北米のリンおよび誘導体市場、製品別(リン酸、リン酸アンモニウム、五酸化リン、塩化リン、硫化リン、工業用リン酸、次亜リン酸、リン酸三カルシウム、リン酸トリエチル、三臭化リン、トリクロロリン酸、アデノシン三リン酸、その他)、形態(乾燥および液体)、用途(肥料、食品および飲料添加物、洗剤、金属仕上げ、水処理化学薬品、量子ドット、難燃性材料、その他)、エンドユーザー(農業、食品および飲料、医薬品/ヘルスケア、化学処理、自動車、ホームケア、その他)、同素体(赤リンおよび白リン) - 2030年までの業界動向および予測。

北米のリンおよび誘導体市場の分析と洞察

リンおよびリン酸は、一般に弱く、無色で無臭の結晶酸を指します。これらの無機物質は鉄金属および合金に対して腐食性があり、水への溶解性は良好です。これらは高温で分解する傾向があります。アルコールと混合すると有毒な煙を形成する可能性があります。これはソフトドリンクにピリッとした風味を与え、砂糖溶液で簡単に増殖するカビや細菌の繁殖を防ぎます。ソーダの酸味のほとんどはリン酸から来ています。

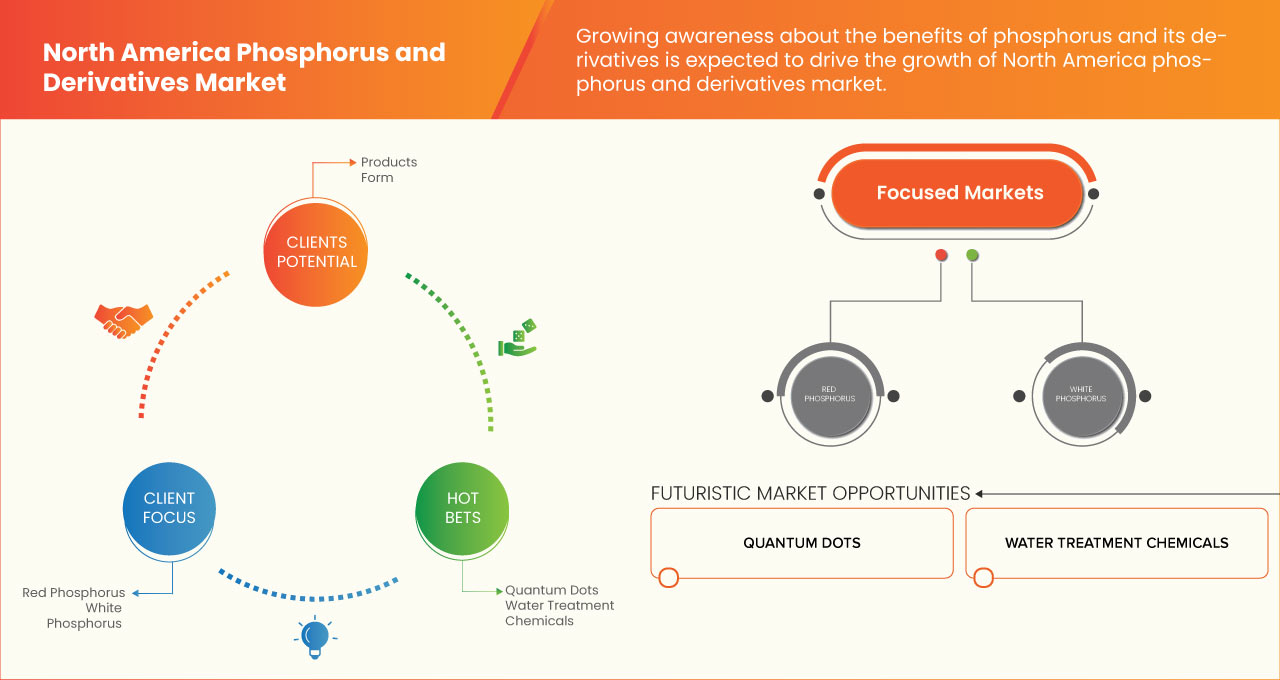

北米のリンおよび誘導体市場の成長の原動力は、農業、食品、食品飲料部門の急速な成長であると考えられます。ただし、リンおよび誘導体の使用に関する政府の厳しい規制により、市場は抑制されると予想されます。

一方、市場関係者による戦略的取り組みや、農業分野、食品・飲料業界の台頭は、北米のリンおよび誘導体市場の成長の機会となる可能性があります。リン酸塩ベースの製品の過剰使用に伴うリスクは、北米のリンおよび誘導体市場に課題をもたらす可能性があります。北米のリンおよび誘導体市場に関連する最近の動向がいくつかあります。

しかし、リンおよびその誘導体が環境に及ぼす有害な影響により、予測期間中の北米のリンおよびその誘導体市場の成長が阻害されると予想されます。

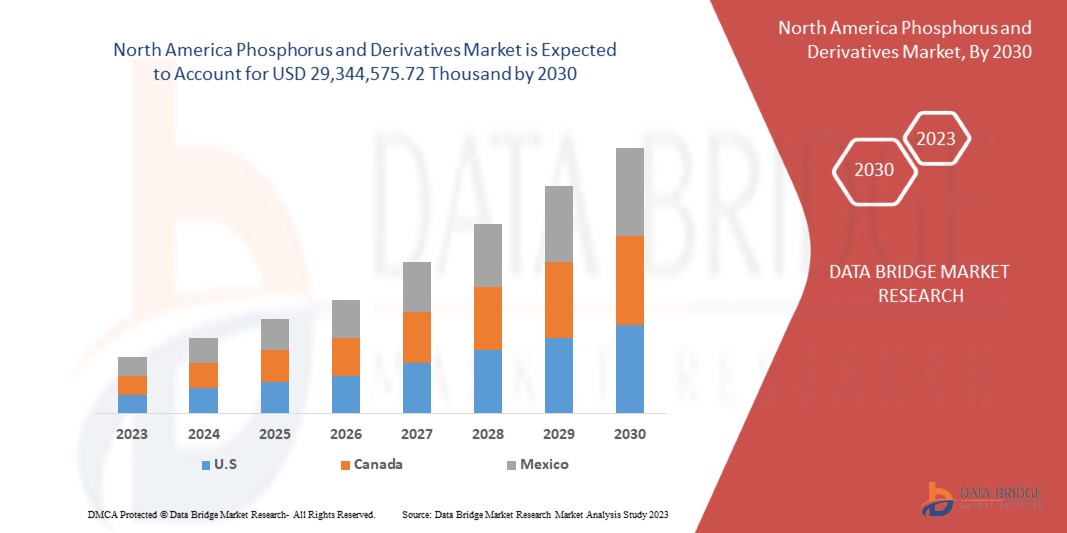

Data Bridge Market Research の分析によると、北米のリンおよび誘導体市場は、予測期間中に 4.03% の CAGR で成長し、2030 年までに 29,344,575.72 千米ドルに達すると予想されています。北米のリンおよび誘導体市場ではリンの使用が増加しているため、リン酸が市場最大の製品セグメントとなっています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021年(2015年 - 2020年) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

製品 (リン酸、リン酸アンモニウム、五酸化リン、塩化リン、硫化リン、工業用リン酸、次亜リン酸、リン酸三カルシウム、リン酸トリエチル、三臭化リン、トリクロロリン酸、アデノシン三リン酸、その他)、形態 (乾燥および液体)、用途 (肥料、食品および飲料添加物、洗剤、金属仕上げ、水処理薬品、量子ドット、難燃性材料、その他)、最終使用者 (農業、食品および飲料、医薬品/ヘルスケア、化学処理、自動車、ホームケア、その他)、同素体 (赤リンおよび白リン) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

ANEXIB Chemicals、日本化学工業株式会社、モザイク社、LANXESS、ソルベイ、Ma'aden、ICL、徐州建平化学有限公司、積水ダイアグノスティクス、その他 |

北米のリンおよび誘導体市場の定義

リンは可燃性の非金属元素で、一般に白リンと赤リンの 2 つの同素体で存在します。リン酸、亜リン酸、オキシ塩化リン、五塩化リン、三臭化リン、次亜リン酸ナトリウム、トリブチルリン酸、トリエチルリン酸は、リンの誘導体です。リン誘導体リン酸は、一般に弱く、無色、無臭の結晶酸です。これらの無機物は鉄金属および合金に対して腐食性があり、水への溶解性は良好です。これらは高温で分解する傾向があります。アルコールと混合すると有毒な煙を形成する場合があります。これはソフトドリンクにピリッとした風味を与え、砂糖溶液で簡単に増殖するカビやバクテリアの繁殖を防ぎます。ソーダの酸味のほとんどは、リン酸から来ています。

リンは、まず化学製造プロセスによって五酸化リンに変換され、その後再度処理されてリン酸になります。

北米のリンおよび誘導体市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 農業における肥料需要の増加

リン酸は、DAP、MAP、NPK、SSP など、いくつかの肥料を生成します。

リン酸二アンモニウム (DAP) は、その物理的特性から、最も人気のあるリン酸肥料です。DAP の成分は N-18%、P2O5 -46% です。DAP 肥料は、作物の成長と発育を通して完全なリン栄養と窒素のスターター用量、および低硫黄を提供するため、あらゆる農作物に最適です。秋の耕作と春の播種および播種前栽培に使用できます。土壌に溶解すると、肥料粒子の周りの土壌溶液の pH が一時的にアルカリ化されるため、酸性土壌での肥料からのリン吸収が向上します。肥料硫黄は、植物による窒素とリンの吸収の向上にも貢献します。

Thus, multiple uses of phosphoric acid to produce phosphate fertilizers are expected to drive the growth of the North America phosphoric acid market.

- Increasing demand in the pharmaceutical sector

Phosphoric acid is mainly used in many medical applications, such as dental cement, for preparing albumin derivatives, acidifying the urine, removing necrotic (dead cells or tissue) debris, anti-nausea medicines, teeth whiteners, and mouth washing liquid.

Phosphoric acid used in teeth whitening phosphoric acid can alter the tooth surface. Using 37% phosphoric acid following bleaching can significantly increase the decalcifying effect of the acid on the enamel surface, creating an uneven etched surface. Moreover, it can create sensitivity in the teeth.

Thus, the growing usage of phosphoric acid in medical applications is expected to drive the growth of the North America phosphoric acid market.

Restraint

- Stringent government regulations on phosphorus and derivatives usage

There are many regulations by different government regulatory bodies for the use and production of phosphoric acid.

The FDA protects the public health by ensuring the safety, efficacy, and security of human and veterinary drugs, biological products, chemicals, and others. USFDA has given some regulations for using phosphoric acid in food and regulations for handling phosphoric acid. Below are some of the parameters by FDA for protection purposes

Thus, due to the stringent government regulations on phosphoric acid, there are limitations on the use of phosphoric acid, which may impede the market growth in the forecast period.

Opportunity

Increasing innovation and new product launches

Leading market players have launched new products that exhibit improved capabilities. Manufacturers have taken the necessary steps to improve the accuracy of new products and overall functionality.

Market players are further focusing on producing phosphoric acid domestically and operating by exporting to other regions to expand their business.

Thus, growing innovations and new product launches are expected to offer an opportunity for the North America phosphoric acid market.

Challenge

Risks associated with over usage of phosphate based products

At state, provisional, and national levels, the phosphoric acid supply is regulated by various government rules as several risks could impact the usage of fertilizers, and there are several environmental impacts during the production of phosphoric acid.

The production of phosphate fertilizers usually uses as raw material sedimentary phosphate rock, which contains enhanced concentrations from U‐series radionuclides about 10–100 times higher than unperturbed soils.

Thus, due to the harmful impacts of phosphoric acid on air, water, soil, and human health, many government bodies have led the implementation of several regulations, high-standard certification schemes, and company registrations for the use of phosphoric acid, which may pose a challenge to the North America phosphoric acid market.

Recent Developments

- In March 2023, Solvay announced that it had been recognized as one of the 60 top suppliers for 2022 in Northrop Grumman Corporation's North America network of more than 10,000 suppliers. This will increase the company's brand image, among others.

- In March 2023, Airedale group announced that the company would continue growing by acquiring McCann chemicals. This will help in increasing the growth and diversification of the company's product portfolio.

North America Phosphorus and Derivatives Market Scope

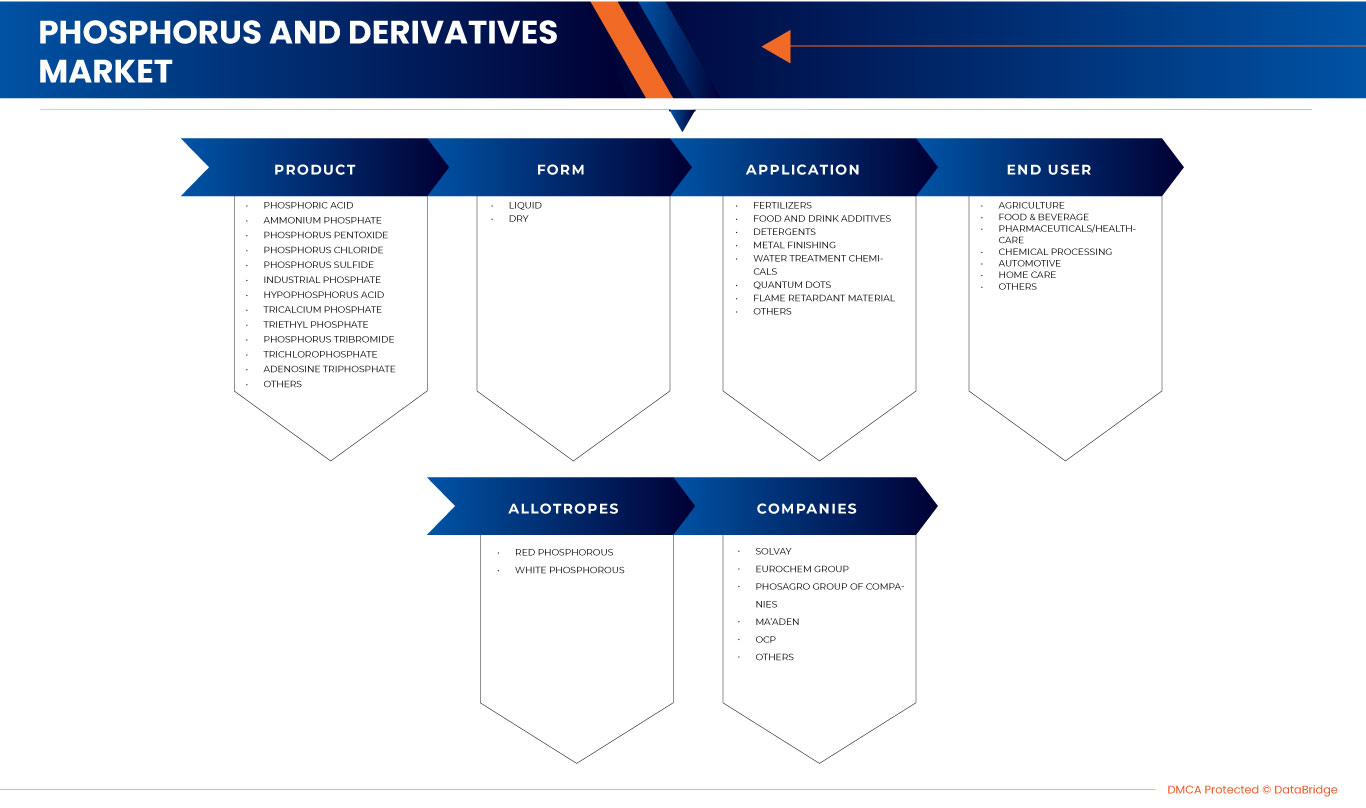

North America phosphorus and derivatives market is segmented into five notable segments such as, product, form, application, end user, and allotropes. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Phosphoric Acid

- Ammonium Phosphate

- Phosphorus Pentoxide

- Phosphorus Chloride

- Phosphorus Sulfide

- Industrial Phosphate

- Hypophosphorus Acid

- Tricalcium Phosphate

- Triethyl Phosphate

- Phosphorus Tribromide

- Trichlorophosphate

- Adenosine Triphosphate

- Others

On the basis of product, North America phosphorus and derivatives market is segmented into phosphoric acid, ammonium phosphate, phosphorus pentoxide, phosphorus chloride, phosphorus sulfide, industrial phosphate, hypophosphorus acid, tricalcium phosphate, triethyl phosphate, phosphorus tribromide, trichlorophosphate, adenosine triphosphate, and others.

Form

- Dry

- Liquid

On the basis of form, the North America phosphorus and derivatives market is segmented into dry and liquid.

Application

- Fertilizers

- Food and Drink Additives

- Detergents

- Metal Finishing

- Water Treatment Chemicals

- Quantum Dots

- Flame Retardant Material

- Others

On the basis of application, the North America phosphorus and derivatives market is segmented into fertilizers, food and drink additives, detergents, metal finishing, water treatment chemicals, quantum dots, flame retardant material, and others.

End User

- Agriculture

- Food & Beverage

- Pharmaceuticals/HealthCare

- Chemical Processing

- Automotive

- Home Care

- Others

On the basis of end user, the North America phosphorus and derivatives market is segmented into agriculture, food & beverage, pharmaceuticals/healthcare, chemical processing, automotive, home care, and others.

Allotropes

- Red Phosphorous

- White Phosphorous

On the basis of allotropes, the North America phosphorus and derivatives market is segmented into red phosphorous and white phosphorous.

North America Phosphorus and Derivatives Market Regional Analysis/Insights

北米のリンおよび誘導体市場は、製品、形態、用途、エンドユーザー、同素体などの 5 つの主要なセグメントに分類されます。

この市場レポートの北米リンおよび誘導体市場がカバーしている国は、米国、カナダ、メキシコです。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個々の市場影響要因と国内規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、リンとその誘導体の存在と可用性、および厳格な規制によって直面する課題も考慮されます。

競争環境と北米のリンおよび誘導体の市場シェア分析

北米のリンおよび誘導体市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、財務、収益、市場の可能性、事業拡大、サービス施設、パートナーシップ、戦略的開発、アプリケーションの優位性、および技術ライフライン曲線が含まれます。上記のデータ ポイントは、北米のリンおよび誘導体市場に対する会社の重点にのみ関連しています。

北米のリンおよび誘導体市場で事業を展開している主要企業としては、ANEXIB Chemicals、日本化学工業株式会社、Mosaic Company、LANXESS、Solvay、Ma'aden、ICL、Xuzhou JianPing Chemical Co., Ltd.、Sekisui Diagnostics などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFELINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ENVIRONMENTAL FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ECONOMICAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER'S FIVE FORCES

4.3 RAW MATERIAL COVERAGE

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 IMPORT-EXPORT SCENARIO

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURES

4.7 VENDOR SELECTION CRITERIA

4.8 PRODUCTION CAPACITY OUTLOOK

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 PRICING ANALYSIS OF PHOSPHORUS

8 SUPPLY CHAIN ANALYSIS

9 REGIONAL SUMMARIES

10 MARKET OVERVIEW

10.1 DRIVERS

10.1.1 INCREASING DEMAND FOR FERTILIZERS IN THE AGRICULTURE INDUSTRY

10.1.2 GROWING AWARENESS ABOUT THE BENEFITS OF PHOSPHORUS AND DERIVATIVES AMONG CONSUMERS

10.1.3 INCREASING DEMAND IN THE PHARMACEUTICAL SECTOR

10.1.4 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES

10.2 RESTRAINTS

10.2.1 STRINGENT GOVERNMENT REGULATIONS ON PHOSPHORUS AND DERIVATIVES USAGE

10.2.2 HARMFUL EFFECTS OF PHOSPHORUS AND DERIVATIVES ON THE ENVIRONMENT

10.3 OPPORTUNITIES

10.3.1 INCREASING USE OF PHOSPHORUS AND DERIVATIVES IN THE FOOD & BEVERAGE INDUSTRY

10.3.2 INCREASING INNOVATION AND NEW PRODUCT LAUNCHES

10.3.3 GROWING USE OF PHOSPHORUS AND DERIVATIVES IN FUEL CELLS

10.4 CHALLENGES

10.4.1 RISKS ASSOCIATED WITH OVER USAGE OF PHOSPHATE-BASED PRODUCTS

10.4.2 INCREASING ADOPTION OF GENETICALLY MODIFIED SEEDS

11 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT

11.1 OVERVIEW:

11.2 PHOSPHORIC ACID

11.3 AMMONIUM PHOSPHATE

11.4 PHOSPHORUS PENTOXIDE

11.5 PHOSPHORUS CHLORIDE

11.6 PHOSPHORUS SULPHIDE

11.7 INDUSTRIAL PHOSPHATE

11.8 HYPHOSPHORUS ACID

11.9 TRICALCIUM PHOSPHATE

11.1 TRIETHYL PHOSPHATE

11.11 PHOSPHORUS TRIBROMIDE

11.12 TRICHLOROPHOSPHATE

11.13 ADENOSINE TRIPHOSPHATE

11.14 OTHERS

12 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM

12.1 OVERVIEW

12.2 DRY

12.3 LIQUID

13 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION

13.1 OVERVIEW:

13.2 FERTILIZERS

13.3 FOOD AND DRINK ADDITIVES

13.4 DETERGENTS

13.5 METAL FINISHING

13.6 WATER TREATMENT CHEMICALS

13.7 QUANTUM DOTS

13.8 FLAME RETARDANT MATERIAL

13.9 OTHERS

14 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER

14.1 OVERVIEW:

14.2 AGRICULTURE

14.3 FOOD AND BEVERAGES

14.4 PHARMACEUTICALS/HEALTHCARE

14.5 CHEMICAL PROCESSING

14.6 AUTOMOTIVE

14.7 HOMECARE

14.8 OTHERS

15 NORTH AMERICA PHOSPHOROUS AND DERIVATIVES MARKET, BY ALLOTROPES

15.1 OVERVIEW

15.2 RED PHOSPHOROUS

15.3 WHITE PHOSPHOROUS

16 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 MEXICO

16.1.3 CANADA

17 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.2 EXPANSIONS

17.3 AGREEMENTS

17.4 RECOGNITIONS

17.5 COLLABORATION

17.6 NEW LAUNCHES/PRODUCTS

17.7 ACQUISITIONS

17.8 PRESENTATION

17.9 NEW PRODUCTION BUILDING

17.1 INVESTMENT

18 COMPANY PROFILE

18.1 SOLVAY

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCTION CAPACITY

18.1.3 SWOT

18.1.4 REVENUE ANALYSIS

18.1.5 COMPANY SHARE ANALYSIS

18.1.6 PRODUCT PORTFOLIO

18.1.7 RECENT DEVELOPMENT

18.2 EUROCHEM GROUP

18.2.1 COMPANY SNAPSHOT

18.2.2 PRODUCTION CAPACITY

18.2.3 SWOT

18.2.4 COMPANY SHARE ANALYSIS

18.2.5 PRODUCT PORTFOLIO

18.2.6 RECENT DEVELOPMENT

18.3 PHOSAGRO GROUP OF COMPANIES

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCTION CAPACITY

18.3.3 SWOT

18.3.4 REVENUE ANALYSIS

18.3.5 COMPANY SHARE ANALYSIS

18.3.6 PRODUCT PORTFOLIO

18.3.7 RECENT DEVELOPMENT

18.4 MA'ADEN

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCTION CAPACITY

18.4.3 SWOT

18.4.4 REVENUE ANALYSIS

18.4.5 COMPANY SHARE ANALYSIS

18.4.6 PRODUCT PORTFOLIO

18.4.7 RECENT DEVELOPMENTS

18.5 OCP

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCTION CAPACITY

18.5.3 SWOT

18.5.4 COMPANY SHARE ANALYSIS

18.5.5 PRODUCT PORTFOLIO

18.5.6 RECENT DEVELOPMENT

18.6 ADITYA BIRLA MANAGEMENT CORPORATION PVT. LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 SWOT

18.6.3 REVENUE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENT

18.7 AIREDALE CHEMICAL COMPANY LIMITED

18.7.1 COMPANY SNAPSHOT

18.7.2 SWOT

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 ANEXIB CHEMICALS

18.8.1 COMPANY SNAPSHOT

18.8.2 SWOT

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 ANHUI GUANGXIN AGROCHEMICAL CO., LTD.

18.9.1 COMPANY SNAPSHOT

18.9.2 SWOT

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 EXCEL INDUSTRIES LTD. (2022)

18.10.1 COMPANY SNAPSHOT

18.10.2 SWOT

18.10.3 REVENUE ANALYSIS

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENT

18.11 FUTONG CHEMICAL CO., LTD

18.11.1 COMPANY SNAPSHOT

18.11.2 SWOT

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 ICL

18.12.1 COMPANY SNAPSHOT

18.12.2 SWOT

18.12.3 REVENUE ANALYSIS

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 INNOPHOS

18.13.1 COMPANY SNAPSHOT

18.13.2 SWOT

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 JORDAN PHOSPHATE MINES COMPANY (PLC)

18.14.1 COMPANY SNAPSHOT

18.14.2 SWOT

18.14.3 REVENUE ANALYSIS

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENT

18.15 KAZPHOSPHATE LLC

18.15.1 COMPANY SNAPSHOT

18.15.2 SWOT

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 LANXESS

18.16.1 COMPANY SNAPSHOT

18.16.2 SWOT

18.16.3 REVENUE ANALYSIS

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 MOSAIC

18.17.1 COMPANY SNAPSHOT

18.17.2 SWOT

18.17.3 REVENUE ANALYSIS

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENT

18.18 NIPPON CHEMICAL INDUSTRIAL CO., LTD.

18.18.1 COMPANY SNAPSHOT

18.18.2 SWOT

18.18.3 REVENUE ANALYSIS

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 NUTRIEN LTD. (2022)

18.19.1 COMPANY SNAPSHOT

18.19.2 SWOT

18.19.3 REVENUE ANALYSIS

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENT

18.2 PCC ROKITA SPÓŁKA AKCYJNA. (A SUBSIDIARY OF PCC GROUP)

18.20.1 COMPANY SNAPSHOT

18.20.2 SWOT

18.20.3 REVENUE ANALYSIS

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENT

18.21 SANDHYA GROUP

18.21.1 COMPANY SNAPSHOT

18.21.2 SWOT

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENT

18.22 SEKISUI DIAGNOSTICS

18.22.1 COMPANY SNAPSHOT

18.22.2 SWOT

18.22.3 PRODUCT PORTFOLIO

18.22.4 RECENT DEVELOPMENT

18.23 SMC NORTH AMERICA

18.23.1 COMPANY SNAPSHOT

18.23.2 SWOT

18.23.3 PRODUCT PORTFOLIO

18.23.4 RECENT DEVELOPMENT

18.24 STREM (A SUBSIDIARY OF ASCENSUS)

18.24.1 COMPANY SNAPSHOT

18.24.2 SWOT

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 XUZHOU JIANPING CHEMICAL CO., LTD.

18.25.1 COMPANY SNAPSHOT

18.25.2 SWOT

18.25.3 PRODUCT PORTFOLIO

18.25.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY REGION, 2019-2022 (AVERAGE SELLING PRICE (USD) PER KG)

TABLE 2 THE RECOMMENDED DIETARY ALLOWANCE (RDA) FOR PHOSPHORUS IS THE FOLLOWING:

TABLE 3 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY COUNTRY, 2016-2030 (TONS)

TABLE 5 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 7 NORTH AMERICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 9 NORTH AMERICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 11 NORTH AMERICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 13 NORTH AMERICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 15 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 17 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 19 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 21 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 23 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 24 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 25 U.S. PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 26 U.S. PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 27 U.S. AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 28 U.S. AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 29 U.S. PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 30 U.S. PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 31 U.S. PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 32 U.S. PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 33 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 34 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 35 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 36 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 37 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 38 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 39 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 40 U.S. PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 41 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 42 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 43 MEXICO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 44 MEXICO PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 45 MEXICO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 46 MEXICO AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 47 MEXICO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 48 MEXICO PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 49 MEXICO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 50 MEXICO PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 51 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 52 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 53 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 54 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 55 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 56 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 57 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 58 MEXICO PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

TABLE 59 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (USD THOUSAND)

TABLE 60 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2016-2030 (TONS)

TABLE 61 CANADA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 62 CANADA PHOSPHORIC ACID IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 63 CANADA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 64 CANADA AMMONIUM PHOSPHATE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 65 CANADA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 66 CANADA PHOSPHORUS CHLORIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 67 CANADA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (USD THOUSAND)

TABLE 68 CANADA PHOSPHORUS SULFIDE IN PHOSPHORUS AND DERIVATIVES MARKET, BY TYPE, 2016-2030 (TONS)

TABLE 69 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (USD THOUSAND)

TABLE 70 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2016-2030 (TONS)

TABLE 71 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (USD THOUSAND)

TABLE 72 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2016-2030 (TONS)

TABLE 73 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (USD THOUSAND)

TABLE 74 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2016-2030 (TONS)

TABLE 75 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (USD THOUSAND)

TABLE 76 CANADA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2016-2030 (TONS)

図表一覧

FIGURE 1 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: PRODUCT LIFELINE CURVE

FIGURE 7 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA PHOSPHORUS AND DERIVATIVES: THE MARKET CHALLENGE MATRIX

FIGURE 13 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SEGMENTATION

FIGURE 14 RISING APPLICATIONS OF PHOSPHORUS AND DERIVATIVES IN SEVERAL INDUSTRIES ARE DRIVING THE GROWTH OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 THE PHOSPHORIC ACID SEGMENT IN THE PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET IN 2023 & 2030

FIGURE 16 PRODUCTION PROCESS OF PHOSPHORUS AND ITS DERIVATIVES

FIGURE 17 UNITED STATES CONSUMPTION OF PHOSPHATE ROCK (2019 – 2022)

FIGURE 18 IMPORT EXPORT SCENARIO OF PHOSPHORUS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET

FIGURE 20 FERTILIZER CONSUMPTION IN EUROPEAN COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 21 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY PRODUCT, 2022

FIGURE 22 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY FORM, 2022

FIGURE 23 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY APPLICATION, 2022

FIGURE 24 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY END USER, 2022

FIGURE 25 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET, BY ALLOTROPES, 2022

FIGURE 26 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: BY PRODUCT (2023 - 2030)

FIGURE 31 NORTH AMERICA PHOSPHORUS AND DERIVATIVES MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。