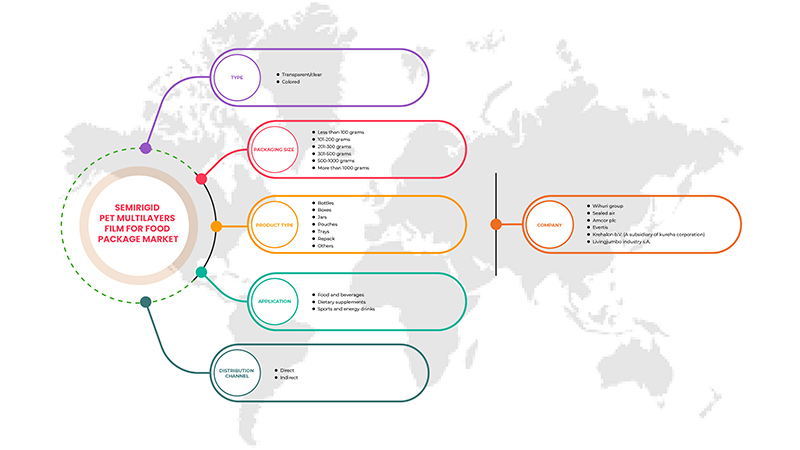

北米の食品包装用半硬質 PET 多層フィルム市場、タイプ別 (透明/クリアおよびカラー)、製品タイプ別 (ボトル、ボックス、ジャー、ポーチ、トレイ、リパック、その他)、包装サイズ別 (100 グラム未満、101 ~ 200 グラム、201 ~ 300 グラム、301 ~ 500 グラム、500 ~ 1000 グラム、1000 グラム以上)、用途別 (食品および飲料、栄養補助食品、スポーツドリンクおよびエネルギードリンク)、流通チャネル別 (直接および間接) 業界動向および 2029 年までの予測。

北米の食品包装向け半硬質PET多層フィルム市場の分析と洞察

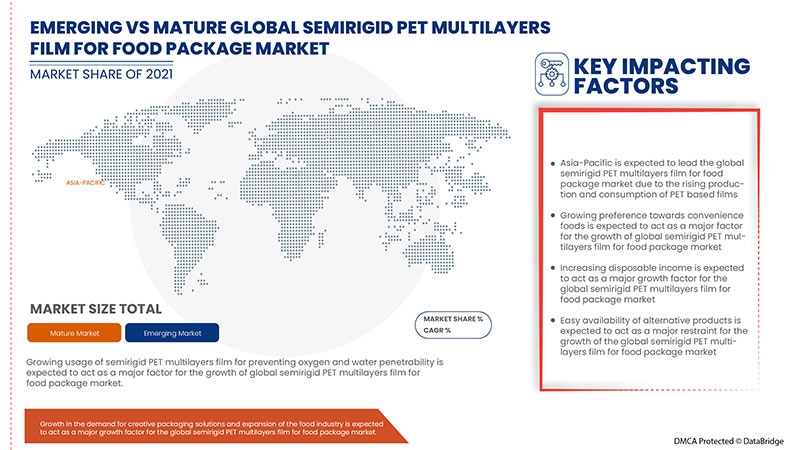

酸素や水の浸透を防ぐための半硬質 PET 多層包装フィルムの使用の増加と、保存期間を延ばすための半硬質多層フィルムの需要と認知度の向上により、北米の食品包装用半硬質 PET 多層フィルム市場の需要が増加すると予想されます。ただし、原材料価格の変動と代替製品の入手可能性により、市場の成長がさらに制限される可能性があります。

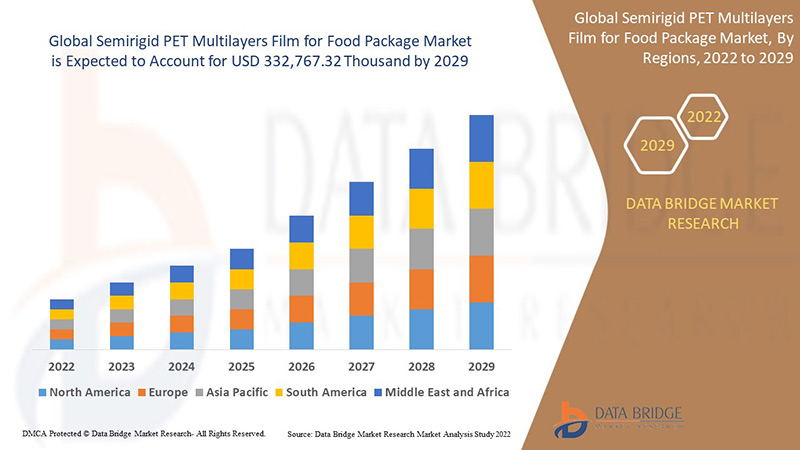

データブリッジマーケットリサーチは、北米の食品包装用半硬質PET多層フィルム市場は、予測期間中に3.6%のCAGRで成長し、2029年までに93,296.20千米ドルに達すると予測しています。透明/クリアは、北米の食品包装用半硬質PET多層フィルム市場で最大のタイプセグメントを占めています。北米の食品包装用半硬質PET多層フィルム市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

タイプ (透明/クリアおよび色付き)、製品タイプ (ボトル、ボックス、ジャー、ポーチ、トレイ、詰め替え用、その他)、パッケージ サイズ (100 グラム未満、101 ~ 200 グラム、201 ~ 300 グラム、301 ~ 500 グラム、500 ~ 1000 グラム、1000 グラム以上)、用途 (食品および飲料、栄養補助食品、スポーツドリンクおよびエナジードリンク)、流通チャネル (直接および間接) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Wihuri Group、Evertis、Sealed Air、Amcor plc、Krehalon BV(クレハ株式会社の子会社)など |

市場の定義

ポリエチレンテレフタレートは、ポリエステルファミリーに属する透明で強度のある軽量プラスチックです。衛生的で強度があり、軽量で、割れにくく、鮮度を保つため、食品包装材料として広く使用されています。半硬質 PET 多層フィルムは、複数の層を組み合わせたものです。これにより、酸素、二酸化炭素、水分の透過率を制御し、保存期間が大幅に延長されます。

メーカーやパッケージ デザイナーは、半硬質 PET 多層フィルムを好みます。これは、安全で、強度があり、透明で、用途が広いためです。これらの特性により、パッケージ デザインとパフォーマンスの両方において優れた革新が可能になります。食品の完全性、鮮度、味を保護するのに役立ちます。消費者は、軽量、再密封性、耐破損性、革新的なスタイルにより、これらのフィルムを高く評価しています。これらのフィルムは、パッケージの内容物を保護して保存する優れたバリア特性を備えています。簡単にリサイクルでき、PET 素材はさまざまな用途に再利用できます。

北米の食品包装向け半硬質 PET 多層フィルム市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 酸素や水の浸透を防ぐ半硬質PET多層包装フィルムの使用が増加

現在の状況では、消費者の嗜好が包装食品の採用へと移行しているため、多層ベースの包装フィルムに対する需要が非常に高くなっています。このようなフィルムは、多層共押出プロセスによって作成されるため、共押出されています。半硬質 PET 多層包装フィルムは、PET の複数の層と、穴あけ、引き裂き、耐熱性などのフィルムの機械的および物理的特性を強化するその他の材料で構成されており、酸素、湿気、二酸化炭素などのその他のガスとの相互作用を防ぎ、鉱油や紫外線の影響を制限します。したがって、包装された製品をガスや湿気から保護するために食品包装用の半硬質 PET 多層フィルムの使用が増えると、これらの多層フィルムの需要が高まり、北米の食品包装市場向けの半硬質 PET 多層フィルムの成長につながると予想されます。

- 保存期間を延ばすための半硬質多層フィルムの需要と認知度の向上

消費者の多忙な現代生活スタイルの増加と、その結果として生じる便利な食品包装への需要により、半硬質PET多層フィルムの需要が絶えず高まっています。これは、半硬質PET多層フィルムがパッケージの製品寿命を延ばすのに役立つためです。複数のポリマー層を混合することで、酸素、二酸化炭素、水分の透過率とパッケージ内の酸素濃度を制御して保存期間を大幅に延ばし、生鮮食品の鮮度を長期間維持します。環境への関心が高まるにつれて、人々はより長い保存期間のために半硬質PET多層フィルム食品包装を意識するようになっています。さらに、世界のほとんどの国でCOVID-19が蔓延したため、消費者が長期保存可能な食品に目を向け、包装食品の需要が通常の3倍に増加しています。

- 消費者の嗜好が包装食品の消費へと移行

調理済み食品の人気は世界中で高まっており、消費者の包装食品へのシフトに影響を与えています。多忙なワークライフバランスと増加する作業量を抱える働くプロフェッショナルが、包装食品の需要を押し上げています。したがって、包装食品の需要の高まりは、北米の食品包装用半硬質 PET 多層フィルム市場の発展を促進すると予想されます。取り扱い中および保管中の食品の腐敗も、今後数年間で包装用 PET 多層フィルムの採用を促進すると予想されます。これは、その不浸透性により包装食品の保管に最適だからです。消費者のライフスタイルがより多忙になり、その結果、包装によるコンビニエンス食品の需要が高まった結果、市場の成長が加速する可能性があります。

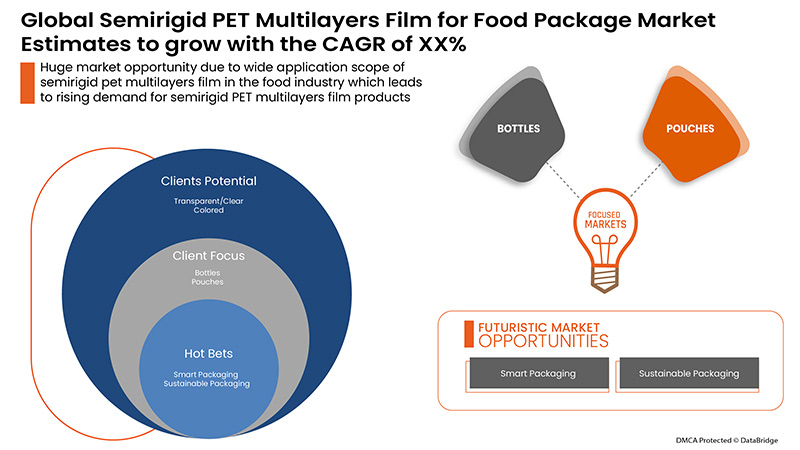

- 食品業界における半硬質PET多層フィルムの幅広い応用範囲

PET フィルムは、その独自の光学的、物理的、機械的、熱的、化学的特性により、多くの用途で使用されています。主に、食品や医薬品から工業製品や消費財まで、幅広い半硬質 PET 多層フィルム包装用途で使用されています。バリアとして、金属接着はラミネート接着、押し出しコーティング接着、印刷、またはシーリング、プレーンまたは金属化、成形可能、熱収縮性、コーティングされています。PET 多層フィルムは、包装市場にとって優れた特性を備えています。半硬質 PET 多層フィルムは、肉、鶏肉、魚、乳製品、スナック、飲料、乾燥食品およびシリアル、ベーカリー製品、菓子、ペットフードなど、食品業界で幅広い用途があります。半硬質 PET 多層フィルムは、パン袋、パスタ袋、スナックおよび栄養バー、高温/電子レンジ/ボイルイン袋包装、ペットフード包装、ポーチ/スタンドアップポーチ/再閉鎖可能なポーチまたはトレイなど、食品包装で幅広い用途があります。

機会

-

新しいデザインアイデアでクリエイティブなパッケージソリューションを成長させる

パッケージングは、新しい材料、技術、プロセスによって常に変化しています。これらの変化は、製品の品質、生産性、物流、環境パフォーマンスの向上、そして常に変化する消費者の嗜好に対するニーズによるものです。食品業界では、ほとんどのパッケージング作業は自動または半自動です。消費者にパーソナライズされたパッケージングソリューションを提供するために、新しい高度な印刷技術の採用が増えています。これにより、企業は市場でのブランド価値を高め、製品パッケージに対する顧客エンゲージメントを強化することができます。したがって、競争上の優位性を生み出し維持するための新しいデザインと革新を備えたパッケージングソリューションの成長、消費者行動の変化への対応、新しい材料と技術の利用可能性は、北米の食品パッケージ用半硬質PET多層フィルム市場にさまざまな成長機会をもたらす可能性があります。

-

顧客に優しいパッケージの需要の高まり

A major factor critical for innovation in food packaging is the increasing consumer demand for convenience. Modern packaging solutions offer many convenience attributes. These include ease of access and opening, disposal and handling, product visibility, reseal ability, microwave ability, and prolonged shelf life. There has also been an inclination towards the consumption of convenience foods. The fast-paced lifestyle changes have increased the demand for ready-to-eat foods. This increases the need for semirigid PET multilayer films for packaging, delivering, and preserving food items. Thus, the ever-changing consumer preferences, trends in the e-commerce industry, and demand for customer-friendly packaging products have opened up ample opportunities for semirigid PET multilayers film packaging solution providers to adopt innovative technologies and designs to increase their market share.

-

Expansion of food industry influences packaging films

The evolution of food service packaging is a major cause of the expansion of the food industry. Foodservice has grown to be a significant part of consumer spending. The food service industry includes restaurants, hotels, cafes, and catering services. As this trend increases, its influence on food packaging also increases. Packaging plays a key role in ensuring food safety and providing convenience to consumers. Furthermore, factors including globalization, changing standard of living, health and wellbeing, and higher disposable incomes are creating demand in the food industry. The food industry has undergone drastic developments in recent times. Therefore the growth and development of the industry may provide new opportunities for the growth of the North America semirigid PET multilayers film for food package market.

Restraints/Challenges

- Volatility in prices of raw materials

PET is a synthetic fiber that has been manufactured. However, its raw materials are still derived from nature, a non-renewable natural resource. It is a type of plastic that is commonly derived from petroleum. There are alternatives to petroleum-derived PET, such as those made from recycled plastic, crops, or even waste. Rising crude oil prices are causing concern in industries that rely on natural oil derivatives, such as semirigid PET multilayer films. The selling prices of semirigid PET multilayer films fluctuate due to changes in the prices of purified terephthalic acid (PTA) and mono ethylene glycol (MEG), the basic raw materials used to make PET from crude oil. PTA and MEG prices are heavily influenced by crude oil prices and currency exchange rates. Some consumers of semirigid PET multilayer films appear to accept the fluctuating price trend, while most consumers do not. As a result, the growth of the North America semirigid PET multilayers film for food packaging market is severely hampered.

- Availability of alternative products

People have been witnessing a never-before-seen global campaign against the production and use of plastic in recent years. Plastic waste has influenced public opinion, and due to this new consumer susceptibility, international legislators are passing restrictive laws on the use of disposable plastics—creating new processes and polymers capable of replacing the current oil-based PET film production. So, the PET alternatives already on the market and those being developed are BIO-PET, other non-biodegradable polymers, and natural and biodegradable polymers. Polyethylene furoate (PEF) and polytrimethylene furan dicarboxylate are two alternative polymers currently available (PTF). They are furan polymers that could be obtained from 100 percent renewable sources. There is a tremendous amount of activity around the world related to developing biodegradable polymers for all types of applications traditionally associated with plastic.

- Concerns about the recycling of multilayer films

Manufacturers can choose different materials and layer combinations while developing multilayer packaging solutions. This has led to prevention in a clear separation of individual material groups. The major challenge in recycling post-consumed plastic waste is sorting the multilayer packaging. The multilayer packaging is difficult to identify and hard to recycle. Identification technologies need to be deployed to identify the different surface properties. Multilayer packaging is a complex mixture of other materials that are also contaminated after use. Therefore, a lack of large-scale industrial sorting and recycling processes for multilayer packaging solutions may challenge the growth of the North America semirigid PET multilayers film for food package market.

- Environmental concerns and strict government regulation

PET is one of the most commonly used plastics. There are growing concerns regarding the serious issues of plastic pollution and its negative environmental impact. It disturbs the environment in many ways by affecting the air, soil, and water quality. Burning PET material releases harmful gases such as nitric oxide, sulfur dioxide, and chlorofluorocarbon. The production process of PET is an energy-intensive process. The emissions from the process severely contaminate water sources with many pollutants. Moreover, improper management and stringent government regulations further decrease the demand for these products in developing countries. This, in turn, may challenge the growth of the North America semirigid PET multilayers film for food package market.

Post-COVID-19 Impact on North America Semirigid PET Multilayers Film For Food Package Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the North America semirigid PET multilayers film for food package market has experienced a significant downfall in sales due to the restaurants and food service outlets being shut down over the past few years.

However, the growth of the North America semirigid PET multilayers film for food package market post-pandemic period is attributed to the opening up of food joints, grocery purchases, and consumer spending. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve their offerings through hygienic and sustainable food packaging solutions.

Recent Developments

- In June 2022, Winpak Ltd. received ISCC (International Sustainability and Carbon Certification) PLUS Certificate for the use of Recycled Content. This certification provides traceability along the supply chain and verifies that companies meet environmental and social standards. ISCC PLUS certification proves that the process to be used by the company for the use of recycled content follows defined and transparent rules. This certification will enhance the company's image in the market and help it gain a competitive advantage

- In May 2022, Sealed Air launched a new portfolio of digital printing, design, and smart packaging solutions. These products have been found under a new brand - prismiq. The brand is aimed at creating value for customers through digital packaging solutions. This new product launch will help the company tap into future digital packaging and graphics, thereby enhancing its product offerings in the market

North America Semirigid PET Multilayers Film For Food Package Market Scope

The North America semirigid PET multilayers film for food package market is segmented based on type, product type, packaging size, application, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Transparent/Clear

- Colored

On the basis of type, the North America semirigid PET multilayers film for food package market is segmented into transparent/clear and colored.

Product Type

- Bottles

- Boxes

- Jars

- Pouches

- Trays

- Repack

- Others

On the basis of product type, the North America semirigid PET multilayers film for food package market is segmented into bottles, boxes, jars, pouches, trays, repack, and others.

Packaging Size

- Less Than 100 Grams

- 101-200 Grams

- 201-300 Grams

- 301-500 Grams

- 500-1000 Grams

- More Than 1000 Grams

On the basis of packaging size, the North America semirigid PET multilayers film for food package market is segmented into less than 100 grams, 101-200 grams, 201-300 grams, 301-500 grams, 500-1000 grams, and more than 1000 grams.

Application

- Food and Beverages

- Dietary Supplements

- Sports and Energy Drinks

On the basis of application, the North America semirigid PET multilayers film for food package market is segmented into food and beverages, dietary supplements, and sports and energy drinks.

Distribution Channel

- Direct

- Indirect

On the basis of distribution channel, the North America semirigid PET multilayers film for food package market is segmented into direct and indirect.

North America Semirigid PET Multilayers Film For Food Package Market

The North America semirigid PET multilayers film for food package market is analyzed, and market size insights and trends are provided by country, type, product type, packaging size, application, and distribution channel as referenced above.

The North America semirigid PET multilayers film for food package market covers countries such as U.S., Canada, and Mexico. The U.S. is expected to dominate the North America semirigid PET multilayers film for food package market as the packaging market is being driven by reducing the weight of packing materials by reducing material usage without compromising the performance. Also, food waste and food safety are becoming more important challenges for regulatory bodies, particularly in the U.S., Canada, and Mexico.

The country section of the North America semirigid PET multilayers film for food package market report also provides individual market impacting factors and domestic regulation changes that impact the market's current and future trends. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the significant pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Semirigid PET Multilayers Film For Food Package Market Share Analysis

The North America semirigid PET multilayers film for food package market competitive landscape provides details of the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points are only related to the companies focus on the North America semirigid PET multilayers film for food package market.

北米の食品包装用半硬質 PET 多層フィルム市場で事業を展開している主要企業としては、Wihuri Group、Evertis、Sealed Air、Amcor plc、Krehalon BV (KUREHA CORPORATION の子会社) などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THE THREAT OF NEW ENTRANTS:

4.1.2 THE THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.3 BRAND OUTLOOK

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.5 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.6 IMPACT OF ECONOMIC SLOWDOWN ON MARKET

4.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 RAW MATERIAL PROCUREMENT

4.8.2 MANUFACTURING AND PACKING

4.8.3 MARKETING AND DISTRIBUTION

4.8.4 END USERS

4.9 VALUE CHAIN ANALYSIS

4.1 RAW MATERIAL PRODUCTION COVERAGE

4.11 REGULATORY FRAMEWORK AND GUIDELINES

5 REGIONAL SUMMARY

5.1 NORTH AMERICA

5.2 ASIA-PACIFIC

5.3 EUROPE

5.4 NORTH AMERICA

5.5 SOUTH AMERICA

5.6 MIDDLE EAST AND AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWTH IN USAGE OF SEMIRIGID PET MULTILAYER PACKAGING FILM FOR PREVENTING OXYGEN AND WATER PENETRABILITY

6.1.2 INCREASE IN DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE

6.1.3 SHIFT IN CONSUMER PREFERENCES TOWARDS THE CONSUMPTION OF PACKAGED FOODS

6.1.4 WIDE APPLICATION SCOPE OF SEMIRIGID PET MULTILAYERS FILM IN THE FOOD INDUSTRY

6.2 RESTRAINTS

6.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

6.2.2 AVAILABILITY OF ALTERNATIVE PRODUCTS

6.3 OPPORTUNITIES

6.3.1 GROWTH OF CREATIVE PACKAGING SOLUTIONS WITH NEW DESIGN IDEAS

6.3.2 UPSURGE IN THE DEMAND FOR CUSTOMER-FRIENDLY PACKAGING

6.3.3 EXPANSION OF THE FOOD INDUSTRY INFLUENCES PACKAGING FILMS

6.4 CHALLENGES

6.4.1 CONCERNS ABOUT THE RECYCLING OF MULTILAYER FILMS

6.4.2 ENVIRONMENTAL CONCERNS AND STRICT GOVERNMENT REGULATION

7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE

7.1 OVERVIEW

7.2 TRANSPARENT/CLEAR

7.3 COLORED

8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 BOTTLES

8.3 BOXES

8.4 JARS

8.5 POUCHES

8.6 TRAYS

8.7 REPACK

8.8 OTHERS

9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE

9.1 OVERVIEW

9.2 LESS THAN 100 GRAMS

9.3 101-200 GRAMS

9.4 201-300 GRAMS

9.5 301-500 GRAMS

9.6 500-1000 GRAMS

9.7 MORE THAN 1000 GRAMS

10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD AND BEVERAGES

10.2.1 FOOD

10.2.1.1 DAIRY

10.2.1.1.1 CHEESE

10.2.1.1.2 ICE CREAM

10.2.1.1.3 MILK POWDER

10.2.1.1.4 DAIRY SPREAD

10.2.1.1.5 YOGURT

10.2.1.1.6 OTHERS

10.2.1.1.7 DAIRY, BY TYPE

10.2.1.1.7.1 TRANSPARENT/CLEAR

10.2.1.1.7.2 COLORED

10.2.1.1.8 DAIRY, BY PRODUCT TYPE

10.2.1.1.8.1 BOTTLES

10.2.1.1.8.2 BOXES

10.2.1.1.8.3 JARS

10.2.1.1.8.4 POUCHES

10.2.1.1.8.5 TRAYS

10.2.1.1.8.6 REPACK

10.2.1.1.8.7 OTHERS

10.2.1.2 BAKERY

10.2.1.2.1 BREADS & ROLLS

10.2.1.2.2 CAKES & PASTRIES

10.2.1.2.3 BISCUITS

10.2.1.2.4 MUFFINS

10.2.1.2.5 COOKIES

10.2.1.2.6 DOUGHNUTS

10.2.1.2.7 OTHERS

10.2.1.2.8 BAKERY, BY TYPE

10.2.1.2.8.1 TRANSPARENT/CLEAR

10.2.1.2.8.2 COLORED

10.2.1.2.9 BAKERY, BY PRODUCT TYPE

10.2.1.2.9.1 BOTTLES

10.2.1.2.9.2 BOXES

10.2.1.2.9.3 JARS

10.2.1.2.9.4 POUCHES

10.2.1.2.9.5 TRAYS

10.2.1.2.9.6 REPACK

10.2.1.2.9.7 OTHERS

10.2.1.3 PROCESSED FOOD

10.2.1.3.1 READY MEALS

10.2.1.3.2 SAUCES, DRESSINGS AND CONDIMENTS

10.2.1.3.3 SOUPS

10.2.1.3.4 JAMS, PRESERVES AND MARMALADES

10.2.1.3.5 OTHERS

10.2.1.3.6 PROCESSED FOOD, BY TYPE

10.2.1.3.6.1.1 TRANSPARENT/CLEAR

10.2.1.3.6.1.2 COLORED

10.2.1.3.7 PROCESSED FOOD, BY PRODUCT TYPE

10.2.1.3.7.1.1 BOTTLES

10.2.1.3.7.1.2 BOXES

10.2.1.3.7.1.3 JARS

10.2.1.3.7.1.4 POUCHES

10.2.1.3.7.1.5 TRAYS

10.2.1.3.7.1.6 REPACK

10.2.1.3.7.1.7 OTHERS

10.2.1.4 CONFECTIONARY

10.2.1.4.1 HARD-BOILED SWEETS

10.2.1.4.2 MINTS

10.2.1.4.3 GUMS & JELLIES

10.2.1.4.4 CHOCOLATE

10.2.1.4.5 CHOCOLATE SYRUPS

10.2.1.4.6 CARAMELS & TOFFEES

10.2.1.4.7 OTHERS

10.2.1.5 CONFECTIONARY, BY TYPE

10.2.1.5.1 TRANSPARENT/CLEAR

10.2.1.5.2 COLORED

10.2.1.6 CONFECTIONARY, BY PRODUCT TYPE

10.2.1.6.1 BOTTLES

10.2.1.6.2 BOXES

10.2.1.6.3 JARS

10.2.1.6.4 POUCHES

10.2.1.6.5 TRAYS

10.2.1.6.6 REPACK

10.2.1.6.7 OTHERS

10.2.1.7 FROZEN DESSERTS

10.2.1.7.1 GELATO

10.2.1.7.2 CUSTARD

10.2.1.7.3 SORBET

10.2.1.7.4 OTHERS

10.2.1.8 FROZEN DESSERTS,BY TYPE

10.2.1.8.1 TRANSPARENT/CLEAR

10.2.1.8.2 COLORED

10.2.1.9 FROZEN DESSERTS, BY PRODUCT TYPE

10.2.1.9.1 BOTTLES

10.2.1.9.2 BOXES

10.2.1.9.3 JARS

10.2.1.9.4 POUCHES

10.2.1.9.5 TRAYS

10.2.1.9.6 REPACK

10.2.1.9.7 OTHERS

10.2.1.10 FUNCTIONAL FOODS

10.2.1.10.1 TRANSPARENT/CLEAR

10.2.1.10.2 COLORED

10.2.1.10.3 BOTTLES

10.2.1.10.4 BOXES

10.2.1.10.5 JARS

10.2.1.10.6 POUCHES

10.2.1.10.7 TRAYS

10.2.1.10.8 REPACK

10.2.1.10.9 OTHERS

10.2.1.11 CONVENIENCE FOOD

10.2.1.11.1 INSTANT NOODLES

10.2.1.11.2 PASTA

10.2.1.11.3 SNACKS AND EXTRUDED SNACKS

10.2.1.11.4 OTHERS

10.2.1.12 CONVENIENCE FOOD, BY TYPE

10.2.1.12.1 TRANSPARENT/CLEAR

10.2.1.12.2 COLORED

10.2.1.13 CONVENIENCE FOOD, BY PRODUCT TYPE

10.2.1.13.1 BOTTLES

10.2.1.13.2 BOXES

10.2.1.13.3 JARS

10.2.1.13.4 POUCHES

10.2.1.13.5 TRAYS

10.2.1.13.6 REPACK

10.2.1.13.7 OTHERS

10.2.1.14 MEAT PRODUCTS

10.2.1.14.1 BEEF MEAT

10.2.1.14.2 PORK MEAT

10.2.1.14.3 POULTRY MEAT

10.2.1.14.4 OTHERS

10.2.1.15 MEAT PRODUCTS, BY TYPE

10.2.1.15.1 TRANSPARENT/CLEAR

10.2.1.15.2 COLORED

10.2.1.16 MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.16.1 BOTTLES

10.2.1.16.2 BOXES

10.2.1.16.3 JARS

10.2.1.16.4 POUCHES

10.2.1.16.5 TRAYS

10.2.1.16.6 REPACK

10.2.1.16.7 OTHERS

10.2.1.17 PROCESSED MEAT PRODUCTS

10.2.1.17.1 BACON

10.2.1.17.2 MEAT SNACKS

10.2.1.17.3 SAUSAGE

10.2.1.17.4 HOT DOGS

10.2.1.17.5 DELI MEAT

10.2.1.17.6 OTHERS

10.2.1.18 PROCESSED MEAT PRODUCTS, BY TYPE

10.2.1.18.1 TRANSPARENT/CLEAR

10.2.1.18.2 COLORED

10.2.1.19 PROCESSED MEAT PRODUCTS, BY PRODUCT TYPE

10.2.1.19.1 BOTTLES

10.2.1.19.2 BOXES

10.2.1.19.3 JARS

10.2.1.19.4 POUCHES

10.2.1.19.5 TRAYS

10.2.1.19.6 REPACK

10.2.1.19.7 OTHERS

10.2.2 BEVERAGES

10.2.2.1 BEVERAGES, BY APPLICATION

10.2.2.1.1 SMOOTHIES

10.2.2.1.2 JUICES

10.2.2.1.3 SPORTS DRINKS

10.2.2.1.4 ENERGY DRINKS

10.2.2.1.5 DAIRY BASED DRINKS

10.2.2.1.5.1 DAIRY BASED DRINKS, BY APPLICATION

10.2.2.1.5.1.1 REGULAR PROCESSED MILK

10.2.2.1.5.1.2 FLAVORED MILK

10.2.2.1.5.1.3 MILK SHAKES

10.2.2.1.5.1.4 FUNCTIONAL BEVERAGES

10.2.2.2 BEVERAGES, BY TYPE

10.2.2.2.1 TRANSPARENT/CLEAR

10.2.2.2.2 COLORED

10.2.2.3 BEVERAGES, BY PRODUCT TYPE

10.2.2.3.1 BOTTLES

10.2.2.3.2 BOXES

10.2.2.3.3 JARS

10.2.2.3.4 POUCHES

10.2.2.3.5 TRAYS

10.2.2.3.6 REPACK

10.2.2.3.7 OTHERS

10.3 DIETARY SUPPLEMENTS

10.3.1 DIETARY SUPPLEMENTS, BY TYPE

10.3.1.1 TRANSPARENT/CLEAR

10.3.1.2 COLORED

10.3.2 DIETARY SUPPLEMENTS, BY PRODUCT TYPE

10.3.2.1 BOTTLES

10.3.2.2 BOXES

10.3.2.3 JARS

10.3.2.4 POUCHES

10.3.2.5 TRAYS

10.3.2.6 REPACK

10.3.2.7 OTHERS

10.4 SPORTS AND ENERGY DRINKS

10.4.1 SPORTS AND ENERGY DRINKS, BY TYPE

10.4.1.1 TRANSPARENT/CLEAR

10.4.1.2 COLORED

10.4.2 SPORTS AND ENERGY DRINKS, BY PRODUCT TYPE

10.4.2.1 BOTTLES

10.4.2.2 BOXES

10.4.2.3 JARS

10.4.2.4 POUCHES

10.4.2.5 TRAYS

10.4.2.6 REPACK

10.4.2.7 OTHERS

11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 COLLABORATION

13.3 CERTIFICATION

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 WIHURI GROUP

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 SEALED AIR

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMCOR PLC

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 EVERTIS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 KREHALON B.V. (A SUBSIDIARY OF KUREHA CORPORATION)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 LIVINGJUMBO INDUSTRY S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF POLYETHYLENE TEREPHTHALATE IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 2 EXPORT DATA OF POLYETHYLENE TEREPHTHALATE, IN PRIMARY FORMS; HS CODE – 390760 (USD THOUSAND)

TABLE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRANSPARENT/CLEAR IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA COLORED IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA BOTTLES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA BOXES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA JARS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA POUCHES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA TRAYS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA REPACK IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA OTHERS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA LESS THAN 100 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA 101-200 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA 201-300 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA 301-500 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA 500-1000 GRAMS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA MORE THAN 1000 GRAMS SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA DIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA INDIRECT IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 NORTH AMERICA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NORTH AMERICA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 78 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 79 NORTH AMERICA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 80 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 81 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 82 NORTH AMERICA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 84 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 NORTH AMERICA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 86 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 87 NORTH AMERICA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 89 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 90 NORTH AMERICA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 91 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 92 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 NORTH AMERICA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 95 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 NORTH AMERICA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 97 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 NORTH AMERICA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 100 NORTH AMERICA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 NORTH AMERICA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 103 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 NORTH AMERICA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 106 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 108 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 109 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 110 U.S. FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 U.S. FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 112 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 U.S. DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 U.S. DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 116 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 117 U.S. BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 118 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 U.S. PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 123 U.S. CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 125 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 126 U.S. FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 U.S. FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 129 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 130 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 U.S. CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 132 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 133 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 U.S. MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 135 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 136 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 U.S. PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 138 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 139 U.S. DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 141 U.S. BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 143 U.S. DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 U.S. SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 U.S. SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 147 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 150 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 151 CANADA FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 152 CANADA FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 154 CANADA DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 CANADA DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 158 CANADA BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 160 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 161 CANADA PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 163 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 164 CANADA CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 166 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 167 CANADA FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 CANADA FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 170 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 CANADA CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 173 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 174 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 CANADA MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 176 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 177 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 178 CANADA PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 180 CANADA DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 CANADA BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 CANADA DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 185 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 186 CANADA SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 187 CANADA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 188 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 189 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PACKAGING SIZE, 2020-2029 (USD THOUSAND)

TABLE 191 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 MEXICO FOOD AND BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 193 MEXICO FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 194 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 MEXICO DAIRY SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 196 MEXICO DAIRY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 198 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 199 MEXICO BAKERY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 200 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 201 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 202 MEXICO PROCESSED FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 204 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 205 MEXICO CONFECTIONARY IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 207 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 208 MEXICO FROZEN DESSERTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 MEXICO FUNCTIONAL FOODS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 211 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 212 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 213 MEXICO CONVENIENCE FOOD IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 214 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 215 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 216 MEXICO MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 217 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 218 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 219 MEXICO PROCESSED MEAT PRODUCTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 220 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 221 MEXICO DAIRY BASED DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 222 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 223 MEXICO BEVERAGES IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 224 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 225 MEXICO DIETARY SUPPLEMENTS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 226 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 227 MEXICO SPORTS AND ENERGY DRINKS IN SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY PRODUCT TYPE, 2020-2029 (USD THOUSAND)

TABLE 228 MEXICO SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

図表一覧

FIGURE 1 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND AND AWARENESS FOR SEMIRIGID MULTILAYER FILMS FOR SHELF-LIFE IS EXPECTED TO DRIVE THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN THE FORECAST PERIOD

FIGURE 15 THE TRANSPARENT/CLEAR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET IN 2022 & 2029

FIGURE 16 SUPPLY CHAIN ANALYSIS – NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 17 VALUE CHAIN OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET

FIGURE 19 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE, 2021

FIGURE 20 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PRODUCT TYPE, 2021

FIGURE 21 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY PACKAGING SIZE, 2021

FIGURE 22 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: BY TYPE (2022-2029)

FIGURE 29 NORTH AMERICA SEMIRIGID PET MULTILAYERS FILM FOR FOOD PACKAGE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。