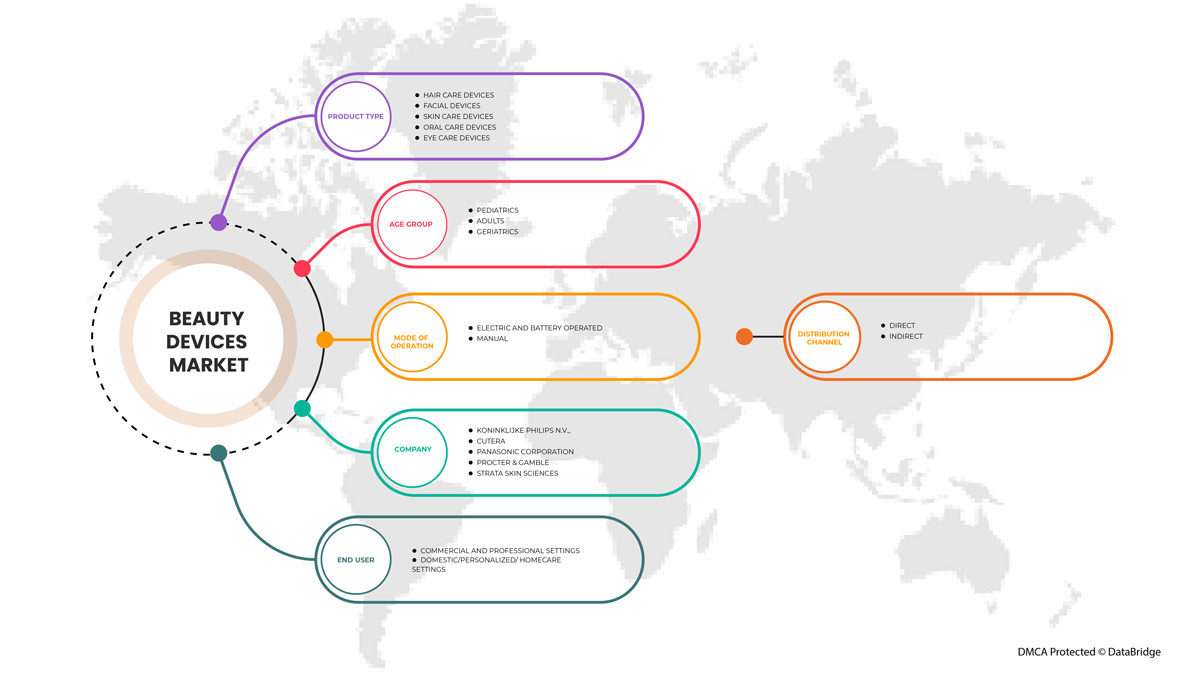

北米の美容機器市場 - 製品タイプ別 (ヘアケア機器、フェイシャル機器、スキンケア機器、オーラルケア機器、アイケア機器)、年齢層別 (小児科、成人および老年科)、操作モード別 (電動および電池式および手動)、エンドユーザー別 (商業および専門環境および家庭/パーソナライズ/在宅ケア環境)、流通チャネル別 (直接および間接)、業界動向および 2029 年までの予測。

北米の美容機器市場の分析と洞察

男性と女性の両方で肌に対する意識が高まったことで、美容機器の需要が加速しています。しわ、ニキビ、色素沈着、シワ、事故による火傷の跡など、肌に関する問題は、人々の間で非常に一般的であり、肌の外観を改善するために適切な治療が必要です。

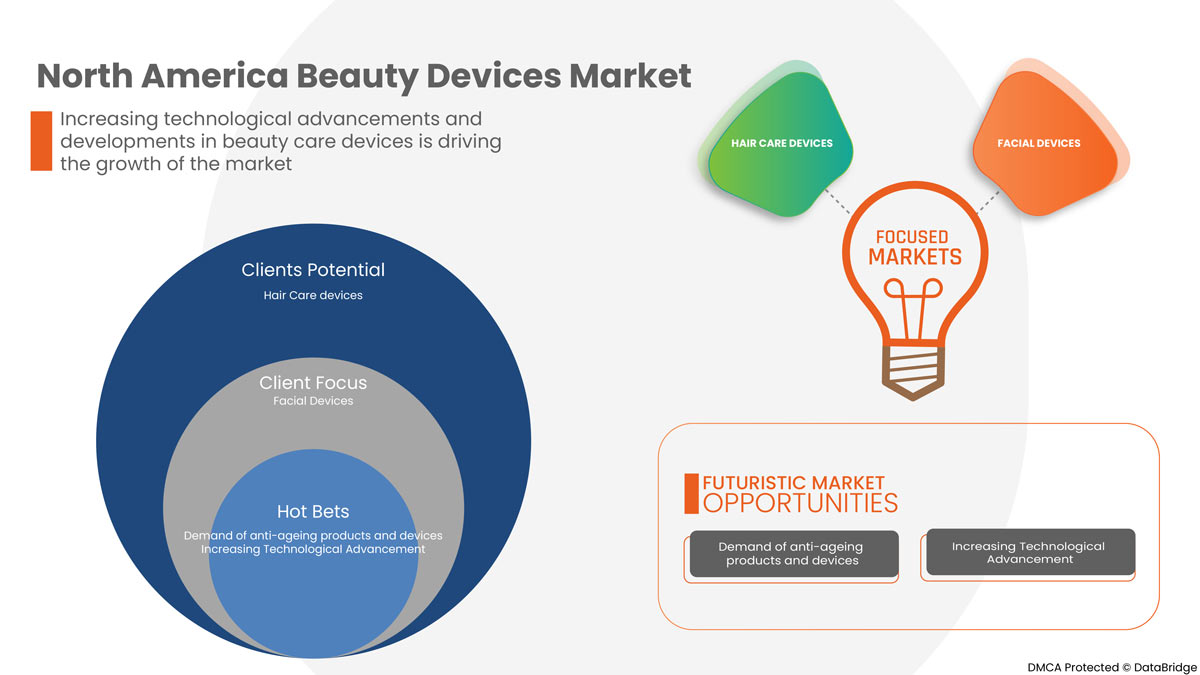

美容機器の市場は、消費者の美的外見に対する意識の高まりや消費者のライフスタイルの向上など、いくつかの理由により、予測年度に成長すると予想されています。これに伴い、メーカーは、美容機器市場で新しい技術に基づく高度な製品を発売するための研究開発活動に取り組んでいます。

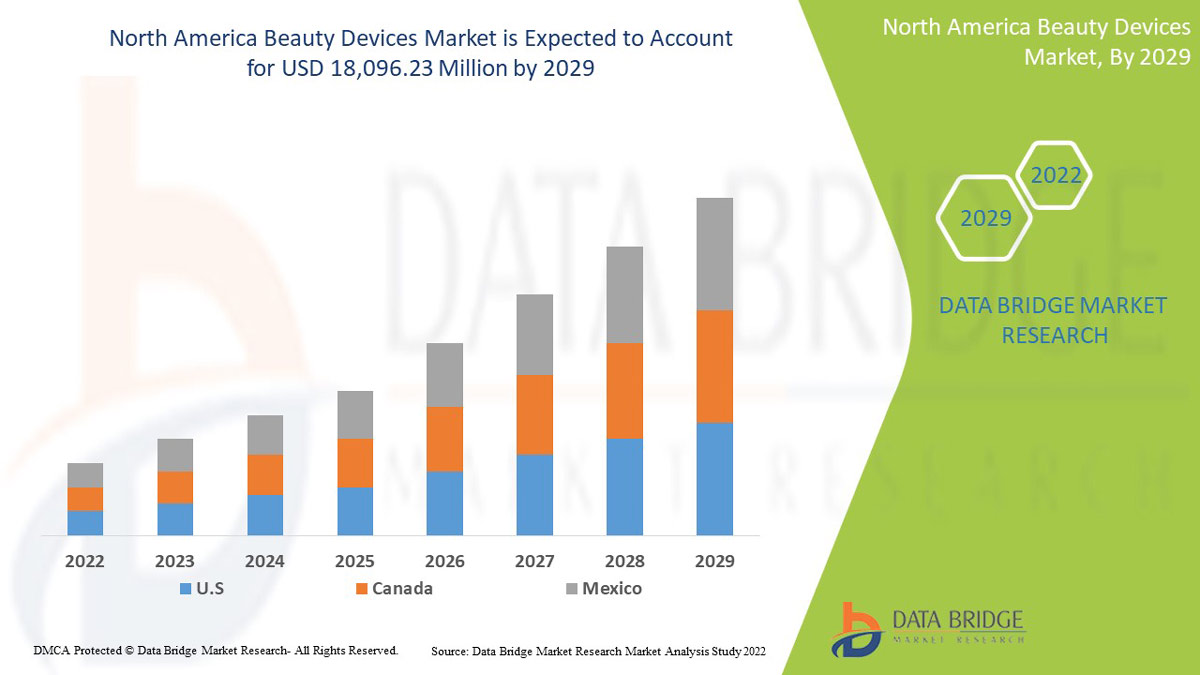

北米の美容機器市場は、2022年から2029年の予測期間に市場が成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に13.5%のCAGRで成長し、2029年までに180億9,623万米ドルに達すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品タイプ (ヘアケア機器、フェイシャル機器、スキンケア機器、オーラルケア機器、アイケア機器)、年齢層 (小児科、成人および高齢者)、動作モード (電動、電池式、手動)、エンドユーザー (商業および専門的設定、家庭/個人/在宅ケア設定)、流通チャネル (直接および間接)。 |

|

対象国 |

米国、カナダ、メキシコ |

|

対象となる市場プレーヤー |

Nu Skin、CANDELA CORPORATION、Curallux LLC、FOREO、Koninklijke Philips NV、Conair Corporation、Lumenis Be Ltd、Cynosure、Sciton、Inc.、Fotona、Procter & Gamble、LUTRONIC、STRATA Skin Sciences、NuFACE、Spectrum Brands、Inc.、Cutera、Merz North America、Inc.、Panasonic Corporation、Procter & Gamble など。 |

北米美容機器市場の定義

美しさは、男性だけでなく女性にとっても欠かせない特徴です。美容機器は、髪、顔、肌、口腔、目など、さまざまな美容関連の課題に使用されています。美容機器は、美容関連の問題の治療に非常に役立ちます。ヘアケア機器、顔面機器、スキンケア機器、口腔ケア機器、目ケア機器など、さまざまな美容機器が市場で販売されており、美的外観を改善するために使用されています。

光/LEDおよび光若返り療法機器は、狭帯域の非熱LED光エネルギーを使用して体内の自然な細胞プロセスを活性化し、肌の若返りと修復を促進する美容システムの一種です。アンチエイジングは美容関連の問題における最大の課題の1つであり、アンチエイジングの事例は急速に増加しており、美容機器はアンチエイジングのさまざまな兆候をターゲットにし、しわや小じわなどのさまざまな老化兆候を軽減します。美容業界は、エンドユーザーの間で広く採用されている高度な技術ベースの製品の市場導入によって細分化されています。

北米の美容機器市場の動向

このセクションでは、市場の推進要因、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

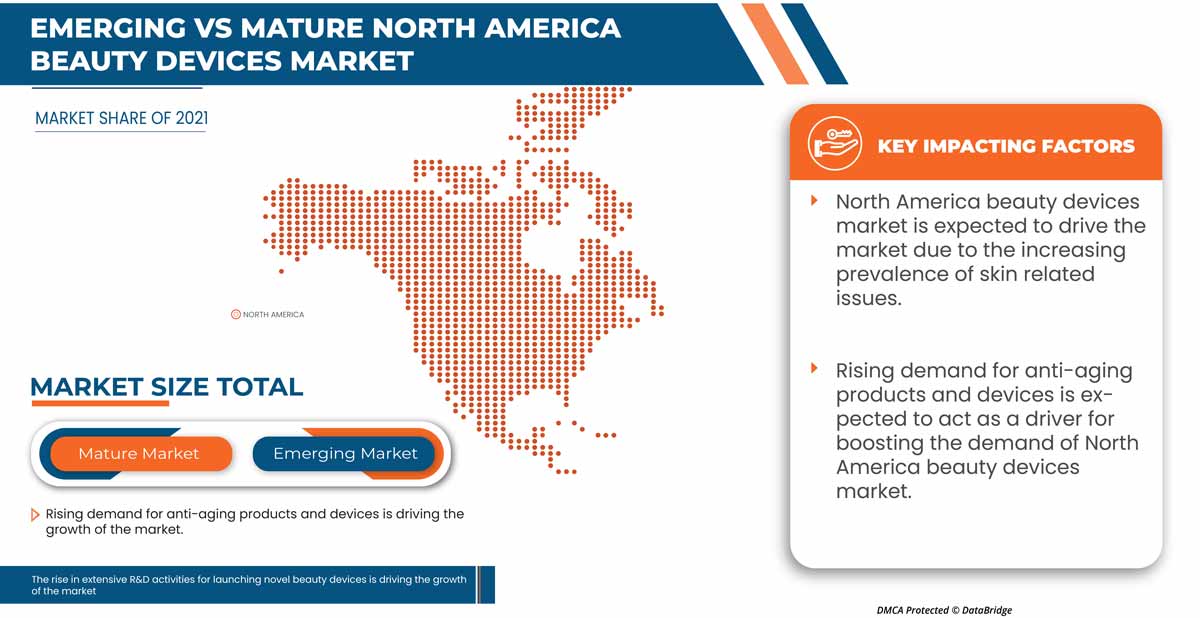

アンチエイジング製品と機器の需要増加

アンチエイジングは、外因性または外在的要因と内因性または内在的要因の組み合わせによって影響を受ける複雑な生物学的プロセスの一種です。アンチエイジング人口は、肌のハリ、脱毛、アンチエイジングによるしわ、口腔ケアの問題など、美容に関連する問題に直面している最大の課題の 1 つです。市場では、アンチエイジングが高齢者の美容に与える影響を最小限に抑えるために使用されるさまざまな美容機器が商品化されています。

高齢者人口が急速に増加しており、美容機器はアンチエイジングのさまざまな兆候をターゲットにし、しわや小じわなど、さまざまな老化の兆候を軽減しています。そのため、アンチエイジング製品や機器の需要が高まり、市場の需要が高まっています。

皮膚関連の問題の増加

皮膚関連の問題は、一般的にプライマリケアの現場で見られる最も一般的な問題です。国立バイオテクノロジー情報センターの調査によると、18~44歳未満では皮膚関連の問題の有病率は34%で、65歳以上では有病率は49.4%に増加しています。ニキビは、青少年人口の79~95%を悩ませている普遍的な皮膚疾患の一種です。

According to the American Medical Association, In the U.S. between 40 million and 50 million individuals are suffering from acne. According to the report, women and men in the U.S. who are over 25 have some degree of facial acne by 40 percent to 54 percent, and clinical facial acne in 12 percent of women and 3 percent of men continues in middle age.

The usages of beauty skin care devices provide additional benefit for skin appearance. Beauty devices are used to improve the health and appearance of the skin, due to which, the increasing prevalence of skin related issues is propelling the demand of the market.

Skin related problems such as creases, acne, pigmentation, wrinkles as well as accident-based burn scars are extremely common among humans. According to the Association of American Academy of Dermatology, acne is the most common skin disease in the USA. Annually, acne affects some 50 million people in the U.S. About 5.1 million people seek acne treatment each year. Approximately between the ages of 12 and 24 years 85% of people experience the onset of minor acne.

Facial wrinkling is one of the most notable signs of skin related issues. Men and women show the different wrinkling patterns of lifestyle and physiological factors. Wide range skin care beauty devices such as light/LED & photo rejuvenation therapy devices, cellulite reduction devices, acne removal devices, oxygen & steamer devices, dermal rollers, cleansing devices and smart devices are used to enhance the appearance of skin, for this reason increasing prevalence of skin related issues is acting as a driver for boosting the demand of North America beauty devices market.

OPPORTUNITIES

Increasing beauty expenditure

According to data from Aesthetic Society members, Americans spent over USD 6 billion on aesthetic surgical procedures and over USD 3 billion on non-surgical aesthetic procedures in 2020. Increase in the beauty expenditure due to several reasons such as improving lifestyle of people and increasing demand of beauty devices to enhance their appearance.

The increasing beauty expenditure will increase the process of adoption of advance beauty devices which will enhance the product profile in the market-leading, for this reason increasing beauty expenditure is acting as an opportunity for boosting the demand of North America beauty devices market.

RESTRAINTS/ CHALLENGES

High cost of beauty devices

The modern technology based beauty devices helps in tone and tightens the face muscles also the devices are used to reducing the appearance of fine lines and wrinkles. Consumers can use beauty device in their home itself.

The beauty devices have been exploding variety of options to treat multiple type of beauty related issue such skin care, hair care and oral care among others. But along with this beauty devices are very expensive to purchase, due to which high cost of beauty devices is hampering the demand of the North America beauty devices market.

Recent Developments

- In January 2021, Candela Corporation, a leading global medical aesthetic device company, announced the availability of the Frax Pro system, an FDA-cleared, non-ablative fractional device for skin resurfacing with both Frax 1550 and the novel Frax 1940 applicators. This helped the company to expand its product portfolio of aesthetics in the North America market.

- In June 2021, Cutera announced the launch of the Secret radiofrequency (RF) microneedling device, Secret PRO. The device would provide practitioners with a multi-layered approach to skin rejuvenation, using CO2 skin resurfacing application 'UltraLight' to target the epidermis. This has helped the company to increase its product portfolio.

North America Beauty Devices Market Scope

North America beauty devices market is segmented into product type, age group, mode of operation, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

- HAIR CARE DEVICES

- FACIAL DEVICES

- SKIN CARE DEVICES

- ORAL CARE DEVICES

- EYE CARE DEVICES

On the basis of product type, North America beauty devices market is segmented into hair care devices, facial devices, skin care devices, oral care devices, and eye care devices.

NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

- Pediatrics

- Adult

- Geriatrics

On the basis of age group, North America beauty devices market is segmented into pediatrics, adult and geriatrics.

NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

- Electric And Battery Operated

- Manual

On the basis of mode of operation, North America beauty devices market is segmented into electric and battery operated and manual.

NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

- Commercial And Professional Settings

- Domestic/Personalized/ Homecare Settings

North America beauty devices market is segmented into commercial and professional settings and domestic/ personalized/ homecare settings.

NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

- Direct

- Indirect

On the basis of distribution channel, the North America beauty devices market is segmented into direct and indirect.

Competitive Landscape and North America Beauty Devices Market Share Analysis

North America beauty devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America beauty devices market.

北米の美容機器市場で取引を行っている主要企業としては、Nu Skin、CANDELA CORPORATION、Curallux LLC、FOREO、Koninklijke Philips NV、Conair Corporation、Lumenis Be Ltd、Cynosure、Sciton、Inc.、Fotona、Procter & Gamble、LUTRONIC、STRATA Skin Sciences、NuFACE、Spectrum Brands、Inc.、Cutera、Merz North America、Inc.、Panasonic Corporation、Procter & Gamble などがあります。

調査方法: 北米美容機器市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場の概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、北米と地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA BEAUTY DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 LIFELINE CURVE, BY PRODUCT TYPE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 NORTH AMERICA BEAUTY DEVICES MARKET: PRICING ANALYSIS

4.4 INDUSTRIAL INSIGHTS:

5 NORTH AMERICA BEAUTY DEVICE MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES

6.1.2 INCREASING PREVALENCE OF SKIN RELATED ISSUES

6.1.3 GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS

6.1.4 EXTENSIVE R&D ACTIVITIES FOR LAUNCHING NOVEL BEAUTY DEVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF BEAUTY DEVICES

6.2.2 SIDE EFFECTS AND ALLERGIES ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

6.3 OPPORTUNITIES

6.3.1 INCREASING APPEARANCE CONSCIOUSNESS AND AWARENESS

6.3.2 INCREASING BEAUTY EXPENDITURE

6.4 CHALLENGES

6.4.1 STRICT REGULATIONS AND STANDARDS FOR THE APPROVAL AND COMMERCIALIZATION OF BEAUTY DEVICES

6.4.2 PRODUCT RECALL

7 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HAIR CARE DEVICES

7.2.1 HAIR REMOVAL DEVICES

7.2.1.1 LASER DEVICES

7.2.1.2 TRIMERS

7.2.1.3 SHAVERS

7.2.1.4 EPILATORS

7.2.1.5 OTHERS

7.2.2 HAIR GROWTH DEVICES

7.2.3 OTHERS

7.3 FACIAL DEVICES

7.3.1 CLEANING DEVICES

7.3.1.1 FACIAL CLEANING BRUSH

7.3.1.2 CLEANING MASSAGER

7.3.1.3 OTHERS

7.3.2 WHITENING DEVICES

7.3.3 MASSAGE DEVICES

7.3.4 OTHER FACIAL DEVICES

7.4 SKIN CARE DEVICES

7.4.1 CLEANSING DEVICES

7.4.2 ACNE TREATMENT DEVICES

7.4.3 ANTI AGING DEVICES

7.4.4 DERMAL ROLLERS

7.4.5 REJUVENATION DEVICES

7.4.6 LIGHT/LED & PHOTO REJUVENATION THERAPY DEVICES

7.4.7 CELLULITE REDUCTION DEVICES

7.4.8 SKIN TEXTURE TONE ENHANCEMENT

7.4.9 OXYGEN & STEAMER DEVICES

7.4.10 OTHERS

7.5 ORAL CARE DEVICES

7.5.1 TOOTHBRUSHES & ACCESSORIES

7.5.1.1 MANUAL TOOTHBRUSHES

7.5.1.2 ELECTRIC TOOTHBRUSHES

7.5.1.3 BATTERY POWERED TOOTHBRUSHES

7.5.1.4 REPLACEMENT TOOTHBRUSH HEAD

7.5.2 OTHERS

7.6 EYE CARE DEVICES

8 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 ADULT

8.2.1 FEMALE

8.2.2 MALE

8.3 GERIATRICS

8.3.1 FEMALE

8.3.2 MALE

8.4 PEDIATRICS

8.4.1 FEMALE

8.4.2 MALE

9 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION

9.1 OVERVIEW

9.2 ELECTRIC AND BATTERY OPERATED

9.2.1 POCKET-SIZED/HANDHELD DEVICE

9.2.2 FIXED

9.3 MANUAL

9.3.1 POCKET-SIZED/HANDHELD DEVICE

9.3.2 FIXED

10 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER

10.1 OVERVIEW

10.2 COMMERCIAL AND PROFESSIONAL SETTINGS

10.2.1 MEDICAL SPA

10.2.2 BEAUTY SPA

10.2.3 CLINICAL

10.3 DOMESTIC/PERSONALIZED/HOMECARE SETTINGS

11 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT

11.3 INDIRECT

11.3.1 STORE BASED RETAILING

11.3.1.1 MODERN TRADE

11.3.1.2 DEPARTMENTAL STORES

11.3.1.3 SPECIALTY STORE

11.3.1.4 OTHERS

11.3.2 NON-STORE BASED RETAILING

11.3.2.1 MULTIBRAND ONLINE SHOP

11.3.2.2 COMPANY WEBSITE

12 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 PROCTER & GAMBLE

15.1.1 COMPANY SNAPSHOT

15.1.2 RECENT FINANCIALS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 KONINKLIJKE PHILIPS N.V.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 PANASONIC CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 RECENT FINANCIALS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CONAIR CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 FOREO

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BAUSCH HEALTH COMPANIES INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 RECENT FINANCIALS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CANDELA CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CURALLUX LLC

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CUTERA

15.9.1 COMPANY SNAPSHOT

15.9.2 RECENT FINANCIALS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 CYNOSURE. INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 DD KARMA LLC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 FOTONA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 HITACHI POWER SEMICONDUCTOR DEVICE, LTD (2021)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 LUTRONIC

15.14.1 COMPANY SNAPSHOT

15.14.2 RECENT FINANCIALS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LIGHTSTIM

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 LUMENIS BE LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 MERZ NORTH AMERICA, INC.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 NU SKIN

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 PHOTOMEDEX

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 PURE DAILY CARE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SCITON, INC.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SPECTRUM BRANDS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 STRATA SKIN SCIENCE

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 PRODUCT PORTFOLIO

15.23.4 RECENT DEVELOPMENTS

15.24 SILKN

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SINCLAIR

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 UNILEVER

15.26.1 COMPANY SNAPSHOT

15.26.2 REVENUE ANALYSIS

15.26.3 PRODUCT PORTFOLIO

15.26.4 RECENT DEVELOPMENTS

15.27 VENUS CONCEPT

15.27.1 COMPANY SNAPSHOT

15.27.2 RECENT FINANCIALS

15.27.3 PRODUCT PORTFOLIO

15.27.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 THE FOLLOWING ARE THE PRICES OF PRODUCTS OFFERED BY THE COMPANIES:

TABLE 2 DEVICES WITH BEAUTY PURPOSE LISTED IN FDA MEDICAL DEVICE CLASSIFICATION DATABASE

TABLE 3 SIDE EFFECTS ASSOCIATED WITH THE USAGE OF BEAUTY DEVICES

TABLE 4 NORTH AMERICA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA BEAUTY DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 U.S. BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 27 U.S. HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 U.S. HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 U.S. FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 U.S. CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 U.S. SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 U.S. ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 U.S. TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 U.S. BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 U.S. ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 36 U.S. GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 37 U.S. PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 38 U.S. BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 39 U.S. ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 40 U.S. MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 41 U.S. BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 42 U.S. COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 43 U.S. BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 U.S. INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 U.S. STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 47 CANADA BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 CANADA HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 CANADA HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 CANADA FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CANADA CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 CANADA SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 CANADA ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 CANADA TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 CANADA BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 56 CANADA ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 57 CANADA GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 58 CANADA PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 59 CANADA BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 60 CANADA ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 61 CANADA MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 62 CANADA BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 63 CANADA COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 CANADA BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 CANADA INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 MEXICO BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 MEXICO HAIR CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 MEXICO HAIR REMOVAL DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 MEXICO FACIAL DEVICES IN BEAUTY DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 MEXICO CLEANING DEVICE IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO SKIN CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO ORAL CARE DEVICES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO TOOTHBRUSHES AND ACCESSORIES IN BEAUTY DEVICES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 77 MEXICO ADULTS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 78 MEXICO GERIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 79 MEXICO PEDIATRICS IN BEAUTY DEVICES MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 MEXICO BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 81 MEXICO ELECTRIC AND BATTERY OPERATED IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 82 MEXICO MANUAL IN BEAUTY DEVICES MARKET, BY MODE OF OPERATION, 2020-2029 (USD MILLION)

TABLE 83 MEXICO BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 84 MEXICO COMMERCIAL AND PROFESSIONAL SETTINGS IN BEAUTY DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 MEXICO BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 MEXICO INDIRECT IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 MEXICO STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 88 MEXICO NON-STORE BASED RETAILING IN BEAUTY DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA BEAUTY DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA BEAUTY DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA BEAUTY DEVICES MARKET: REGIONAL VS COUNRTY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA BEAUTY DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA BEAUTY DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA BEAUTY DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA BEAUTY DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA BEAUTY DEVICES MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING PRODUCTS AND DEVICES AND GROWING TECHNOLOGICAL ADVANCEMENTS AND DEVELOPMENTS ARE EXPECTED TO DRIVE THE NORTH AMERICA BEAUTY DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 HAIR CARE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA BEAUTY DEVICES MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA BEAUTY DEVICES MARKET

FIGURE 14 NUMBER OF AESTHETIC PROCEDURES PERFORMED, U.S., 2020

FIGURE 15 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2021

FIGURE 16 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA BEAUTY DEVICES MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2021

FIGURE 20 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA BEAUTY DEVICES MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 23 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2021

FIGURE 24 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA BEAUTY DEVICES MARKET : BY MODE OF OPERATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2021

FIGURE 28 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA BEAUTY DEVICES MARKET : BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2021

FIGURE 32 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA BEAUTY DEVICES MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA BEAUTY DEVICES MARKET: SNAPSHOT (2021)

FIGURE 36 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021)

FIGURE 37 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 38 NORTH AMERICA BEAUTY DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 39 NORTH AMERICA BEAUTY DEVICES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 40 NORTH AMERICA BEAUTY DEVICES MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。