サウジアラビア、トルコ、エジプトの HbA1c 検査市場、製品タイプ別 (機器、試薬、消耗品)、検査モード別 (処方箋に基づく検査と OTC 検査)、技術別 (イオン交換 HPCL、酵素アッセイ、アフィニティー結合クロマトグラフィー、比濁阻害免疫測定法など)、エンドユーザー別 (研究所、病院、診療所、在宅ケア、外来センター、薬局/ドラッグストアなど)、流通チャネル別 (サードパーティ流通、直接販売、小売販売) – 2030 年までの業界動向と予測。

サウジアラビア、トルコ、エジプトの HbA1c 検査市場の分析と洞察

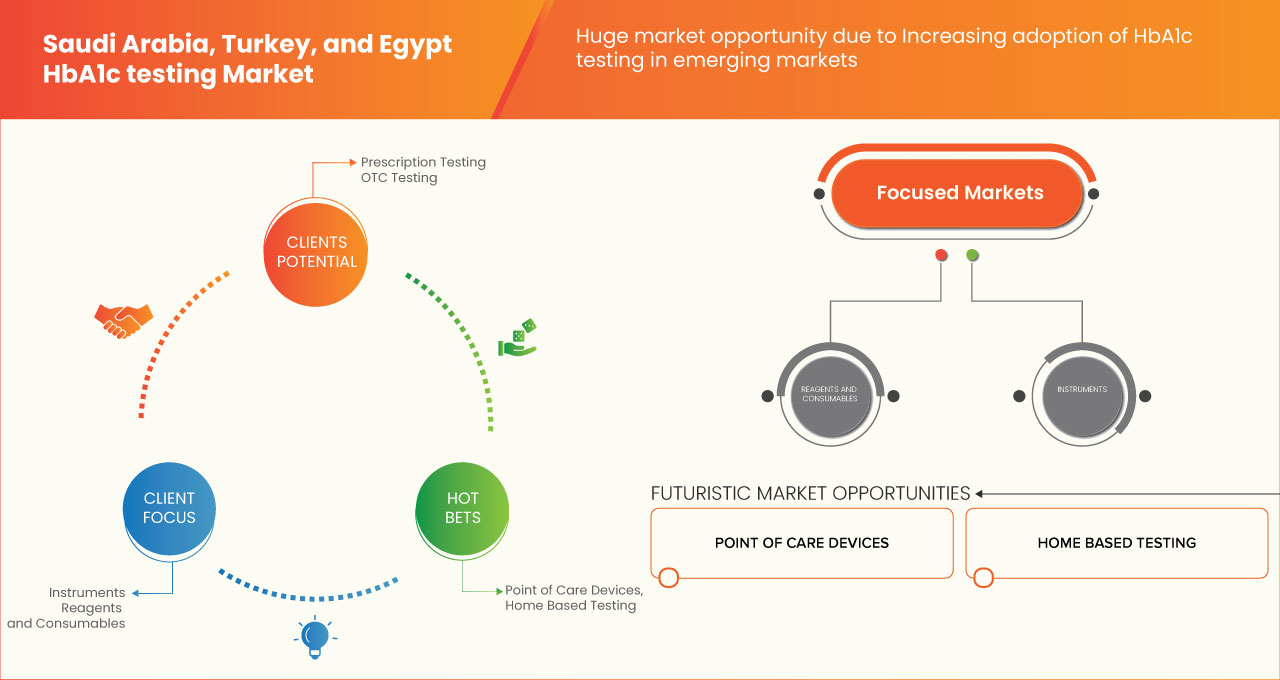

糖尿病と腎臓疾患に関する意識の高まりにより、市場の需要が高まっています。より良い医療サービスを求める医療費の増加も、市場の成長に貢献しています。主要な市場プレーヤーは、この重要な時期にさまざまなサービスの立ち上げと承認に注力しています。さらに、糖尿病用の改善されたポイントオブケアデバイスの増加も、糖尿病またはHBA1C検査の需要の増加に貢献しています。

データブリッジマーケットリサーチは、HbA1c検査市場は2023年から2030年の予測期間に4.4%のCAGRで成長すると予想され、サウジアラビアでは2030年までに6,159万米ドルに達すると予想され、トルコでは2023年から2030年の予測期間に5.4%のCAGRで成長すると予想され、トルコでは2030年までに7,373万米ドルに達すると予想され、エジプトでは2023年から2030年の予測期間に5.4%のCAGRで成長すると予想され、エジプトでは2030年までに6,594万米ドルに達すると予想されていると分析しています。機器セグメントは、高度な技術の開発により市場の成長を促進すると予測されています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品タイプ別(機器、試薬、消耗品)、検査方法別(処方箋に基づく検査およびOTC検査)、技術別(イオン交換HPCL、酵素アッセイ、アフィニティー結合クロマトグラフィー、比濁阻害免疫アッセイなど)、エンドユーザー別(研究所、病院、診療所、在宅ケア、外来センター、薬局/ドラッグストアなど)、流通チャネル別(第三者流通、直接販売および小売販売)、国別(サウジアラビア、エジプト、トルコ) |

|

対象国 |

サウジアラビア、エジプト、トルコ |

|

対象となる市場プレーヤー |

サウジアラビア、エジプト、トルコの HbA1c 検査市場で活動している主要企業には、Siemens Healthcare GmbH、A. Menarini Diagnostics srl、ARKRAY, Inc.、Trinity Biotech、Thermo Fisher Scientific Inc.、Abbott、Wondfo、F. Hoffmann-La Roche Ltd、Ortho Clinical Diagnostics、DxGen Corp. などがあります。 |

サウジアラビア、トルコ、エジプトの HbA1c 検査市場の定義

ヘモグロビン A1C (HbA1C) 検査と呼ばれる血液検査では、過去 2 ~ 3 か月の平均血糖値 (グルコース値) がわかります。血液にはグルコースが含まれています。グルコースは、食べ物から摂取した糖の一種です。グルコースは細胞にエネルギーを供給します。インスリンというホルモンは、細胞によるグルコースの取り込みを助けます。糖尿病の場合、体内のインスリン生成が不十分であるか、細胞がインスリンを適切に利用できません。グルコースが細胞に取り込まれないため、血糖値が上昇します。

糖尿病は世界的な風土病であり、発展途上国と先進国の両方で急速に罹患率が増加しています。糖尿病の診断における空腹時血糖値の代替として考えられるグリコヘモグロビン(HbA1c)HbA1cは、過去2〜3か月の累積血糖履歴を反映する能力を持つ、長期血糖コントロールの重要な指標です。HbA1cは、慢性高血糖の信頼性の高い測定値を提供し、長期的な糖尿病合併症のリスクとよく相関しています。HbA1cの上昇は、糖尿病の有無にかかわらず、冠状動脈性心疾患と脳卒中の独立したリスク要因と見なされてきました。1回のHbA1c検査で提供される貴重な情報により、HbA1cは糖尿病の診断と予後の信頼性の高いバイオマーカーとなっています。ただし、HBA1c検査デバイスとキットの高コスト、および製品の承認と商品化の基準により、市場の成長が抑制されると予想されます。

サウジアラビア、トルコ、エジプトの HbA1c 検査市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 世界中で糖尿病の罹患率が増加

20 歳未満の糖尿病患者の数は、今後さらに急速に増加すると予想されます。小児肥満の増加など、2 型糖尿病の増加についてはさまざまな研究が行われています。出産年齢の人々の糖尿病の存在は、母親の糖尿病が子供の糖尿病リスクを高めるため、非常に重要な問題です。

精度が向上し、時間の制約が少ないHbA1c検査の需要が高まり、主要なプレーヤーは戦略的な取り組みを求めています。糖尿病患者は、糖尿病のない人よりも心臓病や脳卒中、糖尿病の合併症、早期死亡のリスクが高いため、

- 血糖コントロールの重要性についての認識の高まり

血糖コントロール不良は、慢性的に血糖値とグリコヘモグロビン値が高いことが特徴です。特にインスリン治療を受けている糖尿病患者は低血糖を発症するリスクがあります。いくつかの研究では、運動以外の身体活動の増加が食後高血糖を軽減し、血糖コントロールを改善するのに効果的であると示唆されています。

さまざまな研究により、糖尿病患者の多くは血糖コントロールが不十分で貧弱であることが明らかになりました。これは、高齢、糖尿病の罹病期間の長さ、インスリン療法、食事療法の遵守の悪さ、コントロール目標の設定の失敗と関連していました。良好な血糖コントロールを維持するには、特定された要因とカスタマイズされた管理メカニズムに焦点を当てる必要があります。そのため、人々はこの要因についてより懸念し、血糖レベルをコントロールする準備をしています。

しかし、糖尿病に関する知識レベルが低いことは、血糖コントロール不良の予測因子となる可能性はあっても、服薬遵守の予測因子となる可能性は低い。

拘束

- 高価なhba1c検査機器とキット

デバイスとキットのコストは、hba1c 検査市場で重要な役割を果たします。これらのデバイスとキットの開発プロセスは非常に高価であり、R&D、規制、およびその他のさまざまなコンプライアンスを通過するのに長い時間がかかります。これらのデバイスとキットは、設計から製造までのプロセス、製品の製造方法を高レベルで理解することから始める必要があります。どの段階でも 1 つのエラーが発生すると、製造全体に混乱が生じる可能性があります。

例えば、

- 2020年12月、NCBIの記事によると、サウジアラビアでは糖尿病と診断された人々の医療費は、糖尿病でない人々の医療費に比べて10倍も高い。

ただし、これらの hba1c デバイスとキットでは、プロジェクトのリスク管理計画とともに、運用を成功させるために効果的な投資が必要です。

機会

-

新興市場でのHBA1C検査の採用増加

規制と医師の推奨は、HbA1c 検査の採用を増やす上で重要な役割を果たします。厳格な規則と規制は、人間と環境の安全と安心を確保するために政府の承認に必要です。HbA1c は、前糖尿病と糖尿病を診断するために一般的に使用される検査の 1 つであり、あなたとあなたの医療チームが糖尿病を管理するのに役立つ主要な検査とも考えられています。前糖尿病または糖尿病の境界にある人は、血糖値がどれだけ安定しているかを確認するために検査を受けるよう医師から勧められます。一般的な医師の意見では、糖尿病と前糖尿病の人は 3 か月ごとに HbA1c 検査を受ける必要があります。

チャレンジ

- 貧血または腎臓病患者のhba1c値の解釈における課題

HbA1c の予測能力に関連する根本的な課題は、慢性腎臓病の環境でも依然として残っています。血液からの余分な水分と老廃物が体内に残り、心臓病や脳卒中などの他の健康問題を引き起こす可能性があります。

However, HbA1c levels may be falsely elevated or decreased in chronic kidney disease because a uremic environment shortens the red blood cell lifespan. Several studies have provided the speculation that in populations with a high prevalence of inflammation and malnutrition, such as chronic kidney disease HbA1c levels could be less predictive of clinical outcomes.

For instance-

- In February 2022 – As per ncbi article study conducted by researchers in the gulf cooperation council countries stated that HbA1c level of 7% to 8% may be the most favorable for the best outcomes for diabetes mellitus patients in advanced chronic kidney disease

However, mild-to-moderate anemia and chronic kidney disease may not affect the relationship between glycated hemoglobin and blood glucose level.

Recent Developments

- In March 2020, PTS Diagnostics recently announced that they would launch A1CNow+ Controls for the A1CNow®+ Test System. A1CNow+ Controls are initially accessible in the US, EU, and UK. They can be kept frozen for up to three years, chilled for eight months, or at room temperature for seven days. The solution has two levels, each in a dropper-style vial, and may be effectively used in minutes. Its goal is to ensure accurate A1C findings.

- In March 2023, Abbott announced a definitive agreement with Cardiovascular Systems, Inc. (CSI), a manufacturer of medical devices with a cutting-edge atherectomy system used to treat peripheral and coronary artery disease, under which Abbott would purchase CSI. Abbott's market-leading vascular device lineup will gain access to fresh, complementary innovations thanks to the purchase of CSI. This has caused the business to grow for the corporation.

Saudi Arabia, Turkey, and Egypt HbA1c Testing Market Scope

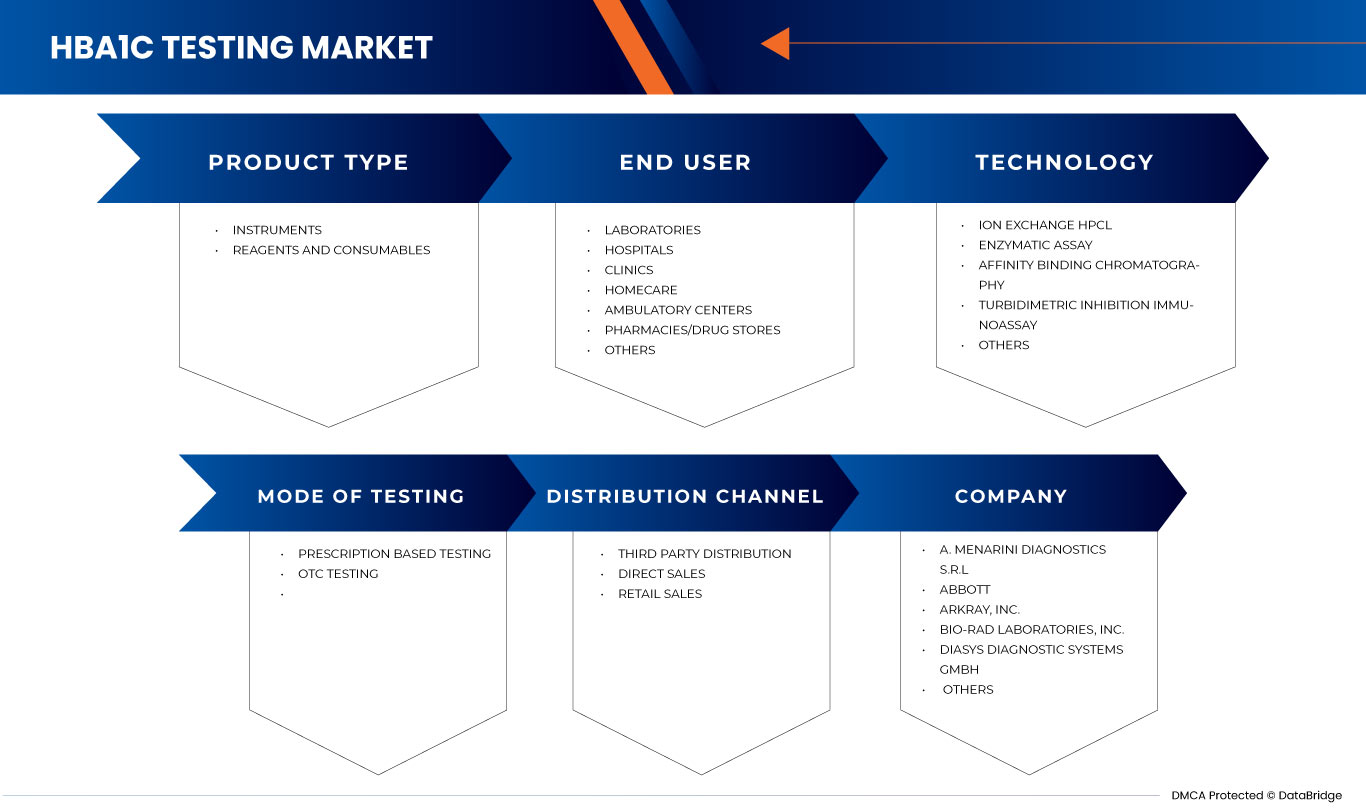

Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into five notable segments such as product type, mode of testing, technology, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Instruments

- Reagents And Consumables

On the basis of product type, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into instruments, reagents, and consumables.

BY MODE OF TESTING

- Prescription Based Testing

- OTC Testing

On the basis of mode of testing, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into prescription based testing and OTC testing.

BY TECHNOLOGY

- Turbidimetric Inhibition Immunoassay

- Ion-Exchange HPLC

- Affinity Binding Chromatography

- Enzymatic Assay

- Others

On the basis of technology, the Saudi Arabia, Turkey, and Egypt HbA1c testing market is segmented into ion exchange HPCL, enzymatic assay, affinity binding chromatography, turbidimetric inhibition immunoassay, and others.

BY END USER

- Laboratories

- Hospitals

- Clinics

- Homecare

- Ambulatory Centers

- Pharmacies/Drug Stores

- Others

エンドユーザーに基づいて、サウジアラビア、トルコ、エジプトの HbA1c 検査市場は、研究所、病院、診療所、在宅ケア、外来センター、薬局/ドラッグストア、その他に分類されます。

流通チャネル別

- 直接販売

- 第三者配信

- 小売販売

流通チャネルに基づいて、サウジアラビア、トルコ、エジプトの HbA1c 検査市場は、サードパーティ流通、直接販売、小売販売に分類されます。

サウジアラビア、トルコ、エジプトの HbA1c 検査市場の地域分析/洞察

サウジアラビア、トルコ、エジプトの HbA1c 検査市場は、製品タイプ、検査モード、テクノロジー、エンドユーザー、流通チャネルなど、4 つの主要なセグメントに分類されています。

この市場レポートで取り上げられている国は、サウジアラビア、トルコ、エジプトです。人口における糖尿病および糖尿病前症の罹患率が上昇しているため、サウジアラビア、トルコ、エジプトの HbA1c 検査市場ではトルコが優位に立つと予想されています。

レポートの州セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパ ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境とサウジアラビア、トルコ、エジプトの HbA1c 検査市場シェア分析

サウジアラビア、トルコ、エジプトの HbA1c 検査市場の競争環境は、競合他社によって詳細が提供されます。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品の承認、製品の幅と幅、アプリケーションの優位性、および技術ライフライン曲線があります。提供されている上記のデータ ポイントは、サウジアラビア、トルコ、エジプトの HbA1c 検査市場への会社の重点にのみ関連しています。

サウジアラビア、トルコ、エジプトの HbA1c 検査市場で活動している主要企業には、Siemens Healthcare GmbH、A. Menarini Diagnostics srl、ARKRAY, Inc.、Trinity Biotech、Thermo Fisher Scientific Inc.、Abbott、Wondfo、F. Hoffmann-La Roche Ltd、Ortho Clinical Diagnostics、DxGen Corp. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, INDUSTRY INSIGHTS

6 REGULATORY FRAMEWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF DIABETES WORLDWIDE

7.1.2 GROWING AWARENESS ABOUT THE IMPORTANCE OF GLYCEMIC CONTROL

7.1.3 GROWING DEMAND FOR POINT-OF-CARE TESTING DEVICES

7.2 RESTRAINTS

7.2.1 HIGH COST OF HBA1C TESTING DEVICES AND KITS

7.2.2 INADEQUATE HEALTHCARE INFRASTRUCTURE IN DEVELOPING COUNTRIES

7.3 OPPORTUNITIES

7.3.1 INCREASING ADOPTION OF HBA1C TESTING IN EMERGING MARKETS

7.3.2 INTEGRATION OF HBA1C TESTING WITH ELECTRONIC MEDICAL RECORDS AND TELEMEDICINE

7.4 CHALLENGES

7.4.1 INACCURATE RESULTS DUE TO INTERFERENCE FROM VARIOUS HEMOGLOBIN VARIANTS

7.4.2 CHALLENGES IN INTERPRETING HBA1C RESULTS IN PATIENTS WITH ANEMIA OR KIDNEY DISEASE

8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 POINT OF CARE DEVICES

8.2.2 FACILITY BASED PLATFORM

8.3 REAGENTS AND CONSUMABLES

9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY MODE OF TESTING

9.1 OVERVIEW

9.2 PRESCRIPTION BASED TESTING

9.3 OTC TESTING

10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 TURBIDIMETRIC INHIBITION IMMUNOASSAY

10.3 ION-EXCHANGE HPLC

10.4 AFFINITY BINDING CHROMATOGRAPHY

10.5 ENZYMATIC ASSAY

10.6 OTHERS

11 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY END USER

11.1 OVERVIEW

11.2 LABORATORIES

11.3 HOSPITALS

11.4 CLINICS

11.5 HOMECARE

11.6 AMBULATORY CENTRES

11.7 PHARMACIES/ DRUG STORES

11.8 OTHERS

12 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTION

12.4 RETAIL SALES

12.4.1 HOSPITAL PHARMACY

12.4.2 ONLINE PHARMACY

12.4.3 OTHERS

13 SAUDI ARABIA, TURKEY AND EGYPT HBA1C TESTING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.2 COMPANY SHARE ANALYSIS: TURKEY

13.3 COMPANY SHARE ANALYSIS: EGYPT

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 F.HOFFMANN- LA ROCHE LTD.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SIEMENS HEALTHINEERS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ORTHO CLINICAL DIAGNOSTICS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ARKRAY, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 THERMO FISCHER SCIENTIFIC INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 ABBOTT

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BIO RAD LABORATORIES, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 DIASYS DIAGNOSTIC SYSTEMS GMBH

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 DXGEN CORP.

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 A. MENARINNI DIAGNOSTICS S.R.L

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 PTS DIAGNOSTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 RADIOMETER MEDICAL APS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 TRINITY BIOTECH

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 VITROSENS BIOTECHNOLOGY

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 WONDFO

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

図表一覧

FIGURE 1 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 SAUDI ARABIA, TURKEY, AND EGYPT HBA1C TESTING MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 12 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE TURKEY HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 13 GROWING AWARENESS OF DIABETES AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE EGYPT HBA1C TESTING MARKET FROM 2023 TO 2030

FIGURE 14 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 15 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE TURKEY HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 16 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EGYPT HBA1C TESTING MARKET IN 2023 & 2030

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF SAUDI ARABIA, TURKEY & EGYPT HBA1C TESTING MARKET

FIGURE 18 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 19 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 SAUDI ARABIA HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 23 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 24 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 25 TURKEY HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 26 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2022

FIGURE 27 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 28 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 29 EGYPT HBA1C TESTING MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 30 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 31 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 32 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 33 SAUDI ARABIA HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 34 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 35 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 36 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 37 TURKEY HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 38 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2022

FIGURE 39 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, 2023-2030 (USD MILLION)

FIGURE 40 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, CAGR (2023-2030)

FIGURE 41 EGYPT HBA1C TESTING MARKET: BY MODE OF TESTING, LIFELINE CURVE

FIGURE 42 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 43 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 44 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 45 SAUDI ARABIA HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 46 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 47 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 48 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 49 TURKEY HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 50 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2022

FIGURE 51 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, 2023-2030 (USD MILLION)

FIGURE 52 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 53 EGYPT HBA1C TESTING MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 54 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 55 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 56 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 57 SAUDI ARABIA HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 58 TURKEY HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 59 TURKEY HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 60 TURKEY HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 61 TURKEY HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 62 EGYPT HBA1C TESTING MARKET: BY END USER, 2022

FIGURE 63 EGYPT HBA1C TESTING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 64 EGYPT HBA1C TESTING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 65 EGYPT HBA1C TESTING MARKET: BY END USER, LIFELINE CURVE

FIGURE 66 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 67 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 68 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 69 SAUDI ARABIA HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 70 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 71 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 72 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 73 TURKEY HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 74 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 75 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 76 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 77 EGYPT HBA1C TESTING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 78 SAUDI ARABIA HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 79 TURKEY HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

FIGURE 80 EGYPT HBA1C TESTING MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。