ヨーロッパの自動車用熱交換器市場、用途別(インタークーラーラジエーターエアコン、オイルクーラー、その他)、設計タイプ別(チューブフィン、プレートバー、その他)、材質別(アルミニウム、銅、その他)、推進タイプ別(内燃機関(ICE)電気自動車(EV))、車両タイプ別(乗用車、軽商用車、大型商用車)業界動向および2029年までの予測。

欧州自動車熱交換器市場の分析と洞察

熱交換器の解析では、U係数と呼ばれる総括伝熱係数を用いると便利な場合が多くあります。熱交換器は通常、流路の配置と構造によって分類されます。熱交換器には、並流型と向流型があります。

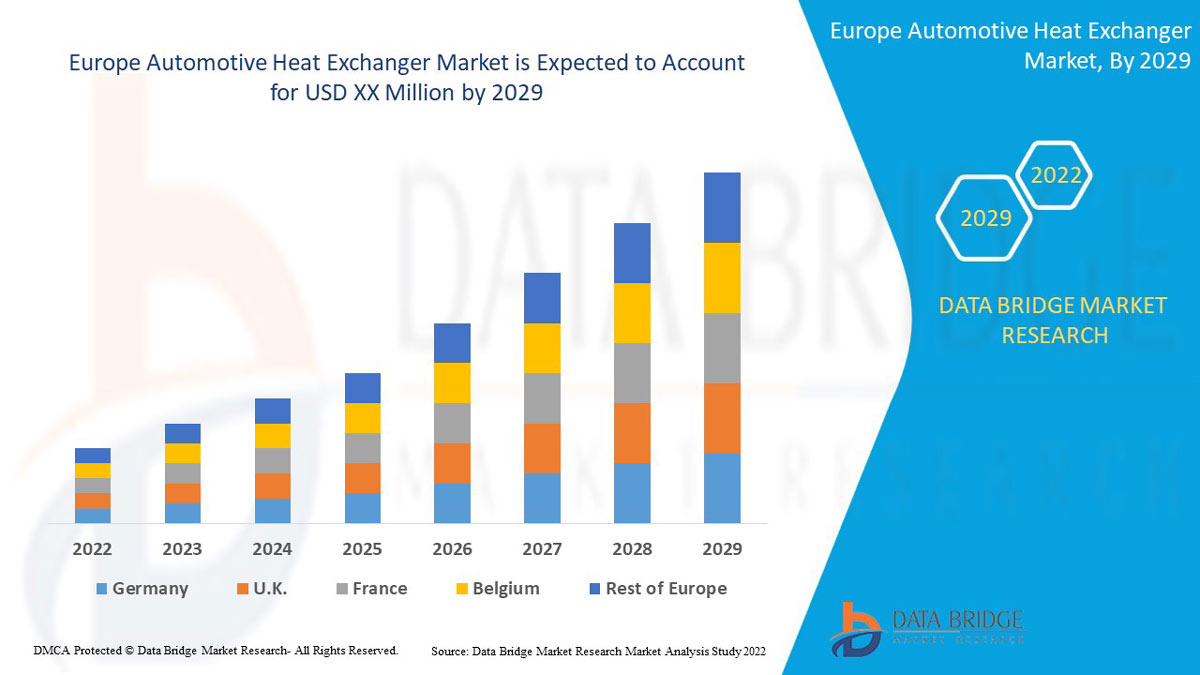

人口増加、急速な都市化、そして工業化は、自動車用熱交換器の成長と普及に重要な影響を与えています。現在の自動車用熱交換器システムは、車両の運動性能と安全機能の向上に広く利用されているからです。データブリッジ・マーケット・リサーチは、欧州の自動車用熱交換器市場は2022年から2029年の予測期間中に6.4%の年平均成長率(CAGR)で成長すると分析しています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020年(2019年~2014年にカスタマイズ可能) |

|

定量単位 |

売上高(百万米ドル)、販売数量(個数)、価格(米ドル) |

|

対象セグメント |

用途別(インタークーラー、ラジエーター、エアコン、オイルクーラー、その他)、設計タイプ別(チューブフィン、プレートバー、その他)、材質別(アルミニウム、銅、その他)、推進タイプ別(内燃機関(ICE)、電気自動車(EV))、車両タイプ別(乗用車、軽商用車、大型商用車)。 |

|

対象国 |

ドイツ、スペイン、フランス、ロシア、トルコ、イギリス、イタリア、オランダ、ベルギー、スイス、その他のヨーロッパ諸国。 |

|

対象となる市場プレーヤー |

MODINE MANUFACTURING COMPANY、株式会社デンソー、MAHLE GmbH、Constellium、サンデン株式会社、G&M Radiator、TYC Brothers Industrial Co., Ltd.、AKG Group、Hanon Systems、Dana Limited、Valeo、Nissens Automotive A/S、マレリホールディングス株式会社、ティラド株式会社、日本軽金属株式会社、PWR Corporate。 |

市場定義

熱交換器は、2つ以上のプロセス流体間で熱を交換する熱伝達装置です。熱交換器は、産業および家庭で広く利用されています。多くの熱交換器は、蒸気発電所、化学処理プラント、建物の暖房・空調システム、輸送用電力システム、冷凍装置などで開発されてきました。熱交換器における熱伝達は、通常、各流体内の対流と、2つの流体を隔てる壁を介した熱伝導によって行われます。

欧州自動車用熱交換器市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解を深めます。これらはすべて、以下で詳細に説明されています。

ドライバー

-

人口増加、急速な都市化、工業化

10年以上にわたり、工業化と都市化は自動車産業の台頭と成長に重要な役割を果たしてきました。世界中で人口が増加し、その大半がより良い機会と生活水準を求めて都市部へ移住する中で、工業化と都市化は自動車産業セクターの形成において重要な役割を果たしています。

-

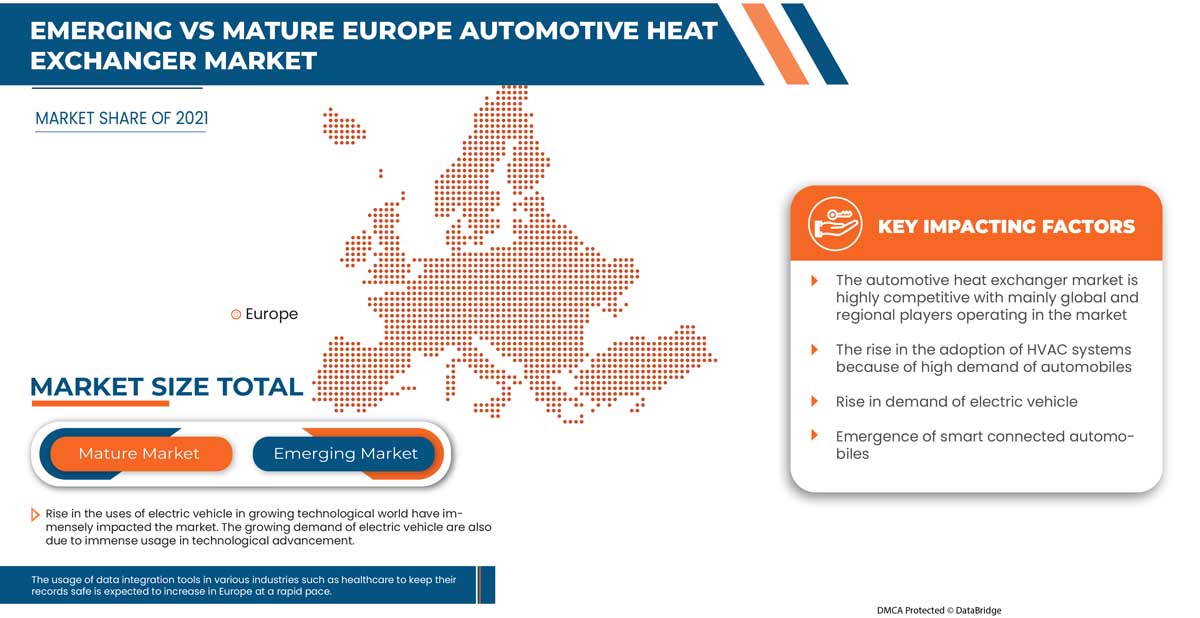

電気自動車(EV)の登場

自動車産業は、高級電気自動車の需要の高まりにより、飛躍的に成長しました。電気自動車(EV)はバッテリー電気自動車とも呼ばれ、車両を動かす電気エネルギーをバッテリーに蓄えます。電気自動車の販売を促進する要因としては、厳格な政府による排出ガス規制や、燃費効率が高く、高性能で、排出ガスが少ない車への需要の高まりなどが挙げられます。こうした状況を受けて、電気自動車はゼロエミッション車として普及し、CO2排出量を効果的に削減しています。

-

ADAS車両の需要増加とサブスクリプションモデル

先進運転支援システム(ADAS)は、自動車に搭載され、車両の運転や自動運転を支援する電子システムです。レーダーやカメラなどのセンサーを用いて状況を分析し、車両の周囲の状況に基づいて自動的に行動します。ADASを自動車に搭載することで、衝突回避、クルーズコントロールの採用、ブレーキのロック解除、照明の自動化、歩行者衝突回避支援(PCAM)など、運転に関する安全システムの強化が可能になります。

-

高級車と高性能車の需要の急増

高級車とは、高品質な内装材、高効率エンジン、トランスミッション、サウンドシステム、テレマティクス、安全機能など、先進的な高級機能を備えた車です。これらの車には、低価格帯の車には搭載されていない機能が搭載されています。

機会

-

スマートコネクテッドカーの登場

コネクテッドカーは、近くのデバイスにワイヤレスネットワークを接続することができます。コネクテッドカーのコンセプトは、AI、ビッグデータ、高度なネットワーク接続、IoTといった技術の進歩によって実現しました。コネクテッドカーは、様々な用途やユースケースで消費者の間で普及が進んでいます。例えば、コネクテッドエンターテイメントシステムでは、消費者の携帯電話をインターネットに接続し、他の車両やモバイルデバイスと双方向通信を行うことができます。

抑制/挑戦

-

自動車部門の二酸化炭素排出量の高さと設計の複雑さ、そして初期費用の高さ

しかし、自動車部門の二酸化炭素排出量が高いことから、政府機関は排出量を抑制するために厳格な措置や規制を講じざるを得なくなり、自動車用熱交換器ソリューションの採用が減少する可能性があります。さらに、設計の複雑さと初期費用の高さは、新しい自動車用熱交換器システムの販売と供給に直接影響を及ぼします。

新型コロナウイルス感染症(COVID-19)による欧州自動車用熱交換器市場への影響

COVID-19は市場に悪影響を及ぼしています。欧州では自動車用熱交換器システムの需要が高まっていますが、マレリホールディングス株式会社、ハノンシステムズ、ニッセンス、グリフィンサーマルプロダクツ、TYCブラザー工業株式会社、ダナ・リミテッドなどの欧州企業は、政府による厳しい規制の影響で半導体制御チップやコントローラーが不足し、新車・旧車を問わず先進的なシステムを提供することが極めて困難になっています。さらに、半導体チップや機器の供給不足は、市場における自動車の供給にも大きな影響を与えています。

最近の開発

- ティラド株式会社は、2022年3月に北米市場において、非住宅用冷却・換気機器(NACE2 2825)を発売しました。同地域における同製品の特長は、ラジエーター、オイルクーラー、インタークーラー、EGRクーラー、エバポレーター、コンデンサー、ウォーターコイル、レキュペレーターなど、複数の製品を投入していることです。これにより、同社は北米市場における収益と販売を拡大しました。

欧州自動車用熱交換器市場の展望

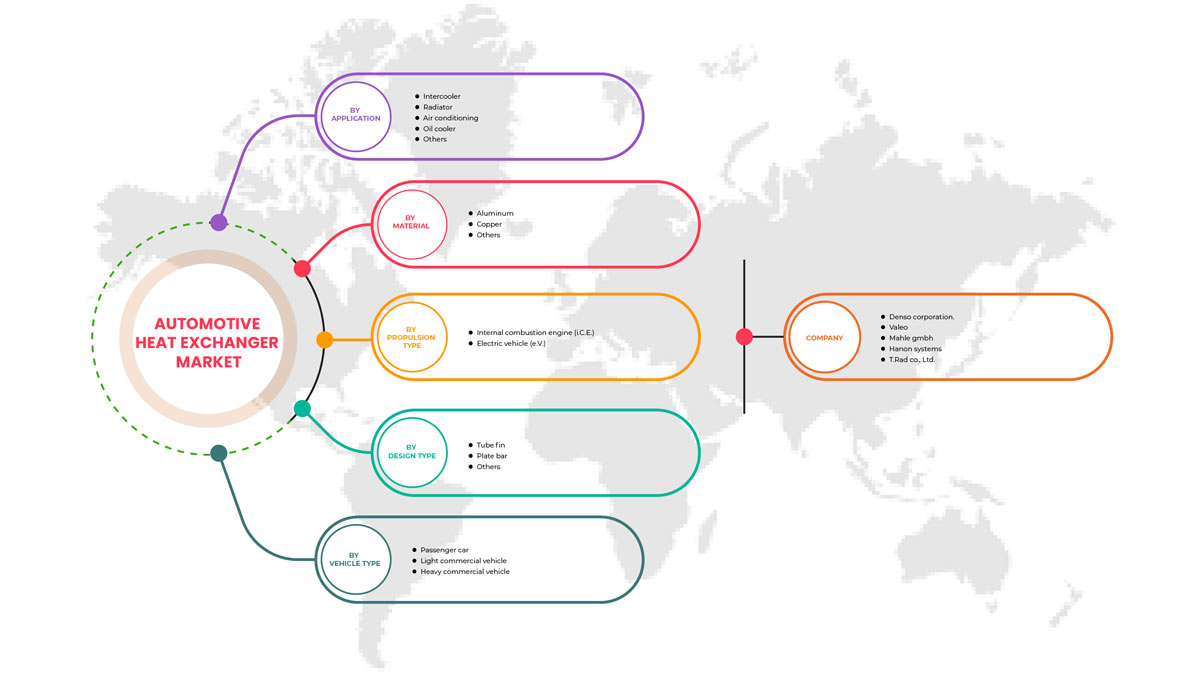

欧州の自動車用熱交換器市場は、用途、設計タイプ、材質、駆動方式、車両タイプに基づいてセグメント化されています。これらのセグメント間の成長は、業界における成長の少ないセグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的意思決定を支援します。

応用

- インタークーラー

- ラジエーター

- 空調

- オイルクーラー

- その他

用途に基づいて、ヨーロッパの自動車用熱交換器市場は、インタークーラー、ラジエーター、エアコン、オイルクーラーなどに分類されます。

デザインタイプ

- 細いチューブ

- プレートバー

- その他

設計タイプに基づいて、ヨーロッパの自動車用熱交換器市場は、チューブフィン、プレートバー、その他に分類されます。

材料

- アルミニウム

- 銅

- その他

On the basis of material, Europe automotive heat exchanger market is segmented into aluminium, copper, and others.

Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicle (EV)

On the basis of propulsion type, Europe automotive heat exchanger market is segmented into internal combustion engine (ICE) and electric vehicle (EV).

Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

On the basis of vehicle type, Europe automotive heat exchanger market is segmented into passenger car, light commercial vehicle, and heavy commercial vehicle.

Europe Automotive Heat Exchanger Market Regional Analysis/Insights

Europe automotive heat exchanger market is analyzed, and market size insights and trends are provided by country, application, design type, material, propulsion type, and vehicle type, as referenced above.

The countries covered in Europe automotive heat exchanger market report are Germany, France, U.K., Italy, Spain, Turkey, Russia, Netherlands, Switzerland, Belgium, and the rest of Europe.

Germany dominates in the Europe region due to an increase in population & rapid urbanization and the emergence of electric vehicles (EVs), which boosts the market growth.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Europe Automotive Heat Exchanger Market Share Analysis

Europe automotive heat exchanger market competitive landscape provides details of a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Europe automotive heat exchanger market.

Some of the major players operating in Europe automotive heat exchanger market are DENSO CORPORATION., MAHLE GmbH, VALEO, Hanon Systems, T.RAD Co., Ltd. among others.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 APPLICATION TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF ELECTRIC VEHICLES (EVS)

5.1.3 GROWING ADOPTION OF ADAS ASSISTED VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH CARBON FOOTPRINT OF AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 STRATEGIC PARTNERSHIP, SOLUTIONS LAUNCHES, AND ACQUISITIONS AMONG MAJOR PLAYERS

5.3.2 EMERGENCE OF SMART CONNECTED AUTOMOTIVE

5.3.3 GROWING ADOPTION OF CONVENIENCE FEATURES SUCH AS HVAC SYSTEMS IN AUTOMOTIVES

5.4 CHALLENGES

5.4.1 UPCOMING EMISSION NORMS COULD POSE A CHALLENGE FOR AUTOMOTIVE HEAT EXCHANGERS

5.4.2 DESIGN COMPLEXITIES AND HIGH UPFRONT COST

6 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 INTERCOOLER

6.3 RADIATOR

6.4 AIR CONDITIONING

6.5 OIL COOLER

6.6 OTHERS

7 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE

7.1 OVERVIEW

7.2 TUBE FIN

7.3 PLATE BAR

7.4 OTHERS

8 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 ALUMINUM

8.3 COPPER

8.4 OTHERS

9 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE

9.1 OVERVIEW

9.2 INTERNAL COMBUSTION ENGINE (ICE)

9.3 ELECTRIC VEHICLE (EV)

10 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CAR

10.3 LIGHT COMMERCIAL VEHICLE

10.4 HEAVY COMMERCIAL VEHICLE

10.4.1 ON-HIGHWAY VEHICLE

10.4.2 OFF-HIGHWAY VEHICLE

10.4.2.1 CONSTRUCTION

10.4.2.2 AGRICULTURE

10.4.2.3 OTHERS

11 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION

11.1 EUROPE

11.1.1 GERMANY

11.1.2 U.K.

11.1.3 FRANCE

11.1.4 ITALY

11.1.5 SPAIN

11.1.6 RUSSIA

11.1.7 SWITZERLAND

11.1.8 NETHERLANDS

11.1.9 BELGIUM

11.1.10 TURKEY

11.1.11 REST OF EUROPE

12 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: EUROPE

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 VALEO

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 BUSINESS PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 MAHLE GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 HANON SYSTEMS

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 BUSINESS PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 T.RAD CO., LTD.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCTS PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 AKG GROUP

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT0

14.7 BANCO PRODUCTS (I) LTD.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CLIZEN INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCTS PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 CONSTELLIUM

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 DANA LIMITED.

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 BUSINESS PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 G&M RADIATOR

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENT

14.12 GRIFFIN THERMAL PRODUCTS

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCTS PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 MARELLI HOLDINGS CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCTS PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 MISHIMOTO AUTOMOTIVE

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENT

14.15 MODINE MANUFACTURING COMPANY

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 NISSENS AUTOMOTIVE A/S

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCTS PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 PWR CORPORATE

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENT

14.18 SANDEN CORPORATION.

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENT

14.19 TYC BROTHER INDUSTRIAL CO., LTD.

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 BUSINESS PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

表のリスト

TABLE 1 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS, SUVS &TRUCK

TABLE 2 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 3 EUROPE INTERCOOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE RADIATOR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE AIR CONDITIONING IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 EUROPE OIL COOLER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE TUBE FIN IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE PLATE BAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 EUROPE ALUMINUM IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE COPPER IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE OTHERS IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE INTERNAL COMBUSTION ENGINE (ICE) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE ELECTRIC VEHICLE (EV) IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PASSENGER CAR IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE LIGHT COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 26 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 33 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 34 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 35 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 36 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 37 GERMANY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 42 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 43 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 44 U.K. AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 45 U.K. HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 U.K. OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 49 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 50 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 51 FRANCE AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 52 FRANCE HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 FRANCE OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 54 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 56 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 57 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 58 ITALY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 59 ITALY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 ITALY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 62 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 63 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 64 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 65 SPAIN AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 69 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 70 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 71 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 72 RUSSIA AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 73 RUSSIA HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 RUSSIA OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 75 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 76 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 77 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 78 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 79 SWITZERLAND AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 80 SWITZERLAND HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 SWITZERLAND OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 82 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 84 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 86 NETHERLANDS AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 87 NETHERLANDS HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 NETHERLANDS OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 89 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 90 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 91 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 92 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 93 BELGIUM AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 94 BELGIUM HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 BELGIUM OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 98 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 99 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 100 TURKEY AUTOMOTIVE HEAT EXCHANGER MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 101 TURKEY HEAVY COMMERCIAL VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 TURKEY OFF-HIGHWAY VEHICLE IN AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 REST OF EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 2 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: DROC ANALYSIS

FIGURE 4 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: SEGMENTATION

FIGURE 10 GROWING ADOPTION OF ADAS ASSISTED VEHICLES IS EXPECTED TO DRIVE EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INTERCOOLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET FROM 2022 TO 2029

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET

FIGURE 13 URBANIZED REGIONS IN THE GLOBE

FIGURE 14 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 15 ROAD TRANSPORT EMISSIONS

FIGURE 16 BENEFITS OF SMART TELEMATICS FOR FLEET MANAGEMENT

FIGURE 17 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION, 2021

FIGURE 18 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY DESIGN TYPE, 2021

FIGURE 19 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY MATERIAL, 2021

FIGURE 20 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY PROPULSION TYPE, 2021

FIGURE 21 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: SNAPSHOT (2021)

FIGURE 23 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021)

FIGURE 24 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: BY APPLICATION (2022-2029)

FIGURE 27 EUROPE AUTOMOTIVE HEAT EXCHANGER MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。