ヨーロッパの健康とウェルネス食品市場、タイプ別(機能性食品、強化および健康的なベーカリー製品、健康的なスナック、BFY食品、飲料、チョコレートなど)、カロリー含有量(無カロリー、低カロリー、カロリー削減)、性質(非遺伝子組み換えおよび遺伝子組み換え)、脂肪含有量(無脂肪、低脂肪、脂肪削減)、カテゴリー(従来型およびオーガニック)、フリーフロムカテゴリー(グルテンフリー、乳製品フリー、大豆フリー、ナッツフリー、ラクトースフリー、人工香料フリー、人工着色料フリーなど)、流通チャネル(店舗型小売業者および非店舗型小売業者)、業界動向および2029年までの予測。

市場分析と洞察

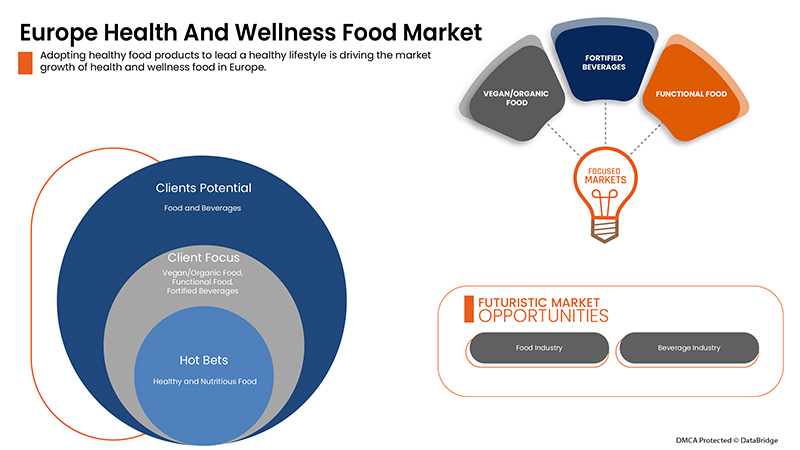

世界の健康とウェルネス食品市場は、バランスの取れた食事へのより総合的なアプローチを採用するために、より自然で機能的な製品を求める顧客の嗜好の変化により、パッケージ食品業界よりも急速に成長しています。食習慣を変え、バランスの取れた栄養のある食事とアクティブなライフスタイルを取り入れる人が増えていることが、健康とウェルネス食品業界の成長を牽引する大きな要因です。世界中の人々が健康的な食事、運動、定期的な身体活動の価値を認識しており、これは市場の成長にとって重要です。ただし、健康とウェルネス食品の高価格と高い維持費が市場の成長を妨げる可能性があります。

無機製品よりも天然原料から作られたオーガニック食品の消費量の増加は、世界の健康食品市場に新たなチャンスをもたらすでしょう。対照的に、市場プレーヤー間の激しい競争は、市場の成長を妨げる可能性があります。

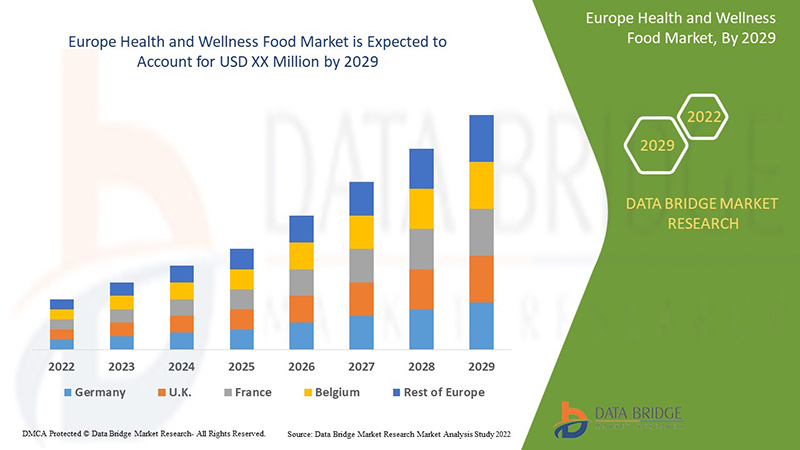

Data Bridge Market Research は、ヨーロッパの健康とウェルネス食品市場は、2022 年から 2029 年の予測期間中に 9.0% の CAGR で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2015 にカスタマイズ可能) |

|

定量単位 |

収益(10億米ドル) |

|

対象セグメント |

タイプ別(機能性食品、栄養強化および健康ベーカリー製品、健康スナック、BFY食品、飲料、チョコレートなど)、カロリー含有量(無カロリー、低カロリー、カロリーカット)、性質別(非遺伝子組み換えおよび遺伝子組み換え)、脂肪含有量(無脂肪、低脂肪、脂肪カット)、カテゴリー別(従来およびオーガニック)、不使用カテゴリー別(グルテンフリー、乳製品フリー、大豆フリー、ナッツフリー、ラクトースフリー、人工香料フリー、人工着色料フリーなど)、流通チャネル別(店舗型小売業者および店舗型以外の小売業者) |

|

対象地域 |

スペイン、イタリア、フランス、ドイツ、イギリス、スイス、オランダ、ベルギー、ロシア、トルコ、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

Maspex、ペプシコ、ゼネラル・ミルズ、マース・インコーポレーテッド、ネスレ、ダノン、アボット、ヒューエル、GSKグループ、クリフ・バー・アンド・カンパニー、ヨープレイトUSA、チョバニ、LLC、SO DELICIOUS DAIRY FREE、ザ・シンプリー・グッド・フーズ・カンパニー、モンデリーズ・インターナショナル、ケロッグ、ザ・クエーカー・オーツ・カンパニー、ヤクルト本社、リベルテ |

市場の定義

食品、健康、ウェルネスはすべて相互に関連しています。私たちが摂取する食品とその産地は、私たちの健康とフィットネスに影響を与えます。ウェルネスは、私たちが日々の生活に取り入れるバランスの取れた食品から生まれます。健康とは、単に良い食品を食べることだけでなく、緊張やストレスを軽減し、定期的に運動することです。食品、健康、ウェルネス食品は、機能的な要素を加えたり、加工方法を変更したりすることで、病気のリスクや治療を減らし、身体的または精神的なパフォーマンスを向上させるのに役立ちます。

ヨーロッパの健康とウェルネス食品市場の動向

ドライバー

- 健康食品への支出増加

消費者の可処分所得が増加し、世帯が貯蓄したり食費に使ったりできるお金が増えたため、当然のことながら健康食品の消費量が増加し、世界的な健康・ウェルネス食品市場の需要が生まれました。このように、消費者の可処分所得が増加することで、健康的な生活を送るためにより多くの栄養飲料を購入できるようになり、市場の成長が促進されます。さらに、健康食品や栄養食品への支出の増加により、人々の健康維持に役立つ食品の需要が高まっています。

このように、可処分所得の増加により、消費者は健康維持のために栄養飲料などの健康食品に多くのお金を使うようになり、それがヨーロッパの健康・ウェルネス食品市場の成長を牽引すると予想されます。

- クリーンラベル食品の需要増加

クリーン ラベル食品には、最も自然で加工度の低い原料が含まれています。消費者は、より健康的なライフスタイルを送るために健康的で衛生的な食品オプションを選択しているため、健康食品とウェルネス食品の需要が高まっています。消費者は、特定のライフスタイルを継続するために、保存料や添加物を含まないクリーンなラベル付き食品を好む傾向が高まっています。また、クリーン ラベル製品を使用することで持続可能な環境を促進することに対する意識が高まっており、市場の成長を後押ししています。クリーン ラベル食品の需要が高まると、健康食品とウェルネス メーカーはより多くの製品を投入できるようになり、市場の成長に寄与します。

したがって、消費者に高品質の製品を提供し、クリーンラベルと健康食品に対する高まるニーズを満たすためにクリーンラベルの安全製品を導入するメーカーの数が増えることで、ヨーロッパの健康・ウェルネス食品市場の成長が促進されると予想されます。

機会

-

ミレニアル世代の食習慣とライフスタイルの変化

The millennials' changing eating habits are more inclined towards conscious indulgence, which means that while they want to indulge in eating out and eating right, they want to be mindful of what they eat and select their places after thorough consideration. Millennials are willing to pay for fresh, healthy food. They love food and flavors from multiple cultures and engage in distribution channels like meal services and smoothie deliveries. Thus, the changing eating habits of millennials create an opportunity for the Europe health and wellness food market.

Thus, these changing eating preferences create an opportunity for the nutritional food and beverages market, and manufacturers are trying to fulfill the demands of millennials. This is projected to create ample opportunities for the growth of the Europe health and wellness food product market.

Restraints/Challenges

- Lack of awareness among people and skepticism towards healthy food & beverages

The limited or lack of awareness about the health benefits and nutritional value of nutritional food & beverages creates skepticism about the products. Consumers are hesitant about consuming nutritional beverages due to increased contamination and adulteration in food & beverages. Thus, this ultimately creates skepticism among the consumers, who think twice before buying the food or beverage to avoid the side effects. This is the key challenging factor for the market growth. Lack of understanding about nutritional labeling on food & beverages creates confusion among consumers. The nutritional labels can be misleading, and in some cases, these are false claims, creating hesitation among consumers to choose proper healthy food & beverages.

However, manufacturers are trying to add more value to the nutritional and healthy beverages and clearly label the products' nutritional value.

Thus, the increasing skepticism and lack of awareness about the nutritional content and health benefits of health and wellness products among some consumers may hamper the market's growth.

Post-COVID-19 Impact on Europe Health and Wellness Food Market

The COVID-19 pandemic has affected the global health and wellness food market significantly. The persistence of COVID-19 for a longer period has affected the supply chain as it got disrupted, and it became difficult to supply the food products to the consumers, initially decreasing the demand for food products. However, post covid, the demand for health and wellness food products has increased significantly owing to increased awareness about the side effects of unhealthy food and the urge to stay fit and healthy. Consumers are trying to have the most nutritious products such as plant-based, vegan, and nutritional food and beverages to avoid medical conditions.

Thus, the trend of having healthy eating patterns has significantly affected the market, which is leading the market towards rapid growth in the coming years.

Recent Developments

- In May 2022, Oreo is launching a new range of gluten-free Oreos in the United States, Oreo Zero in China, Lacta Intense in Brazil, and Caramilk, a chocolate product, in Australia. These products result from new formulations for health-conscious consumers as health and well-being continue to be a focus of innovation for the company

Europe Health and Wellness Food Market Scope

Europe health and wellness food market are segmented on type, calorie content, nature, fat content, category, free from the category, and distribution channel. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Functional Food

- Fortified and Healthy Bakery Products

- Healthy Snacks

- BFY Foods

- Beverages

- Chocolates

- Others

By type, the Europe health and wellness food market is segmented into functional food, fortified and healthy, bakery products, healthy snacks, BFY foods, beverages, chocolates, and others.

Calorie Content

- No calorie

- Low calories

- Reduced calorie

By calorie content, the Europe health and wellness food market is segmented into no calorie, low calories, and reduced calorie.

Nature

- Non-GMO

- GMO

By nature, the Europe health and wellness food market is segmented into non-GMO and GMO.

Fat Content

- No fat

- Low fat,

- Reduced-fat

By fat content, the Europe health and wellness food market is segmented into no fat, low fat, and reduced fat.

Category

- Conventional

- Organic

By category, the Europe health and wellness food market is segmented into conventional and organic

Free From Category

- Gluten-Free

- Dairy-Free

- Soy-Free

- Nut-Free

- Lactose-Free

- Artificial Flavor Free

- Artificial Color Free

- Others

By free from category, the Europe health and wellness food market is segmented into gluten free, dairy free, soy free, nut free, lactose free, artificial flavor free, artificial color free and others.

Distribution Channel

- Store-based retailers

- Non-store retailers

By distribution channel, the Europe health and wellness food market is segmented into store based retailers and non-store retailers.

Europe Health and Wellness Food Market Regional Analysis/Insights

Europe health and wellness food market are analyzed, and market size insights and trends are provided based on as referenced above.

The countries covered in the Europe health and wellness food market report are the Spain, Italy, France, Germany, U.K, Switzerland, Netherlands, Belgium, Russia, Turkey and rest of Europe.

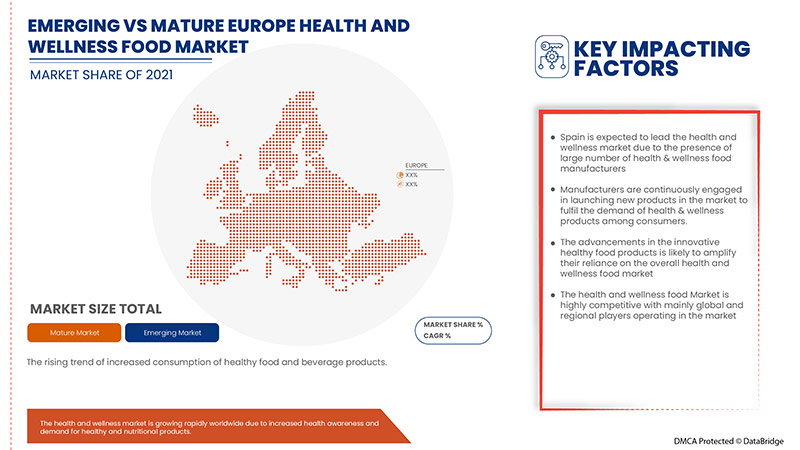

Spain is expected to dominate the Europe health and wellness food market regarding market share and revenue. It is estimated to maintain its dominance during the forecast period due to the rising trend of increased consumption of healthy food and beverage and growing consumer demand for functional food.

レポートの地域セクションでは、市場の現在および将来の傾向に影響を与える個々の市場影響要因と市場規制の変更も提供しています。新規および交換販売、国の人口統計、疾病疫学、輸出入関税などのデータポイントは、個々の国の市場シナリオを予測するために使用される主要な指標の一部です。さらに、国別データの予測分析を提供する際には、グローバルブランドの存在と可用性、地元および国内ブランドとの激しい競争により直面する課題、販売チャネルの影響が考慮されています。

競争環境とヨーロッパの健康・ウェルネス食品市場シェア分析

ヨーロッパの健康とウェルネス食品市場の競争環境は、競合他社の詳細を示しています。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、グローバルなプレゼンス、生産拠点と施設、生産能力、会社の長所と短所、製品の発売、製品の幅と広さ、アプリケーションの優位性が含まれます。上記のデータ ポイントは、ヨーロッパの健康とウェルネス食品市場への企業の重点にのみ関連しています。

ヨーロッパの健康・ウェルネス食品市場で事業を展開している主要企業には、Maspex、PepsiCo、General Mills Inc.、Mars, Incorporated、Nestlé、Danone、Abbott、Huel Inc.、GSK Group of Companies、Clif Bar & Company、Yoplait USA, Inc.、Chobani, LLC.、SO DELICIOUS DAIRY FREE、The Simply Good Foods Company、Mondelez International、Kellogg Co.、The Quaker Oats Company、Yakult Honsha Co., Ltd.、LIBERTÉ などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE HEALTH AND WELLNESS FOOD MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS

4.3 CONSUMER LEVEL TRENDS OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.3.1 OVERVIEW

4.3.2 HIGH NUTRITIONAL VALUE

4.3.3 PLANT-BASED AND ORGANIC PRODUCTS

4.3.4 ON-THE-GO FOOD PRODUCTS

4.3.5 HEALTHY SNACKING

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 GROWING CONSUMERS' INTEREST IN PLANT-BASED DIETS

4.4.2 DEMAND FOR FREE-FROM FOODS PRODUCTS

4.4.3 HEALTHY AND SUSTAINABLE FOOD AVAILABILITY

4.4.4 PRICING OF HEALTH AND WELLNESS FOOD

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF EUROPE HEALTH AND WELLNESS FOOD MARKET

4.5.1 MANUFACTURERS LAUNCHING NATURAL INGREDIENT-BASED FOOD PRODUCTS

4.5.2 GROWING PRODUCTION OF A WIDE RANGE OF HEALTH AND WELLNESS FOOD BY MANUFACTURERS

4.5.3 MANUFACTURERS FOCUSING ON THE DEVELOPMENT OF NUTRACEUTICAL FOOD PRODUCTS

4.6 LIST OF KEY SOURCES OF MARKET INSIGHTS

4.7 MEETING CONSUMER REQUIREMENTS

4.8 NEW PRODUCT LAUNCH STRATEGY

4.8.1 NUMBER OF PRODUCT LAUNCHES

4.8.1.1 LINE EXTENSION

4.8.1.2 NEW PACKAGING

4.8.1.3 RELAUNCHED

4.8.1.4 NEW FORMULATION

4.9 PRIVATE LABEL VS BRAND LABEL

4.1 PROMOTIONAL ACTIVITIES

4.11 REGULATIONS, CERTIFICATION, AND LABELLING CLAIMS

4.11.1 REGULATIONS

4.11.2 LABELING AND CLAIM

4.11.3 CERTIFICATIONS

4.11.3.1 BRC FOOD SAFETY CERTIFICATION

4.11.3.2 AGMARK CERTIFICATION

4.11.3.3 PLANT AND PLANT PRODUCTS

4.12 SHOPPING BEHAVIOR AND DYNAMICS

4.12.1 RECOMMENDATIONS FROM FAMILY AND FRIENDS-

4.12.2 RESEARCH

4.12.3 IMPULSIVE

4.12.4 ADVERTISEMENT:

4.12.4.1 TELEVISION ADVERTISEMENT

4.12.4.2 ONLINE ADVERTISEMENT

4.12.4.3 IN-STORE ADVERTISEMENT

4.12.4.4 OUTDOOR ADVERTISEMENT

4.12.5 CONCLUSION

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIAL PROCUREMENT

4.13.2 MANUFACTURING PROCESS

4.13.3 MARKETING AND DISTRIBUTION

4.13.4 END USERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES

5.1.2 INCREASING DISPOSABLE INCOME AND GROWING EXPENDITURE ON HEALTHY FOOD PRODUCTS

5.1.3 INCREASING DEMAND FOR VEGAN/PLANT-BASED HEALTHY FOOD

5.1.4 GROWING DEMAND FOR CLEAN LABEL FOOD

5.2 RESTRAINTS

5.2.1 INCREASING REGULATION ON FORTIFIED FOOD & BEVERAGES

5.2.2 HIGHER PRICES OF HEALTHY NUTRITIONAL FOOD & BEVERAGES

5.3 OPPORTUNITIES

5.3.1 INCREASE IN NUMBER OF LAUNCHES OF HEALTH AND WELLNESS FOOD & BEVERAGE PRODUCTS

5.3.2 CHANGE IN EATING HABITS AND LIFESTYLE OF MILLENNIALS

5.3.3 GROWING DEMAND FOR NON-ALCOHOLIC DRINKS THAT PROVIDE HEALTH BENEFITS

5.4 CHALLENGES

5.4.1 DISRUPTED SUPPLY CHAIN DUE TO COVID-19

5.4.2 LACK OF AWARENESS AMONG PEOPLE AND SKEPTICISM TOWARDS HEALTHY FOOD & BEVERAGES

6 POST-COVID IMPACT ON THE EUROPE HEALTH AND WELLNESS FOOD MARKET

6.1 AFTERMATH OF COVID-19

6.2 IMPACT ON DEMAND AND SUPPLY CHAIN

6.3 IMPACT ON PRICE

6.4 CONCLUSION

7 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY TYPE

7.1 OVERVIEW

7.2 FUNCTIONAL FOOD

7.2.1 FUNCTIONAL FOOD, BY TYPE

7.2.1.1 BREAKFAST CEREAL PRODUCTS

7.2.1.1.1 BREAKFAST CEREAL FLAKES

7.2.1.1.2 BREAKFAST OATMEAL

7.2.1.1.3 BREAKFAST CEREAL PORRIDGE

7.2.1.1.4 BREAKFAST COOKIES

7.2.1.1.5 OTHERS

7.2.1.2 YOGURTS

7.2.1.2.1 YOGURT, BY TYPE

7.2.1.2.1.1 REGULAR YOGURTS

7.2.1.2.1.2 CONCENTRATED YOGURT

7.2.1.2.1.3 PROBIOTIC YOGURT

7.2.1.2.1.4 SET YOGURT

7.2.1.2.1.5 BIO LIVE YOGURT

7.2.1.2.1.6 STIRRED YOGURT

7.2.1.2.1.7 OTHERS

7.2.1.2.2 YOGURT, BY CATEGORY

7.2.1.2.2.1 FROZEN YOGURT

7.2.1.2.2.2 DRINKABLE YOGURT

7.2.1.2.2.3 SPOONABLE YOGURT

7.2.1.2.2.4 OTHERS

7.2.1.2.3 YOGURT, BY FLAVOR

7.2.1.2.3.1 PLAIN

7.2.1.2.3.2 FLAVORED

7.2.1.2.3.2.1 STRAWBERRY

7.2.1.2.3.2.2 VANILLA

7.2.1.2.3.2.3 BLUEBERRY

7.2.1.2.3.2.4 PEACH

7.2.1.2.3.2.5 BANANA

7.2.1.2.3.2.6 BLACKBERRY

7.2.1.2.3.2.7 CHERRY

7.2.1.2.3.2.8 BUTTERSCOTCH

7.2.1.2.3.2.9 CARAMEL

7.2.1.2.3.2.10 POMEGRANATE

7.2.1.2.3.2.11 CHOCOLATES

7.2.1.2.3.2.12 NUTS

7.2.1.2.3.2.13 COCONUT

7.2.1.2.3.2.14 ORCHARD CHERRY

7.2.1.2.3.2.15 COTTON CANDY

7.2.1.2.3.2.16 HONEY

7.2.1.2.3.2.17 MOCHA

7.2.1.2.3.2.18 AMARETTO

7.2.1.2.3.2.19 PUMPKIN

7.2.1.2.3.2.20 PEPPERMINT

7.2.1.2.3.2.21 OTHERS

7.2.1.3 NUTRITION BARS

7.2.1.3.1 NUTRITION BARS, BY TYPE

7.2.1.3.1.1 CEREALS BARS

7.2.1.3.1.1.1 GRANOLA BARS

7.2.1.3.1.1.2 OAT BARS

7.2.1.3.1.1.3 RICE BARS

7.2.1.3.1.1.4 MIXED CEREAL BARS

7.2.1.3.1.1.5 OTHERS

7.2.1.3.1.2 ENERGY BARS

7.2.1.3.1.2.1 PLANT-BASED PROTEIN BARS

7.2.1.3.1.2.2 ANIMAL-BASED PROTEIN BARS

7.2.1.3.1.2.2.1 WHEY PROTEIN BARS

7.2.1.3.1.2.2.2 CASEIN PROTEIN BARS

7.2.1.3.1.2.2.2.1 FIBER BARS

7.2.1.3.1.2.2.2.2 PROBIOTIC BARS

7.2.1.3.1.2.2.2.3 OMEGA-3 BARS

7.2.1.3.1.2.2.2.4 AMINO ACID BARS

7.2.1.3.1.2.2.2.5 OTHERS

7.2.1.3.1.3 FRUIT BARS

7.2.1.3.1.3.1 BANANA

7.2.1.3.1.3.2 APPLES

7.2.1.3.1.3.3 ORANGES

7.2.1.3.1.3.4 BERRIES

7.2.1.3.1.3.5 CHERRY

7.2.1.3.1.3.6 AVOCADO

7.2.1.3.1.3.7 OTHERS

7.2.1.3.1.4 NUT BARS

7.2.1.3.1.4.1 ALMOND

7.2.1.3.1.4.2 PEANUT

7.2.1.3.1.4.3 HAZELNUTS

7.2.1.3.1.4.4 CASHEW

7.2.1.3.1.4.5 DATES

7.2.1.3.1.4.6 OTHERS

7.2.1.3.1.5 OTHERS

7.2.1.3.2 NUTRITION BARS, BY CATEGORY

7.2.1.3.3 REGULAR

7.2.1.3.4 PRE WORK OUT BARS

7.2.1.3.5 MEAL REPLACEMENT BAR

7.2.1.3.6 POST WORK OUT BARS

7.2.1.3.7 YOGA BARS

7.2.1.3.8 OTHERS

7.2.2 FUNCTIONAL FOODS, BY CATEGORY

7.2.2.1 CONVENTIONAL

7.2.2.2 ORGANIC

7.2.3 FUNCTIONAL FOODS, BY CALORIE CONTENT

7.2.3.1 LOW CALORIES

7.2.3.2 REDUCED CALORIE

7.2.3.3 NO CALORIES

7.3 HEALTHY SNACKS

7.3.1 HEALTHY SNACKS, BY PRODUCT TYPE

7.3.1.1 VEGGIE SNACKS

7.3.1.2 MULTIGRAIN WAFERS, CRACKERS & CHIPS

7.3.1.3 TRAIL MIXES

7.3.1.4 DRY BERRIES SNACKS

7.3.1.5 OTHERS

7.3.2 HEALTHY SNACKS, BY CATEGORY

7.3.2.1 CONVENTIONAL

7.3.2.2 ORGANIC

7.3.3 HEALTHY SNACKS, BY CALORIE CONTENT

7.3.3.1 LOW CALORIES

7.3.3.2 REDUCED CALORIE

7.3.3.3 NO CALORIES

7.4 BEVERAGES

7.4.1 BEVERAGES, BY TYPE

7.4.1.1 FORTIFIED COFFEE

7.4.1.2 BFY BEVERAGES

7.4.1.2.1 HEALTHY SMOOTHIES

7.4.1.2.2 DIET SODA

7.4.1.2.3 PLANT-BASED MILK

7.4.1.2.3.1 PLANT-BASED MILK, BY TYPE

7.4.1.2.3.1.1 ALMOND MILK

7.4.1.2.3.1.2 SOY MILK

7.4.1.2.3.1.3 COCONUT MILK

7.4.1.2.3.1.4 OAT MILK

7.4.1.2.3.1.5 CASHEW MILK

7.4.1.2.3.1.6 OTHERS

7.4.1.2.4 PLANT-BASED MILK, BY FORMULATION

7.4.1.2.4.1.1 SWEETENED

7.4.1.2.4.1.2 UNSWEETENED

7.4.1.2.5 FLAVORED WATER

7.4.1.3 ENERGY DRINKS

7.4.1.4 KOMBUCHA DRINKS

7.4.1.5 HERBAL TEA

7.4.1.5.1 MIXED HERB

7.4.1.5.2 YERBA MATE

7.4.1.5.3 OOLONG

7.4.1.5.4 CHAMOMILE

7.4.1.5.5 MATCHA

7.4.1.5.6 MINT

7.4.1.5.7 ROSEMARY

7.4.1.5.8 PEPPERMINT

7.4.1.5.9 CONVENTIONAL TEA LEAVES

7.4.1.5.10 SINGLE HERB

7.4.1.5.11 CINNAMON

7.4.1.5.12 THYME

7.4.1.5.13 ROSE HIP

7.4.1.5.14 ECHINACEA

7.4.1.5.15 BUBBLE

7.4.1.5.16 OTHERS

7.4.1.6 FRUIT TEA

7.4.1.6.1 SINGLE FRUIT TEA

7.4.1.6.2 PEACH

7.4.1.6.3 ORANGE

7.4.1.6.4 POMEGRANATE

7.4.1.6.5 MANGO

7.4.1.6.6 STRAWBERRY

7.4.1.6.7 APPLE TEA

7.4.1.6.8 PINEAPPLE

7.4.1.6.9 KIWI

7.4.1.6.10 RASPBERRY

7.4.1.6.11 CRANBERRY

7.4.1.6.12 BLUEBERRY

7.4.1.6.13 GOJI BERRY

7.4.1.6.14 PASSION FRUIT

7.4.1.6.15 OTHERS

7.4.1.6.16 MIX FRUIT TEA

7.4.2 BEVERAGES, BY CATEGORY

7.4.2.1 CONVENTIONAL

7.4.2.2 ORGANIC

7.4.3 BEVERAGES, BY CALORIE CONTENT

7.4.3.1 LOW CALORIES

7.4.3.2 REDUCED CALORIES

7.4.3.3 NO CALORIES

7.5 FORTIFIED & HEALTHY BAKERY PRODUCTS

7.5.1 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY TYPE

7.5.1.1 BREAD & ROLLS

7.5.1.2 BISCUIT & COOKIES

7.5.1.3 PANCAKES & OTHER BAKERY MIXES

7.5.1.4 CAKES & PASTRIES

7.5.1.5 TORTILLA

7.5.1.6 CUPCAKES & MUFFINS

7.5.2 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CATEGORY

7.5.2.1 CONVENTIONAL

7.5.2.2 ORGANIC

7.5.3 FORTIFIED & HEALTHY BAKERY PRODUCTS, BY CALORIE CONTENT

7.5.3.1 LOW CALORIES

7.5.3.2 REDUCED CALORIE

7.5.3.3 NO CALORIES

7.6 BFY FOODS

7.6.1 BFY FOODS, BY TYPE

7.6.1.1 HEALTHY PIZZA & PASTA

7.6.1.2 HEALTHY CRISPS

7.6.1.3 HEALTHY CRISPS, BY TYPE

7.6.1.3.1 PROTEIN CRISPS

7.6.1.3.2 VEGGIES CRISPS

7.6.1.3.3 GREEN BEANS CRISPS

7.6.1.3.4 MIX VEGGIE CRISPS

7.6.1.3.5 BEETS CRISPS

7.6.1.3.6 CAULIFLOWER CRISPS

7.6.1.3.7 OTHERS

7.6.1.3.8 HEALTHY CRISPS, BY FLAVOR

7.6.1.3.9 BARBECUE

7.6.1.3.10 CHEESE

7.6.1.3.11 SEA SALT

7.6.1.3.12 SWEET CHILLI

7.6.1.3.13 BUFFALO WING

7.6.1.3.14 SWEET & SALT

7.6.1.3.15 OTHERS

7.6.1.4 SOUPS

7.6.1.5 SPREADS

7.6.1.6 SAUCES, MAYONNAISE & DRESSINGS

7.6.1.7 OTHERS

7.6.2 BFY FOODS, BY CATEGORY

7.6.2.1 CONVENTIONAL

7.6.2.2 ORGANIC

7.6.3 BFY FOODS, BY CALORIE CONTENT

7.6.3.1 LOW CALORIES

7.6.3.2 REDUCED CALORIES

7.6.3.3 NO CALORIES

7.7 CHOCOLATE

7.7.1 CHOCOLATES, BY TYPE

7.7.1.1 DARK CHOCOLATE BARS

7.7.1.2 NUT INFUSED CHOCOLATES

7.7.1.3 FRUIT & NUT INFUSED CHOCOLATE BRITTLES

7.7.1.4 FORTIFIED CHOCOLATE BARS

7.7.1.5 OTHERS

7.7.2 CHOCOLATES, BY FORMULATION

7.7.2.1 SWEET

7.7.2.2 SEMI-SWEET

7.7.2.3 SUGAR FREE

7.7.3 CHOCOLATES, BY CATEGORY

7.7.3.1 CONVENTIONAL

7.7.3.2 ORGANIC

7.7.4 CHOCOLATES, BY CALORIE CONTENT

7.7.4.1 LOW CALORIES

7.7.4.2 REDUCED CALORIE

7.7.4.3 NO CALORIES

7.8 OTHERS

8 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CALORIE CONTENT

8.1 OVERVIEW

8.2 LOW CALORIES

8.3 REDUCED CALORIES

8.4 NO CALORIES

9 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY NATURE

9.1 OVERVIEW

9.2 NON-GMO

9.3 GMO

10 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FAT CONTENT

10.1 OVERVIEW

10.2 NO FAT

10.3 LOW FAT

10.4 REDUCED FAT

11 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY CATEGORY

11.1 OVERVIEW

11.2 ORGANIC

11.3 CONVENTIONAL

12 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY FREE FROM CATEGORY

12.1 OVERVIEW

12.2 GLUTEN FREE

12.3 DAIRY FREE

12.4 SOY FREE

12.5 NUT FREE

12.6 LACTOSE FREE

12.7 ARTIFICIAL FLAVOR FREE

12.8 ARTIFICIAL COLOR FREE

12.9 OTHERS

13 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 STORE BASED RETAILERS

13.2.1 SUPERMARKET/HYPERMARKET

13.2.2 CONVENIENCE STORES

13.2.3 SPECIALTY STORES

13.2.4 GROCERY STORES

13.2.5 OTHERS

13.3 NON-STORE RETAILERS

13.3.1 COMPANY WEBSITES

13.3.2 ONLINE

14 EUROPE HEALTH AND WELLNESS FOOD MARKET, BY REGION

14.1 EUROPE

14.1.1 SPAIN

14.1.2 ITALY

14.1.3 FRANCE

14.1.4 GERMANY

14.1.5 U.K.

14.1.6 SWITZERLAND

14.1.7 NETHERLANDS

14.1.8 BELGIUM

14.1.9 RUSSIA

14.1.10 TURKEY

14.1.11 REST OF EUROPE

15 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: EUROPE

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 PEPSICO

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 DANONE

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 NESTLÉ

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 ABBOTT

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 GENERAL MILLS INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 YAKULT HONSHA CO., LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.7 GSK GROUP OF COMPANIES

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 SIMPLY GOOD FOODS USA, INC.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ALTER ECO

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BARREL. SITE BY BARREL

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 CHOBANI, LLC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 CLIF BAR & COMPANY

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 ENJOY LIFE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 FORAGER PROJECT

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 GREEN VALLEY DAIRIE

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 HUEL INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 KASHI

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 KELLOGG CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENT

17.19 KITE HILL

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 LAKE CHAMPLAIN CHOCOLATES

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 LAVVA

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 LIBERTE

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 MARS, INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 PRODUCT PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 MASPEX GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENTS

17.25 MONDELĒZ INTERNATIONAL.

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 SO DELICIOUS DAIRY FREE

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 STONYFIELD FARM, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 THE QUAKER OATS COMPANY

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 THE SIMPLY GOOD FOODS COMPANY

17.29.1 COMPANY SNAPSHOT

17.29.2 REVENUE ANALYSIS

17.29.3 PRODUCT PORTFOLIO

17.29.4 RECENT DEVELOPMENTS

17.3 YOPLAIT USA, INC.

17.30.1 COMPANY SNAPSHOT

17.30.2 PRODUCT PORTFOLIO

17.30.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE:

19 RELATED REPORTS

図表一覧

FIGURE 1 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 2 EUROPE HEALTH AND WELLNESS FOOD MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE HEALTH AND WELLNESS FOOD MARKET: DROC ANALYSIS

FIGURE 4 EUROPE HEALTH AND WELLNESS FOOD MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE HEALTH AND WELLNESS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE HEALTH AND WELLNESS FOOD MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE HEALTH AND WELLNESS FOOD MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE HEALTH AND WELLNESS FOOD MARKET: SEGMENTATION

FIGURE 10 NORTH AMERICA IS EXPECTED TO DOMINATE THE EUROPE HEALTH AND WELLNESS FOOD MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 RISING DEMAND FOR PROTEIN-BASED NUTRITIONAL AND HEALTHY FOOD & BEVERAGES IS EXPECTED TO DRIVE THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET IN 2022 & 2029

FIGURE 13 SUPPLY CHAIN ANALYSIS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE HEALTH AND WELLNESS FOOD MARKET

FIGURE 15 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE, 2021

FIGURE 16 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CALORIE CONTENT, 2021

FIGURE 17 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY NATURE, 2021

FIGURE 18 EUROPE GMO CROP REVENUE (2018)

FIGURE 19 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FAT CONTENT, 2021

FIGURE 20 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY CATEGORY, 2021

FIGURE 21 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY FREE FROM CATEGORY, 2021

FIGURE 22 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 EUROPE HEALTH AND WELLNESS FOOD MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE HEALTH AND WELLNESS FOOD MARKET: BY TYPE (2022 & 2029)

FIGURE 28 EUROPE HEALTH AND WELLNESS FOOD MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。