チョコレートに含まれるマルチトールの世界市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

178.26 Billion

USD

288.44 Billion

2024

2032

USD

178.26 Billion

USD

288.44 Billion

2024

2032

| 2025 –2032 | |

| USD 178.26 Billion | |

| USD 288.44 Billion | |

|

|

|

|

チョコレートに含まれるマルチトールの世界市場:形態別(クリスタルパウダー、シロップ)、チョコレートの種類別(ホワイトチョコレート、ミルクチョコレート、ダークチョコレート)、用途別(ベーカリー、小売チョコレート、チョコレートインクルージョン) - 業界動向と2032年までの予測

チョコレート市場におけるマルチトールの規模

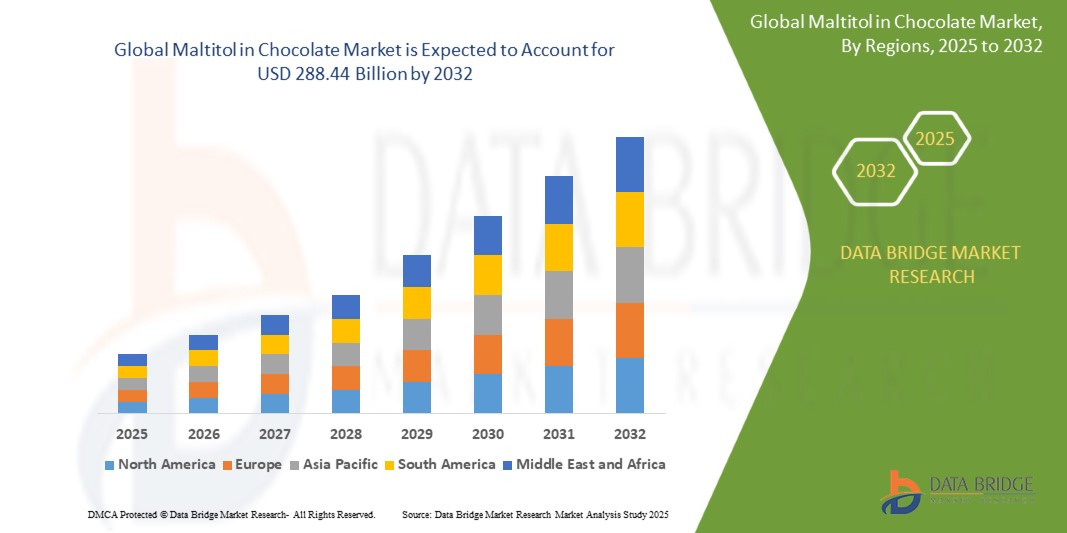

- 世界のチョコレート用マルチトール市場規模は2024年に1,782.6億米ドルと評価され、予測期間中に6.20%のCAGRで成長し、2032年までに2,884.4億米ドル に達すると予想されています。

- 市場の成長は、低カロリーや無糖の菓子製品の需要の高まり、消費者の健康意識の高まり、糖尿病や肥満などの生活習慣病の増加によって主に推進されています。

- さらに、チョコレートメーカーがカロリーを減らしながら甘さと食感を維持するためにマルチトールの使用を拡大していることも、市場の拡大を支えている。

チョコレート市場におけるマルチトール分析

- 消費者はより健康的な代替品へとますます移行しており、マルチトールは砂糖のような味でありながらカロリーが低いため、チョコレートの砂糖代替品として好まれています。

- 糖尿病患者の増加と低血糖甘味料の認知度の高まりにより、マルチトールベースのチョコレート配合の需要が高まっています。

- ヨーロッパは、無糖および低カロリーのチョコレート製品の需要増加と、地域全体での糖尿病人口の増加により、2024年にチョコレートのマルチトール市場で最大の収益シェア37.45%を獲得して優位に立った。

- アジア太平洋地域は、消費者基盤の拡大、健康に良い西洋菓子の嗜好の高まり、インド、中国、日本などの国での低血糖甘味料の採用増加により、世界のチョコレート用マルチトール市場において最も高い成長率を示すことが予想されています。

- クリスタルパウダーセグメントは、取り扱いやすさ、保存期間の長さ、そして従来のチョコレート製造工程との互換性が評価され、2024年には57.3%という最大の収益シェアで市場を席巻しました。クリスタルマルチトールは、固形チョコレートにおいて、望ましい口当たりを維持しながら、一貫した甘さと食感を実現します。ショ糖の特性を模倣しながらも低カロリーであることから、大規模な菓子メーカーの間で好まれています。

レポートの範囲とチョコレート市場のセグメンテーションにおけるマルチトール

|

属性 |

チョコレートのマルチトールに関する主要な市場洞察 |

|

対象セグメント |

|

|

対象国 |

北米

ヨーロッパ

アジア太平洋

中東およびアフリカ

南アメリカ

|

|

主要な市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、価格設定分析、ブランドシェア分析、消費者調査、人口統計分析、サプライチェーン分析、バリューチェーン分析、原材料/消耗品の概要、ベンダー選択基準、PESTLE分析、ポーター分析、規制の枠組みも含まれています。 |

チョコレート市場におけるマルチトールの動向

「クリーンラベルと天然甘味料への嗜好の高まり」

- 消費者は、人工甘味料よりも天然甘味料を優先し、透明な成分表示のあるチョコレート製品を選ぶ傾向が高まっている。

- マルチトールはデンプンから抽出され、味を損なうことなく無糖表示を可能にするクリーンラベルの代替品として人気が高まっている。

- ブランドは、現代の消費者の期待に合わせて、マルチトールベースのチョコレートをケトフレンドリー、糖尿病患者に安全、非遺伝子組み換えとして位置付けています。

- 高級チョコレート分野では、特に健康志向や専門ブランドにおいて、マルチトールの使用が顕著に増加している。

- 例えば、米国に拠点を置くブランドLily'sは、健康志向とクリーンラベルを求める消費者にアピールするために、マルチトールを使用した無糖チョコレートの品揃えを拡大しています。

チョコレート市場の動向におけるマルチトール

ドライバ

「健康意識の高まりと低GIチョコレート製品の需要」

- 糖尿病、肥満、生活習慣病の増加により、マルチトールなどの代替品を使用した低糖チョコレートの需要が高まっている。

- マルチトールは血糖値指数が低く、血糖値への影響が最小限であるため、糖尿病患者向けや体重管理製品に最適です。

- 消費者は、精製糖の悪影響なしに甘さを提供する贅沢なお菓子を求めており、マルチトールの採用が拡大している。

- メーカーはマルチトールを活用して、健康基準と味覚の期待を満たす、機能的で魅力的な配合を生み出しています。

- 例えば、日本では、菓子会社が血糖コントロールと心臓の健康を気にする高齢消費者をターゲットにしたマルチトールベースのチョコレートを発売している。

抑制/挑戦

「糖アルコールの過剰摂取に伴う消化不良」

- マルチトールの過剰摂取は、特に敏感な人の場合、膨満感や下剤効果など、胃腸の不快感を引き起こす可能性があります。

- これらの副作用に対する消費者の認識は、マルチトール含有量の多い製品の購入を控えさせる可能性がある。

- 消化器系の問題の可能性を強調する規制ラベルの要件は、製品の魅力と信頼に悪影響を及ぼす可能性がある。

- 味やコストを犠牲にすることなく、甘さと許容レベルのバランスをとることは、メーカーにとって依然として課題である。

- 例えば、欧州連合では、10%以上のマルチトールを含むチョコレート製品には、下剤効果の可能性に関する警告ラベルを付けることが義務付けられており、製品の利点にもかかわらず、健康志向の購入者を遠ざける可能性がある。

チョコレート市場におけるマルチトールの展望

市場は、形状、チョコレートのカテゴリー、用途に基づいて分類されています。

• フォーム別

チョコレート用マルチトール市場は、形状に基づいて、クリスタルパウダーとシロップに分類されます。クリスタルパウダーは、取り扱いやすさ、保存期間の長さ、そして従来のチョコレート製造工程との適合性の高さから、2024年には57.3%という最大の収益シェアを獲得し、市場を席巻しました。クリスタルマルチトールは、固形チョコレートにおいて、望ましい口当たりを維持しながら、一貫した甘さと食感を実現します。ショ糖の特性を模倣しながらも低カロリーであることから、大規模な菓子メーカーに好まれています。

シロップ分野は、ソフトチョコレート、フィリング、インクルージョンへの使用増加を背景に、2025年から2032年にかけて最も高い成長率を示すと予想されています。シロップベースのマルチトールは優れた溶解性と保湿性を備えており、層状やコーティングされたチョコレート製品の滑らかな食感を維持するのに役立ちます。機能性チョコレートやフィリング入りチョコレートの需要の高まりも、シロップの採用増加に貢献しています。

• チョコレートカテゴリー別

チョコレートのカテゴリーに基づいて、市場はホワイトチョコレート、ミルクチョコレート、ダークチョコレートに分類されます。ミルクチョコレートセグメントは、幅広い消費者の嗜好とバランスの取れた風味に支えられ、2024年には最大の市場収益シェアを獲得しました。マルチトールは、甘さとクリーミーさを保ちながら糖分を大幅に減らすために、ミルクチョコレートによく使用されています。その熱安定性と砂糖の物理的特性を再現する能力により、マスマーケット向けの用途に適しています。

ダークチョコレートセグメントは、高カカオ・低糖の選択肢への消費者の関心の高まりを背景に、2025年から2032年にかけて最も高い成長率を記録すると予想されています。ダークチョコレートはより健康的な嗜好品として位置付けられ続けるため、メーカーは風味の強さを損なうことなく、低血糖や糖尿病患者向けの代替品を求める需要に応えるため、マルチトールを配合した製品を改良しています。

•用途別

用途別に見ると、チョコレート用マルチトール市場は、ベーカリー向け、小売向け、チョコレートインクルージョンに分類されます。小売向けチョコレートセグメントは、無糖・低カロリーのチョコレートバーやスナック菓子の人気が高まっていることから、2024年には市場を席巻し、最大の収益シェアを占めました。消費者はより健康的な嗜好品を求めており、ブランドはマルチトールを使用することで、味と食感を維持しながら食事のニーズにも応えるチョコレートを開発しています。

チョコレートインクルージョンセグメントは、シリアルバー、乳製品、焼き菓子の需要増加に支えられ、2025年から2032年にかけて最も高い成長率を示すと予想されています。メーカーは、風味を高めながら糖質を抑えるため、マルチトールベースのチョコレートチップやチョコレートピースを様々な機能性食品に配合しています。この傾向は、フィットネス志向や糖尿病患者をターゲットとした、高タンパク質・低炭水化物の製品処方において特に顕著です。

チョコレート市場のマルチトールに関する地域分析

- ヨーロッパは、無糖および低カロリーのチョコレート製品の需要増加と、地域全体での糖尿病人口の増加により、2024年にチョコレートのマルチトール市場で最大の収益シェア37.45%を獲得して優位に立った。

- ヨーロッパの消費者はクリーンラベルの原材料に対する意識が高まっており、味を損なわないより健康的なチョコレートの代替品を積極的に求めている。

- この傾向は、砂糖含有量に関する厳格な規制基準、健康志向の消費者の増加、機能性菓子の強力なイノベーションによってさらに後押しされ、マルチトールベースのチョコレート製品は小売および専門店の分野で非常に好まれています。

ドイツのチョコレート市場におけるマルチトールの洞察

ドイツのチョコレート向けマルチトール市場は、健康志向の消費者の間で低糖菓子の人気が高まっていることに牽引され、2024年には欧州最大の売上高シェアとなる31%を獲得しました。大手チョコレートメーカーの存在と、ドイツにおける食品における低糖化の推進が、マルチトールの採用拡大を後押ししています。さらに、マルチトールを配合したビーガンチョコレートや糖尿病患者向けのチョコレート製品の増加も、主流市場とニッチ市場の両方でマルチトールの使用をさらに加速させています。

英国チョコレート市場におけるマルチトールの洞察

英国のチョコレート用マルチトール市場は、健康意識の高まりと低糖菓子の需要増加を背景に、2025年から2032年にかけて最も高い成長率を記録すると予想されています。英国の消費者は、低カロリー、糖尿病患者向け、そしてクリーンラベルといった嗜好に合ったチョコレートを積極的に求めています。砂糖消費量削減プログラムなど、政府による継続的な取り組みは、メーカーにマルチトールなどの代替原料を用いた製品の改良を促しています。機能性スナック菓子やプレミアムウェルネス志向のチョコレートブランドの人気が高まっていることも、小売店や専門店における市場の拡大を後押ししています。

北米チョコレートにおけるマルチトール市場の洞察

北米のチョコレート用マルチトール市場は、無糖およびケトジェニックダイエットに適したチョコレート製品への消費者嗜好の高まりに支えられ、2025年から2032年にかけて最も高い成長率を記録すると予想されています。米国とカナダのメーカーは、食生活の変化に対応するため、マルチトールなどの糖アルコールを使用した製品ラインの改良をますます進めています。小売チャネル全体で機能性スナックや健康に良いおやつへの需要が拡大していることから、この地域全体の市場見通しは引き続き堅調に推移しています。

米国チョコレート市場におけるマルチトールの洞察

米国のチョコレート向けマルチトール市場は、健康意識の高まり、糖尿病患者向け製品の増加、低炭水化物ダイエットやケトジェニックダイエットへの関心の高まりを背景に、2024年には北米で最大の収益シェアを占めると予測されています。食品・菓子ブランドは、カロリーを気にしながらも砂糖を一切使用しない贅沢を求める消費者をターゲットに、マルチトールを使用したチョコレート製品の導入を加速させています。さらに、大手クリーンラベルチョコレートメーカーの存在も、米国市場の成長を後押ししています。

アジア太平洋地域のチョコレートにおけるマルチトール市場の洞察

アジア太平洋地域のチョコレート用マルチトール市場は、都市化の進展、可処分所得の増加、そして中国、日本、インドなどの国々における低糖食品の需要増加に牽引され、2025年から2032年にかけて最も高い成長率を記録すると予想されています。糖尿病と肥満への意識が地域全体に広がるにつれ、消費者は低血糖製品や砂糖代替製品への強い関心を示しています。さらに、西洋食の影響の高まりと高級チョコレートセグメントの発展も、マルチトールベースの配合の採用増加に貢献しています。

チョコレート市場におけるマルチトールの日本市場分析

日本のチョコレート向けマルチトール市場は、健康志向のイノベーションへの注力、人口の高齢化、そして機能性食品への関心の高まりにより、2025年から2032年にかけて最も高い成長率を記録すると予想されています。マルチトールは、糖尿病患者向けのチョコレート製品、特に血糖値への影響を抑えた健康的な嗜好品を求める高齢者層をターゲットとした製品での使用が増えています。マルチトールが主流のチョコレート製品だけでなく、特別なチョコレート製品にも取り入れられていることは、日本が低糖質で健康志向のスナック菓子への幅広い取り組みを反映しています。

中国チョコレート市場におけるマルチトールの洞察

中国のチョコレート向けマルチトール市場は、2024年にアジア太平洋地域最大の収益シェアを占めると予測されています。これは、中流階級人口の増加、ウェルネス製品への関心の高まり、そして無糖菓子の需要に牽引されています。都市部における低糖チョコレート製品の販売促進を行う小売チェーンやeコマースプラットフォームの増加により、消費者のアクセスとリーチが向上しています。さらに、中国のチョコレートメーカーは、健康志向の若い世代や糖尿病患者をターゲットとした新製品開発において、マルチトールを主要原料として活用しています。

チョコレート市場におけるマルチトールのシェア

チョコレートのマルチトール業界は、主に、次のような定評のある企業によって牽引されています。

- 浙江華康製薬有限公司(中国)

- ロケット・フレール(フランス)

- イングレディオン(米国)

- 三菱商事ライフサイエンス株式会社(日本)

- ADM(米国)

- ブレンターク(ドイツ)

- メルクKGaA(ドイツ)

- 山東富味有限公司(中国)

- カーギル社(米国)

- Bフードサイエンス株式会社(中国)

- 杭州ベリーケム科学技術有限公司(中国)

- 海航産業(中国)

- ソサ(スペイン)

- フードケムインターナショナルコーポレーション(中国)

- PT.エコグリーンオレオケミカルズ(インドネシア)

- ミツシ・バイオファーマ(インド)

- MUBY CHEMICALS(インド)

- ハイレン株式会社(韓国)

- ニュートラフードイングリディエンツ(米国)

チョコレート用マルチトールの世界市場の最新動向

- 2023年7月、テイト・アンド・ライル社は、食品・飲料製品における消費者の溶解性に関する課題に対応するため、甘味料ポートフォリオの拡充を発表しました。この戦略的取り組みは、製品の機能性を高め、メーカーにとっての味と食感の向上を実現することを目的としています。テイト・アンド・ライル社は、革新的なソリューションの開発を通じて、変化する消費者の嗜好に対応し、競争の激しい市場環境において、より高い満足度と顧客ロイヤルティの創出を目指しています。

- イングレディオン社は2023年、ドイツにあるマルチトール生産施設の拡張に1億5,000万米ドルを投資する計画を発表しました。この大規模な投資は、人気の砂糖代替品であるマルチトールの需要増加に対応するための生産能力強化を目的としています。イングレディオン社は、製造拠点の強化を通じて、より健康的で低カロリーの食品・飲料への世界的なトレンドの高まりに対応し、市場リーダーとしての地位を確立することを目指しています。

- 2023年1月、カーギルは食品・飲料原料の需要の高まりに支えられ、前年比8%増の堅調な売上高成長を記録しました。この勢いを活かすため、同社はインドのイノベーションセンターに1億米ドルを投資する計画を発表しました。この投資は、現地市場に合わせたカスタマイズされたソリューションを開発し、競争力を強化し、地域の消費者ニーズに効果的に対応することを目指しています。

- 2023年2月、デュポンは食品・飲料部門の売上高が前年比5%増加しました。新興市場への戦略的進出により、2023年の月平均売上高は12億5,000万米ドルに達しました。この成長は、デュポンが新技術への投資と戦略的パートナーシップの構築に注力していることを反映しており、新たな機会を捉え、世界規模で変化する消費者ニーズに対応していくことを目指しています。

- 2022年8月、コロンビアの非上場チョコレートメーカーであるルーカー・チョコレートは、顧客の需要の高まりに応え、エリスリトールとステビアを使用したクーベルチュールの新品種を発売しました。この革新的な製品ラインには、マルチトールで甘味付けしたバージョンや、特定の市場向けにアルロースも含まれています。ルーカー・チョコレートは、製品の多様化により、健康志向で美味しい代替品を求める消費者のニーズに応え、競争の激しいチョコレート業界における存在感をさらに強固なものにすることを目指しています。

- 2022年、MCLS ASIA CO., LTD.は、天然の砂糖代替品として開発された結晶性マルチトール製品「Lesys」を発売しました。再生可能な資源である非遺伝子組み換えタピオカを原料とするLesysは、従来の砂糖に比べて低カロリーでありながら、多様な甘味料の風味を誇ります。この革新的な製品は、健康志向の消費者と、味に妥協しない代替品を求めるメーカーのニーズに応え、MCLS ASIAを天然甘味料市場における重要なプレーヤーへと位置付けています。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。