北米のペットフードフレーバーおよび原料市場、製品タイプ別(フレーバーおよび嗜好性向上剤、カビ抑制剤、抗菌剤、ペレット結合剤、酵素、アミノ酸、飼料酸性化剤、プロバイオティクス、ビタミン、窒素、植物性、カロテノイド、微量ミネラル、酸化防止剤、マイコトキシン結合剤、共着色剤、保存料など)、ペットフードタイプ別(ドッグフード、キャットフード、アクアペットフード、鳥の餌など)、ソース(動物ベース、植物ベース、酵母など)、形態(乾燥および液体)、機能性(保存、加工、栄養など)、カテゴリー(オーガニックおよび従来型)、流通チャネル(直接および間接)業界動向および2030年までの予測。

北米のペットフードフレーバーと原料市場の分析と洞察

近年、ペットを飼ったりペットフードを購入したりするコストが大幅に増加しており、これが北米のペットフードのフレーバーと原料市場の主な原動力となっています。ペットの飼い主がさまざまな種類のペットフードに費やすお金が増えるにつれて、北米のペットフード市場もペットの数の増加とともに成長しています。市場の主な原動力のいくつかは、犬と猫の飼育の増加と、生産性と健康の改善への重点の高まりです。手頃な価格と入手のしやすさから、現在最も安全なペットフードは合成物質で作られています。さらに、穀物不使用やビーガンのペットフードに対する消費者の需要の顕著な変化により、全体的な需要が押し上げられています。ペットフードは小売店、スーパーマーケット、オンラインストアなど、複数のプラットフォームで簡単に入手できるため、業界は引き続き成長すると予想されます。

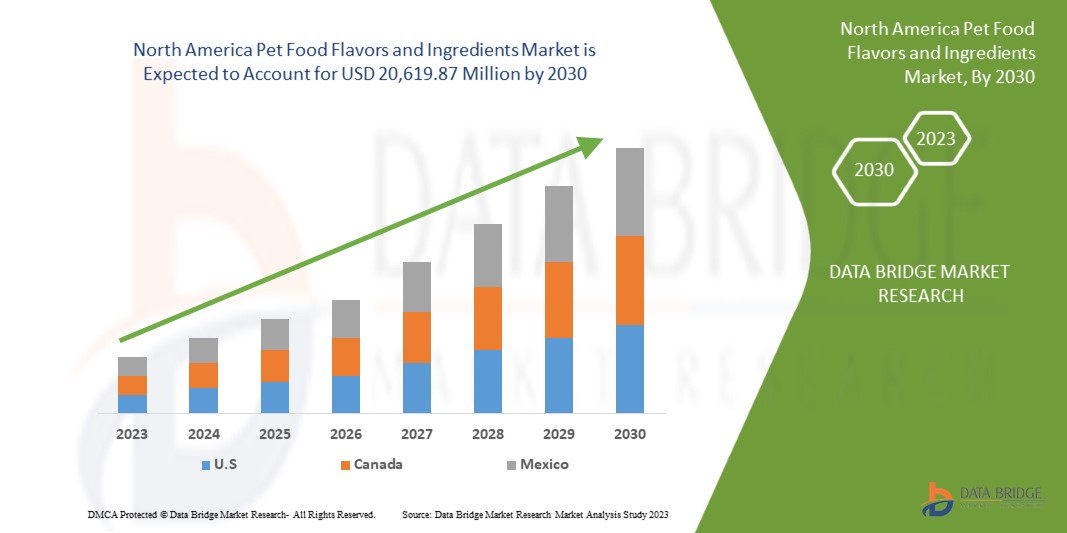

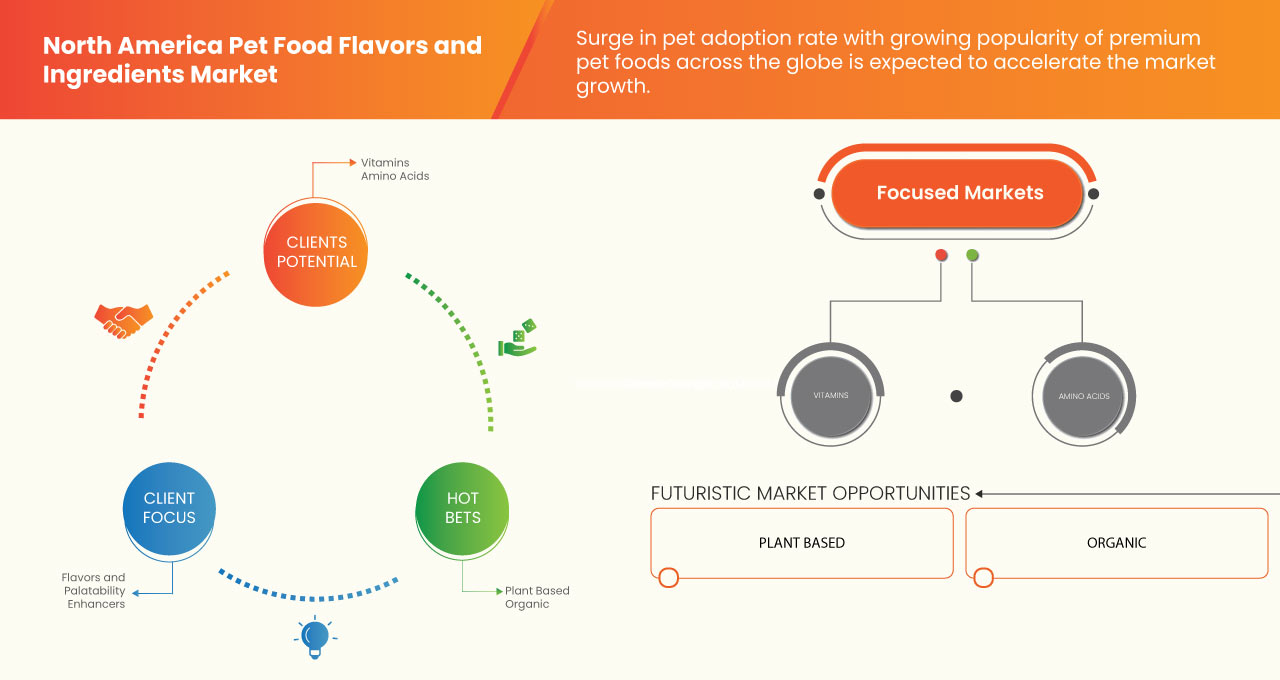

Data Bridge Market Research の分析によると、北米のペットフードのフレーバーと原料市場は、予測期間中に 10.2% の CAGR で成長し、2030 年までに 206 億 1,987 万ドルに達する見込みです。北米のペットの採用増加とペットフードの高品質化により、製品タイプが市場で最大のタイプ セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020~2016年にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品タイプ別 (フレーバーおよび嗜好性向上剤、防カビ剤、抗菌剤、ペレット結合剤、酵素、アミノ酸、飼料酸性化剤、プロバイオティクス、ビタミン、窒素、植物性、カロテノイド、微量ミネラル、酸化防止剤、マイコトキシン結合剤、共着色剤、保存料など)、ペットフードタイプ別 (ドッグフード、キャットフード、アクアペットフード、鳥類用フードなど)、原料別 (動物性、植物性、酵母など)、形態別 (乾燥および液体)、機能性別 (保存、加工、栄養など)、カテゴリー別 (オーガニックおよび従来型)、流通チャネル別 (直接および間接)。 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Glanbia PLC、Ingredion、Barentz、Kerry Group plc.、Cargill, Incorporated、ADM、BASF SE、International Flavors & Fragrances Inc.、DSM、Symrise、Kemin Industries, Inc. およびそのグループ企業、Chr. Hansen Holding A/S、Lallemand Inc.、The Scoular Company、Roquette Frères、Balchem Inc.、Wysong、The Peterson Company、Omega Protein Corporation など。 |

市場の定義

ペットフードは、家畜用の特別な食品、またはペットの栄養ニーズを満たすように設計された食品です。ペットフードは、肉などの植物または動物製品で、ペットに与えるために使用されます。果物や野菜、動物製品、穀物や油糧種子、ビタミン、ミネラルはすべてペットフードに含まれています。ペットフードの成分には、ビタミン、繊維、タンパク質、炭水化物、カルシウムが豊富に含まれています。穀物や野菜は通常、特にドッグフードに使用されます。各成分は、動物の体を豊かにするために不可欠です。肉のタンパク質含有量は一般的に高いと考えられており、食品に風味を加えます。肉、鶏肉、穀物などの多くの成分は安全であると考えられており、市販前の承認は必要ありません。動物の代謝と消化に不可欠なオメガ3脂肪酸とオメガ6脂肪酸も生産されています。ペットフードメーカーは、ペットの栄養バランスをとるためにさまざまな成分を使用しています。防腐剤、コンディショナー、乳化剤、安定剤、および色や風味の代替品として機能することに加えて、ペットフードにも使用されます。

北米のペットフードのフレーバーと原料市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 世界中で高級ペットフードの人気が高まり、ペットの飼育率が急増

The North America pet food flavor ingredients market is poised to show strong growth due to increased adoption of pets, rising expenditure on pet care, increasing demand for insect-based pet food, and a booming pet food market. The pet industry has grown exponentially in recent years. According to the American Pet Products Association, about 85 million households have a pet, and pet ownership has increased from 56 percent to 68 percent over the past 30 years. The introduction of technology and online shopping has contributed to some of the changes in pet ownership. Due to the effects of COVID-19, many people have been forced to stay at home for long periods, either due to shelter-in-place orders or due to work-from-home advice. Soon after, the amount of time spent at home increased, and adoptions and fosters were registered at pet shelters. Since the outbreak of the COVID-19 pandemic, the number of pets around the world has increased significantly. Also, emerging pet food ingredients market trends, such as the increasing popularity of premium foods across the country, are driving the growth of the pet food flavors and ingredients market, and this trend is expected to continue during the forecast period.

Thus, the surge in pet adoption rate and the growing popularity of premium pet foods around the globe are expected to act as an opportunity for the market's growth.

- Increasing demand for customized pet foods from pet owners

Pet owners are adopting the mindset that personalization is right, not a privilege, and the ability for pet owners to have input in what they buy has impacted the pet food industry. Pet owners are now willing to pay more for customized pet food products that satisfy their pet's particular dietary needs. When generational differences among pet owners are considered, young pet owners are expected to pay more for customized treats/pet foods than older pet owners. This shows that the trend toward customization is expected to continue to grow as younger shoppers start their pet parenting journey and gain more buying power.

Thus, increasing demand for customized pet foods from pet owners is expected to act as a driving factor for market growth.

Restraint

- Stringent mandates for pet food manufacturers

Pet food manufacturers, government agencies, and veterinarians play vital roles in ensuring the safety of pet food and safeguarding pets and their owners. It behooves veterinary practitioners to be aware of recent federal legislation affecting pet food safety, the role of the manufacturer in producing safe foods, and their own role in identifying potential pet food–related illnesses, reporting suspected cases and educating pet owners about pet food safety. Since pet food requires extreme safety in production, several associations and governments have set strict standards that manufacturers must adhere to, especially in Western countries. Strict oversight of pet food, from ingredients to production and sales to distribution, market rigidity may prevent large companies from investing in the sector and hamper the growth of the North America pet food flavors and ingredients market in the coming years.

Thus, stringent mandates for pet food manufacturers are expected to act as a restraining factor for the market's growth.

Opportunity

- Increasing demand for cannabidiol (CBD) pet food

A safe and well-processed cannabinoid derived from hemp, CBD pet supplements support pet health by working with their endocannabinoid systems. Some of the main reasons many pet owners turn to CBD pet food are that it supports healthy joints, helps promote cardiovascular function, and prevents the spread of heartworms. In 2020, U.S. pet sales were nearly USD 800 million, and consumers are willing to pay more for pet health services. CBD pet supplements offer a number of claims, including wheat, corn, and soy free, which means they are all-natural and contribute to market growth.

Moreover, growing consumer awareness of nutritional advantages associated with hemp derivatives and increasing production of industrial hemp have directed the growth of the market for hemp derivatives. CBD foods are expected to last longer than traditional pet foods.

Thus, increasing demand for cannabidiol pet food is expected to act as an opportunity for market growth.

Challenge

- Increasing competition in the pet food flavors and ingredients market

The companies within the industry are expected to grow even more in the future, which will create high competition in the pet food flavors and ingredients market. New market players are coming up with innovative marketing strategies, such as offering products at lower costs and using innovative ingredients, which is a challenging factor for the tier-1 and tier-2 players. Competition among companies exists when they produce and market similar services and products aimed at the same consumer group. This is becoming a challenging factor for companies to gain significant market share. Big giants in the pet food flavors and ingredients market, such as ADM, Koninklijke DSM N.V., and DuPont among others, have extensive distribution networks, strong North America footprint, and strong R&D, which poses a problem for small players to compete with these players. A large number of players in Europe's pet food industry increases the completion in the pet food flavors and ingredients market.

Thus, increasing competition in the pet food flavors and ingredients market is expected to act as a challenge for market growth.

Post-COVID-19 Impact on North America Pet Food Flavors and Ingredients Market

The COVID-19 pandemic has had a somewhat positive impact on the pet food flavors and ingredients market. Since the outbreak of the COVID-19 pandemic, the number of pets adopted across the globe. has increased at a significant pace. This rise in the adoption of pets is acting as a catalyst for the market's growth.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technology and test results involved in the pet food flavors and ingredients market.

Recent Developments

- In January 2022, Kerry Group Plc, the world's leading taste and nutrition company, officially opened a new 21,500-square-foot state-of-the-art facility at its Jeddah operation in the Kingdom of Saudi Arabia. The company has invested over EUR 80 million in the region over the past four years and this new facility, which is Kerry's largest in the Middle East, North Africa and Turkey (MENAT) region, is one of the most modern and efficient in the world and will produce great tasting, nutritious and sustainable food ingredients which will be distributed across the Middle East. This has helped the company to grow.

- 2022年11月、ADMは、今後数年間の食品、飲料、動物栄養業界を形成し、市場の成長を促進する北米の消費者動向に関する3回目の年次見通しを発表しました。健康と幸福、持続可能性、食糧安全保障の交差点を分析し、ADMは消費者の進化する行動、態度、願望を詳述する8つの領域を特定しました。この8つの領域は、イノベーションを刺激するアンカーポイントとして機能し、2023年に向けて新しい製品とサービスの波を先導します。これにより、同社は製品ポートフォリオを拡大することができました。

北米のペットフードフレーバーおよび原料市場の範囲

北米のペットフードのフレーバーと原料市場は、製品タイプ、ペットフードの種類、ソース、形式、機能、カテゴリ、流通チャネルに分類されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コアアプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

製品タイプ別

- 風味と嗜好性を高めるもの

- カビ抑制剤

- 抗菌剤

- ペレットバインダー

- 酵素

- アミノ酸

- 飼料用酸性化剤

- プロバイオティクス

- ビタミン

- 窒素

- 植物由来

- カロテノイド

- 微量ミネラル

- 抗酸化物質

- マイコトキシン結合剤

- 共着色剤

- 防腐剤

- その他

製品タイプに基づいて、北米のペットフードフレーバーおよび原料市場は、フレーバーおよび嗜好性向上剤、カビ防止剤、抗菌剤、ペレット結合剤、酵素、アミノ酸、飼料酸性化剤、プロバイオティクス、ビタミン、窒素、植物性、カロテノイド、微量ミネラル、抗酸化剤、マイコトキシン結合剤、共着色剤、防腐剤、その他に分類されます。

ペットフードの種類別

- ドッグフード

- 猫の餌

- アクアペットフード

- 鳥の餌

- その他

ペットフードの種類に基づいて、北米のペットフードのフレーバーと原料市場は、ドッグフード、キャットフード、アクアペットフード、鳥の餌、その他に分類されます。

情報源別

- 動物由来

- 植物由来

- 酵母

- その他

北米のペットフードのフレーバーと原料市場は、供給源に基づいて、動物ベース、植物ベース、酵母、その他に分類されます。

フォーム別

- ドライ

- 液体

形態に基づいて、北米のペットフードのフレーバーと原料市場は、乾燥型と液体型に分類されます。

機能別

- 保存

- 処理

- 栄養

- その他

機能性に基づいて、北米のペットフードのフレーバーと原料市場は、保存、加工、栄養、その他に分類されます。

カテゴリー別

- オーガニック

- 従来の

カテゴリーに基づいて、北米のペットフードのフレーバーと原料市場は、オーガニックと従来型に分類されます。

流通チャネル別

- 直接

- 間接的

流通チャネルに基づいて、北米のペットフードフレーバーおよび原料市場は、直接型と間接型に分類されます。

北米のペットフードフレーバーおよび原料市場の地域分析/洞察

北米のペットフードのフレーバーと原料市場が分析され、製品タイプ、ペットフードの種類、ソース、形式、機能、カテゴリ、流通チャネル別に市場規模の情報が提供されます。

この市場レポートでカバーされている国は、米国、カナダ、メキシコです。

- 2023年には、Kerry Group plc、Cargill、Incorporated、ADM、BASF SEなどの主要企業の強力な存在により、米国が北米のペットフードフレーバーおよび原料市場を支配すると予想されます。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米のペットフードフレーバーおよび原料市場シェア分析

北米のペットフードのフレーバーと原料市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、北米のペットフードのフレーバーと原料市場への会社の重点にのみ関連しています。

北米のペットフードフレーバーおよび原料市場で事業を展開している主要企業には、Glanbia PLC、Ingredion、Barentz、Kerry Group plc、Cargill, Incorporated、ADM、BASF SE、International Flavors & Fragrances Inc.、DSM、Symrise、Kemin Industries, Inc. およびそのグループ企業、Chr. Hansen Holding A/S、Lallemand Inc.、The Scoular Company、Roquette Frères、Balchem Inc.、Wysong、The Peterson Company、Omega Protein Corporation などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES

4.2 FACTORS INFLUENCING PURCHASING DECISIONS OF END-USERS

4.3 GROWTH STRATEGIES ADOPTED BY THE KEY MARET PLAYERS

4.3.1 PARTICIPATING IN TRADE FAIRS AND BUSINESS EVENTS

4.3.2 ORGANIZING PET SHOWS TO GAIN VISIBILITY

4.3.3 PROVIDING QUALITY PRODUCT

4.3.4 ATTRACTIVE PACKAGING

4.3.5 SELLING THE PET FOOD PRODUCT ON E-COMMERCE WEBSITES

4.3.6 MARKETING THROUGH E-MAIL

4.3.7 HIRING A BRAND AMBASSADOR

4.3.8 FEEDBACK FROM CUSTOMER

4.4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET- IMPORT & EXPORT ANALYSIS OF PET FOODS ACROSS THE GLOBE ACCORDING TO PER YEAR

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.5.1 FUTURE PERSPECTIVE:

4.5.2 CONCLUSION:

4.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.7 PRICING ANALYSIS – NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.8 PRODUCTION CAPACITY OF KEY MANUFACTURERS

4.9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: RAW MATERIAL SOURCING ANALYSIS

4.9.1 MEAT

4.9.2 SOYBEAN

4.9.3 SEA FOOD

4.1 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

4.10.1 RAW MATERIAL PROCUREMENT

4.10.2 PET FOOD AND INGREDIENTS PRODUCTION/PROCESSING

4.10.3 MARKETING AND DISTRIBUTION

4.10.4 END USERS

4.11 VALUE CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: REGULATORY FRAMEWORK

5.1 CLASSIFICATION OF PET FOOD (CHINA)

5.2 LABELING REQUIREMENTS (NORTH AMERICA)

5.3 LABELING REQUIREMENTS (EUROPEAN UNION)

5.4 PET FOOD CERTIFICATIONS

5.4.1 ORGANIC

5.4.2 MARINE STEWARDSHIP COUNCIL (MSC)

5.4.3 VEGAN

5.4.4 GMP+ FSA

5.4.5 FAMI-QS CODE

5.4.6 SAFE FEED/SAFE FOOD CERTIFICATION PROGRAM

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 SURGE IN PET ADOPTION RATE WITH GROWING POPULARITY OF PREMIUM PET FOODS ACROSS THE GLOBE

6.1.2 SHIFT FROM PHYSICAL HEALTH TO HOLISTIC WELLNESS

6.1.3 INCREASING DEMAND FOR CUSTOMIZED PET FOODS FROM PET OWNERS

6.1.4 FOCUS ON MINI-MEALS INSTEAD OF MEALS PER DAY FOR PETS

6.2 RESTRAINTS

6.2.1 STRINGENT MANDATES FOR PET FOOD MANUFACTURERS

6.2.2 INTRODUCTION OF CHEMICALS IN THE PET FOOD

6.2.3 LINK BETWEEN CERTAIN PET FOODS AND HEART DISEASES

6.2.4 ADULTERATION IN PET FOOD PRODUCTS

6.3 OPPORTUNITIES

6.3.1 INCREASING DEMAND FOR CANNABIDIOL (CBD) PET FOOD

6.3.2 SUPER PREMIUM PET FOOD PRODUCTS IN THE MARKET

6.3.3 INTRODUCTION OF ALTERNATIVE PROTEIN INGREDIENTS IN PET FOODS

6.3.4 E-COMMERCE SECTOR CONTINUES TO CREATE OPPORTUNITIES IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4 CHALLENGES

6.4.1 INCREASING COMPETITION IN THE PET FOOD FLAVORS AND INGREDIENTS MARKET

6.4.2 THREAT FROM COUNTERFEIT PRODUCTS

7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 VITAMINS

7.2.1 FAT SOLUBLE

7.2.1.1 VITAMIN A

7.2.1.2 VITAMIN D

7.2.1.3 VITAMIN E

7.2.1.4 VITAMIN K

7.2.2 WATER SOLUBLE

7.2.2.1 VITAMIN B COMPLEX

7.2.2.2 VITAMIN C

7.2.2.2.1 ANIMAL BASED

7.2.2.2.2 PLANT BASED

7.2.2.2.3 YEAST

7.2.2.2.4 OTHERS

7.3 AMINO ACID

7.3.1 LYSINE

7.3.2 METHIONINE

7.3.3 TRYPTOPHAN

7.3.4 THREONINE

7.3.5 OTHERS

7.3.5.1 ANIMAL BASED

7.3.5.2 PLANT BASED

7.3.5.3 YEAST

7.3.5.4 OTHERS

7.4 TRACE MINERALS

7.4.1 IRON

7.4.2 COPPER

7.4.3 MANGANESE

7.4.4 ZINC

7.4.5 SELENIUM

7.4.6 OTHERS

7.4.6.1 PLANT BASED

7.4.6.2 ANIMAL BASED

7.4.6.3 YEAST

7.4.6.4 OTHERS

7.5 PRESERVATIVES

7.5.1 NATURAL

7.5.1.1 TOCOPHEROL

7.5.1.2 ASCORBATE

7.5.1.3 OTHERS

7.5.2 SYNTHETIC

7.5.2.1 PROPYLENE GLYCOL

7.5.2.2 BUTYLATED HYDROXYANISOLE (BHA)

7.5.2.3 BUTYLATED HYDROXYTOLUENE (BHT)

7.5.2.4 PROPYL GALLATE

7.5.2.5 THOXYQUIN

7.5.2.6 OTHERS

7.5.2.6.1 PLANT BASED

7.5.2.6.2 ANIMAL BASED

7.5.2.6.3 YEAST

7.5.2.6.4 OTHERS

7.6 FLAVORS AND PALATABILITY ENHANCER

7.6.1 REACTION FLAVORS/DIGESTS

7.6.2 COMPOUNDED FLAVORS

7.6.2.1 NATURAL FLAVORS

7.6.2.2 SYNTHETIC FLAVORS

7.6.2.2.1 ANIMAL BASED

7.6.2.2.2 PLANT BASED

7.6.2.2.3 YEAST

7.6.2.2.4 OTHERS

7.7 PROBIOTICS

7.7.1 LACTOBACILLI

7.7.2 BIFIDOBACTERIA

7.7.3 YEAST

7.7.4 STREPTOCOCCUS THERMOPHILUS

7.7.4.1 YEAST

7.7.4.2 PLANT BASED

7.7.4.3 ANIMAL BASED

7.7.4.4 OTHERS

7.8 ANTIOXIDANTS

7.8.1 BHA

7.8.2 BHT

7.8.3 ETHOXYQUIN

7.8.4 OTHERS

7.8.4.1 PLANT BASED

7.8.4.2 ANIMAL BASED

7.8.4.3 YEAST

7.8.4.4 OTHERS

7.9 PELLET BINDERS

7.9.1 LIGNIN BASED BINDERS/LIGNOSULFONATES

7.9.2 STARCHES

7.9.3 HEMI-CELLULOSE BINDERS

7.9.4 GUMS

7.9.5 OTHERS

7.9.5.1 PLANT BASED

7.9.5.2 ANIMAL BASED

7.9.5.3 YEAST

7.9.5.4 OTHERS

7.1 ENZYMES

7.10.1 AMYLASE

7.10.2 PROTEASE

7.10.3 CELLULASE

7.10.4 XYLANASE

7.10.5 GLUCANASE

7.10.6 PHYTASE

7.10.7 MANNASE

7.10.8 OTHERS

7.10.8.1 PLANT BASED

7.10.8.2 ANIMAL BASED

7.10.8.3 YEAST

7.10.8.4 OTHERS

7.11 FEED ACIDIFIERS

7.11.1 PROPIONIC ACID

7.11.2 CITRIC ACID

7.11.3 LACTIC ACID

7.11.4 SORBIC ACID

7.11.5 FORMALDEHYDE

7.11.6 MALIC ACID

7.11.7 OTHERS

7.11.7.1 ANIMAL BASED

7.11.7.2 PLANT BASED

7.11.7.3 YEAST

7.11.7.4 OTHERS

7.12 MOLD INHIBITORS

7.12.1 SORBATES, SODIUM BENZOATE

7.12.2 SODIUM PROPIONATE

7.12.3 ACETIC ACID

7.12.4 OTHERS

7.12.4.1 PLANT BASED

7.12.4.2 ANIMAL BASED

7.12.4.3 YEAST

7.12.4.4 OTHERS

7.13 MYCOTOXIN BINDERS

7.13.1 SILICATES

7.13.2 CLAYS

7.13.3 CHEMICAL POLYMERS

7.13.4 GLUCAN PRODUCTS

7.13.5 OTHERS

7.14 NITROGEN

7.14.1 UREA

7.14.2 AMMONIA

7.14.3 OTHERS

7.14.3.1 PLANT BASED

7.14.3.2 ANIMAL BASED

7.14.3.3 YEAST

7.14.3.4 OTHERS

7.15 PHYTOGENIC

7.15.1 ESSENTIAL OILS

7.15.2 HERBS & SPICES

7.15.3 OLEORESIN

7.15.4 OTHERS

7.16 CAROTENOIDS

7.16.1 BETA-CAROTENE

7.16.2 LUTEIN

7.16.3 ASTAXANTHIN

7.16.4 CANTHAXANTHIN

7.16.4.1 PLANT BASED

7.16.4.2 ANIMAL BASED

7.16.4.3 YEAST

7.16.4.4 OTHERS

7.17 ANTIMICROBIALS

7.17.1 PLANT BASED

7.17.2 ANIMAL BASED

7.17.3 YEAST

7.17.4 OTHERS

7.18 COLORANTS

7.18.1 ANNATTO EXTRACT

7.18.2 DEHYDRATED BEETS

7.18.3 CARAMEL

7.18.4 TURMERIC

7.18.5 PAPRIKA

7.18.6 SAFFRON

7.18.7 OTHERS

7.18.7.1 PLANT BASED

7.18.7.2 ANIMAL BASED

7.18.7.3 YEAST

7.18.7.4 OTHERS

7.19 OTHERS

8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE

8.1 OVERVIEW

8.2 DOG FOOD

8.2.1 VITAMINS

8.2.2 AMINO ACID

8.2.3 FLAVORS AND PALATABILITY ENHANCER

8.2.4 PELLET BINDERS

8.2.5 TRACE MINERALS

8.2.6 ANTIOXIDANTS

8.2.7 PROBIOTICS

8.2.8 ENZYMES

8.2.9 PRESERVATIVES

8.2.10 FEED ACIDIFIERS

8.2.11 PHYTOGENIC

8.2.12 MOLD INHIBITORS

8.2.13 MYCOTOXIN BINDERS

8.2.14 COLORANTS

8.2.15 ANTIMICROBIALS

8.2.16 NITROGEN

8.2.17 CAROTENOIDS

8.2.18 OTHERS

8.3 CAT FOOD

8.3.1 VITAMINS

8.3.2 AMINO ACID

8.3.3 FLAVORS AND PALATABILITY ENHANCER

8.3.4 PELLET BINDERS

8.3.5 TRACE MINERALS

8.3.6 ANTIOXIDANTS

8.3.7 PROBIOTICS

8.3.8 ENZYMES

8.3.9 PRESERVATIVES

8.3.10 FEED ACIDIFIERS

8.3.11 PHYTOGENIC

8.3.12 MOLD INHIBITORS

8.3.13 MYCOTOXIN BINDERS

8.3.14 COLORANTS

8.3.15 ANTIMICROBIALS

8.3.16 NITROGEN

8.3.17 CAROTENOIDS

8.3.18 OTHERS

8.4 BIRDS FOOD

8.4.1 AMINO ACID

8.4.2 VITAMINS

8.4.3 TRACE MINERALS

8.4.4 ANTIOXIDANTS

8.4.5 PRESERVATIVES

8.4.6 PROBIOTICS

8.4.7 PELLET BINDERS

8.4.8 CAROTENOIDS

8.4.9 ENZYMES

8.4.10 COLORANTS

8.4.11 PHYTOGENIC

8.4.12 FLAVORS AND PALATABILITY ENHANCER

8.4.13 NITROGEN

8.4.14 MOLD INHIBITORS

8.4.15 MYCOTOXIN BINDERS

8.4.16 ANTIMICROBIALS

8.4.17 FEED ACIDIFIERS

8.4.18 OTHERS

8.5 AQUA PETS FOOD

8.5.1 VITAMINS

8.5.2 AMINO ACID

8.5.3 TRACE MINERALS

8.5.4 PELLET BINDERS

8.5.5 ANTIOXIDANTS

8.5.6 CAROTENOIDS

8.5.7 PRESERVATIVES

8.5.8 FLAVORS AND PALATABILITY ENHANCER

8.5.9 PROBIOTICS

8.5.10 ENZYMES

8.5.11 ANTIMICROBIALS

8.5.12 FEED ACIDIFIERS

8.5.13 NITROGEN

8.5.14 COLORANTS

8.5.15 PHYTOGENIC

8.5.16 MOLD INHIBITORS

8.5.17 MYCOTOXIN BINDERS

8.5.18 OTHERS

8.6 OTHERS

9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 PLANT BASED

9.2.1 CEREAL & GRAINS

9.2.2 FRUITS & NUTS

9.2.3 VEGETABLES

9.2.4 OILSEEDS

9.2.5 OTHERS

9.3 ANIMAL BASED

9.3.1 BEEF

9.3.2 POULTRY

9.3.3 PORK

9.3.4 OTHERS

9.4 YEAST

9.5 OTHERS

10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.3 LIQUID

11 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY

11.1 OVERVIEW

11.2 NUTRITION

11.3 PROCESSING

11.4 PRESERVATION

11.5 OTHERS

12 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY

12.1 OVERVIEW

12.2 ORGANIC

12.3 CONVENTIONAL

13 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT

13.3 INDIRECT

14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA.

14.1.3 MEXICO.

15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 CARGILL, INCORPORATED

17.1.1 COMPANY SNAPSHOT

17.1.2 COMAPNT SHARE ANAKYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 ADM

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMAPNT SHARE ANAKYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 SYMRISE

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMAPNT SHARE ANAKYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 DSM

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMAPNT SHARE ANAKYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 BASF SE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMAPNT SHARE ANAKYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 BALCHEM INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 BARENTZ

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 CHR. HANSEN HOLDING A/S

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 GLANBIA PLC

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 INGREDION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 COMAPNT SHARE ANAKYSIS

17.10.5 RECENT DEVELOPMENT

17.11 INTERNATIONAL FLAVORS & FRAGRANCES INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 COMAPNT SHARE ANAKYSIS

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 KEMIN INDUSTRIES, INC. AND ITS GROUP OF COMPANIES

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 KERRY GROUP PLC.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 COMAPNT SHARE ANAKYSIS

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 LALLEMAND INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 OMEGA PROTEIN CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 ROQUETTE FRÈRES

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 THE PETERSON COMPANY

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 THE SCOULAR COMPANY

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 WYSONG

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 EXPORT VALUE OF PET FOOD PER YEAR

TABLE 2 IMPORT OF PET FOOD

TABLE 3 EXPORT OF ANIMAL-ORIGIN PET FOOD PRODUCTS

TABLE 4 VOLUME OF PET FOOD PRODUCED WORLDWIDE / YEAR, BY REGION

TABLE 5 SUPPLY CHAIN OF NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

TABLE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA COLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 72 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 73 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 74 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 75 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 76 NORTH AMERICA YEAST IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 77 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 78 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 79 NORTH AMERICA DRY IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 80 NORTH AMERICA LIQUID IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 81 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 82 NORTH AMERICA NUTRITION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 83 NORTH AMERICA PROCESSING IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 84 NORTH AMERICA PRESERVATION IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 85 NORTH AMERICA OTHERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 86 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 87 NORTH AMERICA ORGANIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 88 NORTH AMERICA CONVENTIONAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 89 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 90 NORTH AMERICA DIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 91 NORTH AMERICA INDIRECT IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 92 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, 2021-2030 (USD MILLION)

TABLE 93 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 94 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 95 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 96 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 NORTH AMERICA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 NORTH AMERICA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 NORTH AMERICA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 100 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 NORTH AMERICA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 102 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 103 NORTH AMERICA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 104 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 NORTH AMERICA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 NORTH AMERICA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 NORTH AMERICA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 108 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 110 NORTH AMERICA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 111 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 112 NORTH AMERICA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 113 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 NORTH AMERICA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 115 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 116 NORTH AMERICA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 117 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 118 NORTH AMERICA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 119 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 120 NORTH AMERICA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 121 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 NORTH AMERICA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 123 NORTH AMERICA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 125 NORTH AMERICA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 126 NORTH AMERICA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 127 NORTH AMERICA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 128 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 NORTH AMERICA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 130 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 131 NORTH AMERICA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 132 NORTH AMERICA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 133 NORTH AMERICA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 134 NORTH AMERICA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 135 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 136 NORTH AMERICA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 137 NORTH AMERICA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 138 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 139 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 140 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 141 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 142 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 143 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 144 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 145 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 U.S. FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 147 U.S. WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 U.S. VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 149 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 U.S. AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 151 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 U.S. TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 153 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 U.S. NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 U.S. SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 U.S. PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 157 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 159 U.S. FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 160 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 161 U.S. PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 162 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 U.S. ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 164 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 165 U.S. PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 166 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 U.S. ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 168 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 U.S. FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 170 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 U.S. MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 172 U.S. MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 174 U.S. NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 175 U.S. PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 U.S. CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 178 U.S. ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 179 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 180 U.S. COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 181 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 182 U.S. DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 183 U.S. CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 184 U.S. BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 185 U.S. AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 186 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 187 U.S. PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 188 U.S. ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 189 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 190 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 191 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 192 U.S. PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 193 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 194 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 195 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 196 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 197 CANADA FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 198 CANADA WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 199 CANADA VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 200 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 CANADA AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 202 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 203 CANADA TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 204 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 CANADA NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 206 CANADA SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 CANADA PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 208 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 210 CANADA FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 211 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 212 CANADA PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 213 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 CANADA ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 215 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 CANADA PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 217 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 CANADA ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 219 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 CANADA FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 221 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 CANADA MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 223 CANADA MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 CANADA NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 226 CANADA PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 CANADA CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 229 CANADA ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 230 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 CANADA COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 232 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 233 CANADA DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 234 CANADA CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 235 CANADA BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 236 CANADA AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 237 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 238 CANADA PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 239 CANADA ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 240 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 241 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 242 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 243 CANADA PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 244 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 245 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 ASP

TABLE 246 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PRODUCT TYPE, 2021-2030 (UNITS)

TABLE 247 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 MEXICO FAT-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 MEXICO WATER-SOLUBLE IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 250 MEXICO VITAMINS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 251 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 252 MEXICO AMINO ACIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 253 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 254 MEXICO TRACE MINERALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 255 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 256 MEXICO NATURAL IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 257 MEXICO SYNTHETIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 258 MEXICO PRESERVATIVES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 259 MEXICO FLAVORS AND PALATABILITY ENHANCER IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 260 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 261 MEXICO PROBIOTICS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 262 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 263 MEXICO ANTIOXIDANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 264 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 MEXICO PELLET BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 266 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 MEXICO ENZYMES IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 268 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 269 MEXICO FEED ACIDIFIERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 270 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 271 MEXICO MOLD INHIBITORS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 272 MEXICO MYCOTOXIN BINDERS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 MEXICO NITROGEN IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 275 MEXICO PHYTOGENIC IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 MEXICO CAROTENOIDS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 278 MEXICO ANTIMICROBIALS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 279 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 280 MEXICO COCOLORANTS IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 281 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 282 MEXICO DOG FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 283 MEXICO CAT FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 284 MEXICO BIRDS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 285 MEXICO AQUA PETS FOOD IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY PET FOOD TYPE, 2021-2030 (USD MILLION)

TABLE 286 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 287 MEXICO PLANT BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 288 MEXICO ANIMAL BASED IN PET FOOD FLAVORS AND INGREDIENTS MARKET, BY SOURCE, 2021-2030 (USD MILLION)

TABLE 289 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FORM, 2021-2030 (USD MILLION)

TABLE 290 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY FUNCTIONALITY, 2021-2030 (USD MILLION)

TABLE 291 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 292 MEXICO PET FOOD FLAVORS AND INGREDIENTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: MARKET DISTRIBUTION CHANNEL COVERAGE GRID

FIGURE 8 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SEGMENTATION

FIGURE 11 THE GROWING RISING TREND OF PET HUMANIZATION AROUND THE WORLD IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET FROM 2023 TO 2030

FIGURE 12 VITAMINS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET

FIGURE 14 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2022

FIGURE 19 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY PET FOOD TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2022

FIGURE 23 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY SOURCE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2022

FIGURE 27 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FORM, LIFELINE CURVE

FIGURE 30 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2022

FIGURE 31 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY FUNCTIONALITY, LIFELINE CURVE

FIGURE 34 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2022

FIGURE 35 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, 2023-2030 (USD MILLION)

FIGURE 36 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY CATEGORY, LIFELINE CURVE

FIGURE 38 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 39 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 40 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 42 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: SNAPSHOT (2022)

FIGURE 43 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022)

FIGURE 44 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 45 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 46 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: BY PRODUCT TYPE (2021-2030)

FIGURE 47 NORTH AMERICA PET FOOD FLAVORS AND INGREDIENTS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。