米国のトマトペースト市場、製品タイプ別(オーガニックトマトペースト、従来型トマトペースト)、ブランドカテゴリー別(ブランド、プライベートラベル)、パッケージタイプ別(ボトル、ジャー、缶、ポーチ、チューブ、その他)、パッケージサイズ別(100グラム未満、101〜250グラム、251〜500グラム、501〜750グラム、751〜1000グラム、1000グラム以上)、エンドユーザー別(家庭/小売店、食品サービス部門、その他)、流通チャネル別(店舗ベース、非店舗ベース) - 2030年までの業界動向と予測。

米国のトマトペースト市場の分析と洞察

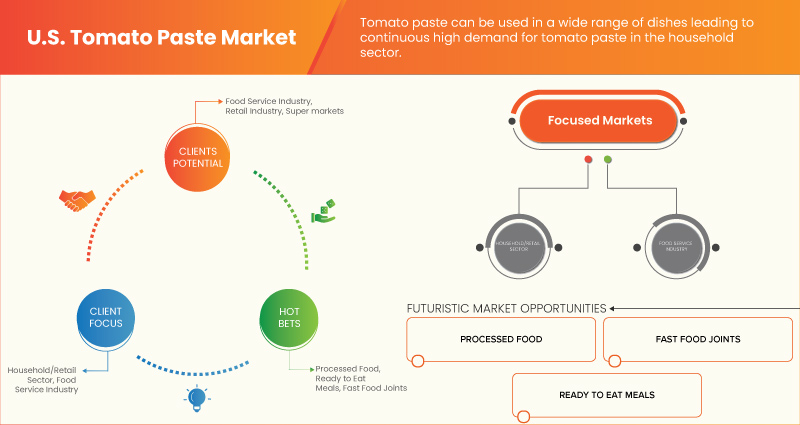

米国のトマトペースト市場は、2023年から2030年の予測期間に大幅に成長すると予想されています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に3.4%のCAGRで成長し、2030年までに100億820万米ドルに達すると分析しています。さまざまな業界のさまざまな用途でのトマトペーストの需要の増加により、市場が拡大すると予想されています。

より幅広い製品が利用できるようになったことが、市場の拡大を牽引しています。さらに、消費者の健康的な食習慣へのシフトの高まりも、市場をさらに左右しています。拡大に加えて、市場における研究開発により、トマトペースト製造業者にとってビジネスの可能性がさらに広がりました。

米国のトマトペースト市場レポートでは、市場シェア、新しい展開、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームは、収益に影響を与えるソリューションを作成し、希望する目標を達成するお手伝いをします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ別 (オーガニック トマトペースト、従来型トマトペースト)、ブランド カテゴリ別 (ブランド、プライベート ラベル)、パッケージ タイプ別 (ボトル、ジャー、缶、ポーチ/サシェ、チューブ、その他)、パッケージ サイズ別 (100 グラム未満、101 ~ 250 グラム、251 ~ 500 グラム、501 ~ 750 グラム、751 ~ 1000 グラム、1000 グラム以上)、エンド ユーザー別 (家庭/小売、食品サービス部門、その他)、流通チャネル別 (店舗ベース、非店舗ベース) |

|

対象国 |

私たち |

|

対象となる市場プレーヤー |

Jovial Foods, Inc および bionaturae (米国)、General Mills Inc. (米国)、PANOS brands(米国)、Neil Jones Food Company(米国)、Pacific Coast Producers(米国)、La Valle Foods USA(米国)、PORT ROYAL SALES (米国)、Del Monte Foods Inc (米国)、Conagra Brands, Inc. (米国)、Cento Fine Foods. (米国)、Mutti SpA (イタリア)、DEI FRATELLI(米国)、Rao's Specialty Foods(米国)、The Morning Star Company(米国)、Trader Joe's(米国)、DeLallo(米国)、The Napoleon Co. (米国)、Goya Foods, Inc. (米国)、POMI USA INC. (米国)、Galil Brands (米国) など。 |

市場の定義

トマトは世界中で広く栽培されている野菜で、その派生物は食品業界で広く使用されています。トマトペーストは、トマトの皮を剥き、残った果肉を蒸発させて濃厚なペースト状にして作られる濃縮調味料です。このペーストは、ケチャップ、スープ、ソース、その他の料理の主要成分として一般的に使用され、さまざまな料理に深みと風味を加えます。塩分は添加されていても添加されていなくてもよく、トマトペーストと見なされるには最低 25 パーセントのトマト固形分を含んでいなければなりません。パスタ、スープ、煮込み肉など、さまざまな料理に濃厚なトマトの風味を添えるために使用されます。

米国のトマトペースト市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

- クリーンでオーガニックなラベルの食品に対する高い需要

オーガニックトマトペーストは、合成農薬や肥料を使用せずに栽培されたトマトから作られています。その結果、有害な化学物質や農薬が含まれておらず、より健康的な選択肢となっています。消費者の間でオーガニック製品の需要が高まっている主な理由の1つは、オーガニック製品がより健康的であるという認識であり、COVID-19の影響により、健康的でクリーンな食品や飲料の摂取に関する意識が高まりました。消費者はより健康的な食品の選択肢を求めており、合成農薬、ホルモン、遺伝子組み換え作物、抗生物質の摂取による潜在的なリスクを懸念しています。さらに、消費者は高度に加工された食品や人工成分を避けたいと考えており、これがオーガニック製品の需要をさらに押し上げています。消費者は、USDA認定オーガニック、非遺伝子組み換え認定、コーシャなどの主張を信じ、望ましくない成分を含まない製品に高いお金を払う可能性が最も高いです。

したがって、健康上の利点と環境への懸念から、消費者の間でオーガニックおよびクリーンラベル製品に対する需要が高まり、オーガニックトマトペーストの市場成長を促進すると予想されます。

機会

- 若い世代の食習慣の変化

消費者のライフスタイルの変化と多忙なスケジュールは食習慣に大きな影響を与え、トマトペーストなどの加工食品や調理済み食品などの便利な食品が好まれるようになっています。さらに、労働人口の増加により、準備が簡単で手間がかからない食品や飲料製品の購入が急増し、市場でのトマトペーストの成長機会がさらに高まっています。

都市化と所得水準の上昇により、消費者は加工食品、包装食品、調理済み食品を好むようになり、トマトペーストの需要が急増しています。この傾向は、食品や飲料を調理するよりも、その利便性にお金を払う意欲が高まっていることに起因しています。さらに、都市化の進行と仕事や勉強のための人々の移住も、店頭で簡単に入手できるトマトペーストの需要増加に寄与しています。

例えば、

- 2022年9月、SIAL Americaの記事によると、ミレニアル世代の購買力は現在2.5兆ドルで、毎年支出額が増加しています。この世代は小売消費者全体の30%を占めており、その割合は着実に増加しています。座って食事をする時間が減るにつれて、フードデリバリーサービスや手軽に持ち帰りできる食事の人気が高まっています。消費者は製品の原材料をますます意識するようになり、品質に関するブランド認知度が高まっています。

- 2020年4月、国際食品情報評議会(IFIC)が実施した調査では、米国人の85%がCOVID-19パンデミックにより食生活や調理習慣に何らかの変化があったと回答したことが明らかになった。同年、IFICは追加の調査を実施し、食品の取り扱いや調理を通じたCOVID-19感染のリスク認識が、細菌による食中毒(20%)を含む他のどの問題よりも多くの米国人(24%)によって食品安全上の最大の懸念事項として挙げられていることを示した。

したがって、ライフスタイルの変化と健康意識の高まりにより消費者の食習慣が徐々に変化し、予測期間中にトマトペーストの市場が拡大すると予想されます。

制約/課題

- 原材料価格の変動

トマトの価格が急激に変動したことにより、製造会社は深刻な危機に陥っており、特にCOVID-19の状況や最近の経済危機や不況が深刻化しています。トマトの価格が不安定なため、トマトをベースとした多くの製品の生産も打撃を受けています。

トマトはさまざまな気候や環境条件下で栽培されます。しかし、昨年の気象条件の激しい変化により、トマトの価格が上昇しました。トマトの価格変動により、トマトペースト市場の成長は不安定で抑制されることになります。

For instance,

- According to Selina Wamucii, the producer prices for tomatoes have fluctuated in the major production regions of the United States. The cost of one kilogram of tomatoes packed and prepared for shipment in Washington and New York is approximately USD 3.28. In 2016, 2017, 2018, and 2019, the cost of exporting tomatoes per tonne in the US was US$ 1,047.30, US$ 1,056.13, US$ 1,027.28, and US$ 1,030.08, respectively. In 2023, the wholesale price of tomato is estimated at the price range of around US$ 1.03 per kilogram

- In September 2022, According to a FreshPlaza article, since the start of 2022, tomato prices in the US have dropped 2% from $1.93 per pound to $1.89 per pound in August

Thus, such fluctuation in tomato prices will result in a disturbed supply chain, as it results in an increased cost of production and less profit margins. Thus, it is expected to disrupt the overall supply chain of the U.S. tomato paste market.

Post COVID-19 Impact on U.S. Tomato Paste Market

The uncertainty caused due to outbreak of the pandemic occurs by coronavirus disease (COVID-19) in the world has affected and changed the complete dynamics of North America industries leading to the pandemic and has had a negative impact on the growth of North America economics. The effects can be seen over the intensity and efficacy of containment efforts, behavioral changes (avoid purchasing and investing), shifts in spending patterns, containment efforts to the supply of disruptions, the after-effects of dramatic tightening in the market are observed, volatile commodity prices and on increasing debt burdens. Due to (COVID-19), all the countries have faced a multi-layered crisis comprising domestic economic disruptions, plummeting external demand, collapse in the prices, and collapse in supply and demand of the products.

Moreover, the high demand for tomato paste will drive the market's growth. Furthermore, the demand for tomato paste in the household and retail industry after the COVID-19 pandemic has increased. Additionally, consumers' interest in tomato paste for its health benefit and research development is expected to fuel the growth of the U.S. market

Recent Developments

- In November 2022, Green Thumb Grown Foods, the largest producer of organic canned tomatoes in the Western US, launched the Take Root Organics line of products available at major retailers throughout the country, offering consumers an affordable option to choose organic food products that are good for their health and the environment. The Take Root Organics line includes six different varieties, including Tomato Paste, which can be found in retail stores such as Kroger, Albertsons, and Food4Less

- In October 2020, Goya Foods, Inc. announced the expansion project worth $80 million for its manufacturing and distribution plant located in Texas. This expansion will include the acquisition of modern and advanced food processing equipment, which will enable the company to boost its production capacity twofold, ultimately catering to the growing demand for its products.

U.S. Tomato Paste Market Scope

The U.S. tomato paste market is segmented into six notable segments based on product type, brand category, packaging type, packaging size, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PRODUCT TYPE

- Conventional Tomato Paste

- Organic Tomato Paste

On the basis of product type, the U.S. tomato paste market is segmented into conventional tomato paste and organic tomato paste.

BY BRAND CATEGORY

- Branded

- Private Labels

On the basis of brand category, the U.S. tomato paste market is segmented into branded and private labels.

BY PACKAGING TYPE

- Bottles

- Jars

- Pouches/Sachets

- Tins/Cans

- Tubes

- Others

On the basis of packaging type, the U.S. tomato paste market is segmented into bottles, jars, pouches/sachets, tins/cans, tubes, and others.

BY PACKAGING SIZE

- Less Than 100 Grams

- 101-250 Grams

- 251-500 Grams

- 501-750 Grams

- 751-1000 Grams

- More Than 1000 Grams

On the basis of packaging size, the U.S. tomato paste market is segmented into less than 100 grams, 101-250 grams, 251-500 grams, 501-750 grams, 751-1000 grams, and more than 1000 grams.

BY END USER

- Household/Retail

- Food Service Sector

- Others

On the basis of end user, the U.S. tomato paste market is segmented into household/retail, food service sector, and others.

BY DISTRIBUTION CHANNEL

- Store Based

- Non-Store Based

On the basis of distribution channel, the U.S. tomato paste market is segmented into store based and non-store based.

U.S. Tomato Paste Market Regional Analysis/Insights

The U.S. tomato paste market are analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered is the U.S.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and U.S. Tomato Paste Market Share Analysis

米国トマトペースト市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供されている上記のデータポイントは、米国のトマトペースト市場に関連する企業の焦点にのみ関連しています。

米国のトマトペースト市場で活動している主な企業としては、Jovial Foods, Inc および bionaturae、General Mills Inc.、PANOS ブランド、Neil Jones Food Company、Pacific Coast Producers、La Valle Foods USA、PORT ROYAL SALES、Del Monte Foods, Inc、Conagra Brands, Inc.、Cento Fine Foods、Mutti SpA、DEI FRATELLI、Rao's Specialty Foods、The Morning Star Company、Trader Joe's、DeLallo、The Napoleon Co.、Goya Foods, Inc.、POMI USA INC.、Galil Brands などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. TOMATO PASTE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CATEGORY LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FACTORS INFLUENCING PURCHASE DECISION

4.1.1 LARGE RANGE OF ATTRACTIVE PRODUCT PACKAGING

4.1.2 COST EFFECTIVENESS

4.1.3 TOMATO PASTE IS A NATURAL FOOD COMPONENT

4.2 PRICING INDEX

4.3 PRIVATE LABEL VS BRAND LABEL

4.4 PROMOTIONAL ACTIVITIES

4.4.1 PROVIDING BUSINESS PERSPECTIVES

4.4.2 ADVERTISEMENT

4.4.3 PROMOTE THROUGH SOCIAL MEDIA

4.5 REGULATORY FRAMEWORK AND GUIDELINES

4.5.1 UNITED STATES DEPARTMENT OF AGRICULTURE

4.5.2 UNITED STATES DEPARTMENT OF AGRICULTURE

4.6 SHOPPING BEHAVIOR AND DYNAMICS

4.6.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS

4.6.2 RESEARCH

4.6.3 IMPULSIVE

4.6.4 ADVERTISEMENT

4.6.4.1 TELEVISION ADVERTISEMENT

4.6.4.2 ONLINE ADVERTISEMENT

4.6.5 IN-STORE ADVERTISEMENT

4.6.6 OUTDOOR ADVERTISEMENT

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 RAW MATERIAL PROCUREMENT

4.7.2 PROCESSING

4.7.3 MARKETING AND DISTRIBUTION

4.7.4 END USERS

4.8 BRAND OUTLOOK

4.8.1 PRODUCT VS BRAND OVERVIEW

4.9 IMPACT OF ECONOMIC SLOWDOWN ON THE MARKET

4.1 MARKETING STRATEGY ADOPTED BY KEY PLAYERS

5 NEW PRODUCT LAUNCH STRATEGY

5.1 OVERVIEW

5.2 NUMBER OF NEW PRODUCT LAUNCHES

5.2.1 NEW PRODUCT LAUNCHES

5.2.2 NEW PACKAGING

5.2.3 RE-LAUNCHED/ NEW FORMULATION

5.2.4 DIFFERENTIAL PRODUCT OFFERING

5.3 NEW PRODUCT LAUNCHES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USE OF TOMATO PASTE IN VARIOUS INDUSTRIES

6.1.2 HIGH DEMAND FOR CLEAN AND ORGANIC LABEL FOOD PRODUCTS

6.1.3 RISING USE OF TOMATO PASTE IN HOUSEHOLD USERS

6.2 RESTRAINTS

6.2.1 FLUCTUATING RAW MATERIAL PRICES

6.2.2 CONTAMINATION AND SPOILAGE ISSUE RELATED TO TOMATO PASTE

6.3 OPPORTUNITY

6.3.1 CHANGING FOOD HABITS IN THE YOUNGER GENERATION

6.3.2 MODERN PACKAGING TECHNOLOGY

6.4 CHALLENGES

6.4.1 HIGH EQUIPMENT AND INDUSTRIAL COST

6.4.2 AVAILABILITY OF OTHER TOMATO-BASED PRODUCTS

7 U.S. TOMATO PASTE MARKET , BY PRODUCT TYPE

7.1 OVERVIEW

7.2 CONVENTIONAL TOMATO PASTE

7.3 ORGANIC TOMATO PASTE

8 U.S. TOMATO PASTE MARKET , BY BRAND CATEGORY

8.1 OVERVIEW

8.2 BRANDED

8.3 PRIVATE LABEL

9 U.S. TOMATO PASTE MARKET , BY PACKAGING TYPE

9.1 OVERVIEW

9.2 BOTTLES

9.2.1 BOTTLES, BY TYPE

9.2.1.1 GLASS BOTTLES

9.2.1.2 PLASTIC BOTTLES

9.3 TINS / CANS

9.4 TUBES

9.5 JARS

9.6 POUCHES / SACHETS

9.7 OTHERS

10 U.S. TOMATO PASTE MARKET, BY PACKAGING SIZE

10.1 OVERVIEW

10.2 101-250 GRAMS

10.3 251-500 GRAMS

10.4 MORE THAN 1000 GRAMS

10.5 501-750 GRAMS

10.6 LESS THAN 100 GRAMS

10.7 751-1000 GRAMS

11 U.S. TOMATO PASTE MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE SECTOR

11.2.1 HOTELS

11.2.2 RESTAURANTS

11.2.3 CAFÉ

11.2.4 BARS / CLUBS

11.2.5 OTHERS

11.3 HOUSEHOLD / RETAIL

11.4 OTHERS

12 U.S. TOMATO PASTE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE-BASED

12.2.1 SUPERMARKETS & HYPERMARKETS

12.2.2 GROCERY STORES

12.2.3 CONVENIENCE STORES

12.2.4 SPECIALTY STORES

12.2.5 OTHERS

12.3 NON-STORE-BASED

12.3.1 E-COMMERCE WEBSITES

12.3.2 COMPANY OWNED WEBSITES

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 DEL MONTE FOODS, INC

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENTS

15.2 CONAGRA BRANDS, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 GOYA FOODS, INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 GENERAL MILLS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 THE MORNING STAR COMPANY

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 CENTO FINE FOODS.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DEI FRATELLI

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DELALLO

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GALIL BRANDS

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 JOVIAL FOODS, INC AND BIONATURAE

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 LA VALLE FOODS USA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 MUTTI S.P.A

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 NEIL JONES FOOD COMPANY

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 PACIFIC COAST PRODUCERS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANOS BRANDS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 POMI USA INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PORT ROYAL SALES

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 RAO’S SPECIALTY FOODS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THE NAPOLEON CO.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TRADER JOE’S

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 BRAND COMPARATIVE ANALYSIS ON THE U.S. TOMATO PASTE MARKET

TABLE 2 NEW PRODUCT LAUNCHES

TABLE 3 NEW PACKAGING

TABLE 4 RE-LAUNCHED/ NEW FORMULATION

TABLE 5 U.S. TOMATO PASTE MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 U.S. TOMATO PASTE MARKET, BY BRAND CATEGORY, 2021-2030 (USD MILLION)

TABLE 7 U.S. TOMATO PASTE MARKET, BY PACKAGING TYPE, 2021-2030 (USD MILLION)

TABLE 8 U.S. BOTTLES IN TOMATO PASTE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. TOMATO PASTE MARKET, BY PACKAGING SIZE, 2021-2030 (USD MILLION)

TABLE 10 U.S. TOMATO PASTE MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 11 U.S. FOOD SERVICE SECTOR IN TOMATO PASTE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.S. TOMATO PASTE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 13 U.S. STORE-BASED IN TOMATO PASTE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 14 U.S. NON-STORE-BASED IN TOMATO PASTE MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 U.S. TOMATO PASTE MARKET: SEGMENTATION

FIGURE 2 U.S. TOMATO PASTE MARKET: DATA TRIANGULATION

FIGURE 3 U.S. TOMATO PASTE MARKET: DROC ANALYSIS

FIGURE 4 U.S. TOMATO PASTE MARKET: REGIONAL MARKET VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. TOMATO PASTE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. TOMATO PASTE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. TOMATO PASTE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. TOMATO PASTE MARKET: SEGMENTATION

FIGURE 9 GROWING USE OF TOMATO PASTE IN VARIOUS INDUSTRIES IS EXPECTED TO DRIVE THE U.S. TOMATO PASTE MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 10 THE CONVENTIONAL TOMATO PASTE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. TOMATO PASTE MARKET IN 2023 & 2030

FIGURE 11 SUPPLY CHAIN OF THE U.S. TOMATO PASTE MARKET

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. TOMATO PASTE MARKET

FIGURE 13 U.S. TOMATO PASTE MARKET: BY PRODUCT TYPE, 2022

FIGURE 14 U.S. TOMATO PASTE MARKET: BY BRAND CATEGORY, 2022

FIGURE 15 U.S. TOMATO PASTE MARKET: BY PACKAGING TYPE, 2022

FIGURE 16 U.S. TOMATO PASTE MARKET: BY PACKAGING SIZE, 2022

FIGURE 17 U.S. TOMATO PASTE MARKET: BY END USER, 2022

FIGURE 18 U.S. TOMATO PASTE MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 19 U.S. TOMATO PASTE MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。