北米創傷ケアモニタリング市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

2.54 Billion

USD

3.81 Billion

2024

2032

USD

2.54 Billion

USD

3.81 Billion

2024

2032

| 2025 –2032 | |

| USD 2.54 Billion | |

| USD 3.81 Billion | |

|

|

|

|

北米創傷ケアモニタリング市場セグメンテーション、製品別(デバイスおよび創傷評価アプリ)、モダリティ別(ウェアラブルおよび非ウェアラブル)、製品タイプ別(接触型創傷測定デバイスおよび非接触型創傷測定デバイス)、創傷タイプ別(慢性創傷および急性創傷)、用途別(創傷治癒モニタリング、創傷評価、感染検出および治療モニタリング)、エンドユーザー別(病院、診療所、在宅医療、長期ケア施設、外傷センターなど)、流通チャネル別(直接入札および小売販売) - 業界動向および2032年までの予測

北米創傷ケアモニタリング市場規模

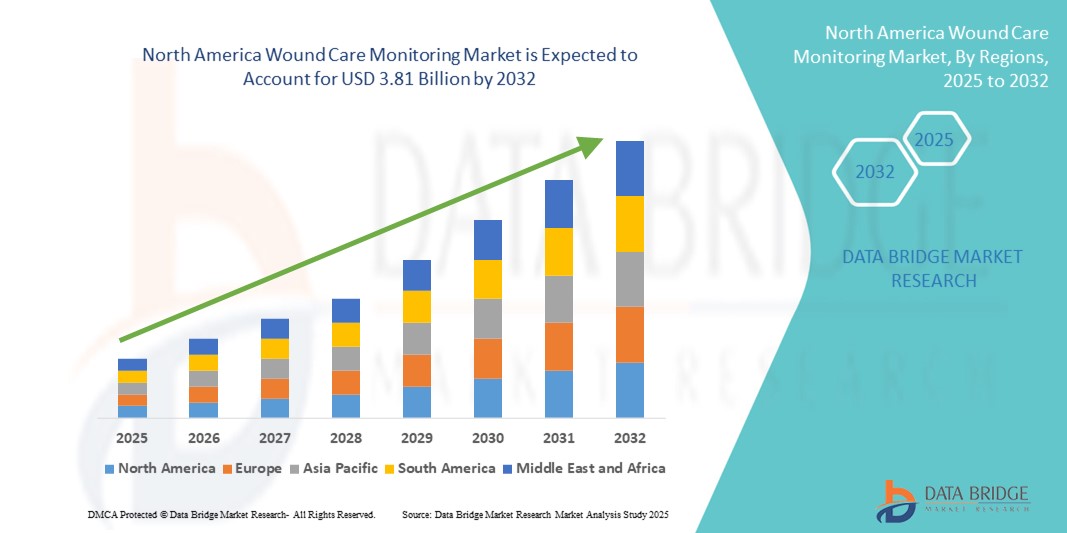

- 北米の創傷ケアモニタリング市場規模は2024年に25億4000万米ドルと評価され、予測期間中に5.20%のCAGRで成長し、2032年には38億1000万米ドル に達すると予想されています 。

- 市場の成長は、慢性創傷の有病率の増加、高齢者人口の増加、そして特に米国とカナダにおける地域全体での糖尿病と肥満の負担の増加によって主に推進されています。

- さらに、センサーベースおよびAI統合型の創傷モニタリング技術の進歩と、在宅医療および遠隔モニタリングソリューションへの関心の高まりにより、創傷ケアモニタリングデバイスの需要が高まっています。これらの相乗効果により市場拡大が加速し、業界の成長を大幅に押し上げています。

北米創傷ケアモニタリング市場分析

- 創傷の進行と治癒状態に関するリアルタイムデータを提供する創傷ケアモニタリングソリューションは、治療の精度を高め、治癒時間を短縮する能力があるため、北米の臨床および在宅ケアの現場の両方で高度な創傷管理プロトコルの重要な要素になりつつあります。

- 創傷ケアモニタリングの需要増加は、主に慢性創傷の有病率の上昇、高齢者や糖尿病患者の増加、早期診断と遠隔モニタリングを重視した価値に基づくケアへの移行によって推進されている。

- 米国は、先進的な医療システム、AIを活用した診断ツールの高い採用率、非接触型および画像ベースの創傷評価技術に重点を置く医療技術革新企業の強力な存在に支えられ、2024年には北米の創傷ケアモニタリング市場で最大の収益シェア42.3%を獲得して市場を支配した。

- カナダは、デジタルヘルスインフラの拡大と長期および在宅創傷ケアソリューションへの重点化により、予測期間中に北米創傷ケアモニタリング市場で最も急速に成長する国になると予想されています。

- デバイスセグメントは、技術の進歩、EHRとの統合、病院や長期ケア施設での使用の増加により、2024年には創傷ケアモニタリング市場を61.8%の市場シェアで支配しました。

レポートの範囲と北米創傷ケアモニタリング市場のセグメンテーション

|

属性 |

北米創傷ケアモニタリングの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米創傷ケアモニタリング市場動向

AI駆動型イメージングとリモートモニタリングの統合

- 北米の創傷ケアモニタリング市場における重要かつ加速的なトレンドは、人工知能(AI)とデジタル画像および遠隔医療プラットフォームの統合であり、創傷評価の精度を高め、予測分析を可能にし、リアルタイムの遠隔ケア調整をサポートする。

- 例えば、米国の病院で広く使用されているSwift Medicalの創傷イメージングプラットフォームは、AIとスマートフォンのカメラを活用して創傷の寸法を自動測定し、組織の種類を検出し、治癒の進行状況を追跡することで、医師がデータに基づいた迅速な意思決定を行えるようにしています。同様に、MolecuLightの蛍光イメージングデバイスは、非侵襲的に細菌の存在を検出し、感染管理の改善に役立ちます。

- AI統合により、より正確な記録と治癒合併症の早期発見が可能になり、積極的な介入が可能になります。また、これらのツールはクラウドプラットフォームとEHR統合を通じた安全なデータ共有をサポートし、医療現場における医療提供者間の効率的な連携を可能にします。

- これらの技術をシームレスに導入することで、主観性を最小限に抑え、治療計画を最適化し、特に長期ケアや遠隔患者モニタリングのシナリオにおいてケアの継続性をサポートすることで、創傷管理を変革しています。

- インテリジェントで画像ベースの、遠隔アクセス可能な創傷モニタリングツールへのトレンドは、臨床ワークフローを変革しつつあります。その結果、Tissue AnalyticsやSpectral AIといった企業は、北米の主要な医療ネットワークに採用されている、AIを活用した高度な創傷ソリューションを開発しています。

- 医療提供者が成果に基づく創傷ケア管理のためのより優れたツールを求めているため、病院、長期ケア施設、在宅ケアの現場では、統合されたインテリジェントな創傷モニタリングシステムの需要が急速に高まっています。

北米創傷ケアモニタリング市場の動向

ドライバ

慢性創傷の有病率増加とアウトカムに基づくケアへの注目

- 糖尿病性足潰瘍、褥瘡、静脈性下肢潰瘍などの慢性創傷の増加は、人口の高齢化と糖尿病の発症率の増加と相まって、北米における高度な創傷ケアモニタリングの需要の主な要因となっています。

- 例えば、3,700万人以上のアメリカ人が糖尿病を患っており、継続的な評価と個別のケア計画を必要とする傷の治癒が遅れるリスクが大幅に高まっています。

- 高度な創傷モニタリングデバイスは、リアルタイムの視覚化、自動文書化、遠隔追跡などの機能を提供し、早期介入、再入院の削減、費用対効果の高い治療を優先する価値ベースのケアモデルをサポートします。

- 在宅医療の重要性が高まり、遠隔医療サービスが拡大するにつれ、さまざまなケア環境で臨床医や介護者をサポートできるインテリジェントでポータブルな創傷モニタリングツールの必要性がさらに高まっています。

抑制/挑戦

デバイスの高コストと相互運用性の制限

- AI搭載画像機器や蛍光診断などの高度な創傷ケアモニタリング技術は比較的高額なため、特に予算が限られている小規模な医療機関や在宅ケア機関にとっては依然として大きな制約となっている。

- 例えば、画像ベースの創傷スキャナの取得と導入には、専門的なトレーニング、ソフトウェアライセンス、ITサポートが必要になる可能性があり、経済的負担が増す。

- さらに、既存の電子医療記録(EHR)システムとのシームレスな相互運用性の欠如と、医療ネットワーク間の統合標準の一貫性の欠如により、運用の非効率性とデータサイロが生じています。

- プライバシーに関する懸念や、米国のHIPAAなどの基準への規制遵守も、特にクラウドベースのプラットフォームを介してデータが送信される場合に課題となる。

- コスト革新、標準化された統合プロトコル、安全なデータ管理ソリューションを通じてこれらの問題に対処することは、地域全体でのより広範な導入を促進するために不可欠です。

北米創傷ケアモニタリング市場の範囲

市場は、製品、モダリティ、製品タイプ、創傷タイプ、用途、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 製品別

製品別に見ると、北米の創傷ケアモニタリング市場は、デバイスと創傷評価アプリに分類されます。デバイスセグメントは、創傷測定の精度と病院情報システムとの統合により、臨床現場で広く採用されていることから、2024年には61.8%という最大の収益シェアで市場を牽引しました。これらのデバイスには、画像診断システムやデジタルスキャナーが搭載されていることが多く、医療従事者は治癒の進行状況を高精度にモニタリングできます。エビデンスに基づく創傷ケアへの需要の高まりと遠隔医療サービスの拡大は、これらの高度なモニタリングツールの普及をさらに促進しています。

創傷評価アプリ分野は、スマートフォンとデジタルヘルスプラットフォームの利用増加に支えられ、2025年から2032年にかけて最も高い成長率を示すと予想されています。これらのアプリにより、介護者と患者は遠隔で創傷の状態を記録し、遠隔診療を可能にし、特に在宅医療や長期ケアの環境において、対面診療の削減が可能になります。

- モダリティ別

北米の創傷ケアモニタリング市場は、モダリティに基づいて、ウェアラブルデバイスと非ウェアラブルデバイスに分類されます。非ウェアラブルデバイスは、2024年には57.6%という最大の市場シェアを獲得しました。これは主に、高解像度の画像と固定式の評価システムが一貫した臨床評価に求められる病院や診療所での広範な利用によるものです。これらのシステムは、通常、創傷ドレッシング交換時に使用され、慢性的な創傷の追跡において高い信頼性を提供します。

ウェアラブル分野は、フレキシブルバイオセンサーとスマートドレッシングのイノベーションに牽引され、予測期間中に最も高い成長率を示すと予測されています。これらのデバイスは、創傷部の温度、湿度、pHを継続的にリアルタイムでモニタリングすることを可能にし、外来および在宅医療における積極的な介入を促進し、創傷治癒の成果を向上させます。

- 製品タイプ別

製品タイプ別に見ると、北米の創傷ケアモニタリング市場は、接触型創傷測定装置と非接触型創傷測定装置に分類されます。非接触型創傷測定装置セグメントは、感染リスクの低減、使いやすさ、そして創傷床を刺激することなく迅速なデータ取得が可能であることなどから、2024年には53.9%の市場シェアを獲得し、市場を牽引しました。これらのツールは、免疫不全患者や高齢患者の慢性創傷管理に特に有効です。

接触創傷測定装置は、リソースが限られた環境や直接的な物理的測定を必要とする特定の臨床手順での関連性により、予測期間中に最も急速に成長すると予想されますが、衛生と患者の快適性への重点が高まっているため、その使用量は減少しています。

- 傷の種類別

北米の創傷ケアモニタリング市場は、創傷の種類に基づいて、慢性創傷と急性創傷に分類されます。慢性創傷セグメントは、糖尿病、肥満、高齢化の増加を背景に、2024年には64.2%という最大のシェアを占め、市場を席巻しました。糖尿病性足潰瘍や褥瘡などの慢性創傷は継続的なモニタリングと記録が必要となるため、高度な創傷モニタリングシステムが不可欠です。

外科的切開や外傷などの急性創傷は、特に外傷センターや術後ケアにおけるモニタリングソリューションの導入により、予測期間中に着実に増加すると予想されます。

- アプリケーション別

北米の創傷ケアモニタリング市場は、用途別に、創傷治癒モニタリング、創傷評価、感染検出、治療モニタリングに分類されます。慢性創傷の治癒率の追跡がますます重視されるようになり、臨床医が治療計画を積極的に調整し、合併症を予防できるようになったため、創傷治癒モニタリングは2024年に38.5%の市場シェアを獲得し、このセグメントをリードしました。

細菌の存在と感染リスクの早期特定を可能にする蛍光イメージングとバイオマーカーベースの創傷分析の技術革新に後押しされ、感染検出は予測期間中に堅調な成長を示すことが期待されています。

- エンドユーザー別

北米の創傷ケアモニタリング市場は、エンドユーザーに基づいて、病院、診療所、在宅医療、長期ケア施設、外傷センター、その他に分類されます。病院セグメントは、専門の創傷ケアチームの存在、高度な画像技術へのアクセス、そして慢性創傷および外科創傷治療の患者数の増加により、2024年には41.1%と最大の収益シェアを獲得しました。

在宅医療は、特に高齢化の進行と遠隔創傷モニタリング技術に支えられた分散型ケア提供への移行により、予測期間中に最も急速な成長が見込まれています。

- 流通チャネル別

流通チャネルに基づいて、北米の創傷ケアモニタリング市場は、直接入札と小売販売に分類されます。病院や大規模医療機関は、通常、交渉による入札や一括購入のための機関契約を通じて創傷モニタリングシステムを調達するため、直接入札セグメントは2024年には63.4%という最大のシェアで市場を支配しました。

小売販売セグメントは、特に消費者向け創傷評価アプリや在宅ケアおよび外来診療向けのポータブルデジタルツールにおいて、予測期間中に着実に成長すると予想されます。

北米創傷ケアモニタリング市場地域分析

- 米国は、先進的な医療システム、AIを活用した診断ツールの高い採用率、非接触型および画像ベースの創傷評価技術に重点を置く医療技術革新企業の強力な存在に支えられ、2024年には北米の創傷ケアモニタリング市場で最大の収益シェア42.3%を獲得して市場を支配した。

- 米国の医療提供者は、特に病院、長期ケア、在宅医療環境において、臨床結果を改善し、治療コストを削減するために、AIを活用した創傷評価ツール、デジタル画像システム、遠隔モニタリングプラットフォームを急速に統合しています。

- この広範な採用は、強力な医療インフラ、多額の研究開発投資、そして大手医療技術企業の存在によってさらに支えられており、米国は公的および民間の医療部門の両方において創傷ケアモニタリングソリューションの革新と実装の主要拠点としての地位を確立しています。

米国北米創傷ケアモニタリング市場インサイト

米国の創傷ケアモニタリング市場は、糖尿病性足潰瘍や褥瘡といった慢性創傷の有病率上昇とデジタルヘルス技術への需要増加を背景に、2024年には北米で最大の収益シェアを獲得しました。医療提供者は、ケアの効率性と患者アウトカムの向上を目指し、AI搭載画像診断システム、非接触型創傷測定ツール、遠隔モニタリングプラットフォームの導入を急速に進めています。高度な医療インフラの整備に加え、有利な償還制度と遠隔医療サービスの普及率の高さが相まって、病院、長期ケア、在宅医療のあらゆる分野で市場拡大を牽引し続けています。

カナダ創傷ケアモニタリング市場インサイト

カナダの創傷ケアモニタリング市場は、予測期間を通じて大幅な年平均成長率(CAGR)で成長すると予測されています。これは主に、デジタルヘルスケアへの政府投資の増加と慢性創傷の負担の拡大によるものです。カナダでは、特に遠隔地や高齢化社会において、非侵襲性モニタリングツールやモバイル創傷評価アプリの導入が急増しています。継続的な創傷追跡とデータに基づく治療計画の利点に対する医療従事者の意識の高まりも市場の成長に貢献しており、診療所、地域医療センター、長期ケア施設などにおける導入が拡大しています。

メキシコ創傷ケアモニタリング市場洞察

メキシコの創傷ケアモニタリング市場は、糖尿病関連合併症の増加と、医療サービスが行き届いていない地域における創傷ケアの改善に対するニーズの高まりを背景に、予測期間中に着実に拡大すると予想されています。プライマリケアと慢性疾患管理の強化に向けた政府の取り組みは、手頃な価格で携帯可能な創傷モニタリングソリューションの導入機会を創出しています。さらに、医療投資の増加と世界的な医療技術企業との提携により、公立病院や外来診療所におけるデジタル創傷評価ツールの導入が促進され、高度な創傷ケア技術へのアクセスが拡大しています。

北米創傷ケアモニタリング市場シェア

北米の創傷ケアモニタリング業界は、主に、次のような定評ある企業によって牽引されています。

- スミス・ネフュー(英国)

- Mölnlycke Health Care AB (スウェーデン)

- B.ブラウンSE(ドイツ)

- コロプラストA/S(デンマーク)

- コンバテックグループPLC(英国)

- インテグラ・ライフサイエンス・ホールディングス・コーポレーション(米国)

- ダーマ・サイエンシズ社(米国)

- オルガノジェネシス社(米国)

- MiMedx Group, Inc.(米国)

- ホリスター・インコーポレーテッド(米国)

- シスタジェニックス創傷管理株式会社(英国)

- Kerecis Limited(アイスランド)

- Essity AB(スウェーデン)

- メドライン・インダストリーズ(米国)

- アドバンシス・メディカル(英国)

- Acelity LP Inc.(米国)

- ウルゴメディカル(フランス)

- Swift Medical Inc.(カナダ)

北米の創傷ケアモニタリング市場の最近の動向は何ですか?

- 2024年4月、AIを活用した創傷ケアソリューションのリーディングカンパニーである米国Swift Medicalは、米国の複数の長期ケア施設にデジタル創傷プラットフォームを拡大することを発表しました。この取り組みは、創傷記録の標準化とスマートフォンベースの画像を用いたリアルタイムモニタリングを可能にし、臨床転帰の改善と入院再発の削減を目指しています。この開発は、スケーラブルでデータ駆動型の技術を通じて慢性創傷ケアを変革するというSwift Medicalのコミットメントを強調するものです。

- 2024年3月、ネットヘルスが買収したデジタル創傷イメージング企業であるティッシュ・アナリティクスは、米国の大手病院ネットワークと提携し、同社の創傷モニタリングシステムと電子医療記録(EHR)を統合しました。この統合により、創傷の進行をシームレスに追跡できるようになり、AIが生成した洞察によって臨床医をサポートすることで、臨床現場におけるインテリジェントで効率的な創傷管理ワークフローへの移行が促進されます。

- 2024年2月、カナダの医療画像診断企業であるMolecuLight Inc.は、i:X蛍光イメージングデバイスのFDA承認拡大を取得しました。この承認により、慢性創傷における細菌の存在検出のためのより幅広い臨床応用が可能になります。このマイルストーンは、創傷診断の進歩と、米国の創傷ケアセンターにおけるタイムリーかつ的を絞った介入の促進におけるMolecuLightの役割をさらに裏付けるものです。

- 2024年1月、米国に拠点を置く創傷ケアテクノロジー企業であるWoundVisionは、褥瘡の早期発見を強化するためにサーモグラフィー画像と分析機能を統合したScoutデバイスのアップグレード版を発表しました。この最新ソリューションは、院内感染の削減と患者の安全性向上に向けた国家的な取り組みと連携し、予防的な創傷ケアの実践を支援するため、米国の複数の病院で試験的に導入されています。

- 2023年1月、ダラスに拠点を置く予測診断企業Spectral AIは、米国生物医学先端研究開発局(BARDA)と契約を締結し、AIを活用した火傷および創傷治癒評価システムのDeepView開発をさらに進めました。この取り組みは、民間および軍事医療環境の両方において、より迅速かつ正確な評価を可能にする最先端の創傷評価ツールへの米国政府の投資を反映しています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。