トルコの物理的セキュリティ市場、コンポーネント別(ハードウェア、サービス、ソフトウェア)、認証別(一要素認証、二要素認証、三要素認証)、導入モデル別(オンプレミスおよびクラウド)、企業規模別(大企業および中小企業)、エンドユーザー別(商業、政府、産業および住宅) - 2029年までの業界動向および予測。

トルコの物理的セキュリティ市場の分析と規模

物理的なセキュリティ対策は、建物と建物内の機器を保護します。つまり、不法侵入者を封鎖し、許可された者のみの侵入を許可します。ネットワークとサイバーセキュリティは重要ですが、物理的なセキュリティの不備や脅威から守ることが、テクノロジー、データ、施設にアクセスできるスタッフや教職員の安全を確保する唯一の方法です。これにより、テロ、火災、強盗、破壊行為、自然災害に対する防御が可能になります。

Data Bridge Market Research の分析によると、トルコの物理的セキュリティ市場は、予測期間中に 9.1% の CAGR で成長し、2029 年までに 16 億 1,006 万米ドルに達すると予想されています。物理的セキュリティ市場レポートでは、価格設定、特許、技術の進歩についても包括的に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

コンポーネント別(ハードウェア、サービス、ソフトウェア)、認証(一要素認証、二要素認証、三要素認証)、導入モデル別(オンプレミスとクラウド)、企業規模別(大企業と中小企業)、エンドユーザー別(商業、政府、産業、住宅) |

|

対象となる市場プレーヤー |

Thales、HID Global Corporation、Bosch Sicherheitssysteme GmbH、Hangzhou Hikvision Digital Technology Co., Ltd.、Pelco(A Motorolla Solutions Company)、Cisco Systems, Inc.、Axis Communications AB、Johnson Controls、Aware, Inc.、IDEMIA |

市場の定義

物理的セキュリティは、組織、企業、機関、または組織に重大な損失をもたらす可能性のある物理的な動作やイベントから人員、ハードウェア、ソフトウェア、ネットワーク、およびデータを保護することを目的としたセキュリティ サービスです。これらのセキュリティ サービスには、火災、洪水、自然災害、強盗、盗難、破壊行為、およびテロからの保護が含まれます。セキュリティ担当者、CCTV カメラ、ロック、安全バリア、アクセス制御プロトコル、およびその他の同様のツールはすべて、相互依存システムを組み込んださまざまなレイヤーに含まれています。

トルコの物理的セキュリティ市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- スマートな相互接続された建物/住宅の出現

最近、消費者の間でスマートホーム/ビルディングの人気が高まっています。スマートホーム/ビルディングとは、インターネットに接続されたデバイスを使用して、リモート監視、アクセス制御ソリューション、スマート照明、スマートロック、スマート生体認証などの機器やシステムの管理を可能にする住宅です。

さらに、スマート ホーム デバイスは効率的で省エネ性に優れているため、電気料金の支払いが削減されます。スマート ホーム デバイスは、革新的な機能、内蔵のモーション ディテクター、インターネット接続、スマートフォン、ラップトップ、その他のデバイスによる制御により、消費者に安全、快適、安心感を与えます。

- あらゆる分野で物理的な生体認証ソリューションの重要性が急速に高まっている

生体認証ベースの物理的セキュリティ デバイスは、世界中のあらゆる地域で増加しています。指紋、物理的アクセス制御システム、ビデオ監視システム、顔認識システムは、ラップトップ、モバイル、その他のスマート ハンドヘルド デバイスなどの電子機器と統合されています。スマートなアプローチでは、これらのアクセス制御ドア ロック、セキュリティ システム、ホーム オートメーション、IoT、自動車、ゲーム コンソール、モバイル デバイスも使用されます。

アクセス制御ドアロックを使用すると、セキュリティ機能が強化され、個人が家や組織に素早くアクセスできるようになります。企業は、高度な物理的生体認証システムをセキュリティ用デバイスに組み込むために、多くの研究活動を行っています。

機会

- 物理的およびサイバーセキュリティシステムに関する組織間の戦略的提携および買収の増加

プロジェクトの調整と投資は、物理セキュリティ市場の持続的な改善を実現するために不可欠です。このため、政府やその他の民間組織はパートナーシップや買収を通じて努力し、業界の成長を加速させています。これは組織の認知度と利益を高めるのに役立ち、業界に新たな発明の余地を生み出します。また、パートナーシップを通じて、企業はより安全で信頼性の高い物理セキュリティ市場のサービスとソリューションを提供するために、高度なテクノロジーにさらに投資することができます。

事業を拡大することで、より多くの人々が会社の製品やサービスにアクセスできるようになり、顧客基盤を拡大することでより多くの顧客を獲得し、売上を伸ばすことができます。これにより、認知度が高まり、組織の利益が増加し、持続可能な成長の余地が生まれます。さらに、これにより、会社はプレミアム市場で認知されるようになります。

制約/課題

- 物理的およびサイバーセキュリティソリューションにおけるサイバーセキュリティの脅威とランサムウェアの増加

Due to COVID-19, cybercrime and cybersecurity issues increased by 600% in 2020. Flaws in network security are a weakness that hackers exploit to perform unauthorized actions within a system. According to Purple Sec L.L.C., in 2018, mobile malware variants for mobile have increased by 54% 2018, out of which 98% of mobile malware target Android devices. 25% of businesses are estimated to have been victims of crypto-jacking. Various companies also include the security industry.

- Complexity associated with the integration of various physical security systems

Integrating security systems involves combining logical and physical security applications, such as biometric identity programs and access control, into a single, all-encompassing plan. For instance, if the access control and intrusion alarm systems are linked, the access control system can be programmed to lock down a facility based on the type of alarm sounds when the system determines an intruder. However, one has to buy all the components from the same vendor. If the vendor provides only minimal support, customers could become saddled with a system that does not meet their needs. Also, redesigning and redeploying web- and mobile-based applications can become exhaustive and time-consuming.

Post-COVID-19 Impact on Turkey Physical Security Market

COVID-19 negatively impacted the physical security market due to lockdown regulations and the shutdown of manufacturing facilities.

The COVID-19 pandemic has impacted the physical security market to an extent positive manner. The surge in demand for video surveillance systems in various industries worldwide has helped the market grow during the pandemic. Also, the growth has been high since the market opened after COVID-19 owing to the increasing adoption of access control protocols in a commercial and industrial environments.

Solution providers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in physical security. With this, the companies will bring advanced technologies to the market. In addition, government initiatives to use automation technology have led to the market's growth.

Recent Developments

- In October 2021, Honeywell and IDEMIA partnered to develop intelligent building offerings. Under the partnership, products had been set for building access which integrated Honeywell security and building management systems with IDEMIA's biometric-based access control systems. This helped the company diversify its product portfolio and gain a new market in the building access control market

- 2020年8月、モトローラソリューションズはペルココーポレーションを1億1,000万米ドルで買収しました。この買収は、ペルコが提供するビデオ管理ソリューションを国際的に展開することを目的としていました。さらに、モトローラソリューションズはペルココーポレーションを物理セキュリティ市場の主要子会社の1つにしました。これにより、両社は消費者に革新的なソリューションを提供することで市場での存在感をさらに高めました。

トルコの物理的セキュリティ市場の範囲

トルコの物理的セキュリティ市場は、コンポーネント、認証、導入モデル、企業規模、エンドユーザー別にセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

成分

- ハードウェア

- サービス

- ソフトウェア

コンポーネントに基づいて、トルコの物理的セキュリティ市場は、ハードウェア、サービス、ソフトウェアに分類されます。

認証

- 単一要素認証

- 2要素認証

- 3要素認証

認証に基づいて、トルコの物理的セキュリティ市場は、単一要素認証、2要素認証、および3要素認証に分類されています。

展開モデル

- オンプレミス

- 雲

展開モデルに基づいて、トルコの物理セキュリティ市場はオンプレミスとクラウドに分類されています。

企業規模

- 大企業

- 中小企業

企業規模に基づいて、トルコの物理的セキュリティ市場は、大企業と中小企業に分類されています。

エンドユーザー

- コマーシャル

- 政府

- 産業

- 居住の

エンドユーザーに基づいて、トルコの物理的セキュリティ市場は、商業、政府、産業、住宅に分類されます。

トルコの物理的セキュリティ市場の地域分析/洞察

トルコの物理的セキュリティ市場が分析され、上記のように国、コンポーネント、認証、展開タイプ、企業規模、エンドユーザー別に市場規模の洞察と傾向が提供されます。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個々の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、トルコ ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮され、国別データの予測分析が提供されます。

競争環境とトルコの物理的セキュリティ市場シェア分析

トルコの物理的セキュリティ市場の競争環境は、競合他社の詳細を提供します。会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、トルコでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性。提供された上記のデータ ポイントは、物理的セキュリティ市場における会社の重点にのみ関連しています。

トルコの物理的セキュリティ市場で活動している主要企業としては、Thales、HID Global Corporation、Bosch Sicherheitssysteme GmbH、Hangzhou Hikvision Digital Technology Co., Ltd.、Pelco (A Motorolla Solutions Company)、Cisco Systems, Inc.、Axis Communications AB、Johnson Controls、Aware, Inc.、IDEMIA などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF TURKEY PHYSICAL AND CYBER SECURITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END USER COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 COMPONENT TIMELINE CURVE

2.11 OFFERING TIMELINE CURVE

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 INVESTMENT POLICY

4.1 CASE STUDY

4.1.1 SECURE SOFTWARE DEVELOPMENT INFRASTRUCTURE

4.1.2 SOC-AS-A-PLATFORM (SOCAAP)

4.1.3 RANSOMWARE & FORENSICS ANALYSIS

4.1.4 WISCONSIN'S DEER DISTRICT SECURITY PLAN

4.1.5 LICENSE PLATE READERS IN SCHOOLS

4.1.6 K-12 SCHOOLS

4.2 VALUE CHAIN ANALYSIS

4.3 PORTERS FIVE FORCES

4.4 PESTLE ANALYSIS

4.5 TECHNOLOGICAL LANDSCAPE

4.5.1 AI AND MACHINE LEARNING

4.5.2 IOT

4.5.3 BLOCKCHAIN

4.6 REGULATORY STANDARDS

4.6.1 CYBER SECURITY

4.6.2 PHYSICAL SECURITY

4.7 LOCAL PLAYERS LIST

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF REMOTE WORKING CULTURE

5.1.2 INCREASE IN CLOUD SERVICES CYBER AND PHYSICAL SECURITY SOLUTIONS

5.1.3 GROWING IMPORTANCE OF PHYSICAL BIOMETRIC SOLUTIONS ACROSS ALL SECTORS

5.1.4 EMERGENCE OF SMART INTERCONNECTED BUILDING/HOME

5.2 RESTRAINTS

5.2.1 RISE IN CYBER SECURITY THREAT AND RANSOMWARE IN PHYSICAL AND CYBER SECURITY SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 RISING STRATEGIC PARTNERSHIP AND ACQUISITION AMONG ORGANIZATIONS FOR PHYSICAL AND CYBER SECURITY SYSTEM

5.3.2 EMERGENCE OF VARIOUS DISRUPTIVE TECHNOLOGY SUCH AS IOT AND AI FOR VARIOUS INDUSTRIES

5.3.3 INCREASE IN CASES OF DATA AND SECURITY BREACHES IN VARIOUS ORGANIZATIONS

5.4 CHALLENGES

5.4.1 LACK OF PROFESSIONAL EXPERTISE FOR CYBER SECURITY SYSTEMS

5.4.2 COMPLEXITY ASSOCIATED WITH THE INTEGRATION OF VARIOUS PHYSICAL SECURITY SYSTEMS

6 TURKEY CYBER SECURITY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SERVICES

6.3 SOLUTIONS/SOFTWARE

7 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 VIDEO SURVEILLANCE SYSTEM

7.2.1.1 CAMERAS

7.2.1.2 RECORDERS

7.2.2 PHYSICAL ACCESS CONTROL SYSTEM

7.2.2.1 BIOMETRICS

7.2.2.2 LOCKS

7.2.2.2.1 ELECTRONIC LOCKS

7.3 SERVICES

7.3.1 MANAGED SERVICES

7.3.2 PROFESSIONAL SERVICES

7.4 SOFTWARE

8 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION

8.1 OVERVIEW

8.2 SINGLE- FACTOR AUTHENTICATION

8.3 TWO- FACTOR AUTHENTICATION

8.4 THREE- FACTOR AUTHENTICATION

9 TURKEY CYBER SECURITY MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 IDENTITY AND ACCESS MANAGEMENT

9.3 DATA SECURITY AND PRIVACY SERVICE OFFERING

9.4 GOVERNANCE RISK AND COMPLIANCE

9.5 UNIFIED VULNERABILITY MANAGEMENT SERVICE OFFERING

9.6 OTHERS

10 TURKEY CYBER SECURITY MARKET, BY SECURITY TYPE

10.1 OVERVIEW

10.2 INFRASTRUCTURE SECURITY

10.3 NETWORK SECURITY

10.4 APPLICATION SECURITY

10.5 CLOUD SECURITY

10.6 ENDPOINT SECURITY

10.7 OTHERS

11 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY DEPLOYMENT MODEL

11.1 OVERVIEW

11.2 ON-PREMISE

11.3 CLOUD

12 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY ENTERPRISE SIZE

12.1 OVERVIEW

12.2 LARGE SIZED ENTERPRISES

12.3 SMALL AND MEDIUM-SIZED ENTERPRISES

13 TURKEY PHYSICAL AND CYBER SECURITY MARKET, BY END USER

13.1 OVERVIEW

13.2 COMMERCIAL

13.3 GOVERNMENT

13.4 INDUSTRIAL

13.5 RESIDENTIAL

14 TURKEY CYBER SECURITY MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: TURKEY

15 TURKEY PHYSICAL SECURITY MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: TURKEY

16 SWOT ANALYSIS

16.1 DBMR ANALYSIS

16.1.1 STRENGTH

16.1.2 WEAKNESS

16.1.3 THREATS

16.1.4 OPPORTUNITY

17 COMPANY PROFILE

17.1 THALES GROUP

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCTS PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 ACCENTURE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 SERVICE PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IDEMIA

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 BAE SYSTEMS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 SERVICE PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 FORTINET, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 SERVICE PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 PALO ALTO NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 AWARE, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 AXIS COMMUNICATIONS AB

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BOSCH SICHERHEITSSYSTEME GMBH

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCTS PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 CHECK POINT SOFTWARE TECHNOLOGIES LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCTS PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 CISCO SYSTEMS, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCTS PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 HEXAGON AB

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 OFFERING PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 HID GLOBAL CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 IBM CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCTS PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 JOHNSON CONTROL

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCTS PORTFOLIO

17.16.4 RECENT DEVELOPMENTS

17.17 JUNIPER NETWORKS, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCTS PORTFOLIO

17.17.4 RECENT DEVELOPMENTS

17.18 MCAFEE, LLC

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCTS PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 MICRO FOCUS

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 MICROSOFT

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 ORACLE

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 SERVICE CATEGORY

17.21.4 RECENT DEVELOPMENT

17.22 PELCO CORPORATIONS

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCTS PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 RAPID7

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 SPLUNK INC.

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCTS PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 TREND MICRO INCORPORATED

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCTS PORTFOLIO

17.25.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 LIST OF LOCAL CYBER SECURITY PLAYERS

TABLE 2 LIST OF LOCAL PHYSICAL SECURITY PLAYERS

TABLE 3 TURKEY CYBER SECURITY MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 4 TURKEY SERVICES IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 TURKEY SOLUTIONS/SOFTWARE IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 7 TURKEY HARWARE IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 TURKEY VIDEO SURVEILLANCE SYSTEM IN HARDWRAE PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 TURKEY CAMERAS IN VIDEO SURVEILLANCE SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 TURKEY RECORDERS IN VIDEO SURVEILLANCE SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 TURKEY PHYSICAL ACCESS CONTROL SYSTEM IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 TURKEY BIOMETRICS IN PHYSICAL ACCESS CONTROL SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 TURKEY LOCKS IN PHYSICAL ACCESS CONTROL SYSTEM PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 TURKEY ELECTRONIC LOCKS IN LOCKS PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 TURKEY SERVICES IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 TURKEY MANAGED SERVICES IN SERVICES PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 TURKEY PROFESSIONAL SERVICES IN SERVICES PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 TURKEY SOFTWARE IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION, 2020-2029 (USD MILLION)

TABLE 20 TURKEY CYBER SECURITY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 TURKEY CYBER SECURITY MARKET, BY SECURITY TYPE, 2020-2029 (USD MILLION)

TABLE 22 TURKEY PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 23 TURKEY CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 24 TURKEY PHYSICAL SECURITY MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 25 TURKEY CYBER SECURITY MARKET, BY ENTERPRISE SIZE, 2020-2029 (USD MILLION)

TABLE 26 TURKEY LARGE SIZED ENTERPRISES IN PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 27 TURKEY LARGE SIZED ENTERPRISES IN CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 28 TURKEY SMALL AND MEDIUM-SIZED ENTERPRISES IN PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 29 TURKEY SMALL AND MEDIUM-SIZED ENTERPRISES IN CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2020-2029 (USD MILLION)

TABLE 30 TURKEY PHYSICAL SECURITY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 31 TURKEY CYBER SECURITY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 TURKEY COMMERCIAL IN PHYSICAL SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 TURKEY COMMERCIAL IN CYBER SECURITY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 TURKEY INDUSTRIAL IN PHYSICAL SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 35 TURKEY INDUSTRIAL IN CYBER SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 36 TURKEY RESIDENTIAL IN PHYSICAL SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

TABLE 37 TURKEY RESIDENTIAL IN CYBER SECURITY MARKET, BY TYPE 2020-2029 (USD MILLION)

図表一覧

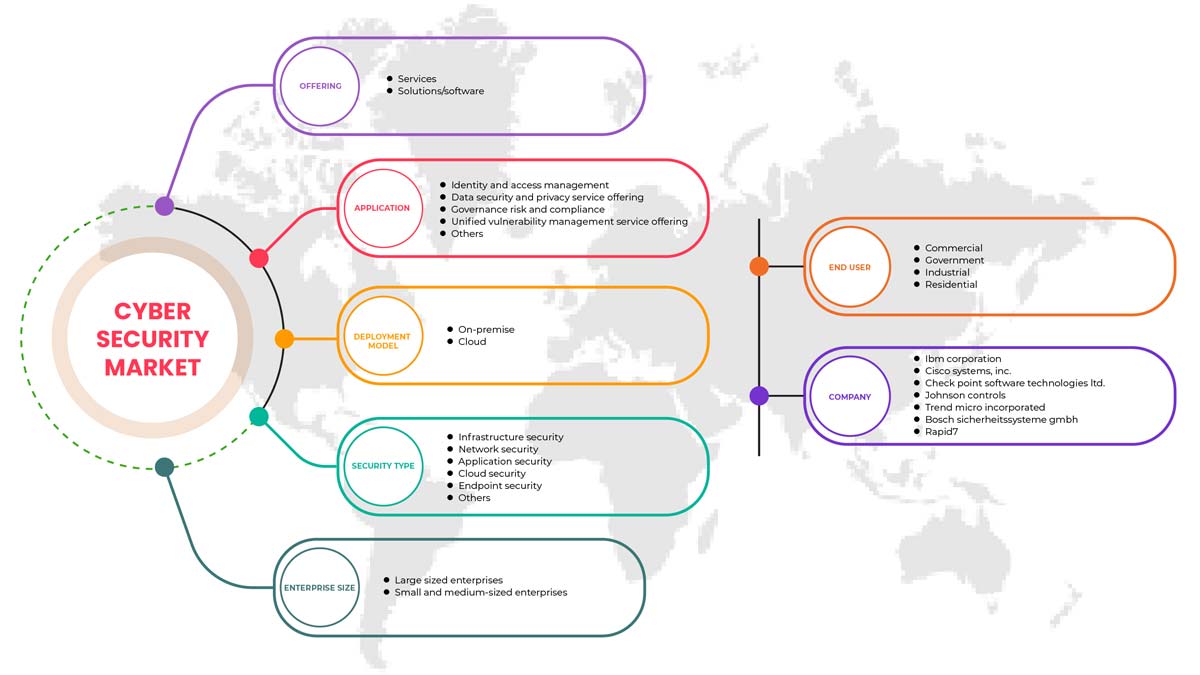

FIGURE 1 TURKEY PHYSICAL AND CYBER SECURITY MARKET: SEGMENTATION

FIGURE 2 TURKEY PHYSICAL AND CYBER SECURITY MARKET: DATA TRIANGULATION

FIGURE 3 TURKEY PHYSICAL AND CYBER SECURITY MARKET: DROC ANALYSIS

FIGURE 4 TURKEY PHYSICAL SECURITY MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 5 TURKEY CYBER SECURITY MARKET: REGIONAL VS COUNTRY ANALYSIS

FIGURE 6 TURKEY PHYSICAL AND CYBER SECURITY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 TURKEY PHYSICAL AND CYBER SECURITY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 TURKEY PHYSICAL SECURITY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 TURKEY CYBER SECURITY MARKET: DBMR MARKET POSITION GRID

FIGURE 10 TURKEY CYBER SECURITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 TURKEY PHYSICAL SECURITY MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 TURKEY PHYSICAL SECURITY MARKET: MARKET END USER COVERAGE GRID

FIGURE 13 TURKEY CYBER SECURITY MARKET: MARKET END USER COVERAGE GRID

FIGURE 14 TURKEY CYBER SECURITY MARKET: SEGMENTATION

FIGURE 15 TURKEY PHYSICAL SECURITY MARKET: SEGMENTATION

FIGURE 16 AN INCREASE IN CLOUD SERVICES CYBER AND PHYSICAL SECURITY SOLUTIONS IS EXPECTED TO DRIVE TURKEY PHYSICAL SECURITY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 17 EMERGENCE OF SMART INTERCONNECTED BUILDING/HOME IS EXPECTED TO DRIVE TRUKEY CYBER SECURITY MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 18 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TURKEY CYBER SECURITY MARKET IN THE FORECASTED PERIOD OF 2022 & 2029

FIGURE 19 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF TURKEY PHYSICAL SECURITY MARKET IN THE FORECASTED PERIOD OF 2022 & 2029

FIGURE 20 VALUE CHAIN FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 21 PORTERS FIVE FORCES ANALYSIS FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 22 PESTLE ANALYSIS FOR PHYSICAL AND CYBER SECURITY MARKET

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF TURKEY PHYSICAL AND CYBER SECURITY MARKET

FIGURE 24 KEY STATS OF REMOTE WORK

FIGURE 25 GROWING PREVALENCE OF BIOMETRIC SOLUTIONS AMONG CONSUMER

FIGURE 26 TECHNOLOGY AMALGAMATION IN SMART HOME/ BUILDINGS

FIGURE 27 IMPACT OF CYBER SECURITY THREAT

FIGURE 28 PHISHING ATTACKS REPORTED IN RESPECTIVE COUNTRIES IN Q2, 2021

FIGURE 29 TURKEY CYBER SECURITY MARKET, BY OFFERING, 2021

FIGURE 30 TURKEY PHYSICAL SECURITY MARKET, BY COMPONENT, 2021

FIGURE 31 TURKEY PHYSICAL SECURITY MARKET, BY AUTHENTICATION, 2021

FIGURE 32 TURKEY CYBER SECURITY MARKET: BY APPLICATION, 2021

FIGURE 33 TURKEY CYBER SECURITY MARKET: BY SECURITY TYPE, 2021

FIGURE 34 TURKEY PHYSICAL SECURITY MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 35 TURKEY CYBER SECURITY MARKET, BY DEPLOYMENT MODEL, 2021

FIGURE 36 TURKEY PHYSICAL SECURITY MARKET, BY ENTERPRISE SIZE, 2021

FIGURE 37 TURKEY CYBER SECURITY MARKET, BY ENTERPRISE SIZE, 2021

FIGURE 38 TURKEY PHYSICAL SECURITY MARKET: BY END USER, 2021

FIGURE 39 TURKEY CYBER SECURITY MARKET: BY END USER, 2021

FIGURE 40 TURKEY CYBER SECURITY MARKET: COMPANY SHARE 2021 (%)

FIGURE 41 TURKEY PHYSICAL SECURITY MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。