北米てんかんモニタリングデバイス市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

470.56 Million

USD

738.76 Million

2024

2032

USD

470.56 Million

USD

738.76 Million

2024

2032

| 2025 –2032 | |

| USD 470.56 Million | |

| USD 738.76 Million | |

|

|

|

|

北米てんかんモニタリングデバイス市場のセグメンテーション、製品タイプ(ウェアラブルデバイス、スマートデバイス、従来型デバイス)、タイプ(焦点性発作、全般性発作)、患者タイプ(小児、高齢者、成人)、エンドユーザー(病院、在宅ケア環境、神経学センター、診断センター、外来手術センターおよびクリニック、その他)、流通チャネル(小売販売、オンライン販売、直接入札、その他) - 2032年までの業界動向と予測

北米てんかんモニタリング機器市場規模

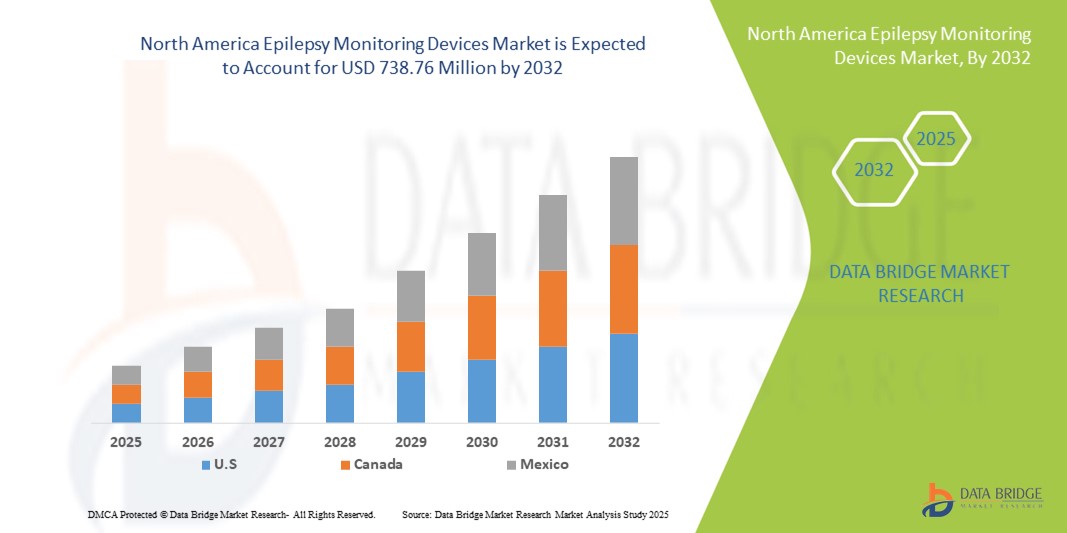

- 北米のてんかんモニタリング機器市場規模は2024年に4億7,056万米ドルと評価され、予測期間中に5.8%のCAGRで成長し、2032年には7億3,876万米ドル に達すると予想されています 。

- 市場の成長は、てんかんの罹患率の増加、神経疾患に対する意識の高まり、そして患者の管理とケアを強化する診断およびモニタリング技術の進歩によって主に推進されている。

- さらに、病院と在宅ケアの両方の現場で、正確でリアルタイムかつ非侵襲的なモニタリングソリューションに対する需要が高まっており、てんかんモニタリングデバイスは神経医療における重要なツールとして位置づけられています。これらの要因が重なり、高度なモニタリングシステムの導入が加速し、市場の成長を大きく促進しています。

北米てんかんモニタリング機器市場分析

- ウェアラブルデバイス、スマートデバイス、従来型デバイスを含むてんかんモニタリングデバイスは、正確でリアルタイムの神経学的モニタリング、診断のサポート、患者管理の改善を可能にするため、病院と在宅ケアの両方の環境でますます重要になっています。

- てんかんモニタリング機器の需要の高まりは、主にてんかんの罹患率の上昇、神経疾患に対する認識の高まり、そして患者の安全性と臨床結果を向上させる継続的で非侵襲的なモニタリングソリューションの必要性によって促進されています。

- 北米てんかんモニタリングデバイス市場では、先進的な医療インフラ、デジタルヘルス技術の導入率の高さ、主要業界プレーヤーの強力な存在感が牽引役となり、2024年には米国が73.3%という最大の収益シェアで市場を席巻しました。ワイヤレス、ポータブル、AI対応のモニタリングシステムの革新に支えられ、病院、神経学センター、在宅ケアの現場でデバイス導入が大幅に増加しています。

- カナダは、医療投資の増加、神経疾患に対する意識の高まり、在宅モニタリングソリューションの需要の増加により、予測期間中にてんかんモニタリングデバイス市場で最も急速に成長する国になると予想されています。

- スマートデバイスセグメントは、高度な機能、リモートモニタリング機能、リアルタイムの発作追跡のためのデジタルヘルスプラットフォームとの統合により、2024年に北米のてんかんモニタリングデバイス市場で48.8%の市場シェアを獲得し、市場を支配しました。

レポートの範囲と北米てんかんモニタリングデバイス市場のセグメンテーション

|

属性 |

北米てんかんモニタリング機器の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

北米てんかんモニタリング機器市場動向

スマートおよびウェアラブルモニタリングソリューションの進歩

- 北米のてんかんモニタリングデバイス市場における重要かつ加速的な傾向として、リアルタイムの発作追跡と継続的な脳波モニタリングを提供し、患者のケアと臨床的意思決定を強化するスマートデバイスやウェアラブルデバイスの採用が増加していることが挙げられます。

- 例えば、Embrace2のようなウェアラブル発作検出デバイスは、患者が発作を追跡し、介護者にリアルタイムで警告することを可能にし、スマートEEGヘッドセットは在宅ケアや臨床現場での遠隔モニタリングを可能にする。

- これらのデバイスにAIを統合することで、自動発作検出、発作リスクの予測分析、パーソナライズされたモニタリング推奨などの機能が可能になり、臨床結果と患者の安全性が向上します。

- てんかんモニタリングデバイスをデジタルヘルスプラットフォームや遠隔医療ソリューションとシームレスに統合することで、集中的なモニタリングと管理が可能になり、神経科医は患者のデータに遠隔でアクセスし、治療計画を効率的に調整できるようになります。

- インテリジェントで接続された患者中心のモニタリングシステムへのこの傾向はてんかん管理を根本的に変革しており、NeuroSigmaなどの企業はリアルタイムの警告、予測的洞察、クラウド接続を提供するAI対応デバイスを開発しています。

- 医療従事者と患者が精度、利便性、継続的なモニタリングを重視するようになったため、スマートでウェアラブルな接続型てんかんモニタリングデバイスの需要は、病院、神経学センター、在宅ケアの現場で急速に高まっています。

北米てんかんモニタリング機器市場の動向

ドライバ

てんかん罹患率の上昇とデジタルヘルスケアの導入による需要の増加

- てんかんの罹患率の上昇とデジタルヘルス技術の導入の増加は、高度なてんかんモニタリング機器の需要の高まりの主な要因となっている。

- 例えば、2024年3月、キャドウェルラボラトリーズは、在宅モニタリングを強化し、患者の快適性を向上させながら、遠隔神経科医のアクセスを可能にするように設計された新しいワイヤレスEEGシステムを発売しました。

- 医療提供者が診断精度と患者の転帰の改善を目指す中、てんかんモニタリングデバイスは、継続的な脳波追跡、リアルタイムアラート、クラウドベースのデータ共有などの機能を提供し、従来の診断方法を大幅に向上させています。

- さらに、遠隔医療サービスや遠隔患者モニタリングプログラムの導入が進むにつれ、これらのデバイスは現代の神経学的ケアに不可欠なツールとして位置づけられつつある。

- ウェアラブルデバイスやスマートデバイスは、臨床医がリアルタイムで追跡したり、遠隔でデータにアクセスしたりできる利便性と、ユーザーフレンドリーなインターフェースを備えているため、病院、神経学センター、在宅ケアの現場で導入が進んでいます。

- AI支援モニタリング、予測分析、シームレスなデジタル統合への傾向は、北米におけるてんかんモニタリングデバイスの成長をさらに後押ししている。

抑制/挑戦

データセキュリティの懸念とデバイスコストの高騰

- 接続型医療機器におけるサイバーセキュリティとデータプライバシーに関する懸念は、てんかんモニタリングソリューションの普及拡大にとって大きな課題となっています。機密性の高い患者データをネットワーク経由で送信する機器は情報漏洩の危険性が高く、医療従事者と患者の間で不安が生じています。

- 例えば、無線EEGシステムやウェアラブル発作追跡装置の脆弱性に関する報告により、一部の機関はクラウド接続型モニタリングソリューションの導入に慎重になっている。

- 堅牢な暗号化、安全な認証プロトコル、HIPAAおよびFDAガイドラインへの準拠を通じてこれらの課題に対処することは、臨床医と患者の間の信頼を築くために不可欠です。

- さらに、従来のシステムと比較して高度なてんかんモニタリング機器のコストが比較的高いため、特に小規模な診療所や予算が限られている在宅ケアの現場では導入の障壁となる可能性がある。

- 基本的なデバイスはより手頃な価格になったが、AI支援による発作検出、ワイヤレス接続、長期にわたる継続的なモニタリングなどのプレミアム機能は、より高額になることが多い。

- 強化されたサイバーセキュリティ、規制遵守、費用対効果の高い監視ソリューションの開発を通じてこれらの課題を克服することは、北米の持続的な市場成長にとって不可欠です。

北米てんかんモニタリング機器市場の範囲

市場は、製品タイプ、発作のタイプ、患者タイプ、エンドユーザー、流通チャネルに基づいてセグメント化されています。

- 製品タイプ別

製品タイプ別に見ると、てんかんモニタリングデバイス市場は、ウェアラブルデバイス、スマートデバイス、従来型デバイスの3つに分類されます。スマートデバイスセグメントは、AIを活用した発作検出システムと遠隔モニタリング機能の導入拡大を背景に、2024年には48.8%という最大の収益シェアで市場を席巻しました。スマートデバイスは、患者の神経活動をリアルタイムで追跡し、発作発生時に介護者や臨床医にアラートを送信することができます。デジタルヘルスプラットフォームや遠隔医療ソリューションとの統合により、遠隔ケア管理が強化され、早期介入をサポートします。病院や神経学センターでは、その正確性、利便性、電子カルテとの互換性から、継続的な患者モニタリングにスマートデバイスを採用するケースが増えています。さらに、在宅ケア環境におけるコネクテッドヘルスケアソリューションへの消費者の関心の高まりも、スマートデバイスの優位性をさらに強化しています。このセグメントは、クラウド接続、予測分析、モバイルアプリケーションサポートなどの技術革新の恩恵を受けており、市場の魅力を高めています。

ウェアラブルデバイス分野は、在宅ケアや外来患者に適したポータブルで非侵襲的なモニタリングソリューションの需要増加に支えられ、2025年から2032年にかけて最も急速な成長を遂げると予想されています。リストバンドやヘッドバンドなどのウェアラブルデバイスは、患者の移動を制限することなく、継続的な発作検出を可能にします。特に小児および高齢者層にとって魅力的であり、介護者は患者を遠隔からリアルタイムでモニタリングすることができます。AI支援による検出や長時間バッテリー駆動といった技術の進歩は、精度と利便性を向上させています。てんかんに対する意識の高まりと予防的管理の必要性から、臨床現場と在宅ケアの両方で導入が進んでいます。さらに、デバイスメーカーとデジタルヘルスプラットフォームとの提携により、ウェアラブルデバイスの使い勝手が向上し、成長がさらに加速しています。

- 発作の種類別

発作の種類に基づいて、てんかんモニタリングデバイス市場は、焦点発作と全般発作に分類されます。全般発作セグメントは、全般てんかんの有病率の高さと、脳全体の活動を捉えることができる包括的なモニタリングソリューションへの需要に牽引され、2024年には54.1%の収益シェアで市場を支配しました。全般発作用に設計されたデバイスは高度な検出アルゴリズムを提供し、医療提供者は発作の頻度、重症度、パターンをより正確に評価できます。病院や神経学センターは、診断の正確性と長期的な管理のために、全般発作をモニタリングできるデバイスを好みます。AIとクラウドベースのモニタリングプラットフォームの利用増加により、全般発作イベントの捕捉と分析におけるデバイスの効率が向上しています。さらに、スマートアラートシステムとモバイル接続により、モニタリングレジメンへの患者の遵守がより適切にサポートされます。全般発作モニタリングデバイスと遠隔医療システムの統合は、北米におけるその優位性をさらに強化します。

局所発作領域は、局所発作検出と個別化治療アプローチへの意識の高まりを背景に、2025年から2032年にかけて最も急速な成長が見込まれています。局所発作を標的とするデバイスは、脳の部位特異的なモニタリングを提供し、正確な介入と投薬調整を可能にします。小児および成人の患者は、発作の種類を区別し、より正確な臨床評価を可能にするデバイスの恩恵をますます受けています。AI支援アルゴリズムとウェアラブル検出ツールの継続的な革新は、局所発作モニタリングソリューションの採用を促進しています。在宅神経学的ケアと遠隔患者モニタリングへの移行は、この領域の成長をさらに促進しています。臨床医は、治療効果を向上させるために、詳細かつ局所的な発作追跡を必要とする患者に対して、局所発作デバイスを積極的に推奨しています。

- 患者タイプ別

患者タイプに基づいて、てんかんモニタリングデバイス市場は、小児、老年、成人の患者に分類されます。成人患者セグメントは、成人におけるてんかんの有病率の高さと、病院や在宅ケアの現場での継続的なモニタリングデバイスの導入増加に牽引され、2024年には50.7%のシェアで市場を支配しました。成人は発作管理のために長期モニタリングを必要とすることが多く、リアルタイムアラートが可能なスマートデバイスとウェアラブルデバイスの両方に対する需要が高まっています。病院や神経学センターは、正確な診断、発作パターンの分析、および治療管理のために、成人に焦点を当てたモニタリングソリューションを優先しています。遠隔医療プラットフォームとの統合は、特に生活の中断を最小限に抑える必要がある働く成人のための遠隔モニタリングをサポートします。北米には先進的なデバイスメーカーと強力な医療インフラが存在し、成人セグメントにおける優位性をさらに強化しています。

小児患者セグメントは、てんかんの早期診断への意識の高まりと小児てんかんの罹患率の増加に後押しされ、2025年から2032年にかけて最も急速な成長を遂げると予想されています。小児用モニタリングデバイスは、非侵襲性で快適、かつ連続装着に適した設計となっており、コンプライアンスを促進します。介護者や病院では、遠隔モニタリングや即時の発作アラートを可能にするウェアラブルデバイスやスマートデバイスの導入がますます進んでいます。AIによる発作検出やモバイルアプリとの統合といった技術革新も、小児患者への急速な普及を後押ししています。特に在宅ケアの現場では、親がてんかん児の信頼性が高く継続的なモニタリングツールを求めており、需要が高まっています。小児向けデバイスは、早期発見と介入を促進する政府の取り組みや啓発キャンペーンからも恩恵を受けています。

- エンドユーザー別

エンドユーザーに基づいて、てんかんモニタリングデバイス市場は、病院、在宅ケア環境、神経学センター、診断センター、外来手術センターおよびクリニック、その他に分類されます。病院セグメントは、継続的なEEG記録、リアルタイムの発作検出、病院ITシステムとの統合が可能な高度なモニタリングデバイスへの好みに牽引され、2024年には45.2%のシェアで市場を支配しました。病院はこれらのデバイスを使用して、診断精度を高め、患者のケアを効率的に管理し、入院期間を短縮します。病院でのスマートデバイスとウェアラブルデバイスの導入により、モニタリング効率が向上し、手動観察が削減され、遠隔医療アプリケーションがサポートされます。神経科医と臨床医は、包括的な患者データの収集にこれらのデバイスを頼りにしており、より情報に基づいた治療決定を可能にしています。さらに、北米の病院は、強力な医療インフラ、償還ポリシー、テクノロジーの採用の恩恵を受けており、優位性を強化しています。

在宅ケア分野は、患者中心のケア、遠隔モニタリング、ウェアラブルデバイスやスマートデバイスの普及への需要の高まりを背景に、2025年から2032年にかけて最も急速な成長が見込まれています。在宅ケアモニタリングにより、患者、特に小児および高齢者は、発作をリアルタイムで検知しながら自立した生活を送ることができます。モバイルアプリケーション、クラウドプラットフォーム、遠隔医療サービスとの統合により、介護者や臨床医は患者の健康状態を遠隔で追跡できます。在宅モニタリングソリューションは、利便性、費用対効果、そしてアクセスのしやすさから、急速に普及しています。軽量ウェアラブルデバイスやAIを活用したアラート機能などの技術革新により、在宅ケアの利便性はさらに向上しています。予防的なてんかん管理と個別ケアへのトレンドは、この分野に大きなビジネスチャンスを生み出しています。

- 流通チャネル別

流通チャネルに基づいて、てんかんモニタリングデバイス市場は、小売販売、オンライン販売、直接入札、その他に分類されます。直接入札セグメントは、病院、神経学センター、在宅ケアサービスプロバイダーによる大量調達に牽引され、2024年には47.5%のシェアで市場を支配しました。直接入札は、合理化された調達、競争力のある価格設定、デバイスの真正性の確保を促進します。病院や診断センターは、サービスおよび保守契約を含む高度なモニタリングシステムを取得するために、直接入札契約を好む傾向があります。入札による大規模な調達により、医療機関は規制基準への準拠を維持しながら、複数のユニットを効率的に装備することができます。北米には大手メーカーと販売業者が存在し、このチャネルにおける優位性を支えています。

オンライン販売セグメントは、eコマースの普及拡大、患者と介護者の間での認知度の高まり、そしてウェアラブルデバイスやスマートモニタリングデバイスの自宅配送の利便性に後押しされ、2025年から2032年にかけて最も急速な成長を遂げると予想されています。オンラインプラットフォームは、より幅広い製品へのアクセス、機能の比較、そして遠隔医療サービスとの統合を可能にします。医療機器をオンラインで購入する傾向は、特に在宅ケアや小児科の患者において、介護者が高度なモニタリングソリューションへの利便性を求める中で、ますます広がっています。メーカーもまた、消費者へのリーチを強化し、シームレスなサポートを提供するために、直販オンラインチャネルへの投資を行っています。デジタルマーケティング、製品デモ、そして簡単な返品ポリシーも、オンライン販売の成長をさらに促進しています。

北米てんかんモニタリング機器市場地域分析

- 米国は、高度な医療インフラ、デジタルヘルス技術の採用率の高さ、主要な業界プレーヤーの強力な存在により、2024年にはてんかんモニタリングデバイス市場で73.3%という最大の収益シェアを獲得して市場を支配した。

- この地域の患者と医療提供者は、精度、リアルタイムモニタリング機能、デジタルヘルスプラットフォームや遠隔医療ソリューションとのデバイスの統合を高く評価しています。

- この広範な採用は、高度な医療インフラ、神経学的機器の強力な研究開発、そして高額な医療費によってさらに支えられており、てんかんモニタリング機器は病院と在宅ケアの両方の環境で不可欠なツールとして確立されています。

米国てんかんモニタリング機器市場に関する洞察

米国のてんかんモニタリングデバイス市場は、てんかんの有病率増加と高度な神経学的モニタリングソリューションの導入拡大に支えられ、2024年には北米で最大の収益シェアを獲得しました。患者と医療提供者は、スマートデバイスやウェアラブルデバイスによる発作の正確かつリアルタイムなモニタリングと遠隔管理を重視しています。在宅モニタリングのトレンドの高まりと、AI支援による検出および遠隔医療との統合に対する堅調な需要が相まって、市場をさらに牽引しています。さらに、てんかんモニタリングデバイスとデジタルヘルスプラットフォームやモバイルアプリケーションとの統合が進んでいることも、市場の拡大に大きく貢献しています。

カナダてんかんモニタリング機器市場に関する洞察

カナダのてんかんモニタリングデバイス市場は、主に神経疾患への意識の高まりと医療インフラへの投資増加に牽引され、予測期間を通じて大幅なCAGRで拡大すると予想されています。在宅ケアモニタリングソリューションとウェアラブルデバイスの需要増加は、特に小児および高齢者患者の間で導入を促進しています。カナダの消費者と医療提供者は、高度なモニタリングシステムが提供する利便性、精度、そしてリアルタイムのデータアクセスに魅力を感じています。この地域では、病院、神経学センター、在宅ケア施設において、新規および既存のケアプログラムの両方にデバイスが統合され、大きな成長が見込まれています。

メキシコのてんかんモニタリング機器市場に関する洞察

メキシコのてんかんモニタリングデバイス市場は、てんかん有病率の上昇と医療費の増加を背景に、予測期間中に注目すべきCAGRで成長すると予想されています。患者の安全性に対する懸念の高まりと、信頼性の高い発作モニタリングの必要性から、病院、診療所、そして介護者はスマートデバイスやウェアラブルデバイスの導入を進めています。メキシコでは、デジタルヘルスインフラの拡大と、神経疾患ケアへのアクセス向上に向けた政府の取り組みが相まって、市場の成長を継続的に促進すると予想されます。さらに、モニタリングデバイスとモバイルアプリケーションや遠隔医療サービスの統合により、アクセシビリティと患者のコンプライアンスが向上しています。

北米てんかんモニタリング機器市場シェア

北米のてんかんモニタリング機器業界は、主に次のような定評のある企業によって牽引されています。

- NeuroPace, Inc.(米国)

- エンパティカ社(米国)

- メドトロニック(アイルランド)

- マシモ(米国)

- キャドウェル・ラボラトリーズ社(米国)

- Natus Medical Incorporated (米国)

- Compumedics Limited(オーストラリア)

- ブレイン・センチネル社(米国)

- EMOTIV(米国)

- ニューロエレクトリックス(米国)

- Koninklijke Philips NV (オランダ)

- GEヘルスケア(米国)

- 日本光電株式会社 (日本)

- リヴァノヴァPLC(英国)

- バイオセレニティ(フランス)

- ゼト社(米国)

- セリベル社(米国)

- シーア・メディカル(オーストラリア)

- スリープメッド社(米国)

- アドバンスト・ブレイン・モニタリング社(米国)

北米てんかんモニタリングデバイス市場の最近の動向は何ですか?

- 2025年4月、EpiWatchのApple WatchベースのアプリはFDAの承認を取得し、服薬リマインダー、発作記録、メンタルヘルストラッキングなどの機能を提供します。ジョンズ・ホプキンス大学医学部と共同開発され、AppleのResearchKitを搭載したこのプラットフォームは、てんかん患者の遠隔モニタリングを強化します。

- 2025年4月、FDAはEpiminder社の持続脳波モニタリングシステム「Minder」にDe Novo承認を与えました。このデバイスは、米国でてんかん患者向けに承認された初めての製品であり、2025年後半に主要なてんかんセンターで導入される予定です。

- 2025年4月、在宅てんかんモニタリングを専門とするオーストラリアの医療技術企業Seer Medicalは、Breakthrough Victoriaから4,000万米ドルの救済契約を獲得しました。この資金は、製品リコールや財務難といった課題を抱えながらも、同社の事業を支援し、米国市場への進出を促進することを目的としています。

- メドトロニックは2025年2月、BrainSense Adaptive深部脳刺激(aDBS)システムのFDA承認を取得しました。主にパーキンソン病の治療を目的としていますが、FDAの承認とメドトロニックの関連発表では、同社のDBS研究の推進への取り組みがてんかん患者の治療選択肢にも変革をもたらすと述べられています。

- 2024年2月、エンパティカは、FDA承認済みの次世代てんかんモニタリングシステム「EpiMonitor」の発売を発表しました。EpiMonitorは、てんかん治療のためのウェアラブル技術における大きな進歩であり、最大1週間のバッテリー駆動時間、強化された発作検出機能、睡眠や活動の追跡を含む包括的な健康情報を提供するユーザーフレンドリーなモバイルアプリを備えています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。