世界の航空宇宙および防衛Cクラス部品市場

Market Size in USD Billion

CAGR :

%

USD

16.77 Billion

USD

24.78 Billion

2021

2029

USD

16.77 Billion

USD

24.78 Billion

2021

2029

| 2022 –2029 | |

| USD 16.77 Billion | |

| USD 24.78 Billion | |

|

|

|

|

世界の航空宇宙および防衛 C クラス部品市場、製品別 (ファスナー、ベアリング、電気部品、機械加工部品)、用途別 (エンジン、航空機構造、内装、機器、安全性、サポート、航空電子工学)、最終用途別 (商用、軍事、ビジネスおよび一般航空、その他)、流通チャネル別 (OEM、アフターマーケット)、航空機タイプ別 (商用航空機、地域航空機、一般航空、ヘリコプター、軍用航空機) – 2029 年までの業界動向と予測。

航空宇宙および防衛Cクラス部品市場の分析と規模

航空宇宙および防衛産業では、優れた部品の選択が重要な要素です。これは、安全性と信頼性、ライフサイクル コスト、リサイクル性、構造効率、飛行性能、積載量、エネルギー消費、廃棄性など、設計段階から廃棄までの航空機の性能のさまざまな側面に影響します。「ファスナー」は、航空機部品の組み立てで重要なコンポーネントとして使用されるワッシャー、ナット、シール、リベット、ボルト、ネジ、リングなどのファスナーの消費量が多いため、最も急速に成長している製品セグメントです。さらに、予測期間中に航空機の快適性と安全性の向上が重視されるようになったため、航空用途における航空宇宙および防衛の C クラス部品の需要が増加しています。

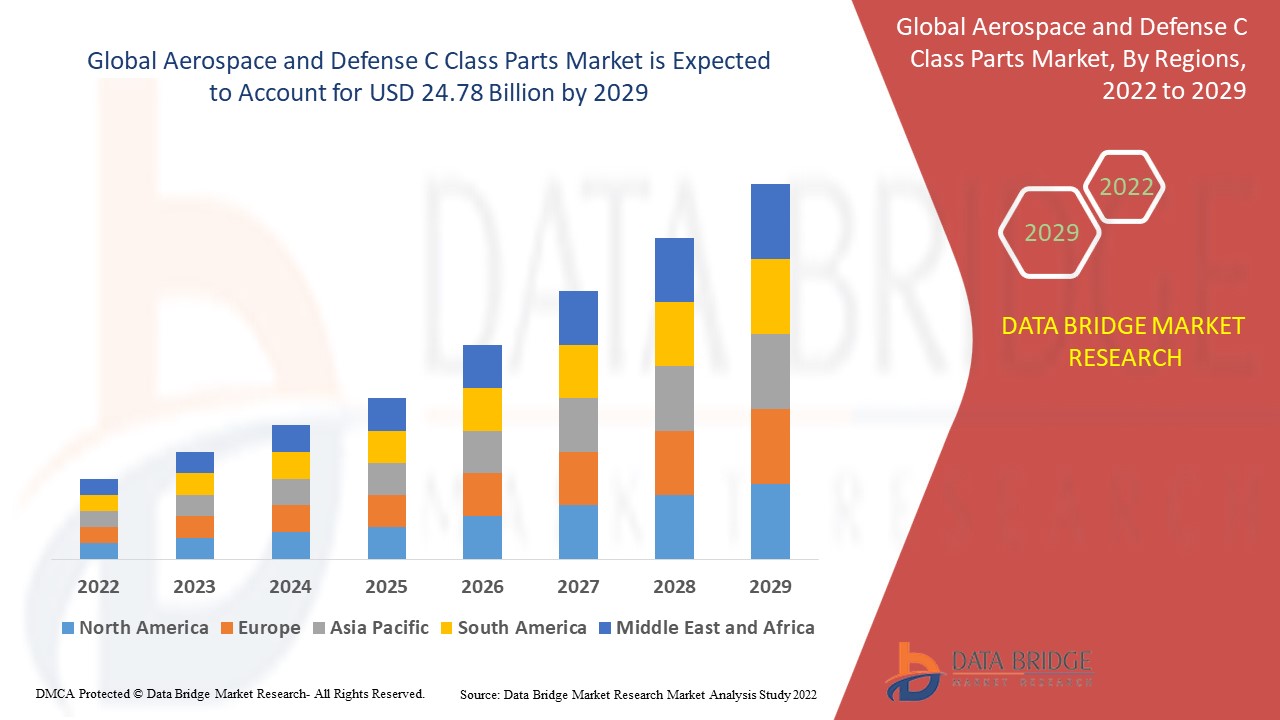

Data Bridge Market Researchは、航空宇宙および防衛Cクラス部品市場は2021年に167億7,000万米ドルと評価され、2022年から2029年の予測期間中に5.00%のCAGRを記録し、2029年には247億8,000万米ドルに達すると分析しています。市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、Data Bridge Market Researchがまとめた市場レポートには、詳細な専門家分析、地理的に表された企業別の生産と生産能力、販売業者とパートナーのネットワークレイアウト、詳細で最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

航空宇宙および防衛Cクラス部品市場の範囲とセグメンテーション

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2014 - 2019 にカスタマイズ可能) |

|

定量単位 |

売上高(10億米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

製品 (ファスナー、ベアリング、電気部品、機械加工部品)、用途 (エンジン、航空機構造、内装、機器、安全性、サポート、航空電子工学)、最終用途 (商用、軍事、ビジネスおよび一般航空、その他)、流通チャネル (OEM、アフターマーケット)、航空機タイプ (商用航空機、地域航空機、一般航空、ヘリコプター、軍用航空機) |

|

対象国 |

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、ヨーロッパではその他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、南米のその他の地域 |

|

対象となる市場プレーヤー |

イートン(アイルランド)、NTNベアリングコーポレーションオブアメリカ(米国)、アンフェノールエアロスペース(米国)、バークシャーハサウェイ社(米国)、アルコニック社(米国)、RBCベアリングインコーポレイテッド(米国)、スタンレーブラックアンドデッカー社(米国)、トライマス社(米国)、ナショナルエアロスペースファスナーズコーポレーション(台湾)、LISIエアロスペース社(フランス)、トライアンフグループ(米国)、サフラン社(フランス)、SKF社(スウェーデン)、TEコネクティビティ社(スイス)、サットコムダイレクト社(米国)、ボーイング社(米国)、エアバスSAS社(フランス)、エンブラエル社(ブラジル)、ATR社(フランス)、ロッキードマーティン社(米国)、テキストロンアビエーション社(米国) |

|

市場機会 |

|

市場の定義

航空宇宙および防衛 C クラスは、ベアリングやファスナーなどの大量かつ低コストの汎用部品です。ファスナーには、リベット、ナット、シール、ボルト、ネジ、ワッシャー、リングなどがあり、航空機の組み立てにおいて重要なコンポーネントです。一方、ベアリングは、着陸装置の支柱やショックアブソーバーのラダーの割れや熱による損傷を防ぐために使用されます。

世界の航空宇宙および防衛Cクラス部品市場の動向

ドライバー

- 効果的なファスナーの需要の高まり

ファスナーは、 航空機の製造と設計において 2 つ以上の物体を組み合わせるハードウェア ツールです。ファスナーにはナット、シール、リベット、ボルト、ネジ、ワッシャー、リングが含まれるため、消費量が増加します。これらのコンポーネントは、航空機部品の組み立てに不可欠なコンポーネントとして使用されます。耐腐食性に優れた軽量ファスナーの需要の高まりは、世界の航空宇宙および防衛 C クラス部品市場のニーズを押し上げている主な要因です。

- 増大する防衛費

過去数年間、世界的に軍事費が大幅に増加しています。ストックホルム国際平和研究所 (SIPRI) のレポートによると、世界の軍事費は 2017 年から 2018 年にかけて約 2.6% 増加しました。防衛費の増加により、ヘリコプター、戦闘機、輸送機などの技術的に高度な航空機の需要が高まると予想されており、航空宇宙および防衛 C クラス部品市場の成長を促進すると予想されています。

さらに、航空宇宙産業の成長、航空機パネルの強度と耐久性を向上させるための航空宇宙用途での製品の使用の増加により、市場における航空宇宙および防衛Cクラス部品の需要が増加すると予想されます。また、乗客数の増加とカスタマイズされたコンポーネントの容易な入手性は、2022〜2029年の予測期間中に航空宇宙および防衛Cクラス部品市場の成長を促進する可能性のある他の重要な要因です。

機会

- 航空観光産業の拡大

航空観光産業の拡大により民間航空機の売上が増加しており、航空宇宙および防衛Cクラス部品の売上に直接影響を与えることが予想されます。いくつかの国では、都市全体や他の外国との航空接続性を高めるために航空部門への投資を増やしており、航空宇宙および防衛Cクラス部品市場の成長を促進することが期待されています。

- 技術の進歩

メーカーは技術の進歩に注力しており、各社は最新かつ洗練されたマウント ソリューションを提供しています。同社は、スマートでエネルギー効率の高い航空宇宙および防衛 C クラス部品のリファレンス デザインとソフトウェアを使用して、開発コストの削減と開発時間の短縮に貢献することを目指しており、これにより航空宇宙および防衛 C クラス部品の需要が増加し、市場価格に有利な機会が生まれることが期待されています。

制約/課題

- 航空宇宙および防衛Cクラス部品市場に関連するデメリット

代替品の入手可能性と信頼できない製造業者の蔓延は、航空宇宙および防衛のCクラス部品市場に対する市場抑制要因として作用し、2022~2029年の予測期間における市場の成長を阻害すると予想されます。

この航空宇宙および防衛 C クラス部品市場レポートでは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリュー チェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場の成長、アプリケーションのニッチと優位性、製品の承認、製品の発売、地理的拡張、市場における技術革新などの詳細が提供されます。航空宇宙および防衛 C クラス部品市場に関する詳細情報を取得するには、アナリスト ブリーフについて Data Bridge Market Research にお問い合わせください。当社のチームが、市場の成長を達成するための情報に基づいた市場決定を行うお手伝いをします。

原材料不足と出荷遅延の影響と現在の市場シナリオ

Data Bridge Market Research は、市場の高水準な分析を提供し、原材料不足や出荷遅延の影響と現在の市場環境を考慮した情報を提供します。これは、戦略的な可能性を評価し、効果的な行動計画を作成し、企業が重要な決定を下すのを支援することにつながります。

標準レポートの他に、予測される出荷遅延からの調達レベルの詳細な分析、地域別の販売代理店マッピング、商品分析、生産分析、価格マッピングの傾向、調達、カテゴリパフォーマンス分析、サプライチェーンリスク管理ソリューション、高度なベンチマーク、その他の調達および戦略サポートのサービスも提供しています。

COVID-19による航空宇宙・防衛Cクラス部品市場への影響

航空宇宙および防衛のCクラス部品メーカーは、主にこのパンデミック中に停止した生産活動に依存しており、サプライチェーンネットワークが混乱しています。ほとんどの航空宇宙および防衛のCクラス部品メーカーは、このCOVID-19パンデミックにより、通常の工場活動が定期的に再開されるかどうか不確実であり、対象企業の需要と供給ネットワークに大きな支障をきたしています。このパンデミックの間、工場の閉鎖や影響を受けた国での労働力の不足など、多くの問題が発生しました。これが最終的に、航空宇宙および防衛のCクラス部品メーカーの主な流動性の問題につながりました。

経済減速が製品の価格と入手可能性に及ぼす予想される影響

経済活動が減速すると、業界は打撃を受け始めます。DBMR が提供する市場分析レポートとインテリジェンス サービスでは、景気後退が製品の価格設定と入手しやすさに及ぼす予測される影響が考慮されています。これにより、当社のクライアントは通常、競合他社より一歩先を行き、売上と収益を予測し、損益支出を見積もることができます。

世界の航空宇宙および防衛Cクラス部品市場の範囲

航空宇宙および防衛 C クラス部品市場は、製品、アプリケーション、最終用途、流通チャネル、航空機の種類に基づいてセグメント化されています。これらのセグメントの成長は、業界のわずかな成長セグメントを分析するのに役立ち、ユーザーに貴重な市場の概要と市場の洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

製品

- ファスナー

- ベアリング

- 電気部品

- 機械加工部品

応用

- エンジン

- 航空構造

- インテリア

- 装置

- 安全性とサポート

- 航空電子機器

最終用途

- コマーシャル

- 軍隊

- ビジネスおよび一般航空

- その他

流通チャネル

- メーカー

- アフターマーケット

航空機の種類

- 民間航空機

- 地域航空機

- 一般航空

- ヘリコプター

- 軍用機

航空宇宙および防衛 C クラス部品市場の地域分析/洞察

航空宇宙および防衛 C クラス部品市場が分析され、市場規模の洞察と傾向が、上記のように国、製品、アプリケーション、最終用途、流通チャネル、航空機の種類別に提供されます。

航空宇宙および防衛Cクラス部品市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

北米は、キャビン内装部品の製造が急速に成長しているため、市場シェアの面で航空宇宙および防衛 C クラス部品市場の支配力を持っています。これは、この地域で確立された航空産業と発展中の防衛産業が普及しているためです。

アジア太平洋地域は、軍事費の増加により、2022~2029年の予測期間中に最も急速に発展する地域になると予想されています。さらに、人々の可処分所得の増加と軍用機の需要の増加は、この地域の市場成長を促進する可能性のある他の主要な要因です。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、グローバル ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境と航空宇宙および防衛Cクラス部品の市場シェア分析

航空宇宙および防衛 C クラス部品市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、世界的なプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、航空宇宙および防衛 C クラス部品市場に関連する会社の焦点にのみ関連しています。

航空宇宙および防衛の C クラス部品市場で活動している主要企業は次のとおりです。

- イートン(アイルランド)

- NTNベアリングコーポレーションオブアメリカ(米国)

- アンフェノールエアロスペース(米国)

- バークシャー・ハサウェイ社(米国)

- アルコニック(米国)

- RBCベアリングインコーポレーテッド(米国)

- スタンレー・ブラック・アンド・デッカー社(米国)

- トリマス(米国)

- 国立航空宇宙ファスナー株式会社(台湾)

- LISI AEROSPACE(フランス)

- トライアンフグループ(米国)

- サフラン(フランス)

- SKF(スウェーデン)

- TEコネクティビティ(スイス)

- Satcom Direct, Inc.(米国)

- ボーイング(米国)

- エアバスSAS(フランス)

- エンブラエル(ブラジル)

- ATR(フランス)

- ロッキード・マーティン社(米国)

- テキストロン・アビエーション社(米国)

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。