北米眼科レーザー市場

Market Size in USD Billion

CAGR :

%

| 2023 –2030 | |

| USD 938.91 Million | |

| USD 1,583.40 Million | |

|

|

|

北米眼科用レーザー市場、製品別(フェムト秒レーザー、エキシマレーザー、Nd:YAG レーザー、ダイオードレーザーなど)、タイプ別(光破壊レーザー、選択的レーザー線維柱帯形成術(SLT)、光凝固レーザー)、用途別(診断および治療)、ガス別(希ガス、ハロゲンガス、バッファーガスなど)、エンドユーザー別(病院、診療所など) - 2030 年までの業界動向と予測。

北米眼科レーザー市場の分析と洞察

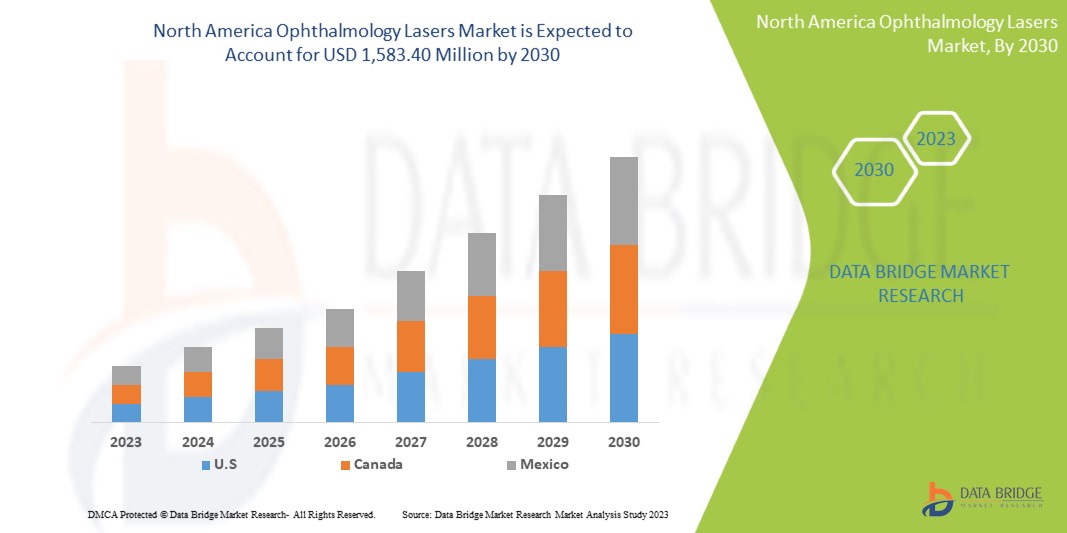

北米の眼科用レーザー市場は、2023年から2030年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年の予測期間に6.8%のCAGRで成長し、2022年の9億3,891万米ドルから2030年までに15億8,340万米ドルに達すると分析しています。

この眼科用レーザー市場レポートでは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリュー チェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場の成長、アプリケーションのニッチと優位性、製品の承認、製品の発売、地理的拡張、市場における技術革新などの詳細が提供されます。眼科用レーザー市場に関する詳細情報を取得するには、アナリスト ブリーフについて Data Bridge Market Research にお問い合わせください。当社のチームは、市場の成長を達成するために情報に基づいた市場決定を行うお手伝いをします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品 (フェムト秒レーザー、エキシマレーザー、Nd:YAG レーザー、ダイオードレーザーなど)、タイプ (光破壊レーザー、選択的レーザー線維柱帯形成術 (SLT)、光凝固レーザー)、用途 (診断および治療)、ガス (希ガス、ハロゲンガス、バッファーガスなど)、エンドユーザー (病院、診療所など) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

ニデック株式会社、カルマーレーザー株式会社、レンズア株式会社、OD-OS、クォンテルメディカル株式会社(ルミバードメディカルの子会社)、アルコン株式会社、ジーマー・オフタルミック・システムズ株式会社、ライトメッド株式会社、ジョンソン・エンド・ジョンソン株式会社、ボシュロム株式会社、メダ株式会社、トプコン株式会社、ルミナスビー株式会社、イリデックス株式会社、ツァイス株式会社など |

市場の定義

Ophthalmology lasers are specialized medical devices that emit focused beams of light to treat various eye conditions. These lasers are commonly used in ophthalmology to perform various procedures, such as treating vision disorders, correcting refractive errors, and managing various eye diseases. The devices gained increased importance and adoption due to the high prevalence of several ophthalmic diseases, such as glaucoma, cataract, and other vision-related issues.

North America Ophthalmology Lasers Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing incidences of chronic and communicable eye diseases

The field of ophthalmology has seen a rise in the incidence of both chronic and communicable eye diseases in recent years. Some of the major factors contributing to this trend include a growing North America population, an aging population, increased urbanization, changing lifestyles, and increased exposure to environmental pollutants. One of the most common chronic eye diseases is Age-Related Macular Degeneration (AMD). AMD is a leading cause of blindness in people over the age of 60 and is caused by damage to the macula, a small part of the retina responsible for central vision. The prevalence of AMD is expected to increase with an aging North America population. Another chronic eye disease that is becoming more prevalent is glaucoma. Glaucoma is a group of eye diseases that cause damage to the optic nerve and can lead to blindness. It is often asymptomatic until it reaches an advanced stage, making regular eye exams crucial for early detection and treatment.

In March 2023, according to an article by Indian Express, North America, glaucoma is the second leading cause of blindness after cataracts. It is estimated to cause blindness in 4.5 million people worldwide. Despite this, glaucoma is largely undiagnosed, with more than 90 percent of untreated cases. Thus, increasing incidences of chronic and communicable eye diseases are expected to drive the market's growth.

- Increased consumer awareness for laser treatments

Consumer awareness of laser therapies has increased, which has benefited the market for ophthalmic lasers North America. Several factors have contributed to this trend, including advancements in technology, increased access to information, and greater emphasis on patient education. One of the main drivers of increased consumer awareness is the development of new laser systems that offer improved precision, reduced recovery times, and better outcomes. These systems have been shown to be effective in treating a range of eye conditions, from refractive errors to more complex retinal disorders. Patients are increasingly interested in these treatments and are seeking out ophthalmologists who are trained to use them. Another factor contributing to increased awareness is the availability of information about ophthalmology lasers. Patients can easily access information online about the different types of laser treatments available, their benefits, and potential risks. This has helped to demystify laser treatments and make them more accessible to a wider range of patients which is expected to drive the market's growth.

- Increasing adoption of outpatient procedures

The field of ophthalmology has seen significant advancements in recent years with the advent of laser technology. With the increasing adoption of outpatient procedures, the North America ophthalmology lasers market presents a significant opportunity for growth. Outpatient procedures are medical procedures that do not require an overnight stay in a hospital. These procedures can be performed in a medical office, ambulatory surgery center, or outpatient clinic. Thus, the increasing adoption of outpatient procedures is expected to drive the market's growth.

Opportunities

-

Technological advancements in ophthalmology

Technological advancements in the field of ophthalmology have revolutionized the diagnosis, treatment, and management of various eye diseases and conditions. These advancements have created significant opportunities in the North America ophthalmology lasers market, with the potential to improve patient outcomes, increase efficiency, and drive growth in the industry. One of the most significant technological advancements in ophthalmology has been the development of femtosecond lasers. These lasers are used for precision surgeries and can create incisions that are more precise and predictable than those created by traditional surgical tools. This technology has revolutionized procedures such as photocoagulation lasers, Selective Laser Trabeculoplasty (SLT), allowing for faster recovery times and better visual outcomes, which is expected to provide a lucrative opportunity for the market's growth.

Restraints/Challenges

- Lack of skilled professionals

Ophthalmology lasers are used in various procedures, including refractive surgeries, cataract surgeries, and glaucoma treatment. However, the effective use of these lasers requires skilled professionals who are proficient in handling them. The lack of such professionals can lead to errors, complications, and adverse outcomes, which can harm patients and damage the industry's reputation.

The main reason for the shortage of skilled professionals is the complexity of the equipment and the procedures involved. Ophthalmology lasers require specialized knowledge and expertise, and the training required to become proficient in using them can be time-consuming and expensive. In addition, the procedures themselves are often intricate and require a high level of skill and precision

Hence, a lack of skilled professionals will impede the growth rate of the ophthalmology lasers market. Additionally, stringent rules and regulations will further challenge the market in the forecast period.

Recent Development

- In November 2022, Alcon, the North America leader in eye care dedicated to helping people see brilliantly, announced that it had completed its acquisition of Aerie Pharmaceuticals, Inc. This transaction helps bolster Alcon's presence in the ophthalmic pharmaceutical space with its growing portfolio of commercial products and development pipeline.

- In March 2023, Bausch + Lomb Corporation and Novaliq GmbH announced that the American Journal of Ophthalmology had published results from MOJAVE, the second pivotal Phase 3 trial for NOV03 (perfluorohexyloctane). NOV03 is being investigated to treat the signs and symptoms of Dry Eye Disease (DED) associated with Meibomian Gland Dysfunction (MGD). Results from the first pivotal Phase 3 trial, GOBI, were published earlier this year in the American Journal of Ophthalmology.

North America Ophthalmology Lasers Market Scope

The North America ophthalmology lasers market is segmented into product, type, application, gases, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- Femtosecond Lasers

- Excimer Lasers

- Nd: YAG Lasers

- Diode Lasers

- Others

On the basis of product, the market is segmented into femtosecond lasers, excimer lasers, Nd: YAG lasers, diode lasers, and others.

Type

- Photodisruption Lasers

- Selective Laser Trabeculoplasty (SLT)

- Photocoagulation Lasers

On the basis of type, the market is segmented into photodisruption lasers, selective laser trabeculoplasty (SLT), and photocoagulation lasers.

Application

- Diagnostics

- Therapeutics

On the basis of application, the market is segmented into diagnostics and therapeutics.

Gases

- Noble gas

- Halogen gas

- Buffer gas

- Others

On the basis of gases, the market is segmented into noble gas, halogen gas, buffer gas, and others.

End User

- Hospitals

- Clinics

- Others

エンドユーザーに基づいて、市場は病院、診療所、その他に分類されます。

北米眼科用レーザー市場の地域分析/洞察

北米の眼科用レーザー市場が分析され、上記のように国、製品、タイプ、用途、ガス、エンドユーザー別に市場規模の洞察と傾向が提供されます。

北米の眼科用レーザー市場に含まれる国は、米国、カナダ、メキシコです。

この地域における眼科疾患の有病率の高さと急速な研究開発により、米国は北米の眼科レーザー市場を支配すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境と北米眼科用レーザー市場シェア分析

北米眼科用レーザー市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、北米眼科用レーザー市場における会社の焦点にのみ関連しています。

北米の眼科用レーザー市場で事業を展開している主要企業としては、NIDEK CO., LTD.、Calmar Laser、LENSAR, INC.、OD-OS、Quantel Medical(Lumibird Medicalの子会社)、Alcon、Ziemer Ophthalmic Systems AG、LIGHTMED、Johnson & Johnson Inc.、Bausch & Lomb Incorporated、MEDA Co., Ltd.、Topcon、Lumenis Be Ltd.、IRIDEX Corporation、Zeissなどが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 STRATEGIC INITIATIVES

5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INCIDENCES OF CHRONIC AND COMMUNICABLE EYE DISEASES

6.1.2 INCREASED CONSUMER AWARENESS FOR LASER TREATMENTS

6.1.3 INCREASING ADOPTION OF OUTPATIENT PROCEDURES

6.1.4 RISING DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES

6.2 RESTRAINTS

6.2.1 HIGH COST OF OPHTHALMOLOGY LASER PROCEDURES

6.2.2 STRINGENT REGULATORY POLICIES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN OPHTHALMOLOGY

6.3.2 EMERGING MARKETS AND GOVERNMENT FUNDING

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 SAFETY CONCERNS

7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 EXCIMER LASERS

7.2.1 ARF

7.2.2 KRF

7.2.3 XECL

7.2.4 XEFL

7.2.5 F2

7.2.6 XEBR

7.3 FEMTOSECOND LASERS

7.3.1 SEMICONDUCTOR LASERS

7.3.2 SOLID-STATE BULK LASERS

7.3.3 FREQUENCY-CONVERTED SOURCES

7.3.4 FIBER LASERS

7.3.5 DYE LASERS

7.3.6 OTHERS

7.4 ND:YAG LASERS

7.4.1 ND: YAG LASER AT 1064 NM

7.4.2 ND: YAG GREEN LASER AT 532 NM

7.5 DIODE LASERS

7.6 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 PHOTOCOAGULATION LASERS

8.3 SELECTIVE LASER TRABECULOPLASTY (SLT)

8.4 PHOTODISRUPTION LASERS

9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 THERAPEUTICS

9.2.1 CATARACT REMOVAL

9.2.2 GLAUCOMA TREATMENT

9.2.3 DIABETIC RETINOPATHY TREATMENT

9.2.4 REFRACTIVE ERROR CORRECTION

9.2.5 AMD TREATMENT

9.2.6 OTHERS

9.3 DIAGNOSTICS

9.3.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.3.2 SCANNING LASER OPHTHALMOSCOPE (SLO)

10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES

10.1 OVERVIEW

10.2 NOBLE GAS

10.2.1 ARGON

10.2.2 XENON

10.2.3 KRYPTON

10.3 HALOGEN GAS

10.3.1 CHLORINE

10.3.2 BROMINE

10.3.3 FLOURINE

10.4 BUFFER GAS

10.4.1 HELIUM

10.4.2 NEON

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS

11.3 CLINICS

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, CPS

15.1 BAUSCH & LOMB INCORPORATED

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ZEISS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 ALCON

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 NIDEK CO., LTD

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ARC LASER GMBH

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AUROLAB

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CALMAR LASER

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 IRIDEX CORPORATION

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 IVIS TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 LENSAR, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 LUMENIS BE LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 LIGHTMED

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDA CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 OD-OS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 QUANTEL MEDICAL (A SUBSIDIARY OF LUMIBIRD MEDICAL)

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SCHWIND EYE-TECH-SOLUTIONS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TOPCON

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 ZIEMER OPHTHALMIC SYSTEMS AG

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 3 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA DIODE LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA PHOTOCOAGULATION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SELECTIVE LASER TRABECULOPLASTY (SLT) IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA PHOTODISRUPTION LASERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA DIAGNOSTICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA NOBLE GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CLINICS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN OPHTHALMOLOGY LASERS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT , 2021-2030 (UNITS)

TABLE 35 NORTH AMERICA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 47 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 49 U.S. OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 50 U.S. EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 U.S. FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 52 U.S. ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 53 U.S. OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 U.S. THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 U.S. DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 57 U.S. OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 58 U.S. NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 59 U.S. HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 60 U.S. BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 61 U.S. OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 62 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 64 CANADA OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 65 CANADA EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 CANADA FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 CANADA ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 68 CANADA OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 CANADA OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 70 CANADA THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 71 CANADA DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 72 CANADA OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 73 CANADA NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 74 CANADA HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 75 CANADA BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 76 CANADA OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 77 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 78 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (UNITS)

TABLE 79 MEXICO OPHTHALMOLOGY LASERS MARKET, BY PRODUCTS, 2021-2030, (ASP)

TABLE 80 MEXICO EXCIMER LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 MEXICO FEMTOSECOND LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 MEXICO ND:YAG LASERS IN OPHTHALMOLOGY LASERS MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 MEXICO OPHTHALMOLOGY LASERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 MEXICO OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 85 MEXICO THERAPEUTICS IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 86 MEXICO DIAGNOSTIC IN OPHTHALMOLOGY LASERS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 87 MEXICO OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 88 MEXICO NOBLE GASES IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 89 MEXICO HALOGEN GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 90 MEXICO BUFFER GAS IN OPHTHALMOLOGY LASERS MARKET, BY GASES, 2021-2030 (USD MILLION)

TABLE 91 MEXICO OPHTHALMOLOGY LASERS MARKET, BY END USER, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SEGMENTATION

FIGURE 11 RISING TRAUMATIC INJURIES AND AN INCREASING GERIATRIC POPULATION ARE EXPECTED TO DRIVE THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 EXCIMER LASERS IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET IN THE FORECAST PERIOD 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA OPHTHALMOLOGY LASERS MARKET

FIGURE 14 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, 2022

FIGURE 15 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, 2022

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, 2022

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY GASES, LIFELINE CURVE

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, 2022

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: BY PRODUCT (2023-2030)

FIGURE 39 NORTH AMERICA OPHTHALMOLOGY LASERS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。