中東・アフリカのカカオ豆市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

834.45 Million

USD

1,364.47 Million

2024

2032

USD

834.45 Million

USD

1,364.47 Million

2024

2032

| 2025 –2032 | |

| USD 834.45 Million | |

| USD 1,364.47 Million | |

|

|

|

|

中東およびアフリカのカカオ豆市場セグメンテーション、カカオ豆の種類(フォラステロカカオ豆、トリニタリオカカオ豆、クリオロカカオ豆)、製品タイプ(焙煎カカオ豆と未焙煎カカオ豆)、性質(従来型および有機)アプリケーション(食品、飲料、パーソナルケアおよび化粧品、栄養補助食品、医薬品、スポーツ栄養、その他) - 2032年までの業界動向と予測

中東およびアフリカのカカオ豆市場規模

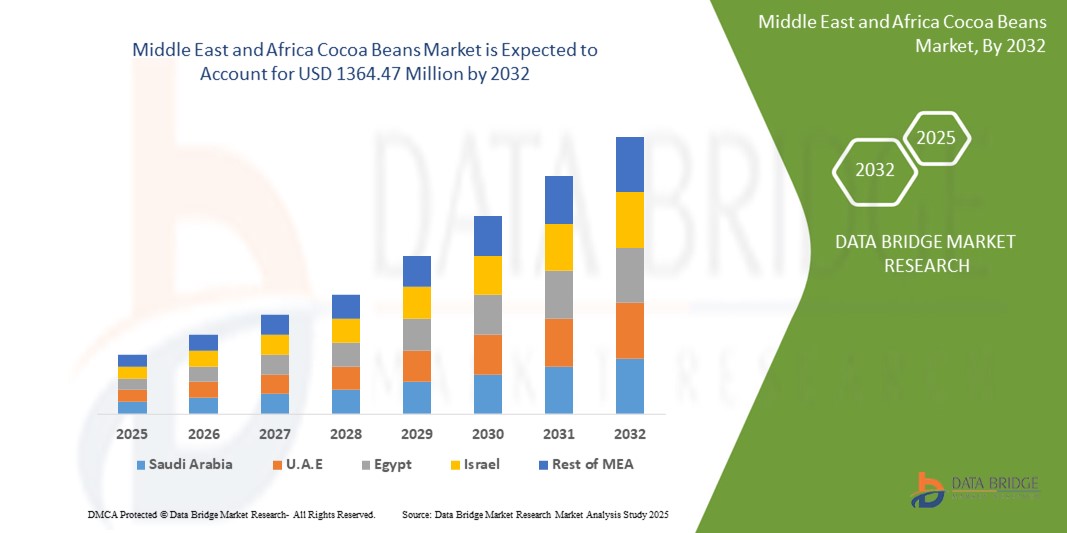

- 中東およびアフリカのカカオ豆市場規模は2024年に8億3,445万米ドルと評価され、予測期間中に6.5%のCAGRで成長し、2032年には1億3,6447万米ドルに達すると予想されています。

- 市場の成長は、主に、可処分所得の増加、消費者の嗜好の変化、先進国と新興国の両方における菓子・ベーカリー部門の拡大によって推進されているチョコレートおよびココアベースの製品の需要増加によって推進されている。

- さらに、持続可能で倫理的に調達されたカカオへの意識の高まりと、カカオ栽培および加工における技術の進歩により、収穫量、品質、トレーサビリティが向上しています。これらの要因が重なり合い、サプライチェーン全体の効率性が向上し、カカオ豆市場の成長を大きく促進しています。

中東・アフリカのカカオ豆市場分析

- カカオ豆は、チョコレート製造をはじめ、幅広い食品、飲料、パーソナルケア製品に使用される主要原料です。加工されたカカオ豆は、ココアリカー、ココアバター、ココアパウダーに加工され、菓子、ベーカリー、飲料、化粧品、栄養補助食品の必須原料として利用されています。

- カカオ豆の需要の高まりは、主に世界的なチョコレート製品の消費量の増加、高品質で特別なカカオ品種への嗜好の増加、そして長期的な供給の安全性を確保するために大手メーカーによる持続可能なカカオ栽培方法への投資の増加によって推進されている。

- 南アフリカは、 チョコレートやココア製品の消費量の増加と、ココア加工や特殊チョコレート生産への投資の増加により、2024年にはココア豆市場を支配した。

- UAEは、プレミアムおよびスペシャルティカカオ製品の需要増加と持続可能な調達慣行の採用増加により、予測期間中にカカオ豆市場で最も急速に成長する国になると予想されています。

- フォラステロ種のカカオ豆は、高い収量、耐病性、そしてコートジボワールやガーナといった主要生産国での広範な栽培により、2024年には63%の市場シェアを獲得し、市場を席巻しました。フォラステロ種は、その豊かな風味、安定した品質、そして低コストから、大手チョコレートメーカーに好まれ、世界のカカオ生産の基盤となっています。この分野の優位性は、広範な加工インフラ、入手しやすさ、そして量販チョコレート製品への適合性によってさらに強化されています。

レポートの範囲と中東およびアフリカのカカオ豆市場のセグメンテーション

|

属性 |

中東およびアフリカのカカオ豆の主要市場分析 |

|

対象セグメント |

|

|

対象国 |

中東およびアフリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

中東およびアフリカのカカオ豆市場動向

チョコレート製品の需要増加

- カカオ豆市場は、菓子、ベーカリー、飲料分野におけるチョコレート製品の需要の高まりにより、力強い成長を遂げています。チョコレートは依然として嗜好品として人気が高く、世界中でカカオ豆の消費量の増加を牽引しています。

- 例えば、モンデリーズ・インターナショナルは、新興地域におけるチョコレート生産拡大への投資を増やし、高級チョコレート製品と大衆向けチョコレート製品の需要の高まりに対応しています。同社の取り組みは、カカオ豆の需要が菓子産業の拡大と密接に結びついていることを浮き彫りにしています。

- 職人技とプレミアムチョコレートブランドの台頭により、消費者が高品質で倫理的に調達された製品への購入意欲を高め、カカオ豆の需要がさらに高まっています。こうしたプレミアム化へのシフトは、フレーバーの革新と倫理的な調達慣行の両方を重視しています。

- さらに、チョコレートが様々なベーカリー製品、アイスクリーム、飲料製品に取り入れられることで、カカオ豆の用途はさらに広がりました。この傾向は特にカフェやクイックサービスレストランで顕著で、チョコレートをベースにしたメニューの革新が市場の需要を継続的に支えています。

- 可処分所得の増加に伴い、新興国はチョコレート消費の重要な成長拠点となりつつあります。アジア太平洋諸国では、都市部におけるカカオ由来製品の消費が拡大しており、この地域はカカオ豆市場の長期的な成長の中心となっています。

- 全体として、マスマーケットからプレミアムまで、複数のセグメントにわたるチョコレート製品の需要の急増は、消費者の嗜好の変化に合わせて進化することが期待される、回復力のあるサプライチェーンの基盤としてのカカオ豆を浮き彫りにしている。

中東およびアフリカのカカオ豆市場の動向

ドライバ

ココアの健康効果に関する認識の高まり

- ココアの消費は、心血管の健康、抗酸化作用、認知機能のサポートといった健康効果への意識の高まりによって、ますます支持されています。ダークチョコレートやココアベースの機能性食品は、健康的な贅沢な選択肢として宣伝されています。

- 例えば、バリー・カレボーは、フラバノールを豊富に含む成分を訴求するカカオ由来製品を発売し、消費者の健康志向と食品業界のイノベーションの両方に対応しています。こうした取り組みは、健康志向のメッセージが世界的にカカオの消費パターンを形成していることを示しています。

- カカオ由来のフラボノイドが血圧を下げ、気分を改善し、脳の健康をサポートするという科学的研究により、消費者の関心が高まっています。カカオと健康・予防栄養との結びつきは、世界的な需要の牽引力を大きく強化します。

- さらに、食品・飲料メーカーは、健康志向の市場セグメントをターゲットとしたココアベースの製品を発売しています。プロテインバー、栄養補助食品、エナジードリンクへのココアの配合は、豆の需要に全く新しい成長の道筋を生み出しています。

- 消費者の健康志向の高まりにより、カカオ豆は菓子市場と健康食品市場の両方においてイノベーションの中心であり続けています。贅沢な食感と機能性を兼ね備えたカカオ豆は、業界全体の長期的な成長軌道を強化しています。

抑制/挑戦

ココア価格の変動とボラティリティ

- カカオ豆市場は、気候条件、生産国の政情不安、需給の不均衡などの影響によるカカオ価格の変動に大きく影響を受けています。こうした予測不可能性は生産者と購入者の双方に混乱をもたらし、長期計画に不確実性をもたらします。

- 例えば、コートジボワールやガーナなどの主要生産国からのカカオの供給は、天候の変動や地域紛争により混乱し、カカオ豆の価格とチョコレートメーカーへの供給に影響を及ぼしている。

- カカオ価格の変動は、菓子メーカーの利益率を圧迫し、消費者のコストを押し上げることが多い。カカオ生産の大部分を占める小規模農家は、価格変動による収入の不安定化にも非常に脆弱である。

- さらに、投機的な取引や為替変動は市場の不安定性をさらに悪化させます。高いボラティリティは、生産者やサプライチェーン全体の企業が安全な契約を締結し、一貫した事業運営を維持することを困難にします。

- この課題に対処するには、持続可能な調達枠組みの構築、生産地域の多様化、そしてフェアトレードの仕組みの導入が必要です。カカオ豆市場の安定化は、価格の安定、公平な所得の確保、そしてチョコレート生産の持続可能な未来を支えるために不可欠です。

中東およびアフリカのカカオ豆市場の展望

市場は、カカオ豆の種類、製品の種類、性質、用途に基づいて分類されています。

- カカオ豆の種類別

カカオ豆の種類に基づいて、市場はフォラステロ種、トリニタリオ種、クリオロ種の3つに分類されます。フォラステロ種は、高い収量、耐病性、そしてコートジボワールやガーナといった主要生産国における広範な栽培によって、2024年には63%という最大の収益シェアを獲得し、市場を席巻しました。フォラステロ種は、その豊かな風味、安定した品質、そして低コストから大手チョコレートメーカーに好まれ、世界のカカオ生産の基盤となっています。この分野の優位性は、広範な加工インフラ、入手しやすさ、そして量販チョコレート製品への適合性によってさらに強化されています。

トリニタリオ種は、繊細な風味を持つプレミアムチョコレートやスペシャルティチョコレートへの消費者需要の高まりを背景に、2025年から2032年にかけて最も高い成長率を示すと予想されています。フォラステロ種とクリオロ種の交配種であるトリニタリオ種は、品質と収量のバランスに優れており、職人ショコラティエや高級ブランドを魅了しています。カカオの産地や風味の差別化に対する意識の高まりにより、グルメ製品や高級菓子へのトリニタリオ種の採用が進んでいます。

- 製品タイプ別

製品タイプ別に見ると、市場は焙煎カカオ豆と未焙煎カカオ豆に分類されます。焙煎カカオ豆セグメントは、チョコレート、ベーカリー製品、菓子類の製造においてすぐに使用できることから、2024年には最大の市場シェアを占めました。焙煎はカカオの風味、香り、色を高めるため、一貫した品質を求めるメーカーにとって好ましい選択肢となっています。このセグメントの成長は、確立された加工技術、容易な保管、そして長い保存期間に支えられており、産業用途および商業用途における幅広い採用を確実なものにしています。

未焙煎カカオ豆セグメントは、自然派、加工度の低い、ローフード製品への消費者嗜好の高まりを背景に、2025年から2032年にかけて最も高い成長が見込まれています。未焙煎カカオ豆は抗酸化物質が豊富で、天然の栄養素をより多く保持すると考えられており、健康志向の消費者や専門食品メーカーにとって魅力的です。機能性食品やローチョコレート製品のトレンドの高まりは、世界中で未焙煎カカオ豆の需要をさらに加速させています。

- 自然によって

性質に基づき、市場は従来型カカオ豆とオーガニックカカオ豆に分類されます。従来型カカオ豆は、確立されたサプライチェーン、高い生産量、そしてオーガニックカカオ豆に比べて低いコストにより、2024年には最大の収益シェアを獲得しました。従来型カカオ豆はチョコレート市場を引き続き支配しており、マスマーケットや業務用菓子の主要原料として利用されています。このセグメントの優位性は、安定した品質、主要なカカオ生産地域における入手しやすさ、そして大規模加工技術との互換性によっても支えられています。

オーガニック分野は、持続可能な農業慣行と無農薬食品に対する消費者意識の高まりを背景に、2025年から2032年にかけて最も急速な成長を遂げると予想されています。合成肥料や農薬を使用せずに栽培されたオーガニックカカオ豆は、健康志向の消費者や高級チョコレートブランドにとって魅力的です。オーガニック食品・飲料セクターの成長に加え、USDAオーガニックやフェアトレードなどの認証取得も、オーガニックの普及をさらに後押ししています。

- アプリケーション別

用途別に見ると、市場は食品、飲料、パーソナルケア・化粧品、栄養補助食品、医薬品、スポーツ栄養、その他に分類されています。食品セグメントは、チョコレート、菓子、ベーカリー、スナック製品におけるココアの広範な使用により、2024年には最大の収益シェアを占め、市場を席巻しました。ココアの汎用性、風味特性、そして機能的利点は、マスマーケット向け食品とプレミアム食品の両方において、主要な原料となっています。世界中でチョコレートやココアベースの珍味に対する高い消費者需要が、このセグメントの優位性を強化し続けています。

パーソナルケア・化粧品セグメントは、スキンケア、ヘアケア、化粧品処方におけるココアバターとココアエキスの配合増加に牽引され、2025年から2032年にかけて最も高い成長が見込まれています。ココアの保湿性、抗酸化作用、抗炎症作用は、プレミアムおよびナチュラルなパーソナルケア製品への採用を促進しています。消費者の天然由来成分や植物由来成分への嗜好の高まりも、このセグメントの市場成長をさらに加速させています。

中東およびアフリカのカカオ豆市場地域分析

- 南アフリカは、チョコレートやココア製品の消費量の増加と、ココア加工や特殊チョコレート生産への投資増加により、2024年に最大の収益シェアでココア豆市場を支配した。

- この国のリーダーシップは、確立されたカカオのサプライチェーン、近代的な加工施設、そして持続可能で倫理的に調達されたカカオへの注力によって強化されています。

- 高品質で追跡可能なカカオに対する消費者の嗜好の高まりと、地元農家の支援や生産効率の向上に向けた取り組みは、南アフリカの地位をさらに強化しています。国際的なカカオ供給業者との戦略的提携と流通ネットワークの拡大は、同国の市場における優位性を支え続けています。

UAEカカオ豆市場の洞察

UAEは、プレミアムおよびスペシャリティカカオ製品の需要増加と持続可能な調達慣行の導入拡大に支えられ、2025年から2032年にかけて中東・アフリカ市場で最も高いCAGRを記録すると予測されています。高級チョコレート製造、最新の加工技術、革新的なカカオベース製品への投資が市場拡大を牽引しています。食品品質基準の推進を促進する政府の取り組みや、国際的なカカオサプライヤーとの提携が市場の成長を後押ししています。倫理的に調達されたカカオとその健康効果に対する消費者意識の高まりも、UAEにおけるカカオの導入をさらに加速させています。

サウジアラビアのカカオ豆市場の洞察

サウジアラビアは、チョコレート・菓子業界の拡大とカカオ関連製品の消費増加に支えられ、2025年から2032年にかけて着実な成長を遂げると予想されています。プレミアムカカオ品種と持続可能な調達慣行への認知度の高まりが、市場浸透を促進しています。近代的な生産施設への投資、国際的なカカオ供給業者との提携、そして高度な加工技術の導入は、市場の効率性を高めています。国内消費と輸出の両方におけるチョコレート製品とカカオ由来製品の需要の高まりも、サウジアラビアのカカオ豆市場の着実な成長に寄与しています。

中東およびアフリカのカカオ豆市場シェア

カカオ豆業界は、主に次のような老舗企業によって牽引されています。

- オラム・インターナショナル・リミテッド(シンガポール)

- MABCO(スイス)

- メリディアン・カカオ社(ポートランド)

- コスタ・エスメラルダス・カカオ社(エクアドル)

- SUCDEN(フランス)

- ECOM Agroindustrial Corp. Limited(スイス)

- カカイトス(スペイン)

- ココア豆(インド)

- パパの遺産(インド)

- ツイントラックココアプロダクツインターナショナル(インド)

中東・アフリカのカカオ豆市場の最新動向

- ネスレは2025年8月、カカオの実の利用率を最大30%向上させる特許取得技術を導入しました。これは、カカオ農家の収穫量と価値の最大化を目指したものです。このイノベーションは、廃棄物を削減し、カカオ農業の経済的実現可能性を向上させることで、持続可能性の課題に取り組みます。抽出効率を高めることで、この技術はサプライチェーン全体を強化し、環境に配慮した生産慣行を支援し、倫理的に調達された高品質のカカオ製品に対する市場の需要の高まりに対応します。

- ネスレは2025年7月、ラジャスタン州ニムラナに新たなチョコレート製造工場を開設し、インドにおける生産拠点の大幅な拡大を図りました。この工場は、地域におけるチョコレート製品の消費拡大に対応し、サプライチェーンの効率性を高めることを目指しています。また、この工場は地元のカカオ調達イニシアチブとの緊密な連携を可能にし、原材料の安定供給、地元農家の支援、そして高品質で持続可能な方法で生産されたチョコレート製品に対する消費者の高まる需要への対応に貢献します。

- ネスレSAは2024年4月、カーギル社と提携し、カカオ生産地域に焦点を当てた革新的なアグロフォレストリー・スキームを通じて、2050年までにネットゼロエミッションを達成することを目指しています。この協働は、気候変動への対応とカカオ生産者の社会経済的状況の改善を図りながら、カカオサプライチェーン全体の持続可能性を高めることを目指しています。環境に配慮した農法を統合し、生産者の収入源を多様化することで、この取り組みはカカオ調達のレジリエンスを強化し、消費者とメーカーからの需要が高まっている責任ある生産を促進します。

- 2024年2月、ECOM Agroindustrial Corp. Limitedは、北米の持続可能性目標に沿い、2030年までにネットゼロエミッションを達成するという戦略的コミットメントを発表しました。この取り組みは、持続可能な慣行と革新的なソリューションに重点を置き、サプライチェーン全体で二酸化炭素排出量を削減するというEcomのコミットメントを強調するものです。同社は、環境への影響を最小限に抑えながら、業務効率を向上させるための高度な技術とプロセスを導入する予定です。持続可能性を優先することで、Ecomは環境に積極的に貢献し、農産物市場における責任ある調達を促進することを目指しています。この動きは、気候変動への取り組みにおける企業責任の重要性を強調し、Ecomを業界のリーダーとして位置づけるものです。

- バリーカレボーは2022年11月、インドのラジャスタン州に新しいチョコレート工場を開設し、事業を拡大すると発表しました。これは、生産能力を増強し、同地域におけるチョコレート製品の需要増加に対応するという同社の戦略の一環です。カカオ豆が主原料であるため、工場の拡張により、より信頼性が高く地域密着型のサプライチェーンが確保され、インド市場における高品質なカカオベース製品の迅速な配送、コスト削減、そして入手性の向上が実現します。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。