Global Biosurgery Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

14.61 Billion

USD

23.64 Billion

2024

2032

USD

14.61 Billion

USD

23.64 Billion

2024

2032

| 2025 –2032 | |

| USD 14.61 Billion | |

| USD 23.64 Billion | |

|

|

|

|

Global Biosurgery Market Segmentation, By Product (Bone-Graft Substitutes, Soft-Tissue Attachments, Hemostatic Agents,Surgical Sealants and Adhesives, Adhesion Barriers, and Staple-Line Reinforcement Agents), Application (General Surgery, Cardiovascular Surgery, Orthopaedic Surgery, Neurological Surgery, Reconstructive Surgery, Gynaecological Surgery, Thoracic Surgery, and Urological Surgery), End-User (Hospitals, Clinics, and Others) - Industry Trends and Forecast to 2032

Biosurgery Market Size

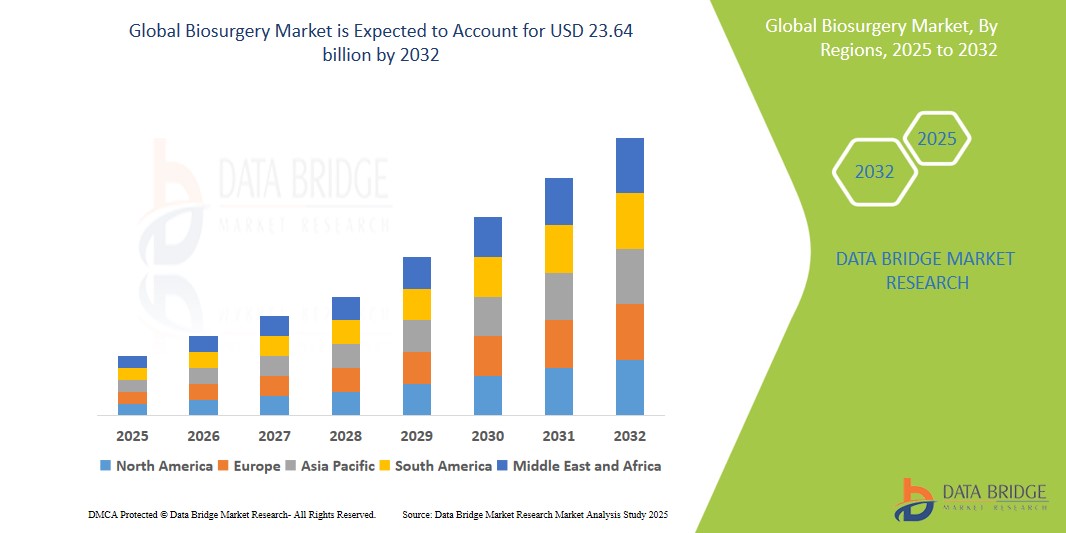

- The global biosurgery market size was valued atUSD 14.61 billion in 2024 and is expected to reachUSD 23.64 billion by 2032, at aCAGR of 6.20%during the forecast period

- This growth is driven by rise in the cases of surgeries

Biosurgery Market Analysis

- Biosurgery systems are critical medical devices utilized during surgical procedures to provide real-time visualization of anatomical structures, improving surgical precision, minimizing complications, and enhancing patient outcomes. These technologies include intraoperativeMRI, CT, and ultrasound, providing essential guidance for intricate surgeries

- The growing demand for biosurgery is primarily driven by the increasing number of complex surgical procedures, the rising preference for minimally invasive surgeries, and advancements in technology that deliver higher image resolution, quicker processing, and improved integration with surgical navigation systems.

- North America is expected to dominate the biosurgery market with the largest market share of 51.54%, driven by its advanced healthcare infrastructure, widespread adoption of cutting-edge surgical technologies, favorable reimbursement policies, and the presence of leading market players in the region

- Asia-Pacific is projected to register the highest growth rate in the biosurgery market during the forecast period, fueled by rapid healthcare infrastructure improvements, growing investments in surgical care, increasing awareness of image-guided surgeries, and heightened healthcare spending in emerging markets such as China and India

- The surgical sealants and adhesives segment is anticipated to capture the largest market share of 27.69%, due to increasing number of surgeries being conducted for various reasons has led to the use of surgical sealants, which act as a barrier to prevent the leakage of fluids, blood, urine, and air

Report Scope and Biosurgery Market Segmentation

|

Attributes |

Biosurgery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Biosurgery Market Trends

“Advancements in Robotic-Assisted Surgery for Biosurgery”

- A significant trend in the biosurgery market is the increasing adoption of robotic-assisted surgical systems, which enhance precision and control during surgeries. These systems allow for minimally invasive procedures with better accuracy, contributing to improved patient outcomes

- Robotic-assisted surgeries provide high-definition imaging, enhanced dexterity, and real-time feedback, enabling surgeons to perform complex procedures with greater confidence and precision

- The trend is also being supported by the integration of advanced robotic systems in major hospitals, improving the efficiency of surgeries and reducing the risk of human error

- For instance, in 2023, the Mayo Clinic expanded its robotic surgery capabilities by adding the da Vinci Surgical System to perform a wide range of minimally invasive procedures

- The increasing reliance on robotic-assisted surgeries is transforming the biosurgery landscape, driving faster recovery times and reducing complications in complex surgeries

Biosurgery Market Dynamics

Driver

“Rising Focus on Surgical Precision and Real-Time Visualization”

- A key driver in the biosurgery market is the growing focus on surgical precision, as modern medical practices emphasize minimizing human error and enhancing real-time visualization during complex procedures

- Advanced imaging technologies such as intraoperative MRI, CT, and ultrasound are becoming indispensable for real-time monitoring, offering high-resolution images that allow surgeons to make informed decisions during critical procedures

- These imaging technologies enable a clearer view of anatomical structures, improving precision and reducing complications in high-stakes surgeries

- For instance, a 2023 study published by the American College of Surgeons revealed that the use of intraoperative MRI in brain surgeries resulted in a 15% increase in tumor removal accuracy

- The drive for precision in surgeries is accelerating the demand for advanced biosurgical imaging systems, fueling market growth

Opportunity

“Increasing Adoption of Personalized Medicine in Biosurgery”

- A significant opportunity for the biosurgery market is the increasing adoption of personalized medicine, which tailors surgical procedures and treatment plans to individual patient needs

- Personalized medicine relies on advanced imaging systems to assess a patient’s unique anatomy and condition, ensuring that surgeries are as effective and precise as possible

- As healthcare providers strive to offer more customized treatments, the demand for sophisticated imaging technologies that support personalized surgery is expected to grow significantly

- For instance, in 2023, a major U.S. hospital network introduced personalized treatment plans for orthopedic surgeries, using 3D imaging and patient-specific surgical models to optimize outcomes

- The integration of personalized medicine in surgery represents a growing opportunity for biosurgical companies to offer innovative solutions tailored to individual patients, driving market expansion

Restraint/Challenge

“Regulatory and Compliance Challenges in Biosurgery Technology Adoption”

- A major challenge in the biosurgery market is the complex regulatory landscape surrounding the approval and adoption of new biosurgery technologies, particularly in emerging markets

- Stringent regulations and lengthy approval processes can delay the availability of new products, hindering market growth, especially for companies looking to introduce innovative biosurgical system

- Compliance with local and international regulatory standards adds significant complexity and costs to the development and distribution of biosurgery systems, limiting market access in some regions

- For instance, in 2023, a major biosurgery firm faced delays in launching a new intraoperative CT system in the European Union due to extended approval timelines

- The regulatory hurdles faced by companies can slow the pace of innovation and adoption, presenting a barrier to wider market penetration

Biosurgery Market Scope

The market is segmented on the basis of product, application, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Application |

|

|

By End User |

|

In 2025, the surgical sealants and adhesives is projected to dominate the market with a largest share in product segment

The surgical sealants and adhesives segment is expected to dominate the biosurgery market with the largest market share of 27.69% in 2025 due to increasing number of surgeries being conducted for various reasons has led to the use of surgical sealants, which act as a barrier to prevent the leakage of fluids, blood, urine, and air. Common types of surgical sealants include fibrin, cyanoacrylates, glutaraldehyde-albumin, and polyethylene-glycol-based sealants.

The adults is expected to account for the largest share during the forecast period in application segment

In 2025, the adults segment is expected to dominate the market with the largest market share of 54.14% due to the high volume of surgical procedures performed on adults, particularly in areas such as orthopedic, cardiovascular, and general surgeries.

Biosurgery Market Regional Analysis

“North America Holds the Largest Share in the Biosurgery Market”

- North America dominates the biosurgery market with the largest market share of 51.54%, driven by the strong presence of key industry players, highly developed healthcare infrastructure, increasing adoption of advanced surgical imaging technologies, and supportive reimbursement policies for intraoperative procedures

- The U.S. holds the largest share within the region due to the widespread use of intraoperative MRI, CT, and ultrasound systems, the rising number of complex surgical procedures, and continuous innovation in imaging modalities tailored for real-time surgical navigation

- Increasing investments in neurosurgery, orthopedic surgery, and oncology applications, coupled with favorable regulatory approvals and growing demand for precision surgeries, are expected to further strengthen North America's leadership in the global biosurgery market

“Asia-Pacific is Projected to Register the Highest CAGR in the Biosurgery Market”

- Asia-Pacific is expected to witness the highest growth rate in the biosurgery market, fueled by rapid improvements in healthcare infrastructure, rising surgical volumes, growing awareness of advanced surgical imaging technologies, and expanding access to healthcare services in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government initiatives for healthcare modernization, increasing investments in hospital facilities, and the growing burden of chronic diseases requiring surgical intervention

- Japan, known for its technological leadership and high healthcare standards, is actively adopting cutting-edge biosurgery solutions, while China and India are witnessing a surge in demand due to healthcare reforms, public-private partnerships, and increased training of medical professionals in image-guided surgeries

Biosurgery Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Baxter (U.S.)

- BD (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (U.S.)

- Sanofi (France)

- B. Braun AG (Germany)

- CryoLife, Inc. (U.S.)

- Stryker (U.S.)

- Hemostasis, LLC (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Pfizer Inc. (U.S.)

- CSL Limited (Australia)

- Exactech, Inc. (U.S.)

- RTI Surgical (U.S.)

- Getinge (Sweden)

- Samyang Holdings Corporation (U.S.)

- TELA Bio, Inc. (U.S.)

- Tissue Regenix (U.K.)

- Osiris Therapeutics, Inc. (U.S.)

Latest Developments in Global Biosurgery Market

- In May 2024, Sanofi announced an investment of over USD 1.10 billion in biomanufacturing in France, in addition to the USD 2.74 billion already allocated for major projects, reinforcing the company’s strategic commitment to enhancing health sovereignty. This investment aims to bolster Sanofi's biomanufacturing capabilities within France, positioning the company for future growth in biosurgery and healthcare innovation

- In November 2023, Johnson & Johnson MedTech’s Ethicon received approval for its ETHIZIA Hemostatic Sealing Patch, designed to effectively manage and stop disruptive bleeding during surgical procedures. This addition strengthens Ethicon's extensive biosurgery portfolio, meeting urgent needs in controlling surgical bleeding with enhanced precision and reliability

- In October 2023, Stryker launched a new catalog of advanced wound care products that utilize unique bioengineered materials, aimed at accelerating the healing process and reducing the risk of infection in surgical and traumatic injuries. This launch reflects Stryker’s dedication to providing advanced biosurgical solutions for improving patient recovery outcomes

- In September 2023, Medtronic announced that it had received FDA approval for a new bioactive tissue adhesive for soft tissue repair procedures, featuring enhanced bond strength and elasticity. This product allows surgeons to perform advanced techniques with greater ease, enhancing surgical precision and patient safety in biosurgery

- In August 2023, Ethicon, a Johnson & Johnson company, introduced a new surgical mesh for hernia repairs, advancing bioengineering to improve tissue integration and reduce complications and healing times post-surgery. This innovation further strengthens Ethicon’s ongoing commitment to enhancing surgical outcomes and biosurgical solutions

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。