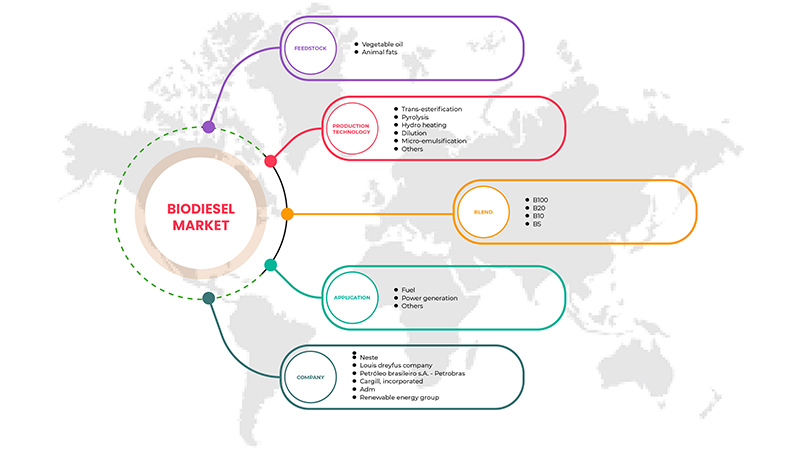

ヨーロッパのバイオディーゼル市場、原料(植物油と動物性脂肪)、ブレンド(B100、B20、B10、B5)、製造技術(エステル交換、熱分解、水加熱、希釈、マイクロ乳化、その他)、用途(燃料、発電、その他)別の業界動向と2029年までの予測。

ヨーロッパのバイオディーゼル市場の分析と洞察

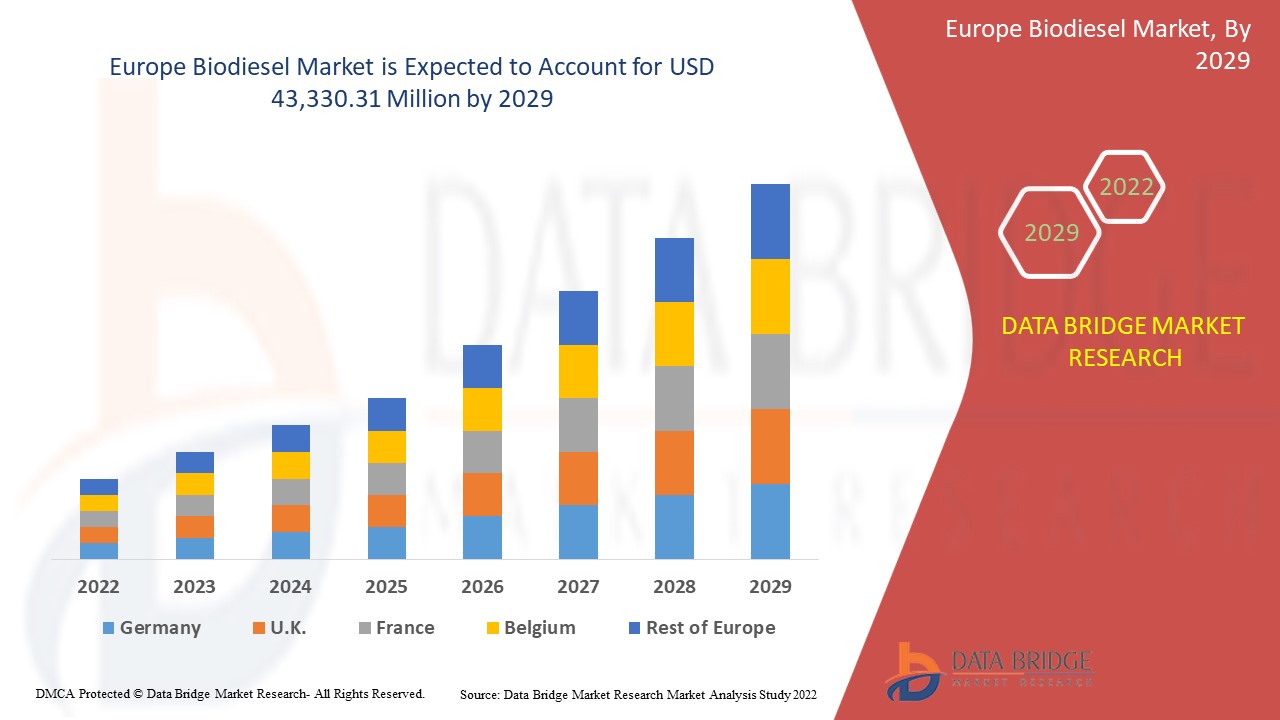

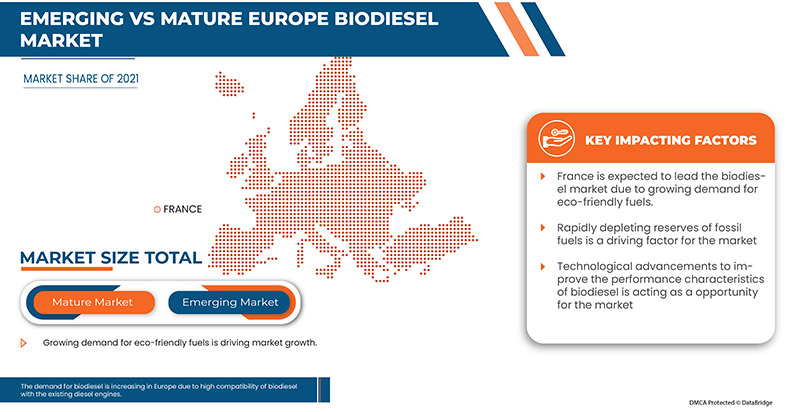

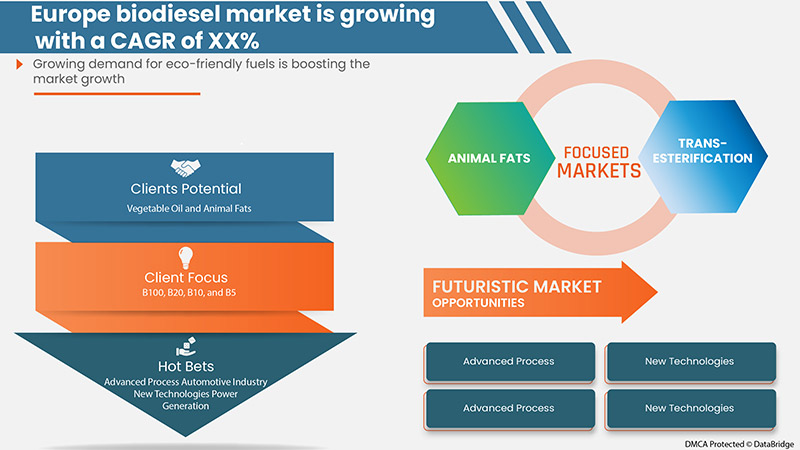

ヨーロッパのバイオディーゼル市場は、2022年から2029年の予測期間に大幅な成長が見込まれています。データブリッジマーケットリサーチは、市場は2022年から2029年の予測期間に4.7%のCAGRで成長し、2029年までに433億3,031万米ドルに達すると分析しています。市場の成長を牽引する主な要因としては、環境に優しい燃料の需要の高まり、バイオディーゼルと既存のディーゼルエンジンとの高い互換性、化石燃料の埋蔵量の急速な枯渇などが挙げられます。

石油由来製品の価格が不安定なため、バイオディーゼルはより手頃な選択肢になりつつあります。バイオディーゼル市場は、環境問題や世界中で急速に枯渇しつつある原油埋蔵量に対する懸念から、排出量を削減し、化石燃料に代わる燃料を求める世論の圧力に応えて発展しています。さらに、バイオディーゼルを使用すると、燃料のセタン価が上がり、潤滑性が向上します。

ヨーロッパのバイオディーゼル市場レポートでは、市場シェア、新しい開発、国内および現地の市場プレーヤーの影響の詳細を提供し、新たな収益源、市場規制の変更、製品承認、戦略的決定、製品発売、地理的拡大、市場における技術革新の観点から機会を分析します。分析と市場シナリオを理解するには、アナリスト概要についてお問い合わせください。当社のチームが、希望する目標を達成するための収益影響ソリューションの作成をお手伝いします。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

収益(百万米ドル) |

|

対象セグメント |

原料別(植物油、動物油脂)、配合別(B100、B20、B10、B5)、製造技術別(エステル交換、熱分解、水加熱、希釈、マイクロ乳化、その他)、用途別(燃料、発電、その他) |

|

対象国 |

英国、ロシア、フランス、スペイン、イタリア、ドイツ、トルコ、オランダ、スイス、ベルギー、ルクセンブルク、その他のヨーロッパ諸国 |

|

対象となる市場プレーヤー |

Louis Dreyfus Company、Münzer Bioindustrie GmbH、Bio-Oils Energy、Argent Energy、Eco Fox Srl、ecomotion.de、ECODIESEL COLOMBIA SA、ADM、Neste、Renewable Energy Group、VERBIO Vereinigte BioEnergie AG、Petroleo Brasileiro SA – Petrobras、およびカーギル、法人化されました。 |

市場の定義

バイオディーゼルは、植物油や動物性脂肪などの再生可能な原料から、油脂を脂肪酸メチルエステルに変換するエステル交換と呼ばれる化学プロセスを利用して得られます。石油ディーゼル燃料の代替品として使用され、他の部品の石油ディーゼル燃料と組み合わせられることがよくあります。石油ディーゼル燃料と比較して、排気ガスの放出を減らすのに効果的です。自動車、海洋、航空、工業、その他の業界で使用されています。海洋業界では、生分解性で無毒であるため、船舶燃料として優れた材料として使用されています。

ヨーロッパのバイオディーゼル市場の動向

ドライバー

- 環境に優しい燃料の需要増加

バイオディーゼル燃料はディーゼル燃料に似ていますが、はるかに環境に優しいです。バイオディーゼルはクリーンで汚染のないエネルギー源です。このグリーン移行はバイオディーゼル市場の触媒とみなされており、バイオディーゼルサプライヤーへの道を開きます。再生可能エネルギー源を統合する必要性は、バイオディーゼルの需要を促進しています。バイオディーゼルは、さまざまな用途で従来の化石燃料の代替品として急速に人気が高まると予想されています。バイオディーゼルは国内で製造され、わずかな改造またはほぼ改造されたディーゼルエンジンに搭載されるため、ヨーロッパのいくつかの国が外国の石油備蓄と輸入への依存を減らすのに役立っています。さらに、藻類を使用して生成されるものなどの第2世代および第3世代のバイオ燃料は、排出量を削減する可能性が高いです。したがって、さまざまな業界での環境に優しく持続可能な燃料とエネルギー源の需要の高まりがバイオディーゼルの需要を促進し、それが市場の成長を促進すると予想されます。

- バイオディーゼルと既存のディーゼルエンジンとの高い互換性

バイオディーゼルはディーゼルなどの従来の燃料よりも揮発性有機化合物 (VOC) の排出量が少ないため、原油の代替として商用車の燃料の需要が高まり、業界は恩恵を受けると予想されています。バイオディーゼル消費の主なターゲットは、燃料と発電の用途です。今日、自動車業界と海洋業界は、大量の原油成分を使用した燃料の大部分を使用しています。これらの従来の燃料は、環境に有毒物質を放出します。また、発電では、機械の構造に少しの変更を加えるだけで済むか、まったく変更を加える必要がない発電機でバイオディーゼルを使用できます。

- 化石燃料の埋蔵量が急速に枯渇

ガソリン、ディーゼル、液化石油ガス (LPG) などの再生不可能なエネルギー源の供給が限られ、価格が高騰していることから、さまざまな産業でバイオディーゼルの利用が進んでいます。バイオ燃料の生産と産業および輸送におけるその使用により、化石燃料への依存が大幅に軽減されます。さらに、温室効果ガス (GHG) 排出量が多い化石燃料を、再生可能で生分解性のあるバイオディーゼルなどのバイオ燃料に置き換える傾向が高まっており、ヨーロッパのさまざまな国で需要に影響を与えています。

機会

- 再生可能エネルギー源の導入に向けた政府の取り組みの増加

多くの国の政府は、バイオディーゼルなどの環境に優しい代替品を支援しています。補助金や義務化などの政府援助は、市場の継続的な成長を示し、促進しています。ヨーロッパ地域の政府は、発電や温室効果ガス排出量の削減のための燃料として再生可能エネルギー源を採用しようと常に取り組んでいます。その結果、燃料用途や発電用途での製品の需要は、近い将来に増加すると予想されます。

- バイオディーゼルの性能特性を向上させる技術の進歩

運輸部門は、主に環境に温室効果ガスを排出する原因となっています。これらの汚染物質は、さまざまな機関車で使用されるガソリンやディーゼルの燃焼によって生成されます。バイオディーゼルは代替燃料として有望かつ最良の資源であることが証明されていますが、その排気ガス、特に亜酸化窒素 (NOx) は有害です。エマルジョンに添加されたナノ粒子は、エンジン性能を損なうことなく排気ガスを削減する可能性があります。バイオディーゼルにナノ添加剤を添加すると、燃料特性が向上します。ナノ粒子は、燃料の表面積と体積の比率と酸化速度を高めます。これにより、着火遅延が減少し、燃焼ゾーンの着火温度が向上します。

制約/課題

- 生産能力不足

ヨーロッパのバイオディーゼル市場は、必要な量のバイオディーゼル生産の効率性の欠如に大きく影響されており、これにはいくつかの要因があります。現在、農家がバイオマス残渣を収集して次世代バイオディーゼル工場に届けることを奨励する政策メカニズムはありません。したがって、バイオマス原料の収集、輸送、取り扱いをカバーするバイオマスの信頼できるサプライチェーンを確立することが重要です。政策立案者が長期的に産業を育成しようとする場合、バイオディーゼル生産の原料を適切に使用するために、協同組合または農業コミュニティが残渣の収集、保管、配送のプロセスに関与できるメカニズムを作成することができます。

- バイオディーゼル生産中に発生する排出物と汚染

従来の燃料をバイオディーゼル混合物に置き換えることは、社会的および環境的理由から極めて重要であると考えられていますが、その使用には潜在的な問題が伴います。全体的な温室効果ガス排出量の削減という点で環境に好ましい影響があるにもかかわらず、バイオディーゼルは NOx 排出量を増加させる可能性があります。石油ディーゼルの約 3% ~ 4%、B40、B100 からはそれぞれ約 4% ~ 6%、4% ~ 6%、6% ~ 9% が排出されます。

- バイオディーゼル生産のための原料コストが高い

従来の石油系燃料よりもバイオディーゼルやクリーンな燃焼燃料の需要が高まっているのは、農産物市場とも関係があります。大豆油、キャノーラ油、パーム油などの植物油は、バイオディーゼル生産の最も一般的な原料です。原料コストは、バイオディーゼル生産コスト全体の約 80% ~ 85% を占めています。そのため、バイオディーゼル生産者が頼りにしている原料の価格変動が激しいと、長期的な財務安定性が脅かされます。原料価格はバイオディーゼル価格と連動して上昇し、利益率が低下します。

最近の開発

- 2022年9月、ネステはフィンランドのポルヴォーにある製油所を非原油精製に移行し、世界をリードする再生可能で循環的なソリューションの拠点にするための戦略的調査を開始しました。共同処理とユニットの改造、および利用可能な精製資産、経験、ノウハウの活用を通じて、ネステはポルヴォーでの再生可能エネルギーと循環型生産を長期的に大幅に拡大することを目指しています。

欧州バイオディーゼル市場の範囲

ヨーロッパのバイオディーゼル市場は、原料、ブレンド、生産技術、および用途に基づいて 4 つの主要なセグメントに分割されています。これらのセグメントの成長は、業界の主要な成長セグメントの分析に役立ち、ユーザーに貴重な市場の概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

原料

- 植物油

- 動物性脂肪

原料に基づいて、市場は植物油と動物性脂肪に分類されます。

ブレンド

- B20

- B10

- B5

- B100

ブレンドに基づいて、市場は B100、B20、B10、B5 に分類されます。

生産技術

- エステル交換反応

- 熱分解

- 水力暖房

- 希釈

- マイクロ乳化

- その他

生産技術に基づいて、市場はエステル交換、熱分解、水加熱、希釈、マイクロ乳化などに分類されます。

応用

- 燃料

- 発電

- その他

用途に基づいて、市場は燃料、発電、その他に分類されます。

ヨーロッパのバイオディーゼル市場の地域分析/洞察

ヨーロッパのバイオディーゼル市場は、原料、ブレンド、生産技術、および用途に基づいてセグメント化されています。

市場に含まれる国は、英国、ロシア、フランス、スペイン、イタリア、ドイツ、トルコ、オランダ、スイス、ベルギー、ルクセンブルク、その他のヨーロッパ諸国です。この地域での商用車の需要が高まっているため、フランスは市場シェアと市場収益の面で市場を支配しています。

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える個別の市場影響要因と市場規制の変更も提供しています。データポイントの下流および上流のバリューチェーン分析、技術動向、ポーターの 5 つの力の分析、およびケーススタディは、個々の国の市場シナリオを予測するために使用される指標の一部です。また、国別データの予測分析を提供する際には、ヨーロッパブランドの存在と可用性、および地元および国内ブランドとの競争が激しいか少ないために直面する課題、および国内関税と貿易ルートの影響が考慮されています。

競争環境と欧州バイオディーゼル市場シェア分析

ヨーロッパのバイオディーゼル市場の競争状況は、競合他社の詳細を提供します。詳細には、会社概要、会社の財務状況、収益、市場の可能性、研究開発への投資、新しい市場への取り組み、生産拠点と施設、会社の強みと弱み、製品の発売、製品試験パイプライン、製品の承認、特許、製品の幅と広さ、アプリケーションの優位性、技術ライフライン曲線が含まれます。提供されている上記のデータ ポイントは、市場に関連する会社の焦点にのみ関連しています。

ヨーロッパのバイオディーゼル市場で活動している主な企業としては、Louis Dreyfus Company、Münzer Bioindustrie GmbH、Bio-Oils Energy、Argent Energy、Eco Fox Srl、ecomotion.de、ECODIESEL COLOMBIA SA、ADM、Neste、Renewable Energy Group、VERBIO Vereinigte BioEnergie AG、Petróleo Brasileiro SA – Petrobras、Cargill, Incorporated などがあります。

研究方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。さらに、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これとは別に、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、企業市場シェア分析、測定基準、ヨーロッパ対地域、ベンダー シェア分析が含まれます。さらに問い合わせる場合は、アナリストへの電話をリクエストしてください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BIODIESEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 BMR TRIPOD DATA VALIDATION MODEL

2.6 FEEDSTOCK LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 BMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BIODIESEL BY-PRODUCTS SCENARIO

4.2 IMPORT EXPORT ANALYSIS

4.3 INDUSTRIAL INSIGHTS

4.4 PRODUCTION CONSUMPTION ANALYSIS

4.5 CERTIFIED STANDARDS

4.5.1 EUROPEAN UNION

4.5.2 EUROPEAN COMMISSION SUSTAINABILITY CRITERIA

4.5.3 RENEWABLE ENERGY DIRECTIVE (RED II)

4.5.4 EUROPEAN DIESEL FUEL SPECIFICATION

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR ENVIRONMENT-FRIENDLY FUELS

5.1.2 HIGH COMPATIBILITY OF BIODIESEL WITH THE EXISTING DIESEL ENGINES

5.1.3 RAPIDLY DEPLETING RESERVES OF FOSSIL FUELS

5.2 RESTRAINTS

5.2.1 INSUFFICIENT PRODUCTION CAPACITY

5.2.2 EMISSIONS AND POLLUTION CAUSED DURING PRODUCTION OF BIODIESEL

5.3 OPPORTUNITIES

5.3.1 RISE IN GOVERNMENT INITIATIVES TO ADOPT TO RENEWABLE ENERGY SOURCES

5.3.2 TECHNOLOGICAL ADVANCEMENTS TO IMPROVE THE PERFORMANCE CHARACTERISTICS OF BIODIESEL

5.4 CHALLENGE

5.4.1 HIGH FEEDSTOCK COSTS FOR BIODIESEL PRODUCTION

6 EUROPE BIODIESEL MARKET, BY FEEDSTOCK

6.1 OVERVIEW

6.2 VEGETABLE OIL

6.2.1 EDIBLE OILS

6.2.1.1 RAPESEED OIL

6.2.1.2 SOYA BEAN OIL

6.2.1.3 PALM OIL

6.2.1.4 CORN OIL

6.2.1.5 CANOLAOIL

6.2.1.6 OTHERS

6.2.2 NON-EDIBLE OILS

6.2.2.1 JATROPHA

6.2.2.2 KARANJA

6.2.2.3 MAHUJA

6.2.2.4 RUBBER SEED

6.2.2.5 MICROALGAE

6.2.2.6 SILK COTTON TREE

6.2.2.7 OTHERS

6.2.2.7.1 FUEL

6.2.2.7.2 POWER GENERATION

6.2.2.7.3 OTHERS

6.3 ANIMAL FATS

6.3.1 WHITE GREASE

6.3.2 TALLOW

6.3.3 POULTRY

6.3.4 OTHERS

6.3.4.1 FUEL

6.3.4.2 POWER GENERATION

6.3.4.3 OTHERS

7 EUROPE BIODIESEL MARKET, BY BLEND

7.1 OVERVIEW

7.2 B20

7.3 B10

7.4 B5

7.5 B100

8 EUROPE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY

8.1 OVERVIEW

8.2 TRANS-ESTERIFICATION

8.3 PYROLYSIS

8.4 HYDRO HEATING

8.5 DILUTION

8.6 MICRO-EMULSIFICATION

8.7 OTHERS

9 EUROPE BIODIESEL MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FUEL

9.2.1 AUTOMOTIVE

9.2.1.1 ON-ROAD VEHICLES

9.2.1.1.1 LIGHT DUTY

9.2.1.1.2 MEDIUM DUTY

9.2.1.1.3 HEAVY DUTY

9.2.1.2 OFF-ROAD VEHICLES

9.2.1.2.1 CONSTRUCTION MACHINERY

9.2.1.2.2 MINING EQUIPMENTS

9.2.1.2.3 LOCOMOTIVES

9.2.1.2.4 OTHERS

9.2.1.1 MARINE

9.2.1.2 AGRICULTURE

9.2.1.3 OTHERS

9.3 POWER GENERATION

9.4 OTHERS

10 EUROPE BIODIESEL MARKET, BY COUNTRY

10.1 EUROPE

10.1.1 FRANCE

10.1.2 GERMANY

10.1.3 SPAIN

10.1.4 U.K.

10.1.5 ITALY

10.1.6 BELGIUM

10.1.7 RUSSIA

10.1.8 SWITZERLAND

10.1.9 NETHRLANDS

10.1.10 TURKEY

10.1.11 LUXEMBURG

10.1.12 REST OF EUROPE

11 EUROPE BIODIESEL MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: EUROPE

11.2 COLLABORATION

11.3 FACILITY EXPANSIONS

11.4 PRODUCT LAUNCH

11.5 ACQUISITION

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 LOUIS DREYFUS COMPANY

13.2.1 COMPANY SNAPSHOT

13.2.2 PRODUCT PORTFOLIO

13.2.3 RECENT DEVELOPMENT

13.3 PETRÓLEO BRASILEIRO S.A. – PETROBRAS

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CARGILL, INCORPORATED

13.4.1 COMPANY SNAPSHOT

13.4.2 PRODUCT PORTFOLIO

13.4.3 RECENT DEVELOPMENTS

13.5 ADM

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ARGENT ENERGY

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 BIO-OILS ENERGY

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 ECOMOTION.DE

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 ECODIESEL COLOMBIA S.A.

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 ECO FOX SRL

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 MÜNZER BIOINDUSTRIE GMBH

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 RENEWABLE ENERGY GROUP

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 VERBIO UNITED BIOENERGY AG

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

表のリスト

TABLE 1 IMPORT DATA OF BIODIESEL AND MIXTURES THEREOF, NOT CONTAINING OR CONTAINING < 70 % BY WEIGHT OF PETROLEUM; HS CODE – 3826 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BIODIESEL AND MIXTURES THEREOF, NOT CONTAINING OR CONTAINING < 70 % BY WEIGHT OF PETROLEUM; HS CODE – 3826 (USD THOUSAND)

TABLE 3 EUROPE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 4 EUROPE VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 5 EUROPE EDIBLE OIL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE NON-EDIBLE OIL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 EUROPE VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 9 EUROPE ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 11 EUROPE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 EUROPE BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ON-ROAD VEHICLE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OFF-ROAD VEHICLE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE BIODIESEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BIODIESEL MARKET, BY COUNTRY, 2020-2029 (MILLION LITERS)

TABLE 19 FRANCE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 20 FRANCE VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 21 FRANCE EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 FRANCE NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 FRANCE VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 24 FRANCE ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 25 FRANCE ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 FRANCE BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 27 FRANCE BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 28 FRANCE BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 FRANCE FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 30 FRANCE AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 FRANCE ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 FRANCE OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 33 GERMANY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 34 GERMANY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 35 GERMANY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 GERMANY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 38 GERMANY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 39 GERMANY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 GERMANY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 41 GERMANY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 GERMANY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 GERMANY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 GERMANY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 45 GERMANY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 GERMANY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 SPAIN BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 48 SPAIN VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 49 SPAIN EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 SPAIN NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 SPAIN VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 52 SPAIN ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 53 SPAIN ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 SPAIN BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 55 SPAIN BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 SPAIN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 57 SPAIN FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 SPAIN AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 SPAIN ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 SPAIN OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 U.K BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 62 U.K VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 63 U.K EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 U.K NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 U.K VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 66 U.K ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 67 U.K ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 U.K BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 69 U.K BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 U.K BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 U.K FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.K AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.K ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 U.K OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 ITALY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 76 ITALY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 77 ITALY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 ITALY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 ITALY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 80 ITALY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 81 ITALY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 ITALY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 83 ITALY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 ITALY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 85 ITALY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 ITALY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 ITALY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 ITALY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 BELGIUM BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 90 BELGIUM VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 91 BELGIUM EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 BELGIUM NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 94 BELGIUM ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 BELGIUM BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 97 BELGIUM BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 BELGIUM BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 BELGIUM FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 BELGIUM AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 BELGIUM ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 BELGIUM OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 104 RUSSIA VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 105 RUSSIA EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 RUSSIA NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 RUSSIA VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 108 RUSSIA ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 109 RUSSIA ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 RUSSIA BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 111 RUSSIA BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 RUSSIA BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 113 RUSSIA FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 RUSSIA AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 RUSSIA ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 RUSSIA OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 SWITZERLAND BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 118 SWITZERLAND VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 122 SWITZERLAND ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 SWITZERLAND BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 SWITZERLAND FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SWITZERLAND AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 SWITZERLAND ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 SWITZERLAND OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 NETHERLANDS BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 132 NETHERLANDS VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 133 NETHERLANDS EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 NETHERLANDS NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 NETHERLANDS VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 136 NETHERLANDS ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 137 NETHERLANDS ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 NETHERLANDS BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 139 NETHERLANDS BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 NETHERLANDS BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 141 NETHERLANDS FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 NETHERLANDS AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 NETHERLANDS ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 NETHERLANDS OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 TURKEY BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 146 TURKEY VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 147 TURKEY EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 TURKEY NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 TURKEY VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 150 TURKEY ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 151 TURKEY ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 152 TURKEY BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 153 TURKEY BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 TURKEY BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 155 TURKEY FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 TURKEY AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 TURKEY ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 TURKEY OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 LUXEMBURG BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

TABLE 160 LUXEMBURG VEGETABLE OIL IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 161 LUXEMBURG EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 LUXEMBURG NON-EDIBLE OILS IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 LUXEMBURG VEGETABLE OIL IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION))

TABLE 164 LUXEMBURG ANIMAL FATS IN BIODIESEL MARKET, BY SEGMENT, 2020-2029 (USD MILLION)

TABLE 165 LUXEMBURG ANIMAL FATS IN BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 LUXEMBURG BIODIESEL MARKET, BY BLEND, 2020-2029 (USD MILLION)

TABLE 167 LUXEMBURG BIODIESEL MARKET, BY PRODUCTION TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 LUXEMBURG BIODIESEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 LUXEMBURG FUEL IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 LUXEMBURG AUTOMOTIVE IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 171 LUXEMBURG ON-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 LUXEMBURG OFF-ROAD VEHICLES IN BIODIESEL MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 REST OF EUROPE BIODIESEL MARKET, BY FEEDSTOCK, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 EUROPE BIODIESEL MARKET

FIGURE 2 EUROPE BIODIESEL MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BIODIESEL MARKET: DROC ANALYSIS

FIGURE 4 EUROPE BIODIESEL MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE BIODIESEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BIODIESEL MARKET: THE FEEDSTOCKLIFE LINE CURVE

FIGURE 7 EUROPE BIODIESEL MARKET: MULTIVARIATE MODELLING

FIGURE 8 EUROPE BIODIESEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 EUROPE BIODIESEL MARKET: DBMR MARKET POSITION GRID

FIGURE 10 EUROPE BIODIESEL MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 EUROPE BIODIESEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 EUROPE BIODIESEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 EUROPE BIODIESEL MARKET: SEGMENTATION

FIGURE 14 GROWING DEMAND FOR ENVIRONMENT FRIENDLY FUELS IS EXPECTED TO DRIVE EUROPE BIODIESEL MARKET IN THE FORECAST PERIOD

FIGURE 15 VEGETABLE OIL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BIODIESEL MARKET IN 2022 & 2029

FIGURE 16 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE BIODIESEL MARKET

FIGURE 18 EUROPE BIODIESEL MARKET: BY FEEDSTOCK, 2021

FIGURE 19 EUROPE BIODIESEL MARKET: BY BLEND, 2021

FIGURE 20 EUROPE BIODIESEL MARKET: BY PRODUCTION TECHNOLOGY, 2021

FIGURE 21 EUROPE BIODIESEL MARKET: BY APPLICATION, 2021

FIGURE 22 EUROPE BIODIESEL MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE BIODIESEL MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE BIODIESEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE BIODIESEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE BIODIESEL MARKET: BY BLEND (2022-2029)

FIGURE 27 EUROPE BIODIESEL MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。