北米の健康診断市場

Market Size in USD Billion

CAGR :

%

USD

2.02 Billion

USD

5.03 Billion

2025

2033

USD

2.02 Billion

USD

5.03 Billion

2025

2033

| 2026 –2033 | |

| USD 2.02 Billion | |

| USD 5.03 Billion | |

|

|

|

|

北米の健康診断市場、検査タイプ別(コレステロール検査、糖尿病検査、がんスクリーニング、一般健康診断、性感染症、血圧検査など)、パッケージタイプ別(基本健康診断、高齢者プロファイル、女性健康診断、男性健康診断、心臓検査、糖尿病検査など)、パネルタイプ別(マルチテストパネルおよびシングルテストパネル)、サンプルタイプ別(血液、尿、血清、唾液など)、技術別(免疫測定法、医療用画像診断、QPCR(定量的ポリメラーゼ連鎖反応)、Q-FISH(定量的蛍光、in situハイブリダイゼーション)、TRF(末端制限断片)、STELA(単一テロメア長分析)など)、病状別(心血管疾患、代謝障害、がん、炎症性疾患、筋骨格障害、神経疾患、C型肝炎合併症、免疫関連疾患など)、サンプル収集場所(病院、住宅、診断研究所、オフィスなど)、流通チャネル(直接入札、小売販売など)、国(米国、カナダ、メキシコ)の業界動向と2028年までの予測。

市場分析と洞察: 北米の健康診断市場

市場分析と洞察: 北米の健康診断市場

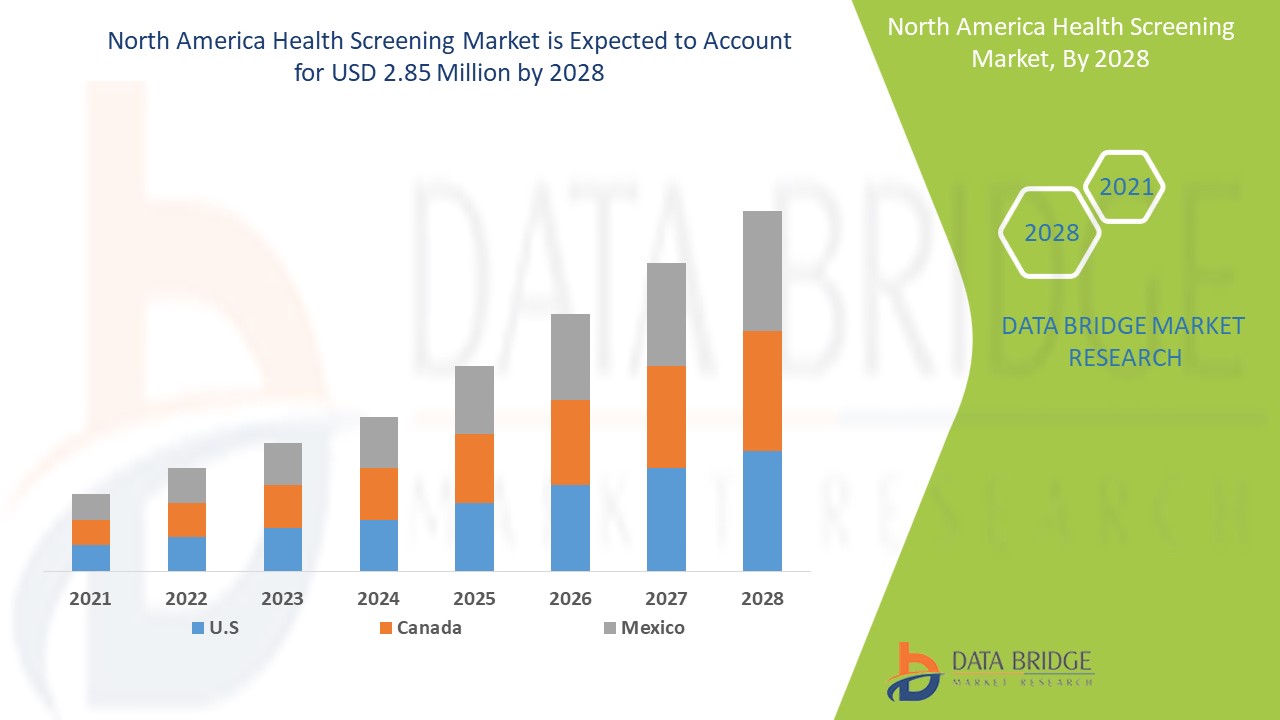

北米の健康診断市場は、2021年から2028年の予測期間に市場の成長が見込まれています。データブリッジマーケットリサーチは、市場は2021年から2028年の予測期間に12.1%のCAGRで成長し、2028年までに285万米ドルに達すると分析しています。慢性疾患の増加、高齢者人口、病気の早期発見と治療に関する意識の高まりが、予測期間における市場の需要を押し上げた主な要因です。

健康診断は、特定の疾患を早期に発見する重要な方法です。スクリーニング検査は、個人が疾患の危険因子の早期兆候を示しているかどうかを特定するために、予防医学でよく使用されます。スクリーニングによって検出される可能性のある疾患には、がん、糖尿病、高コレステロール、高血圧、骨粗しょう症などがあります。慢性疾患の急増、高齢者人口、疾患の早期発見と治療に関する意識の高まりが、健康診断市場の成長を後押ししています。

病気の早期発見と治療に対する人々の意識の高まりと医療費の増加により、健康診断の需要が高まり、市場の牽引役となっています。

健康診断の有効性による需要の高まり、サービス提供者数の増加、健康診断の民間および公的機関による啓発キャンペーンの強化は、予測期間中の健康診断市場の成長を促進し、チャンスとして機能しています。ただし、スクリーニング検査のコストが高いため、予測期間中の市場の成長が妨げられる可能性があります。

北米の健康診断市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響の詳細、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から見た機会の分析が提供されます。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

北米の健康診断市場の範囲と市場規模

北米の健康診断市場の範囲と市場規模

北米の健康診断市場は、テストタイプ、パッケージタイプ、パネルタイプ、サンプルタイプ、テクノロジー、条件、サンプル収集場所、流通チャネルの 8 つの主要なセグメントに基づいて分類されています。セグメント間の成長は、ニッチな成長分野と市場にアプローチするための戦略を分析し、コアアプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- 検査の種類に基づいて、北米の健康診断市場は、コレステロール検査、糖尿病検査、がんスクリーニング、一般健康診断、性感染症、血圧検査などに分類されます。2021年には、コレステロール関連疾患の蔓延と不適切な食習慣によりこれらの検査のリスクが高まるため、コレステロール検査セグメントが市場を支配すると予想されます。

- パッケージの種類に基づいて、北米の健康診断市場は、基本的な健康診断、高齢者プロファイル、女性の健康診断、男性の健康診断、心臓検査、糖尿病検査などに分類されます。2021年には、市場での競争が激化し、さまざまな検査室がパッケージを提供して患者を自社の検査室で検査を受けるよう誘致するため、基本的な健康診断セグメントが市場を支配すると予想されます。

- パネルの種類に基づいて、北米の健康診断市場は、マルチテストパネルとシングルテストパネルに分割されています。2021年には、さまざまな研究所や診断センターがマルチテストパネルを使用してスクリーニングを行い、現在のシナリオでは、病気は症状や発生によって相互に関連しており、同時に異なるテストをスクリーニングするためにマルチパネルの使用が増加しているため、マルチテストパネルセグメントが市場を支配すると予想されています。

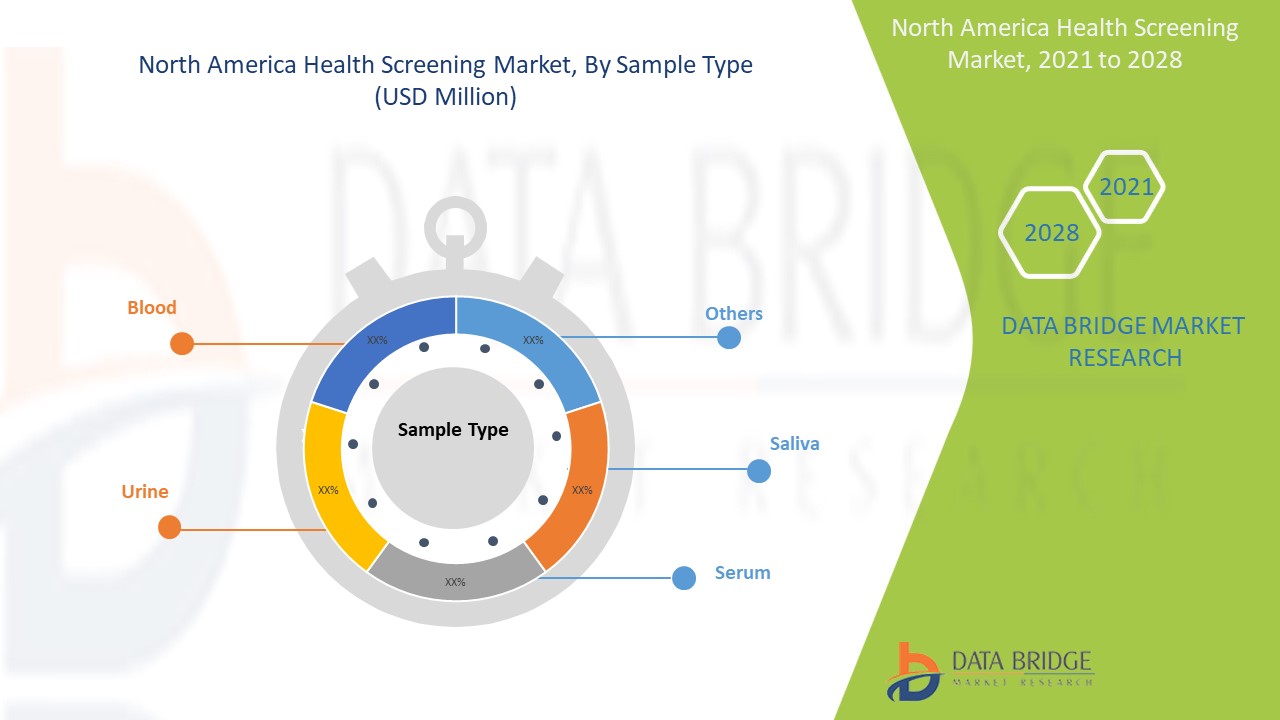

- サンプルの種類に基づいて、北米の健康診断市場は、血液、尿、血清、唾液、その他に分類されます。2021年には、血液セグメントがスクリーニングと診断のための最も簡単で便利な方法であるため、市場を支配すると予想されます。

- 技術に基づいて、北米の健康診断市場は、免疫測定、医療用画像、QPCR(定量的ポリメラーゼ連鎖反応)、Q-FISH(定量的蛍光、in situハイブリダイゼーション)、TRF(末端制限断片)、STELA(単一テロメア長分析)などに分類されます。 2021年には、免疫測定セグメントが市場を支配すると予想されます。これは、免疫測定が輸血、遺伝子治療、インプラント手術、感染症のスクリーニングなど、さまざまなアプリケーションに貢献していることに加えて、米国とカナダが新しい技術の主要市場であり、セグメントの成長の大きな要因でもある既存技術の進歩を信じていることによるものです。

- 北米の健康診断市場は、病状に基づいて、心血管疾患、代謝障害、がん、炎症性疾患、筋骨格障害、神経疾患、C型肝炎合併症、免疫関連疾患、その他に分類されます。2021年には、北米地域で心血管疾患セグメントの有病率が高く、個人の約3%が心臓発作を新規または再発しているため、このセグメントは予測期間中に成長する可能性があります。

- 北米の健康診断市場は、サンプル採取場所に基づいて、病院、自宅、診断研究所、オフィス、その他に分類されます。2021 年には、病院には疾患の診断と治療に必要なすべての設備があるため、病院セグメントが市場を支配すると予想されます。

- 流通チャネルに基づいて、北米の健康診断市場は、直接入札、小売販売、その他に分類されます。2021年には、健康診断プログラムの全体的な売上の増加により、直接入札セグメントが市場を支配すると予想されます。

北米 健康診断市場の国別分析

北米の健康診断市場が分析され、テストの種類、パッケージの種類、パネルの種類、サンプルの種類、技術、状態、サンプル収集場所、流通チャネルに関する市場規模の情報が提供されます。北米の健康診断市場レポートでカバーされている国は、米国、カナダ、メキシコです。

北米地域の中で、米国は、高齢者人口の増加と病気の早期発見・治療に対する意識の高まりにより、2021年から2028年の予測期間に最も高い成長率で成長すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。また、北米ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

世界中で癌、糖尿病、心血管疾患などの慢性疾患が増加し、高齢者人口も増加しているため、北米の健康診断市場の成長が促進されています。

北米の健康診断市場では、医薬品の販売、進歩の影響、技術、健康診断市場へのサポートに関する規制シナリオの変化など、各国のスクリーニング製品産業の成長に関する詳細な市場分析も提供しています。データは、2010 年から 2019 年までの履歴期間について入手できます。

競争環境と北米の健康診断 市場シェア分析

北米の健康スクリーニング市場の競争環境は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータポイントは、銀ジアミンフッ化物(SDF)市場に関連する会社の焦点にのみ関連しています。

北米の心臓スクリーニング市場を扱う主要企業としては、Quest Diagnostics Incorporated、Laboratory Corporation of America、Sonic Healthcare Limited、Exact Sciences Corporation、Healius Limited、GRAIL、Eurofins Scientific、、SYNLAB International GmbH、UNILABS、LabPLUS、BioReference Laboratories、、ACM Global Laboratories、Cerba Healthcare、Quidel Corporation、Innova Medical Group、AMEDES Holding GmbH、RadNet, Inc.、Natera, Inc.、Trinity Biotech、Nuffield Health、RepeatDx、NeoGenomics Laboratories、HU Group Holdings, Inc.、Lifelabs、ARUP Laboratories、Q2 Solutions、Genova Diagnostics、Life Length、DNA Labs India、、Telomere Diagnostics、Charles River Laboratories、Ambry Genetics、SpectraCell Laboratories, Inc.、Dr. Lal PathLabs などがあります。

世界中の企業によって多くのイベント、契約、ウェビナーも開始されており、これも北米の健康診断市場を加速させています。

例えば、

- 2021年4月、Ambry Geneticsは、2021ACMG年次臨床遺伝学会議で発表したことを発表しました。これにより、同社は自社のビジネスアイデアを紹介するプラットフォームを得ることができました。

- 2021年9月、ARUP Laboratoriesは、航空機やその他の施設に血液を供給して患者に医療施設を提供するためにAir medと提携すると発表しました。これにより、予測期間中にラボを支援するサービスプロバイダーの患者プールが拡大します。

コラボレーション、製品の発売、事業拡大、賞や表彰、合弁事業、その他の市場プレーヤーにより、北米の健康診断市場における企業市場が強化され、組織にとっても健康診断薬の提供を改善するメリットがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。