中東およびアフリカの薬局自動化市場、製品別(システム、ソフトウェア、サービス)、薬局タイプ別(独立、チェーン、連邦)、薬局規模別(大規模薬局、中規模薬局、小規模薬局)、アプリケーション別(薬剤調剤および包装、薬剤保管、在庫管理)、エンドユーザー別(入院薬局、外来薬局、小売薬局、オンライン薬局、中央充填/郵送薬局、薬局給付管理組織、その他)、流通チャネル別(直接入札およびサードパーティ販売業者) - 2030年までの業界動向および予測。

中東およびアフリカの薬局自動化市場の分析と洞察

医療用医薬品の誤投与による事故や死亡の増加は、医療全般に多大な負担をかけています。医療従事者と薬剤師はともに、このような頻繁な医療上の不具合を回避するための、より効果的で正確な解決策を模索しています。さらに、患者数、来院者数、それぞれの安全ニーズが増加するにつれて、薬剤投与システムは日を追うごとに複雑化しています。この深刻な問題に対処するために、薬局自動化システムなどの高度な技術が、最も強力なツールとして登場しています。これらの機器の目的は、医療処方の誤投与を減らし、患者の安全を最大限に高めることです。したがって、このような薬局自動化システムを実装することで、医療サービス提供者と薬剤師は損失を最小限に抑え、品質と生産性を向上させることができます。

さらに、技術革新の導入と、薬局自動化システムの改善による自動化システムの進歩により成功率が向上し、処方薬の調合、調剤、保管、ラベル付けのための革新的な製品に対する需要が高まるデバイスの新しい用途が、予測期間中の市場の成長を牽引しています。ただし、コストが高いために薬局自動化システムの導入をためらうなどの要因により、その採用が制限され、市場の成長が抑制されると予想されます。

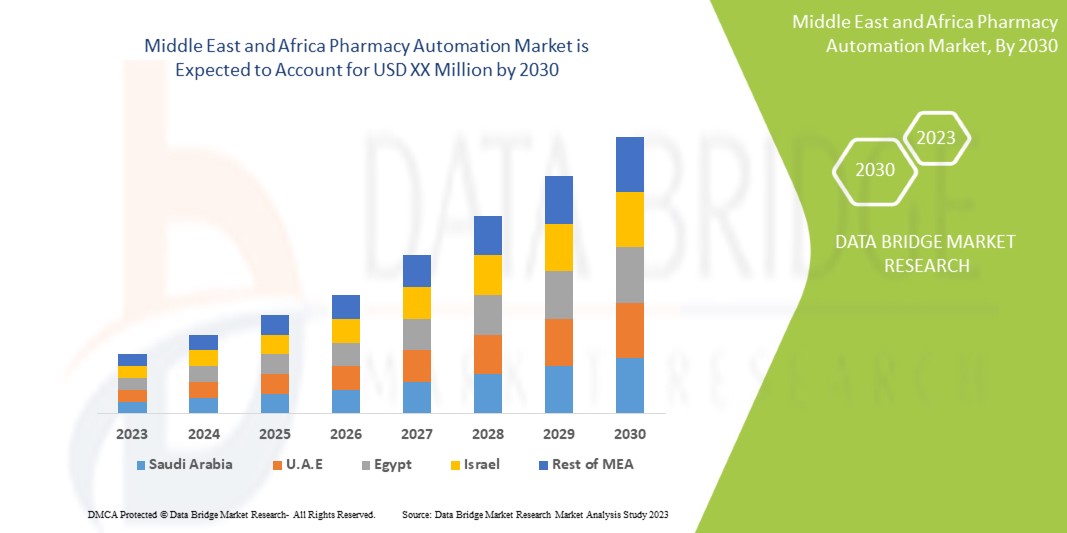

中東およびアフリカの薬局自動化市場は支援的であり、投薬ミスを減らし、患者の安全性を向上させることを目指しています。Data Bridge Market Research は、中東およびアフリカの薬局自動化市場は 2023 年から 2030 年の予測期間中に 7.7% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015 - 2020 にカスタマイズ可能) |

|

定量単位 |

収益は百万ドル、価格は米ドル |

|

対象セグメント |

製品 (システム、ソフトウェア、サービス)、薬局の種類 (独立系、チェーン、連邦系)、薬局の規模 (大規模薬局、中規模薬局、小規模薬局)、アプリケーション (薬剤の調剤と包装、薬剤の保管、在庫管理)、エンド ユーザー (入院薬局、外来薬局、小売薬局、オンライン薬局、中央調剤/郵送薬局、薬剤給付管理組織、その他)、流通チャネル (直接入札およびサードパーティ ディストリビューター) |

|

対象国 |

サウジアラビア、南アフリカ、UAE、イスラエル、エジプト、その他の中東およびアフリカ諸国 |

|

対象となる市場プレーヤー |

ARxIUM、OMNICELL INC.、Cerner Corporation、Capsa Healthcare、ScriptPro LLC、RxSafe, LLC.、MedAvail Technologies, Inc.、Asteres Inc.、InterLink AI, Inc.、BD、Baxter、Fullscript、McKesson Corporation、Innovation Associates、AmerisourceBergen Corporation、UNIVERSAL LOGISTICS HOLDINGS, INC、Takazono Corporation、TOSHO Inc.、Willach Group、BIQHS、Synergy Medical、Yuyama、APD Algoritmos Procesos y Diseños SA、JVM Europe BV、Genesis Automation LTD、myPak Solutions Pty Ltd.、Demodeks Pharmacy Shelving、Deenova Srl、KUKA AG、KLS Pharma Robotics GmbH など |

市場の定義

薬局の自動化は、現代の医療において重要な役割を果たしています。病院の薬局や小売薬局で薬を便利に配達および配布できるようにするためです。薬局の自動化は、投薬の誤りを減らすのに役立ちます。投薬情報の欠落、患者情報の欠落、調剤処方、処方ミス、治療の追跡など、手動プロセス中に発生する可能性のあるエラーを防ぎます。最も一般的なエラーの1つは、ラベル情報と指示の誤りです。医療施設とサービスを改善し、患者の安全を確保するには、処方ミスを減らすことが不可欠です。そのため、薬局自動化システムは、保管、在庫、使用、および検索エラーを排除するために非常に重要な方法で使用されます。薬局自動化の使用は非常に受け入れられ、薬局の効率と精度を高めるのに有益です。さらに、投薬ミスを防ぐ必要性と世界中の高齢者人口の増加は、予測期間中に市場の成長を後押しする可能性があります。

中東およびアフリカの薬局自動化市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 投薬ミスを最小限に抑える必要性の高まり

医療ミスは各国で死亡の主な原因となっており、世界中で入院の増加につながっています。投薬ミスには、処方ミス、調剤ミス、投与ミス、転写ミス、処方ミス、および「設定をまたいだ」ミスなど、薬理学的および薬剤学的患者ケアの連鎖におけるミスを含むさまざまなタイプがあります。

投薬ミスは、医師と薬剤師の間の不適切な発注調整、薬局での不適切な保管方法、同一ラベルの使用から生じる誤解など、さまざまな要因によって発生する可能性があります。

調剤ミスには、間違った用量、薬剤、投薬タイプ、不正確な量の調剤、不十分、不正確、または不適切なラベルの貼付など、処方指示からの異常または逸脱が含まれます。誤解を招くまたは不十分な使用方法の説明、調剤前の薬剤の不適切な計画、包装、または保管も投薬ミスとみなされます。

1 日に 250 件の処方箋を処理する薬局では、1 日に 4 件の割合でエラーが発生し、年間に全国で処理される 30 億件の処方箋のうち、推定 5,150 万件のエラーが発生します。

- 医薬品の需要増加

がん、糖尿病、肥満、喘息などの慢性疾患の発症率が急増しているため、医薬品の需要は世界中で高まっています。これらの疾患に苦しむ人々は、医師から処方された何らかの薬に依存しています。

また、中東やアフリカでは、医療施設の充実により高齢化が進んでいます。特定の疾患に特化した効果的で新しい医薬品の発売につながる研究開発の増加も、医薬品の需要の急増に寄与しています。

さらに、COVID-19の出現により、ビタミンC錠剤やヒドロキシクロロキンなどを含むさまざまな医薬品の需要が世界中で増加し、医薬品の需要が大幅に増加しました。

機会

- 薬局内の業務効率化の必要性

どの薬局も、処方箋を正確かつ効率的に処理すること、高品質の患者ケアを提供すること、従業員の仕事満足度が高く消費者が満足する持続可能なビジネスモデルを維持することなど、同じことを実行しようとしています。

病院全体の戦略と優先事項をサポートして薬局活動の有効性を高め、患者中心の質の高いケアを提供するために、多くの病院や薬局のリーダーが薬局自動化システムの導入を開始しています。

強化されたワークフローと薬局自動化ソフトウェアおよびシステムの導入により、薬局の効率が向上する可能性があります。そのため、薬局内での作業効率を向上させる必要性は、市場成長の機会として機能します。

拘束

- 高額の資本投資

薬局自動化システムは、手動システムに比べて高価です。平均的な薬局自動化システムの価格は 59,198.45 米ドルからですが、より特殊なバージョンでは 591,984.50 米ドルまで高くなることがあります。

薬局自動化システムの導入に必要な資本投資額は非常に高額であるため、発展途上国の病院や薬局、世界中の小規模薬局では、このようなシステムを導入することが困難です。したがって、資本投資額が高いと、薬局自動化システムの導入率が低下します。したがって、市場の成長を抑制します。

チャレンジ

- 厳格な規制手順

病院と薬局は、国の医薬品供給チェーン、つまり一般市民への医薬品の配布において重要な役割を果たすことが求められています。医薬品の調剤業務を規制する州法と連邦法のいくつかの規制の中には、一般市民と業界従事者の両方の保護とセキュリティに関連する 3 つの重要な法律があります。

これらの法律は、医薬品サプライチェーンの保護、規制物質の規制と安全性、医薬品有害廃棄物の管理に適用され、FDA、DEA、EPA によって実施されます。

そのため、自動医薬品システムの製造業者はさまざまな規制に準拠する必要がありますが、こうした規制の遵守は面倒な作業であり、製品の発売が遅れる可能性もあります。そのため、規制手続きの厳格さは市場の成長に対する課題となっています。

最近の動向

- 2023 年 1 月、AmerisourceBergen Corporation は PharmaLex Holding GmbH の買収の完了を発表しました。PharmaLex の買収により、AmerisourceBergen Corporation は専門サービスと中東およびアフリカの医薬品メーカー サービス機能のプラットフォームにおけるリーダーシップを強化し、成長戦略を強化します。

- 2022 年 2 月、バクスターは Common Vulnerability and Exposures (CVE) プログラムから CVE 採番機関としての認可を受けたことを発表しました。

中東およびアフリカの薬局自動化市場

中東およびアフリカの薬局自動化市場は、製品、薬局の種類、薬局の規模、用途、エンドユーザー、流通チャネルに基づいて、6 つの主要なセグメントに分類されています。

製品

- システム

- ソフトウェア

- サービス

製品に基づいて、市場はシステム、ソフトウェア、およびサービスに分類されます。

薬局タイプ

- 独立した

- 鎖

- 連邦政府

薬局の種類に基づいて、市場は独立系、チェーン系、連邦系に分類されます。

薬局の規模

- 大型薬局

- 中規模薬局

- 小規模薬局

薬局の規模に基づいて、市場は大規模薬局、中規模薬局、小規模薬局に分類されます。

応用

- 医薬品の調剤と包装

- 薬品保管

- 在庫管理

アプリケーションに基づいて、市場は薬剤の調剤と包装、薬剤の保管、在庫管理に分類されます。

エンドユーザー

- 入院患者薬局

- 外来薬局

- 小売薬局

- オンライン薬局

- 中央調剤薬局/郵送薬局

- 薬局給付管理組織

- その他

エンドユーザーに基づいて、市場は入院薬局、外来薬局、小売薬局、オンライン薬局、中央調剤/郵送薬局、薬局給付管理組織、その他に分類されます。

流通チャネル

- 直接入札

- サードパーティディストリビューター

流通チャネルに基づいて、市場は直接入札とサードパーティの販売代理店に分割されます。

中東およびアフリカの薬局自動化市場の地域分析/洞察

中東およびアフリカの薬局自動化市場は、製品、薬局の種類、薬局の規模、用途、エンドユーザー、流通チャネルに基づいて、6 つの主要なセグメントに分類されています。

この市場レポートで取り上げられている国は、サウジアラビア、南アフリカ、UAE、イスラエル、エジプト、およびその他の中東およびアフリカ諸国です。

2023年には、手動の方法よりも薬局自動化システムの利点についての認識が高まっているため、サウジアラビアが市場を支配すると予想されています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、中東およびアフリカのブランドの存在と入手可能性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境と中東およびアフリカの薬局自動化市場シェア分析

中東およびアフリカの薬局自動化市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、市場に対する会社の重点にのみ関連しています。

中東およびアフリカの薬局自動化市場で活動している主要な市場プレーヤーには、Cerner Corporation、Capsa Healthcare、ScriptPro LLC、RxSafe、LLC、MedAvail Technologies、Inc.、Asteres Inc.、InterLink AI、Inc.、BD、Baxter、Fullscript、McKesson Corporation、Innovation Associates、AmerisourceBergen Corporation、UNIVERSAL LOGISTICS HOLDINGS、INCなどがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: REGULATIONS

4.1 EXISTING STATE LAWS AND REGULATIONS FOR THE USE OF AUTOMATED DISPENSING SYSTEMS (ADS) IN THE U.S.

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NEED TO MINIMIZE MEDICATION ERRORS

5.1.2 RISING DEMAND FOR PHARMACEUTICALS

5.1.3 RISING LABOR COST

5.1.4 ADVANTAGES OF PHARMACY AUTOMATION SYSTEMS OVER MANUAL METHODS

5.1.5 TECHNOLOGICAL ADVANCEMENTS AND PRECISE ROBOTIC TOOLS

5.2 RESTRAINTS

5.2.1 RELUCTANCE AMONG THE HEALTHCARE ORGANIZATIONS TO ADOPT PHARMACY AUTOMATION SYSTEMS

5.2.2 HIGH CAPITAL INVESTMENT

5.2.3 INTEROPERABILITY PROBLEMS IN PHARMACY AUTOMATION

5.3 OPPORTUNITIES

5.3.1 NEED FOR INCREASING THE EFFICIENCY OF WORK WITHIN THE PHARMACIES

5.3.2 RISING HEALTHCARE EXPENDITURE IN EMERGING NATIONS

5.3.3 STRATEGIC INITIATIVES OF KEY MARKET PLAYERS

5.4 CHALLENGES

5.4.1 STRINGENCY OF REGULATORY PROCEDURES

5.4.2 SKILLED WORK-FORCE CHALLENGES

5.4.3 LIMITATIONS OF PHARMACY AUTOMATION SYSTEMS

6 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 SYSTEMS

6.3 SOFTWARE

6.4 SERVICES

7 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY PHARMACY TYPE

7.1 OVERVIEW

7.2 INDEPENDENT

7.3 CHAIN

7.4 FEDERAL

8 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY PHARMACY SIZE

8.1 OVERVIEW

8.2 LARGE SIZE PHARMACY

8.3 MEDIUM SIZE PHARMACY

8.4 SMALL SIZE PHARMACY

9 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 DRUG DISPENSING AND PACKAGING

9.3 DRUG STORAGE

9.4 INVENTORY MANAGEMENT

10 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 INPATIENT PHARMACIES

10.3 OUTPATIENT PHARMACIES

10.4 RETAIL PHARMACIES

10.5 ONLINE PHARMACIES

10.6 CENTRAL FILL/MAIL ORDER PHARMACIES

10.7 PHARMACY BENEFIT MANAGEMENT ORGANIZATIONS

10.8 OTHERS

11 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 DIRECT TENDER

11.3 THIRD PARTY DISTRIBUTOR

12 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, BY REGION

12.1 MIDDLE EAST & AFRICA

12.1.1 SAUDI ARABIA

12.1.2 SOUTH AFRICA

12.1.3 U.A.E.

12.1.4 ISRAEL

12.1.5 EGYPT

12.1.6 REST OF MIDDLE EAST & AFRICA

13 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 OMNICELL, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 MCKESSON CORPORATION

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 AMERISOURCEBERGEN CORPORATION

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BAXTER

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 TOSHO CO., INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 APD ALGORITMOS PROCESOS Y DISEÑOS S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASTERES INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 ARXIUM

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BD

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 COMPANY SHARE ANALYSIS

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 BIQHS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 CAPSA HEALTHCARE

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 CERNER CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 DEENOVA S.R.L.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 DEMODEKS PHARMACY SHELVING

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 FULLSCRIPT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 GENESIS AUTOMATION LTD

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 IA

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 INTERLINK AI, INC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 JVM EUROPE BV

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 KLS PHARMA ROBOTICS GMBH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 KUKA AG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 COMPANY SHARE ANALYSIS

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 MEDAVAIL TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 MYPAK SOLUTIONS PTY LTD.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 RXSAFE, LLC.

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 SCRIPTPRO LLC

15.25.1 COMPANY SNAPSHOT

15.25.2 COMPANY SHARE ANALYSIS

15.25.3 PRODUCT PORTFOLIO

15.25.4 RECENT DEVELOPMENTS

15.26 SYNERGY MEDICAL

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENTS

15.27 TAKAZONO CORPORATION

15.27.1 COMPANY SNAPSHOT

15.27.2 PRODUCT PORTFOLIO

15.27.3 RECENT DEVELOPMENTS

15.28 UNIVERSAL LOGISTICS HOLDINGS, INC.

15.28.1 COMPANY SNAPSHOT

15.28.2 REVENUE ANALYSIS

15.28.3 PRODUCT PORTFOLIO

15.28.4 RECENT DEVELOPMENTS

15.29 WILLACH GROUP

15.29.1 COMPANY SNAPSHOT

15.29.2 PRODUCT PORTFOLIO

15.29.3 RECENT DEVELOPMENTS

15.3 YUYAMA

15.30.1 COMPANY SNAPSHOT

15.30.2 PRODUCT PORTFOLIO

15.30.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING NEED TO MINIMIZE MEDICATION ERRORS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SYSTEMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET IN 2023 AND 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET

FIGURE 14 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT, 2022

FIGURE 15 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT, 2023-2030 (USD

FIGURE 16 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, 2023-2030 (USD MILLION)

FIGURE 20 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, CAGR (2023-2030)

FIGURE 21 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY TYPE, LIFELINE CURVE

FIGURE 22 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, 2022

FIGURE 23 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, 2023-2030 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, CAGR (2023-2030)

FIGURE 25 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PHARMACY SIZE, LIFELINE CURVE

FIGURE 26 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY APPLICATION, 2022

FIGURE 27 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 28 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY END USER, 2022

FIGURE 31 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 32 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY END USER, CAGR (2023-2030)

FIGURE 33 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 35 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 36 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 37 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: SNAPSHOT (2022)

FIGURE 39 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022)

FIGURE 40 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2023 & 2030)

FIGURE 41 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY COUNTRY (2022 & 2030)

FIGURE 42 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: BY PRODUCT (2023-2030)

FIGURE 43 MIDDLE EAST & AFRICA PHARMACY AUTOMATION MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。