GCC 地域の工業用ドラム市場、タイプ別 (プラスチック ドラム、スチール ドラム、ファイバー ドラム、サルベージ ドラム)、製品タイプ別 (オープン ヘッドとタイト ヘッド)、容量別 (100 リットルまで、100 ~ 250 リットル、250 ~ 500 リットル、500 リットル以上)、エンド ユーザー別 (建築および建設、化学薬品および肥料、食品および飲料、塗料、インク、染料、原油および石油製品、医薬品、その他)、2030 年までの業界動向および予測。

GCC 地域の工業用ドラム市場の分析と洞察

GCC地域の工業用ドラム市場は、2023年から2030年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2023年から2030年にかけて3.8%のCAGRで成長し、2030年までに9億9,627万5,860米ドルに達すると分析しています。工業用ドラム市場の成長を牽引する主な要因は、エンドユーザー間の大陸間取引の増加です。

工業用ドラムは、一般的に油、燃料、化学薬品、および多くの乾燥/液体物品を輸送します。危険物の輸送に使用されるドラムの構造と性能。化学薬品、石油、その他の保管用途の需要の高まり。顧客の仕様に応じた工業用ドラムの可用性が市場を牽引すると予想されます。GCC 地域の石油、化学薬品、肥料などの多くのエンドユーザー間の大陸間取引の増加は、工業用ドラムが危険化学物質と非危険化学物質の保管や材料の輸送におけるその他の材料の保管に使用されるため、大陸間取引での工業用ドラムの使用に影響を与えています。

GCC 地域の工業用ドラム市場レポートでは、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品の承認、戦略的決定、製品の発売、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するためのアナリスト概要については、当社にお問い合わせください。当社のチームは、お客様が希望する目標を達成するための収益に影響を与えるソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2020~2015年にカスタマイズ可能) |

|

定量単位 |

収益(千米ドル) |

|

対象セグメント |

タイプ別 (プラスチックドラム、スチールドラム、ファイバードラム、サルベージドラム)、製品タイプ別 (オープンヘッド、タイトヘッド)、容量別 (100 リットルまで、100 ~ 250 リットル、250 ~ 500 リットル、500 リットル以上)、エンドユーザー別 (建築、化学薬品および肥料、食品および飲料、塗料、インク、染料、原油および石油製品、医薬品、その他)。 |

|

対象国 |

バーレーン、クウェート、オマーン、カタール、サウジアラビア、アラブ首長国連邦。 |

|

対象となる市場プレーヤー |

Greif、Time Technoplast Ltd.、DANA Group of Companies、Al Fujairah Steel Barrels and Drums LLC、Anglo American Steel LLC、Balmer Lawrie (UAE) LLC、Drum Express、Al Yamama Plastic Factory、PGTC Group、Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd、Elan Incorporated FZE、VWR International, LLC.、STARLINK Dubai LLC、INTC Steel Drums LLC、Emirates Plastic Industries Factory、Clouds Drums Dubai LLC など。 |

市場の定義

工業用ドラムは、大型貨物の輸送に使用される円形の中空容器です。工業用ドラムの製造には、プラスチック、スチール、ファイバーなどの材料を使用できます。用途によって、使用される材料が決まります。スチール ドラムは化学処理に使用され、プラスチック ドラムは酸性物質に使用されます。ファイバー ドラムは固体物質に使用されます。工業用ドラムにはさまざまなサイズがあります。55 ガロンの容量を持つ 55 ガロン ドラムは、輸送上の理由で最もよく使用されるドラム サイズです。石油、ガス、石油、食品、飲料、建設、製造、農業などの分野で工業用ドラムが使用されています。

GCC 地域の工業用ドラム市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- エンドユーザー間の大陸間取引の増加

GCC 地域の石油、化学薬品、肥料などの多くの最終ユーザー間の大陸間取引の増加は、工業用ドラムが危険化学物質と非危険化学物質の保管や、材料の輸送におけるその他の材料の保管に使用されるため、大陸間取引での工業用ドラムの使用に影響を与えています。

工業用ドラムは、特に液体の大量の商品を輸送する際の運用効率と有効性を高めます。工業用ドラムは、化学薬品、ワイン、フルーツジュースなどの危険物および非危険物の輸送に費用対効果の高い輸送梱包ソリューションを提供します。また、工業用ドラムは、高い強度、ガスバリア性、優れた処理性能も備えています。移動のしやすさと、さまざまな工業用ドラムが提供する特性は、大陸間取引に工業用ドラムを検討する主な理由です。

- 化学薬品、石油などの貯蔵用途の増加

工業用ドラムは、非危険物および危険物の保管と輸送に広く使用されています。工業用ドラムの最も一般的な用途は、石油、油、肥料、化学産業の最終用途です。

スチールドラムは、半固体、液体、粉末の梱包に広く使用されています。スチールドラムは、炭素鋼またはステンレス鋼で作られています。さらに、熱や炎に関係なく、こぼれたり漏れたりすることなく、構造的完全性を維持しながら、極端な圧力、温度、湿度に耐えることができます。また、適切な作業条件が熱衝撃の影響を受けない場合は、破裂する可能性が低くなります。必要なアプリケーションに基づいて、さまざまなサイズが用意されています。また、交差汚染を避けるために、食品や飲料は、スチールドラムに入れる前にドラムライナーに保管する必要があります。スチールドラムは、化学薬品、農業、石油および潤滑油、塗料、インク、食品および飲料のアプリケーションで使用されます。

機会

- 産業用ドラムにおける企業間の戦略的連携

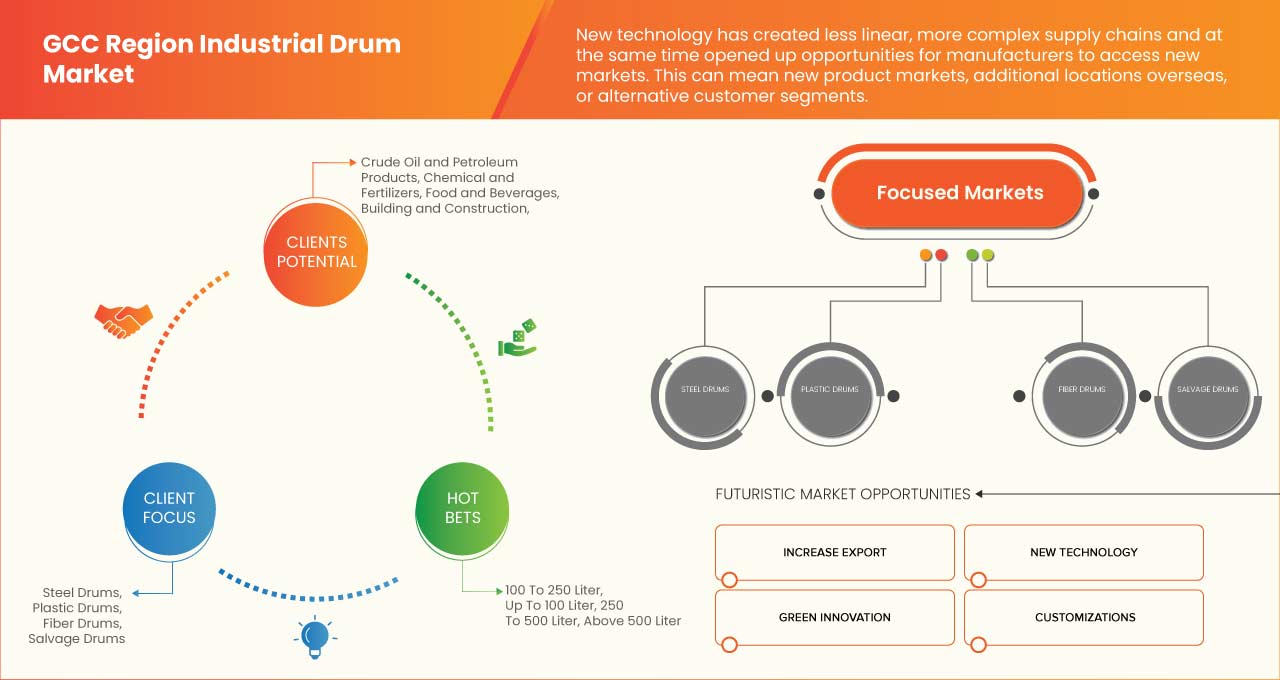

新しいテクノロジーによって、サプライ チェーンは直線的でなくなり、より複雑になりました。同時に、メーカーが新しい市場にアクセスする機会も生まれました。これは、新しい製品市場、海外の追加拠点、または代替顧客セグメントを意味します。戦略的コラボレーションは、新しい市場への参入プロセスを加速し、よりスムーズに進めるための効果的なツールです。戦略的コラボレーションにより、製品とサービスの提供を強化できます。これにより、企業は新しい顧客を引き付け、既存の顧客の満足度を高めることができます。

戦略的提携は、あらゆる規模や業種の企業にとってビジネス戦略の重要な部分です。あらゆる戦略的コラボレーションは、パートナー同士が互いから新たな洞察を得る必要があるという考えのもとに行われます。

- 石油その他の物資の輸出増加

UAE の探査プロジェクトは、グリーンフィールド プロジェクトの機会を創出します。UAE の生産者は、回収率を高め、生産量を延長するために、新しい抽出技術のテストと実装を続けています。非在来型の石油およびガス資源は、UAE にとって大きな関心事です。湾岸諸国が炭化水素から最大限の利益を引き出す方法の 1 つは、石油化学製品および化学物質の下流生産および輸出能力への投資を促進することです。したがって、石油およびその他の化学物質の輸出の増加により、石油およびその他の化学物質の不足と輸送用の工業用ドラムの需要が増加すると予想されます。

制約/課題

- 工業用ドラムに関する厳格な政府ガイドライン

厳格な規制は、業界ごとに策定された技術ベースの国家基準です。業界が経済的に達成可能な最大の汚染物質削減を表しています。これらの制限は、排出を受ける水域の状態に関係なく、規制で定義された業界の範囲内の施設に一律に適用されます。

If one has stored hazardous substances such as cars or fuel oils inside the empty oil drums, they must be disposed of in a health and safety-compliant matter. After all, those rules protect the health of themselves, their employees, and anyone else who could come into contact with hazardous waste. The business owner must ensure that hazardous waste is handled correctly and safely.

- Volatility of raw material price

Raw materials frequently experience market volatility resulting from supply disruptions, pent-up demand, or significant price peaks and troughs. Commodity prices are highly volatile in markets. It is often blamed for these variations, but drum manufacturers will see that changes in supply and demand are the main determinants of commodity prices. High steel prices continue to present problems for steel drum producers.

The raw material for the industrial drum has been exported from different regions as there can be many reasons for the volatility in the price, such as the current Russia-Ukraine war may affect the price of some raw material used for the manufacturing of the industrial drums on the basics of which type of industrial drum the company is manufacturing. So, if the price of the raw material has been increased, the manufacturer may have to increase the final product's price.

Recent Developments

- In March 2022, The UAE's Steel Producers Committee held an urgent meeting to discuss the current developments within the local rebar market, where it affirmed the member's commitment to supply the UAE market with the necessary rebar requirements as well as maintaining market stability to support the construction sector and the economy respectively.

- In March 2022, according to PSU Connect Media Pvt. Ltd, India, pitches for Collaboration with GCC in the Steel sector. An interactive session on 'Steel Usage in UAE & Collaboration Opportunities for Indian Steel Sector' was held between key steel-producing companies from India and steel user companies of the UAE.

GCC Region Industrial Drum Market Scope

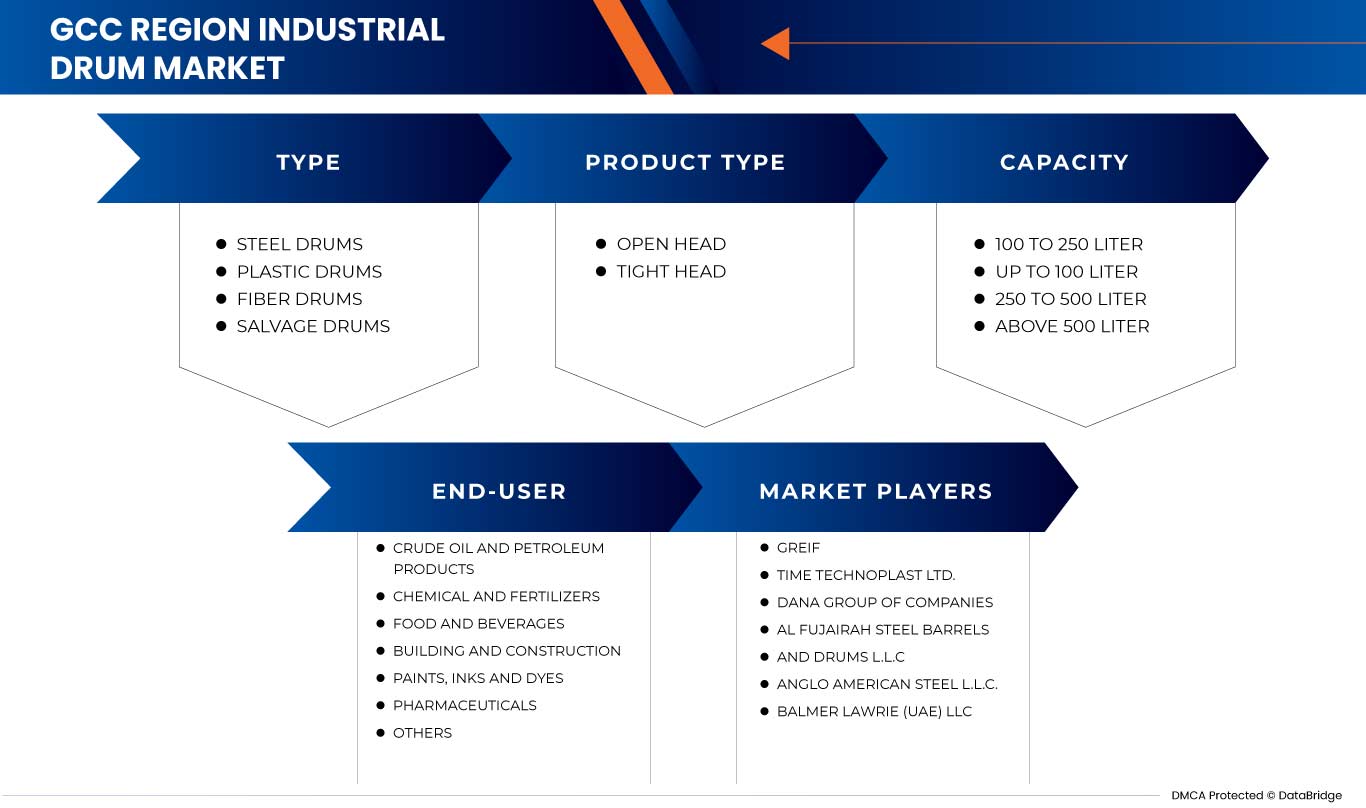

The GCC region industrial drum market is categorized based on type, product type, capacity, and end-user. The growth amongst four segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

BY TYPE

- PLASTIC DRUMS

- STEEL DRUMS

- FIBER DRUMS

- SALVAGE DRUMS

Based on type, the GCC region industrial drum market is classified into four segments plastic drums, steel drums, fiber drums, and salvage drums.

BY PRODUCT TYPE

- OPEN HEAD

- TIGHT HEAD

Based on product type, the GCC region industrial drum market is classified into two segments open head and tight head.

BY CAPACITY

- UP TO 100 LITER

- 100 TO 250 LITER

- 250 TO 500 LITER

- ABOVE 500 LITER

Based on capacity, the GCC region industrial drum market is classified into four segments Up to 100 liter, 100 to 250 liter, 250 to 500 liter, and above 500 liter.

BY END-USER

- 建築・建設

- 化学薬品と肥料

- 食品と飲料

- 塗料、インク、染料

- 原油および石油製品

- 医薬品

- その他

エンドユーザーに基づいて、GCC 地域の工業用ドラム市場は、建築および建設、化学薬品および肥料、食品および飲料、塗料、インクおよび染料、原油および石油製品、医薬品、その他の 6 つのセグメントに分類されます。

GCC 地域工業用ドラム市場地域分析/洞察

GCC 地域の工業用ドラム市場は、タイプ、製品タイプ、容量、およびエンドユーザーに基づいてセグメント化されています。

GCC 地域の工業用ドラム市場に属する国は、バーレーン、クウェート、オマーン、カタール、サウジアラビア、アラブ首長国連邦です。サウジアラビアは、保管および輸送用の工業用ドラムの需要増加により、市場シェアと市場収益の面で GCC 地域の工業用ドラム市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用されるいくつかの指標です。また、国別データの予測分析を提供する際には、GCC ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税の影響、貿易ルートが考慮されています。

競争環境とGCC地域の工業用ドラム市場シェア分析

GCC 地域の工業用ドラム市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務、収益、市場の可能性、研究開発への投資、新しい市場イニシアチブ、生産拠点と施設、会社の長所と短所、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供された上記のデータ ポイントは、GCC 地域の工業用ドラム市場に関連する企業の焦点にのみ関連しています。

GCC 地域の工業用ドラム市場で活動している著名な企業としては、Greif、Time Technoplast Ltd.、DANA Group of Companies、Al Fujairah Steel Barrels and Drums LLC、Anglo American Steel LLC、Balmer Lawrie (UAE) LLC、Drum Express、Al Yamama Plastic Factory、PGTC Group、Al-Babtain Plastic & Insulation Materials Mfg. Co. ltd、Elan Incorporated FZE、VWR International, LLC.、STARLINK Dubai LLC、INTC Steel Drums LLC、Emirates Plastic Industries Factory、Clouds Drums Dubai LLC などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GCC REGION INDUSTRIAL DRUM MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THE THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 PRODUCTION AND CONSUMPTION ANALYSIS

4.4 IMPORT-EXPORT SCENARIO

4.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.6 VENDOR SELECTION CRITERIA

4.7 RAW MATERIAL COVERAGE

4.8 REGULATION COVERAGE

5 SUPPLY CHAIN ANALYSIS

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING AND PACKING

5.3 MARKETING AND DISTRIBUTION

5.4 END USERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS

6.2 INDUSTRY RESPONSE

6.3 GOVERNMENT'S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWTH IN THE USE FOR THE STORAGE OF CHEMICALS, PETROLEUM, AND OTHERS

7.1.2 INCREASED CROSS-CONTINENT TRADING AMONG END-USERS

7.1.3 AVAILABILITY OF INDUSTRIAL DRUM ACCORDING TO CUSTOMER SPECIFICATION

7.2 RESTRAINTS

7.2.1 VOLATILITY OF RAW MATERIAL PRICE

7.2.2 COMPLEXITY IN THE SUPPLY CHAIN

7.3 OPPORTUNITIES

7.3.1 INCREASE IN THE EXPORT OF PETROLEUM AND OTHER MATERIAL

7.3.2 STRATEGIC COLLABORATION AMONG COMPANIES FOR INDUSTRIAL DRUM

7.4 CHALLENGES

7.4.1 STRINGENT GOVERNMENT GUIDELINES FOR INDUSTRIAL DRUM

7.4.2 ECOLOGICAL EFFECT BY RAW MATERIAL USED FOR MANUFACTURING THE INDUSTRIAL DRUM

8 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE

8.1 OVERVIEW

8.2 STEEL DRUMS

8.3 PLASTIC DRUMS

8.4 FIBER DRUMS

8.5 SALVAGE DRUMS

9 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 OPEN HEAD

9.3 TIGHT HEAD

10 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 100 TO 250 LITER

10.3 UP TO 100 LITER

10.4 250 TO 500 LITER

10.5 ABOVE 500 LITER

11 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER

11.1 OVERVIEW

11.2 CRUDE OIL AND PETROLEUM PRODUCTS

11.2.1 STEEL DRUMS

11.2.2 PLASTIC DRUMS

11.2.3 SALVAGE DRUMS

11.2.4 FIBER DRUMS

11.3 CHEMICAL AND FERTILIZERS

11.3.1 STEEL DRUMS

11.3.2 PLASTIC DRUMS

11.3.3 SALVAGE DRUMS

11.3.4 FIBER DRUMS

11.4 FOOD AND BEVERAGES

11.4.1 STEEL DRUMS

11.4.2 PLASTIC DRUMS

11.4.3 FIBER DRUMS

11.4.4 SALVAGE DRUMS

11.5 BUILDING AND CONSTRUCTION

11.5.1 PLASTIC DRUMS

11.5.2 STEEL DRUMS

11.5.3 FIBER DRUMS

11.5.4 SALVAGE DRUMS

11.6 PAINTS, INKS AND DYES

11.6.1 PLASTIC DRUMS

11.6.2 STEEL DRUMS

11.6.3 FIBER DRUMS

11.6.4 SALVAGE DRUMS

11.7 PHARMACEUTICALS

11.7.1 PLASTIC DRUMS

11.7.2 FIBER DRUMS

11.7.3 STEEL DRUMS

11.7.4 SALVAGE DRUMS

11.8 OTHERS

11.8.1 PLASTIC DRUMS

11.8.2 FIBER DRUMS

11.8.3 STEEL DRUMS

11.8.4 SALVAGE DRUMS

12 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY

12.1 SAUDI ARABIA

12.2 UNITED ARAB EMIRATES

12.3 OMAN

12.4 KUWAIT

12.5 QATAR

12.6 BAHRAIN

13 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GCC REGION

13.2 CERTIFICATION

13.3 ACQUISITION

13.4 AWARD

13.5 AGREEMENT

13.6 NEW WEBSITE

13.7 NEW PLANT

13.8 PARTNERSHIP

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 GREIF

15.1.1 COMPANY SNAPSHOT

15.1.2 SWOT ANALYSIS

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 TIME TECHNOPLAST LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 SWOT ANALYSIS

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 VWR INTERNATIONAL, LLC.

15.3.1 COMPANY SNAPSHOT

15.3.2 SWOT ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 STARLINK DUBAI LLC

15.4.1 COMPANY SNAPSHOT

15.4.2 SWOT ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ELAN INCORPORATED FZE

15.5.1 COMPANY SNAPSHOT

15.5.2 SWOT ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AL FUJAIRAH STEEL BARRELS AND DRUMS L.L.C

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 AL YAMAMA PLASTIC FACTORY

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 AL-BABTAIN PLASTIC & INSULATION MATERIALS MFG, CO. LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 SWOT ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 ANGLO AMERICAN STEEL L.L.C.

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 BALMER LAWRIE (UAE) LLC

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 CLOUDS DRUMS DUBAI LLC

15.11.1 COMPANY SNAPSHOT

15.11.2 SWOT ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 DANA GROUP OF COMPANIES

15.12.1 COMPANY SNAPSHOT

15.12.2 SWOT ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 DRUM EXPRESS

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMIRATES PLASTIC INDUSTRIES FACTORY

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 INTC STEEL DRUMS LLC

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 PGTC GROUP

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 GCC REGION INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 4 GCC REGION INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 GCC REGION INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 6 GCC REGION INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 7 GCC REGION CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 GCC REGION CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 GCC REGION FOOD AND BEVERAGE IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 GCC REGION BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 GCC REGION PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 GCC REGION PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 GCC REGION OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 15 GCC REGION INDUSTRIAL DRUM MARKET, BY COUNTRY, 2021-2030 (THOUSAND UNITS)

TABLE 16 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 18 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 20 SAUDI ARABIA INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 21 SAUDI ARABIA CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 SAUDI ARABIA CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SAUDI ARABIA FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 24 SAUDI ARABIA BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SAUDI ARABIA PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 26 SAUDI ARABIA PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SAUDI ARABIA OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 30 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 32 UNITED ARAB EMIRATES INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 33 UNITED ARAB EMIRATES CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 UNITED ARAB EMIRATES CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 UNITED ARAB EMIRATES FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 UNITED ARAB EMIRATES BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 UNITED ARAB EMIRATES PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 UNITED ARAB EMIRATES PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 UNITED ARAB EMIRATES OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 OMAN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 42 OMAN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 OMAN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 44 OMAN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 45 OMAN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 46 OMAN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 OMAN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 OMAN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 OMAN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 OMAN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 OMAN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 KUWAIT INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 54 KUWAIT INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 KUWAIT INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 56 KUWAIT INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 57 KUWAIT CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 KUWAIT CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 KUWAIT FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 KUWAIT BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 KUWAIT PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 KUWAIT PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 KUWAIT OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 QATAR INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 66 QATAR INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 QATAR INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 68 QATAR INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 69 QATAR CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 QATAR CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 QATAR FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 QATAR BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 QATAR PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 QATAR PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 QATAR OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 BAHRAIN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (THOUSAND UNITS)

TABLE 78 BAHRAIN INDUSTRIAL DRUM MARKET, BY PRODUCT TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 BAHRAIN INDUSTRIAL DRUM MARKET, BY CAPACITY, 2021-2030 (USD THOUSAND)

TABLE 80 BAHRAIN INDUSTRIAL DRUM MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 81 BAHRAIN CRUDE OIL AND PETROLEUM PRODUCTS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 BAHRAIN CHEMICAL AND FERTILIZERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 BAHRAIN FOOD AND BEVERAGES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 BAHRAIN BUILDING AND CONSTRUCTION IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 BAHRAIN PAINTS, INKS AND DYES IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 BAHRAIN PHARMACEUTICALS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 BAHRAIN OTHERS IN INDUSTRIAL DRUM MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

図表一覧

FIGURE 1 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 2 GCC REGION INDUSTRIAL DRUM MARKET: DATA TRIANGULATION

FIGURE 3 GCC REGION INDUSTRIAL DRUM MARKET: DROC ANALYSIS

FIGURE 4 GCC REGION INDUSTRIAL DRUM MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GCC REGION INDUSTRIAL DRUM MARKET: TYPE LIFE LINE CURVE

FIGURE 7 GCC REGION INDUSTRIAL DRUM MARKET: MULTIVARIATE MODELLING

FIGURE 8 GCC REGION INDUSTRIAL DRUM MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 GCC REGION INDUSTRIAL DRUM MARKET: DBMR MARKET POSITION GRID

FIGURE 10 GCC REGION INDUSTRIAL DRUM MARKET: APPLICATION COVERAGE GRID

FIGURE 11 GCC REGION INDUSTRIAL DRUM MARKET: CHALLENGE MATRIX

FIGURE 12 GCC REGION INDUSTRIAL DRUM MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 GCC REGION INDUSTRIAL DRUM MARKET: SEGMENTATION

FIGURE 14 AVAILABILITY OF INDUSTRIAL DRUMS ACCORDING TO CUSTOMER SPECIFICATION IS EXPECTED TO DRIVE THE GCC REGION INDUSTRIAL DRUM MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 STEEL DRUMS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GCC REGION INDUSTRIAL DRUM MARKET IN 2023 & 2030

FIGURE 16 GCC REGION INDUSTRIAL DRUM MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (THOUSAND UNITS)

FIGURE 17 IMPORT-EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 SUPPLY CHAIN ANALYSIS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GCC REGION INDUSTRIAL DRUM MARKET

FIGURE 20 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE, 2022

FIGURE 21 GCC REGION INDUSTRIAL DRUM MARKET: BY PRODUCT TYPE, 2022

FIGURE 22 GCC REGION INDUSTRIAL DRUM MARKET: BY CAPACITY, 2022

FIGURE 23 GCC REGION INDUSTRIAL DRUM MARKET: BY END-USER, 2022

FIGURE 24 GCC REGION INDUSTRIAL DRUM MARKET: SNAPSHOT (2022)

FIGURE 25 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022)

FIGURE 26 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 GCC REGION INDUSTRIAL DRUM MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 GCC REGION INDUSTRIAL DRUM MARKET: BY TYPE (2023-2030)

FIGURE 29 GCC REGION INDUSTRIAL DRUM MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。