北米の消毒ワイプ市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

6.02 Billion

2024

2032

USD

3.92 Billion

USD

6.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 6.02 Billion | |

|

|

|

|

北米の消毒用ワイプ市場のセグメンテーション、製品タイプ別(塩素化合物、第四級アンモニウム、酸化剤、フェノール、アルコール、ヨウ素化合物、アルデヒド、グルコン酸クロルヘキシジンなど)、使いやすさ(使い捨てと非使い捨て)、パッケージ(フラットパック、キャニスターなど)、素材タイプ(繊維ワイプ、バージンファイバーワイプ、アドバンスファイバーワイプなど)、消毒レベル(高、中、低)、フレーバー(ラベンダー&ジャスミン、レモン、柑橘類、ココナッツなど)、タイプ(殺菌、殺ウイルス、殺胞子、殺結核、殺真菌、殺菌)、最終用途(医療、商業、工業用キッチン、輸送業界、光学業界、電子&コンピュータ業界など)、流通チャネル(直接入札と小売販売) - 業界2032年までのトレンドと予測

消毒ワイプ市場規模

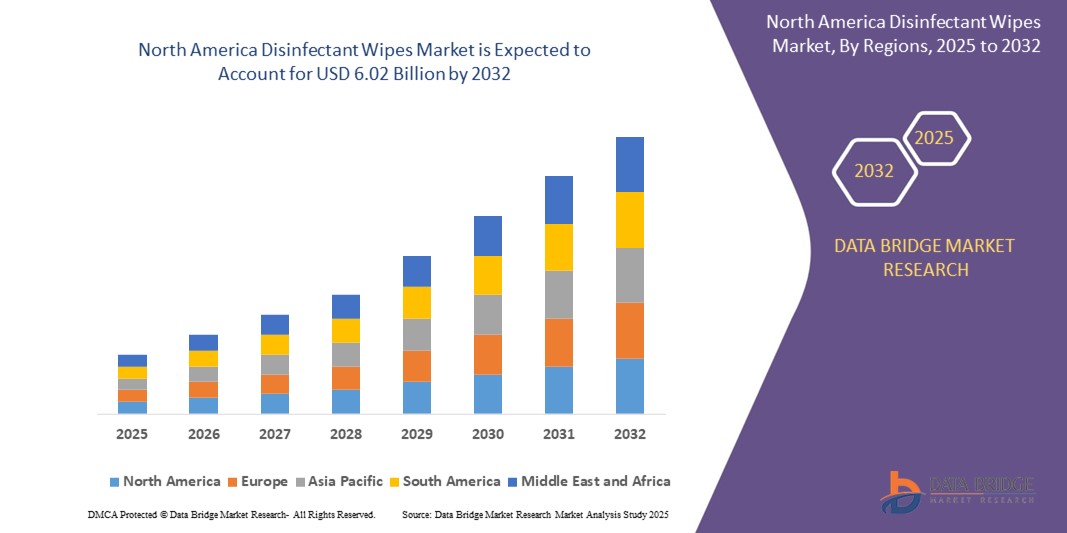

- 北米の消毒ワイプ市場規模は2024年に39億2000万米ドルと評価され、予測期間中に5.5%のCAGRで成長し、2032年までに60億2000万米ドルに達すると予想されています。

- 市場の成長は、主にCOVID-19後の衛生意識の高まりと、表面レベルの感染制御のための便利で効果的なソリューションとして、医療、商業、住宅の環境での消毒ワイプの採用の増加によって促進されています。

- さらに、すぐに使用でき、携帯性に優れ、肌に安全な消毒製品に対する消費者の需要が高まっており、消毒シートは液体消毒剤やスプレーに代わる好ましい代替品として定着しつつあります。これらの要因が重なり、ハイタッチ環境での消毒シートの使用が加速し、業界の成長を大きく押し上げています。

消毒ワイプ市場分析

- 除菌シートは、抗菌剤を配合したウェットティッシュで、硬質面および軟質面から細菌、ウイルス、真菌を除去します。素早く、残留物のない洗浄効果があり、医療施設、家庭、学校、オフィス、公共交通機関などで広く使用されています。

- 消毒用ワイプの需要の高まりは、主に感染予防プロトコルの強化、衛生的で便利な清掃方法への消費者の傾向の高まり、そして市場全体における環境に優しく生分解性の製品オプションの拡大によって推進されています。

- 消毒用ワイプ市場は、医療、住宅、商業施設の清掃用途における旺盛な需要により、2024年には米国が30.58%のシェアを占め、市場をリードする。病院、オフィス、学校、家庭における消毒用ワイプの普及と、パンデミック後の衛生意識の高まりにより、米国は地域リーダーとしての地位を確固たるものにしている。

- カナダは、医療、保育、公共施設での需要の高まりにより、予測期間中に消毒ワイプ市場で最も急速に成長する地域になると予想されています。

- アルコール系ワイプは、その速効性、蒸発性、そして幅広い病原体に対する有効性により、2024年には42.5%の市場シェアを占め、市場を席巻しました。アルコールベースのワイプは、その利便性、非残留性、そして接触頻度の高い環境における感染対策への適合性から、医療、消費者、オフィスの現場で広く好まれています。

レポートの範囲と消毒ワイプ市場のセグメンテーション

|

属性 |

消毒用ワイプの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

消毒ワイプ市場の動向

「衛生意識の向上」

- 消毒用ワイプ市場における重要な加速傾向は、特にCOVID-19パンデミック以降、消費者と企業の両方で衛生と感染予防に対する意識が高まっていることである。

- 例えば、消毒用ワイプの需要は医療、商業、住宅の環境で急増しており、病院、診療所、オフィス、家庭では、感染や交差汚染のリスクを最小限に抑えるために、表面を迅速かつ効果的に清掃するためにこれらの製品に依存しています。

- 消費者や組織が、効果を損なうことなく環境への影響を軽減する持続可能な代替品を求めているため、環境に優しく生分解性の消毒ワイプの導入が進んでいます。

- 大都市や人口密集地域では、公衆衛生キャンペーンや、公共交通機関、学校、小売スペースなどの人通りの多い場所での清潔さを維持する必要性から、消毒用ワイプの採用が増加しています。

- 市場では、製品の配合、パッケージ、流通チャネルの革新も見られ、メーカーは、多様なエンドユーザーのニーズを満たすために、利便性、携帯性、進化する規制基準への準拠に重点を置いています。

- 企業は定期的な消毒の重要性を強化するためのマーケティングおよび教育活動に投資しており、さまざまな分野での消毒ワイプの継続的な成長と主流の受け入れをさらにサポートしています。

消毒ワイプ市場の動向

ドライバ

「業務用消毒ワイプの使用増加」

- 企業が従業員、顧客、業務継続性を守るために衛生を優先しているため、商業用途での消毒ワイプの使用拡大は市場成長の大きな原動力となっている。

- 例えば、医療、ホスピタリティ、食品サービス、輸送などの業界では、厳格な健康および安全規制に準拠するために、頻繁に触れる表面、機器、共用エリアの日常的な清掃に消毒ワイプを採用しています。

- 院内感染の増加と医療施設における厳格な感染制御対策の必要性から、手術室、病室、公共の待合室で消毒ワイプが広く使用されるようになりました。

- 小売店、ジム、オフィスビルでは、顧客や従業員が使用するための消毒用ワイプの提供が増えており、共有スペースに対する公衆の信頼を強化し、パンデミック後のビジネス回復を支援しています。

- 消毒ワイプの利便性、スピード、そして実証済みの有効性は、商業清掃プロトコルに欠かせないツールとなり、複数の業界で持続的な需要を生み出しています。

- 商業部門が成長し進化し続けるにつれて、消毒ワイプを標準操作手順に統合することが、引き続き重要な市場推進力になると予想されます。

抑制/挑戦

「消毒用ワイプの使用による副作用」

- 消毒ワイプの頻繁な使用に伴う潜在的な副作用は、皮膚刺激、アレルギー反応、呼吸器系の問題に対する懸念が一部のユーザーの使用を躊躇させる可能性があるため、市場にとって大きな課題となっている。

- 例えば、第四級アンモニウム化合物やアルコールなどの特定の消毒用ワイプに含まれる化学物質は、特にこれらの製品を頻繁に使用する医療従事者や清掃スタッフに、繰り返し曝露することで乾燥、皮膚炎、または過敏症を引き起こす可能性がある。

- 消毒用ワイプの不適切な使用や過剰使用は、表面に化学物質の残留物が蓄積する可能性があり、特に保育施設や食品調理場などの敏感な環境では健康リスクをもたらす可能性があります。

- これらのリスクに対する消費者の意識の高まりと、化学成分に対する規制当局の監視により、メーカーはユーザーの懸念に対処するために、より安全で肌に優しく、低刺激性の処方を開発するよう促されている。

- 効果的な消毒とユーザーの安全性および快適性のバランスをとるという課題は、企業が副作用を最小限に抑えながら有効性を維持しようとしているため、市場における継続的な研究と製品革新を推進しています。

消毒ワイプ市場の展望

市場は、製品タイプ、使いやすさ、パッケージ、材料タイプ、消毒レベル、風味、タイプ、最終用途、流通チャネルに基づいてセグメント化されています。

- 製品タイプ別

製品タイプ別に見ると、消毒用ワイプ市場は、塩素化合物、第四級アンモニウム、酸化剤、フェノール、アルコール、ヨウ素化合物、アルデヒド、グルコン酸クロルヘキシジン、その他に分類されます。アルコール系ワイプは、その速効性、蒸発性、そして幅広い病原体に対する有効性により、2024年には42.5%と最大の収益シェアを占めました。アルコール系ワイプは、その利便性、非残留性、そしてハイタッチ環境における感染対策への適合性から、医療現場、消費者、オフィスなどで広く好まれています。

第四級アンモニウムセグメントは、その幅広い抗菌スペクトル、幅広い表面への適合性、そして低臭性により、2025年から2032年にかけて最も高い成長率を記録すると予測されています。この化合物は、有効性と表面安全性が重要となる病院グレードの消毒剤に広く使用されています。さらに、住宅用および商業用清掃製品への採用増加も、このセグメントの優位性を支えています。

- ユーザビリティ別

消毒ワイプ市場は、使いやすさに基づいて、使い捨てタイプと使い捨てではないタイプに分かれています。使い捨てタイプは、衛生的な単回使用により交差汚染を最小限に抑え、感染管理基準に適合していることから、2024年には市場を牽引しました。医療施設や公共スペースでの使用の増加も、使い捨てタイプの需要を加速させています。

使い捨てではない製品セグメントは、環境への懸念の高まりと再利用可能な消毒ワイプ製品の開発増加に牽引され、予測期間中に最も高いCAGRを達成すると予想されています。これらの製品は、特に環境意識の高い消費者や持続可能な衛生ソリューションを求める企業の間で勢いを増しています。

- パッケージ別

包装形態に基づいて、市場はフラットパック、キャニスター、その他に分類されます。キャニスターは、その利便性、耐久性、そして医療、フィットネスセンター、オフィス環境での使用への適合性から、2024年には市場を席巻しました。キャニスターは保存期間が長く、取り出しやすいため、大量使用に適した形状です。

フラットパックセグメントは、コンパクトで持ち運びやすいデザインが外出先での消費者に訴求するため、2032年まで最も高い成長率を維持すると予想されています。このパッケージタイプは、持ち運びや廃棄の容易さが重視されるパーソナルケア製品や旅行用品で特に人気があります。

- 素材の種類別

素材の種類に基づいて、市場は繊維ワイプ、バージンファイバーワイプ、アドバンスドファイバーワイプ、その他に分類されます。バージンファイバーワイプは、高い吸収性、強度、そして高い純度により、2024年に最大のシェアを獲得しました。これらのワイプは、一貫した消毒効果に不可欠です。品質保証が最重要視される医療現場で頻繁に使用されています。

高度な繊維ワイプは、2025年から2032年にかけて最も高いCAGRを示すと予測されています。これは、多層構造やナノテクノロジーを注入した素材のイノベーションによって、微生物の殺菌率、耐久性、そして様々な消毒剤との適合性が向上することが牽引役となっています。これらのワイプは、ICUや製薬研究室などの高リスク環境でますます採用されています。

- 消毒レベル別

消毒レベルに基づき、市場は高レベル、中レベル、低レベルに分類されます。高レベル消毒セグメントは、手術室、隔離病棟、検査室などの集中治療環境における需要の増加に牽引され、2024年には最大の収益シェアを獲得しました。これらのワイプは、胞子やウイルスなどの耐性病原体を除去し、厳格な感染管理を確実にするために不可欠です。

中レベル消毒セグメントは、医療施設、商業施設、教育施設における汎用性とコスト効率の高さから、2025年から2032年にかけて最も高い成長率で成長すると予想されています。これらのワイプは、効果と表面への適合性のバランスが取れており、頻繁に触れる場所の日常的な清掃に適しています。

- フレーバー別

フレーバーに基づいて、市場はラベンダー&ジャスミン、レモン、シトラス、ココナッツ、その他に分類されます。レモン風味のセグメントは、その爽やかな香りと消費者の清潔感への強い連想から人気が高く、2024年には市場を牽引しました。レモン風味のワイプは、幅広い層に受け入れられ、消臭効果も高いことから、住宅や商業施設で広く使用されています。

ラベンダーとジャスミンは、消費者の心を落ち着かせるアロマセラピー的な香りへの嗜好の高まりに支えられ、予測期間中に最も高い成長が見込まれています。この傾向は、ジム、サロン、パーソナルケアといったライフスタイル志向の分野で特に顕著で、感覚体験が衛生用品の価値を高めるとされています。

- タイプ別

消毒ワイプ市場は、種類別に、殺菌性、殺ウイルス性、殺胞子性、殺結核性、殺真菌性、殺菌性の5つに分類されます。殺菌性ワイプは、日常の清掃や表面消毒において広く使用されていることから、2024年には市場シェアの大部分を占めました。殺菌性ワイプは、一般的な医療関連感染症(HAI)の制御に不可欠であり、家庭および施設の両方で広く受け入れられています。

ウイルス殺菌分野は、世界的なウイルス発生に伴う意識の高まりと、抗ウイルス表面消毒プロトコルの重要性の高まりを背景に、2025年から2032年にかけて最も高いCAGRで成長すると予測されています。感染リスクが高く、迅速な対応が求められる交通機関や公共施設においても、ウイルス殺菌ワイプの需要は高まっています。

- 最終用途別

最終用途に基づいて、市場は医療、商業、業務用厨房、輸送業界、光学業界、電子・コンピュータ業界、その他に分類されます。厳格な感染管理規制と、病院、診療所、診断センターにおける一貫した需要に牽引され、医療分野は2024年に最大の収益シェアを占めました。これらの環境では、衛生を維持し、交差汚染を防ぐために、頻繁かつ効果的な表面消毒が必要です。

運輸業界は、航空会社、鉄道、公共交通機関における衛生管理への投資増加により、予測期間中に最も高い成長率を記録すると予想されています。パンデミック後の消費者の清潔さと安全に対する期待は、旅行環境における接触頻度の高い表面への消毒用ワイプの導入を引き続き促進しています。

- 流通チャネル別

流通チャネルに基づいて、市場は直接入札と小売販売に分けられます。直接入札セグメントは、標準化された感染予防用品を求める病院、政府機関、企業バイヤーからの大量調達に支えられ、2024年には最大の市場シェアを獲得しました。これらの契約は安定したサプライチェーンを確保し、多くの場合、長期的なベンダー関係に支えられています。

小売販売セグメントは、家庭用衛生製品に対する消費者の意識と需要の高まりを背景に、2025年から2032年にかけて最も高いCAGRで成長すると予測されています。消毒用ワイプはスーパーマーケット、薬局、eコマースプラットフォーム、コンビニエンスストアなどで入手可能であるため、エンドユーザーにとって非常に入手しやすいものとなっています。

消毒ワイプ市場の地域分析

- 米国は、医療、住宅、商業施設の清掃用途における旺盛な需要に牽引され、2024年には消毒用ワイプ市場において30.58%という最大の収益シェアを獲得し、市場を席巻しました。病院、オフィス、学校、家庭における消毒用ワイプの普及と、パンデミック後の衛生意識の高まりにより、米国は地域のリーダーとしての地位を確固たるものにしました。

- 特に接触頻度の高い環境において、使いやすくすぐに使える衛生製品への需要が高まっており、市場拡大を牽引しています。感染管理に対する規制の重視と、高度な抗菌処方を提供する確立されたブランドの存在が、製品の普及をさらに促進しています。

- 主要メーカーの強力な存在、十分に発達した小売流通チャネル、そして生分解性で肌に安全なワイプ配合の継続的な革新により、米国は北米における消毒ワイプの主要市場としての地位を強化しています。

カナダの消毒用ワイプ市場の洞察

カナダは、医療、保育、公共施設における需要の増加に牽引され、2025年から2032年にかけて北米の消毒用ワイプ市場において最も高いCAGRを記録すると予測されています。個人衛生、感染予防、環境に優しい製品の使用に関する意識の高まりが市場の成長を牽引しています。政府の支援的な規制と、現地生産の持続可能な消毒ソリューションへの移行が、カナダ市場をさらに推進しています。

メキシコの消毒用ワイプ市場の洞察

メキシコの消毒用ワイプ市場は、医療インフラの拡大、消費者意識の高まり、産業分野およびホスピタリティ分野における消毒用ワイプの使用増加に支えられ、2025年から2032年にかけて着実な成長を遂げると予想されています。また、国内製造能力の拡大、そしてメキシコが地域輸出および国境を越えたサプライチェーンにおいて戦略的に果たす役割も、成長を後押しする要因となっています。

消毒ワイプ市場シェア

消毒用ワイプ業界は、主に、次のような定評のある企業によって牽引されています。

- GOJO Industries, Inc.(米国)

- PDI社(米国)

- エコラボ(米国)

- Reckitt Benckiser Group PLC (英国)

- KCWW(キンバリークラークワールドワイド社)(米国)

- パーカーラボラトリーズ社(米国)

- Dreumex(オランダ)

- セブンスジェネレーション社(米国)

- STERIS plc(アイルランド)

- SCジョンソン・アンド・サン社(米国)

- クレア・マニュファクチャリング・カンパニー(米国)

- Schülke & Mayr GmbH(ドイツ)

北米の消毒ワイプ市場の最新動向

- 2024年3月、サステナビリティへの取り組みと水、衛生、感染予防に関する製品で知られるエコラボは、倫理的なビジネス基準を設定する権威ある組織であるエシスフィアから「世界で最も倫理的な企業」の一つに選出されました。エコラボは2007年に初めてこの賞が導入されて以来、18年連続でこの賞を受賞しており、市場における同社の信頼性をさらに高めることになります。

- 2022年2月、LysolやDettolなどのブランドで知られるReckitt Benckiser Group plcと、衛生・清掃ソリューションのリーディングカンパニーであるDiversey Holdings, Ltd.が、流通提携を行いました。この提携は、信頼性の高い衛生ソリューションを企業に広く提供し、病原菌の拡散を防ぎ、従業員、顧客、そして顧客の安全を確保することを目的としています。

- 2020年6月、レキットベンキーザーグループは、傘下のブランド「リソル」が、COVID-19の影響を受けた米国各地の学校に通う生徒たちに健康食品を届け、パンデミックのさらなる拡大を防ぐため、「ヘルシースクールプログラム」を開始すると発表しました。この取り組みにより、同社の市場における信頼性は高まりました。

- 2020年11月、SCジョンソン社は、清掃業界における女性のキャリア育成に同社が提供してきたリソースと取り組みが評価され、ISSA 2020 Hygieia Network Member of the Yearに選出されたことを発表しました。この受賞は、市場における同社の信頼性をさらに高めるものです。

- 2022年5月、PURELL製品で知られるGOJO Industries, Inc.は、PURELLヘルスケア表面除菌ワイプを発売し、表面衛生ソリューションのラインアップを拡大しました。このワイプは、強力な除菌効果と安心感を兼ね備え、ユーザーに安心感を与えます。これにより製品ポートフォリオが拡充され、同社の総収益にも貢献しました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。