北米の印刷可能な粘着性ビニールフィルム市場、製造プロセス別(カレンダーフィルムとキャストフィルム)、厚さ(薄い(2〜3ミル)と厚い(3ミル以上))、タイプ別(不透明、透明、半透明)、基材別(床、プラスチック、ガラス、その他)、用途別(車両グラフィックス、船舶グラフィックス、カーラッピング、床グラフィックス、ラベルとステッカー、ウィンドウグラフィックス、展示パネル、屋外広告、家具装飾、壁紙、その他) - 2030年までの業界動向と予測。

北米の印刷可能な粘着ビニールフィルム市場の分析と洞察

印刷可能な粘着ビニールフィルムは、光学的に透明で、簡単に剥がすことができます。これらのフィルムは、販促用デカールやウィンドウ グラフィックとして使用されます。これらのフィルムは、プライバシー保護や広告を目的として、レストラン、ショップ、オフィス、その他の商業施設の窓に貼られます。これらのフィルムは多用途で柔軟性があり、アクリルなどのビニール接着剤で作られています。ロゴ、看板、広告キャンペーンを作成して、ビジネスを宣伝し、大勢の人に情報を広めるために使用されます。

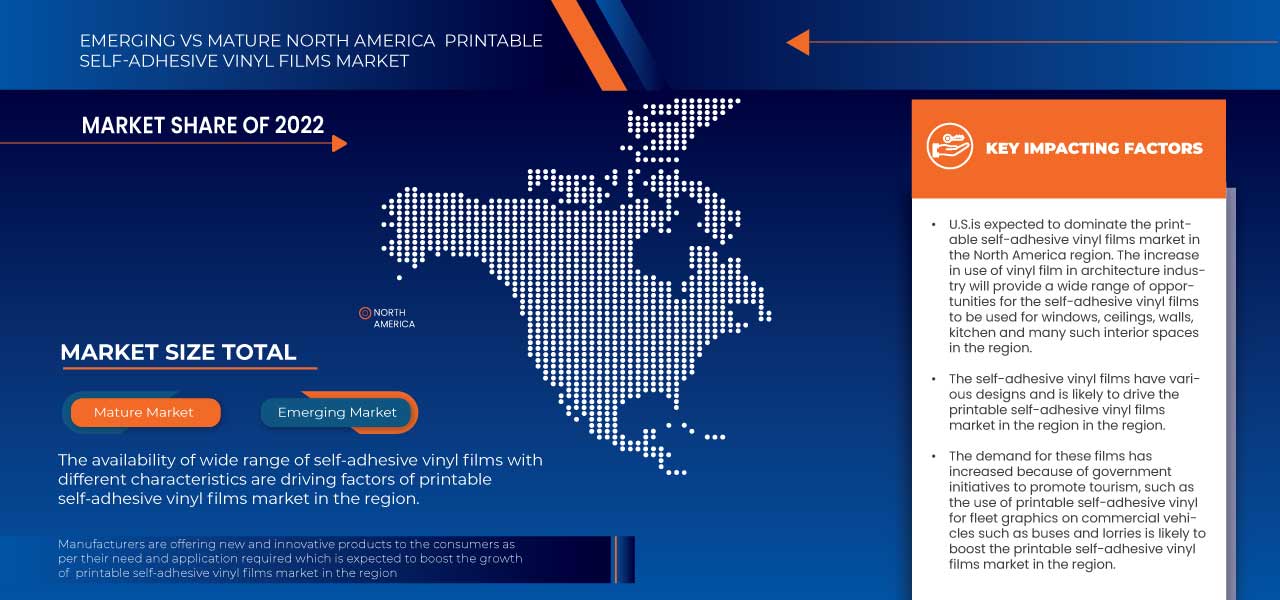

印刷可能な粘着性ビニールフィルムは、主にビニルエステルや酢酸ビニルなどのモノマーを使用する多数のビニルポリマーを使用して製造されています。建設および建築用途における印刷可能な粘着性ビニールフィルムの需要の増加は、北米の印刷可能な粘着性ビニールフィルム市場を牽引すると予想されます。さらに、さまざまな特性を持つ幅広い粘着性ビニールフィルムが利用可能です。ただし、メーカーによる新しい戦略的開発とイニシアチブは、北米市場にとってチャンスとなる可能性があります。一方、環境への懸念と政府の規制の高まりは、北米の印刷可能な粘着性ビニールフィルム市場の成長に深刻な課題をもたらす可能性があります。

印刷可能な粘着ビニールフィルムの需要は増加しており、メーカーはこれにさらに注力し、市場での新製品の発売、プロモーション、賞、認証、イベントへの参加に取り組んでいます。これらの決定は、最終的に市場の成長を促進しています。

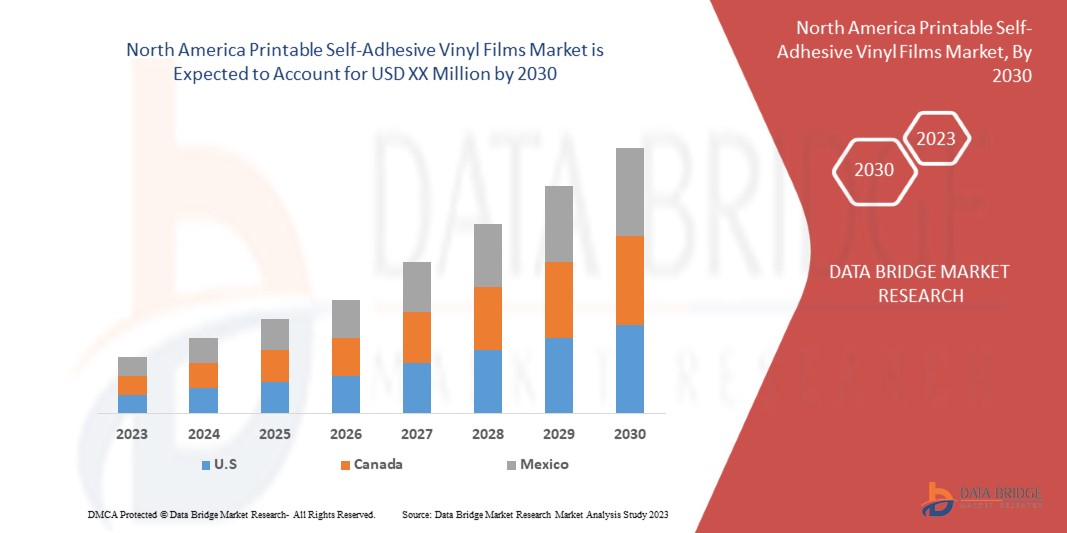

Data Bridge Market Research は、北米の印刷可能な粘着ビニールフィルム市場は 2023 年から 2030 年にかけて 4.1% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2016 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製造工程(カレンダーフィルムとキャストフィルム)、厚さ(薄い(2~3ミル)と厚い(3ミル以上))、タイプ(不透明、透明、半透明)、基材(床、プラスチック、ガラス、その他)、用途(車両グラフィックス、船舶グラフィックス、カーラッピング、床グラフィックス、ラベルとステッカー、ウィンドウグラフィックス、展示パネル、屋外広告、家具装飾、壁紙、その他) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Brite Coatings Private Limited、Item Plastic Corp.、3M、AVERY DENNISON CORPORATION、Arlon Graphics, LLC.、HEXIS SAS、Metamark、DRYTAC、FLEXcon Company, Inc.、TEKRA LLC、LX Hausys、LINTEC Corporation、Stahls' International、POLI-TAPE Group、Innovia Films、Henkel Adhesives Technologies India Private Limited、Responsive Industries Ltd.、ACHILLIES CORPORATION、ORAFOL Europe GmbH、Shubh Plastics |

市場の定義

印刷可能な粘着ビニールフィルムは、光学的に透明で、簡単に剥がすことができます。これらのフィルムは、販促用デカールやウィンドウ グラフィックとして使用されます。これらのフィルムは、プライバシー保護や広告を目的として、レストラン、ショップ、オフィス、その他の商業施設の窓に貼られます。これらのフィルムは多用途で柔軟性があり、アクリルなどのビニール接着剤で作られています。ロゴ、看板、広告キャンペーンを作成して、ビジネスを宣伝し、大勢の人に情報を広めるために使用されます。

北米の印刷可能な粘着ビニールフィルム市場の動向

ドライバー

-

建設および建築用途における印刷可能な粘着ビニールフィルムの需要増加

床材、壁紙、デッキ、プラットフォームのカバーなど、さまざまな建築用途で粘着ビニールフィルムの使用が増えていることは、粘着ビニールフィルムの市場需要にプラスの影響を与えています。粘着フィルムは、さまざまな表面を保護するために使用できる、強力で長持ちする素材です。これらのフィルムは、傷、摩耗、破壊行為、破損、紫外線による損傷、色あせから表面を保護するために広く使用されています。さらに、粘着ビニールフィルムには、壁紙に使用されるさまざまなデザインがあります。

印刷可能な粘着ビニールフィルムは、滑らかな表面に使用することで、表面の質感と色を改善します。最新のデザインと耐久性により、このフィルムは商業施設の改修や新築プロジェクトに最適なソリューションとして人気が高まっています。さらに、さまざまな主要メーカーが建築用途向けの粘着ビニールフィルムを供給しており、北米の粘着ビニールフィルム市場の成長を促進すると予想されています。

例えば、

- DRYTAC は、TimeTech Wall Protector という粘着ビニールフィルムロールを提供しています。このフィルムは、キッチンの壁紙、食器棚、壁装材、家具などに使用できます。

- Avery Dennison Corporation は、エンド ユーザーにインテリア デザイン コレクションを提供しています。MPI 8000 シリーズ フィルムは、さまざまなデザインで提供されています。これらのフィルムはプライマーなしで適用でき、優れた不透明性により、下地の壁を完全に隠すことができます。

したがって、建築および建設用途向けの印刷可能な粘着性ビニールフィルムの需要の増加により、市場の成長が促進されると予想されます。さらに、これらの用途向けに新しく革新的なフィルムを提供するメーカーが、世界的に市場の成長を促進すると予想されます。

-

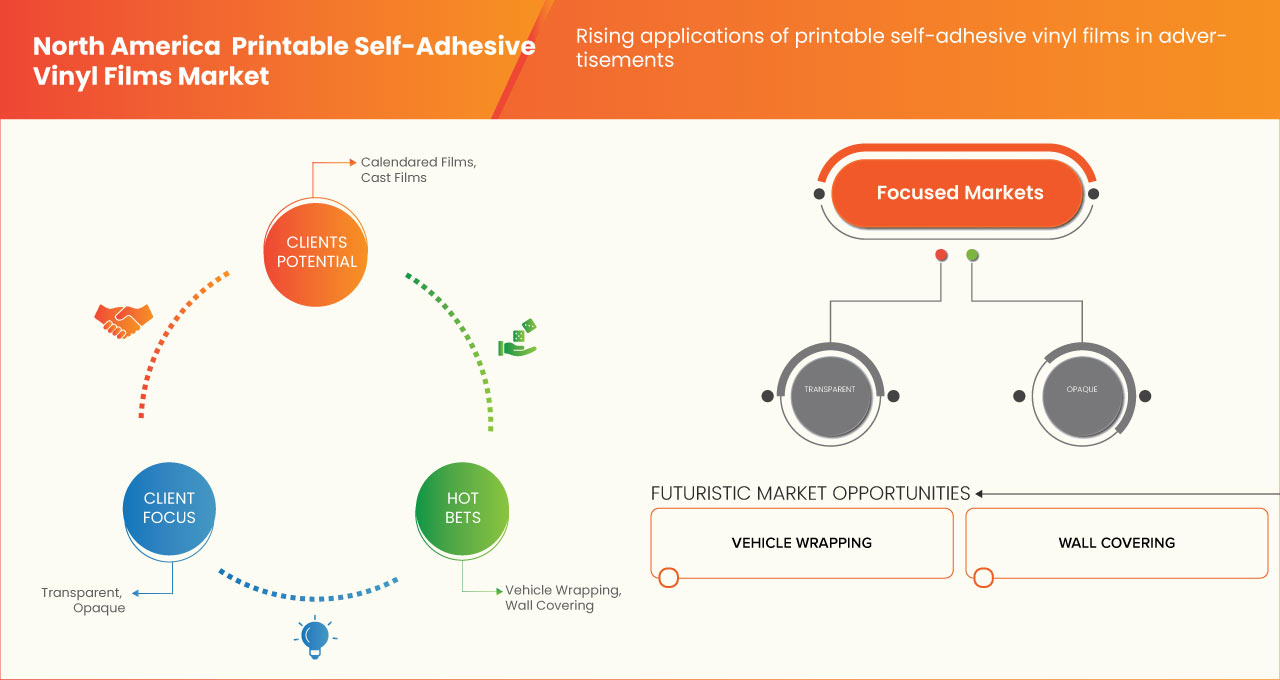

広告における印刷可能な粘着ビニールフィルムの用途増加

粘着性のある印刷可能なビニールフィルムは、広告、特に屋外広告で広く使用されています。これらのフィルムは、一般的に屋外コマーシャルでブランド認知度と視認性を高めるために使用されています。その容量により、企業にブランド メッセージを伝えるためのクリエイティブなキャンバスを提供し、簡単に変更することができます。

ブランディングや広告目的のこれらのフィルムの需要は、旅行者やその他の著名な顧客を引き付ける明るさの増加などの美的特徴によって促進されています。さらに、バスやトラックなどの商用車の車両グラフィックに印刷可能な粘着ビニールを使用するなど、観光を促進するための政府の取り組みの結果として、これらのフィルムの需要が増加しました。さらに、メーカーは広告用に特別に設計された製品を提供しており、市場の成長を促進しています。

例えば、

Avery Dennison Corporation は、さまざまな色合いと仕上げの感圧グラフィック フィルムを幅広く取り揃えています。また、壁から窓、床から家具まで、事実上あらゆる表面を目を引くプロモーション用の機能的なキャンバスに変えることができる次世代のデジタル イメージング フィルムも提供しています。

そのため、印刷可能な粘着ビニールフィルムは、高品質で高解像度の写真や広告を印刷できるため、広告によく使用されています。さらに、広告用フィルムを提供するメーカーも、市場の成長を後押しすると予想されています。

機会

-

主要メーカーによる新たな戦略的展開と取り組み

印刷可能な粘着ビニールフィルムはさまざまな業界で幅広く利用されており、市場での需要が大幅に増加しています。そのため、粘着ビニールフィルムの主要メーカーは、収益を上げ、エンドユーザーの需要を満たすために、新しく革新的な製品を発売しています。さらに、彼らは新たな買収や合併に熱中しており、市場に大きなチャンスを生み出すことが期待されています。

例えば、

-

2022年12月、LXインターナショナルはHanGlasの株式100%を取得することに合意しました。買収の主な目的は、関連会社LX Hausysのコーティングガラスおよび窓事業の規模を拡大することでした。

Hence, the new strategic developments and initiatives by the key manufacturers is expected to crete opportunities in the North America printable self-adhesive vinyl films market.

Restraints/Challenges

- Availability of various substitutes

The printable self-adhesive vinyl films have number of applications such as labels, signs, floor graphics, wall coverings etc. and are used widely across the globe. However, there are plenty of substitutes available for printable self-adhesive vinyl films such as papers, fabrics, biodegradable films, and PVC –free films. Paper can be used for printing labels, stickers and decals. It is biodegradable and also present in range of finishes and textures. Moreover, biodegradable films are an ecofriendly alternative to traditional vinyl films. They are made of materials such as polylactic acid (PLA) or cellulose and are intended to degrade over time. There are various substitutes which are present in the market, which may hamper the growth of market.

For Instance,

- Next Day Flyers offers paper labels such as white BOPP label and clear BOPP label which is gloss laminated, transparent as well as resistant to water, oil and refrigeration. The paper can be used instead of self-adhesive vinyl films.

Post COVID-19 Impact on North America Printable Self-Adhesive Vinyl Films Market

COVID-19 has affected the market to some extent. Due to the lockdown, the trade of raw materials and printable self-adhesive vinyl films across the world severely affected due to quarantine measures, influencing the market. Due to the change in many mandates and regulations, manufacturers can design and launch new products in the market, which will help the market's growth.

Recent Developments

- In February 2022, Stahls’ launched UltraColor Max direct-to-film (DTF) transfers as a new custom heat-transfer service option. The service offers unlimited colors, and extremely fine detail with no white or clear outline. It will expand the product portfolio of the company

- In October 2019, POLI-TAPE Group acquired Aslan, which is a leading developer, manufacturer and marketer of specialised self-adhesive films.

North America Printable Self-Adhesive Vinyl Films Market Scope

The North America printable self-adhesive vinyl films market is segmented into five notable segments based on manufacturing process, thickness, type, substrate and application. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Manufacturing Process

- Calendared Films

- Cast Films

On the basis of manufacturing process, the printable self-adhesive vinyl films market is segmented into calendared films and cast films.

Thickness

- Thick (2-3 mils)

- Thin (more than 3 mils)

On the basis of thickness, the printable self-adhesive vinyl films market is segmented into thin (2-3 mils and thick (more than 3 mils).

Type

- 透明

- 半透明

- 不透明

タイプに基づいて、印刷可能な粘着ビニールフィルム市場は、透明、半透明、不透明に分類されます。

応用

- 艦隊グラフィックス

- 水上船舶グラフィックス

- カーラッピング

- フロアグラフィック

- ラベルとステッカー

- ウィンドウグラフィックス

- 展示パネル

- 屋外広告

- 家具の装飾

- 壁紙

- その他

用途に基づいて、印刷可能な粘着ビニールフィルム市場は、車両グラフィックス、船舶グラフィックス、自動車ラッピング、床グラフィックス、ラベルとステッカー、ウィンドウグラフィックス、展示パネル、屋外広告、家具装飾、壁紙などに分類されます。

北米の印刷可能な粘着ビニールフィルム市場の地域分析/洞察

北米の印刷可能な粘着ビニールフィルム市場が分析され、上記に基づいて市場規模の洞察と傾向が提供されます。

北米の印刷可能な粘着ビニールフィルム市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

米国は、市場シェアと収益の面で北米の印刷可能な粘着ビニールフィルム市場を支配すると予想されています。さまざまな業界で印刷可能な粘着ビニールフィルムの需要が急増しているため、予測期間中もその優位性を維持すると予想されます。また、複数の種類の印刷可能な粘着ビニールフィルムが利用できるため、メーカーはニーズに応じて必要なビニールフィルムの種類を選択できます。

レポートの地域セクションでは、市場の現在および将来の傾向に影響を与える個々の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、北米ブランドの存在と入手可能性、地元および国内ブランドとの激しい競争により直面する課題、および販売チャネルの影響を考慮しながら、国データの予測分析を提供します。

競争環境と北米の印刷可能な粘着ビニールフィルム市場シェア分析

北米の印刷可能な粘着性ビニールフィルム市場の競争状況は、競合他社に関する詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。上記のデータ ポイントは、北米の印刷可能な粘着性ビニールフィルム市場に焦点を当てている企業にのみ関連しています。

この市場で活動している主要企業としては、Brite Coatings Private Limited、Item Plastic Corp.、3M、AVERY DENNISON CORPORATION、Arlon Graphics などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MANUFACTURING PROCESS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE ANALYSIS FOR THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.2.1 BARGAINING POWER OF BUYERS/CONSUMERS:

4.2.2 BARGAINING POWER OF SUPPLIERS:

4.2.3 THE THREAT OF NEW ENTRANTS:

4.2.4 THREAT OF SUBSTITUTES:

4.2.5 RIVALRY AMONG EXISTING COMPETITORS:

4.3 LIST OF KEY BUYERS

4.3.1 NORTH AMERICA

4.4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILM MARKET: PRODUCTION CONSUMPTION ANALYSIS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 TRADE ANALYSIS

4.7 RAW MATERIAL PRODUCTION COVERAGE

4.8 SUPPLY CHAIN ANALYSIS

4.8.1 OVERVIEW

4.8.2 LOGISTIC COST SCENARIO

4.8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.9 TECHNOLOGICAL ADVANCEMENTS IN THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

4.1 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS

6.1.2 RISING APPLICATIONS OF PRINTABLE SELF-ADHESIVE VINYL FILMS IN ADVERTISEMENTS

6.1.3 AVAILABILITY OF A WIDE RANGE OF SELF-ADHESIVE VINYL FILMS WITH DIFFERENT CHARACTERISTICS

6.2 RESTRAINTS

6.2.1 FLUCTUATION IN RAW MATERIAL PRICES

6.2.2 AVAILABILITY OF VARIOUS SUBSTITUTES

6.3 OPPORTUNITIES

6.3.1 NEW STRATEGIC DEVELOPMENTS AND INITIATIVES BY KEY MANUFACTURERS

6.3.2 RISING DEMAND FOR VEHICLE WRAPS

6.3.3 COMPANIES OFFERING SUSTAINABLE PRINTABLE SELF-ADHESIVE VINYL FILMS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG KEY MANUFACTURERS

6.4.2 INCREASING ENVIRONMENTAL CONCERNS AND GOVERNMENT REGULATIONS

7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS

7.1 OVERVIEW

7.2 CALENDERED FILMS

7.3 CAST FILMS

8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS

8.1 OVERVIEW

8.2 THIN (2-3 MILS)

8.3 THICK (MORE THAN 3 MILS)

9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE

9.1 OVERVIEW

9.2 OPAQUE

9.3 TRANSPARENT

9.4 TRANSLUCENT

10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE

10.1 OVERVIEW

10.2 PLASTIC

10.3 FLOOR

10.4 GLASS

10.5 OTHERS

11 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CAR WRAPPING

11.3 FLEET GRAPHICS

11.4 WATERCRAFT GRAPHICS

11.5 FLOOR GRAPHICS

11.6 WINDOW GRPAHICS

11.7 OUTDOOR ADVERTISING

11.8 LABLES& STICKERS

11.9 FURNITURE DECORATION

11.1 WALLCOVERING

11.11 EXHIBITION PANELS

11.12 OTHERS

12 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 COMPANY PROFILE

14.1 3M

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 SWOT

14.1.5 PRODUCT PORTFOLIO

14.1.6 RECENT DEVELOPMENTS

14.2 AVERY DENNISON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 SWOT

14.2.5 PRODUCT PORTFOLIO

14.2.6 RECENT DEVELOPMENTS

14.3 ORAFOL EUROPE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 SWOT

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HENKEL ADHESIVES TECHNOLOGIES INDIA PRIVATE LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 SWOT

14.4.5 PRODUCT PORTFOLIO

14.4.6 RECENT DEVELOPMENTS

14.5 LX HAUSYS

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SWOT

14.5.5 PRODUCT PORTFOLIO

14.5.6 RECENT DEVELOPMENT

14.6 ACHILLIES CORPORATION

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SWOT

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 ARLON GRAPHICS, LLC.

14.7.1 COMPANY SNAPSHOT

14.7.2 SWOT

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 BRITE COATINGS PRIVATE LIMITED

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 SWOT

14.8.4 RECENT DEVELOPMENT

14.9 DRYTAC

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 SWOT

14.9.4 RECENT DEVELOPMENT

14.1 FLEXCON COMPANY, INC.

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 SWOT

14.10.4 RECENT DEVELOPMENTS

14.11 HEXIS S.A.S.

14.11.1 COMPANY SNAPSHOT

14.11.2 SWOT

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENTS

14.12 INNOVIA FILMS

14.12.1 COMPANY SNAPSHOT

14.12.2 SWOT

14.12.3 PRODUCT PORTFOLIO

14.12.4 RECENT DEVELOPMENT

14.13 ITEM PLASTIC CORP.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 SWOT

14.13.4 RECENT DEVELOPMENTS

14.14 LINTEC CORPORATION

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SWOT

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 METAMARK

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 SWOT

14.15.4 RECENT DEVELOPMENTS

14.16 POLI-TAPE GROUP

14.16.1 COMPANY SNAPSHOT

14.16.2 SWOT

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENT

14.17 RESPONSIVE INDUSTRIES LTD.

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 SWOT

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENT

14.18 SHUBH PLASTICS

14.18.1 COMPANY SNAPSHOT

14.18.2 SWOT

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 STAHLS’ INTERNATIONAL

14.19.1 COMPANY SNAPSHOT

14.19.2 SWOT

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

14.2 TEKRA, LLC.

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 SWOT

14.20.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES, OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 2 EXPORT DATA OF SELF-ADHESIVE PLATES, SHEETS, FILM, FOIL, TAPE, STRIP AND OTHER FLAT SHAPES OF PLASTICS, WHETHER OR NOT IN ROLLS, HS CODE OF PRODUCT: 3919 (UNIT: US DOLLAR THOUSAND)

TABLE 3 LIST OF MAJOR RAW MATERIAL SUPPLIERS

TABLE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CALENDERED FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA CAST FILMS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA THIN (2-3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA THICK (MORE THAN 3 MILS) IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPAQUE IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA TRANSPARENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TRANSLUCENT IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA PLASTIC IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FLOOR IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA GLASS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CAR WRAPPING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA FLEET GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA WATERCRAFT GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLOOR GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA WINDOW GRAPHICS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA OUTDOOR ADVERTISING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LABELS & STICKERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA FURNITURE DECORATION IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA WALLCOVERING IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA EXHIBITION PANELS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 37 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 38 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 39 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 41 U.S. PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 43 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 44 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 46 CANADA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 47 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY MANUFACTURING PROCESS, 2021-2030 (USD MILLION)

TABLE 48 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY THICKNESS, 2021-2030 (USD MILLION)

TABLE 49 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY SUBSTRATE, 2021-2030 (USD MILLION)

TABLE 51 MEXICO PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND FOR PRINTABLE SELF-ADHESIVE VINYL FILMS IN CONSTRUCTION AND ARCHITECTURAL APPLICATIONS IS EXPECTED TO DRIVE THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 11 CALENDERED FILM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET

FIGURE 13 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS, 2022

FIGURE 14 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY THICKNESS, 2022

FIGURE 15 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY SUBSTRATE, 2022

FIGURE 17 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY APPLICATION, 2022

FIGURE 18 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: SNAPSHOT (2022)

FIGURE 19 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022)

FIGURE 20 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 21 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 22 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: BY MANUFACTURING PROCESS (2023-2030)

FIGURE 23 NORTH AMERICA PRINTABLE SELF-ADHESIVE VINYL FILMS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。