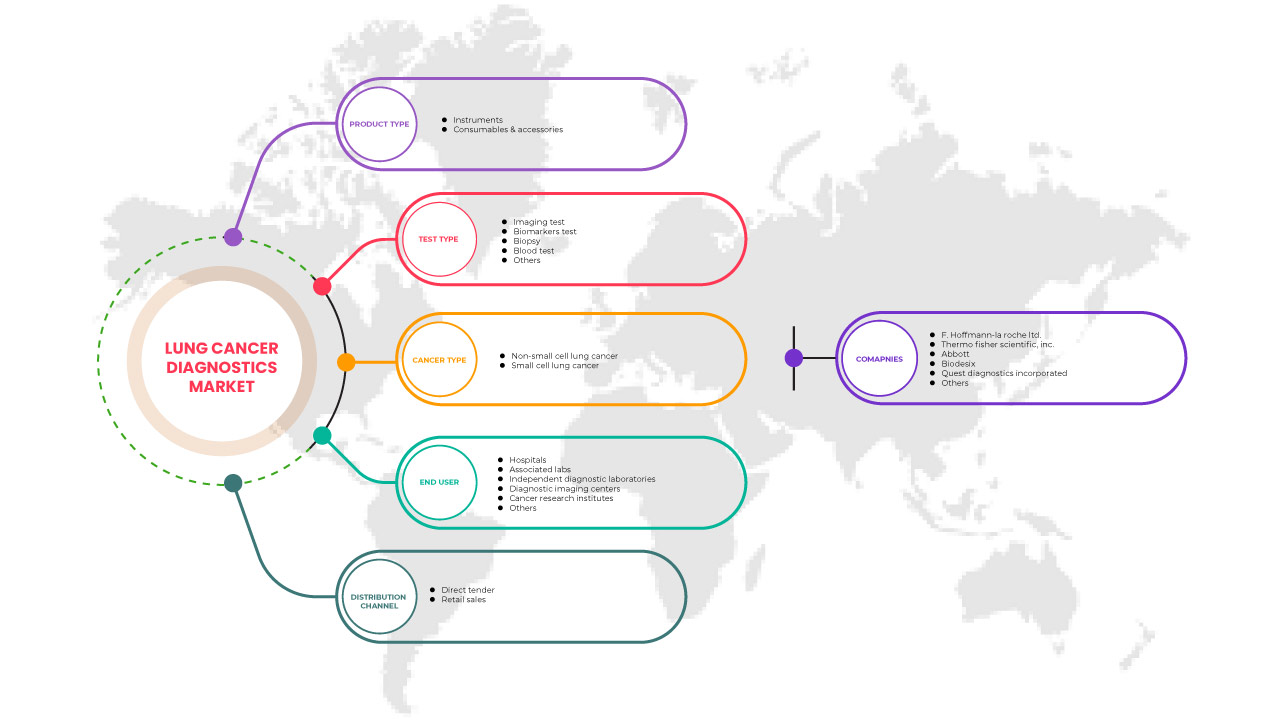

北米の肺がん診断市場、製品タイプ別(機器、消耗品、付属品)、検査タイプ別(バイオマーカー検査、画像検査、生検、血液検査、その他)、がんタイプ別(非小細胞肺がん、小細胞肺がん)、エンドユーザー別(病院、関連研究所、独立診断研究所、診断画像センター、がん研究機関、その他)、流通チャネル別(直接入札、小売販売) - 2030年までの業界動向と予測。

北米の肺がん診断市場の分析と洞察

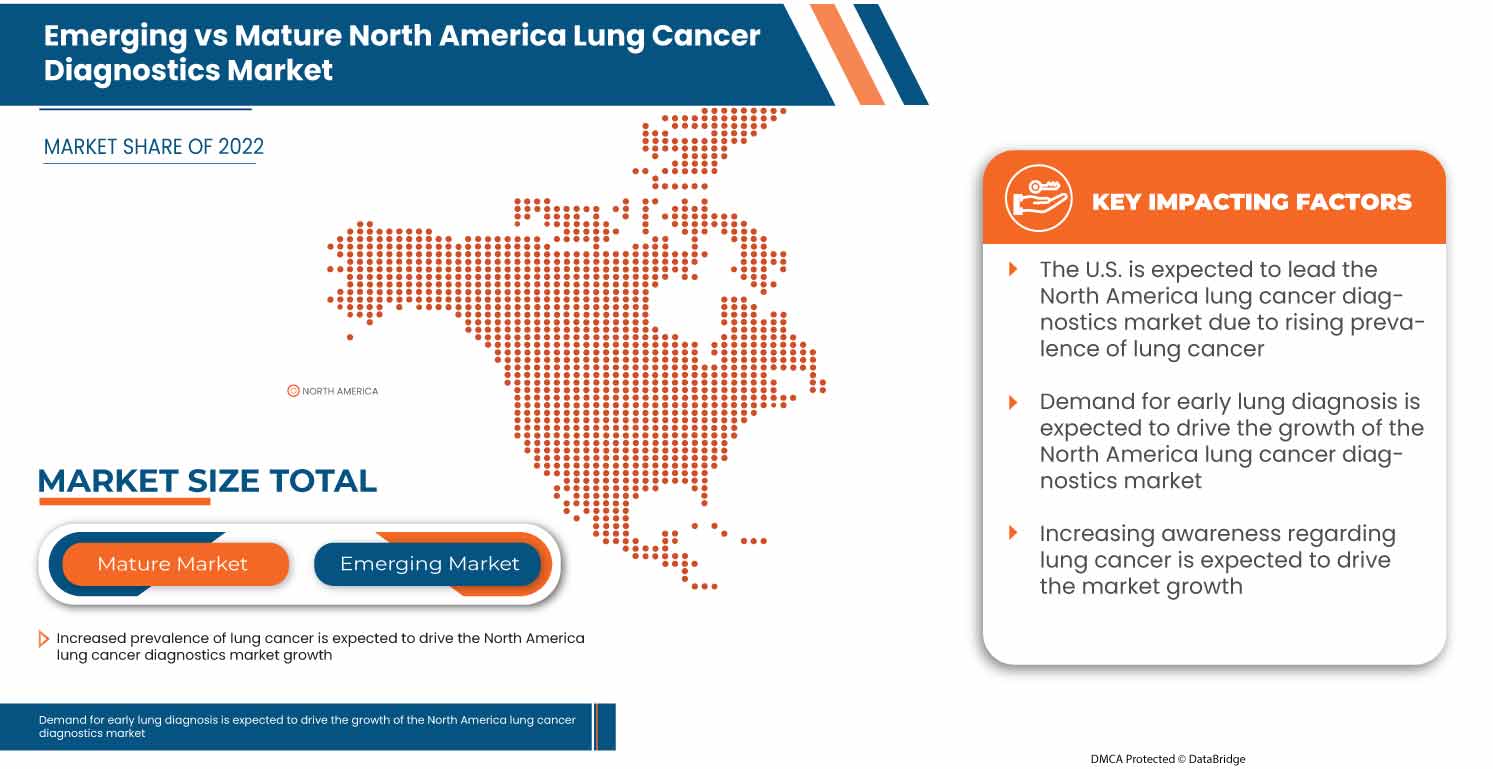

北米の肺がん診断市場は、市場プレーヤーの増加と高度なサービスの利用可能性により、予測年度に成長すると予想されています。これに伴い、メーカーは市場で新しいサービスを開始するための研究開発活動に取り組んでいます。肺がんの診断と開発研究の増加により、市場の成長がさらに促進されると予測されています。ただし、肺がんのスクリーニング技術の難しさにより、予測期間中の北米の肺がん診断市場の成長が妨げられる可能性があります。

がんの診断と治療に対する医療費の増加は、市場に治療を強化する機会を与えると予想されます。しかし、検査のコストの高さと、がん診断製品の承認と商品化に対する厳しい規制と基準が、市場の成長を妨げる可能性があります。

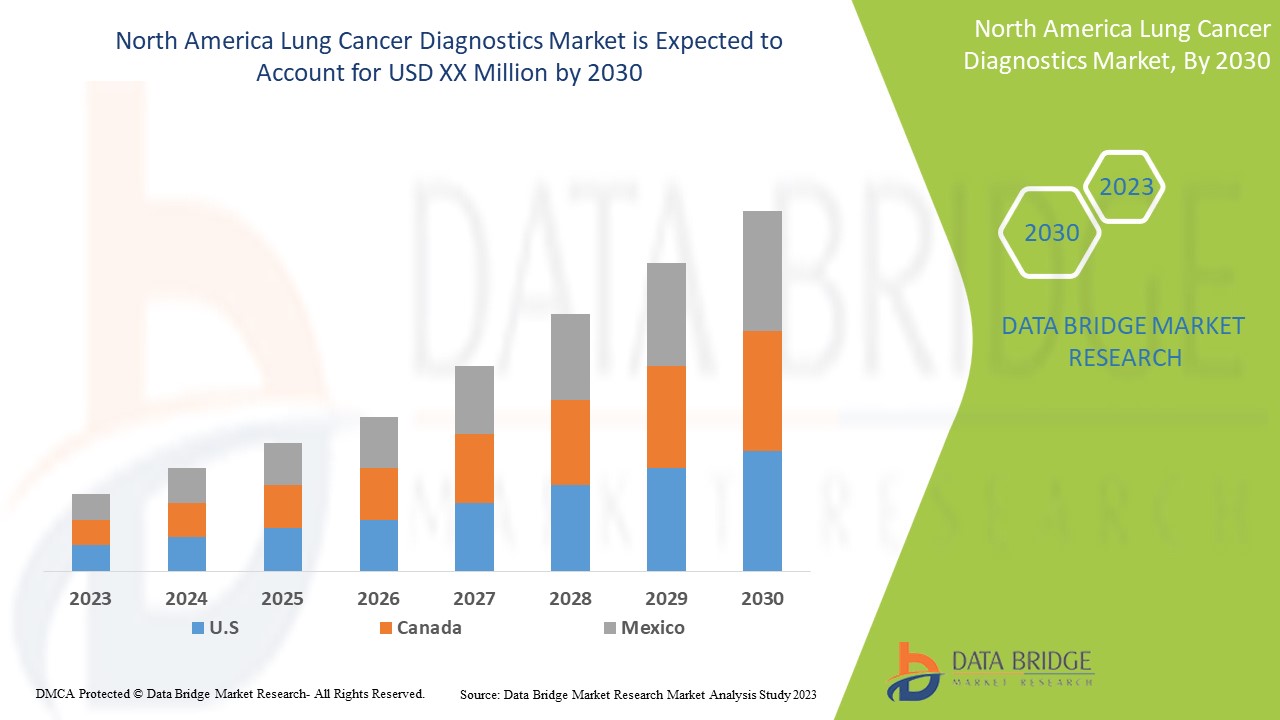

北米の肺がん診断市場は支持的であり、病気の進行を抑えることを目指しています。Data Bridge Market Research は、北米の肺がん診断市場は 2023 年から 2030 年の予測期間中に 14.6% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品タイプ(機器、消耗品、付属品)、検査タイプ(バイオマーカー検査、画像検査、生検、血液検査など)、がんの種類(非小細胞肺がん、小細胞肺がん)、エンドユーザー(病院、関連研究所、独立診断研究所、診断画像センター、がん研究機関など)、流通チャネル(直接入札、小売販売) |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

F. Hoffmann-La Roche Ltd.、Thermo Fisher Scientific Inc.、Abbott、Quest Diagnostics Incorporated、Biodesix、Amoy Diagnostics Co., Ltd.、Bio-Rad Laboratories, Inc.、Biocartis、Boditech Med Inc.、Danaher、Vela Diagnostics、DiaSorin SpA、Exact Sciences UK, Ltd. (Exact Science Corporation の子会社)、20/20 Gene Systems、Guardant Health, Inc.、Inivata Ltd.、LalPathLabs.com、LungLife AI, Inc.、MedGenome、Myriad Genetics, Inc.、NeoGenomics Laboratories、NanoString、Nanoentek、Oncocyte Corporation、PerkinElmer Inc.、PlexBio、QIAGEN、Siemens Healthcare GmbH、Veracyte, Inc. など |

市場の定義

がんは肺で発生し、喫煙者に最も多く発生します。肺がんの主な 2 つのタイプは、非小細胞肺がんと小細胞肺がんです。肺がんの原因には、喫煙、受動喫煙、特定の毒素への曝露、家族歴などがあります。

症状には、咳(血を伴うことが多い)、胸痛、喘鳴、体重減少などがあります。これらの症状は、がんが進行するまで現れないことがよくあります。治療法はさまざまですが、手術、化学療法、放射線療法、標的薬物療法、免疫療法などがあります。

北米の肺がん診断市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

- 肺がんの早期診断の増加

機械学習は、コンピューターに複雑なデータのパターンを見分けるトレーニングを行い、がんの早期診断に革命を起こす可能性があります。ツールには、一般的な健康データ、医療画像、生検サンプル、血液検査の評価などがあり、早期診断とリスク層別化に役立ちます。多くの腫瘍の種類では、がんの早期診断によって治療が成功する確率が高まります。重要な戦略の 1 つは、症状を示さないリスクのある患者を評価し、症状のある患者には迅速かつ適切に対応することです。

がんを早期に発見することで、がん治療が成功する確率が大幅に高まります。がんの早期発見には、スクリーニングと早期診断(またはダウンステージング)という 2 つの要素があります。スクリーニングは、症状が現れる前に健康な個人を評価してがん患者を見つけることですが、早期診断は症状のある患者を可能な限り早期に特定することに重点を置いています。

- 早期がんの検出は、偽陽性率が高く、感度が低いために制限されることが多い

The creation of non-invasive tests that can quickly and reliably identify whether and where in the body a person has early-stage cancer is one of the most promising areas of cancer prevention research. And not just one cancer but a variety of cancers. On this front, significant advancements have been made in recent years. Several multi-cancer early detection (MCED) tests are currently under development, and they are designed to screen for multiple cancer types in otherwise healthy individuals simultaneously. However, detecting early-stage cancer is a challenge as it comes with many barriers, such as high false positives or poor sensitivity. Many cases of poor diagnostics sensitivity lead to a patient's life at risk. The high false positives are also one of the causes of cancer advancing to late stages or advanced stages.

Thus, the detection of early-stage cancers is often limited by high false positives, and sometimes poor sensitivity may act as a major restraining factor for the growth of the North America lung cancer diagnostics market.

- Rise in healthcare expenditure for cancer diagnosis and treatment

Across the globe, research and development activities are escalating owing to the public health expenditure with economic performances. Whereas the healthcare industry ranks second among all industries when it comes to the amount spent on healthcare. Rising healthcare expenditure can result in better provision of research and development opportunities. It is anticipated to increase the demand for lung cancer diagnostics. Increasing the healthcare expenditure for cancer treatment also helps the patient take hassle-free advanced diagnostics and treatment for fast recovery. The spending on healthcare is made up of the combination of out-of-pocket payments (people paying for their care), government expenditure, and sources. It also includes health insurance and activities by non-governmental organizations. This increasing healthcare expenditure for cancer treatment is an opportunity to grow the market's demand.

- Lack of skilled and certified professionals

The requirement of skilled and certified professionals is a big restraint for cancer diagnostics. The demand for cancer diagnostic is increased due to increasing cases of cancer disease in the globe, but the fewer number of skilled professionals present in the diagnostic center is hampering the growth of the market.

The instruments, methods, and procedures of cancer diagnosis have been advanced, but there are certain gaps in standardization, equalization, and knowledge. Technicians face technical training gaps related to problems and adapt advanced methods safely to perform procedures efficiently. In cancer diagnostics, skilled professionals are highly needed for method development, validation, operation, and troubleshooting activities.

A cancer diagnosis is a dynamic component in today's complex time, providing patients with essential information for diagnosing, preventing, treating, and managing their cancer disease. The requirement for trained staff is a big issue for the North America lung cancer diagnostics market. Due to the lack of skilled and certified professionals, end users cannot install advanced products for a cancer diagnosis; this may challenge the growth of the North America lung cancer diagnostics market.

Post-COVID-19 Impact on North America Lung Cancer Diagnostics Market

The high burden of COVID-19 on healthcare systems around the world has raised concerns among medical oncologists about the impact of COVID-19 on lung cancer diagnosis and treatment. We investigated the impact of COVID-19 on lung cancer diagnosis and treatment before and after the COVID-19 era in this retrospective cohort study. During the pandemic, new lung cancer diagnoses decreased by 34.7% with slightly more advanced stages of the disease, and there was a significant increase in radiosurgery as the first definitive treatment and a decrease in systemic treatment and surgery compared to the pre-COVID-19 era. Compared to pre-COVID-19 times, there was no significant delay in starting chemotherapy and radiation treatment during the pandemic.

During the pandemic, however, we observed a delay in lung cancer surgery. COVID-19 appears to have significantly impacted lung cancer patients' diagnoses and treatment patterns at our lung cancer center. Many oncologists are concerned that the number of newly diagnosed lung cancer patients will rise in the coming year. This research is still ongoing, and more information will be gathered and analyzed to understand better the overall impact of the COVID-19 pandemic on our lung cancer patient population.

Recent Developments

- In October 2022, Quest Diagnostics announced a new chapter of the partnership with Decode Health. This partnership has aided the business in decreasing the time and expense involved in creating fresh diagnostic tests and finding new medication targets for various cancers and increased the company's North America presence

- In August 2022, F. Hoffmann-La Roche Ltd. announced the launch of a Digital LightCycler System, a next-generation digital PCR system that helps clinical researchers better understand the nature of a patient's cancer, genetic disease, or infection. This system is designed for laboratories performing highly sensitive and precise DNA and RNA analysis in oncology and infectious diseases

North America Lung Cancer Diagnostics Market Scope

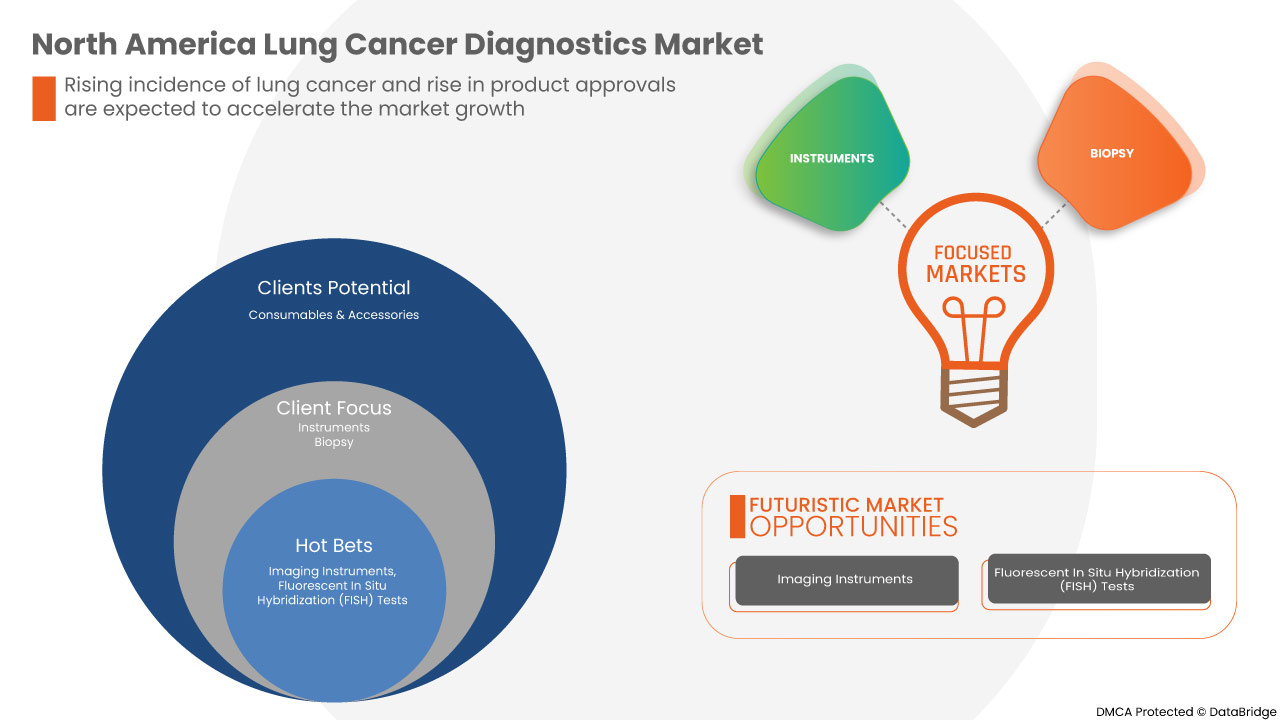

The North America lung cancer diagnostics market is categorized into five notable segments based on product type, test type, cancer type, end user, and distribution channel. The growth amongst these segments will help you analyse meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Instruments

- Consumables & Accessories

On the basis of product type, the North America lung cancer diagnostics market is segmented into instruments, consumables & accessories.

Test Type

- Biomarkers Tests

- Imaging Test

- Biopsy

- Blood Test

- Others

On the basis of test type, the North America lung cancer diagnostics market is segmented into imaging test, biomarkers test, biopsy, blood test, and others.

Cancer Type

- Non-Small Cell Lung Cancer

- Small Cell Lung Cancer

On the basis of cancer type, the North America lung cancer diagnostics market is segmented into non-small cell lung cancer and small cell lung cancer.

End User

- Hospital

- Associated Labs

- Independent Diagnostic Laboratories

- Diagnostic Imaging Centers

- Cancer Research Institutes

- Others

On the basis of end user, the North America lung cancer diagnostics market is segmented into hospital, associated labs, independent diagnostics laboratories, diagnostic imaging centers, cancer research institutes, and others.

Distribution Channel

- Direct Tender

- Retail Sales

On the basis of distribution channel, the North America lung cancer diagnostics market is segmented into direct tender and retail sales.

North America Lung Cancer Diagnostics Market Regional Analysis/Insights

The North America lung cancer diagnostics market is analyzed, and market size insights and trends are provided by country, product type, test type, cancer type, end user, and distribution channel, as referenced above.

Some countries covered in the North America lung cancer diagnostics market are the U.S., Canada, and Mexico.

The U.S. is expected to dominate the North America region due to exponential awareness of cancer diagnostics and consultancy services.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North American brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Lung Cancer Diagnostics Market Share Analysis

北米の肺がん診断市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、北米でのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、北米の肺がん診断市場への会社の焦点にのみ関連しています。

北米の肺がん診断市場のプレーヤーとしては、F. Hoffmann-La Roche Ltd.、Thermo Fisher Scientific Inc.、Abbott、Quest Diagnostics Incorporated、Biodesix、Amoy Diagnostics Co., Ltd.、Bio-Rad Laboratories, Inc.、Biocartis、Boditech Med Inc.、Danaher、Vela Diagnostics、DiaSorin SpA、Exact Sciences UK, Ltd. (Exact Science Corporation の子会社)、20/20 Gene Systems、Guardant Health, Inc.、Inivata Ltd.、LalPathLabs.com、LungLife AI, Inc.、MedGenome、Myriad Genetics, Inc.、NeoGenomics Laboratories、NanoString、Nanoentek、Oncocyte Corporation、PerkinElmer Inc.、PlexBio、QIAGEN、Siemens Healthcare GmbH、Veracyte, Inc. などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET TESTING TYPE COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDUSTRY INSIGHTS

5 EPIDERMIOLOGY

6 REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 UNMET NEED FOR NON-INVASIVE, ACCURATE, AND RELIABLE DIAGNOSTIC TESTS FOR EARLIER CANCER DETECTION

7.1.2 INCREASING EARLY DIAGNOSIS OF LUNGS CANCER

7.1.3 INCREASING CASES OF LUNG CANCER

7.1.4 RISE IN PRODUCT APPROVALS

7.2 RESTRAINTS

7.2.1 POOR & LATE DIAGNOSIS OF LUNG CANCER

7.2.2 HIGH FALSE-POSITIVES AND POOR SENSITIVITY

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE EXPENDITURE FOR CANCER DIAGNOSIS AND TREATMENT

7.3.2 GOVERNMENT INITIATIVES TOWARD CANCER DIAGNOSTICS

7.3.3 RISING AWARENESS OF LUNG CANCER

7.4 CHALLENGES

7.4.1 STRINGENT REGULATORY FRAMEWORK FOR THE APPROVAL AND COMMERCIALIZATION OF CANCER DIAGNOSTIC PRODUCTS

7.4.2 INCREASED COST, SAFETY, AND CONVENIENCE ISSUES

7.4.3 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 IMAGING INSTRUMENTS

8.2.1.1 CT SYSTEMS

8.2.1.2 ULTRASOUND SYSTEMS

8.2.1.3 MRI SYSTEMS

8.2.1.4 OTHERS

8.2.2 BIOPSY INSTRUMENTS

8.2.2.1 NEEDLE BIOPSY

8.2.2.2 ENDOSCOPIC BIOPSY

8.2.2.3 CORE BIOPSY

8.2.2.4 OTHERS

8.2.3 PATHOLOGY-BASED INSTRUMENTS

8.2.3.1 SLIDE STAINING SYSTEMS

8.2.3.2 TISSUE PROCESSING SYSTEMS

8.2.3.3 CELL PROCESSORS

8.2.3.4 PCR INSTRUMENTS

8.2.3.5 OTHERS PATHOLOGY-BASED INSTRUMENTS

8.3 CONSUMABLES AND ACCESSORIES

8.3.1 KITS

8.3.1.1 DNA POLYMERASE KITS

8.3.1.2 NUCLEIC ACID ISOLATION KITS

8.3.1.3 PCR KITS

8.3.1.4 OTHERS

8.3.2 REAGENTS

8.3.2.1 ASSAYS

8.3.2.2 BUFFERS

8.3.2.3 PRIMERS

8.3.2.4 OTHERS

8.3.3 PROBES

8.3.4 OTHER CONSUMABLES

9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE

9.1 OVERVIEW

9.2 IMAGING TEST

9.2.1 COMPUTED TOMOGRAPHY (CT) SCAN

9.2.2 POSITRON EMISSION TOMOGRAPHY (PET) SCAN

9.2.3 CHEST X-RAY

9.2.4 BONE SCAN

9.2.5 MRI

9.2.6 OTHERS

9.3 BIOMARKERS TEST

9.3.1 EGFR MUTATION TEST

9.3.2 KRAS MUTATION TEST

9.3.3 ALK TEST

9.3.4 HER2 TEST

9.3.5 OTHERS

9.4 BIOPSY

9.4.1 NEEDLE BIOPSY

9.4.2 BRONCHOSCOPY BIOPSY

9.4.3 CORE BIOPSY

9.4.4 OTHERS

9.5 BLOOD TEST

9.5.1 COMPLETE BLOOD COUNT (CBC)

9.5.2 BLOOD CHEMISTRY TESTS

9.5.3 OTHERS

9.6 OTHERS

10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE

10.1 OVERVIEW

10.2 NON-SMALL CELL LUNG CANCER

10.3 SMALL CELL LUNG CANCER

11 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.3 ASSOCIATED LABS

11.4 INDEPENDENT DIAGNOSTIC LABORATORIES

11.5 DIAGNOSTIC IMAGING CENTERS

11.6 CANCER RESEARCH INSTITUTES

11.7 OTHERS

12 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 F. HOFFMANN-LA ROCHE LTD. (2022)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 THERMO FISHER SCIENTIFIC INC. (2022)

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 ABBOTT (2022)

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 QUEST DIAGNOSTICS INCORPORATED (2022)

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 BIODESIX (2022)

16.5.1 COMPANY PROFILE

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMOY DIAGNOSTICS CO., LTD. (2022)

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 BIO-RAD LABORATORIES, INC. (2022)

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOCARTIS (2022)

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 BODITECH MED INC.

16.9.1 COMPANY PROFILE

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 DANAHER (2022)

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 DIASORIN S.P.A. (2022)

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 EXACT SCIENCES UK, LTD. (SUBSIDIARY OF EXACT SCIENCE CORPORATION) (2022)

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 20/20 GENE SYSTEMS

16.13.1 COMPANY PROFILE

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 GUARDANT HEALTH INC.

16.14.1 COMPANY PROFILE

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENTS

16.15 INIVATA LTD.

16.15.1 COMPANY PROFILE

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENTS

16.16 LALPATHLABS.COM (2022)

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 LUNGLIFE AI, INC. (2022)

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 MEDGENOME

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MYRIAD GENETICS, INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 NEOGENOMICS LABORATORIES (2022)

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 NANOSTRING (2022)

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

16.22 NANOENTEK

16.22.1 COMPANY PROFILE

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 ONCOCYTE CORPORATION

16.23.1 COMPANY PROFILE

16.23.2 SERVICE PORTFOLIO

16.23.3 RECENT DEVELOPMENTS

16.24 PERKINELMER INC

16.24.1 COMPANY PROFILE

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENTS

16.25 PLEXBIO

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 QIAGEN

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT DEVELOPMENTS

16.27 SIEMENS HEALTHCARE GMBH

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 PRODUCT PORTFOLIO

16.27.4 RECENT DEVELOPMENTS

16.28 VERACYTE, INC. (2022)

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 PRODUCT PORTFOLIO

16.28.4 RECENT DEVELOPMENTS

16.29 VELA DIAGNOSTICS

16.29.1 COMPANY PROFILE

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 DIFFERENT TYPES OF CANCER SCREENING TESTS FOR DIFFERENT TYPES OF CANCERS

TABLE 2 LUNG CANCER RATES

TABLE 3 APPROVED DIAGNOSTICS OF LUNGS CANCER

TABLE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA CONSUMABLES & ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA NON-SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA SMALL CELL LUNG CANCER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HOSPITAL IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA ASSOCIATED LABS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA INDEPENDENT DIAGNOSTIC LABORATORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA DIAGNOSTIC IMAGING CENTERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA CANCER RESEARCH INSTITUTES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA OTHERS IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA DIRECT TENDER IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA RETAIL SALES IN LUNG CANCER DIAGNOSTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 53 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 U.S. IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 U.S. BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 U.S. CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 U.S. KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 U.S. REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 62 U.S. BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 63 U.S. IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 64 U.S. BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 65 U.S. BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 66 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 67 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 68 U.S. LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 69 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 CANADA INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 71 CANADA PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 72 CANADA IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 CANADA BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 74 CANADA CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 75 CANADA KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 CANADA REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 78 CANADA BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 79 CANADA IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 80 CANADA BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 81 CANADA BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 82 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 83 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 84 CANADA LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 85 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 86 MEXICO INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO PATHOLOGY-BASED INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO IMAGING INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 89 MEXICO BIOPSY INSTRUMENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 90 MEXICO CONSUMABLES AND ACCESSORIES IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 91 MEXICO KITS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 MEXICO REAGENTS IN LUNG CANCER DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 94 MEXICO BIOMARKERS TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 95 MEXICO IMAGING TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 96 MEXICO BIOPSY IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO BLOOD TEST IN LUNG CANCER DIAGNOSTICS MARKET, BY TEST TYPE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY CANCER TYPE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 100 MEXICO LUNG CANCER DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA LUNGS CANCER DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA LUNG CANCER DIAGNOSTIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN THE AWARENESS ABOUT LUNG CANCER IS EXPECTED TO DRIVE THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 INSTRUMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET

FIGURE 14 THE NORTH AMERICA MORTALITY RATE DUE TO CANCER

FIGURE 15 THE DATA GIVEN BELOW SHOWS THE INCREASING NORTH AMERICA CANCER RATE IN 2020

FIGURE 16 BARRIERS TO EARLY CANCER DIAGNOSIS AND TREATMENT

FIGURE 17 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022

FIGURE 18 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 19 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 20 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2022

FIGURE 22 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, 2023-2030 (USD MILLION)

FIGURE 23 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, CAGR (2023-2030)

FIGURE 24 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY TEST TYPE, LIFELINE CURVE

FIGURE 25 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2022

FIGURE 26 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, 2023-2030 (USD MILLION)

FIGURE 27 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, CAGR (2023-2030)

FIGURE 28 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY CANCER TYPE, LIFELINE CURVE

FIGURE 29 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2022

FIGURE 30 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 31 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 32 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 34 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 35 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 36 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: SNAPSHOT (2022)

FIGURE 38 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022)

FIGURE 39 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 41 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 42 NORTH AMERICA LUNG CANCER DIAGNOSTICS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。