サウジアラビア、トルコ、エジプトの体外診断(IVD)品質管理市場

Market Size in USD Billion

CAGR :

%

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

USD

867.09 Thousand

USD

1,260.66 Thousand

2022

2030

| 2023 –2030 | |

| USD 867.09 Thousand | |

| USD 1,260.66 Thousand | |

|

|

|

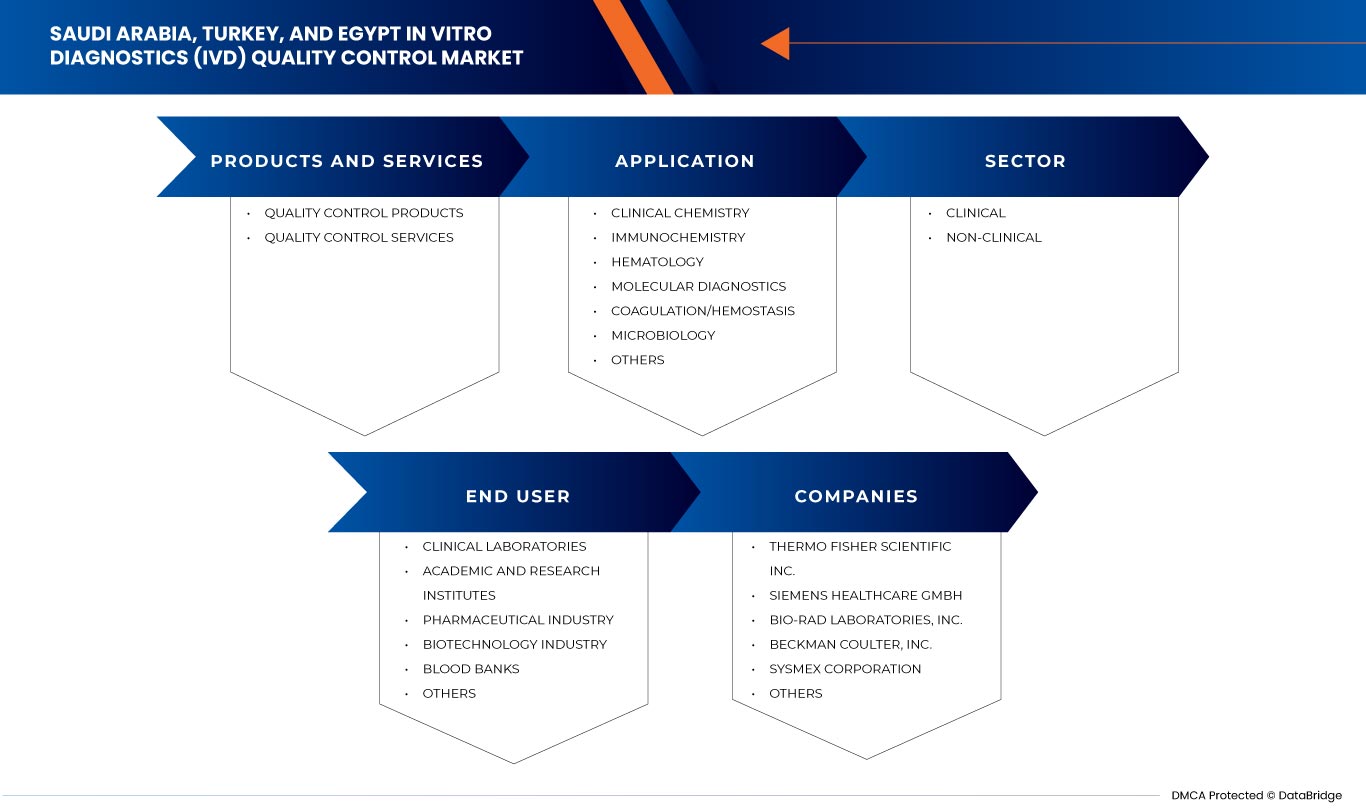

サウジアラビア、トルコ、エジプトの体外診断 (IVD) 品質管理市場、製品およびサービス別 (品質管理製品および品質管理サービス)、アプリケーション別 (臨床化学、免疫化学、血液学、分子診断、凝固/止血、微生物学、その他)、セクター別 (臨床および非臨床)、エンドユーザー別 (臨床検査室、学術研究機関、血液銀行、バイオテクノロジー産業、製薬産業、その他) - 2030 年までの業界動向および予測。

サウジアラビア、トルコ、エジプトの体外診断(IVD)品質管理市場の分析と規模

サウジアラビア、トルコ、エジプト全土で慢性疾患の罹患率が上昇していることから、市場の需要が高まっています。より良い医療サービスを求める医療費の増加も、市場の成長に寄与しています。主要な市場プレーヤーは、この重要な時期にさまざまな製品の発売と承認に注力しています。さらに、品質管理サービスの向上の増加も、IVD 品質管理市場の需要増加に寄与しています。

サウジアラビア、トルコ、エジプトの体外診断(IVD)品質管理市場は、2023年から2030年の予測期間に市場が成長すると予想されています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に4.8%のCAGRで成長し、2022年の867.09千米ドルから2030年には1,260.66千米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

製品およびサービス(品質管理製品および品質管理サービス)、用途(臨床化学、免疫化学、血液学、分子診断、凝固/止血、微生物学、その他)、セクター(臨床および非臨床)、エンドユーザー(臨床検査室、学術研究機関、血液銀行、バイオテクノロジー産業、製薬産業、その他) |

|

対象国 |

サウジアラビア、トルコ、エジプト |

|

対象となる市場プレーヤー |

この市場で取引している主要企業としては、Bio-Rad Laboratories, Inc、Siemens Healthcare Private Limited、Sysmex Europe SE、Randox Laboratories Ltd.、Sera Care、Thermo Fisher Scientific Inc.、Beckman Coulter, Inc.、Technopath Clinical Diagnostics、DiaSorin SpA、Agappe Diagnostics Ltd、Spectrum Diagnosticsなどがあります。 |

市場の定義

体外診断用製品とは、病気やその続発症を治療、緩和、治療、予防するために、健康状態の判定を含む病気やその他の症状の診断に使用することを目的とした試薬、器具、システムです。このような製品は、人体から採取した検体の収集、準備、検査に使用することを目的としています。

IVD 品質管理は、IVD 検査システムの信頼性を検証して検査結果の正確性を確保し、環境条件やオペレーターのパフォーマンスなどの要因が検査結果に与える影響を評価するために使用されるサンプル/材料です。さらに、患者の健康状態を監視し、病気を治療し、医療専門家が患者にとって最も効果的な治療手順や療法を特定できるようにするためにも使用できます。

体外診断(IVD)品質管理市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらはすべて、以下のように詳細に説明されます。

ドライバー

- サウジアラビア、トルコ、エジプトで慢性疾患の罹患率が上昇

慢性疾患や慢性疾患は世界中で増加しています。高齢化と座りがちな生活習慣により、長期的な健康問題が着実に増加しています。慢性疾患や感染症の蔓延が進む中、大手市場プレーヤーによる迅速な診断および検査ツールの導入が進んでいます。さらに、セルフテストやポイントオブケア機器の採用が増えていることで、世界中で体外診断機器の成長がさらに加速しています。

したがって、慢性疾患の増加により、近い将来、IVD品質管理市場の成長が大幅に加速すると予想されます。

- 研究室や病院における品質管理ソリューションの導入増加

患者サンプルの検査は、臨床分析、微生物学的研究、血液銀行検査など、臨床検査室のさまざまな側面に応じて、複雑な手順になることがあります。品質管理 (QC) は、検査室での検査に最も重要な影響を与えるものの 1 つであり、患者サンプルの結果の精度と正確性の両方を保証します。品質管理サンプルの完全性は、全体的な品質の管理と熟練度テストの要件を満たすことの両方にとって重要です。

したがって、研究室や病院での品質管理ソリューションの採用の増加が市場の成長を促進すると予想されます。

機会

-

組織間の戦略的買収と提携の増加

最近、さまざまな組織がパートナーシップと協力を進め、病気の検出に不可欠な体外診断用診断装置 (IVD) の開発に取り組んでいます。パートナーシップと契約の助けを借りて、両社は病気の検出に役立つ新しい一連の技術とプラットフォームを開発できるだけでなく、

長期契約のおかげで、両社は市場の消費者の需要に応えて、寸法価格のIVDを提供することができます。このようなパートナーシップと相互合意は、両社に利益をもたらすだけでなく、市場の成長に多くの機会をもたらします。

-

研究開発活動の活発化

世界中で、経済パフォーマンスに伴う公衆衛生支出により、研究開発活動への支出が増加しています。一方、ヘルスケア業界は、研究開発費の額に関して全業界の中で第 2 位にランクされています。ヘルスケア支出の増加により、研究開発の機会の提供も改善されました。その結果、地域全体で IVD 規制業務のアウトソーシング サービスの需要が高まりました。

制約/課題

- IVDの品質管理とメンテナンスに関連する高コスト

体外診断 (IVD) は、人体から採取された血液や組織などのサンプルに対して行われる検査です。体外診断は、病気やその他の症状を検出し、人の全体的な健康状態を監視して病気の治癒、治療、予防に役立てることができます。

血液や組織の生検を含む身体標本由来の分析物の体外診断は、単独で、または臨床調査と組み合わせて使用され、高品質の医療成果を得るための重要なツールと認識されているため、正確な検査を行うには体外診断の維持と体外診断装置の品質管理に多額の費用がかかります。

そのため、IVD のメンテナンス費用の上昇は、サービス プロセスにおける企業にとっての決定要因となり、市場の成長をさらにある程度抑制することになります。

- サウジアラビア、トルコ、エジプトにおける体外診断に関する厳格な規制

高齢化人口の増加と、早期診断とタイムリーな治療で予防できる慢性疾患の増加に伴い、世界中でIVDの使用が急速に増加しています。同時に、市場でIVD機器を販売する企業は、地域で製品を発売するために上級当局から承認を得るために、一定の規制に従う必要があります。これらの厳格なガイドラインに従う必要があり、これはすべてのステップの中で最も困難な作業の1つです。さまざまな医療機器の市販前承認は、国によって異なります。

したがって、製品承認に関する厳格な規則と規制は、市場の成長に対する制約として機能します。

最近の開発

- 2023年2月、大手医療技術企業であるSiemens Healthineersと大手診断サービスプロバイダーであるUnilabsは、20万ユーロを超える複数年契約を発表しました。UnilabsはSiemens Healthineersの最先端技術に投資し、400台以上のラボ分析装置を取得してラボのインフラストラクチャをさらに改善し、顧客に比類のないサービスを提供します。このパートナーシップは、患者のケアを改善するための最新の診断テストインフラストラクチャに役立っています。

- In July 2021, Thermo Fisher Scientific, the world leader in serving science, announced a collaboration with Ortho Clinical Diagnostics to promote and distribute Thermo Scientific MAS Quality Controls and LabLink xL Quality Assurance Software for use with Ortho Clinical Diagnostics VITROS analyzers. This has helped the company to increase their global presence in the market.

Saudi Arabia, Turkey, and Egypt in Vitro Diagnostics (IVD) Quality Control Market Scope

Saudi Arabia, Turkey, and Egypt in vitro diagnostics (IVD) quality control market is segmented into four notable segments such as product and services, application, type, sector and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product and Services

- Quality Control Products

- Quality Control Services

On the basis of products and services, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into quality control products and quality control services.

Applications

- Clinical Chemistry

- Immunochemistry

- Hematology

- Molecular Diagnostics

- Coagulation/Hemostasis

- Microbiology

- Others

Based on applications, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical chemistry, immunochemistry, hematology, molecular diagnostics, coagulation/hemostasis, microbiology, and others.

Sector

- Clinical

- Non-Clinical

Based on sector, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical and non-clinical.

End User

- Clinical Laboratories

- Academic And Research Institutes

- Blood Banks

- Biotechnology Industry

- Pharmaceutical Industry

- Others

Based on end users, the Saudi Arabia, Turkey, and Egypt In vitro diagnostics (IVD) quality control market is segmented into clinical laboratories, academic and research institutes, blood banks, biotechnology industry, pharmaceutical industry, and others.

Competitive Landscape and In Vitro Diagnostics (IVD) Quality Control Market Share Analysis

The in vitro diagnostics (IVD) quality control market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the ataxia market.

体外診断 (IVD) 品質管理市場で活動している主要企業には、Bio-Rad Laboratories, Inc、Siemens Healthcare Private Limited、Sysmex Europe SE、Randox Laboratories Ltd.、Sera Care、Thermo Fisher Scientific Inc.、Beckman Coulter, Inc.、Technopath Clinical Diagnostics、DiaSorin SpA、Agappe Diagnostics Ltd、Spectrum Diagnostics などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 SAUDI ARABIA PRODUCTS AND SERVICES, LIFELINE CURVE

2.8 EGYPT PRODUCTS AND SERVICES, LIFELINE CURVE

2.9 TURKEY PRODUCTS AND SERVICES, LIFELINE CURVE

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET TESTING TYPE COVERAGE GRID

2.13 VENDOR SHARE ANALYSIS

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL'S MODEL

4.2 PORTER'S 5 FORCES

4.3 INDUSTRY INSIGHTS

5 REGULATORY GUIDELINES FOR IN VITRO DIAGNOSTICS QUALITY CONTROL

5.1 REGULATIONS IN SAUDI ARABIA

5.2 REGULATIONS IN TURKEY

5.3 REGULATIONS IN EGYPT

5.3.1 MEDICAL DEVICE REGISTRATION IN EGYPT, THE PROCESS IN BRIEF:

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA, TURKEY, AND EGYPT

6.1.2 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS

6.1.3 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS

6.1.4 RISING USE OF QUALITY CONTROL IN MOLECULAR DIAGNOSTICS

6.2 RESTRAINTS

6.2.1 HIGH COST RELATED TO QUALITY CONTROL AND MAINTENANCE OF IVD

6.2.2 STRINGENT REGULATIONS REGARDING IVD IN SAUDI ARABIA, TURKEY, AND EGYPT

6.3 OPPORTUNITIES

6.3.1 RISE IN STRATEGIC ACQUISITION AND PARTNERSHIP AMONG ORGANIZATIONS

6.3.2 RISING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 LACK OF INFRASTRUCTURE IN HEALTHCARE SERVICE

6.4.2 SHORTAGE OF SKILLED PERSONNEL FOR HANDLING QUALITY CONTROL OF IN VITRO DIAGNOSTIC DEVICES.

7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCT AND SERVICES

7.1 OVERVIEW

7.2 QUALITY CONTROL PRODUCTS

7.2.1 SERUM/PLASMA-BASED CONTROL

7.2.2 WHOLE BLOOD-BASED CONTROLS

7.2.3 URINE-BASED CONTROLS

7.2.4 OTHER CONTROLS

7.2.5 INTERNAL QUALITY CONTROL

7.2.6 EXTERNAL QUALITY CONTROL

7.3 QUALITY CONTROL SERVICES

8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 CLINICAL CHEMISTRY

8.3 IMMUNOCHEMISTRY

8.4 HEMATOLOGY

8.5 MOLECULAR DIAGNOSTICS

8.5.1 QUALITY CONTROL PRODUCTS

8.5.1.1 INTERNAL QUALITY CONTROL

8.5.1.2 EXTERNAL QUALITY CONTROL

8.5.2 QUALITY CONTROL SERVICES

8.6 COAGULATION/HEMOSTASIS

8.7 MICROBIOLOGY

8.8 OTHERS

9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR

9.1 OVERVIEW

9.2 CLINICAL

9.3 NON-CLINICAL

10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICAL LABORATORIES

10.3 ACADEMIC AND RESEARCH INSTITUTES

10.4 PHARMACEUTICAL INDUSTRY

10.5 BIOTECHNOLOGY INDUSTRY

10.6 BLOOD BANKS

10.7 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

11.2 COMPANY SHARE ANALYSIS: EGYPT

11.3 COMPANY SHARE ANALYSIS: TURKEY

12 SWOT ANALYSIS

13 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, COMPANY PROFILES

13.1 THERMO FISHER SCIENTIFIC INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 SIEMENS HEALTHCARE GMBH

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENT

13.3 BIO-RAD LABORATORIES, INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 BECKMAN COULTER, INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENT

13.5 SYSMEX CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENT

13.6 AGAPPE DIAGNOSTICS LTD

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 DIASORIN MOLECULAR LLC.

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 RANDOX LABORATORIES LTD.

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 SERA CARE

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 SPECTRUM DIAGNOSTICS

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 TECHNOPATH CLINICAL DIAGNOSTICS

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

図表一覧

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 5 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 6 TURKEYS IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COUNTRY MARKET ANALYSIS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: MARKET TESTING TYPE COVERAGE GRID

FIGURE 11 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: SEGMENTATION

FIGURE 13 RISING PREVALENCE OF CHRONIC DISEASES ACROSS SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD

FIGURE 14 RISING ADOPTION OF QUALITY CONTROL SOLUTIONS IN LABORATORIES AND HOSPITALS IS EXPECTED TO DRIVE THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 15 ADVANCEMENTS IN TECHNOLOGY LEADING TO THE DEVELOPMENT OF NEW AND ADVANCED DIAGNOSTIC PRODUCTS ARE EXPECTED TO DRIVE THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN THE FORECAST PERIOD IN THE FORECAST PERIOD

FIGURE 16 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 17 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 18 THE PRODUCT AND SERVICES TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET IN 2023 & 2030

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF SAUDI ARABIA, TURKEY, AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET

FIGURE 20 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 21 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 22 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2022

FIGURE 23 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 24 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 25 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, 2023-2030 (USD THOUSAND)

FIGURE 26 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 27 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 28 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, CAGR (2023-2030)

FIGURE 29 SAUDI ARABIA, TURKEY AND EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 30 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 31 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY PRODUCTS AND SERVICES, LIFELINE CURVE

FIGURE 32 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 33 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 34 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2022

FIGURE 35 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 36 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 37 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 38 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 39 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 40 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, CAGR (2023-2030)

FIGURE 41 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 42 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 43 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY APPLICATION, LIFELINE CURVE

FIGURE 44 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 45 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 46 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2022

FIGURE 47 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 48 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 49 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, 2023-2030 (USD THOUSAND)

FIGURE 50 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 51 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 52 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, CAGR (2023-2030)

FIGURE 53 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 54 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 55 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY SECTOR, LIFELINE CURVE

FIGURE 56 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 57 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 58 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2022

FIGURE 59 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 60 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 61 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 62 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 63 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 64 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, CAGR (2023-2030)

FIGURE 65 SAUDI ARABIA, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 66 TURKEY, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 67 EGYPT, IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET, BY END USER, LIFELINE CURVE

FIGURE 68 SAUDI ARABIA IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 69 EGYPT IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

FIGURE 70 TURKEY IN VITRO DIAGNOSTICS (IVD) QUALITY CONTROL MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。