世界のデータセンターストレージ市場規模、シェア、トレンド分析レポート

Market Size in USD Billion

CAGR :

%

USD

61.61 Billion

USD

147.79 Billion

2024

2032

USD

61.61 Billion

USD

147.79 Billion

2024

2032

| 2025 –2032 | |

| USD 61.61 Billion | |

| USD 147.79 Billion | |

|

|

|

|

世界のデータセンターストレージ市場のセグメンテーション、導入別(ストレージエリアネットワーク(SAN)システム、ネットワーク接続ストレージ(NAS)システム、直接接続ストレージ(DAS)システム)、アプリケーション別(ITおよび通信、BFSI、政府、医療、その他)、ストレージタイプ別(従来型ストレージ、オールフラッシュストレージ、ハイブリッドストレージ) - 2032年までの業界動向と予測

データセンターストレージ市場規模

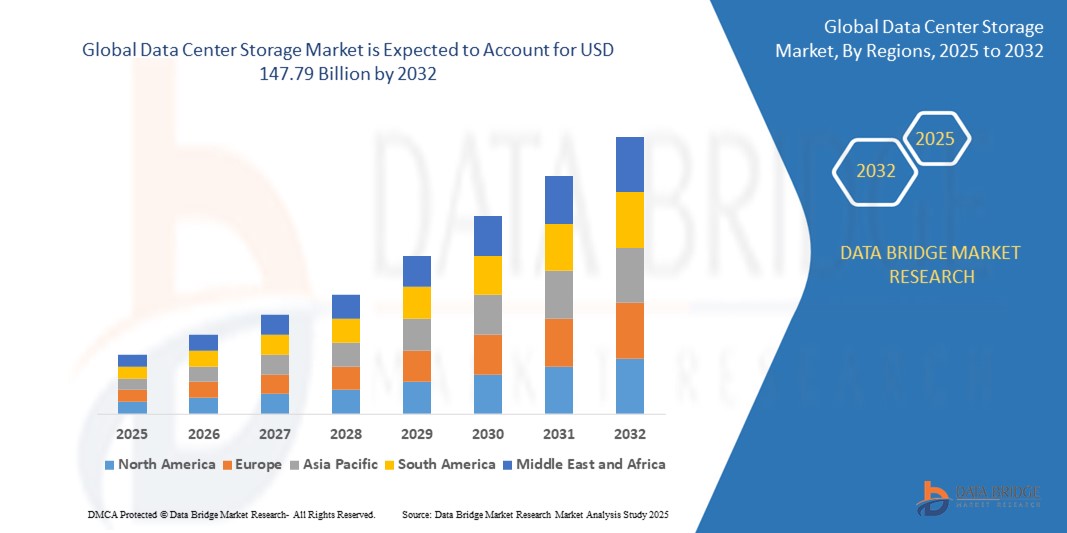

- 世界のデータセンターストレージ市場は2024年に616億1000万米ドル と評価され、予測期間中に11.49%のCAGRで成長し、2032年には1477億9000万米ドルに達すると予想されています。

- この成長は、企業が生成するデータ量の増加、ストレージ技術の進歩、業界全体でのデジタル変革の採用の増加などの要因によって促進されています。

データセンターストレージ市場分析

- データセンターストレージソリューションは、現代のデータセンターで大量のデータを管理および保存するために不可欠であり、クラウドコンピューティング、ビッグデータ分析、エンタープライズアプリケーションの需要をサポートする大容量で高速なストレージシステムを提供します。

- データセンターストレージの需要は、主に企業が生成するデータ量の増加、クラウドサービスの急速な導入、そしてソリッドステートドライブ(SSD)やソフトウェア定義ストレージ(SDS)といったストレージ技術の進歩によって推進されています。世界のデータセンターストレージ需要の半分以上は、クラウドベースのストレージサービスへの需要の高まりによって牽引されており、特にデジタルトランスフォーメーションが進む地域で需要が最も高まっています。

- 北米は、 クラウドサービスの普及率の高さにより、データセンターストレージ市場で最大の市場シェア40.1%を占めると予想されています。

- アジア太平洋地域は、目の健康に関する意識の高まりにより、予測期間中にデータセンターストレージ市場で最も急速に成長する地域になると予想されています。

- クラウドコンピューティング、5Gネットワーク、AI搭載アプリケーションの急速な成長により、ITおよび通信セグメントは23.9%の市場シェアで市場を支配すると予想されています。

レポートの範囲とデータセンターストレージ市場のセグメンテーション

|

特性 |

データセンターストレージの主要市場分析 |

|

対象セグメント |

|

|

対象国 |

北米

ヨーロッパ

アジア太平洋

中東およびアフリカ

南アメリカ

|

|

主要市場プレーヤー |

|

|

市場機会 |

|

|

付加価値データ情報セット |

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、ペストル分析が含まれています。 |

データセンターストレージ市場の動向

「ソフトウェア定義ストレージ(SDS)とクラウド統合の採用拡大」

- 世界のデータセンターストレージ市場における顕著なトレンドの一つは、ソフトウェア定義ストレージ(SDS)とクラウド統合の採用の増加である。

- これらの高度なソリューションは、ストレージ管理をハードウェアから分離することで、拡張性、柔軟性、コスト効率を高め、企業が大量のデータをより機敏に管理できるようにします。

- たとえば、SDSを使用すると、組織は増大するデータ需要に合わせてストレージインフラストラクチャを簡単に拡張でき、クラウド統合によりオフサイトストレージへのシームレスなアクセスが可能になり、データのバックアップ、災害復旧、グローバルなアクセスが容易になります。

- クラウド統合により、地理的に離れた場所でもコラボレーションやデータ共有が強化され、ハイブリッドおよびマルチクラウド環境の導入が促進されます。これは現代のデータセンターでますます一般的になっています。

- この傾向はデータの保存と管理の方法を変え、クラウドサービス、ビッグデータ分析、業界全体のデジタル変革の急速な成長を支えています。

データセンターストレージ市場の動向

推進要因

「データ生成の急増によるニーズの高まり」

- 企業、クラウドサービス、IoT、AI、ビッグデータ分析などの新興技術によって生成されるデータ量の増加は、データセンターストレージソリューションの需要を大幅に押し上げています

- 世界中の産業がデジタル変革を進める中、この膨大なデータ流入を管理するための大容量、拡張性、高性能のストレージシステムの必要性は高まり続けています。

- 特にクラウドコンピューティングは、より多くの企業がデータの保存、管理、分析のためにクラウド環境に移行するにつれて、このデータ爆発の最大の原因の1つとなっています。

- ソフトウェア定義ストレージ(SDS)やNVMeベースのソリューションの開発など、ストレージ技術の継続的な進歩により、複雑なワークロードをサポートし、効率的なデータ管理を確保するための最先端のストレージインフラストラクチャの必要性がさらに強調されています。

- 企業、政府、個人がより多くのデータを作成するにつれて、データの可用性、セキュリティ、重要な情報へのより高速なアクセスを保証する、信頼性が高く拡張可能なストレージソリューションの需要が高まっています。

例えば

- 2022年4月、Statistaのレポートによると、世界のデータ量は2025年までに175ゼタバイトに達すると予想されており、これらの膨大なデータセットを管理および保存するための高度なデータセンターストレージ技術の需要がさらに高まっています

- 2021年8月、IDCの調査では、2025年までに世界のデータセンターに保存されるデータの総量が大幅に増加し、拡大するデータ環境に対応するための効率的でスケーラブルなストレージソリューションの必要性がさらに高まると予測されています。

- デジタルトランスフォーメーションとクラウドベースのサービスへの依存度の増加によってデータ生成が急増した結果、データセンターストレージソリューションの需要が大幅に増加しています。

機会

「人工知能統合によるデータ管理の進化」

- AIを活用したデータセンターストレージソリューションは、ストレージ割り当ての自動化、データ取得の最適化、予測メンテナンスの改善などにより、データ管理機能を強化します。これらのAI駆動型テクノロジーにより、データセンターは膨大な量のデータをより効率的かつ費用対効果の高い方法で処理できるようになります。

- AIアルゴリズムは使用パターンを分析し、ストレージ要件を予測し、リアルタイムの洞察を提供することで、組織がストレージリソースを最適化し、重要なデータを必要なときにいつでも利用できるようにするのに役立ちます。

- さらに、AIは異常検出を支援し、データセンターが潜在的なセキュリティ脅威やハードウェア障害を運用に支障をきたす前に特定できるようにすることで、システムの信頼性を向上させ、ダウンタイムを削減します。

- データセンターのストレージソリューションにAIを統合することで、運用効率の向上、データセキュリティの強化、そしてインフラ全体のコスト削減にもつながります。AI主導のテクノロジーを活用することで、データセンターはストレージ資産をより適切に管理し、リスクを軽減し、継続的で高性能なデータアクセスを確保できます。

制約/課題

「設備とインフラの高コストが市場浸透を阻害している」

- データセンターストレージソリューションの高コストは、特に中小企業(SMB)や予算が限られている発展途上地域の組織にとって依然として大きな課題です。

- 高性能SSD、ソフトウェア定義ストレージ(SDS)、ハイブリッドストレージソリューションなどの高度なストレージテクノロジーは、多くの場合、多額の初期投資コストを伴うため、組織がインフラストラクチャをアップグレードしたり、新しいテクノロジーを採用したりすることを躊躇する可能性があります。

- この経済的障壁は、古くて効率の悪いストレージシステムへの依存につながり、データ管理における最新のイノベーションへのアクセスを制限し、市場全体の成長を妨げる可能性があります。

例えば

- 2024年6月、データセンターナレッジが発表したレポートによると、データセンターインフラの高コストをめぐる主な懸念事項の1つは、ビジネスの拡張性と長期的な運用効率への潜在的な影響です。高性能ストレージシステムへの初期投資は、中小企業の予算を超えることが多く、最先端技術の導入を妨げています

- その結果、このような制限により、大企業と中小企業の間でデータ管理能力に格差が生じ、最終的には世界のデータセンターストレージ市場におけるより広範な採用と成長が妨げられる可能性があります。

データセンターストレージ市場の展望

市場は、展開、アプリケーション、ストレージの種類に基づいてセグメント化されています。

|

セグメンテーション |

サブセグメンテーション |

|

展開別 |

|

|

用途別 |

|

|

ストレージタイプ別 |

|

2025年には、ITと通信がアプリケーションセグメントで最大のシェアを占め、市場を支配すると予測されています

IT・通信分野は、2025年にはデータセンターストレージ市場において最大のシェア23.9%を占め、市場を席巻すると予想されています。この優位性は、同分野が大規模データ処理、ストレージ、管理ソリューションに大きく依存していることに起因しています。クラウドコンピューティング、5Gインフラ、AI活用アプリケーションの急速な拡大により、大容量で効率的かつ拡張性の高いストレージシステムに対する需要が大幅に増加しています。さらに、リアルタイムデータアクセス、ネットワーク最適化、そして顧客体験の向上に対するニーズの高まりも、この分野におけるストレージの導入をさらに加速させています。

ストレージエリアネットワーク(SAN)システムは 、予測期間中に導入セグメントで最大のシェアを占めると予想されます。

2025年には、ストレージエリアネットワーク(SAN)システムセグメントがデータセンターストレージ市場において最大の市場シェア17.8%を獲得し、市場を席巻すると予想されています。この優位性は、SANシステムが高速で信頼性が高く、拡張性に優れたデータストレージソリューションを提供できることに起因しており、エンタープライズワークロードやミッションクリティカルなアプリケーションのサポートに不可欠です。業界全体で仮想化、クラウドサービス、ビッグデータ分析の導入が進むにつれ、SANシステムは強化されたデータ管理、集中型ストレージ、そしてネットワークパフォーマンスの向上を実現するため、需要が高まっています。さらに、ストレージ技術の進歩と効率的な災害復旧ソリューションへのニーズの高まりも、SANシステムセグメントの成長をさらに後押しする要因となっています。

データセンターストレージ市場の地域分析

「北米は データセンターストレージ市場において主要な地域である」

- 北米は、先進的なITインフラストラクチャ、クラウドサービスの高い採用率、そして大手市場プレーヤーの強力な存在により、世界のデータセンターストレージ市場で最大の市場シェア40.1%を占めています。

- 米国は、高性能ストレージソリューションの需要の高まり、データセンターの拡張、NVMeやソフトウェア定義ストレージ(SDS)などのストレージ技術の継続的な進歩により、30.5%という大きなシェアを占めています。

- 強力なデータセキュリティ規制、確立されたクラウドサービスプロバイダー、大手企業による技術への多額の投資が市場をさらに強化しています。

- さらに、ビッグデータ分析、人工知能、IoTの導入の増加により、地域全体で拡張性と効率性に優れたストレージシステムの需要が高まっています。

「アジア太平洋地域は最も高い成長率を記録すると予測される」

- アジア太平洋地域は、デジタルインフラの急速な拡大、データ生成の増加、クラウド導入の増加により、データセンターストレージ市場において最も高い成長率が見込まれています。

- 中国、インド、日本などの国は、急速な都市化、インターネットの普及率の増加、データセンターインフラへの多額の投資により、重要な市場として台頭しています。

- 高度な技術インフラと信頼性の高いストレージソリューションへの高い需要を誇る日本は、データセンター・ストレージプロバイダーにとって依然として重要な市場です。日本は、デジタルトランスフォーメーションを支える大容量・高性能ストレージシステムの導入において、引き続きリードしています。

- 人口規模が大きく増加している中国とインドでは、データストレージとクラウドサービスへの政府投資が増加し、民間セクターも成長しています。世界的なIT大手の存在感の拡大とデータのローカリゼーションへのニーズも、地域全体の市場成長にさらに貢献しています。

データセンターストレージ市場シェア

市場競争環境は、競合他社ごとの詳細情報を提供します。企業概要、財務状況、収益、市場ポテンシャル、研究開発投資、新規市場への取り組み、グローバルプレゼンス、生産拠点・設備、生産能力、強みと弱み、製品投入、製品群の幅広さ、アプリケーションにおける優位性などの詳細が含まれます。上記のデータは、各社の市場への注力分野にのみ関連しています。

市場で活動する主要なマーケットリーダーは次のとおりです。

- デルテクノロジーズ(米国)

- ヒューレット・パッカード・エンタープライズ(米国)

- IBMコーポレーション(米国)

- NetApp(米国)

- 日立ヴァンタラ(日本)

- ファーウェイ・テクノロジーズ(中国)

- ウエスタンデジタルコーポレーション(米国)

- シーゲイト・テクノロジー(米国)

- ピュア・ストレージ(米国)

- シスコシステムズ(米国)

世界のデータセンターストレージ市場の最新動向

- 2023年5月、Pure Storage Inc.は、ディスクベースシステムに保存されている非プライマリまたは「コールド」に分類されるデータの約80%に対応するために設計されたFlashBlade//Eを導入し、フラッシュベースのストレージポートフォリオを拡大しました。この革新的なソリューションは、データセンターのストレージ環境における効率性と費用対効果の両方を向上させることを目指しています。

- 2023年4月、マイクロソフトはポーランドに初の信頼できるクラウドスペースを開設し、グローバル展開をさらに推進しました。これは、中央および東ヨーロッパにおける最初の施設として重要なマイルストーンとなります。この戦略的取り組みは、この地域におけるクラウドのアクセス性を高め、データサービスを向上させることを目的としています。

- 2022年6月、ピュア・ストレージ社はベンガルールに研究開発センターを設立し、FlashArray、FlashBlade、FlashStack、Pure as-a-Serviceなどのストレージおよびデータ管理ソリューションの進歩に戦略的に注力しています。

- 2020年9月、イノベーション重視のテクノロジープラットフォームであるINVITE Systemsは、企業の多様なニーズに対応するために設計された信頼性の高いデータセンターを開発するため、ファーウェイと提携しました。この協業は、テクノロジー分野の企業に堅牢で信頼性の高いインフラソリューションを提供するための、両社の一体となった取り組みを強調するものです。

- 2022年12月、サムスン電子は、業界初の12ナノメートル(nm)クラスのプロセス技術で構築された16ギガビット(Gb)DDR5 DRAMの開発と、AMDとの製品互換性テストの完了を発表した。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER STORAGE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER STORAGE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER STORAGE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE SYSTEM TYPE

6.1 OVERVIEW

6.2 DIRECT ATTACHED STORAGE (DAS)

6.3 NETWORK ATTACHED STORAGE (NAS)

6.3.1 BY PROTOCOLS

6.3.1.1. NETWORK FILE SYSTEM (NFS)

6.3.1.2. COMMON INTERNET FILE SYSTEM (CIFS)

6.3.1.3. FILE TRANSFER PROTOCOL (FTP)

6.3.1.4. HYPER TEXT TRANSFER PROTOCOL (HTTP)

6.3.1.5. OTHERS

6.4 STORAGE AREA NETWORK (SAN)

6.4.1 BY TYPE

6.4.1.1. FC-SAN

6.4.1.2. IP-SAN

7 GLOBAL DATA CENTER STORAGE MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ROUTERS

7.2.2 SWITCHES

7.2.3 FIREWALLS

7.2.4 OTHERS

7.3 SOFTWARE

7.3.1 STORAGE MANAGEMENT SOFTWARE

7.3.2 BACKUP MANAGEMENT SOFTWARE

7.3.3 OTHERS

7.4 SERVICES

7.4.1 PROFESSIONAL SERVICES

7.4.1.1. CONSULTING

7.4.1.2. INTEGRATION

7.4.1.3. SUPPORT & MAINTENANCE

7.4.2 MANAGED SERVICES

8 GLOBAL DATA CENTER STORAGE MARKET, BY SYSTEM ARCHITECTURE

8.1 OVERVIEW

8.2 BLOCK STORAGE DEVICES

8.3 FILE STORAGE DEVICES

9 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TECHNOLOGY

9.1 OVERVIEW

9.2 HARD DISK DRIVE (HDD)

9.3 SOLID STATE DRIVE (SSD)

9.4 HYBRID STORAGE

10 GLOBAL DATA CENTER STORAGE MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 ON-PREMISES

10.3 CLOUD

11 GLOBAL DATA CENTER STORAGE MARKET, BY TYPE OF DATA CENTER

11.1 OVERVIEW

11.2 ENTERPRISE DATA CENTERS

11.3 MANAGED SERVICES DATA CENTERS

11.4 COLOCATION DATA CENTERS

11.5 CLOUD DATA CENTERS

11.6 EDGE DATA CENTERS

11.7 OTHERS

12 GLOBAL DATA CENTER STORAGE MARKET, BY TIER TYPE

12.1 OVERVIEW

12.2 TIER I

12.3 TIER II

12.4 TIER III

12.5 TIER IV

13 GLOBAL DATA CENTER STORAGE MARKET, BY DATA CENTER SIZE

13.1 OVERVIEW

13.2 MICRO DATA CENTER

13.3 SMALL DATA CENTERS

13.4 MID-SIZED DATA CENTERS

13.5 LARGE DATA CENTERS

14 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TYPE

14.1 OVERVIEW

14.2 TRADITIONAL STORAGE

14.3 ALL-FLASH STORAGE

14.4 HYBRID STORAGE

15 GLOBAL DATA CENTER STORAGE MARKET, BY END USER

15.1 OVERVIEW

15.2 ENTERPRISE

15.2.1 BY SIZE,

15.2.1.1. SMALL & MEDIUM SIZE ENTERPRISE

15.2.1.2. LARGE SIZE ENTERPRISE

15.3 COLOCATION PROVIDERS

15.4 CLOUD PROVIDERS

16 GLOBAL DATA CENTER STORAGE MARKET, BY INDUSTRY

16.1 OVERVIEW

16.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

16.2.1 BY STORAGE SYSTEM TYPE

16.2.1.1. DIRECT ATTACHED STORAGE (DAS)

16.2.1.2. NETWORK ATTACHED STORAGE (NAS)

16.2.1.2.1. BY PROTOCOLS

16.2.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.2.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.2.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.2.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.2.1.2.1.5 OTHERS

16.2.1.3. STORAGE AREA NETWORK (SAN)

16.2.1.3.1. BY TYPE

16.2.1.3.1.1 FC-SAN

16.2.1.3.1.2 IP-SAN

16.3 GOVERNMENT & DEFENSE

16.3.1 BY STORAGE SYSTEM TYPE

16.3.1.1. DIRECT ATTACHED STORAGE (DAS)

16.3.1.2. NETWORK ATTACHED STORAGE (NAS)

16.3.1.2.1. BY PROTOCOLS

16.3.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.3.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.3.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.3.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.3.1.2.1.5 OTHERS

16.3.1.3. STORAGE AREA NETWORK (SAN)

16.3.1.3.1. BY TYPE

16.3.1.3.1.1 FC-SAN

16.3.1.3.1.2 IP-SAN

16.4 HEALTHCARE

16.4.1 BY STORAGE SYSTEM TYPE

16.4.1.1. DIRECT ATTACHED STORAGE (DAS)

16.4.1.2. NETWORK ATTACHED STORAGE (NAS)

16.4.1.2.1. BY PROTOCOLS

16.4.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.4.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.4.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.4.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.4.1.2.1.5 OTHERS

16.4.1.3. STORAGE AREA NETWORK (SAN)

16.4.1.3.1. BY TYPE

16.4.1.3.1.1 FC-SAN

16.4.1.3.1.2 IP-SAN

16.5 MANUFACTURING

16.5.1 BY STORAGE SYSTEM TYPE

16.5.1.1. DIRECT ATTACHED STORAGE (DAS)

16.5.1.2. NETWORK ATTACHED STORAGE (NAS)

16.5.1.2.1. BY PROTOCOLS

16.5.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.5.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.5.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.5.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.5.1.2.1.5 OTHERS

16.5.1.3. STORAGE AREA NETWORK (SAN)

16.5.1.3.1. BY TYPE

16.5.1.3.1.1 FC-SAN

16.5.1.3.1.2 IP-SAN

16.6 RETAIL

16.6.1 BY STORAGE SYSTEM TYPE

16.6.1.1. DIRECT ATTACHED STORAGE (DAS)

16.6.1.2. NETWORK ATTACHED STORAGE (NAS)

16.6.1.2.1. BY PROTOCOLS

16.6.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.6.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.6.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.6.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.6.1.2.1.5 OTHERS

16.6.1.3. STORAGE AREA NETWORK (SAN)

16.6.1.3.1. BY TYPE

16.6.1.3.1.1 FC-SAN

16.6.1.3.1.2 IP-SAN

16.7 IT & TELECOM

16.7.1 BY STORAGE SYSTEM TYPE

16.7.1.1. DIRECT ATTACHED STORAGE (DAS)

16.7.1.2. NETWORK ATTACHED STORAGE (NAS)

16.7.1.2.1. BY PROTOCOLS

16.7.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.7.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.7.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.7.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.7.1.2.1.5 OTHERS

16.7.1.3. STORAGE AREA NETWORK (SAN)

16.7.1.3.1. BY TYPE

16.7.1.3.1.1 FC-SAN

16.7.1.3.1.2 IP-SAN

16.8 MEDIA & ENTERTAINMENT

16.8.1 BY STORAGE SYSTEM TYPE

16.8.1.1. DIRECT ATTACHED STORAGE (DAS)

16.8.1.2. NETWORK ATTACHED STORAGE (NAS)

16.8.1.2.1. BY PROTOCOLS

16.8.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.8.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.8.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.8.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.8.1.2.1.5 OTHERS

16.8.1.3. STORAGE AREA NETWORK (SAN)

16.8.1.3.1. BY TYPE

16.8.1.3.1.1 FC-SAN

16.8.1.3.1.2 IP-SAN

16.9 TRANSPORTATION & LOGISTICS

16.9.1 BY STORAGE SYSTEM TYPE

16.9.1.1. DIRECT ATTACHED STORAGE (DAS)

16.9.1.2. NETWORK ATTACHED STORAGE (NAS)

16.9.1.2.1. BY PROTOCOLS

16.9.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.9.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.9.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.9.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.9.1.2.1.5 OTHERS

16.9.1.3. STORAGE AREA NETWORK (SAN)

16.9.1.3.1. BY TYPE

16.9.1.3.1.1 FC-SAN

16.9.1.3.1.2 IP-SAN

16.1 EDUCATION

16.10.1 BY STORAGE SYSTEM TYPE

16.10.1.1. DIRECT ATTACHED STORAGE (DAS)

16.10.1.2. NETWORK ATTACHED STORAGE (NAS)

16.10.1.2.1. BY PROTOCOLS

16.10.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.10.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.10.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.10.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.10.1.2.1.5 OTHERS

16.10.1.3. STORAGE AREA NETWORK (SAN)

16.10.1.3.1. BY TYPE

16.10.1.3.1.1 FC-SAN

16.10.1.3.1.2 IP-SAN

16.11 OTHERS

17 GLOBAL DATA CENTER STORAGE MARKET, BY GEOGRAPHY

GLOBAL DATA CENTER STORAGE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 FRANCE

17.2.3 U.K.

17.2.4 ITALY

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 TURKEY

17.2.8 BELGIUM

17.2.9 NETHERLANDS

17.2.10 NORWAY

17.2.11 FINLAND

17.2.12 SWITZERLAND

17.2.13 DENMARK

17.2.14 SWEDEN

17.2.15 POLAND

17.2.16 REST OF EUROPE

17.3 ASIA PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 NEW ZEALAND

17.3.7 SINGAPORE

17.3.8 THAILAND

17.3.9 MALAYSIA

17.3.10 INDONESIA

17.3.11 PHILIPPINES

17.3.12 TAIWAN

17.3.13 VIETNAM

17.3.14 REST OF ASIA PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 SAUDI ARABIA

17.5.4 U.A.E

17.5.5 OMAN

17.5.6 BAHRAIN

17.5.7 ISRAEL

17.5.8 KUWAIT

17.5.9 QATAR

17.5.10 REST OF MIDDLE EAST AND AFRICA

17.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL DATA CENTER STORAGE MARKET,COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL DATA CENTER STORAGE MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL DATA CENTER STORAGE MARKET, COMPANY PROFILE

20.1 T-SYSTEMS INTERNATIONAL GMBH(A PART OF DEUTSCHE TELEKOM)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 CISCO SYSTEMS, INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 HYPERTEC GROUP INC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 WESTERN DIGITAL CORPORATION

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 MICRON TECHNOLOGY, INC

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 DELL INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 NETAPP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 HITACHI VANTARA LLC

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 PURE STORAGE, INC

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LENOVO

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 FUJITSU

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 SEAGATE TECHNOLOGY LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENT

20.14 AMAZON WEB SERVICES, INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 CLOUDIAN INC

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 EQUINIX, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 HUAWEI TECHNOLOGIES CO., LTD

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 ORACLE

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENT

20.19 NUTANIX

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENT

20.2 DATADIRECT NETWORKS

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 NFINA TECHNOLOGIES, INC

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 QUESTIONNAIRE

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。