北米の電子医療記録 (EMR) 市場、コンポーネント別 (ソフトウェアとサービス)、タイプ別 (従来の EMR、音声対応 EMR、相互運用可能な EMR、その他)、アプリケーション別 (専門アプリケーションと一般アプリケーション)、エンド ユーザー別 (病院、総合診療医クリニック、専門クリニック、外来手術センター、その他)、配信モード別 (クライアント ベースのセットアップ、クラウド ベースのセットアップ、ハイブリッド セットアップ)、業界動向と 2029 年までの予測。

北米の電子医療記録 (EMR) 市場の分析と洞察

世界中の病院やさまざまな診療所における EMR の需要の高まりは、市場全体の成長を後押ししています。EMR ソフトウェアとサービスの技術的進歩の高まりも、市場の成長に貢献しています。主要な市場プレーヤーは、さまざまな新製品の発売に非常に注力しています。さらに、EMR のメンテナンスの容易さとアクセスのしやすさも、市場需要の高まりに貢献しています。

北米の電子医療記録 (EMR) 市場は、市場プレーヤーの増加とさまざまな EMR ブランドが市場に登場したことにより、予測年度に成長しています。これに伴い、メーカーは市場でさまざまな製品の製造に取り組んでいます。医療分野への政府資金の増加は、市場の成長をさらに後押ししています。ただし、EMR サービスに関連する高コストと、データの安全性およびプライバシー セキュリティの問題により、予測期間中の北米の電子医療記録 (EMR) 市場の成長が妨げられる可能性があります。

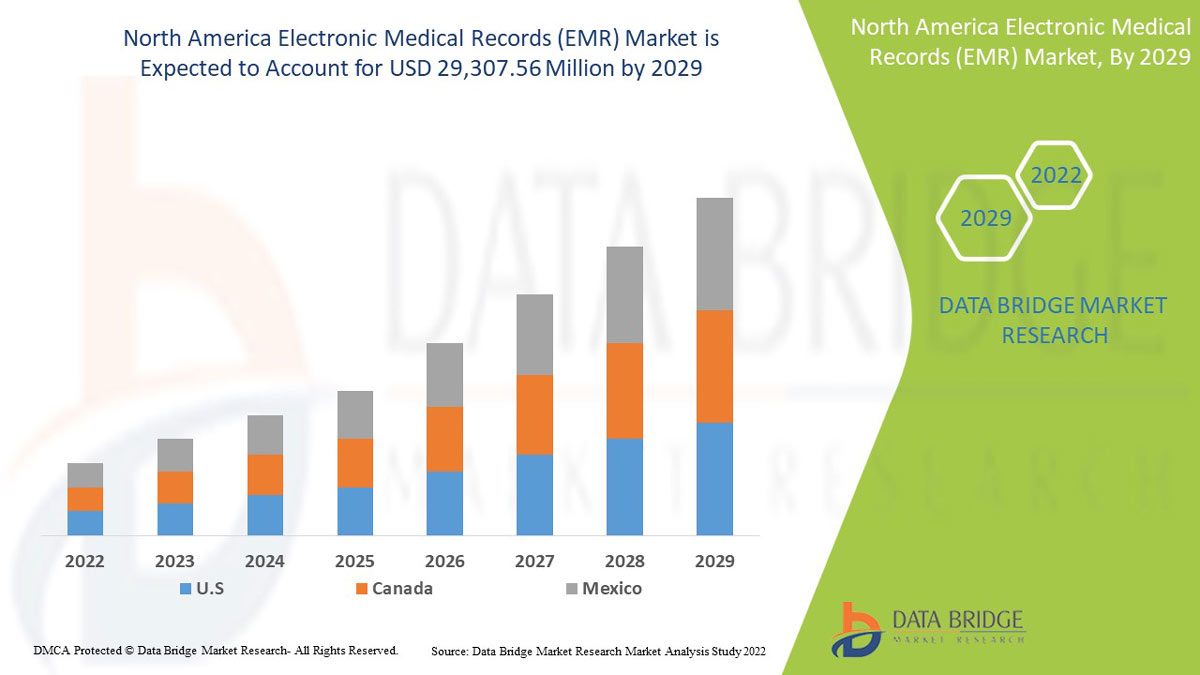

Data Bridge Market Research の分析によると、北米の電子医療記録 (EMR) 市場は、予測期間中に 7.5% の CAGR で成長し、2029 年までに 293 億 756 万ドルに達する見込みです。技術の進歩が進み、メンテナンスが少なく、北米でより広く利用できることから、コンポーネントは市場で最大の診断タイプ セグメントを占めています。この市場レポートでは、価格分析、特許分析、技術の進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2020-2016 にカスタマイズ可能) |

|

定量単位 |

売上高(百万)、販売数量(個)、価格(米ドル) |

|

対象セグメント |

コンポーネント (ソフトウェアとサービス)、タイプ (従来の EMR、音声対応 EMR、相互運用可能な EMR、その他)、アプリケーション (専門アプリケーションと一般アプリケーション)、エンド ユーザー (病院、総合診療医クリニック、専門クリニック、外来手術センター、その他)、配信モード (クライアント ベースのセットアップ、クラウド ベースのセットアップ、ハイブリッド セットアップ) 別。 |

|

対象国 |

米国、カナダ、メキシコ。 |

|

対象となる市場プレーヤー |

Epic Systems Corporation、Greenway Health LLC、NXGN Management, LLC、Experity、InSync Healthcare Solutions、InterSystems Corporation、eClinical Works、Oracle、Allscripts Healthcare, LLC、Athenahealth、Medical Information Technology Inc.、Health Catalyst、Carecloud Inc.、Medhost、CureMD Healthcare、Infor-Med Inc.、PracticeSuite Inc.、PatientNow、WebPT など。 |

市場の定義

電子カルテ (EMR) は、医療提供者の紙のカルテに通常記載されているすべての情報のデジタル版です。医療履歴、診断、投薬、予防接種日、アレルギー、検査結果、医師の診断書などが含まれます。EMR は、1 つの医療提供者のオフィスからの標準的な医療データと臨床データのオンライン医療記録であり、主に医療提供者が診断と治療に使用します。患者の医療履歴、検査、診断、治療を EMR に包括的かつ正確に記録することで、医療提供者のクリニック全体で適切なケアが保証されます。

EMR は単なる紙の記録の代替品ではありません。EMR は医療チームのメンバー間のコミュニケーションと調整を効果的に行い、最適な患者ケアを実現します。

北米の電子医療記録(EMR)市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 技術の進歩の高まり

電子医療記録は、患者の紙ベースの医療情報をデジタルで表現したものです。これらの電子医療記録の目的は、医療の全体的な質を向上させることです。臨床、財務、人口統計、コード化されたヘルスケア データは、電子医療記録の一部です。

したがって、世界における技術の進歩の高まりにより、北米の電子医療記録 (EMR) 市場の成長が促進されると予想されます。

- メンテナンスが少なく、アクセスが簡単

一般的に、EMR ソフトウェアは、ポイントオブケアからすべてのデータを取得して文書化し、必要に応じて推測するための最適なプラットフォームとして機能します。健康分析を行ってベストプラクティス方法を見つけ、プロセスを変更してプロジェクトを改善し、新しい実践レベルの介入を作成し、教育目的を支援するための有益な研究を準備することができます。

医療情報システムのより広範な利用と、患者の臨床情報のより容易な統合と共有により、医療記録へのより広範なアクセスが可能になります。EMR は、セキュリティ ソリューションの面で、また患者記録の正確性と完全性の向上という点でいくつかの利点をもたらす可能性があり、北米の電子医療記録 (EMR) 市場の成長を促進することが期待されています。

拘束

- EHRサービスに関連する高コスト

オンプレミス ソリューションのメンテナンス コストと EHR サービスのコストは非常に高く、今後数年間の市場の成長を妨げる可能性があります。

Financial obstacles prevent hospitals and doctors from adopting and implementing an EHR. These obstacles include adoption and implementation expenses, ongoing maintenance costs, revenue loss due to temporary loss of productivity, and revenue decreases. Investing in and setting up hardware and software, converting paper charts to electronic ones, and providing end users with training are all costs associated with adopting and implementing an EHR. Also, hardware must be replaced, and software must be upgraded on a regular basis which may hinder the market growth in the coming years.

Medical staff and providers' workflows are disrupted by EHR, which results in momentary productivity losses. As end users are still getting used to the new system, there will be a decrease in productivity, which could result in revenue losses which can hinder the market growth in the coming years.

Opportunity

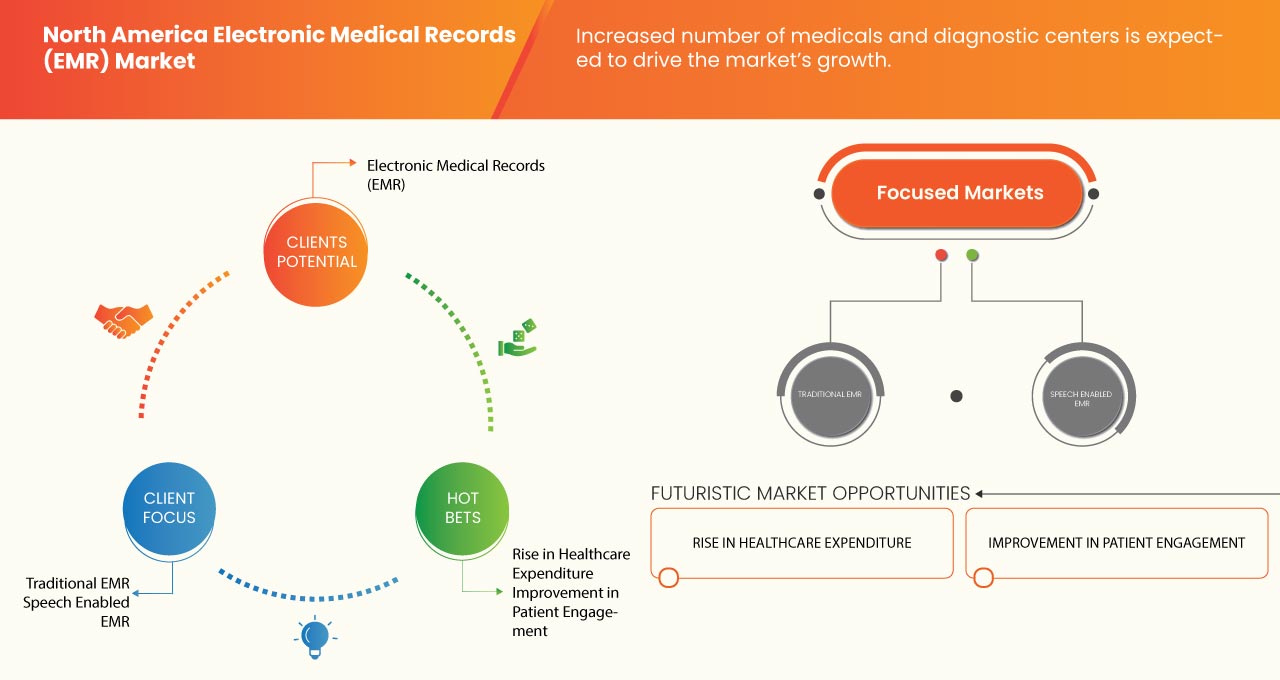

- Increased number of medicals & diagnostic centers

A digital version of a chart containing all the patient information stored in a computer is called electronic medical record (EMR). It can be managed and consulted by authorized clinicians and staff within one healthcare organization. The growing demand for healthcare facilities and awareness among people are the key factors in the increased number of medical and diagnostic centers.

Hence, the number of medical and testing laboratories is increasing vastly especially after the COVID-19 pandemic, and the electronic medical record industry is rising together to fulfill the demands in less time and error-free manner. Technological advancement has made the industry grow rapidly in all aspects.

Challenge

- Software incompatibility issues due to varying data standards

EMR software compatibility refers to a single EMR software's ability to communicate and share data with other EMR software and medical systems. The incompatibility issue is not too prevalent within the same organization. But, it becomes a significant stop gap for patient care once help from outside that organization is needed. For instance, incompatibility may arise when a patient is discharged from the hospital, and later, they need to seek out specialized care from a doctor or physical therapist who uses different EMR software.

The software used for EMR are different from organization to organization, and it causes incompatibility issues when the patient's recorded data is shared between them for further care. Hence, it is a major challenge for the EMR market where medical information is very important.

Post-COVID-19 Impact on North America Electronic Medical Records (EMR) Market

Healthcare firms are ramping up efforts for the treatment of COVID-19 patients. However, with the surge in the number of cases, it is challenging for hospitals to manage patient information precisely. Healthcare IT vendors are thriving to provide healthcare organizations with tools to manage a case, analyze the information, as well as assess the patients remotely. In light of this pandemic, electronic heath record/electronic medical record (EHR-EMR) vendors are trying to augment their existing systems for smooth functionality and coping with this crisis.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities and product launches, and strategic partnerships to improve the technological advancement in the EMR market.

Recent Developments

- In October 2022, Greenway Health LLC, a leading health information technology services provider, announced its newest partnership with Associates in Resource Management (ARM), a one-source partner for Rural Health Centers (RHC), Federal Qualified Health Centers (FQHC), and Private Practices in the states of Kentucky, Tennessee, and Alabama.

- In September 2022, Epic Systems Corporation announced the release of its Life Sciences program, expanding its work to bring together the disconnected parts of healthcare. The program is built to help providers, pharmaceutical companies, and medical device manufacturers recruit research participants, expand clinical trial access to underrepresented communities, and speed up the development of new therapies.

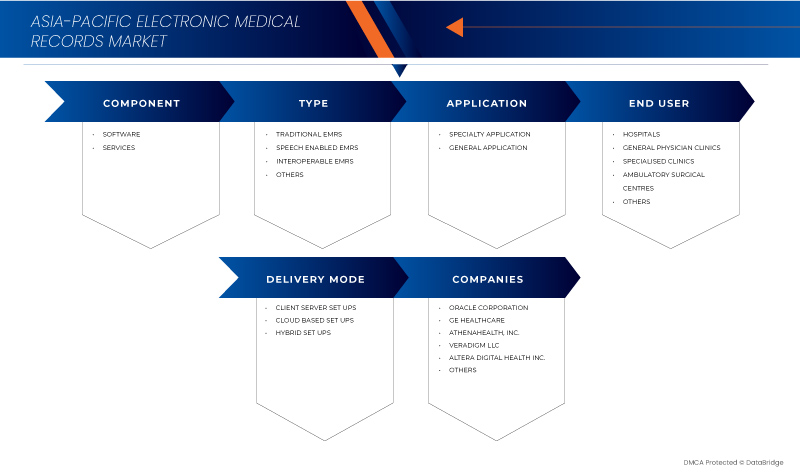

North America Electronic Medical Records (EMR) Market Scope

North America electronic medical records (EMR) market is segmented into component, type, application, end user, and delivery mode. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

BY COMPONENT

- Software

- Services

On the basis of component, the market is segmented into software and services.

BY TYPE

- Traditional EMR

- Speech enabled EMR

- Interoperable EMR

- Others

On the basis of type, the market is segmented into traditional EMR, speech enabled EMR, interoperable EMR, and others.

BY APPLICATION

- Specialty application

- General application

On the basis of application, the market is segmented into specialty application and general application.

BY END USER

- Hospitals

- General physician clinics

- Specialized clinics

- Ambulatory surgical centers

- Others

On the basis of end user, the market is segmented into hospitals, general physician clinics, specialized clinics, ambulatory surgical centers, and others.

BY DELIVERY MODE

- Client Based Setups

- Cloud Based Setups

- Hybrid Setups

On the basis of delivery mode, the market is segmented into client based setups, cloud based setups, and hybrid setups.

North America Electronic Medical Records (EMR) Market Regional Analysis/Insights

北米の電子医療記録 (EMR) 市場が分析され、コンポーネント、タイプ、アプリケーション、エンド ユーザー、配信モード別に市場規模の情報が提供されます。

この市場レポートでカバーされている国は、米国、カナダ、メキシコです。

- 2022年には、高いGDPを誇る最大の消費者市場に主要な市場プレーヤーが存在し、最新の高度な癌診断技術と電子医療記録(EMR)の発明により、米国が北米を支配しました。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、北米ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

競争環境と北米の電子医療記録 (EMR) 市場シェア分析

北米の電子医療記録 (EMR) 市場の競争状況では、競合他社ごとに詳細が提供されます。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と幅、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータ ポイントは、北米の電子医療記録 (EMR) 市場に対する会社の重点にのみ関連しています。

北米の電子医療記録 (EMR) 市場で活動している主要企業には、Epic Systems Corporation、Greenway Health LLC、NXGN Management, LLC、Experity、InSync Healthcare Solutions、InterSystems Corporation、eClinical Works、Oracle、Allscripts Healthcare, LLC、Athenahealth、Medical Information Technology Inc.、Health Catalyst、Carecloud Inc.、Medhost、CureMD Healthcare、Infor-Med Inc.、PracticeSuite Inc.、PatientNow、WebPT などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 OVERVIEW OF NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

1.3 LIMITATIONS

1.4 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPONENT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING TECHNOLOGICAL ADVANCEMENTS

6.1.2 LOW MAINTENANCE AND WIDER ACCESSIBILITY

6.1.3 GROWING INVESTMENT IN HEALTHCARE BY THE GOVERNMENT AND PRIVATE SECTOR

6.2 RESTRAINTS

6.2.1 HIGH COST ASSOCIATED WITH EHR SERVICE

6.2.2 DATA SAFETY ISSUES

6.3 OPPORTUNITIES

6.3.1 INCREASED NUMBER OF MEDICALS & DIAGNOSTIC CENTRES

6.3.2 RISING HEALTHCARE EXPENDITURE

6.4 CHALLENGES

6.4.1 SOFTWARE INCOMPATIBILITY ISSUES DUE TO VARYING DATA STANDARDS

6.4.2 INSUFFICIENT INFRASTRUCTURE

6.4.3 LACK OF SKILLED PROFESSIONALS

7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE

7.2.1 INTEROPERABLE EMR

7.2.2 TRADITIONAL EMR

7.2.3 SPEECH ENABLED EMR

7.2.4 OTHERS

7.3 SERVICES

8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE

8.1 OVERVIEW

8.1.1 INTEROPERABLE EMR

8.1.2 TRADITIONAL EMR

8.1.3 SPEECH ENABLED EMR

8.1.4 OTHERS

9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SPECIALTY APPLICATION

9.2.1 CARDIOLOGY

9.2.1.1 SOFTWARE

9.2.1.2 SERVICES

9.2.2 OBSTERICS & GYNECOLOGY

9.2.2.1 SOFTWARE

9.2.2.2 SERVICES

9.2.3 DERMATOLOGY

9.2.3.1 SOFTWARE

9.2.3.2 SERVICES

9.2.4 ONCOLOGY

9.2.4.1 SOFTWARE

9.2.4.2 SERVICES

9.2.5 NEUROLOGY

9.2.5.1 SOFTWARE

9.2.5.2 SERVICES

9.2.6 RADIOLOGY

9.2.6.1 SOFTWARE

9.2.6.2 SERVICES

9.2.7 OTHERS

9.3 GENERAL APPLICATION

9.3.1 SOFTWARE

9.3.2 SERVICES

10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.2.1 SMALL AND MEDIUM SIZED HOSPITALS

10.2.2 LARGE HOSPITALS

10.3 AMBULATORY SURGICAL CENTERS

10.4 SPECIALIZED CLINICS

10.5 GENERAL PHYSICIAN CLINICS

10.6 OTHERS

11 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE

11.1 OVERVIEW

11.2 CLOUD BASED SETUPS

11.3 HYBRID SETUPS

11.4 CLIENT BASED SETUPS

12 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 EPIC SYSTEMS CORPORATION

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.3 RECENT DEVELOPMENT

15.2 ORACLE CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 ECLINICALWORKS

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENTS

15.4 ATHENAHEALTH

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 INTERSYSTEMS CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ALLSCRIPTS HEALTHCARE, LLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CARECLOUD, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CUREMD HEALTHCARE

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 EXPERITY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 GREENWAY HEALTH LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 HEALTH CATALYST

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 INFOR-MED INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 INSYNC HEALTHCARE SOLUTIONS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 MEDHOST

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MEDICAL INFORMATION TECHNOLOGY,INC

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NXGN MANAGEMENT, LLC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PATIENTNOW

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 PRACTICESUITE INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 WEBPT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 33 U.S. SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 U.S. SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 U.S. CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 U.S. OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 U.S. DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 U.S. ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 U.S. NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.S. RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 U.S. GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 U.S. HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.S. ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 47 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 48 CANADA SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 CANADA SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 CANADA NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 CANADA RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CANADA GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 60 CANADA HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 62 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 MEXICO SOFTWARE IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 MEXICO SPECIALTY APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 MEXICO CARDIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 MEXICO OBSTETRICS & GYNECOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO DERMATOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO ONCOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO NEUROLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO RADIOLOGY IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO GENERAL APPLICATION IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 75 MEXICO HOSPITALS IN ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO ELECTRONIC MEDICAL RECORDS (EMR) MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SEGMENTATION

FIGURE 11 THE GROWING TECHNOLOGICAL ADVANCEMENTS IN EMR SOFTWARES AND RISING MEDICALS AND DIAGNOSTIC CENTRES ARE EXPECTED TO DRIVE THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET

FIGURE 14 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2021

FIGURE 15 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 18 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2021

FIGURE 19 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2021

FIGURE 23 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021

FIGURE 27 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021

FIGURE 31 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, 2021-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: SNAPSHOT (2021)

FIGURE 35 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021)

FIGURE 36 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2022 & 2029)

FIGURE 37 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: BY COUNTRY (2021 & 2029)

FIGURE 38 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPONENT (2022-2029)

FIGURE 39 NORTH AMERICA ELECTRONIC MEDICAL RECORDS (EMR) MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。