北米のトマト市場、タイプ別(チェリートマト、グレープトマト、ローマトマト、ビーフステーキトマト、エアルームトマト、つるトマト、グリーントマトなど)、製品タイプ別(生鮮、冷凍、乾燥)、カテゴリー別(従来型およびオーガニック)、エンドユーザー別(食品サービス業界および家庭/小売業界)、流通チャネル別(直接および間接)業界動向と2030年までの予測。

北米のトマト市場の分析と洞察

北米のトマト市場は、さまざまな料理や加工部門でトマトの使用が増えたことにより、著しい成長を遂げています。トマトはさまざまな種類のトマト製品の製造に使用され、市場で大きな需要があります。トマトは味が良いだけでなく、人間の健康にも役立ちます。

市場の成長を牽引する要因は、食品加工産業におけるトマトの需要の増加と、市場でのトマトの新品種の開発と生産です。市場の成長を抑制している要因は、雨、気温、季節などのさまざまな要因によって左右されるトマトの価格の変動です。市場の成長の機会は、人工知能(AI) の助けを借りてトマトを栽培することです。市場の成長を妨げる要因のいくつかは、貯蔵施設の不足による収穫後の損失の増加です。

市場プレーヤーは、市場シェアを拡大するために、新製品の開発、パートナーシップ、その他の戦略に重点を置いています。したがって、政府機関によって制定された基準や規制の強化にメーカーが従って、製品を市場に販売し、消費者の需要が市場の成長を促進するようにする必要があります。一方、中小企業の技術的専門知識の欠如は、この地域の市場の成長を制限する可能性があります。

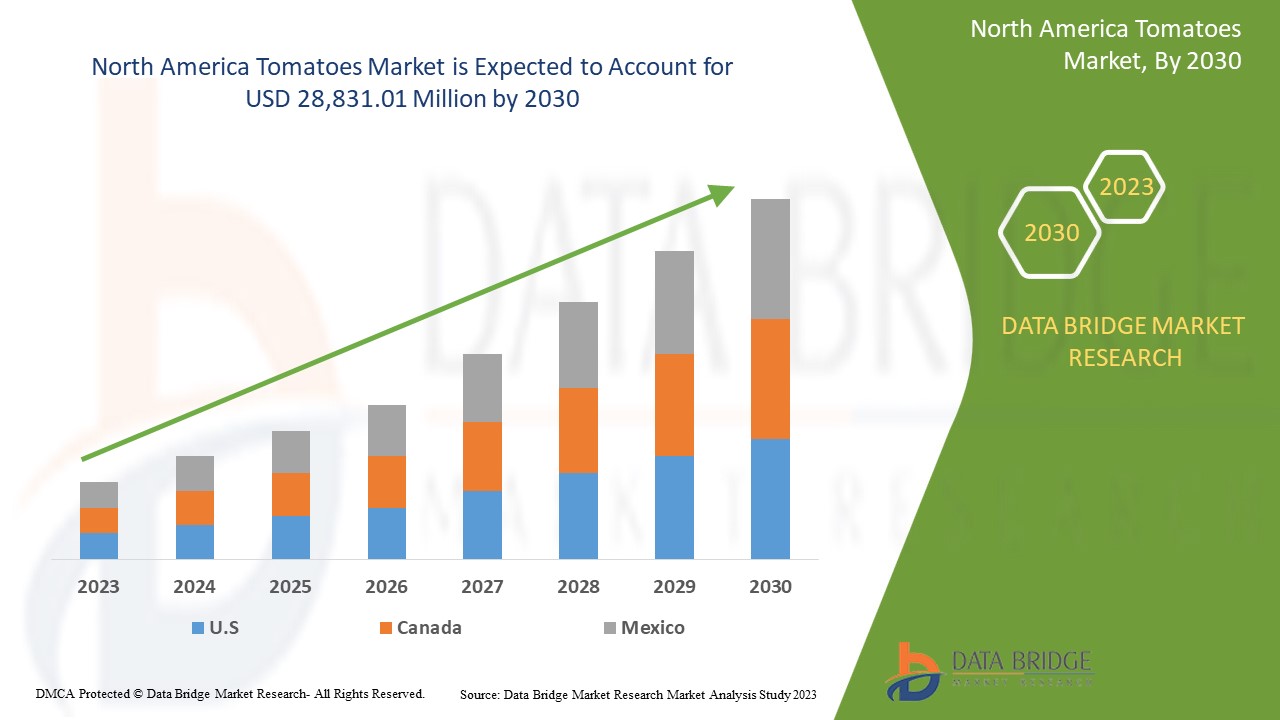

データブリッジ・マーケット・リサーチは、北米のトマト市場は予測期間中に3.0%のCAGRで成長し、2030年までに288億3,101万米ドルの価値に達すると予測しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2019 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別 (チェリートマト、グレープトマト、ローマトマト、ビーフステーキトマト、エアルームトマト、つるトマト、グリーントマトなど)、製品タイプ別 (生鮮、冷凍、乾燥)、カテゴリー別 (従来型およびオーガニック)、エンドユーザー別 (食品サービス業界および家庭/小売業界)、流通チャネル別 (直接および間接)。 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Houwelings、Ontario Processing Vegetable Growers、Tomato Growers Supply Company、Magic Sun、PACIFIC RIM PRODUCE、Mucci Int'l Mrktg Inc.、West Coast Tomato、LLC、Royalpride、Nature Fresh Farms、RedStar Sales BV、Streef Produce Ltd.、Hnatiuk Gardens、Aylmer Family Farm、Exeter Produce、AppHarvest など。 |

市場の定義

トマトは基本的に丸い形の野菜で、調理しても生でも食べられます。トマトは、ソラナム・リコペルシウムというハーブの食用果肉入りの果実です。トマトには、赤、黄、オレンジなど、さまざまな色があります。トマトにはさまざまな味と用途を持つ多くの品種があります。

トマトは食品・飲料業界で幅広く利用されています。スープ、ソース、ピューレ、ジュース、ケチャップなどの製造に使用されています。また、ハンバーガー、サンドイッチ、サラダ、ピザなどの生野菜としても使用されています。

トマトは食品加工産業において幅広い用途を持つ重要な原料であり、人体に有用な必須成分も含んでいます。血圧や健康な皮膚の維持に役立ち、抗炎症作用もあります。

北米のトマト市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- トマトの国内外需要の高まり

トマトの需要増加は、生産者と加工業者のレベルでの効率向上によるものです。果物と野菜を多く含む食生活を取り入れることの利点に対する消費者の意識の高まりと、それらの消費を促進するための公的取り組みにより、新鮮な果物と野菜の消費が増加しています。トマトの需要が大幅に増加したのは、人口の増加、栄養価が高く健康的な食品に対する消費者の需要の高まり、コールドチェーン インフラストラクチャの分野での同時開発、研究による生産性と品質の向上、最新の収穫後処理技術による改善技術の潜在的な利用によるものです。

- 食品加工業界におけるトマトの急成長

B2B 市場では、トマトが他の加工トマト製品の原料として利用されるため、トマトが必要です。トマトは、ジュース、ペースト、ピューレ、角切り/皮むきトマト、ケチャップ、ピクルス、ソース、すぐに食べられるカレーなど、さまざまな形で使用されています。加工トマト製品は、スナック、料理、ホテル、レストラン、ファーストフード小売チェーンなど、食品分野でさまざまな用途があります。トマト製品は調理済みでも生でも食べられ、北米市場で高い需要があります。急速な都市化により、新興国と先進国の消費者は、すぐに食べられる食品やトマト加工製品を食べるように誘われています。高まる需要を満たすために、加工食品メーカーとトマトペースト加工業者は、すぐに食べられる製品に注力しています。

さらに、粉末製品を含むさまざまなトマト製品の導入により、トマト加工食品の範囲が拡大しています。トマトペーストとトマトピューレは、トマトの一次加工製品です。トマトの二次加工製品は、一次製品を加工することで可能になります。トマトペーストとピューレの主な市場は、ケチャップとソース部門です。飲料および食品業界は、トマトペーストとピューレの2番目に大きなユーザーです。

拘束

- トマトの価格変動

不安定で予測不可能な北米市場は、工業企業に広範囲にわたる影響を及ぼします。エネルギー コストの上昇や原材料価格の予想外の変動などの予期せぬ障壁により、サプライ チェーンが混乱し、企業が収益性を維持することが困難になっています。ソース、ドレッシング、調味料のホット フィル ボトル包装に使用する原材料価格の変動により、完成品の価格に追加コストがかかります。主要生産地域での豊作または不作により、トマトの価格が急激に変動する可能性があります。

トマトの価格は、生産の季節性、季節外れの雨、長期にわたる干ばつなど、さまざまな要因によって変動します。また、場所、好み、消費者の年齢、消費者の購買力によっても異なります。季節性があるため、季節外れの時期には価格が上昇し、季節の時期には価格が下がります。

- 環境要素と気候条件の増加

環境の変化は、農業生態系の自然および人的要素の変化を通じて農家の生活、消費者の選択、および食糧安全保障に影響を及ぼし、食料システムの持続可能性に影響を及ぼします。年間降水量および大雨は、特に春に一般的になっています。春の雨が多すぎると、作物の生育が遅れ、植え付けが中断され、いくつかの真菌および細菌による作物の病気の蔓延が増加し、畑での作業が遅れることによって労働問題が発生する可能性があります。気温と降水量の変動は、トマトの生産量と品質に直接影響し、重要な農場作業のスケジュールと害虫、雑草、および病気の経済的影響に間接的に影響を与えます。悪天候は、トマトのサプライチェーンと輸送にも支障をきたします。

さらに、気温の上昇により作物の成長が早まり、その結果、栽培期間が短くなり、収穫量が減少します。対流圏(または地上)オゾンの増加は、植物の酸化ストレスの増加につながり、光合成を阻害して植物の成長を遅らせます。特に洪水や干ばつなどの極端な事象は、作物に害を与え、収穫量を減らし、最終的にはトマト市場に影響を及ぼす可能性があります。

機会

- 人工知能(AI)を使ったトマトの栽培

AI is a wide-ranging branch of computer science engaged in building smart machines capable of performing tasks that typically require human intelligence. It is a growing part of everyday life and is used in the agricultural sector. AI technology is focused on solving various problems to increase and optimize production and operation processes.

Advanced computational approaches are used in AI to solve many real-world issues. These methods can be used in the agricultural industry to conduct original research that will enhance the kind, speed, new variety, and protection. AI can automatically check crop quality, yield, pH value, nutrient proportion, amount of water needed, humidity, and oxygen components. Many nations use mini-bots to assess crop quality and ripeness in the agricultural industry. Mini-bots harvest ripe fruit and vegetables without damaging tomatoes' delicate skin.

Challenge

Scarcity of Water Resources and Salinity of Groundwater

Food production is greatly impacted by water scarcity. Without water, individuals lack the means to water their crops and, as a result, cannot feed the rapidly expanding population. According to the International Water Management Institute, agriculture competes continually with home, industrial, and environmental applications for a limited water supply, accounting for around 70% of North America water withdrawals.

Thus, the growth of the market is hindered due to high prices of raw materials as well as high building cost of these tables. This may challenge the growth of the North America tomatoes market.

Post-COVID-19 Impact on North America Tomatoes Market

Post the pandemic, the demand for tomatoes increased as there was an allowance of fruits and vegetables during the lockdown time and demand for vegetables increased at that time. Also, tomato having properties of increasing immunity led to high demand during COVID-19 time.

Recent Developments

- In September 2022, according to a USDA report, U.S. FTA (Free Trade Agreements) partners reported an annual increase in agricultural exports of the country ranging from 5% (Canada) to 46.2 % (Singapore) in the five years after the signing of their trade agreements.

- In March 2022, according to an article published in Fresh Plaza, Cherry tomato sales climbed 12.04% annually from January to March 2022, while their value increased 12.6% annually in the Jiaxing fruit market in China. Cherry tomato transaction volume climbed by 23.47% year on year, and transaction volume increased by 35.30% year on year.

North America Tomatoes Market Scope

North America tomatoes market is segmented into five notable segments based on type, product type, category, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Cherry Tomatoes

- Grape Tomatoes

- Roma Tomatoes

- Beefsteak Tomatoes

- Heirloom Tomatoes

- Tomatoes On The Vine

- Green Tomatoes

- Others

Based on type, the North America tomatoes market is segmented into cherry tomatoes, grape tomatoes, roma tomatoes, beefsteak tomatoes, heirloom tomatoes, tomatoes on the vine, green tomatoes, and others.

Product Type

- Fresh

- Frozen

- Dried

Based on product type, the North America tomatoes market is segmented into fresh, frozen, and dried.

Category

- Conventional

- Organic

Based on category, the North America tomatoes market is segmented into conventional and organic.

End User

- Food Service Industry

- Household/Retail Industry

Based on end user, the North America tomatoes market is segmented into food service industry and household/retail industry.

Distribution Channel

- Direct

- Indirect

Based on distribution channel, the North America tomatoes market is segmented into direct and indirect.

North America Tomatoes Market Regional Analysis/Insights

The North America tomatoes market is analyzed and market size insights and trends are provided by country, type, product type, category, end user, and distribution channel as referenced above

The countries covered in this report are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America tomatoes market in terms of market share and revenue. It is estimated to maintain its dominance during the forecast period due to the growing demand for these tomatoes, which is the major reason for the growth of tomatoes in the North America region.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Tomatoes Market Share Analysis

The competitive North America tomatoes market provides details about the competitors. Details include company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points are only related to the companies' focus on the market.

北米のトマト市場で事業を展開している大手企業としては、Houwelings、Ontario Processing Vegetable Growers、Tomato Growers Supply Company、Magic Sun、PACIFIC RIM PRODUCE、Mucci Int'l Mrktg Inc.、West Coast Tomato, LLC、Royalpride、Nature Fresh Farms、REDSTAR Sales BV、Streef Produce Ltd.、Hnatiuk Gardens、Aylmer Family Farm、Exeter Produce、AppHarvest などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA Tomatoes Market

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTER OF TOMATOES MARKET

4.2 TOP IMPORTER OF TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 LAUNCHING OF DISEASE RESISTANT VARIETIES

4.3.2 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.3 AUNCHING ORGANIC PRODUCTS

4.3.4 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 NORTH AMERICA TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 NORTH AMERICA TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TPYE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA TOMATOES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 MEXICO

13.1.3 CANADA

14 NORTH AMERICA TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 COMPANY PROFILE

15.1 APPHARVEST

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MASTRONARDI PRODUCE LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HOUWELINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MUCCI INT’L MRKTG INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 REDSTAR SALES BV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AYLMER FAMILY FARM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DUIJVESTIJN TOMATEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EXETER PRODUCE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HNATIUK GARDENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MAGIC SUN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NATURE FRESH FARMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ONTARIO PROCESSING VEGETABLE GROWERS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PACIFIC RIM PRODUCE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 R&L HOLT LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROYALPRIDE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAHYADRI FARMS POST HARVEST CARE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STREEF PRODUCE LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOMATO GROWERS SUPPLY COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 WEST COAST TOMATO, LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 TOP EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHERRY TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GRAPE TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ROMA TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TOMATOES ON THE VINE IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BEEFSTEAK TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA HEIRLOOM TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GREEN TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 COMPANIES PROVIDING FRESH TOMATOES

TABLE 15 NORTH AMERICA FRESH IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FROZEN IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA DRIED IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CONVENTIONAL IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ORGANIC IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HOUSEHOLD/RETAIL INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA DIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 U.S. TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 U.S. TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 U.S. TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 U.S. FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 MEXICO TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 MEXICO TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 MEXICO TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 MEXICO FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 CANADA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CANADA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 CANADA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TOMATOES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TOMATOES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA TOMATOES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND OF TOMATO ON FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 14 THE AVERAGE CHANGE IN THE RETAIL PRICE OF TOMATO PER KG COMPARED TO THE LONG-TERM PRICE TREND

FIGURE 15 NORTH AMERICA TOMATOES MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA TOMATOES MARKET, BY END USER, 2022

FIGURE 19 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 NORTH AMERICA TOMATOES MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。