インドの血液ガス分析装置市場

Market Size in USD Billion

CAGR :

%

USD

51.08 Million

USD

88.51 Million

2022

2030

USD

51.08 Million

USD

88.51 Million

2022

2030

| 2023 –2030 | |

| USD 51.08 Million | |

| USD 88.51 Million | |

|

|

|

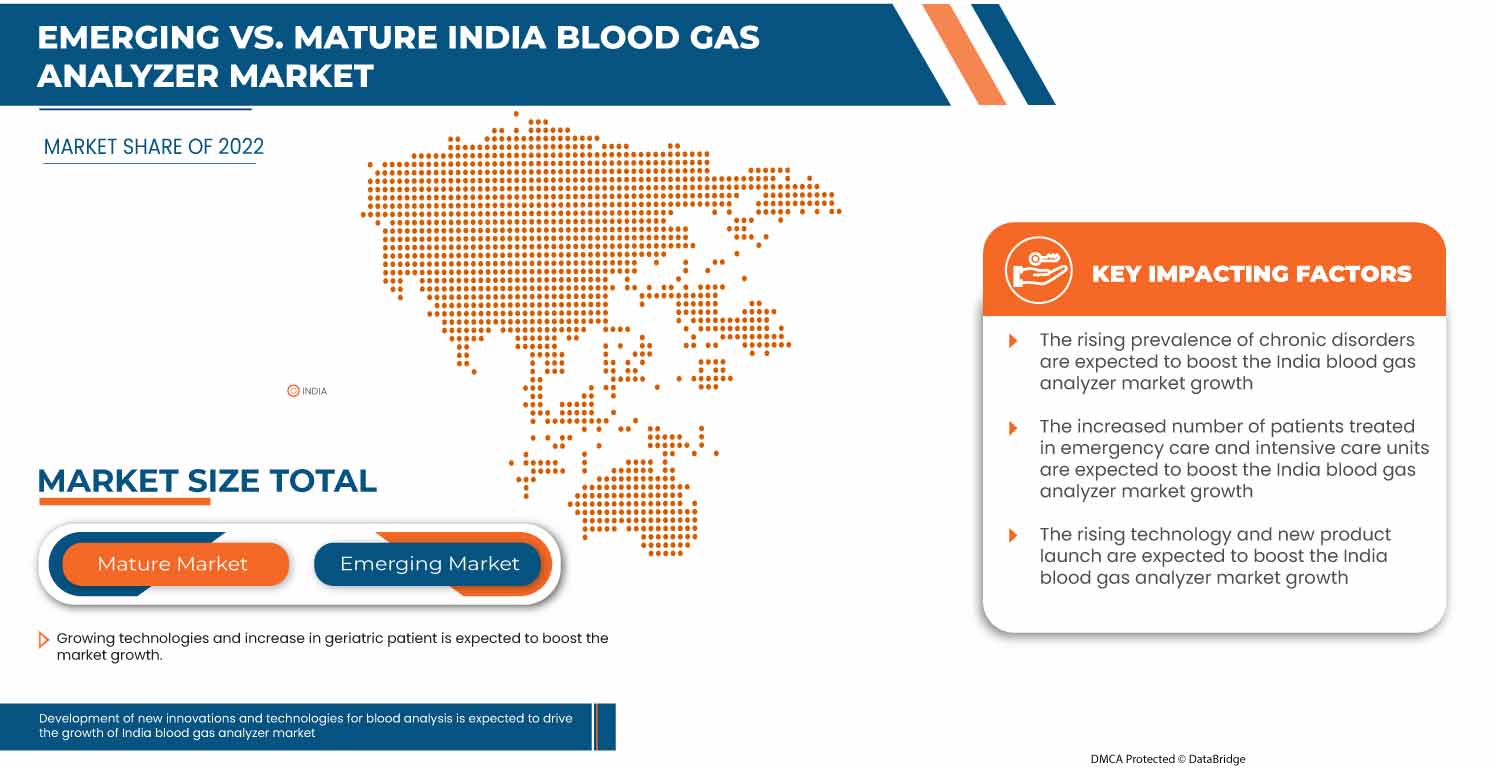

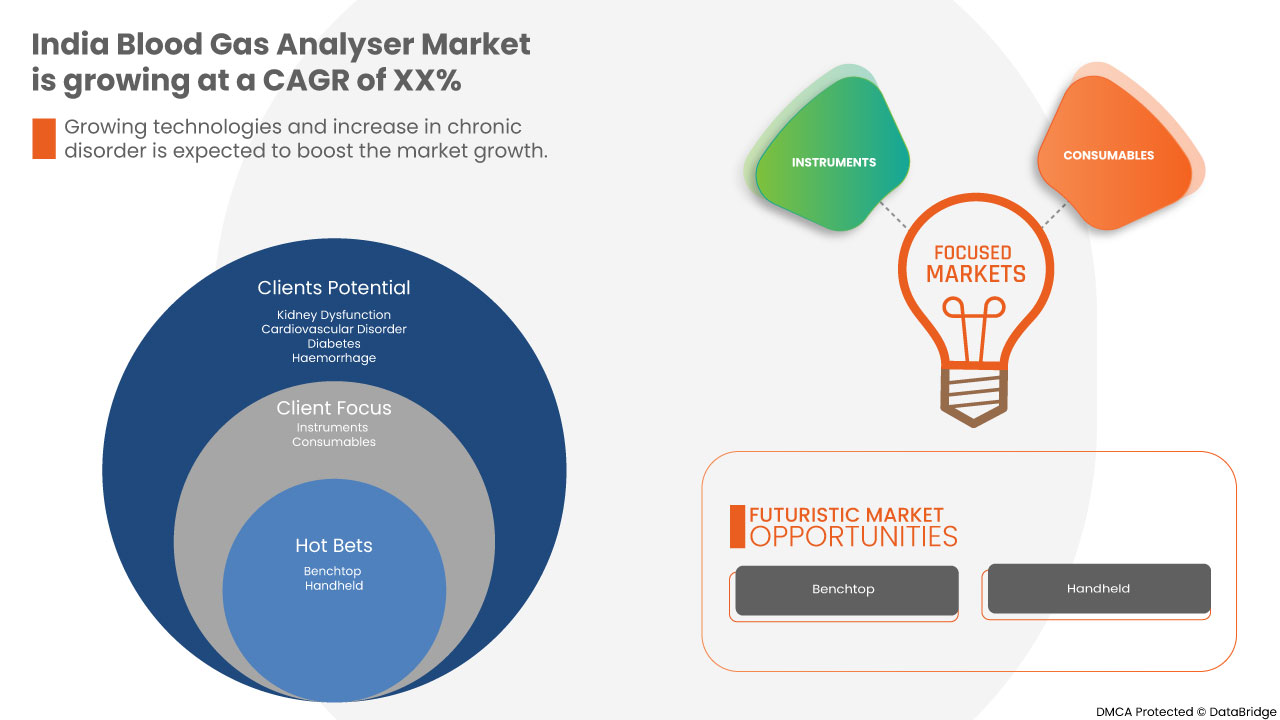

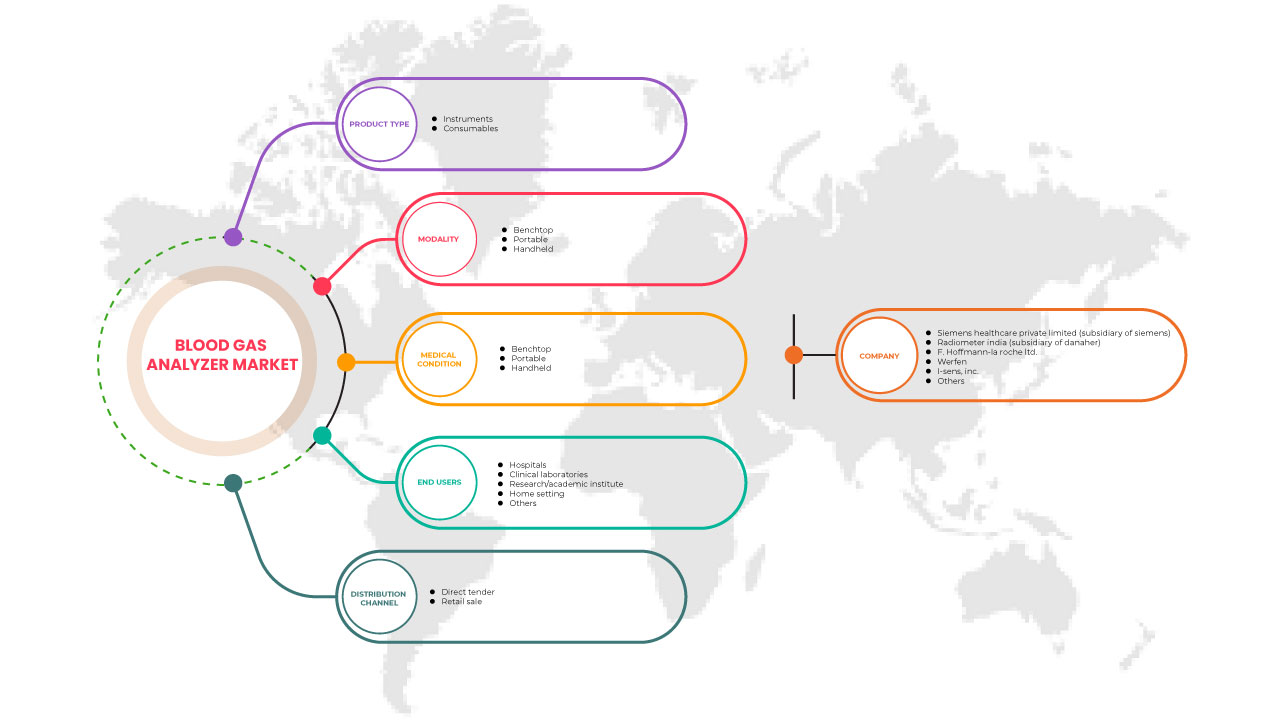

インドの血液ガス分析装置市場、製品タイプ別(機器および消耗品)、モダリティ別(ベンチトップ、ハンドヘルド、ポータブル)、病状別(腎機能障害、心血管障害、糖尿病、出血など)、エンドユーザー別(病院、臨床検査室、研究/学術機関、家庭環境など)、流通チャネル別(直接入札、小売販売) - 2030年までの業界動向と予測。

インドの血液ガス分析装置市場の分析と洞察

業界における血液分析への先進技術の導入は、製品品質の向上と製造コストの削減を同時に実現するという要求、つまり競争力を確保するという要求によって促進されてきました。その結果、医療における血液ガス分析装置の需要の高まりが、予測期間中の市場成長を牽引すると考えられます。

心臓血管や神経などの慢性疾患の発生率の上昇により、市場の成長が加速しています。

インドの血液ガス分析装置市場は、2023年から2030年の予測期間に7.1%のCAGRで成長し、2022年の5,108万米ドルから2030年には8,851万米ドルに達すると予想されています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

製品タイプ(機器および消耗品)、モダリティ(ベンチトップ、ハンドヘルド、ポータブル)、病状(腎機能障害、心血管疾患、糖尿病、出血など)、エンドユーザー(病院、臨床検査室、研究/学術機関、家庭環境など)、流通チャネル(直接入札、小売販売)別 |

|

対象国 |

インド |

|

対象となる市場プレーヤー |

Abbott、Techno MedicaCo., Ltd.、Nova Biomedical、WERFEN、Sensacore、OPTI Medical Systems、HDC India、AFFORD MEDICAL TECHNOLOGIES PVT. LTD.、Radiometer India(Danaherの子会社)、Siemens Healthcare Private Limited(Siemensの子会社)、F. Hoffmann-La Roche Ltd.、i-SENS、Inc.、EDAN Instruments、Inc.、ESCHWEILER GmbH & CO.KG、essential medical、Medica Corporation、Wondfoなど |

市場の定義

「血液ガス分析」(BGA)という用語は、患者の酸素バランスと酸素状態に関連する臨床検査に使用されます。酸素状態は、O2 の分圧(pO2)とヘモグロビン酸素飽和度(sO2)を使用して測定されます。

O2 の分圧 (pO2) はアンペロメトリーで測定され、SO2 の分圧は共酸素測定法で測定されます。共酸素濃度計が組み込まれていない血液ガス分析装置は、PO とさまざまな境界から評価された SO2 を報告します。

現在の分析装置は、血液ガスパラメータだけでなく、電解質(PH、ナトリウム、カリウム、塩素、イオン化カルシウム、イオン化マグネシウム)と代謝物(グルコース、乳酸、ビリルビン、クレアチニン)も測定します。救急科および集中治療科では、患者の臨床状態を評価するための重要な手段として BGA を使用しています。

インドの血液ガス分析装置市場の動向

ドライバー

-

慢性疾患の有病率の上昇

喫煙、飲酒、固定された生活習慣など、生活習慣の変化により、慢性的な病気に悩まされる患者が増えています。慢性疾患の罹患率の上昇により、市場の成長が促進され、血液ガス分析装置市場にプラスの影響を与えることが期待されています。

-

救急治療室および集中治療室で治療を受ける患者数の増加

慢性疾患の増加に伴い、NICU、救急科、ICUで治療を受ける患者数も増加しており、より多くの患者がNICU、救急科、ICUに搬送されています。救急治療室と集中治療室で治療を受ける患者数の増加は、インドの血液ガス分析装置市場の成長における主要な原動力の1つとなるでしょう。

-

製品発売数の増加

血液ガス分析装置の小型化に向けた研究活動の拡大は、大きなチャンスと、市場の主要企業による多数の製品承認をもたらします。製品は複数のテストを実行し、幅広い結果をカバーしているため、血液分析装置市場の台頭に役立ちます。この市場で活動している企業の製品ポートフォリオは広範であり、このため、企業の収益は過去数年間にわたって継続的に増加しています。製品承認数の増加は、予測期間中のインドの血液ガス分析装置市場の成長を促進する原動力として機能します。

機会

-

血液ガス分析装置の技術進歩の高まり

技術の進歩は、疾病負担の増加により生じる投薬ミスの可能性、データ管理のための患者登録、セルフケア機器の臨床検査など、ヘルスケア業界のほぼすべてのプロセスで重要な役割を果たしています。これらの技術革新の範囲は、技術の発展とともにヘルスケアで見ることができます。先進技術ベースの血液ガス分析装置の商品化により、慢性疾患の蔓延により消費者の間で需要が高まり、インドの血液ガス分析装置市場のニーズが高まっています。

- 政府機関による診断ツールの取り組みの増加

Many governmental agencies and key market players in the blood gas analyzer market are involved in spreading the use and importance of devices among society and across the state. These initiatives by the market players and government are helping the users to reach out to take advantage of the policies made for low-income and developing states that make them aware of preventable diseases if diagnosed earlier. The growth of blood gas analyzer in hospitals and emergency rooms are strongly encouraged due to the increased prevalence of chronic diseases in the nation and rising initiatives by government bodies. Various government bodies are taking initiatives to extend healthcare facilities to remote regions, such as Ayushman Bharat Yojana and National Rural Health Mission among others. Increasing initiatives by the government bodies are acting as an opportunity for the growth of the India blood gas analyzer market.

Restraints/Challenges

- Lack of skilled professionals

The lack of capable laboratory professionals is not a new story in diagnosis and healthcare. As with the increase in the burden of chronic diseases, the increase in the aged population and the development of healthcare insurance have increased the demand for healthcare laboratory professionals. Another reason is the lack of training sessions for the professionals. Factors such as the retention rate and workload lack of certification are reasons for the lack of trained laboratory manpower, lack of education, and relevant degrees. These factors are hampering the growth of the India blood gas analyzer market.

- Lack of reimbursement policies for blood gas analyzer

Reimbursement for blood gas analyzer tests and services has been under downward pressure for several years. The blood gas analyzer also faces major roadblocks in its growth due to the lack of reimbursement for these services.

The reimbursement of a device can significantly affect the ability of a provider to access a particular technology, as well as the willingness of a manufacturer to deliver it. If coverage is uncertain, the manufacturer has difficulty predicting whether an investment in new technology will yield enough returns. This lack of predictability is an apparent barrier to obtaining funding for the company. It further compromises innovation and restricts patient access to advanced technology and solutions.

Thus, inadequate reimbursement coverage may act as a restraint to the growth of the market in the forecast period.

- High cost associated with parts of analyzers

The rise in the cost of the blood gas analyzers components is due to robust research and effectiveness. However, the price of the material used and the developments incurred in the therapeutics and services would increase the number of manufacturing units and more workforce and human resources required to diagnose and screen pathogen viability. The rise in the cost of blood gas analyzers is due to technological development and increased demand for non-invasive in hospitals, clinics, nursing facilities, and ambulatory surgical centers. Therefore, the present high cost is expected to show a descending trend in the future.

Post-COVID-19 Impact on India Blood Gas Analyzer Market

COVID-19 has positively affected the India blood gas analyzers market. Lockdowns and isolation during pandemics complicate disease management and medication adherence. The lack of access to healthcare facilities for routine treatment and medication administration will further affect the market.

Recent Development

- In September 2021, Sensacore announced the launch of ST-200 CC Blood Gas Analyzer-Ultra Smart is the highly advanced blood gas model of Sensacore. It is a completely automated, microprocessor-controlled electrolyte system that uses direct current measurement with ION selective electrode (ISE), Impedance (Hct), and Amperometry (pO2) technology to make arterial blood gas analysis and electrolyte measurements

- In September 2020, Agappe diagnostics Ltd. launched a new hematology analyzer- Mispa Count X. Mispa Count X with Smart Impedance Technology is an advanced 3-part differential cell counter which offers quality CBC testing to deliver safe patient care

The India Blood Gas Analyzer Market Scope

India blood gas analyzer market is categorized into five notable segments such as product type, modality, medical condition, end user, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY PRODUCT TYPE

- Instruments

- Consumables

On the basis of product type, the India blood gas analyzer market is segmented into instruments and consumables.

BY MODALITY

- Benchtop

- Portable

- Handheld

On the basis of modality, the India blood gas analyzers market is segmented into handheld, benchtop, and portable.

BY MEDICAL CONDITION

- Kidney dysfunction

- Cardiovascular disorder

- Diabetes

- Hemorrhage

- Others

On the basis of medical condition, the India blood gas analyzers market is segmented into kidney dysfunction, cardiovascular disorder, diabetes, hemorrhage, and others.

BY DISTRIBUTION CHANNEL

- Direct tender

- Retail sale

On the basis of distribution channel, the India blood gas analyzers market is segmented into direct tender and retail sale distributors.

BY END USERS

- Hospital

- Clinical laboratories

- Research/Academic institute

- Home setting

- Others

エンドユーザーに基づいて、インドの血液ガス分析装置市場は、病院、臨床検査室、研究/学術機関、家庭環境、その他に分類されます。

インドの血液ガス分析装置市場の地域分析/洞察

インドの血液ガス分析装置市場が分析され、製品タイプ、モダリティ、病状、エンドユーザー、流通チャネルから市場規模の洞察と傾向が提供されます。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個別の市場影響要因と市場規制の変更についても説明しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、アジア太平洋ブランドの存在と可用性、地元および国内ブランドとの激しい競争によって直面する課題、販売チャネルの影響を考慮しながら、国別データの予測分析を提供します。

競争環境と血液ガス分析装置の市場シェア分析

インドの血液ガス分析装置市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、インドでのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、インドの血液ガス分析装置市場への会社の焦点にのみ関連しています。

この市場で取引を行っている大手企業としては、Abbott、Techno MedicaCo., Ltd.、Nova Biomedical、WERFEN、Sensacore、OPTI Medical Systems、HDC India、AFFORD MEDICAL TECHNOLOGIES PVT. LTD.、Radiometer India(Danaher の子会社)、Siemens Healthcare Private Limited(Siemens の子会社)、F. Hoffmann-La Roche Ltd.、i-SENS、Inc.、EDAN Instruments、Inc.、ESCHWEILER GmbH & CO.KG、essential medical、Medica Corporation、Wondfo などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE INDIA BLOOD GAS ANALYZERS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 INDIA BLOOD GAS ANALYZER MARKET, INDUSTRY INSIGHT

4.4 PATENT ANALYSIS

4.5 PRICING ANALYSIS

4.6 KEY STRATEGIC INITIATIVES

4.7 DEMOGRAPHIC TRENDS: IMPACT OF ALL INCIDENCE RATE

5 REGULATIONS OF INDIA BLOOD GAS ANALYZERS MARKET

5.1 INDIA

6 COUNTRY WRITE-UP

6.1 OVERVIEW

7 INDIA BLOOD GAS ANALYZER MARKET, MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING PREVALENCE OF CHRONIC DISORDERS

7.1.2 INCREASED NUMBER OF PATIENTS TREATED IN EMERGENCY CARE, AND INTENSIVE CARE UNITS

7.1.3 INCREASE IN THE NUMBER OF PRODUCT LAUNCHES

7.1.4 RISING GERIATRIC POPULATION

7.2 RESTRAINTS

7.2.1 LACK OF REIMBURSEMENT POLICIES FOR BLOOD GAS ANALYSER

7.2.2 HIGH COST ASSOCIATED WITH PARTS OF ANALYZERS

7.2.3 COMPLEXITY ASSOCIATED WITH INTERPRETING THE DATA/RESULTS OF BLOOD GAS ANALYZER

7.3 OPPORTUNITIES

7.3.1 RISING TECHNOLOGICAL ADVANCEMENT IN BLOOD GAS ANALYZER

7.3.2 INCREASING INITIATIVES BY GOVERNMENTAL BODIES FOR DIAGNOSTIC TOOLS

7.3.3 RISING HEALTHCARE EXPENDITURE

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 STRINGENT REGULATION FOR PRODUCT APPROVAL

8 INDIA BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 INSTRUMENTS

8.2.1 BY ANALYZER TYPE

8.2.1.1 COMBINED ANALYZER

8.2.1.1.1 FULLY AUTOMATIC

8.2.1.1.2 SEMI-AUTOMATIC

8.2.1.2 ELECTROLYTE ANALYZER

8.2.1.2.1 FULLY AUTOMATIC

8.2.1.2.2 SEMI-AUTOMATIC

8.2.1.3 BLOOD GAS ANALYZER

8.2.1.3.1 FULLY AUTOMATIC

8.2.1.3.2 SEMI-AUTOMATIC

8.2.2 BY SAMPLE VOLUME

8.2.2.1 MORE THAN 100 TO200 µL

8.2.2.2 50 TO 100 µL

8.2.2.3 LESS THAN 50 µL

8.2.2.4 MORE THAN 200 µL

8.3 CONSUMABLES

8.3.1 CARTRIDGES

8.3.1.1 DISPOSABLE

8.3.1.2 NON- DISPOSABLE

8.3.2 REAGENT

8.3.3 TEST STRIPS

8.3.4 BATTERIES

8.3.4.1 RECHARGEABLE

8.3.4.2 DISPOSABLE

8.3.5 OTHERS

9 INDIA BLOOD GAS ANALYZER MARKET, BY MODALITY

9.1 OVERVIEW

9.2 BENCHTOP

9.2.1 15 KG

9.2.2 20 KG

9.2.3 25 KG

9.2.4 OTHERS

9.3 PORTABLE

9.4 HANDHELD

9.4.1 4 KG

9.4.2 5 KG

9.4.3 6 KG

9.4.4 OTHERS

10 INDIA BLOOD GAS ANALYZER MARKET, BY MEDICAL CONDITIONS

10.1 OVERVIEW

10.2 HEMORRHAGE

10.3 DIABETES

10.4 CARDIOVASCULAR

10.5 KIDNEY DYSFUNCTION

10.6 OTHERS

11 INDIA BLOOD GAS ANALYZER MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITAL

11.2.1 ICU

11.2.2 ER

11.2.3 NICU

11.2.4 OR

11.2.5 CENTRAL LAB

11.2.6 STAT LAB

11.2.7 OTHER DEPARTMENT WITHIN THE HOSPITALS

11.3 CLINICAL LABORATORIES

11.4 RESEARCH/ACADEMIC INSTITUTES

11.5 HOME SETTINGS

11.6 OTHERS

12 INDIA BLOOD GAS ANALYZER MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 RETAIL SALES

13 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: INDIA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SIEMENS HEALTHCARE PRIVATE LIMITED (SUBSIDIARY OF SIEMENS)

15.1.1 COMPANY SNAPSHOT

15.1.2 PRODUCT PORTFOLIO

15.1.1 RECENT DEVELOPMENT

15.2 RADIOMETER INDIA (SUBSIDIARY OF DANAHER)

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 F. HOFFMANN-LA ROCHE LTD

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WERFEN

15.4.1 COMPANY SNAPSHOT

15.4.2 PRODUCT PORTFOLIO

15.4.3 RECENT DEVELOPMENT

15.5 I-SENS, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUS ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 ABBOTT.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 AFFORD MEDICAL TECHNOLOGIES PVT. LTD.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 EDAN INSTRUMENTS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ESCHWEILER GMBH & CO.KG

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 ESSENTIAL MEDICAL

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 HDC INDIA

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 MEDICA CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 NOVA BIOMEDICAL

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 OPTI MEDICAL SYSTEMS

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SENSACORE

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 TECHNO MEDICACO., LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WONDFO

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 INDIA BLOOD GAS ANALYZER MARKET, PATENT ANALYSIS

TABLE 2 INDIA BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 3 INDIA INSTRUMENT IN BLOOD GAS ANALYZERS MARKET, BY ANALYZER TYPE, 2021-2030 (USD MILLION)

TABLE 4 INDIA COMBINED ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 INDIA ELECTROLYTE ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 6 INDIA BLOOD GAS ANALYZER IN BLOOD GAS ANALYZERS MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 INDIA INSTRUMENT IN BLOOD GAS ANALYZERS MARKET, BY SAMPLE VOLUME, 2021-2030 (USD MILLION)

TABLE 8 INDIA CONSUMABLES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 INDIA CARTRIDGES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 INDIA BATTERIES IN BLOOD GAS ANALYZERS MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 INDIA BLOOD GAS ANALYZER MARKET, BY MODALITY, 2021-2030 (USD MILLION)

TABLE 12 INDIA BENCHTOP IN BLOOD GAS ANALYZER MARKET, BY WEIGHT 2021-2030 (USD MILLION)

TABLE 13 INDIA HANDHELD IN BLOOD GAS ANALYZER MARKET, BY WEIGHT 2021-2030 (USD MILLION)

TABLE 14 INDIA BLOOD GAS ANALYZER MARKET, BY MEDICAL CONDITION, 2021-2030 (USD MILLION)

TABLE 15 INDIA BLOOD GAS ANALYZER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 16 INDIA HOSPITAL IN BLOOD GAS ANALYZER MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 17 INDIA BLOOD GAS ANALYZER MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 INDIA BLOOD GAS ANALYZERS MARKET: SEGMENTATION

FIGURE 2 INDIA BLOOD GAS ANALYZERS MARKET: DATA TRIANGULATION

FIGURE 3 INDIA BLOOD GAS ANALYZERS MARKET: DROC ANALYSIS

FIGURE 4 INDIA BLOOD GAS ANALYZERS MARKET: GLOBAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA BLOOD GAS ANALYZERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA BLOOD GAS ANALYZERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA BLOOD GAS ANALYZERS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 INDIA BLOOD GAS ANALYZERS MARKET: SEGMENTATION

FIGURE 10 THE INCREASE IN DEMAND FOR BLOOD ANALYSIS AND THE RISE IN CHRONIC DISORDERS ARE EXPECTED TO DRIVE THE INDIA BLOOD GAS ANALYZERS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 INSTRUMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA BLOOD GAS ANALYZERS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE INDIA BLOOD GAS ANALYZERS MARKET

FIGURE 13 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, 2022

FIGURE 14 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 15 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 16 INDIA BLOOD GAS ANALYZERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 17 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, 2022

FIGURE 18 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, 2023-2030 (USD MILLION)

FIGURE 19 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, CAGR (2023-2030)

FIGURE 20 INDIA BLOOD GAS ANALYZER MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 21 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, 2022

FIGURE 22 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, 2023-2030 (USD MILLION)

FIGURE 23 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, CAGR (2023-2030)

FIGURE 24 INDIA BLOOD GAS ANALYZER MARKET: BY MEDICAL CONDITIONS, LIFELINE CURVE

FIGURE 25 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, 2022

FIGURE 26 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 27 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, CAGR (2023-2030)

FIGURE 28 INDIA BLOOD GAS ANALYZER MARKET: BY END USER, LIFELINE CURVE

FIGURE 29 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 30 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 31 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 32 INDIA BLOOD GAS ANALYZER MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 33 INDIA BLOOD GAS ANALYZERS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。