インドネシアの企業向け遠隔医療市場、コンポーネント別(ハードウェア、サービス、ソフトウェア)、配信モード別(クラウド、オンプレミス)、アプリケーション別(仮想プライマリケアおよび継続的ケア、遠隔放射線学、包括的行動健康/遠隔精神医学、皮膚科ケア、高度集中治療、小児企業向け遠隔医療、その他)、接続デバイス別(スマートフォン、ラップトップ、その他)、エンドユーザー別(医療提供者、患者、医療保険者) - 2029年までの業界動向と予測。

インドネシアの企業向け遠隔医療市場の分析と洞察

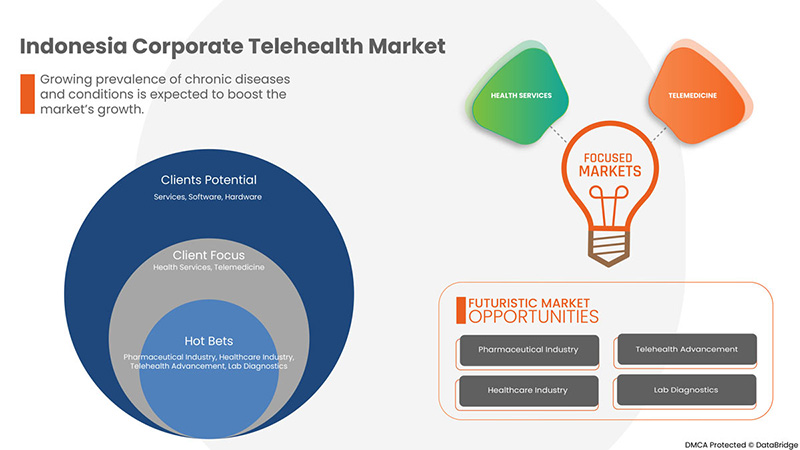

インドネシアの企業向け遠隔医療市場は、2022年から2029年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に3.3%のCAGRで成長し、2029年までに10,180.06千米ドルに達すると分析しています。企業向け遠隔医療市場の成長を牽引する主な要因は、より質の高い医療サービスの提供に向けた取り組みの増加、慢性疾患や症状の蔓延の増加、インドネシアの人口に対する医師や医療スタッフの不足です。

インドネシアは保健制度のさまざまな側面にいくつかの改革を導入しており、保健制度は政府と行政の多部門改革の影響も受けています。主要な多部門改革には、公衆衛生サービスの管理と提供の責任を含む特定の政府機能の権限を中央政府から地方政府に委譲することや、病院を含む公共サービス組織の管理におけるより大きな自治権の段階的な導入が含まれます。

インドネシアの企業向けテレヘルス市場レポートでは、市場シェア、新展開、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、収益に影響を与えるソリューションを作成し、希望する目標を達成できるようお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019~2014 にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

コンポーネント別(ハードウェア、サービス、ソフトウェア)、配信モード別(クラウド、オンプレミス)、アプリケーション別(仮想プライマリケアおよび継続ケア、遠隔放射線学、包括的行動健康/遠隔精神医学、皮膚科ケア、高度集中ケア、小児企業遠隔医療、その他)、接続デバイス別(スマートフォン、ラップトップ、その他)、エンドユーザー別(医療提供者、患者、医療保険支払者) |

|

対象国 |

インドネシア |

|

対象となる市場プレーヤー |

HALODOC、Alodokter、ProSehat、Good Doctor、aido health、PT Medika Komunika Teknologi、Vascular India、Get Healthy India、Intel Corporation、Cisco Systems, Inc Healthy Link、および Trustmedis インドネシア |

市場の定義

遠隔医療により、介護者と看護師は一貫した接続を維持しながら、サプライヤーに患者の健康情報をリアルタイムで提供できます。遠隔医療施設は、テクノロジーを使用して遠隔医療教育を提供し、顧客の成果を向上させます。遠隔医療の需要が急増しているのは、インターネットとスマートフォンの使用が増え、消費者がより健康的なライフスタイルを好むようになったためです。遠隔医療サービスは、電話/ビデオ相談を通じてヘルスケア サービスへのアクセスを提供し、患者の時間を節約し、不要な移動コストを削減するのに役立ちます。

インドネシアの企業向け遠隔医療市場の動向

ドライバー

- より良い医療サービスの質を実現するための取り組みの強化

インドネシア政府は、ユニバーサル ヘルス カバレッジの実現に向けて医療関連の制度を拡大するとともに、サービスの質とアクセス性における地域格差の解消、リソースの効果的な管理、コストの削減、詐欺の最小化にも取り組んでいます。さらに、政府は民間部門を巻き込み、健康促進および予防プログラムへの投資を維持しています。インドネシア政府 (GoI) は最近この方向に動いています。政府は、2014 年に国家社会保障制度に関する法律第 40/2004 号を制定し、国民健康保険制度 (JKN) を申請しました。

- 慢性疾患や症状の増加

慢性疾患の蔓延により、遠隔地および都市部での診察が着実に増加しており、これがインドネシアの企業向け遠隔医療市場の着実な成長に寄与すると期待されています。医療費の増加、医療分野における技術革新の促進、遠隔地での医療分野のアクセス性の問題に対処するための解決策を見つける取り組みは、インドネシアを含む世界中の発展途上国における長年の問題です。同時に、高血圧、高コレステロール、肥満、喫煙などの非感染性疾患(NCD)のリスク要因が増加しています。複数のマクロトランジションの中でこのますます複雑化する疫学的パターンに対応することは、国の医療システムにとって大きな課題の1つであり、企業の遠隔医療サービスを使用することで効果的に対応されています。

- インドネシアの人口に対する医師と医療スタッフの不足

テレヘルスは、パンデミック中のインドネシアの人口動態に非常に適していることが証明された代替製品です。パンデミック後、医療施設や社会経済センターへのアクセスが制限されたため、健康、相談、治療について定期的に情報を必要とする患者が妨げられ、医療の情報技術が必要になりました。テレヘルスを備えたヘルスケアシステムは、このパンデミックの間、コミュニティと院内感染の拡大を減らしながら、「自宅待機」命令と物理的距離の確保措置の中で、外来患者のケアの継続性を維持します。

機会

- 主要な遠隔医療プラットフォームを活用したプログラムを展開する政府の対策が強化される

インドネシア政府は、国民全員が費用の制約なしに包括的で質の高い医療サービスを受けられるように、ユニバーサル・ヘルス・カバレッジ(UHC)の達成に向けて懸命に取り組んでいます。さらに、国民健康保険/ヘルシー・インドネシア・カード(JKN/KIS)プログラムは、2014年1月1日から存在しています。保健社会保障局(BPJS)は、2004年の国家社会保障制度(SJSN)に関する法律第40号に基づいてこのプログラムを担当しています。このプログラムは、国民に医療サービスへのアクセスを提供し、経済的保護を提供することを目的としています。2020年の参加者のほとんどは、PBI(APBN)セグメントからのもので、49.10%でした。ただし、参加者の前年比で最も大幅な増加は、非PBIで発生しました。2020年末までに、JKN / KISの総カバー率は2億2,240万人に達しました。

- 消費者の嗜好が遠隔医療サービスに移行

The recent episodes of the COVID-19 pandemic have altered lives in many sectors and forced people to apply social distancing in daily life. Various directions from the Centers for Disease Control and Prevention (CDC) to people and healthcare providers in areas of the coronavirus (COVID-19) pandemic have been placed. These directions implement social distancing practices and specifically recommend that healthcare facilities and providers should use virtualized on-clinical services. Patients who receive palliative care through telehealth are typically very satisfied because they save more time and money. Telehealth refers to telecommunications and information technology (IT) to access health assessment, diagnosis, intervention, consultation, surveillance, and information across distances.

Restraints/Challenges

- Risks associated with cyber-security threats and securing data protections

Telehealth relies on meeting and sending information electronically using computer networks and the public internet. Information exchanged during these sessions (as well as the connected networks themselves) are more exposed to cyber threats. In today's climate of strictly regulated protection, leaks can cause serious problems for medical institutions in terms of both reputational damage and fines from regulators. Therefore, this rapid expansion of corporate telehealth services by a growing number of private and public providers comes during a time of the enhanced cyber assault on the healthcare sector. These forces create the imperative to address the unique cyber security issues faced by clinicians, patients, and the systems in which they work. Healthcare organizations need to partner with telemedicine and cybersecurity vendors to leverage these technologies to understand how to best implement and use their infrastructure and products.

- Increasing instances of healthcare fraud

As the number of medical patients seeking telehealth visits bloomed, so did the potential for fraud and abuse. In the era of corporate telehealth services, clinicians must ensure their malpractice or liability insurance covers telemedicine and, if needed, that it covers services provided across state lines. During the COVID-19 outbreak, many clinicians were first-time users of telehealth services who must ensure they were protected before providing services. There has been rising telemedicine fraud by companies that often pay kickbacks to doctors, labs, and others to generate orders paid by Medicare and another federal health program, some of which are a part of a telemarketing network that lure thousands of elderly or disabled patients to get unnecessary genetic testing or orders for medical equipment. Apart from this, there have been various frauds regarding billing and payments during the telehealth sessions, and the money has not been credited to the hospital or corporate telehealth service provider.

- Technical problems related to medical procedures

One of the biggest challenges related to telehealth use is the inability to conduct direct physical examinations, issues regarding the compatibility of certain professional activities with telehealth, and issues around inter professional collaboration. The most significant limitation of telehealth is that some hospitals and large physician practices are equipped to deliver care in this way. Still, most hospitals and private practices are not such as some hospitals may not have dedicated technology for programs such as stroke care or emergency first aid on telehealth services. Gaps in technology access and use among some groups of patients are a serious concern.

Recent Development

- In April 2021, HALODOC raised a funding of USD 80 million in funding led by a new investor, PT Astra Digital Internasional, a subsidiary of PT Astra International Tbk (Astra). Some other investors Temasek, Telkomsel’s TMI, Acrew Diversify Capital Fund, Novo Holdings, and Bangkok Bank. UOB Venture Management, Singtel Innov8, Blibli Group, Allianz X, Openspace Ventures, and other existing investors also participated

Impact of COVID-19 on Indonesia Corporate Telehealth Market

The recent episodes of the COVID-19 pandemic have altered lives in many sectors and forced everyone to apply social distancing in daily life. Various directions from the Centers for Disease Control and Prevention (CDC) to people and healthcare providers in areas of the Coronavirus (COVID-19) pandemic have been placed. The implementation of telehealth by integrating it within the national health system was urgently done to fight the COVID-19 pandemic and other health-related complications. The government of Indonesia announced that patients with mild symptoms of COVID-19 should be treated via telehealth. The implementation of telehealth by integrating it within the national health system is urgently done to fight the COVID-19 pandemic and other health-related complications. Thus, COVID-19 has positively affected the Indonesia corporate telehealth market and boosted its growth.

Indonesia Corporate Telehealth Market Scope

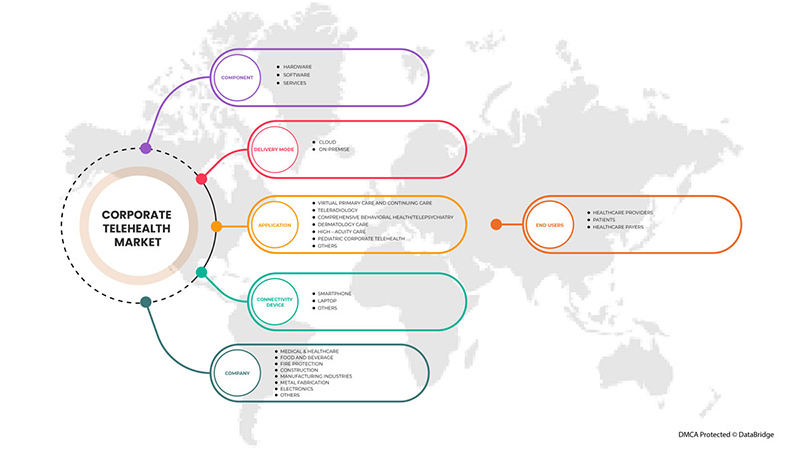

Indonesia corporate telehealth market is categorized based on component, delivery mode, application, connectivity device, and end-user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Component

- Services

- Software

- Hardware

Based on components, the Indonesia corporate telehealth market is classified into hardware, software, and services.

Delivery Mode

- Cloud

- On-premise

Based on a delivery mode, the Indonesia corporate telehealth market is classified into cloud and on-premise.

Application

- Virtual primary care and continuing care

- Teleradiology

- Comprehensive behavioral health/telepsychiatry

- Dermatology care

- High-acuity care

- Pediatric corporate telehealth

- Others

アプリケーションに基づいて、インドネシアの企業向け遠隔医療市場は、仮想プライマリケアと継続ケア、遠隔放射線学、包括的行動健康/遠隔精神医学、皮膚科ケア、高度集中治療、小児遠隔医療などに分類されます。

接続デバイス

- スマートフォン

- ラップトップ

- その他

接続デバイスに基づいて、インドネシアの企業向け遠隔医療市場は、スマートフォン、ラップトップ、その他に分類されます。

エンドユーザー

- 医療提供者

- 患者

- 医療保険支払者

エンドユーザーに基づいて、インドネシアの企業遠隔医療市場は、医療提供者、患者、医療支払者に分類されます。

競争環境とインドネシアの企業向け遠隔医療市場シェア分析

インドネシアの企業向け遠隔医療市場の競争状況は、競合他社の詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線などがあります。提供された上記のデータポイントは、インドネシアの企業向け遠隔医療市場に関連する企業の焦点にのみ関連しています。

インドネシアの企業向け遠隔医療市場で活動している著名な企業としては、HALODOC、Alodokter、ProSehat、Good Doctor、aido health、PT Medika Komunika Teknologi、Vascular Indonesia、Get Healthy Indonesia、Intel Corporation、Cisco Systems, Inc Healthy Link、Trustmedis Indonesiaなどが挙げられます。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、インドネシア対地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDONESIA CORPORATE TELEHEALTH MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 COMPONENT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MARKET STRATEGIC INITIATIVES

4.2 PESTLE ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 LEGAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 TECHNOLOGICAL ANALYSIS

4.5 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY

5.1.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.1.3 SHORTAGE OF PHYSICIANS AND MEDICAL STAFF AS PER THE INDONESIAN POPULATION

5.2 RESTRAINTS

5.2.1 RISKS ASSOCIATED WITH CYBER-SECURITY THREATS AND SECURING DATA PROTECTIONS

5.2.2 INCREASING INSTANCES OF HEALTHCARE FRAUDS

5.3 OPPORTUNITIES

5.3.1 RISING ' 'GOVERNMENT'S MEASURES TO DEPLOY PROGRAMS WITH LEADING TELEHEALTH PLATFORMS

5.3.2 SHIFTING CONSUMER PREFERENCE TOWARD TELEHEALTH SERVICES

5.4 CHALLENGE

5.4.1 TECHNICAL PROBLEMS RELATED TO MEDICAL PROCEDURES

6 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT

6.1 OVERVIEW

6.1.1 SERVICES

6.1.1.1 MANAGED SERVICES

6.1.1.2 PROFESSIONAL SERVICES

6.1.1.3 TRAINING AND CONSULTING

6.1.1.4 IMPLEMENTATION AND INTEGRATION

6.1.1.5 SUPPORT AND MAINTENANCE

6.1.2 SOFTWARE

6.1.2.1 REAL-TIME INTERACTIONS

6.1.2.2 REMOTE PATIENT MONITORING

6.1.2.3 STORE-AND-FORWARD CONSULTATIONS

6.1.2.4 OTHERS

6.1.3 HARDWARE

6.1.3.1 MONITORS

6.1.3.2 MEDICAL PERIPHERAL DEVICES

6.1.3.3 BLOOD PRESSURE MONITORS

6.1.3.4 BLOOD GLUCOSE METERS

6.1.3.5 PULSE OXIMETERS

6.1.3.6 WEIGHT SCALES

6.1.3.7 PEAK FLOW METERS

6.1.3.8 ECG MONITORS

6.1.3.9 ACCESSORIES

6.1.3.10 OTHERS

7 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL

7.1 OVERVIEW

7.1.1 CLOUD

7.1.2 ON-PREMISE

8 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION

8.1 OVERVIEW

8.1.1 VIRTUAL PRIMARY CARE AND CONTINUING CARE

8.1.1.1 DIABETIC SOLUTIONS

8.1.1.1.1 DIABETIC

8.1.1.1.2 PRE-DIABETIC

8.1.1.2 WEIGHT MANAGEMENT

8.1.1.3 OUTPATIENT CARE SOLUTIONS

8.1.1.4 HEART DISEASE

8.1.1.5 ASTHMA

8.1.2 TELERADIOLOGY

8.1.3 COMPREHENSIVE BEHAVIORAL HEALTH/TELEPSYCHIATRY

8.1.4 DERMATOLOGY CARE

8.1.4.1 HIGH-ACUITY CARE

8.1.4.1.1 STROKE SOLUTIONS

8.1.4.1.2 ICU

8.1.5 PEDIATRIC CORPORATE TELEHEALTH

8.1.6 OTHERS

9 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE

9.1 OVERVIEW

9.1.1 SMART PHONE

9.1.2 LAPTOP

9.1.3 OTHERS

10 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER

10.1 OVERVIEW

10.2 HEALTHCARE PROVIDERS

10.3 HOSPITALS

10.4 CLINICS

10.5 DIAGNOSTIC CENTERS

10.6 PHARMACIES

10.7 AMBULATORY SURGERY CENTERS (ASCS)

10.8 OTHERS

10.9 PATIENTS

10.1 HEALTHCARE PAYERS

10.11 PRIVATE

10.12 ICU

11 INDONESIA CORPORATE TELEHEALTH MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: INDONESIA

11.1.1 CERTIFICATIONS

11.1.2 FUNDING

11.1.3 ACHIEVEMENT

11.1.4 COLLOBORATION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 HALODOC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 ALODOKTER

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT UPDATES

13.3 PROSEHAT

13.3.1 COMPANY SNAPSHOT

13.3.2 PRODUCT PORTFOLIO

13.3.3 RECENT UPDATES

13.4 GOOD DOCTOR

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT UPDATE

13.5 AIDO HEALTH

13.5.1 COMPANY SNAPSHOT

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT UPDATE

13.6 PT MEDIKA KOMUNIKA TEKNOLOGI

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT UPDATES

13.7 VASCULAR INDONESIA

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT UPDATES

13.8 CISCO SYSTEMS, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATE

13.9 GET HEALTHY INDONESIA

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATES

13.1 HEALTHY LINK

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT UPDATES

13.11 INTEL CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 TRUSTMEDIS INDONESIA

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATES

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 2 INDONESIA SERVICES IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 3 INDONESIA SOFTWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 4 INDONESIA HARDWARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 5 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2020-2029 (USD THOUSAND)

TABLE 6 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 7 INDONESIA VIRTUAL PRIMARY CARE AND CONTINUING CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 INDONESIA DIABETIC SOLUTIONS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 INDONESIA HIGH-ACUITY CARE IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2020-2029 (USD THOUSAND)

TABLE 11 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2020-2029 (USD THOUSAND)

TABLE 12 INDONESIA HEALTHCARE PROVIDERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 13 INDONESIA HEALTHCARE PAYERS IN CORPORATE TELEHEALTH MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

図表一覧

FIGURE 1 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 2 INDONESIA CORPORATE TELEHEALTH MARKET: DATA TRIANGULATION

FIGURE 3 INDONESIA CORPORATE TELEHEALTH MARKET: DROC ANALYSIS

FIGURE 4 INDONESIA CORPORATE TELEHEALTH MARKET: INDONESIA MARKET ANALYSIS

FIGURE 5 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDONESIA CORPORATE TELEHEALTH MARKET: THE COMPONENT LIFE LINE CURVE

FIGURE 7 INDONESIA CORPORATE TELEHEALTH MARKET: MULTIVARIATE MODELLING

FIGURE 8 INDONESIA CORPORATE TELEHEALTH MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 INDONESIA CORPORATE TELEHEALTH MARKET: DBMR MARKET POSITION GRID

FIGURE 10 INDONESIA CORPORATE TELEHEALTH MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 INDONESIA CORPORATE TELEHEALTH MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 INDONESIA CORPORATE TELEHEALTH MARKET: SEGMENTATION

FIGURE 13 INCREASE IN EFFORTS TO EMPLOY BETTER HEALTHCARE SERVICES QUALITY IS EXPECTED TO DRIVE INDONESIA CORPORATE TELEHEALTH MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 14 SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDONESIA CORPORATE TELEHEALTH MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF INDONESIA CORPORATE TELEHEALTH MARKET

FIGURE 16 INDONESIA CORPORATE TELEHEALTH MARKET, BY COMPONENT, 2021

FIGURE 17 INDONESIA CORPORATE TELEHEALTH MARKET, BY DELIVERY MODEL, 2021

FIGURE 18 INDONESIA CORPORATE TELEHEALTH MARKET, BY APPLICATION, 2021

FIGURE 19 INDONESIA CORPORATE TELEHEALTH MARKET, BY CONNECTIVITY DEVICE, 2021

FIGURE 20 INDONESIA CORPORATE TELEHEALTH MARKET, BY END-USER, 2021

FIGURE 21 INDONESIA CORPORATE TELEHEALTH MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。