世界のがん診断市場の規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

110.11 Billion

USD

199.32 Billion

2024

2032

USD

110.11 Billion

USD

199.32 Billion

2024

2032

| 2025 –2032 | |

| USD 110.11 Billion | |

| USD 199.32 Billion | |

|

|

|

|

世界のがん診断市場のセグメンテーション、製品(消耗品、機器)、技術(体外診断検査、画像診断、生検技術)、タイプ(画像診断検査、バイオマーカー検査、体外診断検査、生検、その他)、用途(肺がん、乳がん、大腸がん、黒色腫がん、前立腺がん、肝臓がん、その他)、エンドユーザー(診断センター、病院・診療所、研究機関、その他) - 2032年までの業界動向と予測

がん診断市場規模

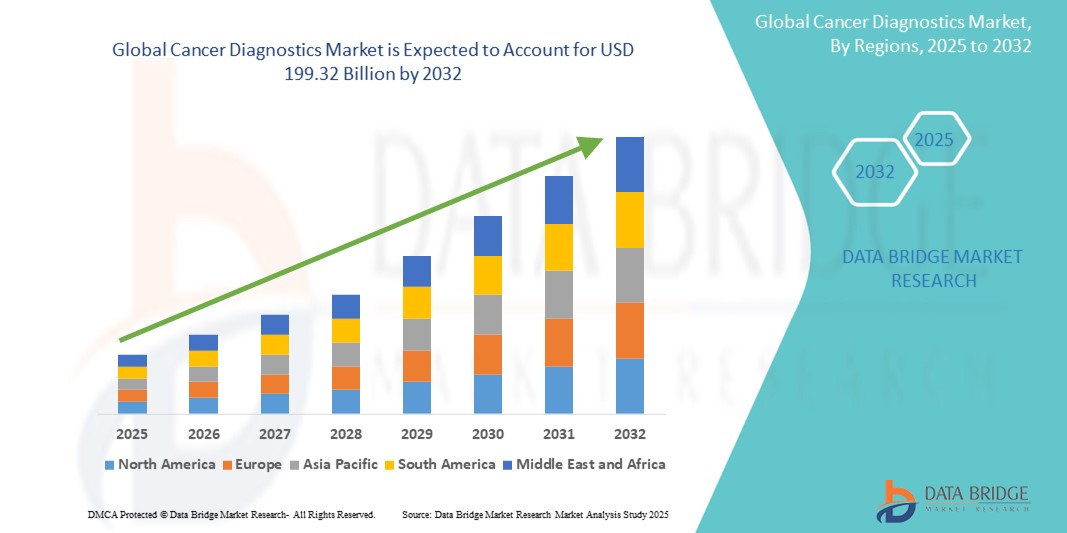

- 世界のがん診断市場規模は2024年に1101億1000万米ドル と評価され、予測期間中に7.70%のCAGRで成長し、2032年には1993億2000万米ドルに達すると予想されています。

- この成長は、世界的ながん負担の増加、がんの早期発見に対する意識の高まり、液体生検やAIを活用した画像診断などの診断技術の進歩などの要因によって推進されている。

がん診断市場分析

- がん診断ツールは、画像診断、生検、腫瘍マーカー、分子診断などの方法を活用し、さまざまな種類のがんの早期発見、診断、モニタリングに不可欠です。

- がん診断の需要は、世界的ながん発症率の増加、早期発見の利点に関する認識の高まり、診断方法の技術的進歩によって大きく推進されている。

- 北米は、確立された医療インフラ、高い癌罹患率、研究開発への多額の投資により、癌診断市場において最大の市場シェア41.18%を占めると予想されています。

- アジア太平洋地域は、高齢化の進行、医療費の増加、診断サービスへのアクセスの拡大により、予測期間中にがん診断市場で最も急速に成長する地域になると予想されています。

- COVID-19パンデミックによる検査需要の増加に伴い、体外診断検査(IVD)の導入が拡大し、体外診断検査分野が52.1%という最大の市場シェアを占めると予想されています。病院や検査室向けに、正確で効率的、かつエラーのない診断を提供する自動化IVDシステムの開発が、市場の成長を牽引すると期待されています。

レポートの範囲とがん診断市場のセグメンテーション

|

属性 |

がん診断の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

ヨーロッパ

アジア太平洋

中東およびアフリカ

南アメリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。 |

がん診断市場の動向

「AI、リキッドバイオプシー、多発がん性早期発見(MCED)の台頭がゲームチェンジャーとなるトレンド」

- 世界のがん診断市場における顕著なトレンドの一つは、人工知能(AI)、液体生検、多発がん性早期発見(MCED)技術が主流の診断実践に急速に統合されていることだ。

- これらのイノベーションは、単一のサンプルから複数の癌種をより早く、より正確に、より低侵襲に検出できるようにすることで、診断の状況を一変させています。

- 例えば、液体生検プラットフォームは血液中の循環腫瘍DNA(ctDNA)を検出し、外科的生検を必要とせずに腫瘍の変異に関するリアルタイムの洞察を提供する一方、AIを搭載した画像ツールは放射線学や病理学における診断精度を向上させている。

- これらの傾向は、個別化医療への移行を促進し、臨床意思決定を改善し、特に無症状の集団における大規模な癌スクリーニングの可能性を拡大しています。

がん診断市場の動向

ドライバ

「がんの負担増加と早期発見の必要性」

- 高齢化、ライフスタイルの変化、環境要因により、がんの世界的な負担は増大しており、高度ながん診断ツールの需要が大幅に増加しています。

- がんは世界中で依然として主要な死亡原因であるため、早期発見は公衆衛生上の重要な優先事項となり、政府や医療提供者はスクリーニングと診断のインフラに多額の投資をしています。

- 分子検査、画像診断、次世代シークエンシングなどの革新的な診断法の利用により、治療可能な段階で癌を特定することで早期介入が可能になり、生存率が向上します。

例えば、

- 世界保健機関(WHO)によると、2022年には世界で2000万人が新たにがんに罹患し、1000万人ががん関連で死亡すると推定されており、今後数十年間で罹患率が急増すると予測されている。

- がん罹患率の上昇と早期診断の利点の認識の結果、正確で迅速かつ拡張可能ながん診断ソリューションに対する世界的な需要が大幅に増加しています。

機会

「新興国におけるがん検診プログラムの拡大」

- 急速な都市化、医療投資の増加、そして意識の向上により、低・中所得国における組織的ながん検診プログラムの拡大が促進されている。

- 政府や保健機関は、乳がん、子宮頸がん、大腸がんなどの負担の大きいがんの早期発見を目的とした取り組みを開始しており、手頃な価格で拡張可能な診断技術への大きな需要を生み出しています。

- さらに、携帯型診断機器や遠隔医療ソリューションの利用可能性により、農村部やサービスが行き届いていない地域での検査サービスの提供が容易になっている。

例えば、

- 2023年10月、世界保健機関(WHO)は、早期発見と適切な時期の診断の改善を通じて世界の乳がん死亡率を低下させることを目的とした世界乳がんイニシアチブを立ち上げ、特に低所得国と中所得国への支援に重点を置いています。

- がん関連死亡を減らすための世界的な取り組みが強化される中、新興市場は診断会社にとって、費用対効果が高く、アクセスしやすく、革新的ながん検出ソリューションを導入するための大きな成長機会を提供している。

抑制/挑戦

「高度な診断技術の高コストとアクセスの制限」

- 分子検査、次世代シークエンシング(NGS)、PET/CT画像などの高度ながん診断ツールは高額であるため、特に低所得国や中所得国では、広く普及するための大きな障壁となっている。

- これらの技術は、非常に正確である一方で、高度なインフラ、熟練した人員、継続的な運用コストを必要とすることが多く、リソースが限られた環境では医療予算に負担をかける可能性があります。

- この財政的負担は、包括的ながん検査プログラムの拡張性を制限し、特に医療サービスが行き届いていない地域では診断が遅れる原因となっている。

例えば、

- 国際がん研究機関(IARC)の2023年の報告書では、診断サービスへのアクセスに大きな格差が指摘されており、低所得国では子宮頸がんや大腸がんなどのがんの診断カバー率が30%未満であるのに対し、高所得国では80%を超えている。

- その結果、高度な診断へのアクセスが制限され、早期発見と公平な医療提供が妨げられ、がん診断の世界的な拡大に大きな課題が生じている。

がん診断市場の展望

市場は、製品、技術、タイプ、アプリケーション、エンドユーザーに基づいてセグメント化されています。

|

セグメンテーション |

サブセグメンテーション |

|

製品別 |

|

|

テクノロジー別 |

|

|

タイプ別 |

|

|

アプリケーション別 |

|

|

エンドユーザー別 |

|

2025年には、 体外診断検査がタイプセグメントで最大のシェアを占め、市場を支配すると予測されています。

COVID-19パンデミックによる検査の増加に伴い、体外診断検査(IVD)の導入が拡大していることから、体外診断検査分野はがん診断市場において最大のシェア(52.1%)を占めると予想されています。病院や検査室向けに、正確で効率的かつエラーのない診断を提供する自動化IVDシステムの開発が、市場の成長を牽引すると期待されています。

消耗品は予測期間中に製品セグメントで最大のシェアを占めると予想されます。

2025年には、消耗品セグメントが市場シェア58.5%で最大規模を占めると予想されています。これは、画像診断技術の開発や、悪性細胞によって生成される抗原や低分子化学物質を検出するための効果的なモノクローナル抗体ベースのアッセイの開発により、診断医療が大きく向上すると考えられるためです。mAb技術はまだ初期段階ですが、組換え抗原合成および抗体作製技術の新たな発展により、診断におけるその可能性は大きく拡大しています。

がん診断市場の地域分析

「北米はがん診断市場で最大のシェアを占めている」

- 北米は、高度な医療インフラ、最先端の診断技術の採用率の高さ、そして大手のがん研究機関や診断企業の存在により、世界のがん診断市場で最大の市場シェア41.18%を占めています。

- 米国は、がんの罹患率の増加、確立された償還制度、分子診断および画像技術の継続的な進歩により、36.4%という大きなシェアを占めています。

- がん研究に対する政府の強力な取り組み、医療費の高騰、がんの早期発見への関心の高まりが、この地域の市場を牽引する主な要因となっている。

- さらに、パーソナライズ医療や精密医療の利用可能性の拡大とがん検査率の高さが、北米のがん診断市場の成長に貢献しています。

「アジア太平洋地域はがん診断市場において最も高いCAGRを記録すると予測されています」

- アジア太平洋地域は、医療インフラの急速な進歩、がんに対する意識の高まり、診断技術へのアクセスの改善により、がん診断市場において最も高い成長率を達成すると予想されています。

- 中国、インド、日本などの国は、人口の高齢化、がん罹患率の上昇、医療施設の改善により、重要な市場として台頭している。

- 日本は、強力な医療制度と革新的な診断ソリューションへの注力により、がん診断の主要市場であり続けています。AIを活用した画像診断やリキッドバイオプシーといった先進技術を、がんの早期発見のために導入し続けています。

- 人口が多く、がんの負担が増大している中国とインドでは、がん検査・診断サービスへの投資が急増しています。世界的な診断企業の存在感の高まりと、医療アクセスの拡大に向けた政府の取り組みが、この地域の市場成長をさらに促進しています。

がん診断市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、グローバルプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

市場で活動している主要なマーケットリーダーは次のとおりです。

- F. ホフマン・ラ・ロシュ社(スイス)

- サーモフィッシャーサイエンティフィック(米国)

- アボット (米国)

- シーメンス・ヘルシニアーズ(ドイツ)

- Koninklijke Philips NV (オランダ)

- BD(米国)

- GEヘルスケア(米国)

- ホロジック社(米国)

- イルミナ社(米国)

- エグザクト・サイエンシズ・コーポレーション(米国)

- ガーダント・ヘルス(米国)

- ミリアド・ジェネティクス(米国)

- ネオジェノミクス・ラボラトリーズ(米国)

- ビオメリューSA(フランス)

- Qiagen NV(ドイツ)

- ライカバイオシステムズ(ドイツ)

- セフェイド(米国)

- ダナハーコーポレーション(米国)

- アジレントテクノロジー(米国)

- F. ホフマン・ラ・ロシュ社(スイス)

世界のがん診断市場の最新動向

- 2024年7月、DELFI Diagnosticsは、メルク・グローバルヘルス・イノベーション・ファンドから株式投資を獲得したことを発表しました。この戦略的資金は、高度ながんスクリーニング向けに設計されたDELFIのAI駆動型フラグメンタミクス・プラットフォームの開発を加速させます。この協業は、診断能力の向上と、より正確ながん検出に使用される方法論の進歩に重点を置いています。このパートナーシップは、AIを活用した診断ソリューションと精密腫瘍学への高まりつつあるトレンドと一致しています。この投資は、早期がん検出に革命をもたらし、市場におけるイノベーションを促進し、高度な診断ツールの世界的な利用を拡大する最先端技術の開発を支援します。

- 2024年5月、Quest Diagnosticsは、人工知能(AI)統合への注力を強化する戦略的取り組みの一環として、PathAIのデジタル病理学ラボを分離することを発表しました。この動きは、同社の事業におけるAI技術の導入を促進し、デジタル病理学機能の強化と診断精度の向上を目指しています。この動きは、AI主導のソリューションを診断ワークフローに組み込むというトレンドの高まりを浮き彫りにしています。Quest Diagnosticsは、デジタル病理学サービスの進化により、より正確で効率的ながん検出への移行の最前線に立っています。

- 2023年2月、F・ホフマン・ラ・ロシュは、個別化医療の取り組みをさらに推進するため、ヤンセンとの提携を拡大することを発表しました。この強化されたパートナーシップは、コンパニオン診断薬の開発に重点を置き、より正確で個別化された治療アプローチを可能にすることで、患者の治療成績を向上させることを目指します。この提携は、プレシジョン・オンコロジー(精密腫瘍学)への移行の進展と、がん治療の改善におけるコンパニオン診断薬の重要性の高まりを強調するものです。

- 2023年11月、アボットはAlinity mプラットフォーム向けに開発されたHPV検査についてFDAの承認を取得しました。この診断ツールは、HPVの一次スクリーニングと、がん、特に子宮頸がんに関連する高リスクHPV型の検出を目的として設計されています。この承認により、アボットの子宮頸がん予防・診断ポートフォリオは大幅に強化され、世界のがん診断市場における高度なスクリーニングソリューションへの需要の高まりに対応します。

- 2022年、Precipio社は、米国の有力な販売パートナーとHemeScreen製品の販売契約を締結しました。同社は、医師所有の検査室、全国および地域の病院ネットワーク、そしてリファレンス検査室をターゲットに、HemeScreenの拡大成長計画を戦略的に推進しています。この動きは、血液がんのより正確かつ効率的な検出を可能にする高度な診断ツールに対する需要の高まりを反映しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。