝, 쉘, 해치, 해군 격벽 접합 패널 및 기타), 하류 용도별(항공, 해양, 도로, 철도 및 기타)

|

포함 국가

|

러시아, 우크라이나, 이란, 인도

|

시장 참여자 포함

|

Hexcel Corporation(미국), EURO-COMPOSITES(룩셈부르크), Showa Aircraft Industry Co., Ltd.(일본), TEIJIN LIMITED(일본), DuPont(미국), Honylite(인도), Godrej(인도), The Gill Corporation(미국), Axxor(네덜란드)

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 참여자와 같은 시장 시나리오에 대한 통찰력 외에도 심층 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석 및 규제 프레임워크가 포함됩니다.

|

세그먼트 분석:

CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장은 소재, 아라미드 유형, 크기, 두께, 응용 분야, 등급, 유용성 및 하위 응용 분야를 기준으로 8개의 주요 세그먼트로 세분화됩니다.

- 시장은 소재 기준으로 노멕스(Nomex)와 노멕스 외 소재로 구분됩니다. 2023년에는 노멕스 부문이 72.95%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년까지 1억 6,650만 4300달러 규모에 도달할 것으로 예상됩니다. 항공우주 및 해양 산업에서 아라미드 허니콤 코어 소재에 대한 수요가 증가함에 따라 2023년부터 2030년까지 연평균 성장률(CAGR) 4.8%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

2023년에는 Nomex 소재 부문이 CIS ( 러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니컴 코어 소재 시장을 장악할 것으로 예상됩니다 .

2023년에는 항공우주 및 해양 산업의 아라미드 허니콤 코어 소재 수요 증가로 노멕스(Nomex) 부문이 시장을 주도할 것으로 예상됩니다. 노멕스 부문은 2023년부터 2030년까지 예측 기간 동안 4.8%의 가장 높은 연평균 성장률(CAGR)을 기록할 것으로 예상됩니다.

- 아라미드 시장은 유형에 따라 메타 아라미드와 파라 아라미드로 구분됩니다. 2023년에는 메타 아라미드 부문이 61.34%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년에는 1억 4,024만 7,740달러에 도달할 것으로 예상됩니다. 2023년부터 2030년까지 예측 기간 동안 연평균 성장률 4.8%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

- 시장은 크기에 따라 48인치 * 96인치, 48인치 * 48인치, 24인치 * 48인치 등으로 세분화됩니다. 2023년에는 48인치 * 96인치 부문이 31.13%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년에는 7,058만 4,910달러에 도달하여 2023년부터 2030년까지 가장 높은 연평균 성장률(CAGR) 4.7%를 기록할 것으로 예상됩니다.

- 두께를 기준으로 시장은 .060인치, .125인치, .250인치, .500인치 등으로 세분화됩니다. 2023년에는 .060인치 부문이 25.49%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년에는 5,782만 6,970달러에 도달할 것으로 예상됩니다. 2023년부터 2030년까지 예측 기간 동안 연평균 성장률 4.7%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

- 시장은 용도에 따라 외장재와 내장재로 구분됩니다. 2023년에는 외장재 부문이 54.18%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년에는 1억 2,410만 4,930달러에 도달할 것으로 예상됩니다. 2023년부터 2030년까지의 예측 기간 동안 연평균 성장률 4.8%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

- 시장은 등급 기준으로 항공우주 및 상업 부문으로 구분됩니다. 2023년에는 항공우주 부문이 71.27%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년에는 1억 6,274만 9,720달러에 도달할 것으로 예상됩니다. 2023년부터 2030년까지 예측 기간 동안 연평균 성장률 4.8%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

- 실용성을 기준으로 시장은 지붕, 문, 바닥, 항공기 날개, 항공 패널, 테일붐, 선체, 선실, 갑판, 화물 라이닝, 외판, 해치, 해군 격벽 연결 패널 등으로 세분화됩니다. 2023년에는 지붕 부문이 15.30%의 시장 점유율로 시장을 주도할 것으로 예상되며, 2030년까지 4,002만 9,790달러에 도달하여 2023년부터 2030년까지의 예측 기간 동안 연평균 성장률 6.6%로 가장 높은 성장률을 기록할 것으로 예상됩니다.

- 하류 적용을 기준으로 시장은 항공, 해상, 도로, 철도 및 기타로 세분화됩니다.

2023년에는 항공 부문이 하류 애플리케이션 부문에서 가장 큰 시장 점유율을 차지할 것으로 예상됩니다.

2023년에는 항공 부문이 72.19%의 시장 점유율로 시장을 지배할 것으로 예상되며, 2030년까지 1억 6,430만 5,320달러에 도달할 것으로 예상되며, 2023년부터 2030년까지의 예측 기간 동안 4.7%의 가장 높은 CAGR로 성장할 것으로 예상됩니다.

주요 플레이어

Data Bridge Market Research에서는 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장의 주요 아라미드 허니콤 코어 소재 시장 주체로 Hexcel Corporation(미국), EURO-COMPOSITES(룩셈부르크), Showa Aircraft Industry Co., Ltd.(일본), TEIJIN LIMITED(일본), DuPont(미국), Honylite(인도), Godrej(인도), The Gill Corporation(미국), Axxor(네덜란드)를 꼽았습니다.

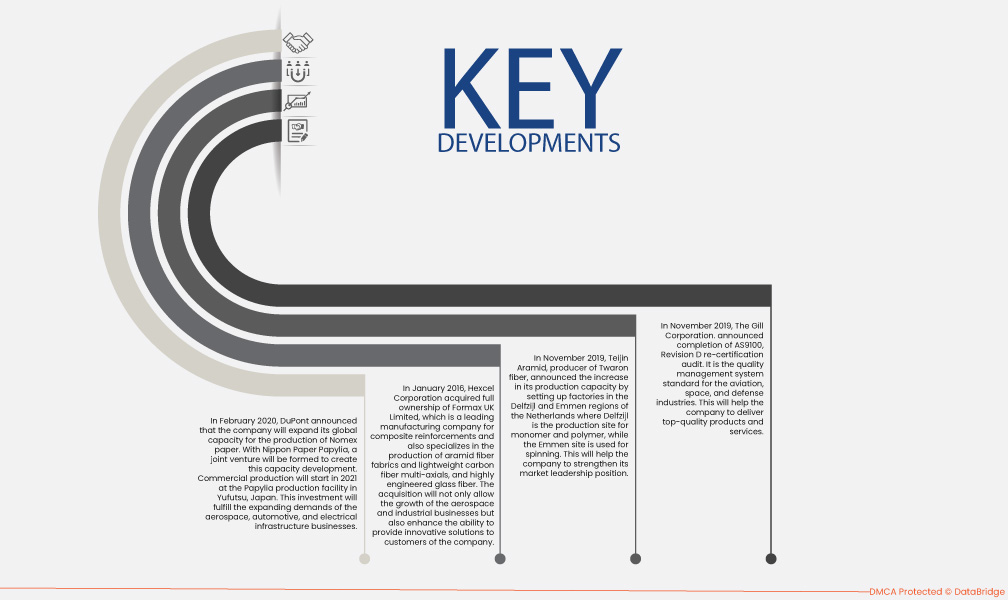

시장 개발

- 2020년 2월, 듀폰은 노멕스(Nomex) 제지 생산을 위한 글로벌 용량 확장 계획을 발표했습니다. 일본 제지(Nippon Paper) 파필리아(Papylia)와 합작법인을 설립하여 이러한 용량 개발을 추진할 예정입니다. 2021년 일본 유후츠(Yufutsu)에 위치한 파필리아 생산 시설에서 상업 생산이 시작될 예정입니다. 이번 투자는 항공우주, 자동차, 전기 인프라 산업의 증가하는 수요를 충족할 것입니다.

- 2016년 1월, Hexcel Corporation은 복합소재 강화재 분야의 선도적인 제조 기업인 Formax UK Limited의 지분을 완전히 인수했습니다. Formax UK Limited는 아라미드 섬유 직물, 경량 탄소 섬유 다축, 그리고 고도로 엔지니어링된 유리 섬유 생산을 전문으로 합니다. 이번 인수는 항공우주 및 산업 분야의 성장을 촉진할 뿐만 아니라, Hexcel Corporation 고객에게 혁신적인 솔루션을 제공할 수 있는 역량을 강화할 것입니다.

- 2019년 11월, 트와론 섬유 생산업체인 테이진 아라미드는 네덜란드 델프지일과 엠멘 지역에 공장을 설립하여 생산 능력을 확대한다고 발표했습니다. 델프지일 지역은 모노머와 폴리머 생산을 담당하고, 엠멘 지역은 방적을 담당합니다. 이를 통해 테이진은 시장 선도적 지위를 더욱 강화할 수 있을 것입니다.

- 2022년 4월, 듀폰은 기후 위기에 대응하기 위해 케블라, 노멕스, 타이벡 등 자사의 신뢰받는 브랜드를 운영에 필수적인 재생에너지를 사용하여 생산할 것이라고 발표했습니다. 이는 2030년 지속가능성 목표의 일환으로 재생에너지 목표 달성과 기후 관리 조치 이행에 대한 듀폰의 의지를 보여줍니다.

- 2021년 4월, Showa Aramid Honeycomb(SAH)는 2021년 2월 16일, AIRBUS의 추가 규격인 AIMS11-01-001(ABS5035) 및 AIMS11-01-005(ABS5676) 인증을 획득했습니다. 이는 회사의 사업 확장에 도움이 될 것입니다.

- 2019년 11월, The Gill Corporation은 AS9100 개정판 D 재인증 심사 완료를 발표했습니다. 이는 항공, 우주 및 방위 산업을 위한 품질 경영 시스템 표준입니다. 이를 통해 The Gill Corporation은 최고 품질의 제품과 서비스를 제공할 수 있게 되었습니다.

지역 분석

지리적으로 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장에 포함된 국가는 러시아, 우크라이나, 이란, 인도입니다.

Data Bridge Market Research 분석에 따르면:

인도(남아시아)는 2023~2030년 예측 기간 동안 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니컴 코어 소재 시장에서 주도적인 국가입니다.

2023년 인도는 항공우주 산업의 성장에 힘입어 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장을 주도할 것입니다. 인도는 시장 점유율과 매출 측면에서 계속해서 시장을 주도할 것이며, 예측 기간 동안에도 그 우위를 더욱 확대할 것입니다. 이는 인도의 해양 및 항공우주 산업 성장에 기인합니다.

인도(남아시아)는 2023-2030년 예측 기간 동안 CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니컴 코어 소재 시장에서 가장 빠르게 성장하는 국가로 추산됩니다.

CIS(러시아, 우크라이나), 중동(이란), 남아시아(인도) 아라미드 허니콤 코어 소재 시장 보고서에 대한 자세한 내용은 여기를 클릭하세요. - https://www.databridgemarketresearch.com/reports/cis-russia-ukraine-middle-east-iran-south-asia-india-aramid-honeycomb-core-materials-market