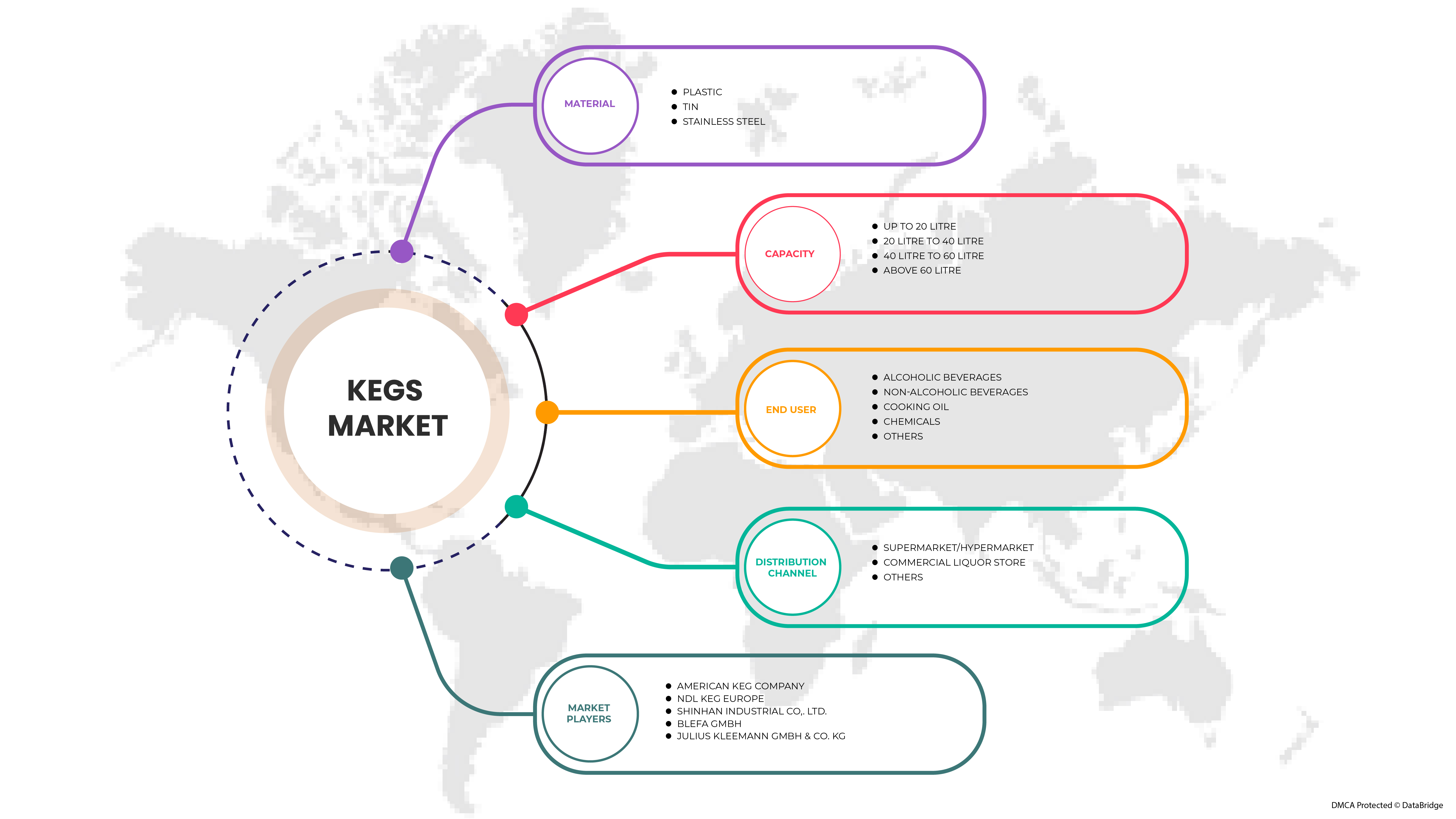

ヨーロッパの樽市場、材質別(プラスチック、スズ、ステンレス鋼)、容量別(20リットルまで、20リットルから40リットル、40リットルから60リットル、60リットル以上)、エンドユーザー別(アルコール飲料、ノンアルコール飲料、食用油、化学薬品、その他)、流通チャネル別(スーパーマーケット/ハイパーマーケット、商業酒屋、その他)業界動向と2029年までの予測。

ヨーロッパの樽市場の分析と規模

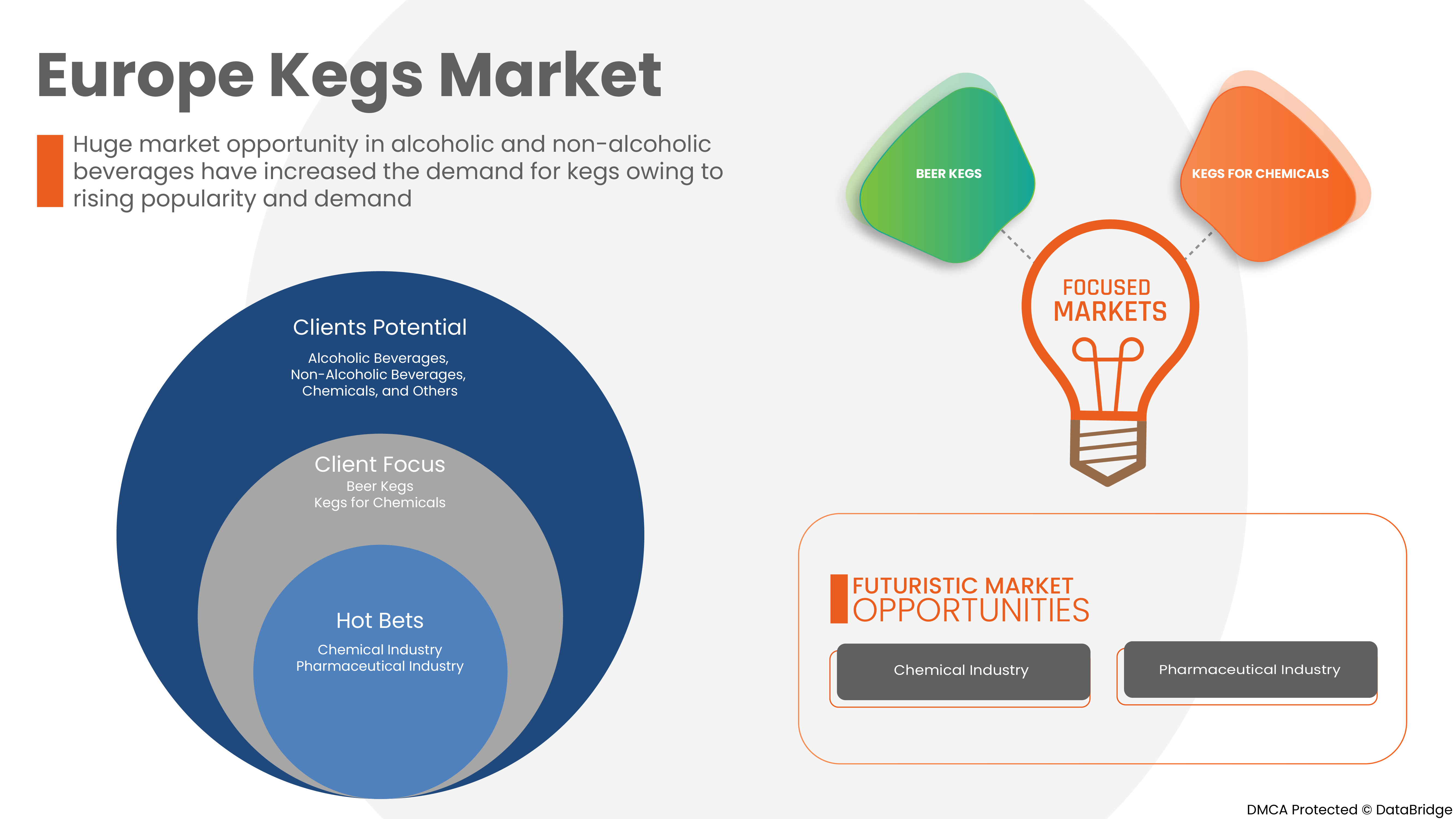

ヨーロッパの樽市場は、さまざまな業界での樽の用途の増加によって牽引されています。さらに、市場の成長は、アルコール飲料とノンアルコール飲料の需要の高まりによって促進されています。しかし、市場の成長を制限する主な要因は、商業用樽に関連する高コストです。樽の需要の高まりを受けて、メーカーは最先端の技術を採用し、認定機関によって認定された新製品の発売にさらに力を入れています。市場の拡大は、最終的にはこれらの選択によって促進されます。

市場の成長を牽引する要因としては、化学分野や食品・飲料分野での樽の用途拡大や、ライフスタイルの緩やかな変化による飲料の消費増加などが挙げられます。しかし、樽の寿命が長いため樽の交換が遅いという制約が市場の成長を妨げると予想されます。

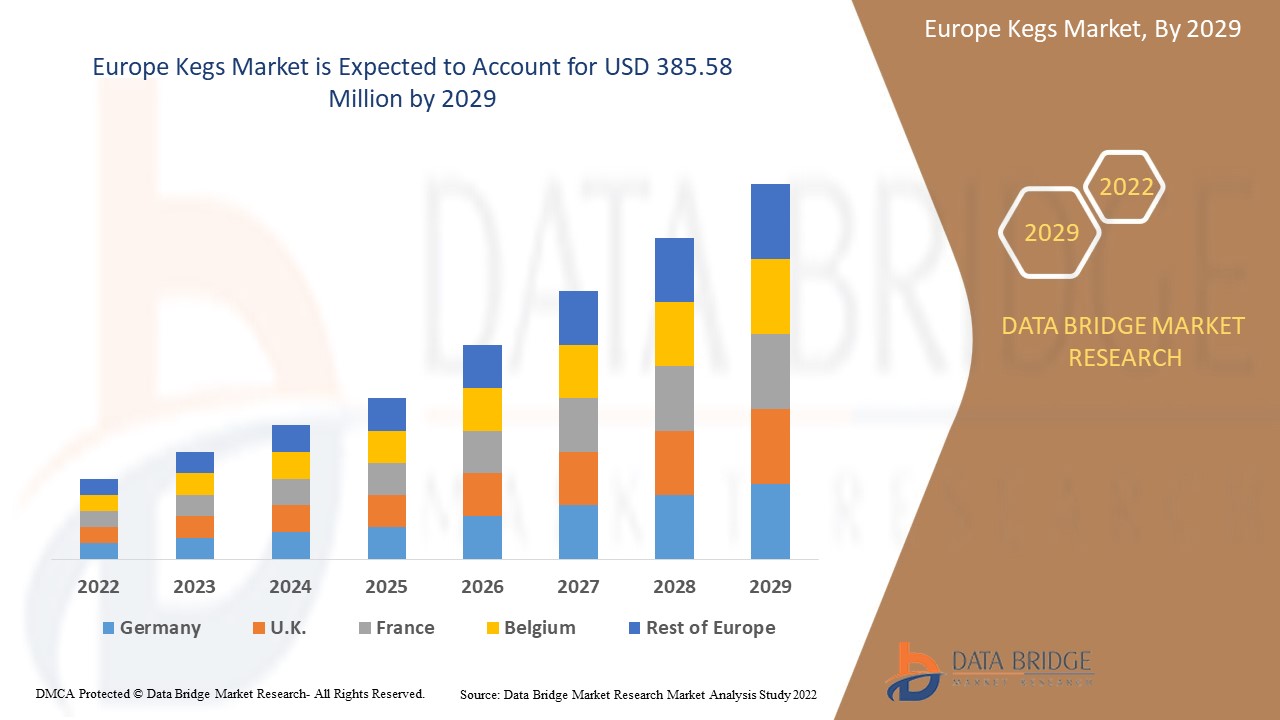

Data Bridge Market Researchは、ヨーロッパの樽市場は予測期間中に4.2%のCAGRで成長し、2029年までに3億8,558万米ドルの価値に達すると予測していると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、販売数量は百万単位、価格は米ドル |

|

対象セグメント |

材質別(プラスチック、ブリキ、ステンレス)、容量別(20リットルまで、20リットルから40リットル、40リットルから60リットル、60リットル以上)、エンドユーザー別(アルコール飲料、ノンアルコール飲料、食用油、化学薬品、その他)、流通チャネル別(スーパーマーケット/ハイパーマーケット、商業酒屋、その他)。 |

|

対象国 |

英国、ドイツ、フランス、オランダ、ベルギー、スペイン、スイス、イタリア、ロシア、トルコ、その他のヨーロッパ諸国。 |

|

対象となる市場プレーヤー |

NDL Keg Europe、BLEFA GmbH、Julius Kleemann GmbH & Co.KG、The Metal Drum Company、Petainer Ltd.、NEW MAISONNEUVE KEG、Schaefer Container Systems、Supermonte Group Italy, Inc.、および KeyKeg |

市場の定義

ケグは小さな樽です。飲料、化学薬品、油、さまざまな液体は、さまざまな原材料で作られたケグで輸送され、保管されます。ケグは一般にステンレス鋼で作られることが多いですが、内側にプラスチックコーティングが施されている場合はアルミニウムも使用できます。ビールは頻繁に輸送され、提供され、保管されます。ケグには、炭酸入りまたは炭酸なしの追加のアルコール飲料やノンアルコール飲料を入れることもできます。炭酸飲料の圧力を維持して、溶液中の二酸化炭素を維持し、飲料の炭酸が抜けないようにするのが一般的な方法です。

ヨーロッパの樽市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

- 化学分野での樽の用途拡大

化学薬品貯蔵樽は、さまざまな業界でさまざまなタイプの化学物質を保管するために使用されている高品質の貯蔵容器です。さまざまな形やサイズがあり、常に人気があります。工業用化学薬品貯蔵樽は重要な化学薬品貯蔵システムです。化学物質は腐食性があるため、安全な場所に保管する必要があります。化学薬品樽は、化学業界で頻繁に使用される化学薬品貯蔵容器です。さまざまなサイズと形状があり、原材料と完成した化学製品の両方の静的貯蔵、処理、混合、輸送に使用されます。

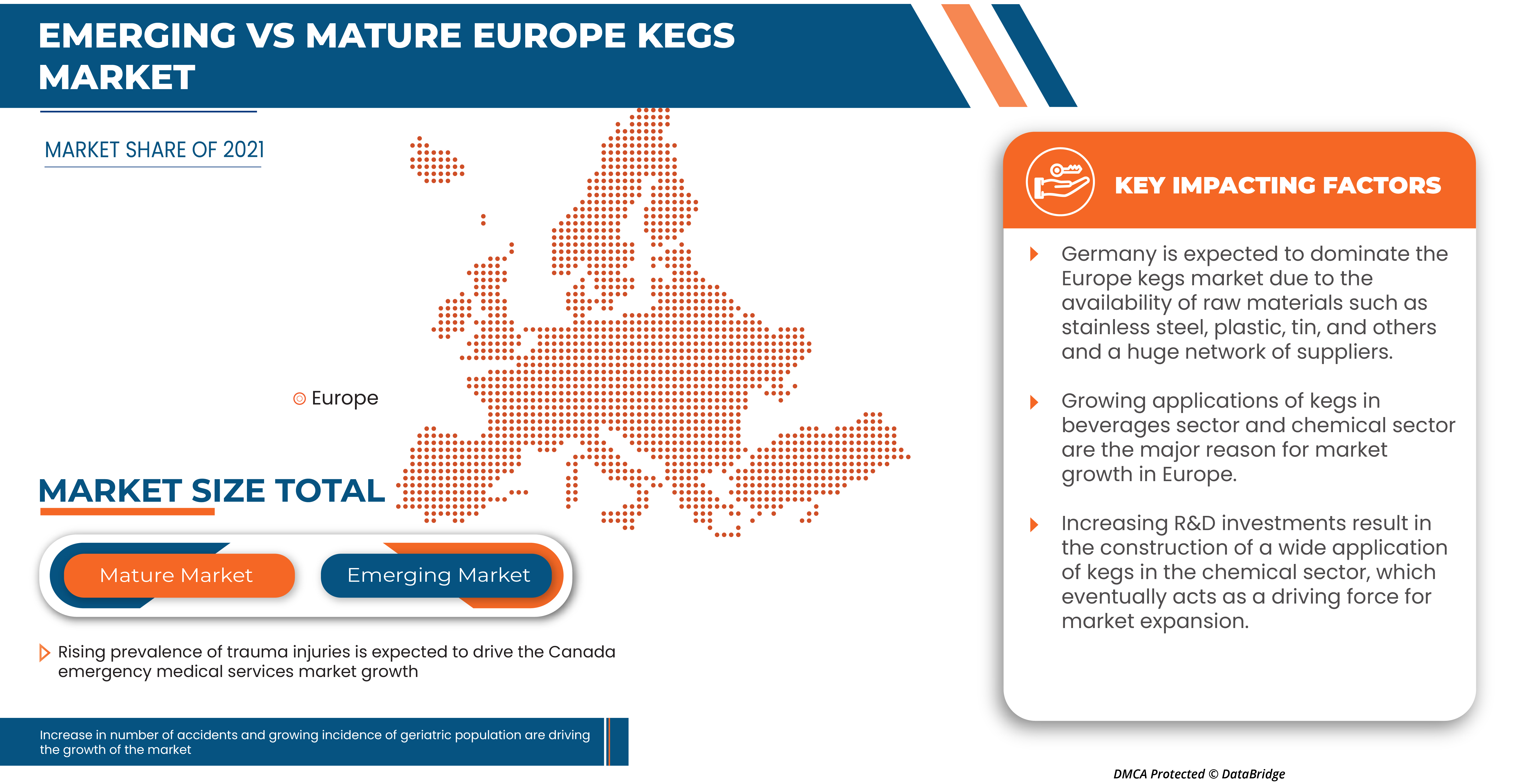

現在、ほとんどの樽および化学企業は研究開発に投資しており、化学分野での樽の用途が急増しています。

研究開発投資の増加により、化学分野での樽の幅広い用途の構築が実現し、最終的には市場拡大の原動力として機能します。

- 長期保存包装および保存ソリューションのトレンドが増加

飲料業界では、樽をパッケージングソリューションとして使用することに将来性があると予想されています。プラスチック製の樽はリサイクルでき、返送コストも低くなります。一方、樽の人気が高まり、メーカーが樽をリースで提供するようになったため、樽の採用が拡大しています。使い捨ての樽は、従来のスチール製の樽よりも経済的で効果的な代替品であり、近い将来広く使用されるようになると予想されています。さらに、クラフトビールに対する消費者の熱意により地ビール部門が拡大しており、世界の樽業界を後押ししています。パッケージの重量制限を低く抑えるという法的制約により、樽の使用が促進されると予想されます。また、樽は飲料、油、化学薬品などの溶液を保存して、製品の品質と風味を保つためにも使用されます。

例えば、

- 2021年9月、Newsmatics Inc.は「樽は有望な長期的包装ソリューションとして人気が高まっている」と題した記事を発表し、飲料の包装オプションとして樽は有望な将来性があると予想されていると伝えています。

- 2020年9月、Hospitality Net™は「樽詰めワイン:スイスの持続可能なイノベーション」と題した記事を公開し、樽詰めワインはワインの品質を完璧に保護しながら、実用的で環境に優しく、費用対効果が高いと伝えています。

長期包装や保存ソリューションなどの樽の用途に対するエンドユーザーの意識の高まりが市場の成長を促進しています。

拘束

- 樽の寿命が長いため、樽の交換が遅い

樽の寿命が長いため、顧客が製品を購入する頻度は低くなります。古い樽から新しい樽に切り替えるには長い時間がかかるため、このタイムラグが市場拡大の障壁となる可能性があります。

例えば、

- 2020 年 3 月、Keg Works は「樽はどのくらい新鮮さを保てるか」という記事を公開しました。記事では、適切な温度で保管した場合、低温殺菌したビールの樽の賞味期限は約 90 ~ 120 日 (または 3 ~ 4 か月)、低温殺菌していない生ビールの賞味期限は約 45 ~ 60 日 (または 6 ~ 8 週間) であると述べられています。

さまざまな樽の寿命は、以下の表に記載されています。

|

製品名 |

寿命 |

|

ワイン樽 |

6~8週間 |

|

非加熱ビール樽 |

6~8週間 |

|

低温殺菌樽 |

3~4週間 |

|

カクテル樽 |

約2ヶ月 |

|

サイダー樽 |

6~8週間 |

寿命の長い樽はエンドユーザーに役立つかもしれませんが、樽の交換の遅れは市場の成長の障壁となる可能性があります。

- 商業用樽に関連する高コスト

価格が下がれば、ほぼ確実に新規の消費者や樽の売上が生まれます。一方、価格が高ければ、購入者は製品を購入する量が減り、結果として会社の売上が減ります。業務用樽のコストが高いことは、エンドユーザーが業務用樽に投資し続ける余裕がないため、市場の障壁となります。最終的には、市場の成長の障壁として機能します。

例えば、

|

製品名 |

価格 |

|

業務用ビールディスペンサー ケグレーター - 4 タップストア 4 ケグ |

44,000インドルピー |

|

ボールロック コーニーケグ: 自家製醸造用発酵槽 |

5,824インドルピー |

|

ステンレススチールビール樽 商業用樽 50リットル ユーロ規格 |

1個あたり55~65米ドル |

|

1ガロン、30リットルの商業醸造ビール樽、CO2レギュレーター付き |

54.59~56.69米ドル/個 |

|

空の商業醸造カスタマイズ樽 30l ステンレススチールビール樽 30l ビール樽 |

44.48~57.65米ドル/個 |

前述の業務用樽の価格は高く、最終消費者の手の届かない価格であるため、市場の拡大はいずれ鈍化するでしょう。

機会

- 最先端技術などの樽の技術の進歩が進む

自動化と技術の発展により、樽製造の効率が向上しました。これらの施設では、GPS と RFID 技術の両方を使用してモノのインターネット (IoT) にリンクされたスマート樽追跡センサーや、温度制御などにより、コストと主要システムをより適切に管理できます。樽自動化技術には、スマートセンサー、モバイルタブレットとスマートフォン、ソフトウェア、API、クラウドデータベースが含まれます。樽の技術主導の自動化により、アルコール飲料やノンアルコール飲料、炭酸飲料や非炭酸飲料、その他の飲料のフルフィルメントが強化され、保管と輸送が改善されます。

The quick increase in R&D and technological progress in keg manufacturing will help in providing an opportunity for market growth and expansion.

As a result, opportunities in the market are anticipated to arise from ongoing technological developments in keg manufacturing.

CHALLENGE

- Growing stiff competition among players

Since there is intense competition among the current kegs industry players, this will result in lower prices and less overall profitability for the sector. Kegs is a highly competitive packaging and container market. The organization's total long-term profitability is affected by this competition. Due to the intense rivalry, businesses primarily concentrate on increasing the number of product releases, campaigns, and marketing to attract consumers. So, this competition among the players will be a challenge for the market.

Companies that produce and supply comparable goods are more competitive with one another, which could threaten the market due to large supply and low demand.

Post-COVID-19 Impact on Europe Kegs Market

Post-pandemic, the demand for kegs increased as there were no restrictions on movement, hence, the supply of products was easy. The persistence of COVID-19 for a longer period affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially increasing the demand for products. However, post-COVID-19, the demand for kegs increased significantly owing to good nutrient content and other nutritional availability.

Recent Developments

- In June, 2022, Ara Partners ("Ara"), a private equity firm specializing in industrial decarburization investments, announced the acquisition of Petainer Ltd. ("Petainer" or the "Company"), a UK-based global producer of sustainable beverage packaging solutions. Ara acquired Petainer in collaboration with Petainer Management and Next Wave Partners LLP affiliates.

- In May 2022, BLEFA joined forces with other leading global keg supply chain companies to launch the new Steel Keg Association (SKA) to give benefits of steel kegs to breweries and beverage companies, as well as bars and restaurants, a unified voice.

Europe Kegs Market Scope

The Europe kegs market is segmented into four notable segments based on material, capacity, end user, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Material

- Plastic

- Tin

- Stainless Steel

Based on material, the market is segmented into plastic, tin, and stainless steel.

Capacity

- Up To 20 Litre

- 20 Litre To 40 Litre

- 40 Litre To 60 Litre

- Above 60 Litre

Based on capacity, the market is segmented into up to 20 litre, 20 litre to 40 litre, 40 litre to 60 litre, and above 60 litre.

End User

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cooking Oil

- Chemicals

- Others

エンドユーザーに基づいて、市場はアルコール飲料、ノンアルコール飲料、食用油、化学薬品、その他に分類されます。

流通チャネル

- スーパーマーケット/ハイパーマーケット

- 商業酒類販売店

- その他

流通チャネルに基づいて、市場はスーパーマーケット/ハイパーマーケット、商業酒屋、その他に分類されます。

ヨーロッパの樽市場の地域分析/洞察

ヨーロッパの樽市場が分析され、市場規模の洞察と傾向が、上記のように国、材料、容量、エンドユーザー、流通チャネル別に提供されます。

この市場レポートで取り上げられている国は、英国、ドイツ、フランス、オランダ、ベルギー、スペイン、スイス、イタリア、ロシア、トルコ、およびその他のヨーロッパ諸国です。

ドイツはヨーロッパの樽市場を独占しています。飲料の需要増加がヨーロッパの市場成長の主な理由です。さらに、飲料市場はヨーロッパ地域で着実に成長しています。この市場の成長は樽市場の成長に直接影響します。ただし、商業用樽のコストが高いため、市場の成長が制限される可能性があります。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパ ブランドの存在と可用性、地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境とヨーロッパの樽市場シェア分析

ヨーロッパの樽市場の競争状況は、競合他社ごとに詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、ヨーロッパでのプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、市場に対する会社の重点にのみ関連しています。

この市場で活動している主要企業としては、NDL Keg Europe、BLEFA GmbH、Julius Kleemann GmbH & Co.KG、The Metal Drum Company、Petainer Ltd.、NEW MAISONNEUVE KEG、Schaefer Container Systems、Supermonte Group Italy、Inc.、KeyKeg などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE KEGS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 MATERIAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.3 IMPORT-EXPORT ANALYSIS

4.4 LIST OF KEY BUYERS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 CLIMATE CHANGE SCENARIO

7 SUPPLY CHAIN ANALYSIS

7.1 RAW MATERIAL

7.2 SUPPLYING/MANUFACTURING

7.3 DISTRIBUTION

7.4 END-USERS

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING TREND OF LONG-TERM PACKAGING AND PRESERVING SOLUTIONS

8.1.2 INCREASING CONSUMPTION OF BEVERAGES DUE TO CHANGE IN GRADUAL LIFESTYLE

8.1.3 GROWING APPLICATION OF KEGS IN CHEMICAL SECTORS

8.2 RESTRAINTS

8.2.1 HIGH COST ASSOCIATED WITH COMMERCIAL KEGS

8.2.2 SLOW REPLACEMENT OF KEGS DUE TO THEIR PROLONGED LIFESPAN

8.3 OPPORTUNITIES

8.3.1 INCREASED DEMAND FOR ECO-FRIENDLY KEGS AS A RESULT OF THE SUSTAINABILITY TREND

8.3.2 INCREASING ADVANCEMENTS IN TECHNOLOGIES IN KEGS SUCH AS CUTTING-EDGE TECHNOLOGY

8.4 CHALLENGES

8.4.1 WIDE FLUCTUATIONS IN PRICE OF RAW MATERIAL

8.4.2 GROWING STIFF COMPETITION AMONG PLAYERS

9 EUROPE KEGS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 STAINLESS STEEL

9.3 PLASTIC

9.4 TIN

10 EUROPE KEGS MARKET, BY CAPACITY

10.1 OVERVIEW

10.2 40 LITRE TO 60 LITRE

10.3 20 LITRE TO 40 LITRE

10.4 ABOVE 60 LITRE

10.5 UP TO 20 LITRE

11 EUROPE KEGS MARKET, BY END USER

11.1 OVERVIEW

11.2 ALCOHOLIC BEVERAGES

11.2.1 BEER

11.2.2 WINE

11.2.3 SPIRITS

11.2.4 CIDER

11.3 NON-ALCOHOLIC BEVERAGES

11.3.1 SOFT-DRINKS

11.3.2 RTD-BEVERAGES

11.3.3 JUICES

11.3.4 OTHERS

11.4 CHEMICALS

11.5 COOKING OIL

11.6 OTHERS

12 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 COMMERCIAL LIQUOR STORE

12.3 SUPERMARKET / HYPERMARKET

12.4 OTHERS

13 EUROPE KEGS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 SPAIN

13.1.3 U.K.

13.1.4 ITALY

13.1.5 FRANCE

13.1.6 NETHERLANDS

13.1.7 BELGIUM

13.1.8 SWITZERLAND

13.1.9 RUSSIA

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILES

16.1 BLEFA GMBH

16.1.1 COMPANY SNAPSHOT

16.1.2 COMPANY SHARE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 PETAINER LTD.

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 JULIUS KLEEMANN GMBH & CO. KG

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 NDL KEG EUROPE

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 NEW MAISONNEUVE KEG

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 AMERICAN KEG COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 KEYKEG

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENTS

16.8 SCHAEFER CONTAINER SYSTEMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 SHINHAN INDUSTRIAL CO,. LTD.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 SUPERMONTE GROUP ITALY, INC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 THE METAL DRUM COMPANY

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

表のリスト

TABLE 1 IMPORT OF KEGS, 2020-2021, IN USD MILLION

TABLE 2 EXPORT OF KEGS (CASKS, BARRELS, VATS, TUBS AND OTHER COOPERS' PRODUCTS PARTS THEREOF, OF WOOD, INCL. STAVES), 2020-2021, IN USD MILLION

TABLE 3 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 4 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 5 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE STAINLESS STEEL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE PLASTIC IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TIN IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 13 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE 40 LITRE TO 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE 20 LITRE TO 40 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 17 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ABOVE 60 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 19 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 EUROPE UP TO 20 LITRE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 21 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 22 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 23 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 25 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 27 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 29 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 31 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 EUROPE CHEMICALS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 33 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 EUROPE COOKING OIL IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 35 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 37 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 39 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 EUROPE COMMERCIAL LIQUOR STORE IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 41 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 EUROPE SUPERMARKET / HYPERMARKET IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 43 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 EUROPE OTHERS IN KEGS MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 45 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE KEGS MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 47 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 48 EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 49 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 50 EUROPE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 51 EUROPE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 52 EUROPE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 53 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 54 EUROPE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 55 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 56 EUROPE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 57 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 59 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 60 GERMANY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 61 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 62 GERMANY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 63 GERMANY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 64 GERMANY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 65 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 66 GERMANY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 67 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 GERMANY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 69 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 70 GERMANY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 71 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 72 SPAIN KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 73 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 75 SPAIN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 76 SPAIN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 77 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 78 SPAIN ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 79 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 80 SPAIN NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 81 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 SPAIN KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 83 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 84 U.K. KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 85 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 86 U.K. KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 87 U.K. KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 88 U.K. KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 89 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 90 U.K. ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 91 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 U.K. NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 93 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 U.K. KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 95 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 ITALY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 97 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 98 ITALY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 99 ITALY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 ITALY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 101 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 102 ITALY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 103 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 104 ITALY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 105 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 ITALY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 107 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 108 FRANCE KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 109 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 110 FRANCE KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 111 FRANCE KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 112 FRANCE KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 113 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 114 FRANCE ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 115 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 FRANCE NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 117 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 118 FRANCE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 119 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 120 NETHERLANDS KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 121 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 122 NETHERLANDS KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 123 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 124 NETHERLANDS KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 125 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 126 NETHERLANDS ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 127 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 128 NETHERLANDS NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 129 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 130 NETHERLANDS KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 131 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 132 BELGIUM KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 133 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 134 BELGIUM KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 135 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 136 BELGIUM KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 137 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 BELGIUM ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 139 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 BELGIUM NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 141 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 BELGIUM KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 143 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 144 SWITZERLAND KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 145 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 146 SWITZERLAND KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 147 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 148 SWITZERLAND KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 149 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 150 SWITZERLAND ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 151 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 152 SWITZERLAND NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 153 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 154 SWITZERLAND KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 155 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 156 RUSSIA KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 157 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 158 RUSSIA KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 159 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 RUSSIA KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 161 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 162 RUSSIA ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 163 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 RUSSIA NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 165 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 166 RUSSIA KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 167 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 168 TURKEY KEGS MARKET, BY MATERIAL, 2020-2029 (THOUSAND UNITS)

TABLE 169 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (USD MILLION)

TABLE 170 TURKEY KEGS MARKET, BY CAPACITY, 2020-2029 (THOUSAND UNITS)

TABLE 171 TURKEY KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 172 TURKEY KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 173 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 174 TURKEY ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 175 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 176 TURKEY NON-ALCOHOLIC BEVERAGES IN KEGS MARKET, BY END USER, 2020-2029 (THOUSAND UNITS)

TABLE 177 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 178 TURKEY KEGS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (THOUSAND UNITS)

TABLE 179 REST OF EUROPE KEGS MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 2 EUROPE KEGS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE KEGS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE KEGS MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE KEGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE KEGS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE KEGS MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE KEGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE KEGS MARKET: SEGMENTATION

FIGURE 10 RISING TREND OF LONG-TERM PAKAGING&PRESERVING SOLUTIONS IS EXPECTED TO DRIVE THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 STAINLESS STEEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE KEGS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 SUPPLY CHAIN OF EUROPE KEGS MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE KEGS MARKET

FIGURE 14 EUROPE KEGS MARKET, BY MATERIAL, 2021

FIGURE 15 EUROPE KEGS MARKET, BY CAPACITY, 2021

FIGURE 16 EUROPE KEGS MARKET, BY END USER, 2021

FIGURE 17 EUROPE KEGS MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 18 EUROPE KEGS MARKET: SNAPSHOT (2021)

FIGURE 19 EUROPE KEGS MARKET: BY COUNTRY (2021)

FIGURE 20 EUROPE KEGS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 EUROPE KEGS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 EUROPE KEGS MARKET: BY MATERIAL (2022-2029)

FIGURE 23 EUROPE KEGS MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。