北米の食肉・鶏肉・シーフード加工機器市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

5.57 Billion

USD

8.36 Billion

2024

2032

USD

5.57 Billion

USD

8.36 Billion

2024

2032

| 2025 –2032 | |

| USD 5.57 Billion | |

| USD 8.36 Billion | |

|

|

|

|

北米の食肉、鶏肉、シーフード加工機器市場の細分化、機器タイプ別(ポーション機器、フライ機器、濾過機器、コーティング機器、調理機器、燻製機器、屠殺・屠殺機器、冷蔵機器、高圧処理(高圧プロセッサー)、マッサージ機器、その他)、プロセス別(サイズ縮小、サイズ拡大、均質化、混合、その他)、操作モード別(自動、半自動、手動)、用途別(生肉加工、生調理、調理済み、生発酵、乾燥肉、塩漬け、冷凍、その他)、機能別(カット、ブレンド、軟化、充填、マリネ、スライス、粉砕、燻製、屠殺・羽毛除去、骨抜き・皮剥ぎ、内臓除去、内臓除去、フィレ加工、その他)、加工製品タイプ別(食肉、鶏肉、シーフード) - 業界動向と2025年までの予測2032

北米の食肉、鶏肉、魚介類加工機器市場の規模と成長率はどれくらいですか?

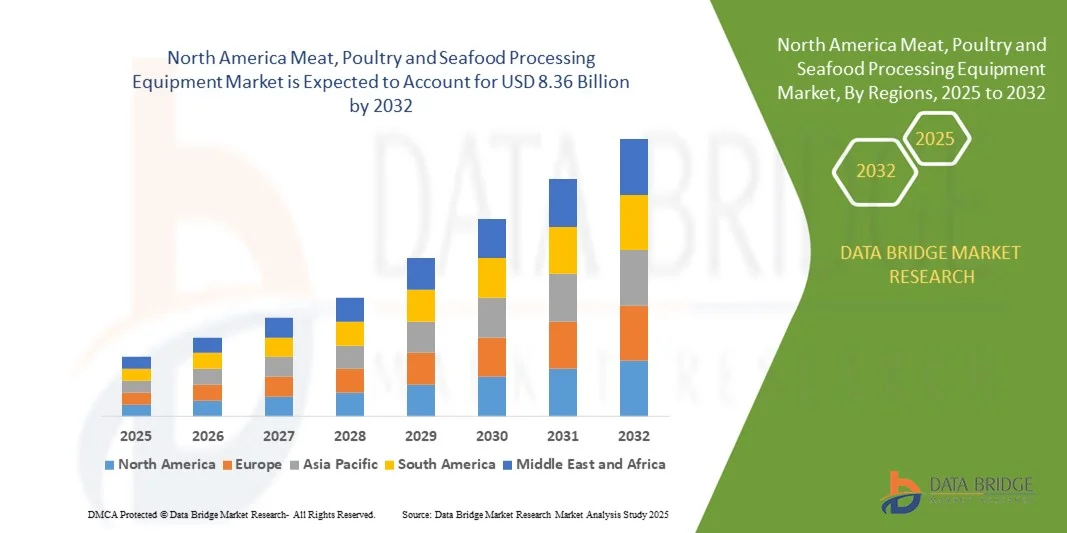

- 北米の食肉、鶏肉、魚介類加工機器市場規模は2024年に55億7000万米ドルと評価され、予測期間中に5.2%のCAGRで成長し、2032年には83億6000万米ドル に達すると予想されています 。

- 加工肉、鶏肉、魚介類製品の消費量の増加、そして市場におけるファストフードやレストランチェーンの増加により、より高品質な加工肉などの製品に対する需要が高まっています。また、特に肉、鶏肉、魚介類の加工機器市場における技術革新も、現在、市場価値を高めています。

- 市場の成長を抑制している要因は、高額な資本投資、寿命の延長による設備の交換の遅れである。

肉、鶏肉、魚介類加工機器市場の主なポイントは何ですか?

- 食品加工業界における自動化の増加は、肉、鶏肉、魚介類加工機器市場にとって最高の機会となる可能性があります。

- 機械の高コスト、発展途上国におけるインフラの低さ、加工やパイプライン洗浄時の過剰な水の使用は、市場にとって脅威となる可能性がある。

- 2025年、米国は北米の食肉、鶏肉、魚介類加工機器市場を支配し、急速な工業化、自動化の導入率の高さ、先進的な食品加工技術への投資の増加により、42.6%という最大の収益シェアを獲得しました。

- カナダの食肉、鶏肉、魚介類加工機器市場は、加工・冷凍の食肉、鶏肉、魚介類製品の需要増加と、食品加工部門の近代化に向けた政府の取り組みにより、11.2%という最も高い成長率を記録すると予測されています。

- 2025年には、大規模な食肉・魚介類加工工場における精密スライス、ポーションコントロール、自動トリミングの需要増加により、切断・ポーション機器セグメントが42.8%の市場シェアで市場を支配しました。

レポートの範囲と食肉、鶏肉、魚介類加工機器市場のセグメンテーション

|

属性 |

食肉、鶏肉、魚介類加工機器の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

肉、鶏肉、魚介類加工機器市場の主な傾向は何ですか?

自動化と持続可能な処理技術

- 食肉、鶏肉、水産物加工機器市場を形作る大きなトレンドの一つは、効率性の向上、廃棄物の削減、食品の安全性向上を目的とした自動化と持続可能な加工システムの急速な導入です。エネルギー効率の高い運用と衛生的な設計への関心が高まるにつれ、メーカーは環境に配慮したイノベーションへと向かっています。

- 企業はロボット工学、AIベースの検査、IoT対応の監視システムを統合して、骨抜き、切断、包装プロセスを合理化し、精度を確保し、人的ミスを削減する傾向が強まっている。

- さらに、加工業者が持続可能性規制を満たし、運用コストを削減することを目指しているため、節水および廃棄物削減技術の使用が普及しつつあります。

- 注目すべき例としては、GEA Group Aktiengesellschaft(ドイツ)が、スマートオートメーション、効率的な冷却、廃棄物回収システムを統合した持続可能な加工ラインを導入し、肉や魚介類の生産を最適化した。

- インテリジェントで環境に優しく、省エネなソリューションへの移行は業界を変革し、生産性、安全性、持続可能性のバランスが取れた次世代機器への投資を促進しています。

肉、鶏肉、魚介類加工機器市場の主な推進要因は何ですか?

- タンパク質を豊富に含む食品の世界的な消費量の増加と、加工肉や魚介類の需要増加が、市場を押し上げる主な要因となっています。消費者は、利便性、安全性、そして衛生的に加工された食品の選択肢を求めており、これが設備の近代化を促進しています。

- 例えば、2025年にマレル(アイスランド)は、鶏肉や魚介類の加工における歩留まり精度と製品の一貫性を高める自動分割およびスライスシステムで製品ラインを拡大しました。

- 食品業界は、食品安全規制や輸出インフラへの政府の投資からも恩恵を受けており、高度な加工機械の需要が高まっている。

- さらに、調理済み食品(RTE)や冷凍食品の増加により、包装、冷蔵、保管能力を向上させるための設備のアップグレードが加速している。

- AI駆動型仕分けシステム、衛生的なコンベア、真空シール技術などのイノベーションにより、製品の品質がさらに向上し、保存期間が延長され、産業および商業分野全体で市場拡大が促進されています。

肉、鶏肉、魚介類加工機器市場の成長を阻害する要因は何ですか?

- 高額な設備投資と維持費は、特に中小規模の加工業者にとって、導入を阻む大きな課題となっています。自動骨抜き機や真空充填機などの設備は、多額の初期投資を必要とします。

- 例えば、2025年にはステンレス鋼や電子部品の価格上昇により、BAADER(ドイツ)やJBT Corporation(米国)などの主要企業の設備製造コストが増加し、利益率に影響を与えた。

- さらに、複雑な清掃と衛生要件によりダウンタイムが長くなり、生産効率に影響を与える可能性があります。

- 環境およびエネルギー規制により、企業は排出量の削減と水使用量の削減のためにシステムを継続的にアップグレードする必要に迫られています。

- こうした障壁にもかかわらず、GEAグループAktiengesellschaftやKey Technology(米国)といった企業は、モジュール式でエネルギー効率が高く、清掃しやすい設計を通じてこれらの問題に取り組んでいます。市場における長期的な成長と競争力を確保するには、コスト、コンプライアンス、持続可能性のバランスをとることが依然として重要です。

肉、鶏肉、魚介類加工機器市場はどのように区分されていますか?

肉、鶏肉、魚介類加工機器市場は、機器の種類、プロセス、操作モード、用途、機能、加工製品の種類に基づいて分類されています。

- 機器の種類別

機器の種類別に見ると、市場はポーション機器、フライ機器、濾過機器、コーティング機器、調理機器、燻製機器、屠殺・屠畜機器、冷蔵機器、高圧処理(HPP)機器、マッサージ機器、その他に分類されます。2025年には、大規模な食肉・水産加工工場における精密スライス、ポーションコントロール、自動トリミングの需要増加に牽引され、カッティング・ポーション機器セグメントが42.8%の市場シェアで市場を牽引しました。これらのシステムは、効率性を高め、廃棄物を最小限に抑え、製品品質の一貫性を維持します。

高圧処理(HPP)装置セグメントは、栄養価や食感を損なうことなく肉や魚介類製品の保存期間を延ばし、病原菌のない状態を確保するための非熱保存技術の採用増加に支えられ、2026年から2033年にかけて最も速いCAGRを記録すると予測されています。

- プロセス別

食肉・鶏肉・水産加工機器市場は、工程別にサイズダウン、サイズ拡大、均質化、混合、その他に分類されます。サイズダウンセグメントは2025年に49.5%の市場シェアで市場を牽引しました。これは、粉砕、切断、ミンチ化が食肉加工における重要な初期段階であり、ソーセージ、パティ、水産加工製品の均一な食感と均一性を確保するためです。最新のサイズダウンシステムの効率性は、スループットと品質の最適化に役立ちます。

ミキシング分野は、混合肉、マリネ、加工魚介類の需要増加に牽引され、2026年から2033年にかけて最も高いCAGRを達成すると予想されています。材料の均一な分散、風味の一貫性、製品の安定性向上のため、高度な真空ミキサーやパドルミキサーの導入がますます進んでいます。

- 動作モード別

動作モードに基づいて、市場は自動、半自動、手動に分類されます。自動セグメントは、人件費の削減、生産効率の向上、衛生基準の遵守確保を目的とした自動化の導入拡大に牽引され、2025年には56.7%の市場シェアで市場を牽引しました。自動化システムは、ロボット、センサー、ソフトウェアを統合し、骨抜きや包装などの複雑な作業を高精度に実行します。

半自動機セグメントは、中小規模の加工業者が自動化のメリットと価格のバランスを模索していることから、2026年から2033年にかけて最も高いCAGRを記録すると予測されています。半自動システムは、柔軟性、運用の複雑さの軽減、そして多様な生産規模への適応性を提供します。

- アプリケーション別

用途別に見ると、食肉・鶏肉・水産加工機器市場は、生鮮加工品、生調理済み、調理済み、生発酵、乾燥肉、塩漬け、冷凍、その他に分類されます。生鮮加工品セグメントは、高度な切断、ブレンド、コーティング機械を必要とするソーセージ、ナゲット、パテなど、最小限の加工で済ませた食肉・水産製品の消費量が多いことから、2025年には51.2%という最大の市場シェアを獲得しました。この需要は、新鮮な味わいで調理済みの食事を求める消費者の嗜好に支えられています。

冷凍食品セグメントは、冷凍シーフードと調理済み食品の世界的な人気上昇に牽引され、2026年から2033年にかけて最も高いCAGRで成長すると予想されています。冷凍技術とコールドチェーン物流の改善により、保存期間の延長と食感と風味の保持が可能になっています。

- 機能別

機能別に見ると、市場はカッティング、ブレンディング、テンダライジング、フィリング、マリネ、スライス、グラインディング、スモーク、屠殺・羽毛除去、骨抜き・皮剥ぎ、内臓除去、内臓除去、フィレ加工、その他に分類されます。カッティング・スライシング分野は、ほぼすべての食肉・魚介類加工工程における中核機能であるため、2025年には46.4%の市場シェアで市場を牽引しました。精密なカッティング・スライシングシステムへの需要は、均一な厚さの実現、廃棄物の削減、製品の完全性の維持といったニーズによって高まっています。

骨抜き・皮剥ぎセグメントは、特に鶏肉や魚の加工ラインにおいて、手作業を最小限に抑え、歩留まりを向上させ、衛生を強化する高効率システムのニーズに牽引され、2026年から2033年にかけて最も速いCAGRを示すことが予想されています。

- 加工品の種類別

加工品の種類に基づいて、市場は食肉、鶏肉、魚介類に分類されます。食肉セグメントは2025年に54.9%の市場シェアで市場を牽引しました。これは、特に北米と中南米におけるソーセージ、ベーコン、ハムなどの加工食肉製品の消費量の増加によるものです。食肉加工ラインでは、安全性と品質を確保するために、粉砕、塩漬け、包装のための高度なシステムが必要です。

水産物セグメントは、加工魚、エビ、貝類の世界的な需要増加に支えられ、2026年から2033年にかけて最も高いCAGRで成長すると予想されています。水産物輸出の増加と、フィレ加工および冷凍技術の進歩が相まって、世界中の水産物加工施設の自動化と生産能力の拡大を促進しています。

肉、鶏肉、魚介類加工機器市場で最大のシェアを占める地域はどこですか?

- 2025年、米国は北米の食肉、鶏肉、魚介類加工機器市場を支配し、急速な工業化、自動化の導入率の高さ、先進的な食品加工技術への投資の増加により、42.6%という最大の収益シェアを獲得しました。

- 同国の強固な製造基盤と、食品安全および品質基準への規制の重点が相まって、近代的な食肉、鶏肉、水産物加工設備の広範な生産と活用を支えています。国内外の大手企業は、エネルギー効率が高く、自動化され、追跡可能なシステムに投資し、市場を牽引しています。

- 全体的に、米国はイノベーション、インフラ、技術導入におけるリーダーシップにより、北米の食肉、鶏肉、魚介類加工機器市場において主導的な地位を築いています。

カナダの食肉、鶏肉、魚介類加工機器市場に関する洞察

カナダの食肉、鶏肉、水産物加工機器市場は、加工・冷凍食肉、鶏肉、水産物の需要増加と、食品加工部門の近代化に向けた政府の取り組みに牽引され、11.2%という最も高い成長率を記録すると予測されています。カナダのメーカーは、業務効率の向上と食品安全規制へのコンプライアンス維持のため、自動化された切断、骨抜き、マリネ、包装ソリューションへの投資を増やしています。省エネ冷蔵や節水といった持続可能性対策も成長に貢献しています。カナダはイノベーション、自動化、品質保証に注力しており、北米地域における主要な成長エンジンとしての地位を確立しています。

メキシコの食肉、鶏肉、魚介類加工機器市場に関する洞察

メキシコの食肉、鶏肉、水産加工機器市場は、加工タンパク質製品の国内消費量の増加と、米国をはじめとするラテンアメリカ諸国への輸出需要の増加に支えられ、着実に拡大しています。メキシコのメーカーは、衛生基準を満たし生産性を向上させるため、最新の屠殺、スライス、包装、ポーション分け設備を導入しています。加工工場の近代化を支援する政府の優遇措置と、コールドチェーンインフラへの投資増加が、市場への導入をさらに加速させています。戦略的な立地、熟練した労働力、そして成長する産業基盤を有するメキシコは、北米の食肉、鶏肉、水産加工機器市場の強化において重要な役割を果たしています。

肉、鶏肉、魚介類加工機器市場のトップ企業はどれですか?

食肉、鶏肉、魚介類加工機器業界は、主に、次のような定評のある企業によって牽引されています。

- エキパミエントス カルニコス、SL (スペイン)

- BRAHER INTERNACIONAL, SA (スペイン)

- RZPO(ポーランド)

- ミネルバ・オメガ・グループ(イタリア)

- GEA Group Aktiengesellschaft (ドイツ)

- RISCO SpA(イタリア)

- PSS SVIDNÍK(スロバキア)

- メタルバッド(ポーランド)

- バーダー(ドイツ)

- JBTコーポレーション(米国)

- マレル(アイスランド)

- キーテクノロジー(米国)

- イリノイ・ツール・ワークス社(米国)

- ミドルビー・コーポレーション(米国)

- ベッチャー・インダストリーズ社(米国)

- BIZERBA(ドイツ)

北米の食肉、鶏肉、魚介類加工機器市場の最近の動向は何ですか?

- 2025年2月、JBTマレルはAce Aquatecと戦略的提携を締結し、同社を食品加工機械向け魚類気絶ソリューションの優先ベンダーに任命しました。この提携により、JBTマレルは持続可能な水産加工における地位を強化し、革新的な機械ポートフォリオを拡大します。

- 2025年1月、米国に拠点を置くJBTはMarel社を完全買収し、新会社JBT Marel Corporationを設立しました。この合併により、食品加工技術における強力なグローバルリーダーが誕生し、複数の食品分野における効率性と革新性が向上します。

- 2024年11月、Fortifi Food Processing Solutionsは、タンパク質処理システムの主要メーカーであるJWE-BANSS GmbH(ドイツ)の知的財産、顧客関係、一部の在庫、および固定資産の買収を発表しました。この買収により、Fortifiの食肉加工における専門知識が強化され、北米市場におけるプレゼンスが強化されます。

- ロスインダストリーズは2024年7月、中規模および小規模の食肉加工業者向けに、業務効率と最終製品の品質向上を目的としたソリューション「AMS 400メンブレンスキナー」を発売しました。この発売は、ロスインダストリーズが中小規模の食品生産者の進化する自動化ニーズへの対応に注力していることを反映しています。

- 2024年3月、Fortifi Food Processing Solutionsは、5大陸に展開する食品加工および自動化ブランドの統合グローバルプラットフォームとして正式に設立されました。この設立は、タンパク質、乳製品、果物および野菜加工業界全体にわたる統合ソリューションの提供に向けた戦略的一歩となります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。