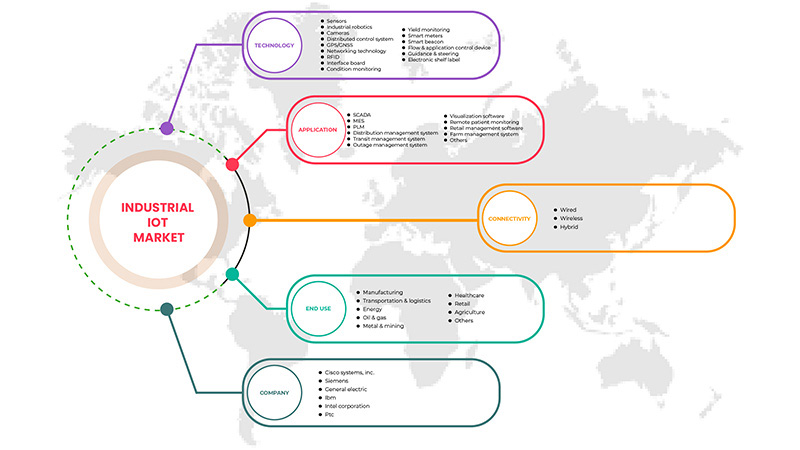

中東およびアフリカの産業用 IoT 市場、テクノロジー別 (センサー、産業用ロボット、カメラ、分散制御システム、GPS/GNSS、ネットワーク テクノロジー、RFID、インターフェイス ボード、状態監視、収量監視、スマート メーター、スマート ビーコン、フローおよびアプリケーション制御デバイス、ガイダンスおよびステアリング、電子棚札)、アプリケーション別 (SCADA、MES、PLM、配電管理システム、輸送管理システム、停電管理システム、可視化ソフトウェア、遠隔患者監視、小売管理ソフトウェア、農場管理システムなど)、接続性別 (有線、無線、ハイブリッド)、最終用途別 (製造、輸送および物流、エネルギー、石油およびガス、金属および鉱業、ヘルスケア、小売、農業など) – 2029 年までの業界動向と予測

中東およびアフリカの産業用 IoT 市場の分析と規模

エンドユーザー業界での人工知能(AI) と機械学習 (ML)の採用による産業用 IoT 市場の利用増加も、市場の成長を牽引しています。デバイスの盗難やデータ侵害の可能性が高まることで、産業用 IoT 市場は抑制されると予想されます。世界中でインターネットの普及とデジタル化が進むことは、産業用 IoT 市場にとってチャンスです。中東およびアフリカの産業用 IoT 市場は、設置コストの高さと IoT デバイスの統合の難しさから課題に直面しています。

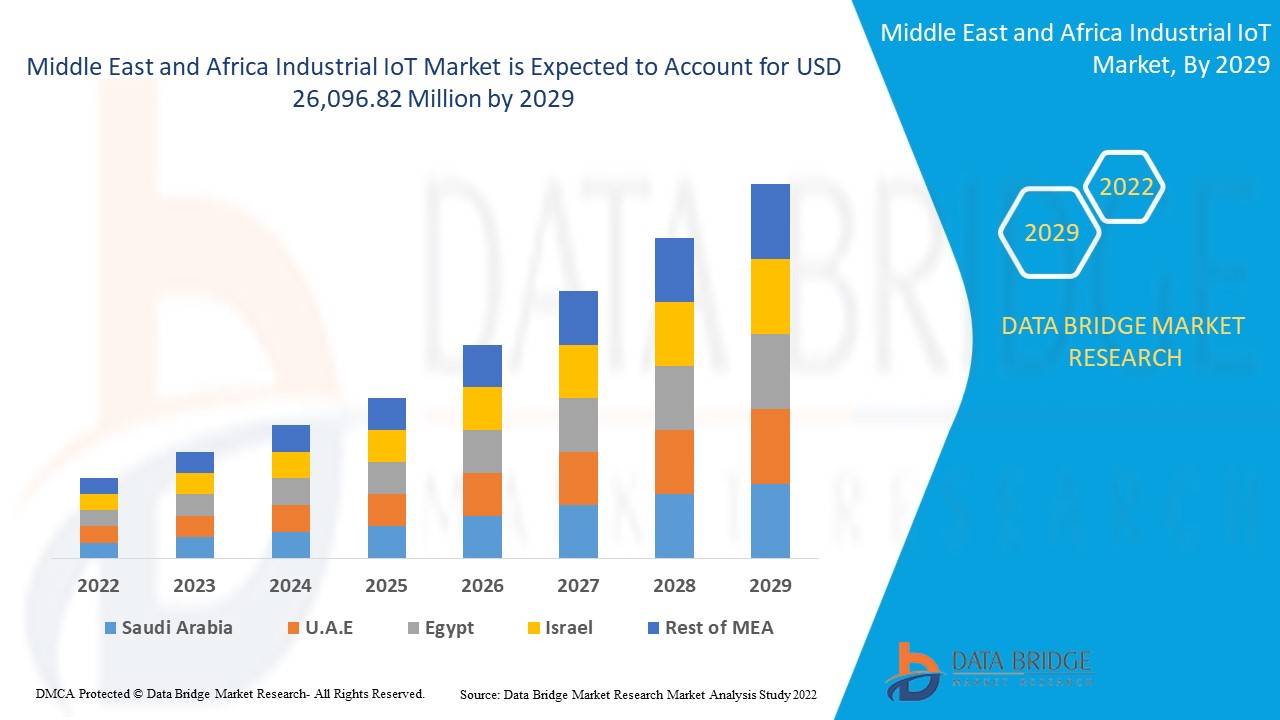

Data Bridge Market Research の分析によると、中東およびアフリカの産業用 IoT 市場は、予測期間中に 8.5% の CAGR で成長し、2029 年までに 260 億 9,682 万米ドルに達すると予想されています。「センサー」は、このタイプの技術が需要があり、産業用コンポーネントから情報を抽出するのに最適なオプションであるため、最も重要な技術セグメントを占めています。産業用 IoT 市場レポートでは、価格分析、特許分析、技術の進歩についても詳細に取り上げています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

テクノロジー別(センサー、産業用ロボット、カメラ、分散制御システム、GPS/GNSS、ネットワーク技術、RFID、インターフェースボード、状態監視、収量監視、スマートメーター、スマートビーコン、フローおよびアプリケーション制御デバイス、ガイダンスおよびステアリング、電子棚札)、アプリケーション別(SCADA、MES、PLM、配電管理システム、輸送管理システム、停電管理システム、可視化ソフトウェア、遠隔患者監視、小売管理ソフトウェア、農場管理システムなど)、接続性別(有線、無線、ハイブリッド)、最終用途別(製造、輸送および物流、エネルギー、石油およびガス、金属および鉱業、ヘルスケア、小売、農業など)– 2029年までの業界動向と予測 |

|

対象国 |

サウジアラビア、南アフリカ、エジプト、イスラエル、その他の中東諸国、アフリカ |

|

対象となる市場プレーヤー |

シスコシステムズ、シーメンス、ゼネラル・エレクトリック、IBM、インテル、PTC、ハネウェル・インターナショナル、NEC、ロックウェル・オートメーション、ABB、SAP SE、テキサス・インスツルメンツ、ロバート・ボッシュ、エマソン・エレクトリック、マイクロソフト、KUKA AG、Sigfox Network Limited(UnaBizの子会社)、Wipro、Arm Limited(ソフトバンクグループ株式会社の子会社)、Huawei Technologies Co., Ltd.など |

市場の定義

産業分野およびアプリケーションにおけるモノのインターネット (IoT) の拡張と適用は、産業用モノのインターネット (IIoT) と呼ばれます。マシンツーマシン (M2M) モノのインターネット (IIoT) は、M2M 接続、ビッグ データ、機械学習に重点を置いているため、企業や産業の効率と信頼性が向上します。ロボット工学、医療技術、ソフトウェア定義の生産プロセスなどの産業用アプリケーションはすべて、IIoT に含まれます。

産業用IoT市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- エンドユーザー業界における人工知能(AI)と機械学習(ML)の導入増加

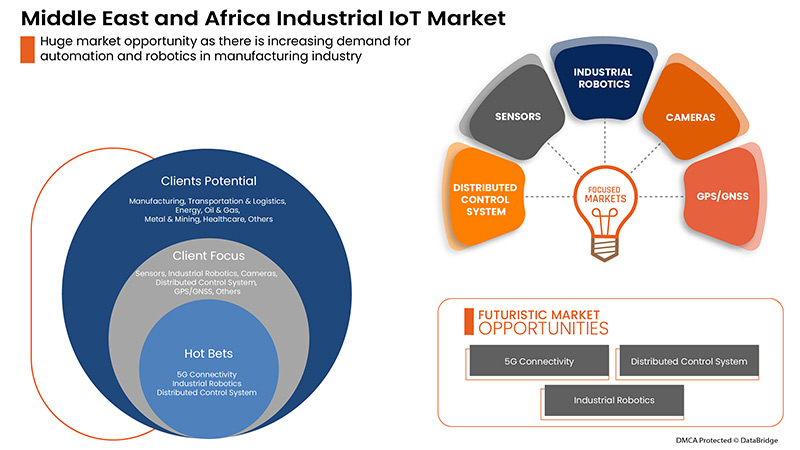

AI と ML の人気は、製造、医療、エネルギー、石油・ガスなど、さまざまな業界で年々高まっています。これらの業界のほとんどは、作業効率の向上、サービス提供プロセスの自動化、および市場での競合他社との競争において重要な役割を果たしているサービスの近代化のためにこのテクノロジーを採用しています。したがって、AI と ML の採用の増加傾向は、中東およびアフリカの産業用 IoT 市場の成長の主な原動力となっています。

- ビジネスオペレーションにおけるセンサーと分散制御システムの導入が急増

The adoption of sensors and distributed control system will help control and manage the work process and automate the management process for all industrial processes. Thus, the demand for implementing sensors and DCS in various business operations will increase yearly. Thus, globally, the need for sensors and DCS is rising due to various advantages associated with the implementation. And promotes the growth of the Middle East and Africa industrial IoT market and acts as a driver for the market's growth.

- Increase in the need for real-time data solutions and services

The real-time data solutions require a wide range of electronic devices, and majorly the demand for IoT devices is expected to increase because to support the real-time data analysis in business operations to support the quick understanding of data and guide the decisions to deliver products or services to customers. Thus, there is high demand for the adoption of real-time solutions, which directly involve the usage of IoT devices for industries. Therefore, it is expected to be a major driver of market growth.

Restraints/Challenges

- Lack of skilled labor and training sessions

Adopting IoT solutions for industries is not quick and easy; it involves detailed visualization and an adequate method of automating the sector. Therefore, end users need more time and labor to adopt the solutions and train the employees to understand the operation and maintenance.

- Higher probability of device theft and data breaches

The dependability of the IT climate suggests getting the plant's resources, organization, and information created by these associated gadgets. Reliability is more responsible for adopting digitalization in business operations; however, there is a high probability of safety disadvantages.

- Rise in the technical complexities due to day-by-day technological advancement

Flexible security is one thought for giving medical care, instruction, and lodging help, whether somebody is officially utilized. Furthermore, action records can back deep-rooted training and laborer retraining. Regardless of how individuals decide to invest energy, there should be ways for individuals to live satisfying lives irrespective of whether society needs fewer specialists. Thus, continuous technological advancement will lead to constant employee training and hinder the market growth.

Post COVID-19 Impact on Industrial IoT Market

COVID-19 significantly impacted the industrial IoT market as almost every country has opted for the shutdown for every production facility except those producing essential goods. The government has taken strict actions, such as shutting down production and sale of non-essential goods, blocking international trade, and many more, to prevent the spread of COVID-19. The only business dealing in this pandemic situation is the essential services allowed to open and run the processes.

農業、電力会社、鉱業、石油・ガス、輸送など、生産プロセスとサプライチェーンのデジタル化により、産業用IoT市場の成長が加速しています。さらに、パンデミックによりあらゆる種類のビジネスにおけるIoTの重要性が実証されたため、2020年から2021年にかけて、産業界でのIoT導入は大きく進展しました。最大限の労働力の関与を避けるための自動化の需要の急増が、産業界でのIoT導入を促進しました。これは、COVID-19がIIoT市場に与えたプラスの影響を再現するものであり、インダストリー4.0テクノロジーの導入を通じてビジネスをさらに促進しています。

メーカー各社は、COVID-19後の回復に向けてさまざまな戦略的決定を下しています。各社は、産業用IoT市場の技術を向上させるために、複数の研究開発活動を行っています。各社は、高度で正確なソリューションを市場に投入します。

最近の開発

- 2022年3月、シスコシステムズは、サービスの信頼性の向上と運用コストの削減に役立つ高度なIoTコントロールセンタープラットフォームを開発しました。この開発により、同社はソリューションポートフォリオを多様化し、より高品質のソリューションを提供できるようになります。

- 2022年4月、Arm LimitedはArm Cortex-M85とCortex-Aという2つの新しいソリューションを発表しました。これらの新製品とソリューションにより、同社は顧客に優れたソリューションを提供し、新規顧客を獲得し、収益の成長を加速させることができます。

中東およびアフリカの産業用IoT市場の範囲

産業用 IoT 市場は、テクノロジー、アプリケーション、接続性、および最終用途に基づいてセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントを分析するのに役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

テクノロジー別

- センサー

- 産業用ロボット

- カメラ

- 分散制御システム

- GPS/GNSS

- ネットワーク技術

- RFID

- インターフェースボード

- 状態監視

- 収量モニタリング

- スマートメーター

- スマートビーコン

- フローおよびアプリケーション制御デバイス

- ガイダンスとステアリング

- 電子棚札

技術に基づいて、中東およびアフリカの産業用 IoT 市場は、センサー、産業用ロボット、カメラ、分散制御システム、GPS/GNSS、ネットワーク技術、RFID、インターフェース ボード、状態監視、収量監視、スマート メーター、スマート ビーコン、フローおよびアプリケーション制御デバイス、ガイダンスおよびステアリング、電子棚札に分類されます。

アプリケーション別

- SCADA

- 株式会社

- プロダクトマネジメント

- 流通管理システム

- 交通管理システム

- 停電管理システム

- 可視化ソフトウェア

- 遠隔患者モニタリング

- 小売管理ソフトウェア

- 農場管理システム

- その他

アプリケーションに基づいて、中東およびアフリカの産業用 IoT 市場は、SCADA、MES、PLM、配電管理システム、輸送管理システム、停電管理システム、可視化ソフトウェア、遠隔患者モニタリング、小売管理ソフトウェア、農場管理システムなどに分類されています。

接続性別

- 有線

- 無線

- ハイブリッド

接続性に基づいて、中東およびアフリカの産業用 IoT 市場は、有線、無線、ハイブリッドに分類されています。

最終用途別

- 製造業

- 運輸・物流

- エネルギー

- 石油・ガス

- 金属・鉱業

- 健康管理

- 小売り

- 農業

- その他

最終用途に基づいて、中東およびアフリカの産業用 IoT 市場は、製造、輸送および物流、エネルギー、石油およびガス、金属および鉱業、ヘルスケア、小売、農業、その他に分類されています。

産業用 IoT 市場の地域分析/洞察

産業用 IoT 市場が分析され、上記のようにテクノロジー、アプリケーション、接続性、最終用途別に市場規模の洞察と傾向が提供されます。

モノのインターネット(IoT)デバイス市場レポートで取り上げられている国は、サウジアラビア、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカです。

サウジアラビアは中東およびアフリカの産業用 IoT 市場を支配しています。サウジアラビアは、最も急速に成長する産業用 IoT 市場になると思われます。サウジアラビアは、セキュリティを向上させ、政府、企業、輸送、コミュニティに新しいレベルの運用インテリジェンスを提供することを目的としたクラウドベースのソリューションとサービスを開発しています。これにより、中東およびアフリカの産業用 IoT 製品が促進されるでしょう。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、中東およびアフリカのブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートも考慮され、国別データの予測分析が提供されます。

競争環境と産業用 IoT 市場シェア分析

産業用 IoT 市場の競争状況は、競合他社に関する詳細情報を提供します。含まれる要素は、企業概要、企業の財務状況、収益、市場の可能性、研究開発への投資、新規市場への取り組み、中東およびアフリカでのプレゼンス、生産拠点と施設、生産能力、企業の強みと弱み、製品の発売、製品の幅広さと幅広さ、アプリケーションの優位性です。上記のデータ ポイントは、企業が産業用 IoT 市場に注力していることにのみ関連しています。

産業用 IoT 市場で活動している主要企業は次のとおりです。

- シスコシステムズ株式会社

- シーメンス

- ゼネラル・エレクトリック

- IBMコーポレーション

- インテルコーポレーション

- PTCC

- ハネウェルインターナショナル株式会社

- 日本電気株式会社

- ロックウェル・オートメーション株式会社

- ABB社

- SAP SE

- テキサス・インスツルメンツ株式会社

- ロバート・ボッシュ GmbH

- エマーソンエレクトリック社

- マイクロソフト

- クーカAG

- Sigfox パートナー ネットワーク (UnaBiz の子会社)

- ウィプロ

- Arm Limited(ソフトバンクグループ株式会社の子会社)

- ファーウェイテクノロジーズ株式会社

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TECHNOLOGY TIMELINE CURVE

2.1 MARKET END USE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 OVERVIEW

4.1.2 PREDICTIVE MAINTENANCE

4.1.3 LOCATION TRACKING

4.1.4 WORKPLACE ANALYTICS

4.1.5 REMOTE QUALITY MONITORING

4.1.6 ENERGY OPTIMIZATION

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY

5.1.2 SURGE IN IMPLEMENTATION OF SENSORS AND DISTRIBUTED CONTROL SYSTEMS IN BUSINESS OPERATIONS

5.1.3 INCREASE IN THE NEED FOR REAL-TIME DATA SOLUTIONS AND SERVICES

5.1.4 INCREASE IN THE PENETRATION OF INDUSTRY 4.0 IN AUTOMOTIVE AND MANUFACTURING INDUSTRIES

5.2 RESTRAINTS

5.2.1 LACK OF SKILLED LABOR AND TRAINING SESSIONS

5.2.2 HIGHER PROBABILITY OF DEVICE THEFT AND DATA BREACHES

5.2.3 RISE IN THE TECHNICAL COMPLEXITIES DUE TO DAY-BY-DAY TECHNOLOGICAL ADVANCEMENT

5.3 OPPORTUNITIES

5.3.1 RISE IN INTERNET PENETRATION ACROSS THE GLOBE

5.3.2 RISE IN THE DIGITALIZATION TREND

5.3.3 PROGRESSION IN SMART TECHNOLOGIES

5.3.4 HIGH ADOPTION OF CLOUD-BASED DEPLOYMENT MODEL

5.4 CHALLENGES

5.4.1 HIGH INSTALLATION COST

5.4.2 DIFFICULTIES IN INTEGRATION OF IOT DEVICES

6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 SENSORS

6.3 INDUSTRIAL ROBOTICS

6.4 CAMERAS

6.5 DISTRIBUTED CONTROL SYSTEM

6.6 GPS/GNSS

6.7 NETWORKING TECHNOLOGY

6.8 RFID

6.9 INTERFACE BOARD

6.1 CONDITION MONITORING

6.11 YIELD MONITORING

6.12 SMART METERS

6.13 SMART BEACON

6.14 FLOW & APPLICATION CONTROL DEVICE

6.15 GUIDANCE & STEERING

6.16 ELECTRONIC SHELF LABEL

7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SCADA

7.3 MES

7.4 PLM

7.5 DISTRIBUTED CONTROL SYSTEM

7.6 TRANSIT MANAGEMENT SYSTEM

7.7 OUTAGE MANAGEMENT SYSTEM

7.8 VISUALIZATION SOFTWARE

7.9 REMOTE PATIENT MONITORING

7.1 RETAIL MANAGEMENT SOFTWARE

7.11 FARM MANAGEMENT SYSTEM

7.12 OTHERS

8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY

8.1 OVERVIEW

8.2 WIRED

8.3 WIRELESS

8.4 HYBRID

9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE

9.1 OVERVIEW

9.2 MANUFACTURING

9.3 TRANSPORTATION & LOGISTICS

9.4 ENERGY

9.5 OIL & GAS

9.6 METAL & MINING

9.7 HEALTHCARE

9.8 RETAIL

9.9 AGRICULTURE

9.1 OTHERS

10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SAUDI ARABIA

10.1.2 SOUTH AFRICA

10.1.3 EGYPT

10.1.4 ISRAEL

10.1.5 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 CISCO SYSTEMS, INC.

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 GENERAL ELECTRIC

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 IBM CORPORATION

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 INTEL CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ARM LIMITED (A SUBSIDIAIRY OF SOFTBANK GROUP)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EMERSON ELECTRIC CO.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HONEYWELL INTERNATIONAL INC.

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 HUAWEI TECHNOLOGIES CO., LTD.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 KUKA AG

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 MICROSOFT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 NEC CORPORATION

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 PTC

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 ROBERT BOSCH GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 ROCKWELL AUTOMATION, INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 SAP SE

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SIGFOX PARTNER NETWORK

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 TEXAS INSTRUMENTS INCORPORATED

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 WIPRO

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA SENSORS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA INDUSTRIAL ROBOTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA CAMERAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA GPS/GNSS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA NETWORKING TECHNOLOGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA RFID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA INTERFACE BOARD IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA CONDITION MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA YIELD MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA SMART METERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA SMART BEACON IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA FLOW & APPLICATION CONTROL DEVICE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA GUIDANCE & STEERING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA ELECTRONIC SHELF LABEL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA SCADA IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA MES IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029, (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA PLM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA DISTRIBUTED CONTROL SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA TRANSIT MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OUTAGE MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA VISUALIZATION SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA REMOTE PATIENT MONITORING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA RETAIL MANAGEMENT SOFTWARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FARM MANAGEMENT SYSTEM IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA WIRED IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA WIRELESS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA HYBRID IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA MANUFACTURING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA TRANSPORTATION & LOGISTICS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA ENERGY IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA OIL & GAS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA METAL & MINING IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA HEALTHCARE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA RETAIL IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA AGRICULTURE IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA OTHERS IN INDUSTRIAL IOT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 44 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 46 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 48 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 49 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 51 SAUDI ARABIA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 52 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 55 SOUTH AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 56 EGYPT INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 EGYPT INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 EGYPT INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 59 EGYPT INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 60 ISRAEL INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 61 ISRAEL INDUSTRIAL IOT MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 ISRAEL INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2020-2029 (USD MILLION)

TABLE 63 ISRAEL INDUSTRIAL IOT MARKET, BY END USE, 2020-2029 (USD MILLION)

TABLE 64 REST OF MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: SEGMENTATION

FIGURE 11 INCREASE IN ADOPTION OF ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML) IN END USER INDUSTRY IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SCADA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET IN 2022 AND 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET

FIGURE 14 AI ADOPTION RATES AROUND THE GLOBE

FIGURE 15 COMPANIES GETTING BENEFITS FROM ANALYTICAL SOLUTIONS

FIGURE 16 GROWING INTERNET USERS WORLDWIDE

FIGURE 17 UNEMPLOYMENT RATE IN THE MIDDLE EAST AND NORTH AFRICA REGION

FIGURE 18 RESEARCH AND DEVELOPMENT EXPENDITURE (% OF GDP)

FIGURE 19 WORLDWIDE CLOUD INVESTMENT, 2019 – 2025

FIGURE 20 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY TECHNOLOGY, 2021

FIGURE 21 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY APPLICATION, 2021

FIGURE 22 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY CONNECTIVITY, 2021

FIGURE 23 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET, BY END USE, 2021

FIGURE 24 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: SNAPSHOT (2021)

FIGURE 25 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021)

FIGURE 26 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA INDUSTRIAL IOT MARKET: BY TECHNOLOGY (2022 & 2029)

FIGURE 29 MIDDLE EAST & AFRICA INDUSTRIAL IOT MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。