Global Companion Animal Vaccines Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

5.47 Billion

2024

2032

USD

3.53 Billion

USD

5.47 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 5.47 Billion | |

|

|

|

|

Global Companion Animal Vaccines Market Segmentation, By Product Type (Attenuated Live Vaccines, Conjugate Vaccines, Inactivated Vaccines, Subunit Vaccines, Toxoid Vaccines, DNA Vaccines and Recombinant Vaccines), Species Type (Canine, Avian, Feline and Equine), Distribution Channel (Veterinary Clinics, Veterinary Hospitals, Veterinary Research Institutes, Retail Pharmacies and Others) - Industry Trends and Forecast to 2032

Companion Animal Vaccines Market Size

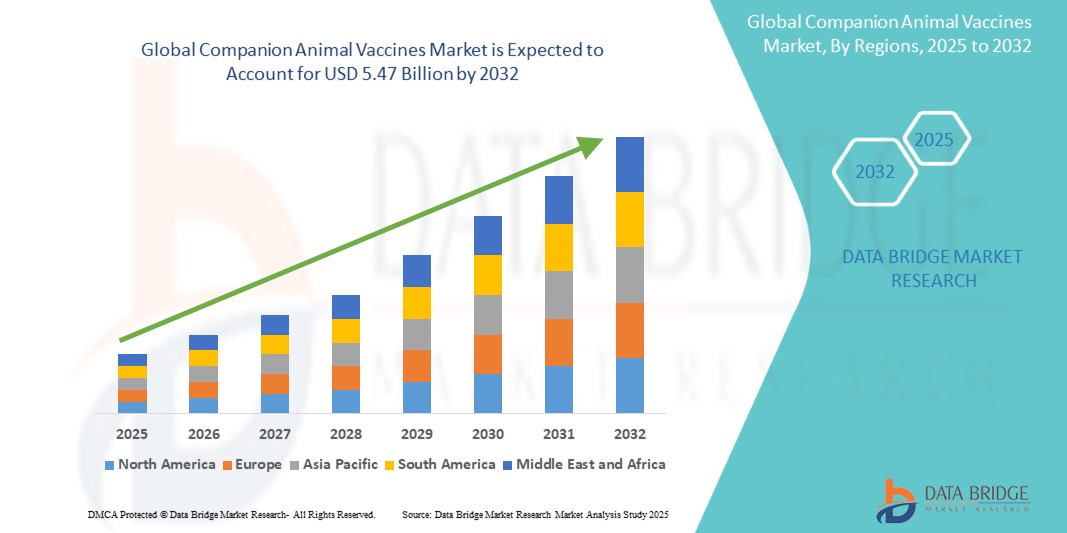

- The global companion animal vaccines market size was valued atUSD 3.53 billion in 2024and is expected to reachUSD 5.47 billion by 2032, at aCAGR of 5.60%during the forecast period

- This growth is driven by factors such as the rising pet ownership, increased awareness of animal health, and advancements in vaccine technology

Companion Animal Vaccines Market Analysis

- Companion animal vaccines are essential for preventing a wide range of diseases in pets, such as dogs, cats, and horses. These vaccines play a crucial role in ensuring the health and longevity of companion animals by providing immunity againstinfectious diseases

- The demand for companion animal vaccines is driven by increasing pet ownership, rising awareness of preventive healthcare, and advancements in vaccine technology, including more effective and longer-lasting vaccines

- North America is expected to dominate the companion animal vaccines market with a market share of 40.5%, due to high pet ownership, a well-established veterinary healthcare system, and strong demand for advanced preventive care for pets

- Asia Pacific is expected to be the fastest growing region in the companion animal vaccines market with a market share of 23.5%, during the forecast period due to rapid expansion in healthcare infrastructure, increasing awareness about pet health, and rising pet ownership in the region

- Attenuated Live Vaccinessegment is expected to dominate the market with a market share of 37.5% due to its ability to induce strong, long-lasting immune responses with fewer doses. These vaccines closely mimic natural infections, offering superior protection

Report Scope andCompanion Animal Vaccines Market Segmentation

|

Attributes |

Companion Animal Vaccines KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Companion Animal Vaccines Market Trends

“Advancements in Vaccine Technology & Increased Focus on Preventive Healthcare for Pets”

- One prominent trend in the companion animal vaccines market is the development of more effective and longer-lasting vaccines, incorporating advanced technologies such as recombinant DNA and mRNA platforms, offering enhanced immune responses and broader protection

- These innovations improve vaccine safety and efficacy, reducing the number of doses required and extending the duration of immunity. As a result, pet owners are increasingly opting for vaccines that offer prolonged protection and fewer visits to the veterinarian

- For instance, the development of combined vaccines, which protect against multiple diseases with a single shot, is gaining popularity. This is especially beneficial for dogs and cats, as it simplifies vaccination schedules and improves compliance

- These advancements are reshaping the companion animal healthcare landscape, improving pet health outcomes, and driving the demand for next-generation vaccines that offer superior protection with enhanced convenience for pet owners

Companion Animal Vaccines Market Dynamics

Driver

“Increasing Pet Ownership and Awareness of Preventive Health”

- The growing trend of pet ownership, coupled with heightened awareness of the importance of preventive healthcare, is significantly driving the demand for companion animal vaccines. As more people adopt pets, the need for effective vaccination to protect against various diseases becomes increasingly important

- With rising disposable income, especially in emerging markets, pet owners are becoming more willing to invest in their pets' health, leading to a growing demand for high-quality vaccines that ensure long-term immunity

- In addition, as awareness about the risks of zoonotic diseases and the importance of preventive measures grows, pet owners are more likely to vaccinate their animals, ensuring better health outcomes for their pets and reducing the spread of diseases

For instance,

- According to a 2023 report by the American Pet Products Association, pet ownership in the U.S. has reached historic highs, with over 70 million households now owning pets. This surge in pet ownership has directly contributed to an increased demand for veterinary care, including vaccinations

- As a result, the increasing pet ownership and awareness of preventive healthcare continue to drive the demand for companion animal vaccines, contributing to market growth globally

Opportunity

“Advancements in Vaccine Development and Customization for Different Species”

- The continuous development of new and improved vaccines tailored to specific species and age groups presents significant growth opportunities in the companion animal vaccines market. Innovations in vaccine formulation, such as DNA-based and mRNA vaccines, are enhancing their effectiveness and safety profiles for different types of companion animals

- Personalized vaccines, which are designed to target specific health concerns based on the breed or genetic makeup of the animal, offer an opportunity to provide more effective and targeted healthcare, reducing the risk of side effects and improving overall health outcomes

- In addition, advancements in adjuvants and vaccine delivery systems are increasing the effectiveness of vaccines and expanding their applications across various species, including dogs, cats, and exotic pets

For instance,

- In March 2025, a study published in Veterinary Research Communications highlighted the development of a novel vaccine for cats, targeting feline leukemia virus (FeLV), which is a major concern for feline health. The new vaccine uses a unique adjuvant system that increases immunity without causing adverse reactions

- These advancements in vaccine technology and the ability to tailor vaccines to the specific needs of different companion animals provide an opportunity for the growth of the global companion animal vaccines market, offering better protection and improved health outcomes for pets

Restraint/Challenge

“High Costs of Vaccines and Distribution Challenges”

- The high cost of companion animal vaccines, especially for premium vaccines with advanced technologies, poses a significant challenge for the market. This is particularly concerning in emerging markets, where the affordability of veterinary care is a key barrier to widespread vaccination

- Premium vaccines, such as those using recombinant DNA or mRNA technology, can be significantly more expensive than traditional vaccines, which may deter pet owners in lower-income regions from seeking timely vaccinations for their pets

- In addition, logistical challenges related to the cold-chain distribution required for some vaccines, particularly in regions with limited infrastructure, further complicate vaccine accessibility and affordability, limiting market penetration

For instance,

- In December 2023, an article published by the Global Health Review highlighted that in rural areas of India, the high cost of vaccines and distribution barriers such as poor infrastructure and lack of refrigeration often prevent pet owners from vaccinating their animals. This leads to low vaccination rates, increasing the risk of outbreaks of preventable diseases

- Consequently, these financial and logistical limitations hinder the growth of the companion animal vaccines market, particularly in regions with fewer resources and limited access to veterinary services, affecting overall market expansion

Companion Animal Vaccines Market Scope

The market is segmented on the basis of product type, species type, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Species Type |

|

|

ByDistribution Channel

|

|

In 2025, the attenuated live vaccines is projected to dominate the market with a largest share in product type segment

The attenuated live vaccines segment is expected to dominate the companion animal vaccines market with the largest share of 37.5% in 2025 due to its ability to induce strong, long-lasting immune responses with fewer doses. These vaccines closely mimic natural infections, offering superior protection. In addition, growing demand for effective disease prevention in pets is boosting their adoption

The canine is expected to account for the largest share during the forecast period in species type market

In 2025, the canine segment is expected to dominate the market with the largest market share of 53.9% due to its high prevalence of canine diseases and increasing pet ownership worldwide. Dogs are the most commonly kept companion animals, driving demand for vaccines. In addition, growing awareness of preventive healthcare for pets is contributing to the segment's dominance

Companion Animal Vaccines Market Regional Analysis

“North America Holds the Largest Share in the Companion Animal Vaccines Market”

- North America dominates thecompanion animal vaccines market with a market share of estimated 40.5%, driven, by high pet ownership, a well-established veterinary healthcare system, and strong demand for advanced preventive care for pets

- U.S.holds a market share of 75.4%, due to the increasing adoption of pets, heightened awareness about the importance of vaccination, and a strong presence of key market players offering innovative vaccine solutions

- The availability of robust healthcare infrastructure, favorable reimbursement policies for veterinary care, and high spending on pet health contribute significantly to the growth of the market in this region

- In addition, the increasing focus on preventive healthcare for pets and rising concerns about zoonotic diseases further support the market expansion

“Asia-Pacific is Projected to Register the HighestCAGR in the Companion Animal Vaccines Market”

- Asia-Pacificis expected to witness the highest growth rate in thecompanion animal vaccines marketwith a market share of 23.5%, driven by rapid expansion in healthcare infrastructure, increasing awareness about pet health, and rising pet ownership in the region

- Countries such as China, India, and Japan are emerging as key markets for companion animal vaccines. The growing middle-class population in these countries, combined with increasing disposable income, is encouraging pet ownership and driving demand for veterinary services, including vaccinations

- Japan remains a significant market in the region, with a high rate of pet ownership and a strong focus on advanced veterinary technologies. As awareness about preventive healthcare continues to rise, Japan is expected to contribute substantially to market growth

- India is projected to register the highest CAGR of 13.2% in the market, driven by expanding veterinary care infrastructure, increasing awareness about the importance of vaccines, and rising prevalence of pet diseases

Companion Animal Vaccines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zoetis Services LLC(U.S.)

- Merck & Co., Inc.(U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Elanco(U.S.)

- Virbac(France)

- Ceva (France)

- Vetoquinol (France)

- Heska Corporation (U.S.)

- Phibro Animal Health (U.S.)

- Richmond Veterinary Laboratory (U.K.)

- Hubei Wudang Animal Pharmaceutical Co., Ltd. (China)

- DAIICHI SANKYO COMPANY, LIMITED. (Japan)

- Bioveta, a.s. (Czech Republic)

- HIPRA, S.A. (Spain)

- HESTER BIOSCIENCES LIMITED (India)

- Neogen Corporation (U.S.)

- Bayer AG (U.S.)

- IDEXX (U.S.)

Latest Developments in Global Companion Animal Vaccines Market

- In September 2024, Elanco Animal Health partnered with the University of Veterinary Medicine Vienna to develop vaccines for feline infectious peritonitis (FIP). This collaboration aims to bring more effective and affordable vaccines to market, particularly in Europe and Asia, where FIP has been a growing concern due to limited vaccine availability

- In October 2024, Boehringer Ingelheim announced the launch of a new canine vaccine line in Latin America. The updated vaccines offer broader protection against diseases such as kennel cough, leptospirosis, and parvovirus, addressing increasing concerns about infectious diseases among pets in urban areas

- In April 2020, Boehringer Ingelheim U.K. collaborated with VetHelpDirect, that offered all U.K. veterinary practices free access to an online video consultation platform for a period of three months during the pandemic

- In September 2020, Applied DNA Sciences Inc. and Evvivax SRL announced their plans to initiate a veterinary clinical trial for LineaDNA vaccine candidates upon receiving approval for the clinical plan from the US Department of Agriculture. The goal of the vaccine trial is to evaluate the vaccine candidate as a strategy for preventing the COVID-19 (a zoonotic disease) infection in companion felines of humans

- In June 2020, Elanco received regulatory clearance for the acquisition of Bayer AG's animal health business

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。