米国の茶色い紙市場、紙の種類別(印刷用紙、コピー用紙、ワックスペーパー、グリーティングカード用紙、ボンド紙、トレーシングペーパー、ティッシュペーパー、インクジェット用紙、タバコ巻紙)、最終用途別(包装、文房具、ホームケアおよびパーソナルケア、建築および建設、その他)、流通チャネル別(直接販売/B2B、専門店、電子商取引、その他) - 2030年までの業界動向および予測。

米国のブラウンペーパー市場の分析と規模

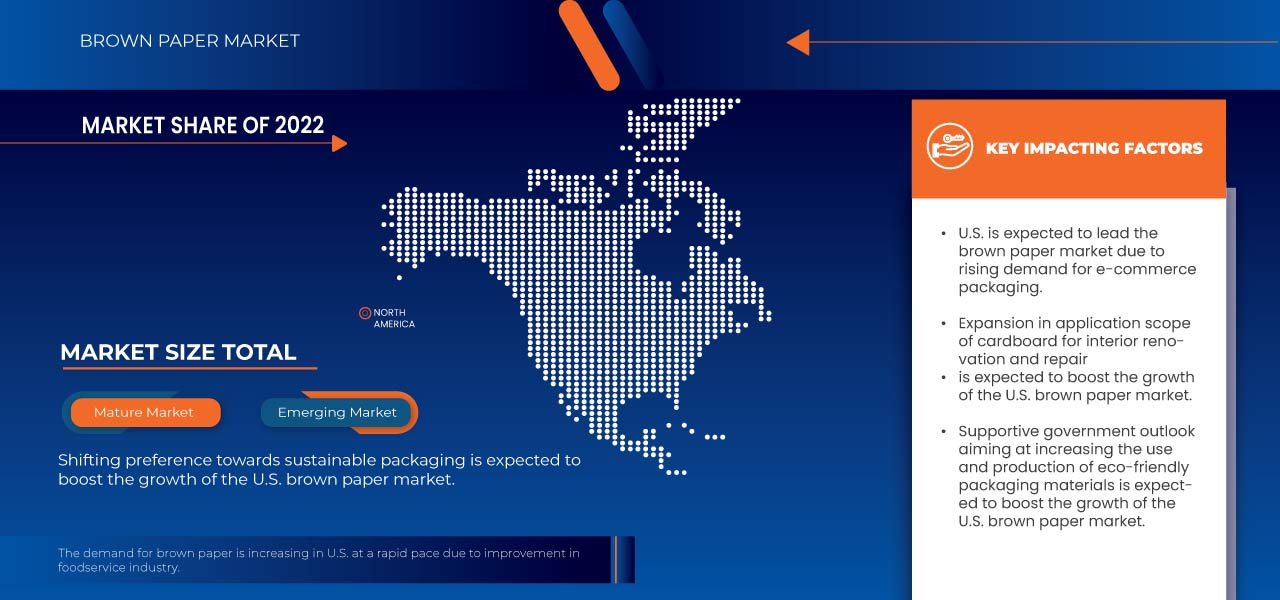

持続可能な包装への嗜好の変化と食品サービス業界の改善は、米国の茶色の紙市場の重要な推進力となっています。市場の成長を牽引する要因としては、電子商取引の包装に対する需要の増加、内装の改修や修理のための段ボールの適用範囲の拡大、柔らかい電子部品に対する需要の増加などが挙げられます。ただし、他の用途での紙パルプの使用による供給制約と、高品質の原材料へのアクセスの制限が、市場の成長を妨げると予想されます。

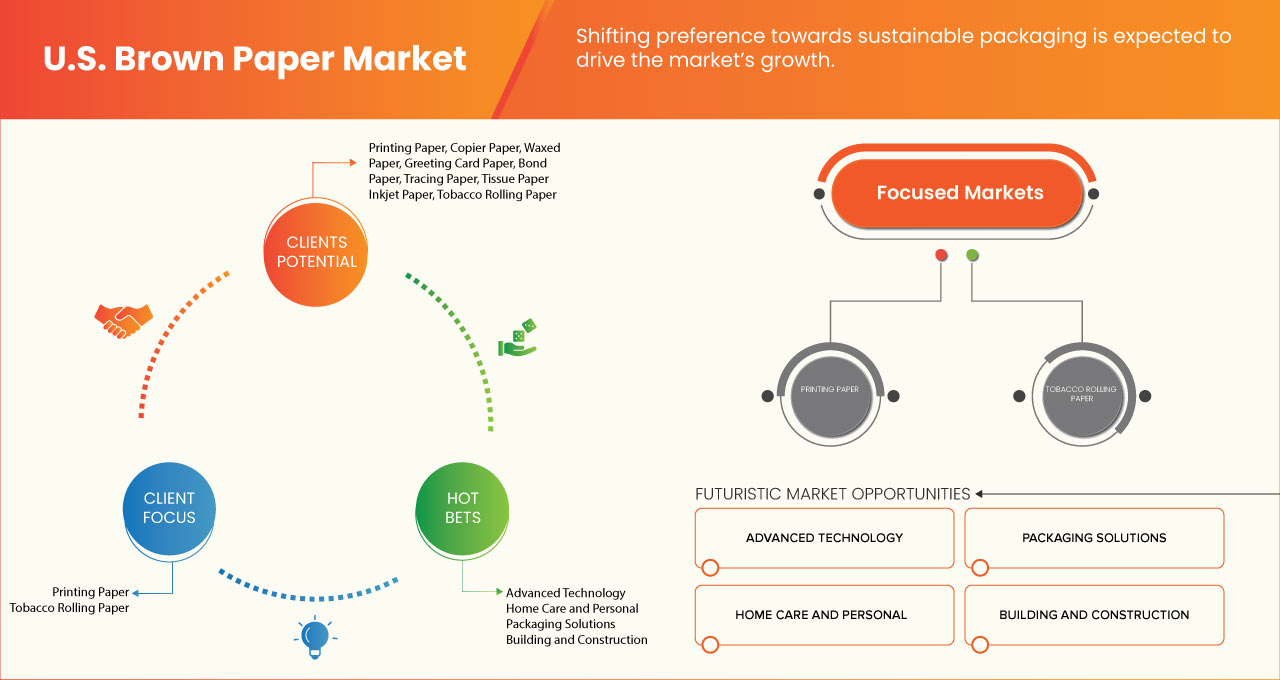

Data Bridge Market Research の分析によると、米国の茶色の紙市場は、予測期間中に 3.5% の CAGR で成長し、2030 年までに 72 億 5,859 万米ドルに達すると予想されています。印刷用紙は、印刷用紙としての茶色の紙の用途が拡大しているため、米国の茶色の紙市場で最大の紙タイプ セグメントを占めています。米国の茶色の紙市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高(百万)、販売量(キロトン)、価格(米ドル) |

|

対象セグメント |

用紙の種類(印刷用紙、コピー用紙、ワックスペーパー、グリーティングカード用紙、ボンド紙、トレーシングペーパー、ティッシュペーパー、インクジェット用紙、タバコ巻紙)、最終用途(包装、文房具、ホームケアおよびパーソナルケア、建築および建設、その他)、流通チャネル(直接販売/B2B、専門店、Eコマース、その他) |

|

対象国 |

私たち |

|

対象となる市場プレーヤー |

Richerpaper.com、Primo Tedesco SA、Georgia-Pacific、Graphic Packaging International、LLC、WestRock Company、王子ホールディングス株式会社、Nordic Paper、Smurfit Kappaなど |

市場の定義

茶色の紙は、引き裂き強度と強度に優れた紙です。主に包装業界で使用され、他の多くのユーザーにも使用されています。木材パルプとリサイクル材料に化学物質が加えられ、紙の軽量性を維持しながら繊維の強度、厚み、耐久性が向上します。茶色の紙は一般的な包装用紙の中で最も強度が高く、工業用バッグ、食料品用バッグ、多層袋の内側の層、または無地の包装紙などの用途で最大限の強度が必要な場合に使用されます。茶色の紙は、段ボールのライナーの製造にも使用されます。

米国のブラウンペーパー市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

- 持続可能な包装への好みの変化

消費者の間では、堆肥化可能で持続可能な包装材料の使用が増えています。これは、プラスチックやその他の非生分解性包装のバリエーションやオプションの有害な影響に関する認識が高まっているためです。茶色の紙の包装ソリューションは、生分解性があり、耐久性があり、使いやすいです。そのため、食品・飲料、電子機器・電気製品、医薬品、建築・建設など、さまざまな最終用途産業でその需要が絶えず増加しています。

さらに、環境に優しい製品に追加料金を支払うことをいとわない消費者の購買傾向の変化により、企業が責任あるビジネス慣行への取り組みを強化し、持続可能な包装ソリューションを使用する必要性が高まっており、包装業界における茶色の紙の需要がさらに高まるでしょう。

- 電子商取引パッケージの需要増加

電子商取引の梱包とは、指定された場所に安全に配送するために商品や製品を包装するプロセスです。電子商取引ショッピングの増加に伴い、後者に関連するサービスが主要な市場として浮上しています。配送用ボックスは、急成長している電子商取引セクターとともに大きな注目を集めています。

さらに、電子商取引の人気の高まりとそれに関連する開発により、クラフト包装のプレミアム化が進んでいます。これには、少量印刷で高品質のグラフィックを印刷できる茶色の紙素材の需要が含まれます。さらに、市場で活動している主要企業は、茶色のクラフト紙と紙袋の生産を改善および加速し、製品の保護を強化する多くの革新を開始しました。

機会

- 新しい茶色の紙の包装ソリューションの技術的進歩への支出の増加

日用消費財(FMCG)業界の組織は、より持続可能な包装ソリューションの導入を通じて、より持続可能になるよう取り組んでいます。主要な市場プレーヤーや紙市場のさまざまな新興企業は、消費者に優しいバッグ、スタンドアップポーチ、ジッパーポーチなど、新しいクラフト紙または茶色の紙の包装ソリューションを開発しています。

茶色の紙のパッケージングソリューションを製造する企業も、スマートパッケージングのさまざまな側面を考慮しています。スマートパッケージングには、アクティブパッケージング、調整雰囲気、湿度制御、ガス除去剤、スマートラベル、および特に食品に直接接触するパッケージ用の時間と温度のインジケーターが含まれます。

- 環境に優しい包装材料の使用と生産を増やすことを目指す政府の支援的な見通し

The surge in the trend towards eco-friendly packaging materials, which are modern at the same time with visual appeal, brand identity, and long shelf life, has increased. The main advantage of brown paper is that it can be blended with a variety of fibers. This improves the characteristics of the paper and expands the range of its applications. These brown papers are environmentally friendly, have improved packaging properties, and are easy to stack and recycle.

Regulatory authorities are paying more attention to the introduction of paper recycling practices. Owing to the packaging properties of various foods such as sandwiches, pizzas, and burgers, the industry has had a significant increase in demand for brown paper from the food and beverage industry due to the shift in consumer focus to improving the appearance of end-user products.

Restraints

- Credible threat from external substitutes, such as plastics

Plastic packaging has many forms that can vary based on different applications, from flexible and adaptable to sturdy and resilient types like plastic containers. In addition, there is an availability of bioplastics, which are made from biodegradable sources such as vegetables, rice, and other organic and plant-based compounds.

Moreover, plastic bags are more durable than brown paper bags. They are less prone to tearing, easier to carry, and can also be used in bad weather. Plastic bags are reusable, as trashcan liners and as storage bags. Plastic bags last longer and can be repurposed, unlike paper bags. Low density, strength, user-friendly designs, fabrication capabilities, extended life, low weight, and low cost are all characteristics that have contributed to plastic's rapid rise. This is expected to restrain the markets growth.

- Emergence of other paper counterparts

With the cost of wood pulp rising and deforestation regularly on the environmental agenda, a number of companies are looking at other raw ingredients and methods for creating eco-friendly paper products that may act as a substitute for brown paper. These companies are looking to this and taking a creative approach to the materials used in producing paper to produce different types and grades of paper. Many of these paper types are recyclable and sustainable in nature, making them the preferred choice in various applications.

Challenges

- Limited access of high-quality raw materials

The availability of raw materials is very important for any kind of industry to function effectively. Agricultural residues have become one of the most important substitute resources due to the growth in the request for fibrous raw materials, the shortage of trees in many countries, and the growing sustainability consciousness. There is a scarcity of wood resources despite the fact that the world has enough forest soil to provide wood.

Other factors, such as severe weather storms in the U.S., have led to temporary shortages in certain materials over the course of the pandemic. The entire paper mill industry, including manufacturers, wholesalers, printers, and marketing companies, are experiencing difficulties securing the necessary amount of materials and goods.

- Supply constraints as a result of the use of paper pulp in other applications

The main source of cellulosic fiber used for pulp and paper production comes from wood, while non-wood fibers are used to a lesser extent. The need for pulp and paper is rising significantly due to exponential population growth, industrialization, and urbanization. Most paper manufacturing industries use wood fibers to meet pulp and paper requirements. The shortage of fibrous wood resources and increased deforestation are linked to the excessive dependence on wood for pulp and paper production.

Most of the cellulosic fibers used come from wood species, mainly hardwoods and softwoods. Nevertheless, in recent years there has been an increase in consumer awareness regarding the need to preserve the environment.

Recent Developments

- In February 2023, Smurfit Kappa was recognized as a top ESG performer by leading research and analytics company Morningstar Sustainalytics. The company's 2022 ESG Risk Rating has improved, seeing the FTSE 100 listed company positioned in Sustainalytics' list of Top Rated companies both for the industry and regional categories. The ESG Industry Top Rated badge received by Smurfit Kappa is a global benchmark and reaffirms Smurfit Kappa's ESG Risk Rating as 'low-risk'.

- In February 2021, Graphic Packaging International launched ProducePack, a sustainable paperboard packaging range of solutions for fresh produce. The product launch led to new business relations as well as partnerships. Additionally, gaining a lot of attention from larger customers around the globe.

U.S. Brown Paper Market Scope

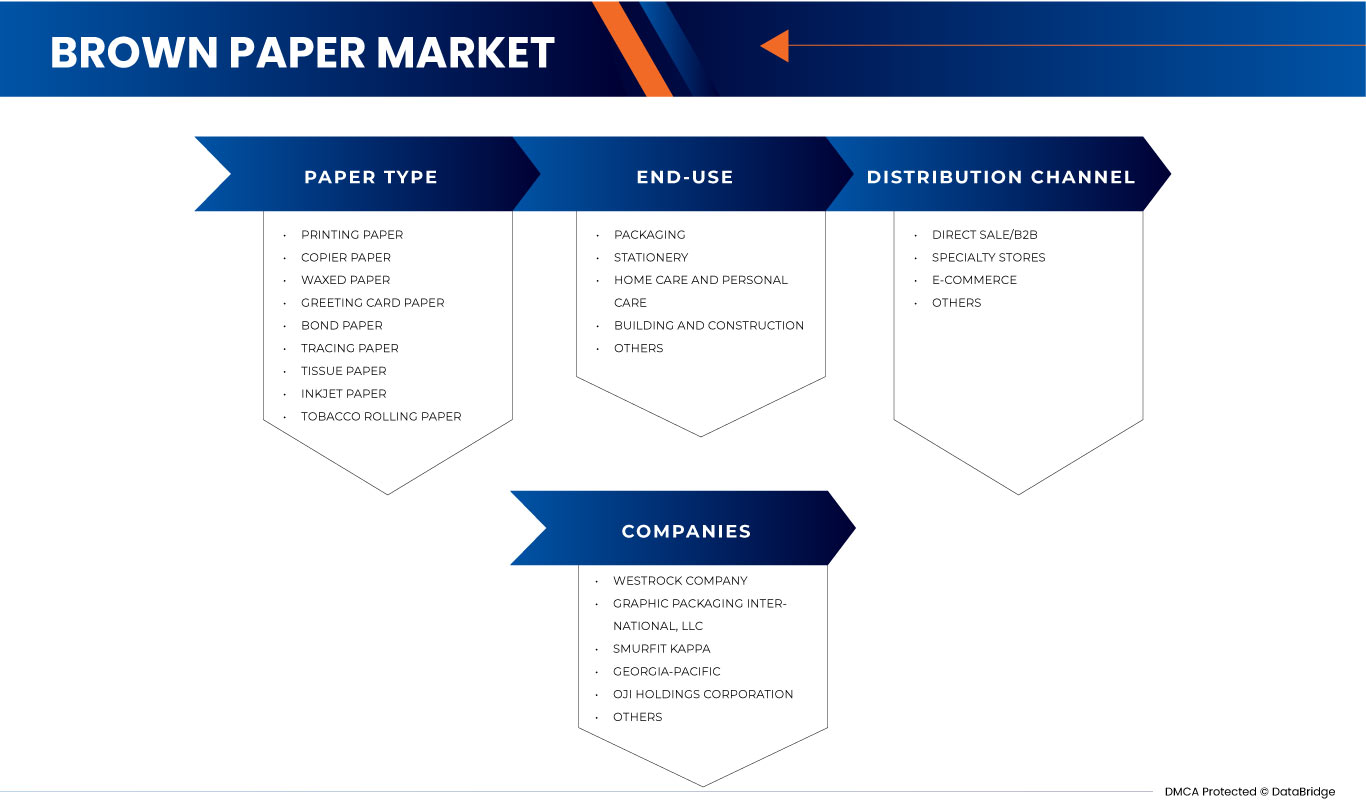

The U.S. brown paper market is segmented on the basis of paper type, end-use, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Paper Type

- Printing Paper

- Copier Paper

- Waxed Paper

- Greeting Card Paper

- Bond Paper

- Tracing Paper

- Tissue Paper

- Inkjet Paper

- Tobacco Rolling Paper

On the basis of paper type, the U.S. brown paper market is segmented into printing paper, copier paper, waxed paper, greeting card paper, bond paper, tracing paper, tissue paper, inkjet paper, and tobacco rolling paper.

End-Use

- Packaging

- Stationery

- Home Care and Personal Care

- Building and Construction

- Others

On the basis of end-use, the U.S. brown paper market has been segmented into packaging, stationery, home care and personal care, building and construction, and others.

Distribution Channel

- Direct Sale/B2B

- Specialty Stores

- E-Commerce

- Others

流通チャネルに基づいて、米国の茶色の紙市場は、直接販売/B2B、専門店、電子商取引、その他に分類されています。

競争環境と米国のブラウンペーパー市場シェア分析

米国のブラウン ペーパー市場の競争状況では、競合他社ごとに詳細が提供されます。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、米国のブラウン ペーパー市場への会社の重点にのみ関連しています。

米国の茶色の紙市場で事業を展開している主要企業としては、Richerpaper.com、Primo Tedesco SA、Georgia-Pacific、Graphic Packaging International、LLC、WestRock Company、Oji Holdings Corporation、Nordic Paper、Smurfit Kappa などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF U.S. BROWN PAPER

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PAPER TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT'S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 LIST OF KEY PATENTS LAUNCHED

4.5 SUPPLY CHAIN ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.7 VENDOR SELECTION CRITERIA

4.8 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SHIFTING PREFERENCE TOWARD SUSTAINABLE PACKAGING

5.1.2 IMPROVEMENT IN THE FOOD SERVICE INDUSTRY

5.1.3 RISING DEMAND FOR E-COMMERCE PACKAGING

5.1.4 EXPANSION IN APPLICATION SCOPE OF CARDBOARD FOR INTERIOR RENOVATION AND REPAIR

5.2 RESTRAINTS

5.2.1 CREDIBLE THREAT FROM EXTERNAL SUBSTITUTES, SUCH AS PLASTICS

5.2.2 EMERGENCE OF OTHER PAPER COUNTERPARTS

5.3 OPPORTUNITIES

5.3.1 RISING SPENDING ON TECHNOLOGICAL ADVANCEMENTS OF NEW BROWN PAPER PACKAGING SOLUTIONS

5.3.2 SUPPORTIVE GOVERNMENT OUTLOOK AIMING AT INCREASING THE USE AND PRODUCTION OF ECO-FRIENDLY PACKAGING MATERIALS

5.4 CHALLENGES

5.4.1 LIMITED ACCESS TO HIGH-QUALITY RAW MATERIALS

5.4.2 SUPPLY CONSTRAINTS AS A RESULT OF THE USE OF PAPER PULP IN OTHER APPLICATIONS

6 U.S. BROWN PAPER MARKET, BY PAPER TYPE

6.1 OVERVIEW

6.2 PRINTING PAPER

6.2.1 BAGS & POUCHES

6.2.2 CORRUGATED SHEETS

6.2.3 COMPOSITE CANS

6.2.4 CARTONS

6.2.5 SACKS

6.2.6 ENVELOPES

6.2.7 OTHERS

6.3 COPIER PAPER

6.4 WAXED PAPER

6.5 GREETING CARD PAPER

6.6 BOND PAPER

6.7 TRACING PAPER

6.8 TISSUE PAPER

6.9 INKJET PAPER

6.1 TOBACCO ROLLING PAPER

7 U.S. BROWN PAPER MARKET, BY END-USE

7.1 OVERVIEW

7.2 PACKAGING

7.2.1 PRINTING PAPER

7.2.2 WAXED PAPER

7.3 STATIONERY

7.3.1 COPIER PAPER

7.3.2 GREETING CARD PAPER

7.3.3 BOND PAPER

7.3.4 PRINTING PAPER

7.3.5 INKJET PAPER

7.3.6 TRACING PAPER

7.4 HOME CARE AND PERSONAL CARE

7.4.1 TISSUE PAPER

7.4.2 TRACING PAPER

7.4.3 WAXED PAPER

7.5 BUILDING AND CONSTRUCTION

7.5.1 PRINTING PAPER

7.6 OTHERS

7.6.1 PRINTING PAPER

7.6.2 TOBACCO ROLLING PAPER

8 U.S. BROWN PAPER MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT SALE/B2B

8.3 SPECIALTY STORES

8.4 E-COMMERCE

8.5 OTHERS

9 U.S. BROWN PAPER MARKET, COMPANY LANDSCAPE

9.1 COMPANY SHARE ANALYSIS: U.S.

9.2 ACQUISITION

9.3 NEW PRODUCT LAUNCH

9.4 CERTIFICATION

9.5 AWARDS

10 SWOT ANALYSIS

11 COMPANY PROFILES

11.1 WESTROCK COMPANY

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENTS

11.2 GRAPHIC PACKAGING INTERNATIONAL, LLC

11.2.1 COMPANY SNAPSHOT

11.2.2 PRODUCT PORTFOLIO

11.2.3 RECENT DEVELOPMENTS

11.3 SMURFIT KAPPA

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENTS

11.4 GEORGIA-PACIFIC

11.4.1 COMPANY SNAPSHOT

11.4.2 PRODUCT PORTFOLIO

11.4.3 RECENT DEVELOPMENTS

11.5 NORDIC PAPER

11.5.1 COMPANY SNAPSHOT

11.5.2 REVENUE ANALYSIS

11.5.3 PRODUCT PORTFOLIO

11.5.4 RECENT DEVELOPMENTS

11.6 OJI HOLDINGS CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 REVENUE ANALYSIS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT DEVELOPMENT

11.7 PRIMO TEDESCO SA

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENTS

11.8 RICHERPAPER.COM

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENTS

12 QUESTIONNAIRE

13 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF UNCOATED KRAFT PAPER AND PAPERBOARD IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE – 4804 (USD THOUSAND)

TABLE 2 EXPORT DATA OF UNCOATED KRAFT PAPER AND PAPERBOARD IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE – 4804 (USD THOUSAND)

TABLE 3 REGULATORY FRAMEWORK

TABLE 4 U.S. BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 5 U.S. BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (KILO TONS)

TABLE 6 U.S. PRINTING PAPER IN BROWN PAPER MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 7 U.S. BROWN PAPER MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 8 U.S. PACKAGING IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 9 U.S. STATIONERY IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 10 U.S. HOME CARE AND PERSONAL CARE IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 11 U.S. BUILDING AND CONSTRUCTION IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 12 U.S. OTHERS IN BROWN PAPER MARKET, BY PAPER TYPE, 2021-2030 (USD MILLION)

TABLE 13 U.S. BROWN PAPER MARKET, BDISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 U.S. BROWN PAPER MARKET

FIGURE 2 U.S. BROWN PAPER MARKET: DATA TRIANGULATION

FIGURE 3 U.S. BROWN PAPER MARKET: DROC ANALYSIS

FIGURE 4 U.S. BROWN PAPER MARKET: U.S. MARKET ANALYSIS

FIGURE 5 U.S. BROWN PAPER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. BROWN PAPER MARKET: THE PAPER TYPE LIFE LINE CURVE

FIGURE 7 U.S. BROWN PAPER MARKET: MULTIVARIATE MODELLING

FIGURE 8 U.S. BROWN PAPER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 U.S. BROWN PAPER MARKET: DBMR MARKET POSITION GRID

FIGURE 10 U.S. BROWN PAPER MARKET: MARKET END-USE COVERAGE GRID

FIGURE 11 U.S. BROWN PAPER MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 U.S. BROWN PAPER MARKET: SEGMENTATION

FIGURE 13 SHIFTING PREFERENCE TOWARD SUSTAINABLE PACKAGING IS EXPECTED TO DRIVE U.S. BROWN PAPER MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 14 PRINTING PAPER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. BROWN PAPER MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF U.S. BROWN PAPER MARKET

FIGURE 16 U.S. BROWN PAPER MARKET: BY PAPER TYPE, 2022

FIGURE 17 U.S. BROWN PAPER MARKET: BY END-USE, 2022

FIGURE 18 U.S. BROWN PAPER MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 19 U.S. BROWN PAPER MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。