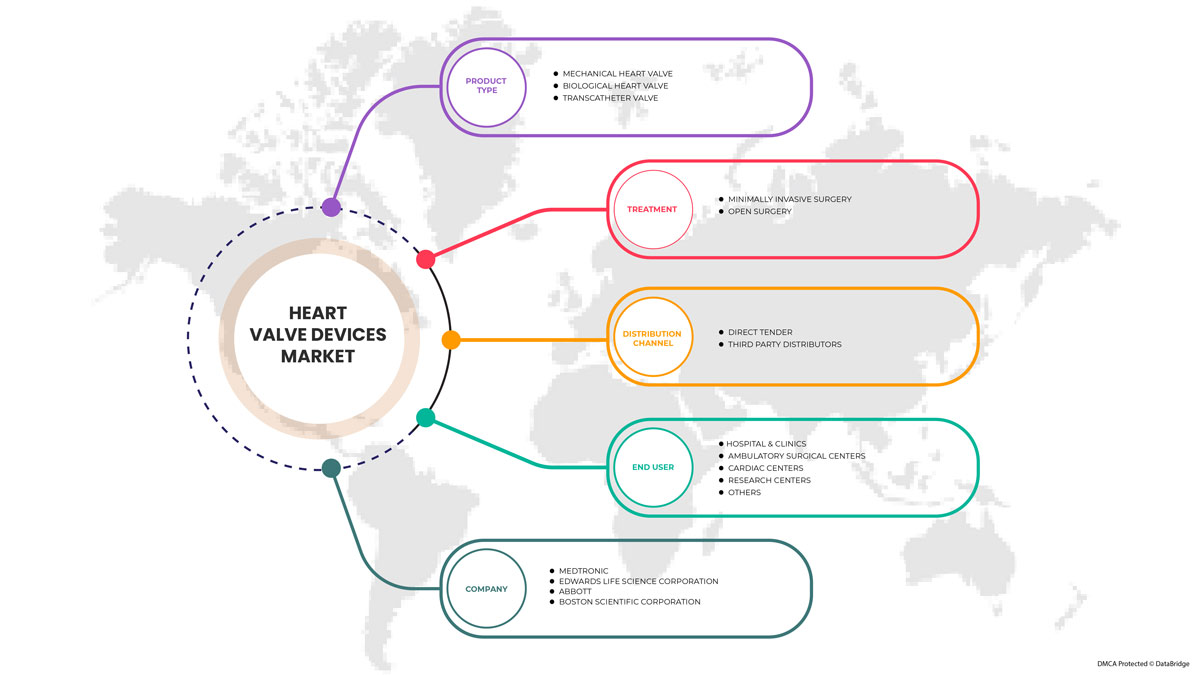

北米の心臓弁デバイス市場、製品タイプ別(機械式心臓弁、生物学的心臓弁、経カテーテル弁)、治療(開腹手術および低侵襲手術(MIS))、エンドユーザー別(病院および診療所、外来手術センター、心臓センター、研究センターなど)、流通チャネル別(直接入札、サードパーティ販売業者)の業界動向および2030年までの予測。

北米心臓弁デバイス市場の分析と洞察

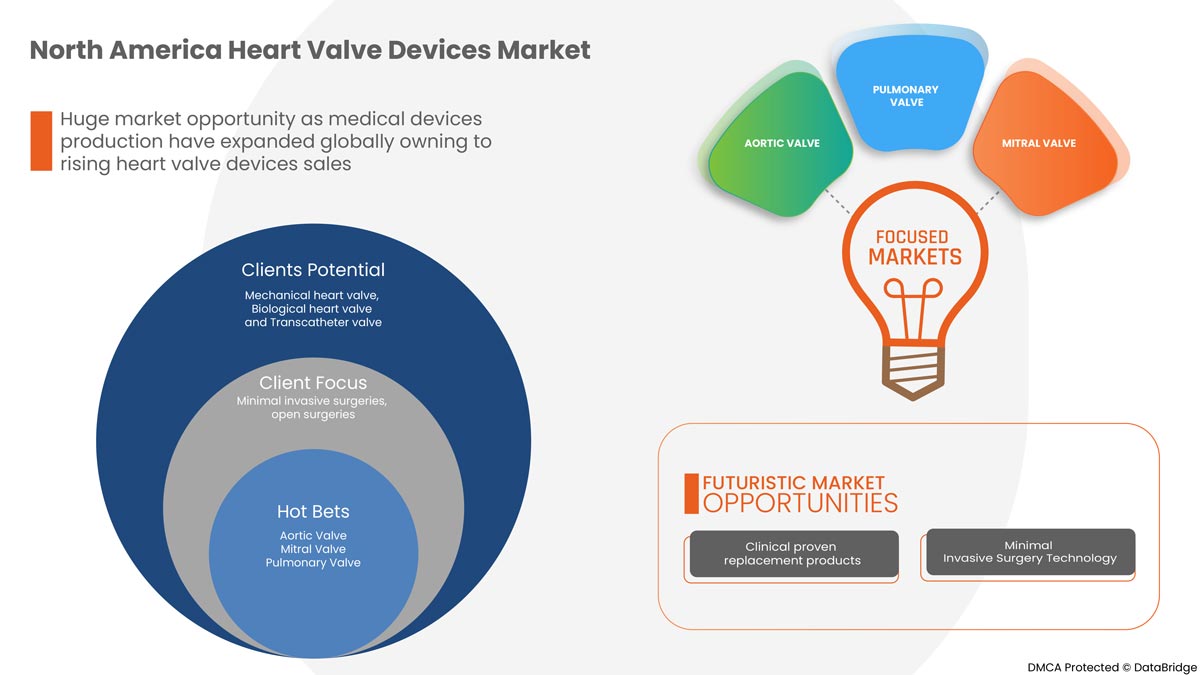

心臓弁デバイスは閉塞した心臓弁を治療するために使用され、これらのデバイスの移植は最も一般的な手順の1つです。市場で入手可能な構造的心臓弁デバイスには、機械弁、生物学的弁、および経カテーテル弁が含まれます。北米の心臓弁デバイス市場は、世界中で心臓弁手術の数が増加しているため、予測期間中に着実に成長する可能性があります。北米の心臓弁デバイス市場の成長は、大動脈弁、左心房閉塞デバイス、組織弁または生物学的弁などの構造的心臓デバイスと手順の開発によって推進されると予想されます。組織弁はすでに心臓弁デバイス市場に革命をもたらしました。次世代の心臓弁手術は、低出産患者プロファイル、より制御された手術、より優れた弁機能、弁周囲逆流の減少、耐久性の向上、および低コストを提供します。主要な市場プレーヤーによる製品革新により、より多くの患者層に対応し、より良い臨床結果を達成できるようになり、市場の成長が促進されました。

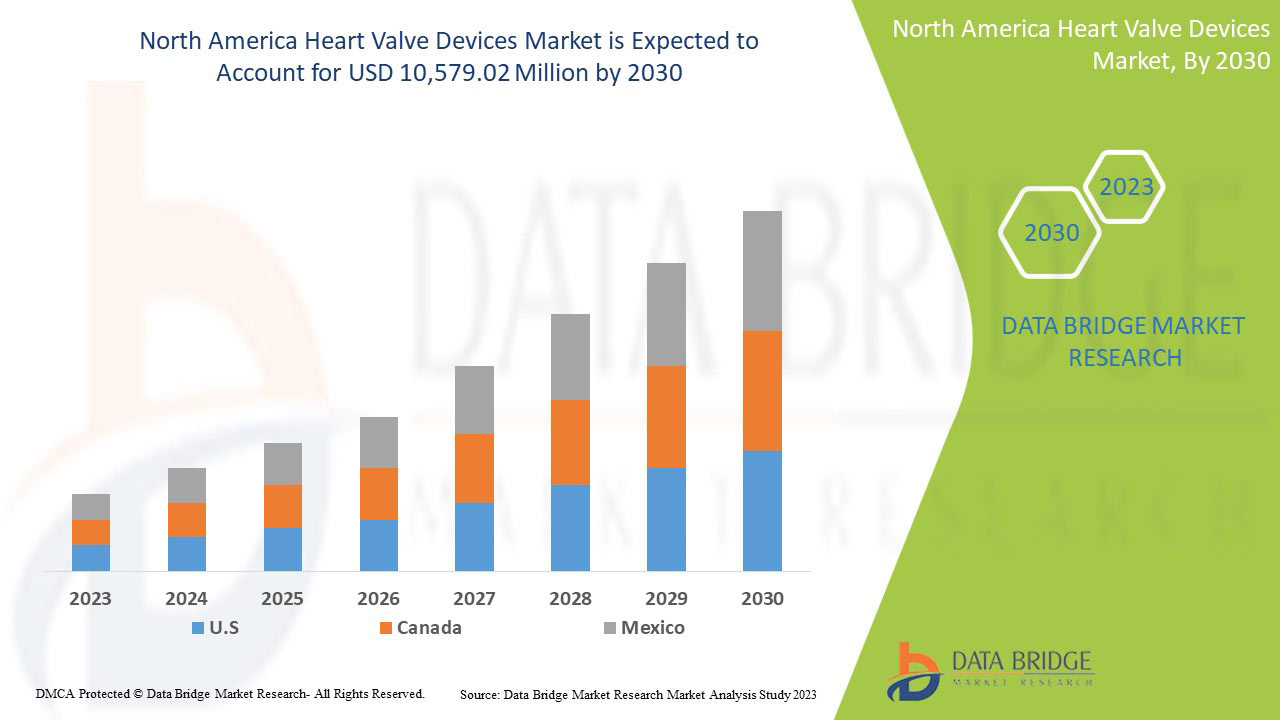

Data Bridge Market Research の分析によると、心臓弁デバイス市場は予測期間中に 13.6% の CAGR で成長し、2030 年までに 105 億 7,902 万米ドルに達する見込みです。世界中で心臓弁デバイスの需要が急増しているため、製品タイプが市場で最大のセグメントを占めています。この市場レポートでは、価格分析、特許分析、技術進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品タイプ別(機械心臓弁、生物学的心臓弁、経カテーテル弁)、治療(開腹手術および低侵襲手術(MIS)、エンドユーザー別(病院および診療所、外来手術センター、心臓センター、研究センターなど)、流通チャネル別(直接入札、サードパーティ販売業者)。 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Abbott、Boston Scientific Corporation またはその関連会社、Artivion, Inc.、Edwards Lifesciences Corporation、Medtronic、NeoVasc、Micro Interventional Devices Incorporated、XELTIS、TTK、Meril Life Sciences Pvt. Ltd、Foldax, Inc.、Venus Medtech (Hangzhou) Inc.、Colibri Heart Valve など。 |

心臓弁デバイス市場の定義

心臓弁は、体内の血液の流れをスムーズに正しい方向に導くために必要です。心臓弁は、一定の血流と血圧の維持を担っています。心臓弁が適切に機能しないと、心臓が遮断され、狭窄を引き起こします。心臓病には、一般的に心臓に大きな影響を与えるいくつかの病気が含まれます。心臓弁の規制は、心血管疾患を患う患者数の増加に伴い、過去 10 年間で急速に増加しています。心臓弁の市場成長は、不安定なライフスタイル、生活習慣病、喫煙人口の増加、人口の高齢化、医療の質の向上、予測期間中の医療償還の急速な発展などの要因によって加速されています。さらに、心臓弁の高コストと心臓インプラントの感染リスクは、上記の予測期間中に心臓弁市場の成長を鈍化させる可能性が高い理由である可能性があります。医療ビジネスの側面と新興経済国での基盤の成長は、医療ツーリズムの成長を促進し、心臓弁デバイス市場を牽引しています。心臓異常を治療するための低侵襲手術の必要性が大幅に増加しています。経カテーテル大動脈弁置換術(TAVR)などの心臓弁手術における現在の自動化の応用は、同様の手術の多様性の増加に取って代わっています。高齢化人口の割合の増加から判断すると、生命保険契約の増加も心臓弁市場の成長に寄与すると予想されます。

心臓弁デバイス市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 心臓弁デバイスの革新により臨床結果が改善

低侵襲手術用の新製品の発売は、北米の心臓弁デバイス市場を牽引する可能性が高いでしょう。生体弁は心臓弁市場に革命をもたらしました。次世代の心臓弁手術では、送達曲線が少なくなり、配置がより制御され、弁機能が向上し、弁逆流が減少し、耐久性が向上し、コストが削減されます。製品の革新により、より多くの患者を優れた臨床結果で治療できるため、心臓弁デバイス市場のプレーヤーの成長見通しが高まりました。近年の大きな進歩にもかかわらず、構造的介入心臓学は大きな可能性を秘めた新興市場のままです。

さらに、インテリジェントな設計、新しいテクノロジー、生体材料の応用により、新製品開発の限界が押し上げられ続け、これらのデバイスが今後何年にもわたって介入製品のイノベーションの最前線に立つことが確実になります。設計のイノベーションにより、市場プレーヤーは心臓弁デバイスにおける収益性の高い成長機会を活用できます。

したがって、北米の心臓弁デバイス市場は、心臓弁デバイスの技術革新の増加により、成長が加速すると予想されます。

- さまざまな心臓病の増加

心臓発作や脳卒中は通常、急性の出来事であり、主に心臓や脳への血流をブロックする閉塞によって引き起こされます。COVID-19パンデミックの最初の1年間で、心臓病と脳卒中による死亡はそれぞれ5.8%と6.8%増加しました。ただし、加齢に伴う増加は、心臓病と脳卒中でそれぞれ1.6%と1.7%でした。最も一般的な原因は、心臓や脳に血液を供給する血管の内層に脂肪沈着物が蓄積することです。脳卒中は、脳の血管内の出血や血栓によって引き起こされる可能性があります。この傾向は、人口増加と高齢化により心血管疾患の発生率が劇的に増加する可能性があることを示唆しています。

さらに、高糖尿病や高血圧、高血中コレステロール、喫煙は心臓病の主な危険因子です。米国人の約半数 (47%) は、これら 3 つの危険因子のうち少なくとも 1 つを抱えています。不健康な食事、運動不足、過度の飲酒など、その他の病状やライフスタイルの選択も、心臓病のリスクを高める可能性があります。

さらに、心臓疾患の増加は、北米の心臓弁装置市場の推進力となることが予想されます。

機会

- 義肢装具に対する意識の向上

人工弁は、失われた身体の一部を置き換えたり、身体の一部の機能を改善したりするために設計された装置です。人工心臓弁は、介入を必要とする自然弁の異常の場合にますます使用されています。一般的に、人工弁は機械心臓弁、生体弁、同種移植に分類できます。人工弁の目的は、副作用を最小限に抑えながら、自然弁のように血行動態的に機能することです。心臓血管の人工弁装置は、損傷した心臓組織を置き換えるために開発されました。これらの医療機器は、正常な心血管器官の機能を模倣するように設計されています。人工心臓により、心臓外科医は心ブロックの治療を増やすことができます。

さらに、人工弁の普及率は、1,000人中0.2人から1,000人中5.3人の範囲です。

したがって、補綴装置に関する認識の高まりは、市場の成長の機会として機能します。

抑制/挑戦

- 設備の生産コストが高い

米国では、大動脈弁疾患の治療を受ける患者数が急速に増加しています。経カテーテル大動脈弁置換術 (TAVR) は、外科的大動脈弁置換術 (SAVR) と薬物治療 (MT) に取って代わります。これらの傾向の経済的影響は不明です。したがって、TAVR の総費用は SAVR よりも高く、MT 単独よりもはるかに高額です。TAVR の費用は時間の経過とともに減少していますが、SAVR と MT の費用は変わりません。

In addition, the high surgical cost of TAVI is mainly due to the high cost of the production. However, due to the shorter hospital stay, the cost of non-surgical TAVI is lower compared to AVR. The cost of the TAVI implant kit alone (valve, balloon, sheath) is $32,500, while the surgical valve only costs about $5,000, just like in Switzerland, the TAVI implant set costs about 32,000 francs (around of $35,000), while the cost of a biosurgical prosthesis is about 3,000 Swiss francs (about US$3,300). Depending on comorbidities and complications, reimbursement in the United States is between $ 0,000 and $ 5,000, TAVI in Switzerland is about 72,000 francs ($78,000), and AVR is about 3,000 francs ($ 7,000), which means a financial loss for the hospital.

Thus, the rising production cost of equipment may hamper the market's growth.

Recent Developments

- In September 2023, Abbott released data from five late-stage presentations showing the benefits of its minimally invasive devices in treating people with various structural heart diseases. The data includes findings that support the value of MitraClip™. It is the world's first and leading transcatheter edge-to-edge repair (TEER) to treat leaky valves in people with mitral regurgitation (MR). New data on Abbott's structural heart therapies were presented at the Cardiovascular Research Foundation's 34th Annual Transcatheter Cardiovascular Therapy (TCT) Scientific Symposium in Boston. This has helped the company to increase its business position in the market.

- In September 2020, Boston Scientific Corporation announced that it had introduced a controlled launch of the ACURATE neo2™ aortic valve system in Europe. This next-generation transcatheter aortic valve implantation (TAVI) technology is a new platform designed with multiple features to improve the clinical performance of the original ACURATE new platform. Compared to the previous generation, the ACURATE neo2 valve system has an expanded indication for patients with aortic stenosis. This has helped the company to gain its product portfolio.

Heart Valve Devices Market Scope

The heart valve devices market is segmented into product type, treatment, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY PRODUCT TYPE

- Mechanical Heart Valves

- Biological Heart Valve

- Transcatheter Valves

On the basis of product type, the heart valve devices market is segmented into mechanical heart valve, biological heart valve and transcatheter valve.

BY TREATMENT

- OPEN SURGERY

- MINIMALLY INVASIVE SURGERY

On the basis of treatment, the heart valve devices market is segmented into open surgery and minimal invasive surgery.

BY END USER

- HOSPITAL & CLINICS

- AMBULATORY SURGICAL CENTERS

- CARDIAC CENTERS

- RESEARCH CENTERS

- OTHERS

エンドユーザーに基づいて、心臓弁装置市場は、病院と診療所、外来手術センター、心臓センター、研究センターなどに分類されます。

流通チャネル別

- 直接入札

- サードパーティディストリビューター

流通チャネルに基づいて、心臓弁デバイス市場は、直接入札とサードパーティの販売代理店に分類されます。

北米心臓弁デバイス市場地域分析/洞察

心臓弁装置市場が分析され、製品タイプ、治療、エンドユーザー、流通チャネルに関する市場規模の情報が提供されます。

この市場レポートでカバーされている国は、米国、カナダ、メキシコです。

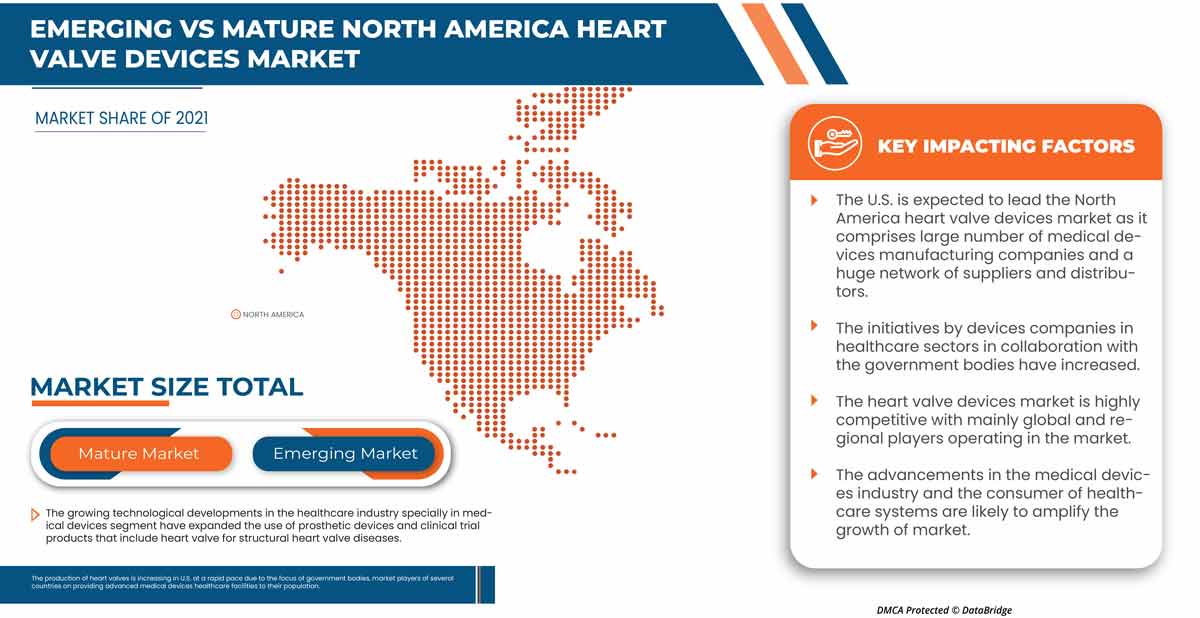

北米は、研究開発への投資の増加により、市場を支配しています。主要企業の強力な存在により、米国は北米地域を支配しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と心臓弁デバイス市場シェア分析

心臓弁装置市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線などがあります。提供されている上記のデータ ポイントは、心臓弁装置市場に対する会社の重点にのみ関連しています。

心臓弁デバイス市場で活動している主要企業としては、Abbott、Boston Scientific Corporation またはその関連会社、Artivion, Inc.、Edwards Lifesciences Corporation、Medtronic、NeoVasc、Micro Interventional Devices Incorporated、XELTIS、TTK、Meril Life Sciences Pvt. Ltd、Foldax, Inc.、Venus Medtech (Hangzhou) Inc.、Colibri Heart Valve などが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMIOLOGY

3.2 PESTEL ANALYSIS

3.3 PORTER'S FIVE FORCE

4 MARKET OVERVIEW

4.1 DRIVERS

4.1.1 INNOVATIONS IN HEART VALVE DEVICES OFFER IMPROVED CLINICAL OUTCOME

4.1.2 RISING NUMBER OF VARIOUS HEART DISEASES

4.1.3 ADVANCEMENTS IN TRANSCATHETER VALVE TECHNOLOGY

4.1.4 INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES

4.2 RESTRAINTS

4.2.1 HIGH COST ASSOCIATED WITH THE SURGERIES

4.2.2 COMPLICATIONS ASSOCIATED WITH HEART VALVE REPLACEMENT

4.3 OPPORTUNITIES

4.3.1 INCREASING AWARENESS OF PROSTHETIC DEVICES

4.3.2 RISING PREVALENCE OF STROKE & CARDIAC ARREST TO REINFORCE DEMAND FOR HEART VALVE DEVICES

4.3.3 INCREASING FDA APPROVALS OF TRANSCATHETER AORTIC VALVES

4.4 CHALLENGES

4.4.1 STRICT GOVERNMENT REGULATIONS

4.4.2 EXPENSIVE PRODUCTION COST OF EQUIPMENT

5 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE

5.1 OVERVIEW

5.2 MECHANICAL HEART VALVES

5.2.1 AORTIC VALVE

5.2.2 MITRAL VALVE

5.3 BIOLOGICAL HEART VALVES

5.3.1 AORTIC VALVE

5.3.2 MITRAL VALVE

5.3.3 PULMONARY VALVE

5.3.4 TRICUSPID VALVE

5.4 TRANSCATHETER VALVE

5.4.1 AORTIC VALVE

5.4.2 MITRAL VALVE

5.4.3 PULMONARY VALVE

6 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT

6.1 OVERVIEW

6.2 MINIMALLY INVASIVE SURGERY (MIS)

6.2.1 CARDIAC VALVE REPLACEMENT

6.2.2 CARDIAC VALVE REPAIR

6.3 OPEN SURGERY

6.3.1 CARDIAC VALVE REPLACEMENT

6.3.2 CARDIAC VALVE REPAIR

7 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER

7.1 OVERVIEW

7.2 HOSPITAL & CLINICS

7.3 AMBULATORY SURGICAL CENTERS

7.4 CARDIAC CENTERS

7.5 RESEARCH CENTERS

7.6 OTHERS

8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT TENDER

8.3 THIRD PARTY DISTRIBUTORS

9 NORTH AMERICA HEART VALVE DEVICES MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 EDWARDS LIFESCIENCES CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 ABBOTT

12.3.1 COMPANY SNAPSHOT

12.3.2 REVENUE ANALYSIS

12.3.3 COMPANY SHARE ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 BOSTON SCIENTIFIC CORPORATION OR ITS AFFILIATES.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 ARTIVION, INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENTS

12.6 COLIBRI HEART VALVE

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 FOLDAX, INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 MERIL LIFE SCIENCES PVT. LTD.

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENTS

12.9 MICRO INTERVENTIONAL DEVICES, INCORPORATED.

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 NEOVASC

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENTS

12.11 TTK

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 VENUS MEDTECH (HANGZHOU) INC.

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 XELTIS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS & CLINICS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA CARDIAC CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA RESEARCH CENTERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OTHERS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA DIRECT TENDER IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN HEART VALVE DEVICES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA HEART VALVE DEVICES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 U.S. HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 33 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 34 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 35 U.S. MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 36 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 38 U.S. BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 39 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 41 U.S. TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 42 U.S. HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 43 U.S. MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 44 U.S. OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 45 U.S. HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 46 U.S. HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 48 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 50 CANADA MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 51 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 53 CANADA BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 54 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 55 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 56 CANADA TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 57 CANADA HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 58 CANADA MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 59 CANADA OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 60 CANADA HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 CANADA HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 62 MEXICO HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 65 MEXICO MECHANICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 66 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 67 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 68 MEXICO BIOLOGICAL HEART VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 69 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 UNITS, (VOLUME)

TABLE 71 MEXICO TRANSCATHETER VALVES IN HEART VALVE DEVICES MARKET, BY PRODUCT TYPE, 2021-2030 ASP, (USD)

TABLE 72 MEXICO HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 73 MEXICO MINIMALLY INVASIVE SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 74 MEXICO OPEN SURGERY IN HEART VALVE DEVICES MARKET, BY TREATMENT, 2021-2030 (USD MILLION)

TABLE 75 MEXICO HEART VALVE DEVICES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 76 MEXICO HEART VALVE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA HEART VALVE DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA HEART VALVE DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA HEART VALVE DEVICES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA HEART VALVE DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA HEART VALVE DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA HEART VALVE DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA HEART VALVE DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA HEART VALVE DEVICES MARKET: SEGMENTATION

FIGURE 11 GROWING PREVALENCE OF VALVULAR DISEASES, SUCH AS AORTIC STENOSIS & AORTIC REGURGITATION, AND INCREASING PREFERENCE FOR MINIMALLY INVASIVE SURGERIES ARE EXPECTED TO DRIVE THE NORTH AMERICA HEART VALVE DEVICES MARKET IN THE FORECAST PERIOD

FIGURE 12 MECHANICAL HEART VALVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA HEART VALVE DEVICES MARKET IN 2023 & 2030

FIGURE 13 INCIDENDE AND PREVALENCE OF HEART VALVE OF NORTH AMERICA

FIGURE 14 INCIDENDE AND PREVALENCE OF HEART VALVE OF EUROPE

FIGURE 15 INCIDENDE AND PREVALENCE OF HEART VALVE OF ASIA-PACIFIC

FIGURE 16 INCIDENDE AND PREVALENCE OF HEART VALVE OF SOUTH AMERICA & MIDDLE EAST AND AFRICA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA HEART VALVE DEVICES MARKET

FIGURE 18 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2022

FIGURE 19 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA HEART VALVE DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2022

FIGURE 23 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA HEART VALVE DEVICES MARKET : BY TREATMENT, LIFELINE CURVE

FIGURE 26 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2022

FIGURE 27 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA HEART VALVE DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA HEART VALVE DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA HEART VALVE DEVICES MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA HEART VALVE DEVICES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA HEART VALVE DEVICES MARKET: BY PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA HEART VALVE DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。