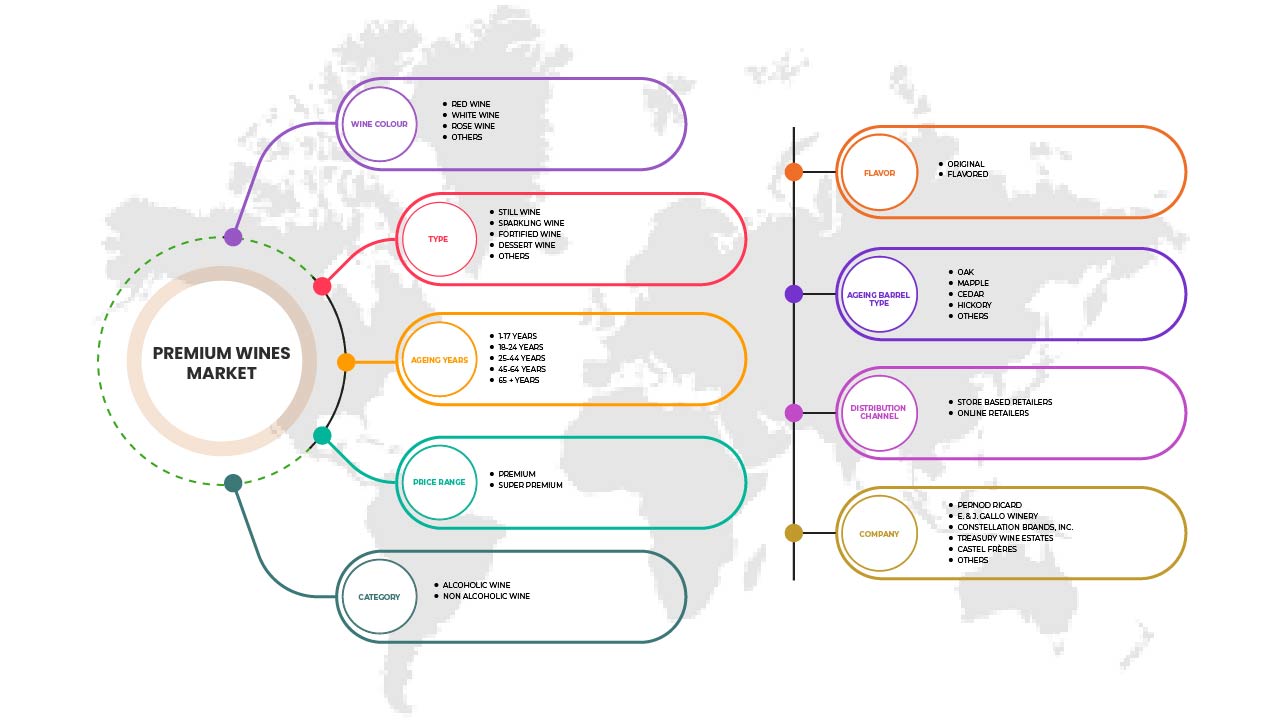

中東およびアフリカの高級ワイン市場、ワインカラー別(赤ワイン、白ワイン、ロゼワイン、その他)、製品タイプ別(スティルワイン、酒精強化ワイン、スパークリングワイン、デザートワイン)、製品カテゴリー別(アルコールワインおよびノンアルコールワイン)、フレーバー別(オリジナルおよびフレーバー付き)、熟成年数別(1~17年、18~24年、25~44年、45~64年および65年以上)、熟成樽タイプ別(オーク、メープル、シダー、ヒッコリー、その他)、価格帯別(プレミアムおよびスーパープレミアム)、流通チャネル別(店舗型小売業者およびオンライン小売業者) - 2029年までの業界動向および予測。

中東およびアフリカの高級ワイン市場の分析と洞察

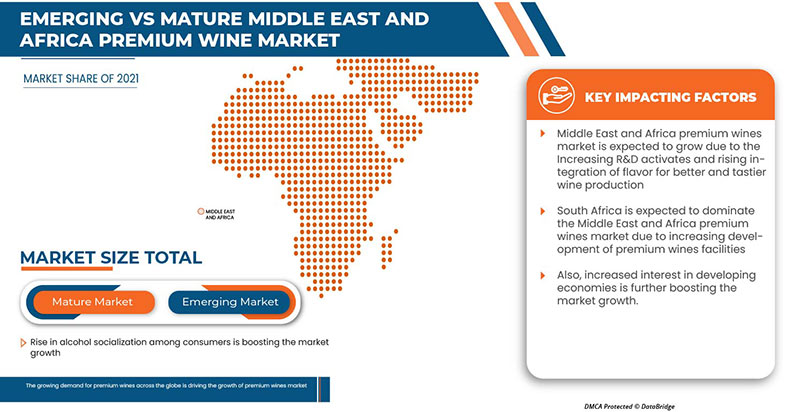

さまざまな健康上の利点によるワインの需要の高まりは、市場全体の成長を後押ししています。eコマース、宅配便、ワイン配達サービスの増加も市場の成長に貢献しています。主要な市場プレーヤーは、さまざまな新しいワインの発売に非常に注力しています。さらに、消費者の間でのアルコールの社交化の増加も、市場の需要の増加に貢献しています。

中東およびアフリカの高級ワイン市場は、市場プレーヤーの増加と市場でのさまざまな高級ワインブランドの入手可能性により、予測年度に成長しています。これに伴い、メーカーは市場でさまざまなワインを生産しています。バーやレストランの増加により、市場の成長がさらに加速しています。ただし、ワイン生産の高コストと、消費者が徐々に他のアルコール飲料に移行していることが、予測期間中の中東およびアフリカの高級ワイン市場の成長を妨げる可能性があります。

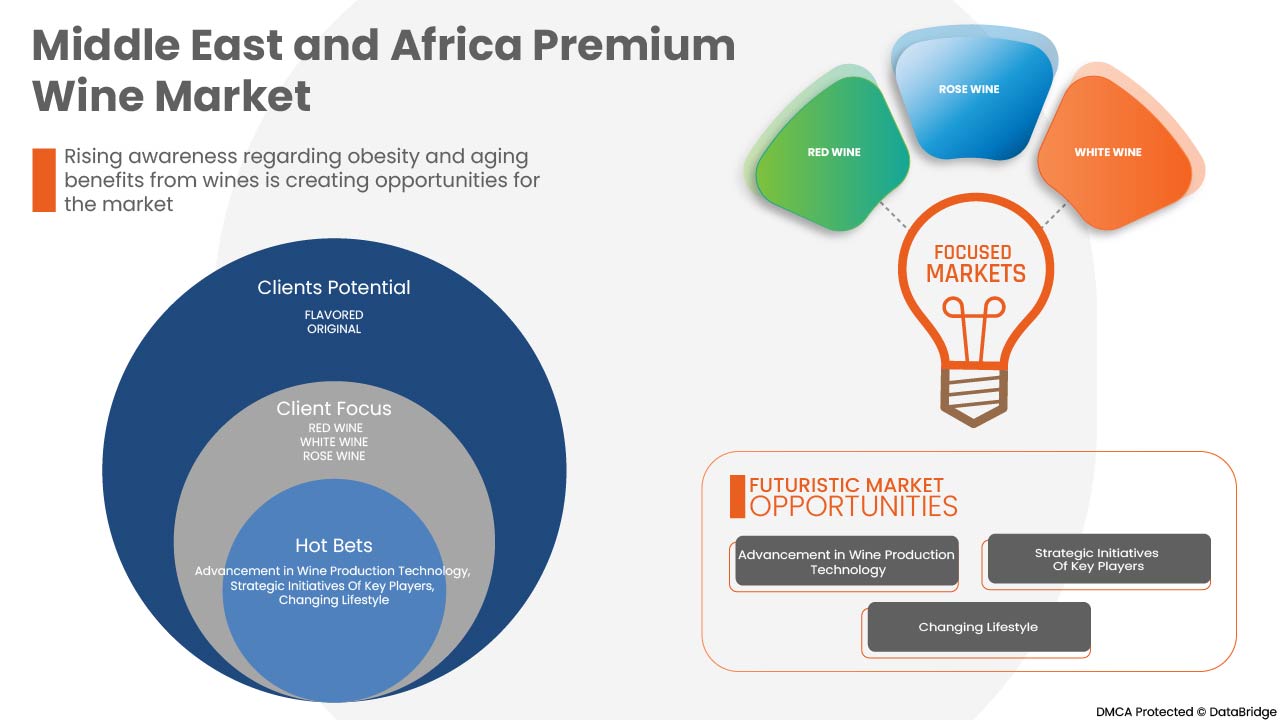

さまざまな健康上の利点、ライフスタイルの変化、市場関係者による戦略的取り組みは、市場にチャンスを与えています。しかし、ワインの過剰消費がさまざまな深刻な病気を妨げていること、消費者の需要を満たすことの難しさや複雑さが、市場の成長にとって重要な課題となっています。

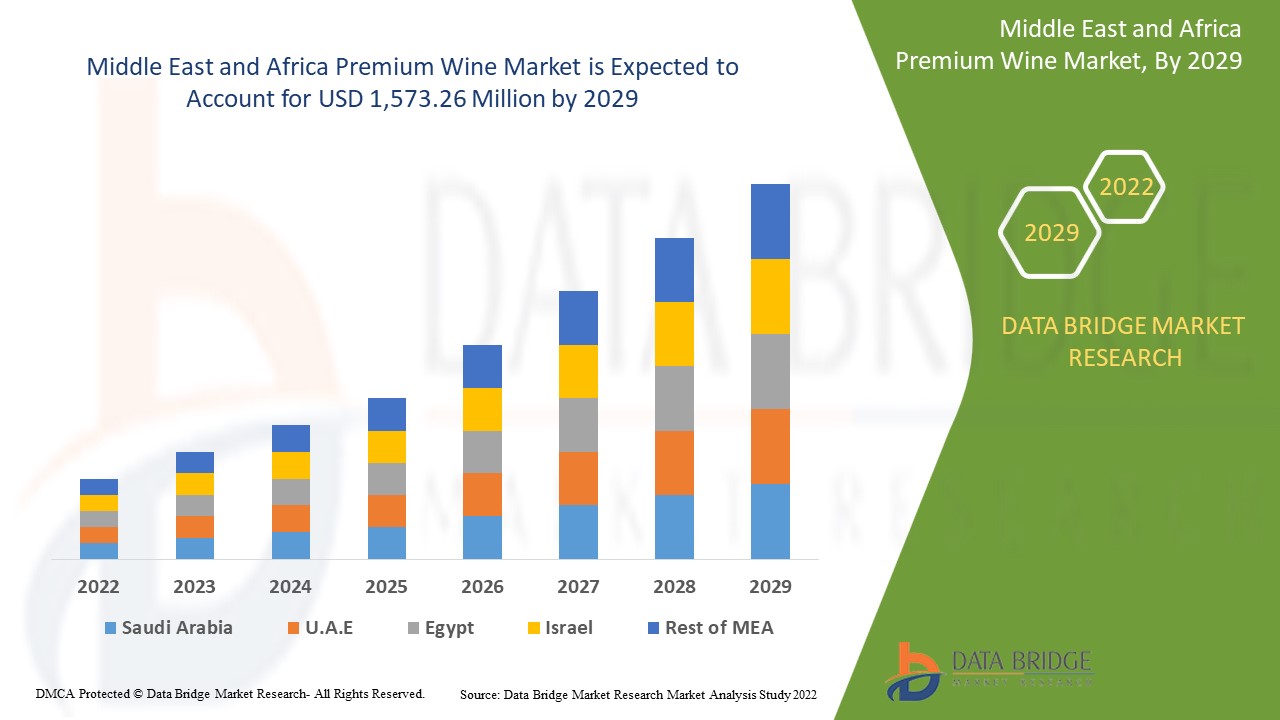

中東およびアフリカの高級ワイン市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に4.6%のCAGRで成長し、2029年までに15億7,326万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

ワインの色 (赤ワイン、白ワイン、ロゼワイン、その他)、製品タイプ (スティルワイン、酒精強化ワイン、スパークリングワイン、デザートワイン)、製品カテゴリー (アルコールワイン、ノンアルコールワイン)、フレーバー (オリジナル、フレーバー付き)、熟成年数 (1~17 年、18~24 年、25~44 年、45~64 年、65 年以上)、熟成樽の種類 (オーク、メープル、シダー、ヒッコリー、その他)、価格帯 (プレミアム、スーパープレミアム)、流通チャネル (店舗型小売業者、オンライン小売業者) |

|

対象国 |

南アフリカ、エチオピア、UAE、その他の中東およびアフリカ |

|

対象となる市場プレーヤー |

この市場で取引を行っている主要企業としては、Vina Concha Y Toro、Treasury Wine Estates、Mount Mary Vineyard、Vins Grands Crus、Sula Vineyards、Moss Wood、Leeuwin Estate、E. & J. Gallo Winery、Constellation Brands、Inc.、Castel Freres、The Wine Group、Accolade Wines、Pernod Ricard、Rockford、Henschke Cellars、Gioconda、Cullen Wines、Bass Philip、Changyu Pioneer Wine Company、Casella、Chateau Cheval Blanc、Miguel Torres SA、Fetzer、GRUPO PENFLOR などがあります。 |

プレミアムワイン市場の定義

ワインは、発酵によって自然にアルコールが生成されるアルコール飲料です。発酵はプロセスの第 1 段階であり、ブドウの皮に生息するバクテリアによって行われます。その後、特定の酵母株を主な発酵産物に加えて、望ましい結果を得ます。ブドウの糖分は、ワインの酵母またはバクテリアによって二酸化炭素とエタノールに変換されます。糖分の多いワインは味が異なり、デザート ワインもその 1 つです。破砕、アルコール発酵、マロラクティック発酵、ワインの澱引き、安定化と熟成、瓶内精製は、ワイン製造にかかわる 6 つの基本的なプロセスです。

高級ワイン市場の動向

ドライバー

- さまざまな健康効果によりワインの需要が増加

過去数年間、ワインのさまざまな健康効果に対する認識が高まったため、ワインの消費量が増加しています。研究者によると、アルコール度数が 12% ~ 15% のワインを毎日適度に摂取すると、さまざまな病気の予防に役立ちます。以下は、ワインの健康効果の一部です。

ワインには抗酸化作用があります。抗酸化物質は炎症や酸化ストレスによる細胞の損傷を防ぐ化合物です。ブドウにはポリフェノールや抗酸化物質が多く含まれており、酸化ストレスや炎症を軽減することが分かっています。

- 電子商取引、宅配便、ワイン配達サービスの増加

電子商取引業界は常に変化しており、私たちの日常生活において重要な役割を果たしています。電子商取引は、人々が望むものをいつでも好きなときに売買できるプラットフォームを提供します。商人は、消費者の変化する需要を満たすために、電子商取引ビジネスの戦略とアプローチを継続的に作成し、改善しています。

電子商取引は、世界中でビジネスのやり方を変えました。この業界の成長の多くは、インターネットとスマートフォンの普及率の増加によって引き起こされました。また、技術の進歩と利用可能なマーケットプレイスの成長により、オンライン ポータルを通じて商品を売買することが容易になりました。商店と配送サービスは、オンライン プラットフォームでの消費者の需要に応え続け、記録的な数の電子商取引に群がっています。

- 消費者のアルコールとの付き合いの増加

ワインの生産と消費はここ数十年で急速に成長し、消費量も増加しています。今日では、社交行事、近代化、西洋文化の受容の高まりなどが、消費者がアルコールと付き合うことを奨励する要素となっており、市場の成長をさらに加速させるでしょう。

アルコール消費は社会的ステータスの象徴となりつつあり、低アルコール飲料市場の成長を支えています。また、その爽快感と低アルコール度数(ABV)の製品により、ミレニアル世代や若者の間で大きな人気を集めています。主にさまざまな機会に関連付けられ、発展途上国では日常の食事とともにテーブルドリンクとして提供されています。

需要の増加により、メーカーは革新的な製品の発売や導入をさらに促進し、今後数年間で市場の成長が促進されることも期待されています。

機会

-

ライフスタイルの変化

人々は、本物の味のために高級ワインを好みます。ワインは、健康に良い成分と悪い成分の両方が含まれているにもかかわらず、パーティーやさまざまな機会に欠かせない社会的地位や一般的なものになっています。さまざまな集団を対象とした疫学調査では、毎日適度な量のワインを飲む習慣のある人は、禁酒または過度の飲酒をする人に比べて、全死亡率、特に心血管疾患による死亡率が大幅に低下することが明らかになっています。

-

バーやラウンジの増加

世界中でレストラン、バー、特別なワインバーが増えているため、高級ワインの需要が高まっています。これらの高級ワインはバーやラウンジで簡単に入手できるため、特別なワインバーの需要も高まっています。認定された高級ワインの年間サブスクリプションを提供するワインバーやラウンジは、人々をより贅沢にさせています。

制約/課題

- ワイン生産コストの上昇

世界中で、ワインの生産コストが上昇しています。ワイン業界は、ガソリン価格の上昇により、商品のコストや輸送コストなど、いくつかの課題に直面しています。特にサプライチェーンの課題とガソリン価格の上昇により、実際のワインボトルは入手困難になっています。コロナ、ガソリン価格の上昇、インフレにより、ワインボトルの入手は容易ではありません。ワイン業界では、2022年にコストが30%増加しました。したがって、ワイン生産コストの上昇が市場の成長を妨げています。

- 消費者が徐々に他のアルコール飲料に移行

The growing modernization and rise in alcohol consumption are ongoing trends across the globe, which has nudged alcohol producers to launch innovative and bold variants in alcoholic beverages. Consumers are gradually shifting preferences towards various alcoholic beverages such as liqueurs, spirits, beer, and others due to their availability at economical prices.

Post COVID-19 Impact on Premium Wine Market

The COVID-19 has negatively affected the market. Lockdowns and isolation during pandemics caused the closure for most of the bars and restaurants and thus, affected the sale of wine. Online wine purchase increased as compared to vendor purchase. Thus COVID-19 affected premium wine market negatively.

Recent Developments

- In June 2022, Pernod Ricard announced the launch of a digital label system to better inform consumers about the products they purchase as well as responsible drinking. This initiative aims to offer consumers an efficient solution to their desire for more transparency on product content and health information. A European pilot program has been launched in July 2022, before being rolled out globally across all brands in the Group’s portfolio by 2024. This has helped company to provide better services to consumers through such innovations in the organization.

- In August 2022, E. & J. Gallo Winery announced that the Gallo is the official Wine Sponsor of the National Football League (NFL). This has helped company to increase their Middle East and Africa presence in the market

Middle East and Africa Premium Wine Market Scope

Middle East and Africa premium wine market is segmented into wine colour, product type, product category, ageing barrel type, by price range, distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Wine Colour

- Red Wine

- White Wine

- Rose Wine

- Others

On the basis of wine colour, the Middle East and Africa premium wine market is segmented into red wine, white wine, rose wine and others.

Product Type

- Still Wine

- Sparkling Wine

- Fortified Wine and

- Dessert Wine

Based on product type, the Middle East and Africa premium wine market is segmented into still wine, sparkling wine, fortified wine and dessert wine.

Product Category

- Alcoholic Wine

- Non-Alcoholic Wine

Based on product category, the Middle East and Africa premium wine market is segmented into alcoholic wine and non-alcoholic wine.

Flavour

- Original

- Flavored

Based on flavour, the Middle East and Africa premium wine market is segmented into original and flavoured.

Aging Years

- 1-7 Years

- 18-24 Years

- 25-44 Years

- 45-64 Years

- 65+ Years

Based on aging years, the Middle East and Africa premium wine market is segmented into 1-7 years, 18-24 years, 25-44 years, 45-64 years and 65+ years.

Ageing Barrel Type

- Oak

- Maple

- Cedar

- Hickory

- Others

Based on barrel type, the Middle East and Africa premium wine market is segmented into oak, maple, cedar, hickory and others.

By Price Range

- Premium

- Super Premium

Based on price range, the Middle East and Africa premium wine market is segmented into premium and super premium.

Distribution Channel

- Store Based Retailers

- Online Retailers

Based on distribution channel, the Middle East and Africa premium wine market is segmented into store based retailers and online retailers.

Premium Wine Market Regional Analysis/Insights

The premium wine market is analysed and market size insights and trends are provided by country, wine colour, product type, product category, ageing barrel type, by price range, distribution channel.

The countries in the premium wine market are South Africa, Ethiopia, U.A.E, Rest of Middle East and Africa.

South Africa dominates the premium wine marketing terms of market share and market revenue and will continue to flourish its dominance during the forecast period.

The South Africa premium wine market is expected to grow due to a rise in wine consumption with meals, consumption of premium wine at social gatherings and celebrations, an increase in consumer preference for premium wines, Increase in options to customize the flavor, color, and packaging of premium wine are expected to drive the regional market in the forecasted period.

The rapid technological advancements and perfection in traditional art of wine making are increasing the demand for premium wine. The growing population of alcohol consuming adults is further fuelling the market growth. Moreover, the different packaging options of premium wine, along with its customization, online availability, presence of major market players in the region, and high living standards, are also boosting the market's growth.

Competitive Landscape and Premium Wine Market Share Analysis

The premium wine market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on premium wine market.

Some of the major players operating in the premium wine market are Vina Concha Y Toro, Treasury Wine Estates, Mount Mary Vineyard, Vins Grands Crus, Sula Vineyards, Moss Wood, Leeuwin Estate, E. & J. Gallo Winery, Constellation Brands, Inc., Castel Freres, The Wine Group, Accolade Wines, Pernod Ricard, Rockford, Henschke Cellars, Gioconda, Cullen Wines, Bass Philip, Changyu Pioneer Wine Company, Casella, Chateau Cheval Blanc, Miguel Torres S.A., Fetzer, GRUPO PENFLOR and among others.

Research Methodology

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、中東およびアフリカと地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PREMIUM WINE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 WINE COLOUR LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET WINE COLOUR COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT EXPORT ANALYSIS

4.2 INDUSTRY TRENDS AND FUTURE PERSPECTIVES

4.3 REGULATORY FRAMEWORK AND GUIDELINES

4.3.1 ADVERTISING & PROMOTIONS –

4.4 TAXATION AND DUTY LEVIES

4.5 COMPARATIVE ANALYSIS OF TYPES OF WINE

4.6 DEMOGRAPHIC PREFERENCES

4.7 BRAND COMPETITIVE ANALYSIS

5 PRICING INDEX

6 PRODUCTION CAPACITY OF KEY MANUFACTURERS

7 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: REGULATIONS

8 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON SUPPLY CHAIN

8.3 IMPACT ON SHIPMENT

8.4 IMPACT ON COMPANY'S STRATEGIC DECISIONS

9 BRAND OUTLOOK –

9.1 COMPARATIVE BRAND ANALYSIS

9.2 PRODUCT VS BRAND OVERVIEW –

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 GROWING DEMAND FOR WINE OWING TO DIFFERENT HEALTH BENEFITS

10.1.2 RISING E-COMMERCE, COURIER, AND WINE DELIVERY SERVICES

10.1.3 RISE IN ALCOHOL SOCIALIZATION AMONG CONSUMERS

10.2 RESTRAINTS

10.2.1 INCREASED COST OF WINE PRODUCTION

10.2.2 GRADUAL SHIFT OF CONSUMERS TOWARD OTHER ALCOHOLIC BEVERAGES

10.3 OPPORTUNITIES

10.3.1 CHANGING LIFESTYLE

10.3.2 INCREASING NUMBER OF BARS AND LOUNGES

10.3.3 RISING AWARENESS REGARDING OBESITY AND AGING BENEFITS FROM WINES

10.4 CHALLENGES

10.4.1 HIGH CONSUMPTION LEADING SEVERE HEALTH PROBLEMS

10.4.2 LABOUR-INTENSIVE AND TIME-CONSUMING

11 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY WINE COLOR

11.1 OVERVIEW

11.2 RED WINE

11.2.1 FULL-BODIED

11.2.2 MEDIUM-BODIED

11.2.3 LIGHT-BODIED

11.3 WHITE WINE

11.4 ROSE WINE

11.5 OTHERS

12 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRODUCT TYPE

12.1 OVERVIEW

12.2 STILL WINE

12.3 SPARKLING WINE

12.4 FORTIFIED WINE

12.5 DESSERT WINE

12.5.1 LIGHT SWEET

12.5.2 RICHLY SWEET

12.5.3 SWEET RED WINE

13 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY

13.1 OVERVIEW

13.2 ALCOHOLIC

13.3 NON-ALCOHOLIC

13.3.1 0.5% ABV

13.3.2 MORE THAN 0.05% ABV

13.3.3 0.05% ABV

13.3.4 LESS THAN 0.05% ABV

14 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY FLAVOR

14.1 OVERVIEW

14.2 FLAVORED

14.2.1 FRUITS

14.2.1.1 CHERRY

14.2.1.2 PEACH

14.2.1.3 LEMON

14.2.1.4 GREEN APPLE

14.2.1.5 ORANGE

14.2.1.6 POMOGRANATE

14.2.1.7 MELON

14.2.1.8 FIG

14.2.1.9 MANGO

14.2.1.10 PINEAPPLE

14.2.1.11 OTHERS

14.2.2 BERRY

14.2.2.1 CRANBERRIES

14.2.2.2 BLUEBERRY

14.2.2.3 RASPBERRY

14.2.2.4 STRAWBERRY

14.2.2.5 OTHERS

14.2.3 FLORAL

14.2.3.1 ROSE

14.2.3.2 HIBISCUS

14.2.3.3 OTHERS

14.2.4 HERBAL

14.2.4.1 SMOKED TOBACCO

14.2.4.2 TRUFFLE

14.2.4.3 OTHERS

14.2.5 SPICES

14.2.5.1 CINNAMON

14.2.5.2 NUTMEG

14.2.5.3 PEPPER

14.2.5.4 GINGER

14.2.5.5 CLOVES

14.2.5.6 OTHERS

14.2.6 CHOCOLATE

14.2.7 MAPLE

14.2.8 HONEY

14.2.9 VANILLA

14.2.10 CARAMEL

14.3 ORIGINAL

15 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY AGEING YEARS

15.1 OVERVIEW

15.2 1-17 YEARS

15.3 18-24 YEARS

15.4 25-44 YEARS

15.5 45-64 YEARS

15.6 65+ YEARS

16 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE

16.1 OVERVIEW

16.2 OAK

16.3 HICKORY

16.4 MAPLE

16.5 CEDAR

16.6 OTHERS

17 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRICE RANGE

17.1 OVERVIEW

17.2 PREMIUM

17.3 SUPER PREMIUM

18 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL

18.1 OVERVIEW

18.2 STORE BASED RETAILERS

18.2.1 LIQUOR STORES

18.2.2 CONVENIENCE STORE

18.2.3 SUPERMARKETS/HYPERMARKETS

18.2.4 WHOLESALERS

18.2.5 SPECIALITY STORES

18.2.6 GROCERY STORES

18.2.7 OTHERS

18.3 ONLINE RETAILERS

19 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY REGION

19.1 MIDDLE EAST AND AFRICA

19.1.1 SOUTH AFRICA

19.1.2 ETHIOPIA

19.1.3 UAE

19.1.4 REST OF MIDDLE EAST AND AFRICA

20 COMPANY LANDSCAPE

20.1 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: COMPANY LANDSCAPE

20.1.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

21 SWOT ANALYSIS

22 COMPANY PROFILE

22.1 PERNOD RICARD

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 COMPANY SHARE ANALYSIS

22.1.4 PRODUCT PORTFOLIO

22.1.5 RECENT DEVELOPMENT

22.2 E. & J. GALLO WINERY

22.2.1 COMPANY SNAPSHOT

22.2.2 COMPANY SHARE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT DEVELOPMENTS

22.3 CONSTELLATION BRANDS, INC.

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 COMPANY SHARE ANALYSIS

22.3.4 PRODUCT PORTFOLIO

22.3.5 RECENT DEVELOPMENTS

22.4 TREASURY WINE ESTATES

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 COMPANY SHARE ANALYSIS

22.4.4 PRODUCT PORTFOLIO

22.4.5 RECENT DEVELOPMENTS

22.5 CASTEL FRÈRES

22.5.1 COMPANY SNAPSHOT

22.5.2 PRODUCT PORTFOLIO

22.5.3 RECENT DEVELOPMENTS

22.6 ACCOLADE WINES

22.6.1 COMPANY SNAPSHOT

22.6.2 PRODUCT PORTFOLIO

22.6.3 RECENT DEVELOPMENTS

22.7 BASS PHILLIP WINES

22.7.1 COMPANY SNAPSHOT

22.7.2 PRODUCT PORTFOLIO

22.7.3 RECENT DEVELOPMENT

22.8 CASELLA

22.8.1 COMPANY SNAPSHOT

22.8.2 PRODUCT PORTFOLIO

22.8.3 RECENT DEVELOPMENT

22.9 CHANGYU

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUS ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT DEVELOPMENT

22.1 CHATEAU CHEVAL BLANC

22.10.1 COMPANY SNAPSHOT

22.10.2 PRODUCT PORTFOLIO

22.10.3 RECENT DEVELOPMENTS

22.11 CULLEN WINES

22.11.1 COMPANY SNAPSHOT

22.11.2 PRODUCT PORTFOLIO

22.11.3 RECENT DEVELOPMENTS

22.12 FETZER

22.12.1 COMPANY SNAPSHOT

22.12.2 PRODUCT PORTFOLIO

22.12.3 RECENT DEVELOPMENTS

22.13 GIACONDA MARKETING PTY. LTD.

22.13.1 COMPANY SNAPSHOT

22.13.2 PRODUCT PORTFOLIO

22.13.3 RECENT DEVELOPMENTS

22.14 GRUPO PEÑAFLOR

22.14.1 COMPANY SNAPSHOT

22.14.2 PRODUCT PORTFOLIO

22.14.3 RECENT DEVELOPMENTS

22.15 HENSCHKE

22.15.1 COMPANY SNAPSHOT

22.15.2 PRODUCT PORTFOLIO

22.15.3 RECENT DEVELOPMENTS

22.16 LEEUWIN ESTATE

22.16.1 COMPANY SNAPSHOT

22.16.2 PRODUCT PORTFOLIO

22.16.3 RECENT DEVELOPMENT

22.17 MIGUEL TORRES S.A

22.17.1 COMPANY SNAPSHOT

22.17.2 PRODUCT PORTFOLIO

22.17.3 RECENT DEVELOPMENTS

22.18 MOSS WOOD

22.18.1 COMANY SNAPSHOT

22.18.2 PRODUCT PORTFOLIO

22.18.3 RECENT DEVELOPMENT

22.19 MOUNT MARY VINEYARD

22.19.1 COMPANY SNAPSHOT

22.19.2 PRODUCT PORTFOLIO

22.19.3 RECENT DEVELOPMENTS

22.2 ROCKFORD

22.20.1 COMPANY SNAPSHOT

22.20.2 PRODUCT PORTFOLIO

22.20.3 RECENT DEVELOPMENTS

22.21 SULA VINEYARDS PVT. LTD.

22.21.1 COMPANY SNAPSHOT

22.21.2 PRODUCT PORTFOLIO

22.21.3 RECENT DEVELOPMENT

22.22 THE WINE GROUP

22.22.1 COMPANY SNAPSHOT

22.22.2 PRODUCT PORTFOLIO

22.22.3 RECENT DEVELOPMENTS

22.23 VINA CONCHA Y TORO

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT DEVELOPMENT

22.24 VINS GRAND CRUS

22.24.1 COMPANY SNAPSHOT

22.24.2 PRODUCT PORTFOLIO

22.24.3 RECENT DEVELOPMENTS

23 QUESTIONNAIRE

24 RELATED REPORTS

表のリスト

TABLE 1 BELOW ARE THE MOST COMMON RED WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 2 BELOW ARE THE MOST COMMON WHITE WINE TYPES BY AROMA, BODY, AND SWEETNESS:

TABLE 3 BELOW IS THE TABULAR REPRESENTATION OF THE OVERALL TOTAL CONSUMPTION OF WINE IN DIFFERENT COUNTRIES :

TABLE 4 THE PRICES OF THESE WINES VARY FROM REGION TO REGION. BELOW ARE THE PRICES OF SOME OF THE MOST POPULAR RED WINES ACROSS THE GLOBE.

TABLE 5 BELOW ARE THE PRICES OF SOME OF THE WORLD’S BEST WHITE WINES ACROSS THE GLOBE.

TABLE 6 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA RED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RED WINE IN PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA WHITE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA ROSE WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA STILL WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SPARKLING WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA FORTIFIED WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA DESSERT WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA NON-ALCOHOLIC IN PREMIUM WINE MARKET, BY ABV %, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA FLAVORED IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA FRUITS IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA ORIGINAL IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY AGEING, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA 1-17 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA 18-24 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA 25-44 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA 45-64 YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA 65+ YEARS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OAK IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA HICKORY IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA MAPLE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA CEDAR IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA OTHERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA SUPER PREMIUM WINE IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA ONLINE RETAILERS IN PREMIUM WINE MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 57 MIDDLE EAST AND AFRICA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 59 MIDDLE EAST AND AFRICA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 60 MIDDLE EAST AND AFRICA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 61 MIDDLE EAST AND AFRICA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 62 MIDDLE EAST AND AFRICA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 64 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 65 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 66 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 MIDDLE EAST AND AFRICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 SOUTH AFRICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SOUTH AFRICA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SOUTH AFRICA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 SOUTH AFRICA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 73 SOUTH AFRICA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 74 SOUTH AFRICA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 75 SOUTH AFRICA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 76 SOUTH AFRICA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 77 SOUTH AFRICA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 78 SOUTH AFRICA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 79 SOUTH AFRICA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 80 SOUTH AFRICA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 SOUTH AFRICA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 82 SOUTH AFRICA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 83 SOUTH AFRICA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH AFRICA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 SOUTH AFRICA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 ETHIOPIA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 87 ETHIOPIA RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ETHIOPIA PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 ETHIOPIA DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 ETHIOPIA PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 91 ETHIOPIA NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 92 ETHIOPIA PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 93 ETHIOPIA FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 94 ETHIOPIA FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 95 ETHIOPIA BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 96 ETHIOPIA FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 97 ETHIOPIA HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 98 ETHIOPIA SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 99 ETHIOPIA PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 100 ETHIOPIA PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 101 ETHIOPIA PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 102 ETHIOPIA PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 ETHIOPIA STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 U.A.E PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

TABLE 105 U.A.E RED WINE IN PREMIUM WINE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 U.A.E PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 U.A.E DESSERT WINE IN PREMIUM WINE MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.A.E PREMIUM WINE MARKET, BY PRODUCT CATEGORY, 2020-2029 (USD MILLION)

TABLE 109 U.A.E NON-ALCOHOLIC WINE IN PREMIUM WINE MARKET, BY ABV % , 2020-2029 (USD MILLION)

TABLE 110 U.A.E PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 111 U.A.E FLAVORED WINES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 112 U.A.E FRUIT IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 113 U.A.E BERRY IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 114 U.A.E FLORAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 115 U.A.E HERBAL IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 116 U.A.E SPICES IN PREMIUM WINE MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 117 U.A.E PREMIUM WINE MARKET, BY AGEING YEARS, 2020-2029 (USD MILLION)

TABLE 118 U.A.E PREMIUM WINE MARKET, BY AGEING BARREL TYPE, 2020-2029 (USD MILLION)

TABLE 119 U.A.E PREMIUM WINE MARKET, BY PRICE RANGE, 2020-2029 (USD MILLION)

TABLE 120 U.A.E PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 121 U.A.E STORE BASED RETAILERS IN PREMIUM WINE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 122 REST OF MIDDLE EAST AND AFRICA PREMIUM WINE MARKET, BY WINE COLOR, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: MARKET WINE COLOUR COVERAGE GRID

FIGURE 9 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: SEGMENTATION

FIGURE 11 THE GROWING DEMAND OF WINE OWING TO DIFFERENT HEALTH BENEFITS AND RISING E-COMMERCE, COURIER AND WINE DELIVERY SERVICES ARE EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PREMIUM WINE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 RED WINE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PREMIUM WINE MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA PREMIUM WINE MARKET

FIGURE 14 THE FOLLOWING GRAPH SHOWCASES THE INCREASE IN THE CONSUMPTION OF WINE IN THE U.S.

FIGURE 15 TOP FIVE LARGEST E-COMMERCE MARKETS IN 2019 (USD BILLION)

FIGURE 16 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY WINE COLOR, 2021

FIGURE 17 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY WINE COLOR, 2022-2029 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY WINE COLOR, CAGR (2022-2029)

FIGURE 19 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY WINE COLOR, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 23 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2021

FIGURE 25 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, 2022-2029 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, CAGR (2022-2029)

FIGURE 27 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRODUCT CATEGORY, LIFELINE CURVE

FIGURE 28 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY FLAVOR, 2021

FIGURE 29 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY FLAVOR, 2022-2029 (USD MILLION)

FIGURE 30 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY FLAVOR, CAGR (2022-2029)

FIGURE 31 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY FLAVOR, LIFELINE CURVE

FIGURE 32 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING YEARS, 2021

FIGURE 33 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING YEARS, 2022-2029 (USD MILLION)

FIGURE 34 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING YEARS, CAGR (2022-2029)

FIGURE 35 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING YEARS, LIFELINE CURVE

FIGURE 36 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2021

FIGURE 37 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, 2022-2029 (USD MILLION)

FIGURE 38 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, CAGR (2022-2029)

FIGURE 39 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY AGEING BARREL TYPE, LIFELINE CURVE

FIGURE 40 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRICE RANGE, 2021

FIGURE 41 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRICE RANGE, 2022-2029 (USD MILLION)

FIGURE 42 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRICE RANGE, CAGR (2022-2029)

FIGURE 43 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY PRICE RANGE, LIFELINE

FIGURE 44 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 45 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 46 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 47 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: BY DISTRIBUTION CHANNEL, LIFELINE

FIGURE 48 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET: SNAPSHOT (2021)

FIGURE 49 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET: BY COUNTRY (2021)

FIGURE 50 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 51 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 52 MIDDLE EAST AND AFRICA PREMIUM WINE MARKET: WINE COLOR (2022-2029)

FIGURE 53 MIDDLE EAST & AFRICA PREMIUM WINE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。