ヨーロッパの契約製造市場、製品別(医薬品製造および医療機器製造)、エンドユーザー別(製薬会社、バイオテクノロジー会社、バイオ医薬品会社、医療機器会社、OEM、研究機関)、流通チャネル別(小売販売、直接入札、その他) - 2030 年までの業界動向と予測。

ヨーロッパの契約製造市場の分析と洞察

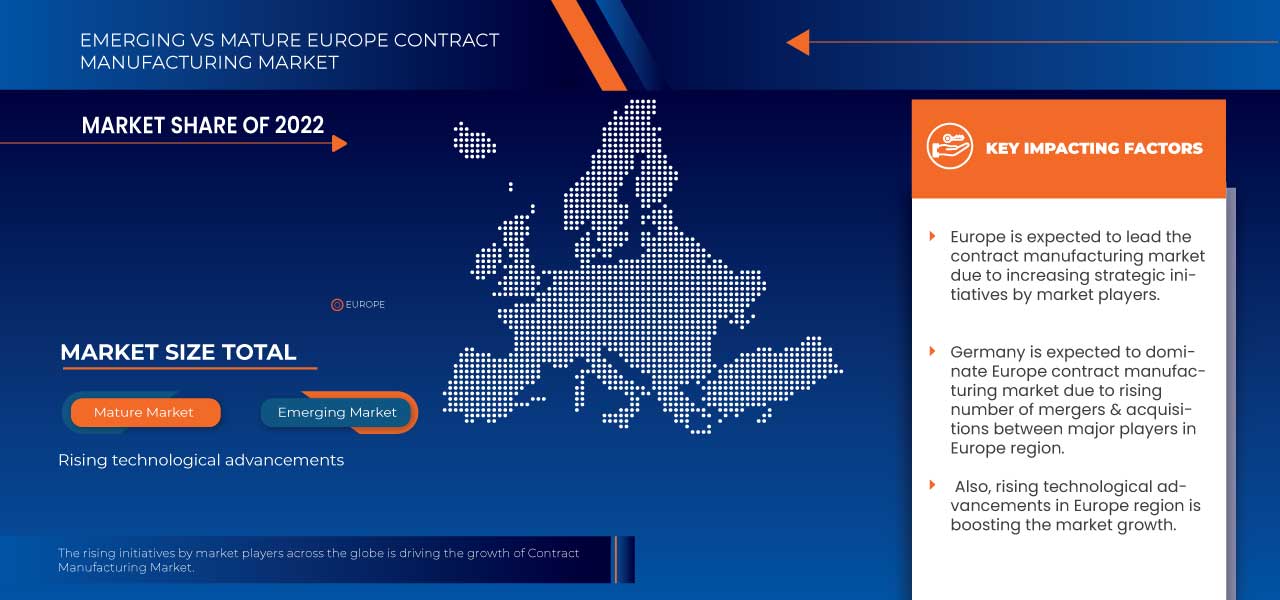

ヨーロッパの契約製造市場は、医薬品やパイプライン製品の技術進歩とコスト効率の向上による需要の高まり、研究開発への投資の増加などの要因によって推進されており、市場の成長につながっています。現在、先進国と新興国全体で医療費が増加しており、メーカーが新しい革新的な製品を開発するための競争上の優位性が生まれると予想されています。

契約製造とは、企業と製造業者の間で、指定された期間内に企業のために一定数の部品または製品を製造する契約です。製造された商品は、企業のラベルまたはブランドで販売されます。これはプライベート ラベル製造と呼ばれます。国境を越えて行われる場合は、アウトソーシングとも呼ばれます。製造業者は、顧客が独自の設計、処方、仕様を提供しない限り、独自の設計、処方、仕様に基づいてサービスを提供します。製造業者は、競合企業であっても、契約した相手にこれらの製品を作成します。

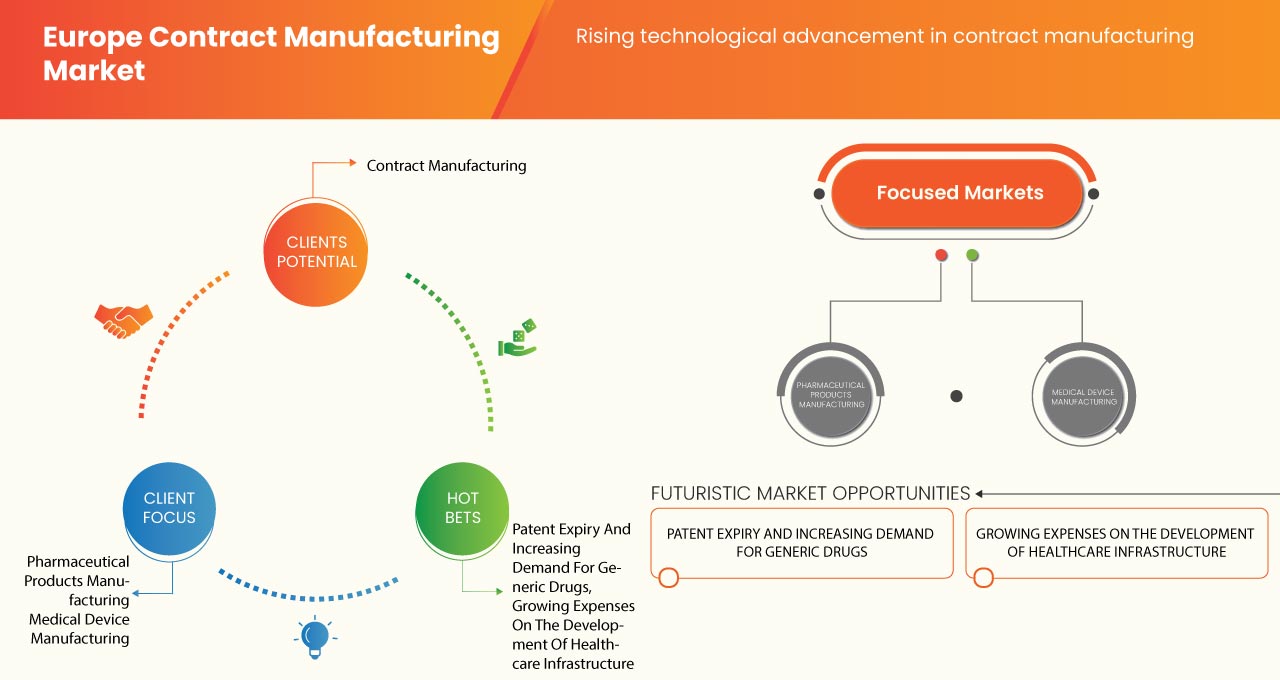

契約製造市場の成長を牽引する主な要因の 1 つは、医療機器および医薬品部門の需要の高まりです。いくつかの企業がより良い診断のために行っている継続的な臨床試験研究は、市場の拡大につながります。市場は、技術の進歩とコスト効率の向上にも影響されます。ただし、機密情報のリスクと厳格な規制は、予測期間中にヨーロッパの契約製造市場の抑制要因となる可能性があります。

一方、特許の期限切れやジェネリック医薬品の需要増加、医療インフラの費用増加、主要市場プレーヤーによる戦略的取り組みは、市場の成長の機会となります。しかし、知的財産リスクや独自の製造ユニットを設立する製薬会社の増加は、ヨーロッパの契約製造市場に課題をもたらす可能性があります。

欧州では、ポイントオブケア診断への傾向の高まりにより、受託製造の需要が増加するでしょう。さまざまな企業が、徐々に市場の成長につながる取り組みを行っています。

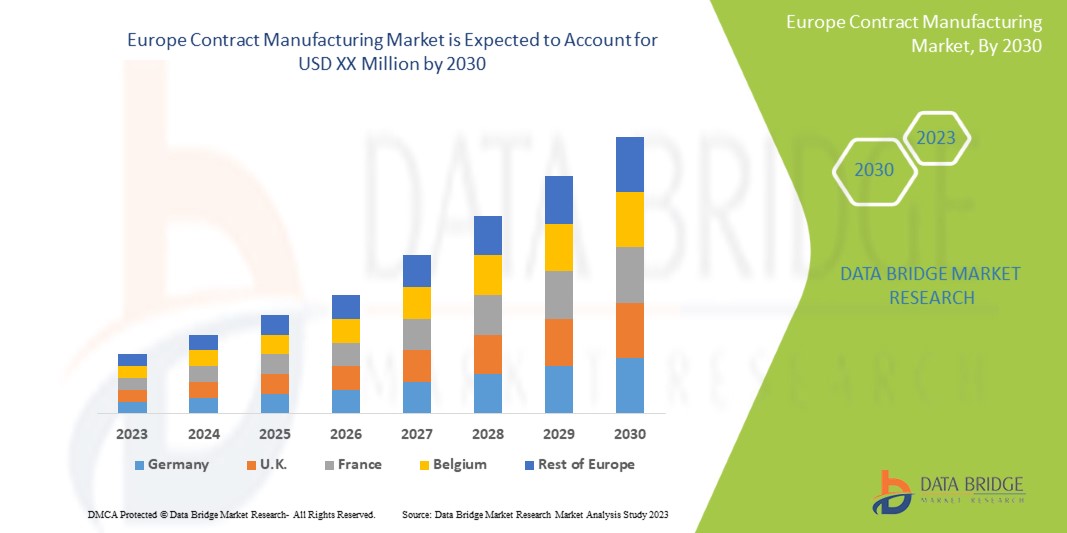

ヨーロッパの契約製造市場は支援的であり、医療機関の製造努力の削減を目指しています。データブリッジマーケットリサーチは、ヨーロッパの契約製造市場は2023年から2030年の予測期間中に6.0%のCAGRで成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

製品別(医薬品製造および医療機器製造)、エンドユーザー別(製薬会社、バイオテクノロジー会社、バイオ医薬品会社、医療機器会社、OEM、研究機関)、流通チャネル別(小売販売、直接入札、その他) |

|

対象国 |

ドイツ、フランス、イタリア、イギリス、スペイン、オランダ、ロシア、スイス、トルコ、オーストリア、ノルウェー、ハンガリー、リトアニア、アイルランド、ポーランド、ルクセンブルク、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

Aenova Group、Thermo Fisher Scientific Inc.、EVONIK INDUSTRIES AG、Lonza、Boehringer Ingelheim Biopharmaceuticals GmbH、Catalent, Incなど |

ヨーロッパの契約製造業の動向

市場の定義

国際市場での契約製造は、ある会社が別の国の別の会社に自社製品の製造を依頼する場合に使用されます。これは、国際下請けまたは国際アウトソーシングとも呼ばれます。会社は製造業者にすべての仕様を提供し、該当する場合は製造プロセスに必要な材料も提供します。このタイプの契約では、製品の品質、認証、数量、条件、納期などに関して製造業者が満たさなければならない要件が規定されます。また、製造を委託する会社またはその顧客が定める製品の検査およびテストのガイドラインも確立されます。さらに、注文の変更、契約違反の場合の保証および補償も概説されます。このプロセスは基本的に、最終製品をプライベートブランド化するパートナーに海外市場での製造をアウトソーシングすることであるため、このタイプの契約を利用できるさまざまな会社や業界があります。

ドライバー

- 製造企業にとってのコスト効率

時間のかかる製造と、複数のものに対する非効率的な生産および管理は、公共部門および民間部門の組織にとって大きな負担です。また、単一の組織では変化を推進し、時には必要な結果を得るのに効果的ではないため、複雑な課題に対処するためにも契約製造会社は不可欠です。契約製造会社は、政府部門と民間部門の両方にとって新たな機会として機能します。

精度が向上し、時間的制約が緩和された契約製造の需要が高まるにつれ、主要プレーヤーは戦略的な取り組みを迫られています。契約製造を所有することで、機械、材料、その他の労働力への投資に必要な諸経費が削減され、生産プロセスが簡素化され、全体的なコストが削減されてサプライ チェーンが合理化されます。

しかし、大手市場プレーヤーは、エンドユーザーの需要を満たすために製造に多額の資本を投入しています。契約製造プレーヤーは、戦略の立案と実行に関与し、プレーヤーの生産コストを削減します。他の企業への契約製造サービスでは、生産サイクルに必要な効果的な労働力、戦略的インテリジェンス、または作業リソースを使用することで、リソースの効率と最適な使用も保証されます。

- 契約製造における技術進歩の台頭

製薬業界の需要が急増しているため、新薬を迅速に市場に投入するには、製造に多額の投資が必要です。一部の薬は処方が複雑で、大量生産には特別な設備と技術が必要となるため、高度な技術とスキルが必須です。

医薬品の開発や医療機器の製造において、機械学習、ビッグデータ、人工知能などの革新的な技術を迅速かつ迅速に活用することが検討されています。これらの技術の進歩は、短期間での大量生産と拡張性にも役立ちます。

しかし、製薬会社は通常、契約製造組織の生産および配送プロセスを監査または監督し、リアルタイムのリモート追跡を使用して製造プロセスを監視しています。

機会

- 医療インフラ整備にかかる費用の増加

インフラストラクチャは、すべての患者のケアと健康水準の向上、そして優れた医療システムの体験を促進するという基本目標を支える重要な柱です。同時に、医療システムとスタッフは、人口全体の効果的な健康促進、予防、セルフケアをサポートする必要があります。インフラストラクチャは、急性期および入院患者のケアの中心である病院をより広範な医療システムに統合し、質の高い患者体験、有効性、効率性、適時性、安全性、公平性、持続可能性の 7 つの領域を促進する必要があります。インフラストラクチャには、構築された環境と、機器、アクセス、情報技術 (IT)、システムとプロセス、持続可能性の取り組み、スタッフなどのサポート要素が含まれます。

しかし、医療インフラの開発にかかる費用の増加は、予測期間中のヨーロッパの契約製造市場の成長を促進しています。

制約/課題

- 医薬品製造拠点の設置数増加

Most pharmaceutical companies are building manufacturing sites to produce pharmaceutical products to reduce costs. Manufacturers are more focused on introducing advanced technologies and the digitalization process. The Pharma industry also faces disruptions due to new business models and a more focused population on personalized medicines and treatments. Hence, the demand for personalized care is high. Occupational profiles are also changing: some jobs are disappearing due to automation while entirely new jobs are emerging.

Hence, the increasing number of pharmaceutical companies setting up their manufacturing units may challenge the growth of the Europe contract manufacturing market in the forecast period.

Recent Developments

- In October 2021, Boehringer Ingelheim International gmbh., had inaugurated its state-of-the-art biopharmaceutical production facility Large Scale Cell Culture (LSCC) in Vienna, Austria, with an investment volume of more than 700 million EUR, which is the single largest investment in the company's history

- In March 2023, Evonik Industries AG has announced that it is opening a new GMP facility to manufacture lipids for advanced, pharmaceutical drug delivery applications. The lipid launch facility is located at the company’s site in Hanau, Germany and provides customers with quantities of lipids as needed for clinical and small-scale commercial manufacturing

Europe Contract Manufacturing Market Segmentation

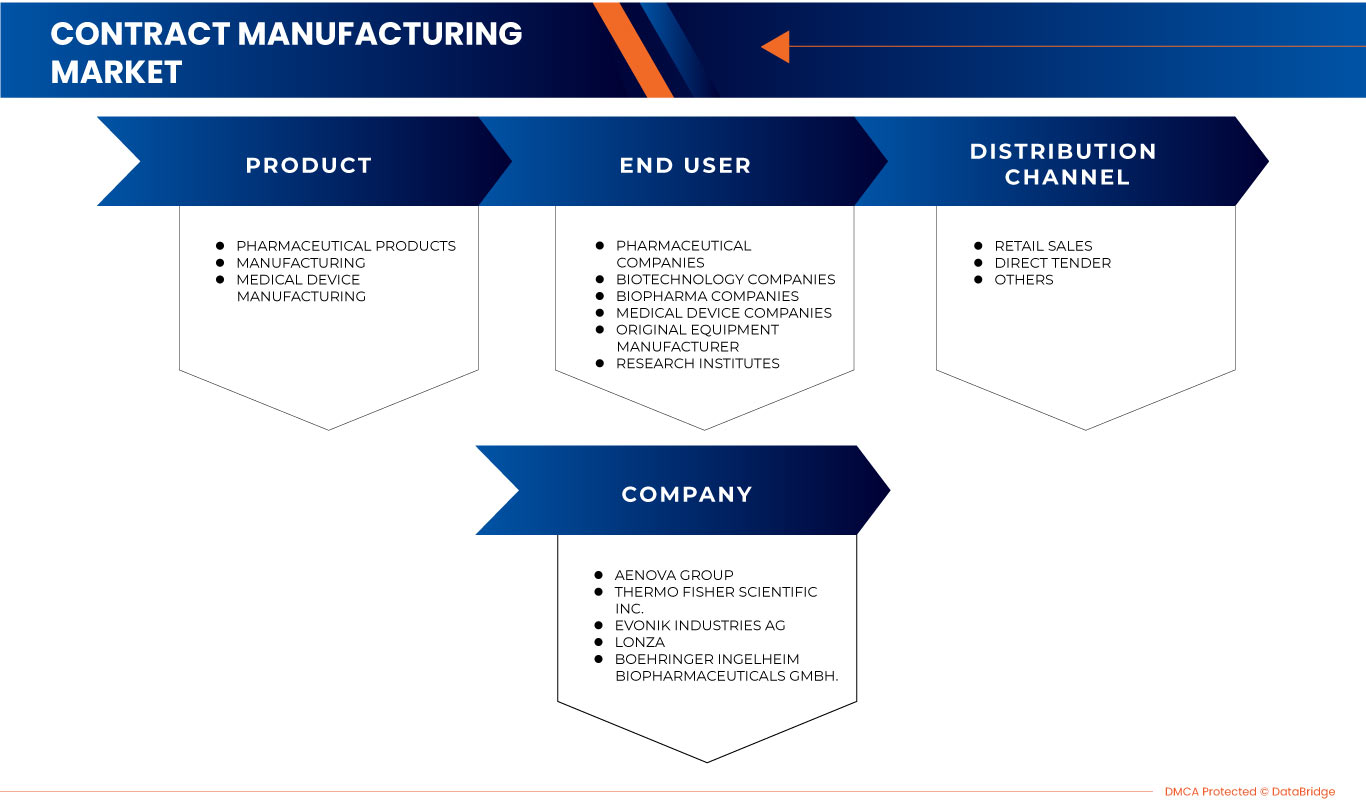

The Europe contract manufacturing market is categorized into three notable segments based on product, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Medical Device Manufacturing

- Pharmaceutical Products Manufacturing

On the basis of product, the Europe contract manufacturing market is segmented into medical device manufacturing and pharmaceutical products manufacturing.

End User

- Pharmaceutical Companies

- Biotechnology Companies

- Biopharma Companies

- Medical Device Companies

- Original Equipment Manufacturer

- Research Institutes

On the basis of end user, the Europe contract manufacturing market is segmented into original equipment manufacturer, medical device companies, pharmaceutical companies, biotechnology companies, biopharma companies, and research institutes.

Distribution Channel

- Retail Sales

- Direct Tender

- Others

On the basis of distribution channel, the Europe contract manufacturing market is segmented into direct tenders, retail sales, and others.

Europe Contract Manufacturing Market Regional Analysis/Insights

The Europe contract manufacturing market is analyzed, and market size insights and trends are provided by product, end user, and distribution channel as referenced above.

ヨーロッパの契約製造レポートで取り上げられている国には、ドイツ、フランス、イタリア、イギリス、スペイン、オランダ、ロシア、スイス、トルコ、オーストリア、ノルウェー、ハンガリー、リトアニア、アイルランド、ポーランド、ルクセンブルク、その他のヨーロッパ諸国などがあります。

発展途上地域での技術進歩の進展により、英国が優位に立つことが予想されます。

レポートの国別セクションでは、市場の現在および将来の傾向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。下流および上流のバリュー チェーン分析、技術動向、ポーターの 5 つの力の分析、ケース スタディなどのデータ ポイントは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパ ブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、国内関税と貿易ルートの影響も考慮されます。

競争環境と欧州の契約製造市場シェア分析

ヨーロッパの契約製造市場の競争状況は、競合他社による詳細を提供します。含まれる詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、ヨーロッパでのプレゼンス、生産拠点と施設、生産能力、会社の強みと弱み、製品の発売、製品の幅と広さ、アプリケーションの優位性などがあります。提供されている上記のデータ ポイントは、ヨーロッパの契約製造市場における会社の焦点にのみ関連しています。

この市場のプレーヤーとしては、Aenova Group、Thermo Fisher Scientific Inc.、EVONIK INDUSTRIES AG、Lonza、Boehringer Ingelheim Biopharmaceuticals GmbH、Catalent, Inc などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE CONTRACT MANUFACTURING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

5 REGULATORY FRAMEWORK

5.1 REGULATORY SCENARIO BY FDA

5.2 REGULATORY SCENARIO IN AUSTRALIA

5.3 REGULATORY SCENARIO IN EUROPE FOR MEDICINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 COST-EFFECTIVENESS FOR THE MANUFACTURING COMPANIES

6.1.2 RISE OF TECHNOLOGICAL ADVANCEMENTS IN CONTRACT MANUFACTURING

6.1.3 EUROPE PRESENCE AND CONNECTED NETWORK

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AMONG VARIOUS JURISDICTIONS

6.2.2 RISK OF CONFIDENTIAL INFORMATION

6.3 OPPORTUNITIES

6.3.1 PATENT EXPIRY AND INCREASING DEMAND FOR GENERIC DRUGS

6.3.2 GROWING EXPENSES ON THE DEVELOPMENT OF HEALTHCARE INFRASTRUCTURE

6.3.3 INCREASE IN NUMBER OF STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INTELLECTUAL PROPERTY RISKS

6.4.2 INCREASE IN NUMBER OF PHARMACEUTICAL COMPANIES TO SET UP THEIR MANUFACTURING SITES

7 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PHARMACEUTICAL PRODUCTS MANUFACTURING

7.2.1 TYPES OF PRODUCTS

7.2.1.1 TABLETS

7.2.1.2 CAPSULES

7.2.1.3 BIOLOGICS

7.2.1.4 SMALL MOLECULE

7.2.1.5 CELL & GENES MANUFACTURING

7.2.1.6 NUTRACEUTICALS

7.2.1.7 OTHERS

7.2.2 TYPE OF SERVICES

7.2.2.1 DRUG DEVELOPMENT SERVICES

7.2.2.2 TABLET MANUFACTURING SERVICES

7.2.2.3 BIOLOGICS API MANUFACTURING

7.2.2.4 BIOLOGICS FDF MANUFACTURING SERVICES

7.2.2.5 OTHERS

7.2.3 BY DOSAGE FORM

7.2.3.1 SOLID FORMULATIONS

7.2.3.2 LIQUID FORMULATIONS

7.2.3.2.1 INJECTABLE

7.2.3.2.2 SYRUPS

7.2.3.3 SEMI-SOLID FORMULATIONS

7.2.3.4 TOPICAL DRUG FORMULATIONS

7.2.3.5 OTHERS

7.3 MEDICAL DEVICE MANUFACTURING

7.3.1 TYPE OF DEVICES

7.3.1.1 SYRINGES AND NEEDLES

7.3.1.2 INFUSION DEVICES & ADMINISTRATION SETS

7.3.1.3 MEDICAL ACCESSORIES, COMPONENTS & CONSUMABLES

7.3.1.4 DISPOSABLES

7.3.1.5 IVD DEVICES

7.3.1.6 CARDIOVASCULAR DEVICES

7.3.1.7 DIABETES CARE DEVICES

7.3.1.8 GENERAL SURGERY DEVICES

7.3.1.9 ORTHOPEDIC DEVICES

7.3.1.10 RESPIRATORY DEVICES

7.3.1.11 OPHTHALMIC DEVICES

7.3.1.12 DENTAL DEVICES

7.3.1.13 GYNECOLOGY/UROLOGY DEVICES

7.3.1.14 LABORATORY EQUIPMENT

7.3.2 TYPE OF SERVICES

7.3.2.1 MEDICAL DEVICE DESIGN AND DEVELOPMENT

7.3.2.2 DEVICE ASSEMBLY

7.3.2.3 REGULATORY ASSISTANCE

7.3.2.4 PACKAGING & LABELLING

7.3.2.5 STERILIZATION SERVICES

7.3.2.6 TRAINING AND VALIDATION

7.3.2.7 QUALITY ASSURANCE

7.3.2.8 OTHERS

7.3.3 BY DEVICE CLASS

7.3.3.1 CLASS I MEDICAL DEVICES

7.3.3.2 CLASS IIA MEDICAL DEVICES

7.3.3.3 CLASS IIB MEDICAL DEVICES

7.3.3.4 CLASS III MEDICAL DEVICES

8 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER

8.1 OVERVIEW

8.2 PHARMACEUTICAL COMPANIES

8.3 BIOTECHNOLOGY COMPANIES

8.4 BIOPHARMA COMPANIES

8.5 MEDICAL DEVICES COMPANIES

8.6 ORIGINAL EQUIPMENT MANUFACTURER

8.7 RESEARCH INSTITUTES

9 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.3 DIRECT TENDER

9.4 OTHERS

10 EUROPE CONTRACT MANUFACTURING MARKET, BY REGION

10.1 EUROPE

10.1.1 GERMANY

10.1.2 FRANCE

10.1.3 U.K.

10.1.4 ITALY

10.1.5 SPAIN

10.1.6 RUSSIA

10.1.7 TURKEY

10.1.8 BELGIUM

10.1.9 NETHERLANDS

10.1.10 SWITZERLAND

10.1.11 REST OF EUROPE

11 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 AENOVA GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 THERMO FISHER SCIENTIFIC INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 EVONIK INDUSTRIES AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 LONZA

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ALMAC GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVID BIOSERVICES, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAXTER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 CATALENT, INC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 FAMAR HEALTH CARE SERVICES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JUBILANT PHARMA LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 KIMBALL INTERNATIONAL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MERCK KGAA

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 NIPR0

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PFIZER INC

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 RECIPHARM AB.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SIEGFRIED HOLDING AG

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SUN PHARMACEUTICAL INDUSTRIES LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 TE CONNECTIVITY

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 VETTER PHARMA-FERTIGUNG GMBH & CO. KG

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 EUROPE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 EUROPE MEDICAL DEVICE MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 EUROPE CONSUMABLES AND ACCESSORIES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 EUROPE TYPE OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 EUROPE PHARMACEUTICAL COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 EUROPE BIOTECHNOLOGY COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 EUROPE BIOPHARMA COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 EUROPE AMBULATORY SURGICAL CENTERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 EUROPE ORIGINAL EQUIPMENT MANUFACTURER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 EUROPE RESEARCH INSTITUTES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 EUROPE RETAIL SALES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 EUROPE DIRECT TENDER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 EUROPE OTHERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 EUROPE CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 EUROPE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (UNIT)

TABLE 29 EUROPE TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030, 2021-2030 (ASP)

TABLE 30 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 EUROPE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 32 EUROPE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 EUROPE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 EUROPE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 35 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 36 EUROPE TYPES OF DEVICES IN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 37 EUROPE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 EUROPE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 EUROPE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 EUROPE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 GERMANY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 42 GERMANY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 43 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 45 GERMANY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 46 GERMANY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 GERMANY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 GERMANY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 GERMANY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 GERMANY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 GERMANY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 54 GERMANY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 GERMANY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 56 GERMANY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 57 FRANCE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 FRANCE PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 59 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 61 FRANCE TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 62 FRANCE BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 FRANCE BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 FRANCE LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 FRANCE MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 68 FRANCE TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 69 FRANCE TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 70 FRANCE BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 FRANCE CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 FRANCE CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 U.K. CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 U.K. PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 75 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 76 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 77 U.K. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 78 U.K. BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 79 U.K. BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 80 U.K. LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 U.K. MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 84 U.K. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 85 U.K. TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 U.K. BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 87 U.K. CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 U.K. CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 ITALY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 ITALY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 91 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 93 ITALY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 94 ITALY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 ITALY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 ITALY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 ITALY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 99 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 100 ITALY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 101 ITALY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 102 ITALY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 ITALY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 104 ITALY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 105 SPAIN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 106 SPAIN PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 107 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 108 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 109 SPAIN TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 110 SPAIN BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 111 SPAIN BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 112 SPAIN LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 SPAIN MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 116 SPAIN TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 117 SPAIN TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 118 SPAIN BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 119 SPAIN CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 120 SPAIN CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 121 RUSSIA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 122 RUSSIA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 123 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 124 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 125 RUSSIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 126 RUSSIA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 127 RUSSIA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 128 RUSSIA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 129 RUSSIA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 130 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 131 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 132 RUSSIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 133 RUSSIA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 134 RUSSIA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 135 RUSSIA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 136 RUSSIA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 137 TURKEY CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 138 TURKEY PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 139 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 140 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 141 TURKEY TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 142 TURKEY BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 143 TURKEY BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 144 TURKEY LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 145 TURKEY MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 146 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 147 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 148 TURKEY TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 149 TURKEY TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 150 TURKEY BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 151 TURKEY CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 152 TURKEY CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 153 BELGIUM CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 154 BELGIUM PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 155 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 156 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 157 BELGIUM TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 158 BELGIUM BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 159 BELGIUM BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 160 BELGIUM LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 161 BELGIUM MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 162 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 163 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 164 BELGIUM TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 165 BELGIUM TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 166 BELGIUM BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 167 BELGIUM CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 168 BELGIUM CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 169 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 170 NETHERLANDS PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 171 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 172 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 173 NETHERLANDS TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 174 NETHERLANDS BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 175 NETHERLANDS BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 176 NETHERLANDS LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 177 NETHERLANDS MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 178 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 179 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 180 NETHERLANDS TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 181 NETHERLANDS TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 182 NETHERLANDS BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 183 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 184 NETHERLANDS CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 185 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 186 SWITZERLAND PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 187 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 188 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 189 SWITZERLAND TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 190 SWITZERLAND BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 191 SWITZERLAND BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 192 SWITZERLAND LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 193 SWITZERLAND MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 194 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 195 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 196 SWITZERLAND TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 197 SWITZERLAND TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 198 SWITZERLAND BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 199 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 200 SWITZERLAND CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 201 REST OF EUROPE CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 2 EUROPE CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE CONTRACT MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE CONTRACT MANUFACTURING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE CONTRACT MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE CONTRACT MANUFACTURING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 EUROPE CONTRACT MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE CONTRACT MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS AND COST-EFFECTIVENESS OF PHARMACEUTICAL AND MEDICAL PRODUCTS ARE EXPECTED TO DRIVE THE GROWTH OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 12 THE PHARMACEUTICAL PRODUCTS MANUFACTURING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE CONTRACT MANUFACTURING MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE CONTRACT MANUFACTURING MARKET

FIGURE 14 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2022

FIGURE 15 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 16 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 17 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 18 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2022

FIGURE 19 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 20 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 21 EUROPE CONTRACT MANUFACTURING MARKET: BY END USER, LIFELINE CURVE

FIGURE 22 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 24 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 25 EUROPE CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 26 EUROPE CONTRACT MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 27 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 28 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 EUROPE CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 EUROPE CONTRACT MANUFACTURING MARKET: BY PRODUCT (2023-2030)

FIGURE 31 EUROPE CONTRACT MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。