米国の高容量フォークリフト市場、エンドユーザー(小売および卸売、建設、製造、貨物輸送および物流、倉庫および工場、鉱業、食品および飲料、天然資源、その他)の業界動向と2029年までの予測。

米国の高容量フォークリフト市場の分析と洞察

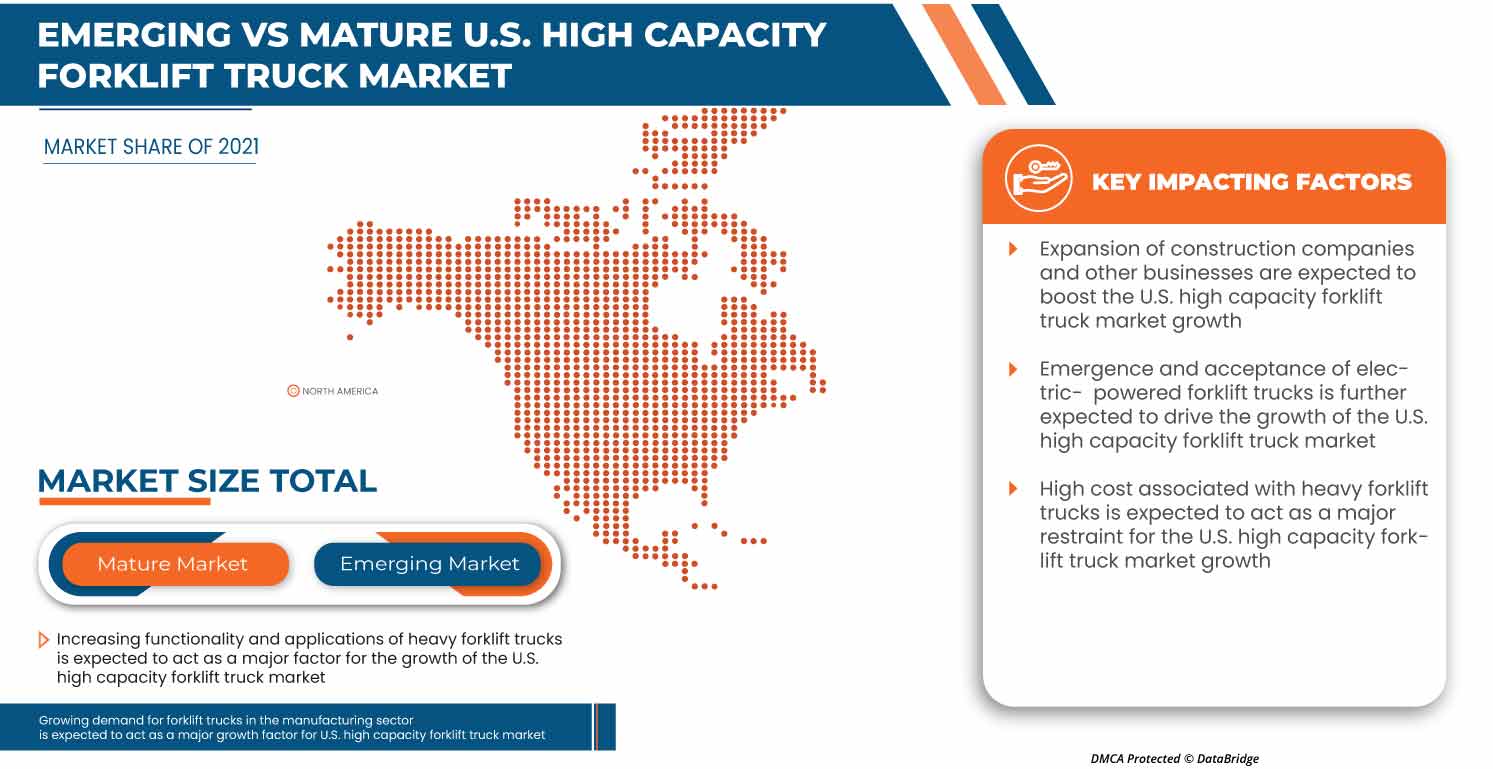

国内のメーカーやサプライヤーは、さまざまな仕様と機能を備えた大容量のフォークリフトを提供しています。建設会社の急速な工業化/拡大と製造部門におけるフォークリフトの需要の高まりは、市場の成長の主な原動力となると推定されています。さらに、電動フォークリフトの出現と普及により、市場はさらに拡大しています。ただし、これらのトラックに関連する高コストと、複数の車両所有者のメンテナンスコストが高いため、市場の成長が妨げられる可能性があります。さらに、最新のフォークリフトは業界環境に適しておらず、電動フォークリフトのインフラストラクチャの欠如が現在市場に課題をもたらすと推定されています。

Data Bridge Market Research の分析によると、米国の高容量フォークリフト市場は、予測期間中に 4.8% の CAGR で成長し、2029 年までに 9 億 9,979 万米ドルに達すると予想されています。建設部門は、米国の高容量フォークリフト市場で最大の供給部門を占めています。米国の高容量フォークリフト市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019-2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

エンドユーザー(小売・卸売、建設、製造、貨物・物流、倉庫・工場、鉱業、食品・飲料、天然資源、その他) |

|

対象国 |

私たち |

|

対象となる市場プレーヤー |

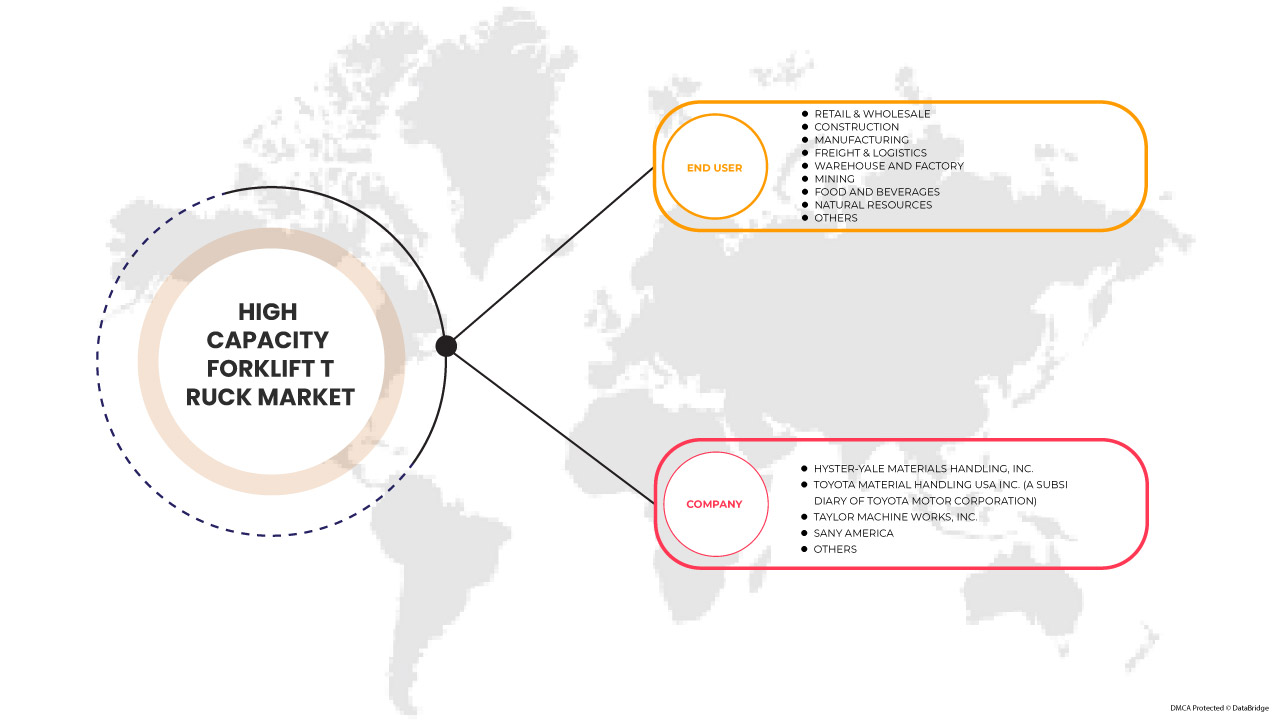

Hyster-Yale Materials Handling, Inc.、Toyota Material Handling USA Inc.(トヨタ自動車の子会社)、Taylor Machine Works, Inc.、SANY AMERICA、Manitou Group、Anhui Heli Co., Ltd.、HUBTEX Maschinenbau & Co. KG、BPR-RICO EQUIPMENT, INC. など |

市場の定義

High-capacity forklift trucks are high-powered vehicles designed to move or carry heavy objects over a distance and can also place them at a certain height. The adoption of forklift trucks is popular among industries affiliated with loading and unloading goods, such as logistics, manufacturing, and warehouses. These vehicles are commonly used in dockyards, storehouses, and recycling factories among others. These vehicles are used with some attachments, such as platforms and grippers, for efficient handling of goods and are classified based on their weight-bearing capacity. The demand for these trucks is estimated to increase in the U.S. due to factors such as the growth of e-commerce and warehouse management.

U.S. High Capacity Forklift Truck Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

-

Rapid industrialization/expansion of construction companies

An industrial vehicle with a front-powered platform is called a forklift. It has a fork that can be lifted or lowered and inserted underneath a load for lifting and moving purposes. Combustion engines or electrical batteries can power forklifts.

Some forklift models let the driver sit while operating the machine, while others demand that the driver stand (stand-up forklifts). In general, forklifts are used to transfer materials and things.

-

Growing demand for forklift trucks in the manufacturing sector

Material handling requirements vary widely in the manufacturing industry, such as order pickers are required to pick parts, tuggers are required to move them throughout the factory, and forklifts are required to move product pallets.

During the Industrial Revolution in the 18th and 19th centuries, the manufacturing industries underwent a significant transformation that increased the demand for appropriate material handling. Since then, there have been numerous changes made to material handling procedures.

Opportunity

-

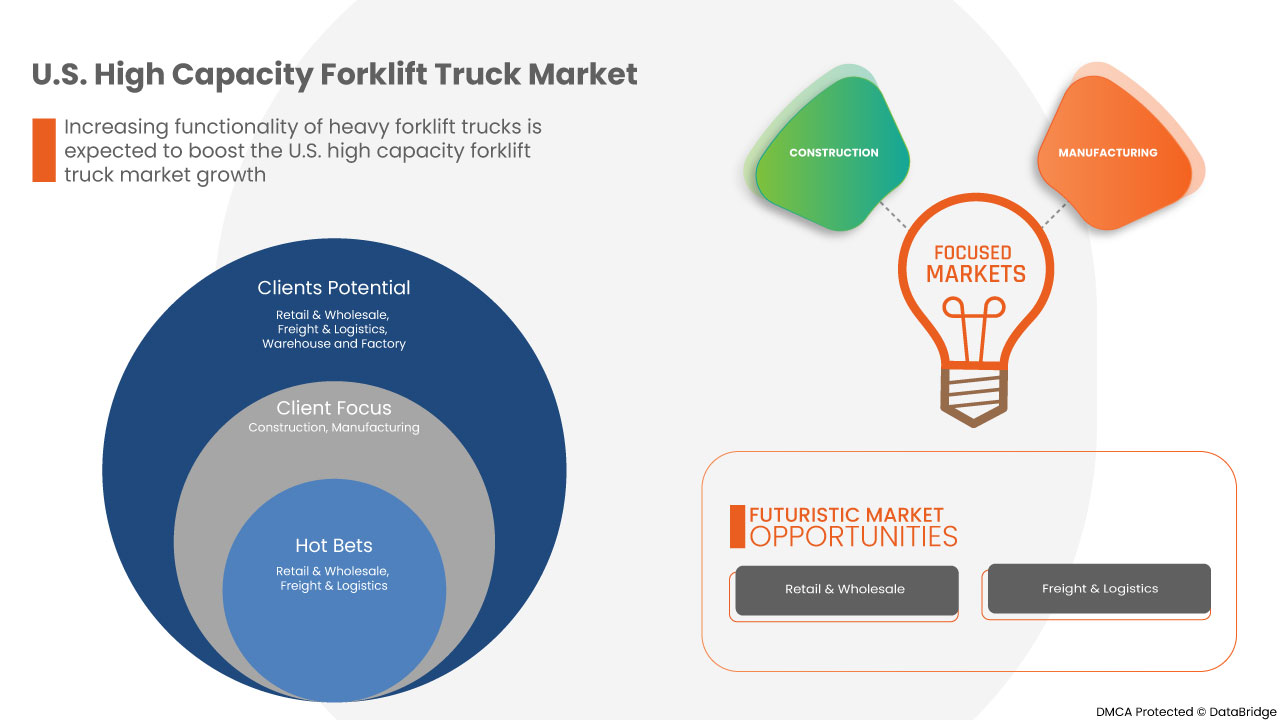

Growing demand for forklift trucks in warehouse management

The warehouse is a building where raw materials or manufactured goods may be stored before their distribution for sale. Warehouses are used by all different types of businesses that need to temporarily store products in bulk before either shipping them to other locations or individually to end consumers. For instance, many e-commerce businesses; purchase products in bulk from their suppliers, who ship them to their warehouses for storage. When an end customer places an order from the e-commerce site, the business or its third-party fulfilment provider; picks and packs the product from the warehouse and ships it directly to the customer. As there is constant growth in the e-commerce segment across the U.S., the number of warehouses is also increasing. In return, this positively affects the market as these trucks are used in the warehouse to store heavy goods and efficiently use the warehouse space. Thus, the growing warehouse number across the U.S. is increasing the demand for forklift trucks for its management. This is expected to be an opportunity for the U.S. high capacity forklift truck market.

Restraint/Challenge

- High maintenance cost for multiple fleet owners

Every 200–250 hours of operation, or every six weeks, forklifts must be completely serviced and maintained. Any forklift used on a job site should go through a daily inspection. Forklift maintenance not only keeps your machine in peak shape but also aids in reducing safety risks. The Occupational Safety and Health Administration (OSHA) fines businesses that don't do enough forklift maintenance because regular maintenance is crucial.

The term "forklift maintenance" is intentionally wide. The amount and kind of maintenance your forklift requires may fluctuate depending on the type of power it uses. Regular cleaning, testing safety features, and replacing damaged equipment are all included in maintenance. Companies ensure the greatest return on investment by staying on top of maintenance.

COVID-19 Impact on U.S. High Capacity Forklift Truck Market

COVID-19 significantly impacted various industries as almost every country has opted for the shutdown for every facility except those in the essential goods segment. The government has taken some strict actions, such as shutting facilities and selling non-essential goods, blocking international trade, and many more to prevent the spread of COVID-19. This boosted the U.S. high capacity forklift truck market with the emergence and acceptance of electric-powered forklift trucks.

Recent Developments

- In July 2022, Toyota Material Handling announced that the company had acquired PennWest Toyota Lift, a Pennsylvania-based forklift dealership located in Mount Pleasant, Pittsburgh, and Erie, Pennsylvania. Through this acquisition, the company has increased its market reachability in the U.S. and has aimed to increase its market share in the market

- 2021年11月、ハイスター・イェール・マテリアルズ・ハンドリング社は、ベアード・バーチャル・グローバル・インダストリアル・カンファレンスに参加することを発表しました。この参加により、同社は市場で提供する製品ポートフォリオを通じて産業部門での影響力を高めることができました。

米国の高容量フォークリフト市場の範囲

米国の高容量フォークリフト市場は、エンドユーザーに基づいてセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

エンドユーザー別

- 小売・卸売

- 工事

- 製造業

- 貨物輸送と物流

- 倉庫と工場

- 鉱業

- 食品・飲料

- 天然資源

- その他

エンドユーザーに基づいて、米国の大容量フォークリフト市場は、小売・卸売、建設、製造、貨物・物流、倉庫・工場、鉱業、食品・飲料、天然資源、その他に分類されます。

競争環境と米国の高容量フォークリフト市場シェア分析

米国の高容量フォークリフト市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、米国の高容量フォークリフト市場に関連する会社の焦点にのみ関連しています。

米国の高容量フォークリフト市場で事業を展開している主要企業としては、Hyster-Yale Materials Handling, Inc.、Toyota Material Handling USA Inc.(トヨタ自動車の子会社)、Taylor Machine Works, Inc.、SANY AMERICA、Manitou Group、Anhui Heli Co., Ltd.、HUBTEX Maschinenbau & Co. KG、BPR-RICO EQUIPMENT, INC. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END-USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 PRODUCT TYPE CURVE

2.1 CHALLENGE MATRIX

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS ANALYSIS

4.2 LIST OF END USER COMPANIES (DOCKYARDS, PORTS, AND RECYCLING)

4.3 U.S. SAFETY DEPARTMENT CONTACT LIST

4.4 OSHA FORKLIFT RULES AND REGULATIONS

4.5 TECHNOLOGICAL TRENDS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RAPID EXPANSION OF CONSTRUCTION COMPANIES

5.1.2 GROWING DEMAND FOR FORKLIFT TRUCKS IN THE MANUFACTURING SECTOR

5.1.3 EMERGENCE AND ACCEPTANCE OF ELECTRIC-POWERED FORKLIFT TRUCKS

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH HEAVY FORKLIFT TRUCKS

5.2.2 HIGH MAINTENANCE COST FOR MULTIPLE FLEET OWNERS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR FORKLIFT TRUCKS IN WAREHOUSE MANAGEMENT

5.3.2 INCREASING FUNCTIONALITY OF HEAVY FORKLIFT TRUCKS

5.3.3 INCREASING PARTNERSHIP AND ACQUISITION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 MODERN FORKLIFT TRUCKS ARE UNSUITABLE FOR THE INDUSTRY ENVIRONMENT

5.4.2 LACK OF INFRASTRUCTURE FOR ELECTRIC FORKLIFT TRUCKS

6 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER

6.1 OVERVIEW

6.2 CONSTRUCTION

6.2.1 INTERNAL COMBUSTION ENGINE POWERED

6.2.1.1 DIESEL

6.2.1.2 LPG/GASOLINE

6.2.2 ELECTRIC POWERED

6.3 FREIGHT & LOGISTICS

6.3.1 INTERNAL COMBUSTION ENGINE POWERED

6.3.1.1 DIESEL

6.3.1.2 LPG/GASOLINE

6.3.2 ELECTRIC POWERED

6.4 MANUFACTURING

6.4.1 INTERNAL COMBUSTION ENGINE POWERED

6.4.1.1 DIESEL

6.4.1.2 LPG/GASOLINE

6.4.2 ELECTRIC POWERED

6.5 NATURAL RESOURCES

6.5.1 INTERNAL COMBUSTION ENGINE POWERED

6.5.1.1 DIESEL

6.5.1.2 LPG/GASOLINE

6.5.2 ELECTRIC POWERED

6.6 WAREHOUSE & FACTORY

6.6.1 INTERNAL COMBUSTION ENGINE POWERED

6.6.1.1 DIESEL

6.6.1.2 LPG/GASOLINE

6.6.2 ELECTRIC POWERED

6.7 MINING

6.7.1 INTERNAL COMBUSTION ENGINE POWERED

6.7.1.1 DIESEL

6.7.1.2 LPG/GASOLINE

6.7.2 ELECTRIC POWERED

6.8 FOOD & BEVERAGES

6.8.1 INTERNAL COMBUSTION ENGINE POWERED

6.8.1.1 DIESEL

6.8.1.2 LPG/GASOLINE

6.8.2 ELECTRIC POWERED

6.9 RETAIL & WHOLESALE

6.9.1 INTERNAL COMBUSTION ENGINE POWERED

6.9.1.1 DIESEL

6.9.1.2 LPG/GASOLINE

6.9.2 ELECTRIC POWERED

6.1 OTHERS

7 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, COMPANY LANDSCAPE

7.1 COMPANY SHARE ANALYSIS: U.S.

8 SWOT ANALYSIS

9 COMPANY PROFILE

9.1 HYSTER-YALE MATERIALS HANDLING, INC.

9.1.1 COMPANY SNAPSHOT

9.1.2 REVENUE ANALYSIS

9.1.3 BRAND PORTFOLIO

9.1.4 RECENT DEVELOPMENTS

9.2 TOYOTA MATERIAL HANDLING (A SUBSIDIARY OF TOYOTA MOTOR CORPORATION)

9.2.1 COMPANY SNAPSHOT

9.2.2 REVENUE ANALYSIS

9.2.3 PRODUCT PORTFOLIO

9.2.4 RECENT DEVELOPMENTS

9.3 TAYLOR MACHINE WORKS, INC

9.3.1 COMPANY SNAPSHOT

9.3.2 PRODUCT PORTFOLIO

9.3.3 RECENT DEVELOPMENTS

9.4 MANITOU GROUP

9.4.1 COMPANY SNAPSHOT

9.4.2 REVENUE ANALYSIS

9.4.3 PRODUCT PORTFOLIO

9.4.4 RECENT DEVELOPMENT

9.5 ANHUI HELI CO.

9.5.1 COMPANY SNAPSHOT

9.5.2 PRODUCT PORTFOLIO

9.5.3 RECENT DEVELOPMENT

9.6 BPR-RICO EQUIPMENT, INC.

9.6.1 COMPANY SNAPSHOT

9.6.2 PRODUCT PORTFOLIO

9.6.3 RECENT DEVELOPMENT

9.7 HUBTEX MASCHINENBAU & CO. KG

9.7.1 COMPANY SNAPSHOT

9.7.2 PRODUCT PORTFOLIO

9.7.3 RECENT DEVELOPMENTS

9.8 SANY AMERICA

9.8.1 COMPANY SNAPSHOT

9.8.2 PRODUCT PORTFOLIO

9.8.3 RECENT DEVELOPMENTS

10 QUESTIONNAIRE

11 RELATED REPORTS

表のリスト

TABLE 1 SUMMARY TABLE ON USE OF INDUSTRIAL TRUCKS IN VARIOUS LOCATIONS

TABLE 2 SUMMARY TABLE ON USE OF INDUSTRIAL TRUCKS IN VARIOUS LOCATIONS - CONTINUED

TABLE 3 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 4 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET, BY END USER, 2020-2029 (VOLUME IN THOUSAND)

TABLE 5 U.S. CONSTRUCTION IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 6 U.S. CONSTRUCTION IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 7 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 8 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 9 U.S. FREIGHT & LOGISTICS IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 10 U.S. FREIGHT & LOGISTICS IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 11 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 12 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 13 U.S. MANUFACTURING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 14 U.S. MANUFACTURING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 15 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 16 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 17 U.S. NATURAL RESOURCES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 18 U.S. NATURAL RESOURCES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 19 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 20 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 21 U.S. WAREHOUSE & FACTORY IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 22 U.S. WAREHOUSE & FACTORY IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 23 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 24 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 25 U.S. MINING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 26 U.S. MINING IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 27 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 29 U.S. FOOD & BEVERAGES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 30 U.S. FOOD & BEVERAGES IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 31 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 33 U.S. RETAIL & WHOLESALE IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (USD MILLION)

TABLE 34 U.S. RETAIL & WHOLESALE IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY POWER SOURCE, 2020-2029 (VOLUME IN THOUSAND)

TABLE 35 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (USD MILLION)

TABLE 36 U.S. INTERNAL COMBUSTION ENGINE POWERED IN HIGH CAPACITY FORKLIFT TRUCK MARKET, BY FUEL TYPE, 2020-2029 (VOLUME IN THOUSAND)

図表一覧

FIGURE 1 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 2 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DATA TRIANGULATION

FIGURE 3 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DROC ANALYSIS

FIGURE 4 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: DBMR MARKET POSITION GRID

FIGURE 8 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: MARKET END-USER COVERAGE GRID

FIGURE 9 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: SEGMENTATION

FIGURE 10 RAPID INDUSTRIALIZATION/EXPANSION OF CONSTRUCTION COMPANIES IS THE MAJOR FACTOR BOOSTING THE GROWTH TO BE A KEY DRIVER FOR U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET IN THE FORECAST PERIOD

FIGURE 11 CONSTRUCTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET

FIGURE 13 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: BY END USER, 2021

FIGURE 14 U.S. HIGH CAPACITY FORKLIFT TRUCK MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。