北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場

Market Size in USD Billion

CAGR :

%

USD

9,596.92 Million

USD

3.27 Million

2022

2029

USD

9,596.92 Million

USD

3.27 Million

2022

2029

| 2023 –2029 | |

| USD 9,596.92 Million | |

| USD 3.27 Million | |

|

|

|

|

北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場、製品別(血管形成術用バルーン、ステント、カテーテル、血管内動脈瘤修復用ステントグラフト、下大静脈(IVC)フィルター、プラーク修正デバイス、付属品、血行動態血流調整デバイス)、タイプ別(従来型および標準型)、手順別(腸骨動脈インターベンション、大腿膝窩動脈インターベンション、脛骨(膝下)インターベンション、末梢血管形成術、動脈血栓摘出術および末梢アテローム切除術)、適応症別(末梢動脈疾患および冠動脈インターベンション)、年齢層別(高齢者、成人および小児)、エンドユーザー別(病院、外来手術センター、介護施設、クリニックなど)、流通チャネル別(直接入札、サードパーティ販売業者など)、国別(米国、カナダ、メキシコ)業界動向と2029年までの予測

市場分析と洞察:北米のインターベンショナルカーディオロジーおよび末梢血管デバイス市場

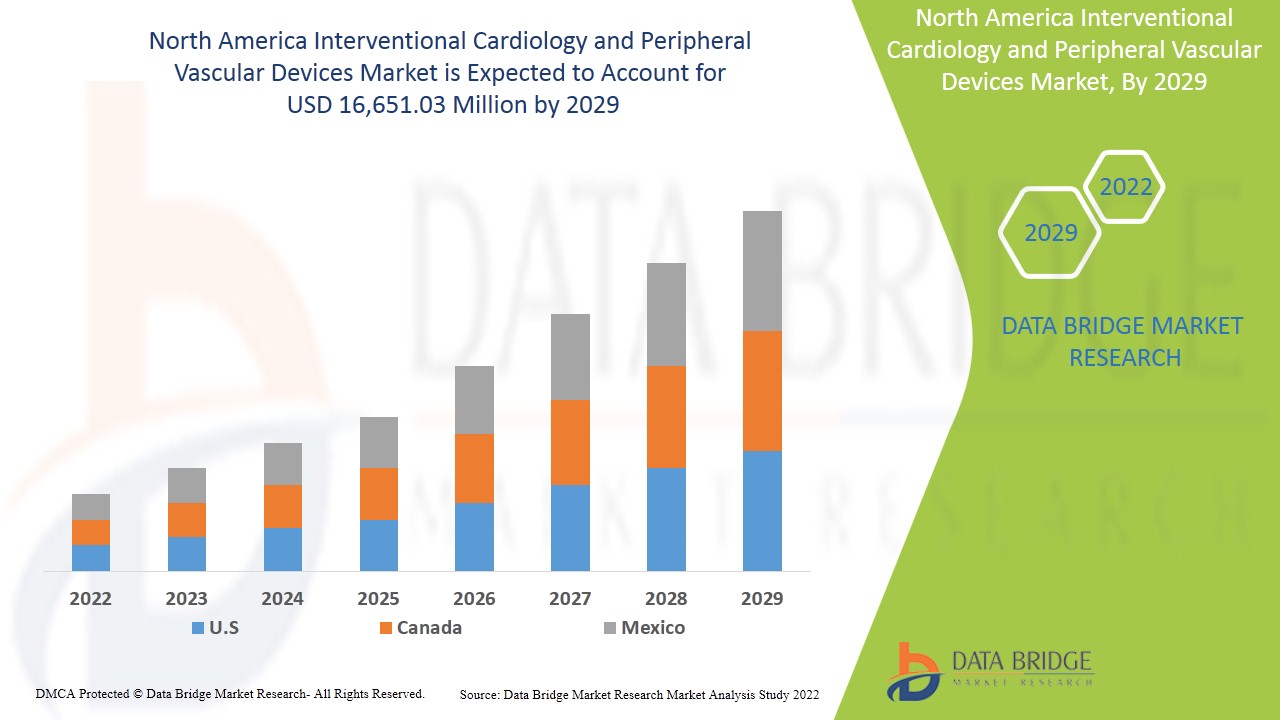

北米のインターベンショナルカーディオロジーおよび末梢血管デバイス市場は、2022年から2029年の予測期間に市場成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に7.7%のCAGRで成長し、2021年の95億9,692万米ドルから2029年には166億5,103万米ドルに達すると分析しています。冠動脈疾患、虚血性心疾患、血管疾患の罹患率の増加、タイムリーな治療とデバイスの使用に関する意識の高まりが、予測期間における市場の需要を押し上げる主な原動力となると考えられます。

インターベンショナル・カーディオロジーとは、心臓病学および末梢血管デバイスという専門分野に属する医学の一分野であり、強化診断技術、従来診断技術、先進診断技術、その他の診断技術を用いて冠動脈および心室内の血流と血圧を評価するとともに、心血管系の機能を阻害する異常を治療するための技術的処置や薬剤を使用します。インターベンショナル・カーディオロジーおよび末梢血管デバイスは、これらのデバイスが運動不足の生活習慣に変化をもたらすことから利用されています。冠動脈疾患、虚血性心疾患、血管疾患などの慢性心疾患の合併症を軽減します。

冠動脈疾患は女性の死亡原因の第1位です。心臓血管疾患に関する知識は、健康的なライフスタイルにつながります。症状とその危険因子に関する適切な認識は、修正可能な危険因子への曝露を減らし、予防・管理戦略に貢献する可能性があります。心血管疾患の症状に関する認識は、適切なタイミングでの治療につながります。

北米におけるインターベンショナル・カーディオロジーおよび末梢血管デバイス市場の成長を牽引する要因としては、冠動脈疾患、虚血性心疾患、血管疾患の罹患率の上昇、デバイスの適切な治療と使用に関する意識の高まり、心臓病および末梢血管デバイスにおける技術の進歩、非侵襲性手術への関心の高まり、そして有利な償還政策などが挙げられます。一方、市場の成長を抑制する要因としては、デバイス価格の上昇、デバイス使用時に観察されるリスク、製品リコールの増加、そして代替治療法の利用可能性などが挙げられます。一方で、市場プレーヤーによる戦略的取り組み、医療費の増加と研究開発活動の活発化、そして高齢化人口の増加は、北米におけるインターベンショナル・カーディオロジーおよび末梢血管デバイス市場の成長機会となる可能性があります。熟練した専門知識の必要性、病院インフラの不足、そして規制当局の承認といった点が、北米におけるインターベンショナル・カーディオロジーおよび末梢血管デバイス市場にとって課題となる可能性があります。

北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場レポートでは、市場シェア、新規開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響に関する詳細な情報に加え、新たな収益源、市場規制の変更、製品承認、戦略的意思決定、製品発売、地理的拡大、市場における技術革新といった機会分析を提供しています。分析と市場シナリオを理解するには、アナリストブリーフをご請求ください。当社のチームが、お客様の目標達成に向けた収益インパクトソリューションの構築をお手伝いいたします。

北米のインターベンショナルカーディオロジーおよび末梢血管デバイス市場の範囲と市場規模

北米のインターベンショナル心臓病学および末梢血管デバイス市場は、製品、タイプ、手順、適応症、年齢層、エンドユーザー、流通チャネルの 7 つのセグメントに分類されます。

- 製品別に見ると、北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場は、血管形成術用バルーン、ステント、カテーテル、血管内動脈瘤修復用ステントグラフト、下大静脈(IVC)フィルター、プラーク除去デバイス、付属品、血行動態血流調節デバイスに分類されます。2022年には、末梢動脈疾患の症例増加、運動不足によるリスク増加、血管形成術用バルーンの技術進歩、そして米国における心疾患治療に対する医療費償還制度の存在により、血管形成術用バルーンセグメントが北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場を席巻すると予想されます。

- 北米のインターベンション・カーディオロジーおよび末梢血管デバイス市場は、種類別に従来型と標準型に分類されます。2022年には、冠動脈疾患や頸動脈疾患といった心血管疾患の罹患率の上昇、そして米国およびカナダの病院に勤務する医師や心臓専門医による従来型のインターベンション・カーディオロジーおよび末梢血管デバイスの利用可能性と選好により、従来型セグメントが北米のインターベンション・カーディオロジーおよび末梢血管デバイス市場の大部分を占めると予想されます。

- 北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場は、手技に基づいて、腸骨インターベンション、大腿膝窩動脈インターベンション、脛骨(膝下)インターベンション、末梢血管形成術、動脈血栓除去術、末梢アテローム切除術に分類されます。過去10年間の高度な末梢血管形成術デバイスの技術進歩により、2022年には、末梢血管形成術セグメントが北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場の大部分を占めると予想されます。

- 北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場は、適応症に基づいて、末梢動脈疾患と冠動脈インターベンションに分類されます。2022年には、末梢動脈疾患の増加、高齢者人口の増加、製品承認の増加により、末梢動脈疾患セグメントが北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場の大部分を占めると予想されます。

- 北米のインターベンション心臓病および末梢血管デバイス市場は、年齢層別に高齢者、成人、小児に分類されています。2022年には、高齢者セグメントが北米のインターベンション心臓病および末梢血管デバイス市場の大部分を占めると予想されています。高齢者は、様々な血管疾患に対する免疫力が低いことに加え、米国では高齢者を最低費用で治療するためのメディケアなどの償還制度が利用可能であることから、より脆弱です。

- 北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場は、エンドユーザー別に、病院、外来手術センター、介護施設、クリニック、その他に分類されます。2022年には、冠動脈疾患や血管疾患などの慢性心疾患の増加、手術件数の増加、高度な病院設備の普及、そして病院における慢性心疾患治療への意識の高まりにより、病院セグメントが北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場を牽引すると予想されます。

- 流通チャネルに基づいて、北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場は、直接入札、サードパーティ販売業者、その他に分類されます。2022年には、顧客志向の高まり、調達価格の低下、そしてコスト削減の減少により、サードパーティ販売業者セグメントが北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場を独占すると予想されます。

北米のインターベンション心臓病学および末梢血管デバイス市場の国別分析

北米のインターベンショナル心臓病学および末梢血管デバイス市場が分析され、製品、タイプ、手順、適応症、年齢層、エンドユーザー、流通チャネル別に市場規模の情報が提供されます。

北米のインターベンショナル心臓病学および末梢血管デバイス市場レポートで取り上げられている国は、米国、カナダ、メキシコです。

- 2022年には、高いGDPを誇る世界最大の消費者市場を持つ米国が、市場を席巻すると予想されています。さらに、米国は世界最大の家計支出を誇り、複数の国と貿易協定を締結していることから、消費財市場として最大の市場となっています。患者数の増加、大手市場プレーヤーの存在、そして地域における技術進歩の加速も、米国を牽引する要因となっています。

本レポートの国別セクションでは、市場の現在および将来の動向に影響を与える、各国の市場に影響を与える要因や国内市場における規制の変更についても解説しています。新規販売台数、交換販売台数、国の人口動態、規制法、輸出入関税といったデータは、各国の市場シナリオを予測する上で主要な指標として活用されています。また、北米ブランドのプレゼンスと入手可能性、そして現地ブランドや国内ブランドとの競争の激しさや希少性によって直面する課題、販売チャネルの影響についても、国別データの予測分析において考慮されています。

新興経済国におけるインターベンション心臓学および末梢血管デバイスの成長ポテンシャルと市場プレーヤーによる戦略的取り組みは、北米のインターベンション心臓学および末梢血管デバイス市場に新たな機会を生み出しています。

北米のインターベンション・カーディオロジーおよび末梢血管デバイス市場は、各国における特定の業界におけるインターベンション・カーディオロジーおよび末梢血管デバイスの売上成長、インターベンション・カーディオロジーおよび末梢血管デバイスの進歩の影響、そしてインターベンション・カーディオロジーおよび末梢血管デバイス市場を支援する規制状況の変化など、詳細な市場分析を提供します。データは2019年から2021年までの履歴期間で入手可能です。

競争環境と北米のインターベンショナルカーディオロジーおよび末梢血管デバイス市場シェア分析

北米のインターベンショナル・カーディオロジーおよび末梢血管デバイス市場の競争環境は、競合他社ごとに詳細な情報を提供しています。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、生産拠点・設備、強みと弱み、製品発売、製品試験パイプライン、製品承認、特許、製品ラインナップの幅広さ、アプリケーションの優位性、技術ライフラインカーブなどの詳細が含まれています。上記のデータは、インターベンショナル・カーディオロジーおよび末梢血管デバイス市場における企業の注力分野にのみ関連しています。

インターベンショナル心臓病学および末梢血管デバイスを提供している大手企業としては、メドトロニック、BD、コーディス、アボット、ボストン・サイエンティフィック・コーポレーション、クック、カーディオバスキュラー・システムズ社、アンジオダイナミクス、エドワーズ・ライフサイエンス社、バイオセンサーズ・インターナショナル・グループ社、オーバスネイチ・メディカル・カンパニー・リミテッド、メリット・メディカル・システムズ、テルモ・メディカル・コーポレーション、B. ブラウン・メルスンゲン AG、マイクロポート・サイエンティフィック・コーポレーション、レプ・メディカル・テクノロジー(北京)有限公司、コーニンクレッカ・フィリップスNVなどが挙げられます。

DBMR アナリストは競争上の強みを理解し、競合他社ごとに競合分析を提供します。

市場プレーヤーによる戦略的取り組みと北米のインターベンション心臓学および末梢血管デバイスの新しい技術進歩により、慢性創傷治療のギャップが埋められています。

例えば、

- 2022年1月、オーバスネイチ・メディカル株式会社は、新製品「Scoreflex NC」を発売し、米国食品医薬品局(FDA)より市販前承認(PMA)を取得したと発表しました。本製品は、冠動脈狭窄部の拡張カテーテルとして用いることを目的としたカテーテルであり、これにより同社の製品群が市場拡大に貢献します。

市場プレーヤーによるコラボレーション、ジョイントベンチャー、その他の戦略により、インターベンション心臓病学および末梢血管デバイス市場における企業市場が強化され、組織が北米のインターベンション心臓病学および末梢血管デバイス市場への提供を改善するメリットももたらされます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 THE RISE IN PREVALENCE OF CHRONIC DISEASES, SUCH AS CORONARY ARTERY DISEASE, ISCHEMIC HEART DISEASE AND VASCULAR DISEASES

6.1.2 AWARENESS AMONG THE POPULATION ABOUT THE TREATMENT AND USE OF THE DEVICES

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.1.4 FAVORABLE REIMBURSEMENT POLICIES

6.1.5 INCREASED INTEREST FOR MINIMALLY INVASIVE PROCEDURES

6.2 RESTRAINTS

6.2.1 RISE IN COST OF THE CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.2 RISKS OBSERVED WHILE USING INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES

6.2.3 RISE IN PRODUCT RECALL

6.2.4 AVAILABILITY OF ALTERNATE TREATMENTS

6.3 OPPORTUNITIES

6.3.1 GROWING GERIATRIC POPULATION

6.3.2 RISING HEALTHCARE EXPENDITURE

6.3.3 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.3.4 INCREASING RESEARCH AND DEVELOPMENT ACTIVITIES

6.4 CHALLENGES

6.4.1 STRINGENT RULES & REGULATIONS

6.4.2 LACK OF HOSPITAL INFRASTRUCTURE

7 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

7.1 PRICE IMPACT

7.2 IMPACT ON DEMAND

7.3 IMPACT ON SUPPLY CHAIN

7.4 STRATEGIC DECISIONS FOR MANUFACTURERS/ SERVICE PROVIDERS

7.5 CONCLUSION

8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ANGIOPLASTY BALLOONS

8.2.1 OLD/NORMAL BALLOONS

8.2.2 DRUG ELUTING BALLOONS

8.2.3 CUTTING AND SCORING BALLOONS

8.3 STENT

8.3.1 ANGIOPLASTY STENTS

8.3.2 CORONARY STENTS

8.3.2.1 BARE-METAL STENTS

8.3.2.2 DRUG-ELUTING STENTS (DES)

8.3.2.3 BIO ABSORBABLE STENTS

8.3.3 PERIPHERAL STENTS

8.3.4 OTHERS

8.4 CATHETERS

8.4.1 ANGIOGRAPHY CATHETERS

8.4.2 GUIDING CATHETERS

8.4.3 OTHERS

8.5 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

8.5.1 ABDOMINAL AORTIC ANEURYSM

8.5.2 THORACIC AORTIC ANEURYSM

8.6 INFERIOR VENA CAVA (IVC) FILTERS

8.6.1 RETRIEVABLE FILTERS

8.6.2 PERMANENT FILTERS

8.7 PLAQUE MODIFICATION DEVICES

8.7.1 THROMBECTOMY DEVICES

8.7.2 ATHERECTOMY DEVICES

8.8 HEMODYNAMIC FLOW ALTERATION DEVICES

8.8.1 EMBOLIC PROTECTION DEVICES

8.8.2 CHRONIC TOTAL OCCLUSION DEVICES

8.9 OTHERS AND ACCESSORIES

8.9.1 GUIDEWIRES

8.9.2 INTRODUCER SHEATHS

8.9.3 BALLOON INFLATION DEVICES

8.9.4 VASCULAR CLOSURE DEVICES

8.9.5 OTHERS

9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CONVENTIONAL

9.2.1 STENTS

9.2.2 CATHETERS

9.2.3 GUIDEWIRES

9.2.4 VASCULAR CLOSURE DEVICES (VCD)

9.2.5 OTHERS

9.3 ADVANCED

9.3.1 BALLOON CATHETERS

9.3.2 STENT GRAFTS

10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 PERIPHERAL ANGIOPLASTY

10.2.1 ANGIOPLASTY BALLOONS

10.2.2 STENT

10.2.3 CATHETERS

10.2.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.2.5 INFERIOR VENA CAVA (IVC) FILTERS

10.2.6 PLAQUE MODIFICATION DEVICES

10.2.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.2.8 OTHERS AND ACCESSORIES

10.3 ILIAC INTERVENTION

10.3.1 ANGIOPLASTY BALLOONS

10.3.2 STENT

10.3.3 CATHETERS

10.3.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.3.5 INFERIOR VENA CAVA (IVC) FILTERS

10.3.6 PLAQUE MODIFICATION DEVICES

10.3.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.3.8 OTHERS AND ACCESSORIES

10.4 TIBIAL (BELOW-THE-KNEE) INTERVENTIONS

10.4.1 ANGIOPLASTY BALLOONS

10.4.2 STENT

10.4.3 CATHETERS

10.4.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.4.5 INFERIOR VENA CAVA (IVC) FILTERS

10.4.6 PLAQUE MODIFICATION DEVICES

10.4.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.4.8 OTHERS AND ACCESSORIES

10.5 ARTERIAL THROMBECTOMY

10.5.1 ANGIOPLASTY BALLOONS

10.5.2 STENT

10.5.3 CATHETERS

10.5.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.5.5 INFERIOR VENA CAVA (IVC) FILTERS

10.5.6 PLAQUE MODIFICATION DEVICES

10.5.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.5.8 OTHERS AND ACCESSORIES

10.6 PERIPHERAL ATHERECTOMY

10.6.1 ANGIOPLASTY BALLOONS

10.6.2 STENT

10.6.3 CATHETERS

10.6.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.6.5 INFERIOR VENA CAVA (IVC) FILTERS

10.6.6 PLAQUE MODIFICATION DEVICES

10.6.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.6.8 OTHERS AND ACCESSORIES

10.7 FEMOROPOPLITEAL INTERVENTIONS

10.7.1 ANGIOPLASTY BALLOONS

10.7.2 STENT

10.7.3 CATHETERS

10.7.4 ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS

10.7.5 INFERIOR VENA CAVA (IVC) FILTERS

10.7.6 PLAQUE MODIFICATION DEVICES

10.7.7 HEMODYNAMIC FLOW ALTERATION DEVICES

10.7.8 OTHERS AND ACCESSORIES

11 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION

11.1 OVERVIEW

11.2 PERIPHERAL ARTERIAL DISEASE

11.2.1 ATHEROSCLEROSIS

11.2.2 ABDOMINAL AORTIC ANEURYSM

11.2.3 LOWER EXTREMITY PERIPHERAL ARTERIAL DISEASE

11.2.4 SUPRA-INGUINAL ARTERIAL DISEASE

11.2.5 INFRA-INGUINAL ARTERIAL DISEASE

11.2.6 INFRA-POPLITEAL DISEASE

11.2.7 UPPER EXTREMITY OCCLUSIVE DISEASE

11.2.8 CAROTID ARTERY DISEASE

11.2.9 OTHERS

11.3 CORONARY INTERVENTION

11.3.1 ISCHEMIC HEART DISEASE

11.3.2 THORACIC AORTIC ANEURYSM

11.3.3 VALVE DISEASE

11.3.4 PERCUTANEOUS VALVE REPAIR OR REPLACEMENT

11.3.5 CONGENITAL HEART ABNORMALITIES

11.3.6 OTHERS

12 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULTS

12.4 PEDIATRIC

13 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.2.1 PRIVATE

13.2.2 PUBLIC

13.3 AMBULATORY SURGICAL CENTERS

13.4 NURSING FACILITIES

13.5 CLINICS

13.6 OTHERS

14 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY DISTRIBUTORS

14.3 DIRECT TENDER

14.4 OTHERS

15 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 BOSTON SCIENTIFIC CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENT

18.1.6 ACQUSITION

18.2 CORDIS.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.2.6 PRODUCT LAUNCHES

18.3 ABBOTT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.3.6 PRODUCT LAUNCHES

18.4 BD (2021)

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENT

18.5 TERUMO CORPORATION

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.5.6 PARTNERSHIP

18.5.7 PRODUCT LAUNCH

18.6 ANGIODYNAMICS.(2021)

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENTS

18.7 B. BRAUN MELSUNGEN AG (2021)

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 BIOSENSORS INTERNATIONAL GROUP, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 CARDIOVASCULAR SYSTEMS, INC. (2021)

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 COOK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.10.4 EXPANSION

18.10.5 PRODUCT LAUNCHES

18.11 EDWARDS LIFESCIENCES CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENTS

18.12 KONINKLIJKE PHILIPS N.V.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.12.5 PRODUCT UPDATES

18.13 LEPU MEDICAL TECHNOLOGY (BEIJING) CO., LTD. (2021)

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 MEDTRONIC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.14.5 COLLABORATION

18.14.6 PRODUCT LAUNCH

18.15 MERIT MEDICAL SYSTEM

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 MICROPORT SCIENTIFIC CORPORATION.

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

18.16.4.1 PRODUCT APPROVALS

18.17 ORBUSNEICH MEDICAL COMPANY LIMITED

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.17.4 PRODUCT LAUNCH

18.18 SMT

18.18.1 COMPANY SNAPSHOT

18.18.2 PRODUCT PORTFOLIO

18.18.3 RECENT DEVELOPMENTS

18.19 TELEFLEX INCORPORATED.

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.19.5 ACQUISITIONS

18.2 W. L. GORE & ASSOCIATES, INC.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STENT IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CATHETERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA OTHER AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA PERIPHERAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GERIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA ADULTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PEDIATRIC IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA NURSING FACILITIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CLINICS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA DIRECT TENDER IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA OTHERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 85 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 U.S. CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 U.S. ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 91 U.S. INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 U.S. PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 U.S. HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 94 U.S. OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 95 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 U.S. CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 99 U.S. ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 100 U.S. FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 102 U.S. PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 103 U.S. ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 104 U.S. PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 105 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 106 U.S. PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 107 U.S. CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 108 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 109 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 110 U.S. HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 U.S. INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 113 CANADA ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 CANADA STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 CANADA CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 CANADA ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 CANADA INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 CANADA PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 CANADA HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 CANADA OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 CANADA CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 CANADA ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 126 CANADA ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 127 CANADA FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 128 CANADA TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 129 CANADA PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 130 CANADA ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 131 CANADA PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 132 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 133 CANADA PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 134 CANADA CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 135 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 136 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 137 CANADA HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 CANADA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 139 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 MEXICO ANGIOPLASTY BALLOONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 MEXICO STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 142 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 143 MEXICO CORONARY STENTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 144 MEXICO ENDOVASCULAR ANEURYSM REPAIR STENT GRAFTS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 145 MEXICO INFERIOR VENA CAVA (IVC) FILTERS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 MEXICO PLAQUE MODIFICATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 MEXICO HEMODYNAMIC FLOW ALTERATION DEVICES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 MEXICO OTHERS AND ACCESSORIES IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 MEXICO CONVENTIONAL IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO ADVANCED IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 152 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 153 MEXICO ILIAC INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO FEMOROPOPLITEAL INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TIBIAL (BELOW-THE-KNEE) INTERVENTIONS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 156 MEXICO PERIPHERAL ANGIOPLASTY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 157 MEXICO ARTERIAL THROMBECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PERIPHERAL ATHERECTOMY IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 159 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 160 MEXICO PERIPHERAL ARTERIAL DISEASE IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 161 MEXICO CORONARY INTERVENTION IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY INDICATION, 2020-2029 (USD MILLION)

TABLE 162 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 163 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 MEXICO HOSPITALS IN INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 MEXICO INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASED PREVALENCE OF CHRONIC CARDIAC DISEASES, RISE IN TECHNOLOGICAL ADVANCEMENTS IN NON-INVASIVE SURGERIES AND PRODUCT APPPROVALS IS EXPECTED TO DRIVE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 TO 2029

FIGURE 13 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET FROM 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET

FIGURE 15 NORTH AMERICA PREVALENCE AND DISABILITY RATE OF ISCHEMIC HEART DISEASE (IHD) IN 2021

FIGURE 16 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2021

FIGURE 25 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PROCEDURE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2021

FIGURE 29 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY INDICATION, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 33 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2021

FIGURE 37 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 47 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: BY PRODUCT (2021-2029)

FIGURE 49 NORTH AMERICA INTERVENTIONAL CARDIOLOGY AND PERIPHERAL VASCULAR DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。