中東およびアフリカのチョコレートのマルチトール市場

Market Size in USD Billion

CAGR :

%

USD

3,503.64 Thousand

USD

4,807.32 Thousand

2021

2029

USD

3,503.64 Thousand

USD

4,807.32 Thousand

2021

2029

| 2022 –2029 | |

| USD 3,503.64 Thousand | |

| USD 4,807.32 Thousand | |

|

|

|

中東およびアフリカのチョコレート市場におけるマルチトール、形態別(クリスタルパウダーシロップ)、チョコレートカテゴリー別(ホワイトチョコレート、ミルクチョコレート、ダークチョコレート)、用途別(ベーカリー、小売チョコレート、チョコレートインクルージョン)、国別(南アフリカ、サウジアラビア、UAE、クウェート、その他の中東およびアフリカ)業界動向および2029年までの予測。

市場分析と洞察:中東およびアフリカのチョコレートのマルチトール市場

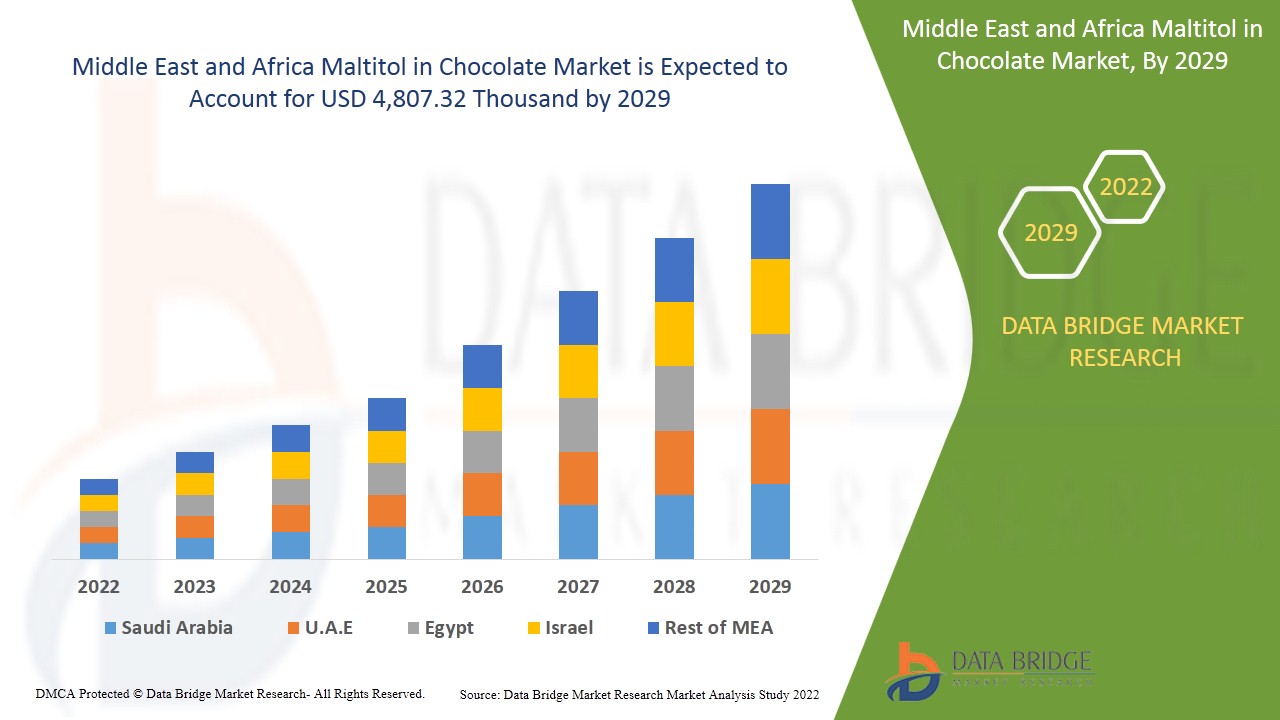

チョコレートのマルチトール市場は、2022年から2029年の予測期間に成長すると予想されています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に4.1%のCAGRで成長し、2021年の3,503.64千米ドルから2029年には4,807.32千米ドルに達すると分析しています。

マルチトールは糖アルコールまたはポリオールと呼ばれる炭水化物です。マルチトールは多くの果物や野菜に自然に含まれる水溶性化合物です。大規模にマルチトールは麦芽糖を豊富に含むデンプンから生産されます。食品業界でのマルチトールの主な用途は、焼き菓子、無糖チョコレート、チューインガム、ハードキャンディー、チョコレートコーティングです。マルチトールは、欧州連合、世界保健機関、オーストラリアやカナダなどの国など、世界中の保健当局によって安全性が検討され、確認されているため、人間の消費に安全です。マルチトールの味は通常の砂糖と同じです。砂糖の約90%に似た甘さがあり、1グラムあたりのカロリーは砂糖のほぼ半分です(砂糖の4カロリーに対して、マルチトールは2.1カロリー)。

マルチトールは、果物、野菜、デンプンなどのさまざまな原料から得られる糖アルコールです。デンプンからの麦芽糖がマルチトールの原料であり、無糖チョコレート、ハードキャンディー、焼き菓子、チョコレートコーティング、チューインガムなど、さまざまな食品および飲料製品の低カロリー甘味料として使用されています。人々の健康志向が高まり、世界中の糖尿病人口も増加するにつれて、低カロリー甘味料の需要が高まっています。したがって、低カロリーチョコレートと無糖チョコレートのマルチトールの需要も世界中で増加しています。市場の成長を促進する要因は、低カロリーおよび無糖チョコレート製品の需要の増加、通常の砂糖成分によって引き起こされる健康問題の増加、スクロースの代替品としてのマルチトールの採用の増加、豊富な原材料源です。市場の成長を抑制している要因は、マルチトールの副作用、他の甘味料と比較したマルチトールの高コスト、および市場で入手可能な代替品の数です。多くの企業が、マルチトールを含むチョコレートの需要の高まりに対応するために製造施設を拡張しています。

チョコレートに含まれるマルチトールの市場レポートでは、市場シェア、新開発、製品パイプライン分析、国内および現地の市場プレーヤーの影響、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から見た機会の詳細が提供されます。分析とチョコレートに含まれるマルチトールのグローバル市場シナリオを理解するには、アナリスト概要について Data Bridge Market Research にお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

チョコレートのマルチトール市場の範囲と市場規模

チョコレートのマルチトール市場は、形状、チョコレートのカテゴリー、用途に基づいて 3 つの主要なセグメントに分かれています。セグメント間の成長は、ニッチな成長分野と市場へのアプローチ戦略を分析し、コア アプリケーション領域とターゲット市場の違いを決定するのに役立ちます。

- 形態に基づいて、チョコレートのマルチトール市場は、結晶、粉末、シロップに分類されます。2022年には、他の形態に比べてシロップのコストが低いなどの要因により、シロップセグメントが市場シェアを支配すると予想されます。

- チョコレートのカテゴリーに基づいて、チョコレートのマルチトール市場は、ホワイトチョコレート、ミルクチョコレート、ダークチョコレートに分類されます。2022年には、幼児の親の間でホワイトチョコレートの需要が高いなどの要因により、ホワイトチョコレートセグメントが市場シェアを支配すると予想されます。

- 用途に基づいて、チョコレートのマルチトール市場は、ベーカリー、小売チョコレート、チョコレートインクルージョンに分類されます。2022年には、低カロリーチョコレート製品の需要が高いため、小売チョコレートセグメントが市場を支配すると予想されます。

チョコレート市場のマルチトールに関する国別分析

チョコレートのマルチトール市場が分析され、上記のように形態、チョコレートのカテゴリー、用途別に市場規模の情報が提供されます。

チョコレートのマルチトール市場レポートで取り上げられている国は、南アフリカ、サウジアラビア、UAE、クウェート、その他の中東およびアフリカです。

サウジアラビアは、砂糖不使用チョコレートの製造用マルチトールの需要が高まっているため、中東およびアフリカのチョコレート用マルチトール市場で主導権を握っています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、グローバル ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、販売チャネルの影響も考慮されます。

チョコレートに含まれるマルチトールの認知度を高めるために主要な市場プレーヤーが戦略的な活動を拡大し、チョコレートに含まれるマルチトール市場の成長を後押ししています。

チョコレートのマルチトール市場は、特定の市場における各国の成長に関する詳細な市場分析も提供します。さらに、市場プレーヤーの戦略と地理的なプレゼンスに関する詳細な情報も提供します。データは、2012 年から 2020 年までの履歴期間で利用できます。

チョコレート市場における競争環境とマルチトールのシェア分析

チョコレートのマルチトール市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。上記のデータ ポイントは、チョコレートのマルチトール市場への会社の重点にのみ関連しています。

チョコレートのマルチトール市場で事業を展開している主要企業には、浙江華康製薬株式会社、ロケット・フレール、イングレディオン、三菱商事ライフサイエンス株式会社、ADM、ブレンタグ、メルクKGaA、山東富味株式会社、カーギル株式会社、Bフードサイエンス株式会社、杭州ベリーケム科学技術株式会社、海航産業、Sosa、Foodchem International Corporation、PT. Ecogreen Oleochemicals、Mitushi Biopharma、MUBY CHEMICALS、Hylen株式会社、Nutra Food Ingredientsなどがあります。

例えば、

- 2020年12月、メルクKGaAはマルチトール生産を含むライフサイエンス事業のために米国の生産施設を拡張しました。これらの拡張により、2021年末と2022年末までにこれらの施設の生産能力と生産量が大幅に増加し、約700の新しい製造職が創出されます。この拡張により、同社は地理的プレゼンスを拡大することができました。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 INGREDIENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 IMPORT & EXPORT ANALYSIS OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

4.1.1 IMPORT-EXPORT ANALYSIS

5 LIST OF SUBSTITUTES

6 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: MARKETING STRATEGIES

7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: REGULATIONS

7.1 REGULATIONS ON THE MALTITOL BY EUROPEAN UNIONS

7.2 REGULATIONS ON THE USE OF FOOD ADDITIVES

7.3 REGULATIONS ON MALTITOL BY THE U.S. FDA

8 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SUPPLY CHAIN ANALYSIS

8.1 RAW MATERIAL PROCUREMENT

8.2 MANUFACTURING

8.3 MARKETING AND DISTRIBUTION

8.4 END USERS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS

9.1.2 GROWING NUMBER OF HEALTH ISSUES CAUSED BY REGULAR SUGAR INGREDIENT

9.1.3 GROWING ADOPTION OF MALTITOL AS SUCROSE ALTERNATIVE

9.1.4 ABUNDANT SOURCES OF RAW MATERIAL

9.2 RESTRAINTS

9.2.1 SIDE EFFECTS OF MALTITOL

9.2.2 HIGH COST OF MALTITOL AS COMPARED TO OTHER SWEETENERS

9.2.3 NUMBER OF SUBSTITUTES AVAILABLE IN THE MARKET

9.3 OPPORTUNITIES

9.3.1 MALTITOL IS AN IMPORTANT INGREDIENT IN CHOCOLATES TO PREVENT DENTAL CARIES IN CHILDREN AND ADULTS

9.3.2 HEALTH BENEFITS ASSOCIATED WITH CONSUMPTION OF MALTITOL

9.4 CHALLENGES

9.4.1 HIGH COST OF CHOCOLATES CONTAINING MALTITOL

9.4.2 STRINGENT GOVERNMENT REGULATIONS

10 COVID-19 IMPACT ON MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

10.1 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

10.2 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

10.3 IMPACT ON PRICE

10.4 IMPACT ON DEMAND

10.5 IMPACT ON SUPPLY CHAIN

10.6 CONCLUSION

11 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM

11.1 OVERVIEW

11.2 SYRUP

11.2.1 HIGH MALTOSE SYRUP

11.2.2 EXTRA HIGH MALTOSE SYRUP

11.3 CRYSTAL

11.4 POWDER

12 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY

12.1 OVERVIEW

12.2 MILK CHOCOLATE

12.3 DARK CHOCOLATE

12.4 WHITE CHOCOLATE

13 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 RETAIL CHOCOLATES

13.2.1 CHOCOLATE BARS

13.2.2 CANDIES

13.2.3 ASSORTMENT CHOCOLATES

13.2.4 BITES

13.2.5 CHOCOLATE WAFFERS

13.2.6 OTHERS

13.3 BAKERY

13.3.1 CAKES & PASTRIES

13.3.2 BREADS & ROLLS

13.3.3 BISCUIT

13.3.4 COOKIES & CRACKERS

13.3.5 OTHERS

13.4 CHOCOLATE INCLUSIONS

13.4.1 CHOCOLATE SHAPES

13.4.2 JIMMIES

13.4.3 DRAGEES

13.4.3.1 OVAL DRAGEES

13.4.3.2 PEARL DRAGEES

13.4.4 CHOCOLATE SYRUPS

13.4.5 CHOCOLATE FLAKES

13.4.6 QUINS

13.4.7 NONPAREILS

13.4.8 CHOCOLATE CHUNKS

13.4.9 CHOCOLATE SHELLS

13.4.10 CHOCOLATE CUPS

13.4.11 OTHERS

14 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 U.A.E.

14.1.3 SAUDI ARABIA

14.1.4 KUWAIT

14.1.5 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 INGREDION

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CARGILL, INCORPORATED

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 MERCK KGAA

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 ROQUETTE FRÈRES

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ADM

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SHANDONG FUTASTE CO.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BRENNTAG

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 B FOOD SCIENCE CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 FOODCHEM INTERNATIONAL CORPORATION

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 HANGZHOU VERYCHEM SCIENCE AND TECHNOLOGY CO.LTD

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 HAIHANG INDUSTRY

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 HYLEN CO., LTD

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 MITSUBISHI CORPORATION LIFE SCIENCES LIMITED

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 MITUSHI BIOPHARMA

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 MUBY CHEMICALS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 NUTRA FOOD INGREDIENTS

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 PT. ECOGREEN OLEOCHEMICALS

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SOSA

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ZHEJIANG HUAKANG PHARMACEUTICAL CO., LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: 1107 MALT (USD THOUSAND)

TABLE 3 LIST OF MALTITOL SUBSTITUTES

TABLE 4 A COMPARISON OF SOME PHYSICO-CHEMICAL PROPERTIES FOR SUCROSE AND MALTITOL

TABLE 5 FREQUENCY AND MEAN SCORE OF INTOLERANCE SYMPTOMS INTENSITY AFTER REGULAR CONSUMPTION OF INCREASING DOSES OF MALTITOL IN 12 HEALTHY VOLUNTEERS

TABLE 6 PRICES INDICATION OF DIFFERENT SWEETENERS

TABLE 7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA CRYSTAL IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA POWDER IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA MILK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA DARK CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA WHITE CHOCOLATE IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 34 SOUTH AFRICA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 35 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 36 SOUTH AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 37 SOUTH AFRICA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 38 SOUTH AFRICA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 SOUTH AFRICA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 SOUTH AFRICA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 41 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 42 U.A.E. SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 44 U.A.E. MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 45 U.A.E. BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 46 U.A.E. RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 47 U.A.E. CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 U.A.E. DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 49 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 SAUDI ARABIA SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 52 SAUDI ARABIA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 53 SAUDI ARABIA BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 54 SAUDI ARABIA RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 55 SAUDI ARABIA CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 SAUDI ARABIA DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 57 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 58 KUWAIT SYRUP IN MALTITOL IN CHOCOLATE MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2020-2029 (USD THOUSAND)

TABLE 60 KUWAIT MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 61 KUWAIT BAKERY IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 KUWAIT RETAIL CHOCOLATES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 KUWAIT CHOCOLATE INCLUSIONS IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 64 KUWAIT DRAGEES IN MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 65 REST OF MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2020-2029 (USD THOUSAND)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE: MARKET APPLICATION GRID

FIGURE 9 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 INCREASING DEMAND FOR LOW CALORIE AND SUGAR-FREE CHOCOLATE PRODUCTS ARE LEADING TO THE GROWTH OF THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET IN THE FORECAST PERIOD

FIGURE 13 SYRUP SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET IN 2022 & 2029

FIGURE 14 SUPPLY CHAIN OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET

FIGURE 16 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY FORM, 2021

FIGURE 17 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY CHOCOLATE CATEGORY, 2021

FIGURE 18 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET, BY APPLICATION, 2021

FIGURE 19 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: SNAPSHOT (2021)

FIGURE 20 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021)

FIGURE 21 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA MALTITOL IN CHOCOLATE MARKET: BY FORM (2022 & 2029)

FIGURE 24 MIDDLE EAST & AFRICA MALTITOL IN CHOCOLATE MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。