>中東およびアフリカの海底ケーブル システム市場、製品別 (ウェット プラント製品とドライ プラント製品)、電圧 (中電圧と高電圧、超高電圧)、提供内容 (設置と試運転、修理と保守とアップグレード)、ファイバー クラス (非中継と中継)、ケーブル タイプ (ルーズ チューブ ケーブル、リボン ケーブルなど)、装甲タイプ (軽量装甲、シングル装甲、ダブル装甲、ロック装甲)、深さ (0 ~ 500 メートル、500 メートル ~ 1000 メートル、1000 メートル ~ 5000 メートルなど)、アプリケーション (電源ケーブルと通信ケーブル) - 2029 年までの業界動向と予測。

中東およびアフリカの海底ケーブルシステム市場の分析と規模

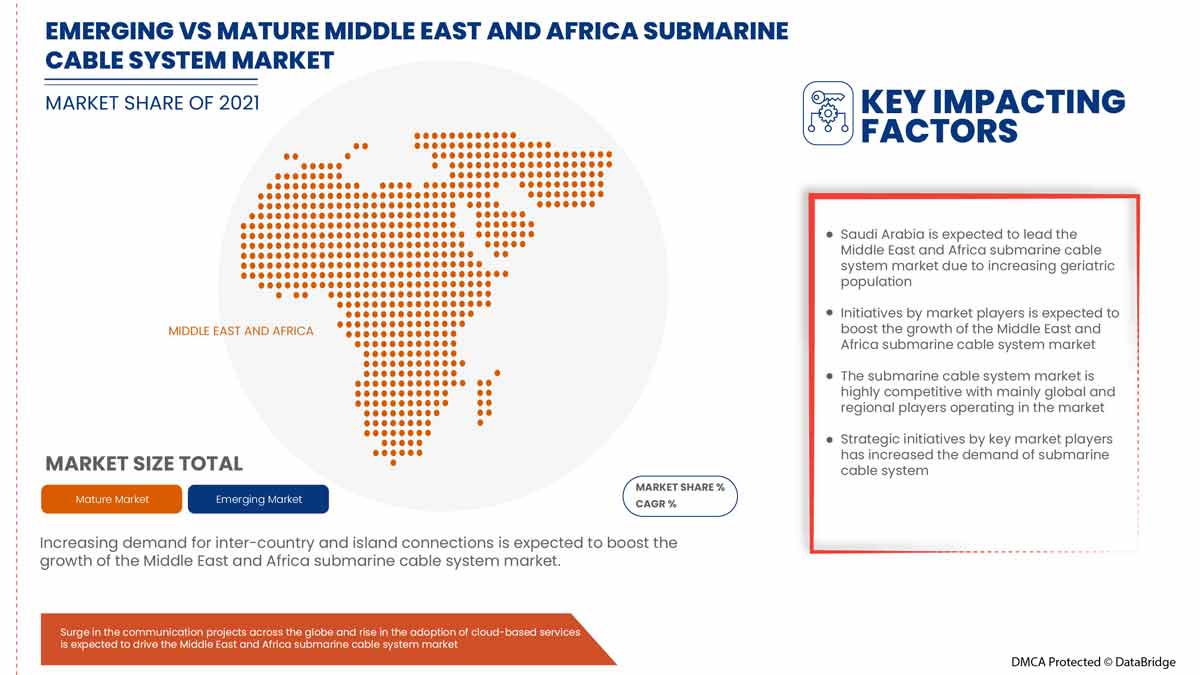

海底ケーブルは、海や大洋を越えて通信信号を運ぶために、陸上の局間の海底に敷設されます。通信加入者数の増加と洋上風力発電所への多額の投資は、海底ケーブル市場の成長に直接影響を与えています。また、コンテンツおよびクラウドサービスプロバイダーの投資の増加も、海底ケーブル市場の成長を後押ししています。また、新興地域でのインターネットトラフィックの増加も、市場の成長にプラスの影響を与えています。さらに、帯域幅の需要の増加も、海底ケーブル市場の成長の積極的な成長原動力として機能しています。さらに、洋上風力発電所の数の増加と、国と島の間の電力接続の需要の高まりにより、海底ケーブルの需要が大幅に増加し、海底ケーブル市場の成長が促進されています。

しかし、遅延につながる規制、環境、複雑な認可手続き、および深海電力ケーブルリンクの複雑な修理手続きは、上記の予測期間における海底ケーブルの成長に対する主な制約として機能しており、一方で宇宙ベースのインターネット通信コンステレーションに関する話題の高まりは、海底ケーブル市場の成長に課題をもたらす可能性があります。

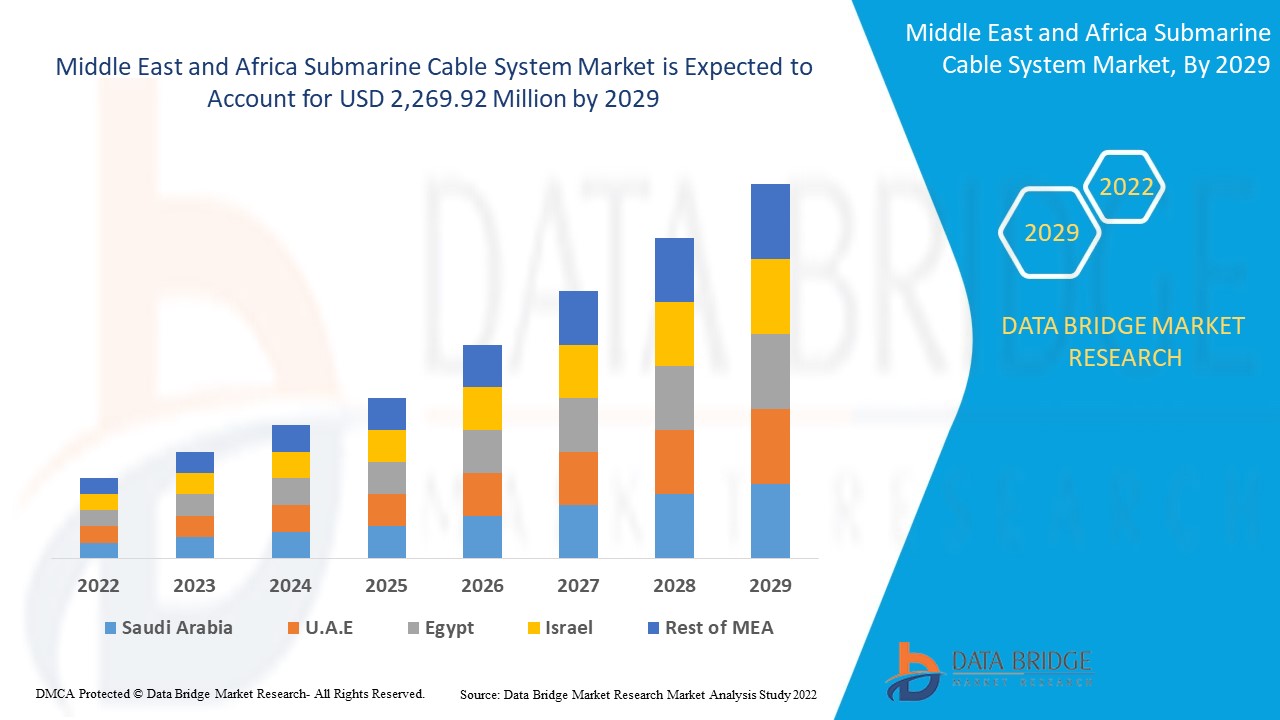

Data Bridge Market Research の分析によると、中東およびアフリカの海底ケーブル システム市場は、予測期間中に 6.1% の CAGR で成長し、2029 年までに 22 億 6,992 万米ドルに達すると予想されています。「ドライ プラント製品」は、最も顕著な技術セグメントを占めています。このタイプの技術は、重要なエリアにケーブルを設置する必要がないため、作業効率が最大限に高まるため、需要があります。海底ケーブル システム市場レポートでは、価格、特許、技術の進歩についても包括的に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

対象セグメント |

By Product (Wet Plant Products and Dry Plant Products), Voltage (Medium Voltage and High Voltage, Extra High Voltage), Offering (Installation And Commissioning, Repair And Maintenance And Upgrades), Fiber Class (Unrepeatered and Repeatered), Cables Type (Loose Tube Cables, Ribbon Cables and Others), Armor Type (Light Weight Armor, Single Armor, Double Armor and Rock Armor), Depth (0 to 500M, 500M to 1000M, 1000M to 5000M and Others), Application (Power Cables and Communication Cables) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel & Rest of Middle East and Africa |

|

Market Players Covered |

HENGTONG GROUP CO., LTD, TE Connectivity, Saudi Ericsson, APAR, NEC Corporation, NXT A/S, Norddeutsche Seekabelwerke GmbH (A Subsidiary of Prysmian Group), JDR Cable Systems Ltd, ZTT, Hexatronic Group, Alcatel Submarine Networks, Corning Incorporated, The Okonite Company, AFL (a subsidiary of Fujikura Ltd.), LEONI, NEXANS, Ocean Specialists, Inc. (a subsidiary of Continental Shelf Associates, Inc.), TFKable, Sumitomo Electric Industries, Ltd., Tratos, Hellenic Cables S.A. and HESFIBEL SUBSEA CABLES among others. |

Market Definition

A submarine cable system refers to the cable frameworks connected to a land-based station that helps to transmit the signals over the ocean and marine water bodies. The connectivity combination over long distances combines communication and electricity transmission through the cable systems laid under water.

The demand and the deployment of the submarine cable system are completely dependent on the Middle East and Africa increase in telecom and internet subscriptions. They are expected to expand the submarine systems in unexplored areas. Moreover, sea freight and GPS play a major role in developing submarine cables across all countries and regions in the modern world. This needs the application of proper and unique government regulations to develop a standard procedure and connectivity. Hence it includes several set of rules and regulations which helps to boost the market.

Submarine Cable System Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers/Opportunities

- Rise in the trend of offshore wind power generation

Submarine cables have been around since the mid-1800s. But, for a large portion of their set of experiences, such cables were utilized fundamentally to send power from conventional sources, for example, coal plants, either between nations or out to islands or oil stages. The submarine cable industry faced a decline during the 19th century. That changed during the 2000s, as rising energy costs and worries about environmental change animated interest in growing offshore wind and more effective transnational power grids.

Wind power generation is a clean energy source that does not require fuel and power generation offshore has strong winds, attracting offshore wind power generation development projects across the globe.

- Rise in the adoption of cloud-based services

The development over the air using various new satellite groups of stars being sent off and the rising fondness for getting to content through portable organizations over remote wireless transmissions. These remote transmissions are connected through data center infrastructures. They are interconnected through cables laid in a submarine to develop connections among different data centers in different countries and regions. This implies a need for submarine cables that helps to connect data centers and directly improve cloud-based connectivity for all types of organizations. Thus, the adoption of cloud-based services and solutions is expected to be a major driver of the growth of the submarine cable system market.

- Deployment of various technologies in submarine cable systems

Power feeding to submarine cable systems is a long-established practice, from coaxial submarine systems to present-day optical amplifier systems. The main principles of electrical powering to the submarine cable systems, as discussed in this chapter, are power feeding equipment (PFE) installed in the terminal stations, return path through earth and sea, and the PFE feeding a constant current to stabilize the repeater characteristics and transmission performance.

Restraint/Challenges

- High initial investments act as an entry barrier for SMEs

The connection through subsea cable is lengthy and thus the cost is directly dependent on the length of the cable systems used which directly Thus, it has been observed that usually, the major players in the market involves in the submarine cable service business as it involves huge investments which the SMEs cannot offer. This will restrict more players from entering the market and promote dominance, which is expected to restrict market growth.

- Complex repairing procedures

Cable ships are loaded with enough cable for repairs, maybe 5-10 km, which can be loaded in a few hours. Cable has to be added to make the repair, since there is not enough slack to bring the cable up and cut a piece out. After the cable is retrieved and on board, in a repair room that looks like a laboratory, engineers repair the cable.

Post COVID-19 Impact on Submarine Cable System Market

COVID-19 significantly impacted the submarine cable system market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology in the submarine cable system market. The companies will bring advanced and accurate solutions to the market.

Recent Development

- In November 2021, LEONI announced the partnership in the ADOPD project developing ultrafast fiber-optical computational units based on Adaptive Optical Dendrites. This project will help the company to understand the various processes and interactions and result in the development of better product technologies in various segments, especially in cable systems

- In July 2022, NEXANS announced winning a new project by EuroAsia interconnector Limited to develop European electricity interconnection linking the national grids of Israel, Cyprus, and Greece (Crete). This project will help the company provide technology for deep water subsea power cables utilizing NEXANS long term developments for 3,000m ultradeep waters and the installation capabilities that will be recognized in the market.

Middle East and Africa Submarine Cable System Market Scope

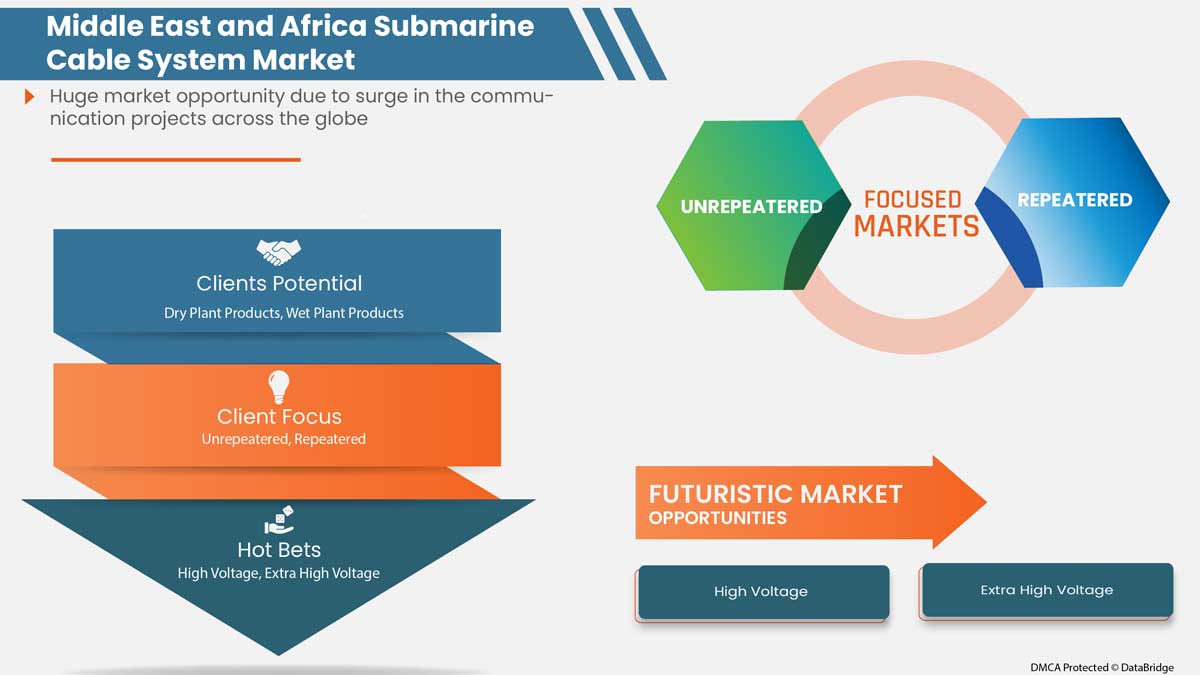

The submarine cable system market is segmented based on product, voltage, offering, fiberglass, cable type, armor type, depth, and application. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Product

- Wet plant Products

- Dry Plant Products

On the basis of product, the Middle East and Africa submarine cable system market is segmented into wet plant products and dry plant products.

By Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

On the basis of voltage, the Middle East and Africa submarine cable system market is segmented into medium voltage, high voltage, and extra high voltage.

By Offering

- Maintenance

- Upgrades

- Installation and Commissioning

On the basis of offering, the Middle East and Africa submarine cable system market is segmented into maintenance, upgrades, and installation and commissioning.

By Fiber Glass

- Unrepeatered

- Repeatered

On the basis of fiber glass, the Middle East and Africa submarine cable system market is segmented into unrepeatered and repeatered.

By Cables Type

- Loose Tube Cables

- Ribbon Cables

- Others

On the basis of cables type, the Middle East and Africa submarine cable system market is segmented into loose tube cables, ribbon cables, and others.

By Armor Type

- Light Weight Armor

- Single Armor

- Double Armor

- Rock Armor

On the basis of armor type, the Middle East and Africa submarine cable system market is segmented into light weight armor, single armor, double armor, and rock armor.

By Depth

- 0 To 500 M

- 500 M-1000 M

- 1000 M-5000 M

- Others

On the basis of depth, the Middle East and Africa submarine cable system market is segmented into 0 to 500m, 500m to 1000m, 1000m to 5000m, and others.

By Application

- 電源ケーブル

- 通信ケーブル

用途に基づいて、中東およびアフリカの海底ケーブル システム市場は、電力ケーブルと通信ケーブルに分類されます。

海底ケーブルシステム市場の地域分析/洞察

海底ケーブル システム市場が分析され、上記のように、製品、電圧、提供内容、グラスファイバー、ケーブルの種類、装甲の種類、深さ、および用途別に市場規模の洞察と傾向が提供されます。

海底ケーブル システム市場レポートで取り上げられている国は、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカです。

サウジアラビアは中東およびアフリカの海底ケーブル システム市場を独占しています。サウジアラビアは、政府、企業、交通機関、コミュニティのセキュリティを向上させ、新しいレベルの運用インテリジェンスを提供することを目的としたクラウドベースのソリューションとサービスを開発しています。これにより、中東およびアフリカでの海底ケーブル システム製品の需要が高まります。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮され、国別データの予測分析が提供されます。

競争環境と海底ケーブルシステムの市場シェア分析

海底ケーブル システム市場の競争状況は、競合他社に関する詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などが含まれます。上記のデータ ポイントは、海底ケーブル システム市場に焦点を当てている会社にのみ関連しています。

海底ケーブルシステム市場で活動している主要企業としては、HENGTONG GROUP CO., LTD、TE Connectivity、Saudi Ericsson、APAR、NEC Corporation、NXT A/S、Norddeutsche Seekabelwerke GmbH(Prysmian Groupの子会社)、JDR Cable Systems Ltd、ZTT、Hexatronic Group、Alcatel Submarine Networks、Corning Incorporated、The Okonite Company、AFL(Fujikura Ltd.の子会社)、LEONI、NEXANS、Ocean Specialists, Inc.(Continental Shelf Associates, Inc.の子会社)、TFKable、住友電気工業株式会社、Tratos、Hellenic Cables SA、HESFIBEL SUBSEA CABLESなどが挙げられます。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 PRODUCT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 SURGE IN THE COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE

5.1.2 RISE IN THE TREND OF OFFSHORE WIND POWER GENERATION

5.1.3 GROWING DEMAND FOR HIGH BANDWIDTH, LOW-LATENCY, AND HIGH REDUNDANCY OWING TO THE EMERGENCE OF 5G

5.1.4 RISE IN THE ADOPTION OF CLOUD-BASED SERVICES

5.2 RESTRAINTS

5.2.1 HIGH INITIAL INVESTMENTS ACT AS ENTRY BARRIER FOR SMES

5.2.2 HIGH PROBABILITY OF DAMAGE DUE TO VULNERABLE CONDITIONS

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF SUBMARINE CABLE OWING TO THE INCREASING INTERNET TRAFFIC ACROSS THE REGION

5.3.2 INCREASING STRATEGIC PARTNERSHIP AMONG MAJOR MARKET PLAYERS FOR CABLE SYSTEMS

5.3.3 RISING INVESTMENTS BY OTT PROVIDERS TO CREATE ABUNDANT OPPORTUNITIES FOR SALES OF SUBMARINE CABLES

5.3.4 DEPLOYMENT OF VARIED TECHNOLOGIES IN SUBMARINE CABLE SYSTEMS

5.4 CHALLENGES

5.4.1 ALTERNATIVE MODES OF INTERNET SERVICE PROVISIONING

5.4.2 COMPLEX REPAIRING PROCEDURES

6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 DRY PLANT PRODUCTS

6.2.1 POWER FEEDING EQUIPMENT (PFE)

6.2.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

6.2.3 SUBMARINE LINE MONITOR (SLM)

6.2.4 OTHERS

6.3 WET PLANT PRODUCTS

6.3.1 CABLES

6.3.2 REPEATER

6.3.3 BRANCHING UNIT (BU)

6.3.4 OTHERS

7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE

7.1 OVERVIEW

7.2 HIGH VOLTAGE

7.3 EXTRA HIGH VOLTAGE

7.4 MEDIUM VOLTAGE

8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING

8.1 OVERVIEW

8.2 INSTALLATION AND COMMISSIONING

8.3 REPAIR AND MAINTENANCE

8.4 UPGRADES

9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS

9.1 OVERVIEW

9.2 UNREPEATERED

9.3 REPEATERED

10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE

10.1 OVERVIEW

10.2 LOOSE TUBE CABLES

10.3 RIBBON CABLES

10.4 OTHERS

11 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE

11.1 OVERVIEW

11.2 SINGLE ARMOR

11.3 DOUBLE ARMOR

11.4 LIGHT WEIGHT ARMOR

11.5 ROCK ARMOR

12 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH

12.1 OVERVIEW

12.2 1000M-5000M

12.3 5000M-1000M

12.4 0M-500M

12.5 0THERS

13 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 COMMUNICATION CABLES

13.2.1 DRY PLANT PRODUCTS

13.2.1.1 POWER FEEDING EQUIPMENT (PFE)

13.2.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.2.1.3 SUBMARINE LINE MONITOR (SLM)

13.2.1.4 OTHERS

13.2.2 WET PLANT PRODUCTS

13.2.2.1 CABLES

13.2.2.2 REPEATER

13.2.2.3 BRANCHING UNIT (BU)

13.2.2.4 OTHERS

13.3 POWER CABLES

13.3.1 DRY PLANT PRODUCTS

13.3.1.1 POWER FEEDING EQUIPMENT (PFE)

13.3.1.2 SUBMARINE LINE TERMINAL EQUIPMENT (SLTE)

13.3.1.3 SUBMARINE LINE MONITOR (SLM)

13.3.1.4 OTHERS

13.3.2 WET PLANT PRODUCTS

13.3.2.1 CABLES

13.3.2.2 REPEATER

13.3.2.3 BRANCHING UNIT (BU)

13.3.2.4 OTHERS

14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SAUDI ARABIA

14.1.2 U.A.E.

14.1.3 EGYPT

14.1.4 SOUTH AFRICA

14.1.5 ISRAEL

14.1.6 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ZTT

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 HENGTONG GROUP CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT CATEGORIES

17.2.4 RECENT DEVELOPMENT

17.3 NKT A/S

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 CORNING INCORPORATED

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 NEXANS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 HELLENIC CABLES S.A.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 ALCATEL SUBMARINE NETWORKS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 AFL (A SUBSIDIAIRY OF FUJIKURA LTD.)

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APAR

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HESFIBEL SUBSEA CABLES

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HEXATRONIC GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 JDR CABLE SYSTEMS LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 LEONI

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 NEC CORPORATION

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 NORDDEUTSCHE SEEKABELWERKE GMBH

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 OCEAN SPECIALISTS, INC. (A SUBSIDIARY OF CONTINENTAL SHELF ASSOCIATES, INC.)

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SAUDI ERICSSON

17.17.1 COMPANY SNAPSHOT

17.17.2 SOLUTION PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 SUMITOMO ELECTRIC INDUSTRIES, LTD.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

17.19 TE CONNECTIVITY

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 SOLUTION PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TFKABLE

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

17.21 THE OKONITE COMPANY

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 TRATOS

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA EXTRA HIGH VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA MEDIUM VOLTAGE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA INSTALLATION AND COMMISSIONING IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA REPAIR AND MAINTENANCE IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA UPGRADES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA UNREPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA REPEATERED IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA LOOSE TUBE CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA RIBBON CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA SINGLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA DOUBLE ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA LIGHT WEIGHT ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA ROCK ARMOR IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA 1000M-5000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA 500M-1000M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA 0M-500M IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA OTHERS IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA COMMUNICATION CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA POWER CABLES IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 48 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 50 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 MIDDLE EAST AND AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 SAUDI ARABIA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SAUDI ARABIA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 61 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 62 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 63 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 64 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 65 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 66 SAUDI ARABIA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 67 SAUDI ARABIA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 SAUDI ARABIA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SAUDI ARABIA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SAUDI ARABIA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 U.A.E. DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 U.A.E. WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 77 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 78 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 79 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 80 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 82 U.A.E. SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 U.A.E. COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.A.E. DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.A.E. WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 U.A.E. POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 U.A.E. DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 U.A.E. WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 EGYPT DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 93 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 94 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 95 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 96 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 97 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 98 EGYPT SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 EGYPT COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 EGYPT DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 EGYPT WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 EGYPT POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 EGYPT DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 EGYPT WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 SOUTH AFRICA DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH AFRICA WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 109 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 110 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 111 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 114 SOUTH AFRICA SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 115 SOUTH AFRICA COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 SOUTH AFRICA DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SOUTH AFRICA WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SOUTH AFRICA POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SOUTH AFRICA DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SOUTH AFRICA WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 ISRAEL DRY PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 ISRAEL WET PLANT PRODUCTS IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2020-2029 (USD MILLION)

TABLE 125 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2020-2029 (USD MILLION)

TABLE 126 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2020-2029 (USD MILLION)

TABLE 127 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2020-2029 (USD MILLION)

TABLE 128 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2020-2029 (USD MILLION)

TABLE 129 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2020-2029 (USD MILLION)

TABLE 130 ISRAEL SUBMARINE CABLE SYSTEM MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 ISRAEL COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 ISRAEL DRY PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 ISRAEL WET PLANT PRODUCTS IN COMMUNICATION CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 ISRAEL POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 ISRAEL DRY PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 ISRAEL WET PLANT PRODUCTS IN POWER CABLE IN SUBMARINE CABLE SYSTEM MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 REST OF SOUTH AMERICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: SEGMENTATION

FIGURE 11 SURGE IN COMMUNICATION PROJECTS UNDERSEA PATH ACROSS THE GLOBE IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET IN THE FORECAST PERIOD

FIGURE 12 DRY PLANT PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET FROM 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET

FIGURE 14 FDI PROJECTS FOR COMMUNICATIONS AND MEDIA (2019-2020)

FIGURE 15 OFFSHORE WIND ELECTRICITY GENERATION

FIGURE 16 NET ANNUAL WIND CAPACITY EXPANSIONS, 2018-2020

FIGURE 17 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY PRODUCT, 2021

FIGURE 18 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY VOLTAGE, 2021

FIGURE 19 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY OFFERING, 2021

FIGURE 20 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY FIBER CLASS, 2021

FIGURE 21 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY CABLES TYPE, 2021

FIGURE 22 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY ARMOR TYPE, 2021

FIGURE 23 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET, BY DEPTH, 2021

FIGURE 24 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: BY APPLICATION, 2021

FIGURE 25 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA SUBMARINE CABLE SYSTEM MARKET: BY PRODUCT (2022-2029)

FIGURE 30 MIDDLE EAST & AFRICA SUBMARINE CABLE SYSTEM MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。