世界の低電力バスバー市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

7.71 Billion

USD

12.74 Billion

2024

2032

USD

7.71 Billion

USD

12.74 Billion

2024

2032

| 2025 –2032 | |

| USD 7.71 Billion | |

| USD 12.74 Billion | |

|

|

|

|

世界の低電力バスバー市場のセグメント化、導体(アルミニウムと銅)、重量(1kg未満と1kg超)、形状(面取りと長方形)、絶縁体(エポキシパワーコーティング、テオニックス、テドラー、マイラー、ノーメックス、カプトン、その他)、長さ(1m未満、1m~2m、2m~3m、3m超)、バスバータイプ(単導体バスバー、複数導体バスバー、フレキシブルバスバー、ラミネートバスバー)、エンドユーザー(産業用、住宅用、公共施設用、商業用) - 2032年までの業界動向と予測

低電力バスバー市場分析

低電力バスバー市場は、モジュラーバスバーシステムの導入とスマートエネルギー管理技術の統合によって、大きな進歩を遂げています。モジュラーシステムは設計、設置、拡張の柔軟性を提供し、コンパクトな配電アプリケーションに最適です。さらに、エポキシ樹脂コーティングなどの絶縁材料の革新により、耐久性、耐熱性、安全性が向上しています。

バスバーにIoT対応の監視システムを導入することで、リアルタイムのデータ収集が可能になり、エネルギー管理と予知保全の改善につながります。例えば、センサーを搭載したスマートバスバーは、過負荷や温度変動を検知し、ダウンタイムを最小限に抑え、産業施設や住宅環境における信頼性を向上させます。

この市場の成長は、再生可能エネルギーインフラへの投資増加に牽引されており、低電力バスバーは効率的な電力供給に不可欠です。さらに、データセンターや商業ビルにおけるエネルギー効率の高いソリューションの需要も、導入を促進しています。アジア太平洋地域およびアフリカの新興経済国は、急速な都市化と工業化により、市場の拡大に大きく貢献しています。

低電力バスバー市場規模

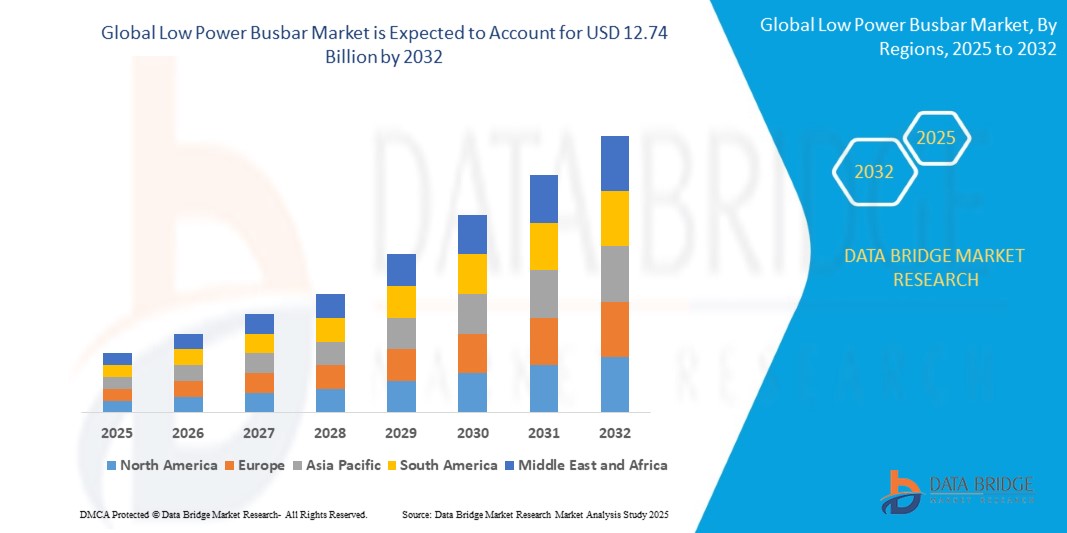

世界の低電力バスバー市場規模は、2024年に77億1,000万米ドルと評価され、2025年から2032年の予測期間中に6.51%のCAGRで成長し、2032年には127億4,000万米ドルに達すると予測されています。市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、データブリッジ市場調査がまとめた市場レポートには、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売代理店とパートナーのネットワークレイアウト、詳細で最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

低電力バスバー市場の動向

「スマートでグリーンな都市開発におけるバスバーの統合」

スマートシティやグリーンシティのプロジェクトにおけるバスバーの採用は、低電力バスバー市場の成長を牽引する重要なトレンドです。効率性と省スペース設計で知られるバスバーは、都市インフラにおいて従来の配線システムに取って代わるケースが増えています。この変化は、現代の都市環境における持続可能かつ効率的な配電ソリューションへのニーズによって推進されています。例えば、バルセロナのスマート街路照明システムでは、モジュラーバスバーの導入によりエネルギー消費量が削減され、都市環境におけるエネルギー効率向上におけるバスバーの有効性が浮き彫りになっています。

レポートの範囲と低電力バスバー市場のセグメンテーション

|

属性 |

低電力バスバーの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、ヨーロッパではその他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米 |

|

主要な市場プレーヤー |

ABB(スイス)、シーメンス(ドイツ)、シュナイダーエレクトリック(フランス)、イートン(アイルランド)、ゼネラル・エレクトリック(米国)、ルグラン(フランス)、メルセン・コーポレート・サービスSAS(フランス)、EMSインダストリアル&サービスカンパニー(米国)、オリエンタル・カッパー社(タイ)、リッタル社(ドイツ)、CHINTグループ(カンボジア)、プロメットAG(スイス)、メソッド・エレクトロニクス(米国)、サンキング・テクノロジー・グループ・リミテッド(中国)、ロジャース・コーポレーション(米国)、アンフェノール(米国)、ワッターエッジLLC(米国)、エマソン・エレクトリック社(米国)、バスバー・システムズ・ベルギー(ベルギー) |

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。 |

低電力バスバー市場の定義

低電力バスバーは、ネットワーク全体に電力を効率的に分配するために設計された電気導体システムです。通常、住宅、小規模オフィス、特定の産業用途など、低電圧・低電流容量が求められる環境で使用されます。これらのバスバーはコンパクトでコスト効率に優れ、エネルギー分配のための合理化されたソリューションを提供し、配線の複雑さと電力損失を軽減します。銅やアルミニウムなどの材料が使用されることが多く、安全のため絶縁材で覆われています。主な利点としては、設置の容易さ、拡張性、エネルギー効率の向上などが挙げられます。低電力バスバーは、省エネと効率的な負荷分散を重視する用途でますます人気が高まっています。

低電力バスバー市場の動向

ドライバー

- 効率的な電力送電における再生可能エネルギーの統合

太陽光や風力などの再生可能エネルギー源の導入拡大に伴い、効率的な送電ソリューションへの需要が高まり、低電力バスバー市場が拡大しています。バスバーは、クリーンエネルギーを電力網に統合し、エネルギー損失を最小限に抑えながら効率的な配電を確保する上で重要な役割を果たします。例えば、米国やインドなどの国の太陽光発電所では、太陽光パネルをインバータや電力網に接続するために低電力バスバーの導入が進み、エネルギー効率が向上しています。世界中の政府が持続可能性目標の達成に向けて再生可能エネルギープロジェクトに投資する中、バスバーの信頼性、拡張性、省エネ性は、現代の電力システムに不可欠な要素として位置づけられています。

- 都市化と電力配電インフラ整備

急速な都市化は、信頼性の高い配電システムへの需要を大幅に高め、低電力バスバー市場の成長を牽引しています。拡大する都市中心部では、住宅、商業、産業開発を支える効率的な電力インフラが求められています。コンパクトな設計と高い信頼性で知られるバスバーは、途切れることのないエネルギーフローを確保する上で重要な役割を果たします。例えば、インドの「100スマートシティ・ミッション」や中国の都市開発イニシアチブといったスマートシティプロジェクトでは、バスバーが不可欠な高度な配電システムが優先されています。さらに、近代的な高層ビルや工業団地の建設には、スペース効率が高く信頼性の高い電気ソリューションを提供するためにバスバーが組み込まれることが多く、拡大する都市の増大するエネルギー需要に対応しています。

機会

- 通信・データセンター部門の成長

通信・データセンター分野の急速な拡大は、低電力バスバー市場に大きなビジネスチャンスをもたらしています。これらの施設では、大量のデータ負荷に対応し、継続的な運用を確保するために、信頼性が高くエネルギー効率の高い配電システムが求められています。例えば、GoogleやMicrosoftといった巨大IT企業によるデータセンター投資の急増は、拡張性の高い電力インフラへのニーズの高まりを浮き彫りにしています。コンパクトな設計と低エネルギー損失で知られるバスバーは、こうした需要を満たす上で不可欠です。5GやIoTに対応するために通信ネットワークが拡大するにつれ、高度な配電ソリューションへの依存度が高まり、バスバーの採用がさらに増加し、この分野の市場成長を牽引しています。

- 効率的な電気システムのための工業化の促進

世界的な工業化の進展は、低電力バスバー市場に大きなビジネスチャンスを生み出しています。産業界は、事業運営に電力を供給するための効率的で信頼性の高い電気システムへの需要をますます高めており、バスバーは効率的な電力供給のための堅牢なソリューションを提供します。例えば、製造工場や加工施設では、バスバーは途切れることのない電力の流れを可能にし、ダウンタイムを削減し、生産性を向上させます。インドやベトナムなどの国々では、急速な産業成長が見られ、高度な電気インフラに対する需要が高まっています。さらに、産業設備における持続可能でエネルギー効率の高いソリューションへのトレンドは、低電力バスバーの採用をさらに後押しし、イノベーションと市場拡大を促進しています。

制約/課題

- スペースの制限と複雑な電力配分

スペースの制約は、設置と電力分配を複雑化し、低電力バスバー市場の成長を著しく阻害しています。物理的な設置面積が限られた環境では、従来のバスバーシステムを効果的に統合することが困難になります。この問題は、コンパクトな産業施設、高密度の都市インフラ、そしてスペースの最適化が不可欠なデータセンターにおいて特に深刻です。限られたスペースにバスバーをシームレスに設置・適応させることができないと、電力フローが遮断され、システム効率と信頼性が低下します。さらに、スペース要件の異なる多様な業界に対応する市場の能力も制限されます。これらの制約は、広範な導入を阻害するだけでなく、イノベーションを阻害し、市場の成長の可能性を阻害します。

- システム導入にかかる初期費用が高い

低電力バスバーシステムの導入に伴う初期コストの高さは、市場の成長にとって大きな課題となっています。特に中小企業や予算重視のプロジェクトでは、資材調達、カスタムシステムの設計、設置にかかる費用は法外な負担となる可能性があります。この経済的負担は、特にインフラ整備のための資金が限られている地域や業界において、バスバーシステムの導入を躊躇させる要因となることがよくあります。その結果、製造業、商業ビル、再生可能エネルギーなど、様々な分野への低電力バスバーの導入が遅れています。この経済的障壁は、低電力バスバー市場全体の拡大を阻害し、様々な業界でのより広範な導入と成長の可能性を制限しています。

この市場レポートは、最近の新たな動向、貿易規制、輸出入分析、生産分析、バリューチェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリー市場の成長、アプリケーションのニッチと優位性、製品承認、製品発売、地理的拡大、市場における技術革新など、詳細な情報を提供しています。市場に関する詳細情報については、Data Bridge Market Researchまでアナリストブリーフをご請求ください。当社のチームが、市場成長を実現するための情報に基づいた意思決定をお手伝いいたします。

低電力バスバー市場の展望

市場は、導体、重量、形状、絶縁体、長さ、バスバーの種類、そしてエンドユーザーに基づいてセグメント化されています。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

指揮者

- アルミニウム

- 銅

- 電解タフピッチ

- 無酸素

重量について

- 1kg未満

- 1kg以上

シェイプワイズ

- 面取り

- 矩形

絶縁

- エポキシパウダーコーティング

- テオニックス

- テドル

- マイラー

- ノーメックス

- キャプチャ

- その他

長さ

- 1m未満

- 1メートルから2メートル

- 2メートルから3メートル

- 300万以上

バスバータイプ

- 単導体バスバー

- 複数導体バスバー

- フレキシブルバスバー

- ラミネートバスバー

エンドユーザー

- 産業

- 化学および石油

- 食品と飲料

- 金属および鉱業

- 製造業

- 居住の

- ユーティリティ

- コマーシャル

- ホテル

- 病院

- 学術

低電力バスバー市場の地域分析

市場は分析され、導体、重量、形状、絶縁、長さ、バスバータイプ、および上記のエンドユーザー別に市場規模の洞察と傾向が提供されます。

市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、スウェーデン、ポーランド、デンマーク、イタリア、英国、フランス、スペイン、オランダ、ベルギー、スイス、トルコ、ロシア、ヨーロッパではその他のヨーロッパ、日本、中国、インド、韓国、ニュージーランド、ベトナム、オーストラリア、シンガポール、マレーシア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、ブラジル、アルゼンチン、南米の一部としてのその他の南米、UAE、サウジアラビア、オマーン、カタール、クウェート、南アフリカ、中東およびアフリカ (MEA) の一部としてのその他の中東およびアフリカ (MEA) です。

アジア太平洋地域は、新興国における業界への投資増加に牽引され、世界の低電力バスバー市場において最大の市場シェアを獲得し、市場を席巻すると予想されています。中国は同地域のバスバー市場を牽引しており、インドは投資拡大により最も高い成長率を達成し、ダイナミックな市場環境における地位を確固たるものにすると予想されています。

北米は、大手企業の存在に牽引され、世界の低電力バスバー市場において最も急速な成長を遂げる地域になると予想されています。北米では米国がリードしており、急速な成長が見込まれています。カナダも僅差で追随しており、この地域の市場拡大が有望な軌道にあることを示しています。

本レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個別の市場要因と市場規制の変更についても解説しています。下流および上流のバリューチェーン分析、技術トレンド、ポーターの5つの力の分析、ケーススタディといったデータポイントは、各国の市場シナリオを予測するための指標として活用されています。また、グローバルブランドの存在と入手可能性、そして現地および国内ブランドとの激しい競争または競争の少なさによって直面する課題、国内関税や貿易ルートの影響についても、国別データの予測分析において考慮されています。

低電力バスバーの市場シェア

市場競争環境は、競合他社ごとに詳細な情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、グローバルプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

低電力バスバー市場で活躍するマーケットリーダーは以下のとおりです。

- ABB(スイス)

- シーメンス(ドイツ)

- シュナイダーエレクトリック(フランス)

- イートン(アイルランド)

- ゼネラル・エレクトリック(米国)

- ルグラン(フランス)

- Mersen Corporate Services SAS (フランス)

- EMSインダストリアル&サービスカンパニー(米国)

- オリエンタルカッパー株式会社(タイ)

- Rittal GmbH & Co. KG (ドイツ)

- CHINTグループ(カンボジア)

- Promet AG(スイス)

- メソッド・エレクトロニクス(米国)

- サンキングテクノロジーグループリミテッド(中国)

- ロジャースコーポレーション(米国)

- アンフェノール(米国)、

- ウォーターエッジLLC(米国)

- エマーソン・エレクトリック社(米国)

- バスバーシステムベルギー(ベルギー)

低電力バスバー市場の最新動向

- 2024年4月、ロックウェル・オートメーション製品の正規代理店であるReferro Systemsは、南アフリカでCu-Flexフレキシブル銅バスバーを発売し、製品ラインナップを拡大しました。これらのバスバーは、電気システムに柔軟性、耐久性、信頼性を提供するように設計されており、効率的で適応性の高い配電ソリューションを必要とする産業用途に対応します。

- 2023年1月、米国政府は国内の農村電力インフラを強化するため、27億ドルの投資を決定しました。この戦略的投資は、送電網のセキュリティ強化、老朽化したインフラの近代化、そして農村電力システムの効率向上を目的としています。これらのアップグレードにより、全国の電力配電業界の大幅な成長が促進されると期待されています。

- 2021年9月、デジタルインフラソリューションのグローバルプロバイダーであるVertiv Holdings Companyは、E&I Engineering IrelandとそのUAE関連会社であるPowerbar Gulfを18億米ドルで買収しました。買収額には、2億米ドルのアーンアウト(追加)が含まれています。この買収により、Vertivのバスバーシステムのポートフォリオが拡充され、重要な電力システム市場における地位が強化されます。

- シーメンスは2021年2月、バスバートランキング技術を採用した先進的なバス車庫を建設し、電動バスの充電ステーションの最適化を実現しました。この導入により、シーメンスの事業ポートフォリオが拡大し、収益と利益が増加しました。効率的な配電ソリューションの導入は、持続可能な交通インフラの推進に対するシーメンスのコミットメントを改めて示すものです。

- 2020年11月、ゼネラル・エレクトリックは、バスバーなどの包括的なアクセサリを備えたElfaPlusミニチュア遮断器(MCB)を発売しました。この製品ポートフォリオへの追加により、GEの事業内容が拡大し、収益性の向上に貢献しました。バスバーを一体化したElfaPlus MCBは、電気部品市場におけるGEのイノベーションと多様化への取り組みを強化しました。

- 2020年10月、シュナイダーエレクトリックは、画期的なSM AirSetスイッチギアにより、クールアースフォーラム(ICEF)から世界トップ10イノベーションに選出されました。デジタル中電圧技術と統合バスバーを備えたこのイノベーションは、環境への配慮を示すだけでなく、シュナイダーエレクトリックの収益と業界における地位の向上にも貢献します。

- 2020年8月、シュナイダーエレクトリックはラーセン・アンド・トゥブロの電気・オートメーション事業の買収を成功裏に完了し、低電圧および産業オートメーション分野における地位を強化しました。この戦略的な動きにより、シュナイダーエレクトリックの事業ポートフォリオは拡大し、多様な製品・サービスの提供を通じて収益と収益性の向上に貢献しました。

- シュナイダーエレクトリックは、2020年7月、革新的なSM AirSeTスイッチギアで産業エネルギー効率賞を受賞しました。この環境に配慮したデジタル統合型中電圧技術は、収益を生み出すバスバーを備えており、収益増加に貢献しています。この賞は、シュナイダーエレクトリックのエネルギー分野における持続可能なソリューションと技術革新への取り組みを高く評価したものです。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。