オーストラリアとニュージーランドのヘルスケア物流市場、サービス別(輸送、梱包、保管と倉庫、監視など)、温度(常温、冷蔵/冷蔵、冷凍と極低温)、物流タイプ別(海上貨物物流、航空貨物物流、陸上物流)、用途別(医薬品、バルク医薬品取扱業者、患者物流、ワクチン、生物材料と臓器、危険貨物など)、エンドユーザー別(バイオ医薬品会社、医療機器会社、基準および診断研究所、病院と診療所、学術研究機関、救急医療サービス会社など)、流通チャネル別(サードパーティと従来型物流) - 2030年までの業界動向と予測。

オーストラリアとニュージーランドのヘルスケア物流市場の分析と洞察

ヘルスケアは、人々の感染症、病気、怪我、その他の身体的および精神的障害の診断、予防、治療、回復、または修復を通じて、健康を維持または改善することを目的としています。ヘルスケアのサポートは、関連医療分野の医療専門家の助けを借りて行われます。歯科、薬学、看護、聴覚学、医学、検眼、助産、心理学、作業療法および身体療法、その他の医療専門職はすべて、ヘルスケアに関係しています。

ヘルスケア物流管理は、道路、鉄道、海上、航空など、さまざまな輸送手段に使用されます。道路経路を介した貨物輸送は、このセグメントに分類されます。これは、単一の通関書類処理を必要とするため、最も一般的な輸送手段です。鉄道輸送は燃料効率が非常に高く、「グリーン」輸送手段と言えます。海上輸送は、バルク商品の移動に使用されます。航空輸送は、最も速い輸送手段であり、ヘルスケア物流における「ジャストインタイム」(JIT)在庫補充を実現するために広く使用されています。

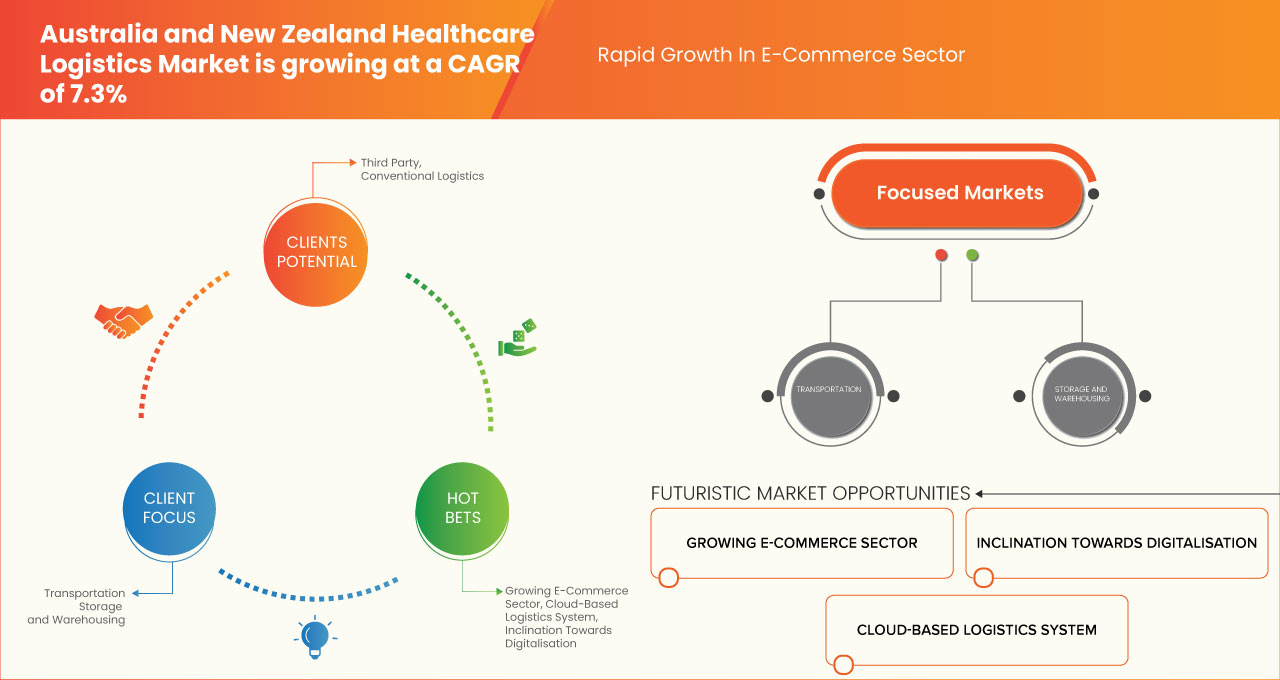

データブリッジマーケットリサーチの分析によると、オーストラリアのヘルスケア物流市場は予測期間中に7.6%のCAGRで2030年までに8億4,359万米ドルの価値に達すると予想され、ニュージーランドのヘルスケア物流市場は予測期間中に5.5%のCAGRで2030年までに1億803万米ドルの価値に達すると予想されています。オーストラリアとニュージーランドのヘルスケア物流市場では物流の利用が増えているため、輸送は市場で最大のサービスセグメントとなっています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2023年から2030年 |

|

基準年 |

2022 |

|

歴史的な年 |

2021 (2015~2020年にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

サービス別(輸送、梱包、保管および倉庫、監視など)、温度(常温、冷蔵/冷蔵、冷凍および極低温)、物流タイプ別(海上貨物物流、航空貨物物流、陸上物流)、用途別(医薬品、バルク医薬品取扱業者、患者物流、ワクチン、生物材料および臓器、危険貨物など)、エンドユーザー別(バイオ医薬品会社、医療機器会社、基準および診断研究所、病院および診療所、学術研究機関、救急医療サービス会社など)、流通チャネル別(サードパーティおよび従来型物流) |

|

対象国 |

オーストラリアとニュージーランド |

|

対象となる市場プレーヤー |

ACFS Port Logistics Pty Ltd.、United Parcel Service of America, Inc.、Logistics Bureau Pty Ltd.、AP MOLLER-MAERSK、Linfox Pty Ltd、KERRY LOGISTICS NETWORK LIMITED、Kuehne+Nagel、DSV、CEVA logistics、Rhenus Group、Deutsche Post AG、Toll Holdings Limited.、DB Schenker、FedEx、EBOS Group Limited、CH Robinson Worldwide, Inc.、YUSEN LOGISTICS CO., LTD、CRYOPDP、MTF Logistics Pty Ltd、Pik Pak など。 |

オーストラリアとニュージーランドのヘルスケア物流市場の定義

ヘルスケアは、人々の感染症、病気、怪我、その他の身体的および精神的障害の診断、予防、治療、回復、または修復を通じて、健康を維持または改善することを目的としています。ヘルスケアのサポートは、関連医療分野の医療専門家の助けを借りて行われます。歯科、薬学、看護、聴覚学、医学、検眼、助産、心理学、作業療法および身体療法、その他の医療専門職はすべてヘルスケアの一部です。

ヘルスケア物流管理は、道路、鉄道、海上、航空など、さまざまな輸送手段に使用されています。道路経路を介した貨物の移動は、このセグメントに分類されます。単一の通関書類プロセスを必要とするため、最も一般的な輸送手段です。鉄道輸送は燃料効率が非常に高く、「グリーン」輸送手段と言えます。海上輸送はバルク商品の移動に使用されます。航空輸送は最速の輸送手段であり、ヘルスケア物流における「ジャストインタイム」(JIT)在庫補充を実現するために広く使用されています。航空輸送やその他のさまざまな輸送手段による物流の増加は、物流需要全体を押し上げる要因の一部です。

オーストラリアとニュージーランドのヘルスケア物流市場の動向

このセクションでは、市場の推進要因、利点、機会、制約、課題について理解します。これらについては、以下で詳しく説明します。

ドライバー

電子商取引分野の急速な成長

電子商取引または電子商取引は、電子ネットワークまたはオンライン プラットフォーム (主にインターネット) を介して商品やサービスを売買するプロセスです。最近では、Amazon、Flipkart、eBay などの電子商取引プラットフォームの普及により、オンラインでの商品の売買が大幅に増加しました。これにより、消費者がヘルスケア製品を自由に購入し、必要に応じて使用できるプラットフォームが提供されています。

ニュージーランドとオーストラリアは、国境を越えた支出が高く、eコマースイベントが盛んに行われているという特徴を持つeコマース市場です。インターネットの普及、スマートフォンユーザーの増加、ソーシャルメディアの影響など、さまざまな要因がeコマースの成長に貢献しています。さらに、eコマース部門を後押しする政府の取り組みも、市場の成長の大きな理由です。さまざまな地域で、政府はeコマースを促進するためにさまざまな措置を講じています。

上記の根拠は、電子商取引業界が世界的に継続的に成長していることを意味しており、オーストラリアとニュージーランドのヘルスケア物流市場の成長の主要な原動力となることが期待されています。

サードパーティロジスティクスが提供する大きなメリット

サードパーティ ロジスティクスは、基本的に倉庫保管から配送までの運用ロジスティクスをアウトソーシングするもので、これには貨物輸送、梱包、注文履行、在庫予測、ピッキングと梱包、倉庫保管、輸送など、サプライ チェーンにおける多数のサービスの提供が含まれます。サードパーティ ロジスティクスは、事業主が製品開発、マーケティング、販売など、事業の他の側面にもっと集中できるように支援するため、幅広いメリットを提供します。したがって、サードパーティ ロジスティクスが提供する高いメリットは、オーストラリアとニュージーランドのヘルスケア ロジスティクス市場の成長を促進する主な要因となっています。

サードパーティロジスティクスは、倉庫保管と物流のコスト削減に役立ち、新薬物流に非常に有益です。さらに、ヘルスケア製品の需要は年間を通じて変動し続け、資本を投入する必要がないため、企業はリスクを軽減できます。これらの利点により、企業は支出をより賢明に投資することができ、オーストラリアとニュージーランドのヘルスケア物流市場の主要な成長要因として機能することが期待されています。

拘束

リバースロジスティクスに関連する高コスト

さまざまなメーカーやサービス プロバイダーが提供するリバース ロジスティクス サービスに関連するコストは高額です。さまざまなヘルスケア関連製品の需要が高いため、ヘルスケア分野ではリバース ロジスティクス サービスが非常に人気があります。Thomas Publishing Company によると、産業機器の返品率は約 4% ~ 8% ですが、ヘルスケア機器の返品率は 8% ~ 20% です。リバース ロジスティクス サービスが高額な理由は、これらのサービスの価格を決定するさまざまな要因の組み合わせです。

These are the factors that determine the reverse logistics services offered by various healthcare service providers. Generally, healthcare reverse logistics average between 7 to 10 % of the cost of goods, which is quite high. This can be expected to act as a major restraint for the growth of the Australia and New Zealand healthcare logistics market.

Opportunity

Adoption of Cloud based Logistics Solutions

Cloud technology is a vital online technology that is used all around the globe. Cloud technology enables the users to access storage, files, software, and servers using their internet-connected devices. It also means or signifies having the ability to store and access data and programs over the Internet instead of on a hard drive which can be utilized by logistic businesses of any size. Unlike traditional hardware and software methods, cloud technologies can help logistic businesses to stay at the forefront of technology.

Cloud technologies can help optimize healthcare logistics and improve its return supply chain management; therefore, adopting cloud technologies is expected to act as a lucrative opportunity for the growth of the Australia and New Zealand healthcare logistics market.

Challenge

Inadequate Labour Resources to Handle Return

The overall supply chain management process involves analyzing a large amount of data and a large number of returns. Due to rapid growth in the E-commerce sector, the workforce needs to take the necessary steps at the right time. The information provided needs to be well-executed in order to provide optimum results and quality of services.

However, a lack of skilled workers and training to the employees can lead to several errors causing inefficiency in the services offered, acting as a major challenge for the growth in the healthcare logistics sector. This can be a major setback as customer satisfaction is everything in the healthcare logistics sector. The workforce working in healthcare logistics must be trained in identifying specific serial or part numbers. Moreover, the workforce must know the authoritative inventory, warranty policy, and accounting information housed in their central enterprise resource planning (ERP) system, but it's difficult to find a skilled workforce for handling returns of healthcare products.

Recent Developments

- In March 2023, A.P. Moller - Maersk announced that it had expanded its footprint in Latin America with new warehouses in Chile and Peru. This helps the organization in developing more revenue.

- In February 2022, ACFS Port Logistics Pty Ltd. announced that it had partnered with sany heavy forklifts. This collaboration helps the organization in developing more product portfolio and also helps in generating revenue.

Australia and New Zealand Healthcare Logistics Market Scope

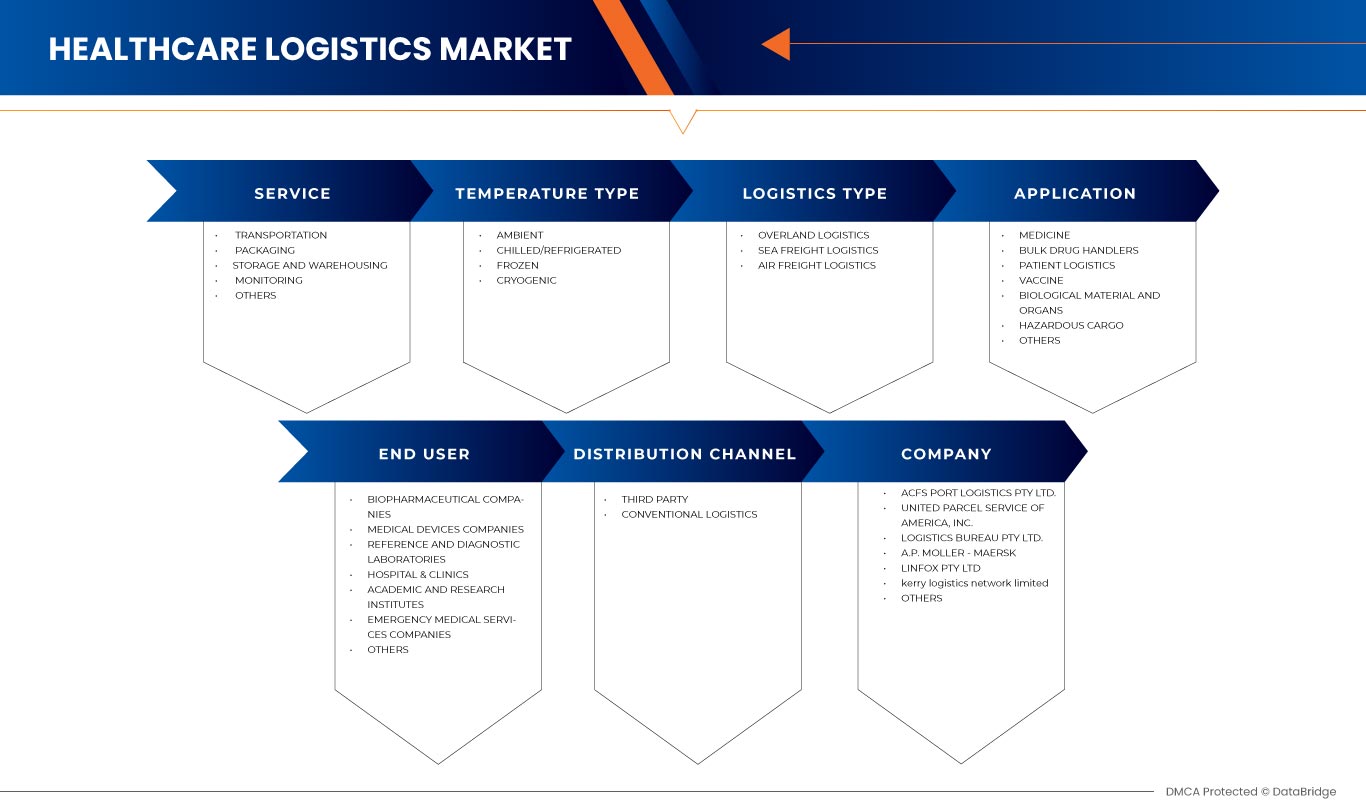

Australia and New Zealand healthcare logistics market is segmented into six notable segments such as services, temperature type, logistic type, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICES

- Transportation

- Packaging

- Storage And Warehousing

- Monitoring

- Others

On the basis of Services Australia and New Zealand healthcare logistics market is segmented into transportation, packaging, storage and warehousing, monitoring, and others.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

- Chilled/ Refrigerated

- Frozen

- Ambient

- Cryogenic

On the basis of application Australia and New Zealand healthcare logistics market is segmented into chilled/ refrigerated, frozen, ambient, and cryogenic.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

- Sea Freight Logistics

- Air Freight Logistics

- Overland Logistics

On the basis of logistics type, the Australia and New Zealand healthcare logistics market is segmented into sea freight logistics, air freight logistics, and overland logistics.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY APPLICATION

- Medicine

- Bulk Drug Handlers

- Patient Logistics

- Vaccine

- Biological Material And Organs

- Hazardous Cargo

- Others

On the basis of application, the Australia and New Zealand healthcare logistics market is segmented into medicine, bulk drug handlers, patient logistics, vaccine, biological material and organs, hazardous cargo and others.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY END USER

- Biopharmaceutical Companies

- Medical Devices Companies

- Reference And Diagnostic Laboratories

- Hospital & Clinics

- Academic And Research Institutes

- Emergency Medical Services Companies

- Others

On the basis of end user, the Australia and New Zealand healthcare logistics market is segmented into biopharmaceutical companies, medical devices companies, reference and diagnostic laboratories, hospital & clinics, academic and research institutes, emergency medical services companies, and others.

AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

- Third Party

- Conventional Logistics

On the basis of distribution channel, the Australia and New Zealand healthcare logistics market is segmented into third party and conventional logistics.

Australia and New Zealand Healthcare Logistics Market Regional Analysis/Insights

The Australia and New Zealand healthcare logistics market is segmented into six notable segments such as services, temperature type, logistic type, application, end user, distribution channel

The countries covered in this market report Australia and New Zealand.

レポートの国別セクションでは、市場の現在および将来の動向に影響を与える国内市場における個別の市場影響要因と規制の変更も提供しています。新規販売、交換販売、国の人口統計、規制行為、輸出入関税などのデータ ポイントは、各国の市場シナリオを予測するために使用される主要な指標の一部です。また、国別データの予測分析を提供する際には、ヘルスケア ブランドの存在と可用性、および輸送によって直面する課題も考慮されます。

競争環境とオーストラリアおよびニュージーランドのヘルスケア物流市場シェア分析

オーストラリアとニュージーランドのヘルスケア物流市場の競争状況では、競合他社ごとに詳細が提供されます。詳細には、会社概要、会社の財務状況、収益、市場の可能性、事業拡大、サービス施設、パートナーシップ、戦略的開発、アプリケーションの優位性、およびテクノロジーライフライン曲線が含まれます。提供されている上記のデータポイントは、オーストラリアとニュージーランドのヘルスケア物流市場に対する会社の重点にのみ関連しています。

オーストラリアとニュージーランドのヘルスケア物流市場で活動している主要企業には、ACFS Port Logistics Pty Ltd.、United Parcel Service of America, Inc.、Logistics Bureau Pty Ltd.、AP Moller –MAERSK、Linfox Pty Ltd、KERRY LOGISTICS NETWORK LIMITED、Kuehne+Nagel、DSV、CEVA logistics、Rhenus Group、Deutsche Post AG、Toll Holdings Limited.、DB Schenker、FedEx、EBOS Group Limited、CH Robinson Worldwide, Inc.、YUSEN LOGISTICS CO., LTD、CRYOPDP、MTF Logistics Pty Ltd、Pik Pak などがあります。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 AUSTRALIA TRANSPORTATION MODE TIMELINE CURVE

2.1 NEW ZEALAND TRANSPORTATION MODE TIMELINE CURVE

2.11 MARKET INDUSTRY COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

4.3 TRANSPORT

4.3.1 MEDICAL TUBS- TRANSPORT FLEET

4.3.2 PARCELS

4.3.3 MEDICAL DEVICES, PRODUCTS TRANSPORTATION

4.3.4 MED PHARMA PRODUCTS TRANSPORTATION

4.3.5 GLASS MATERIAL TRANSPORTATION

4.3.6 RADIOACTIVE MATERIAL TRANSPORTATION

4.3.7 SENSITIVE FREIGHT TRANSPORTATION

4.4 VALUE ADDED SERVICES

4.4.1 TEMPERATURE CONTROLLED PACKAGING

4.4.2 STOCK COUNTING SERVICES

4.4.3 DRY ICE

4.4.4 CRYO VALUE ADDED SERVICES

4.5 WAREHOUSE

4.5.1 3PL –KITTING

4.5.2 3PL - TEMP-CONTROLLED PACKAGING

4.6 PATENT ANALYSIS

4.7 INCREASING VISIBILITY THROUGH THE INTERNET OF THINGS

4.8 STRATEGIC INITIATIVES SHAPING FUTURE OF LOGISTICS

5 GLOBAL HEALTHCARE LOGISTICS MARKET, BY REGION

5.1 OVERVIEW

6 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, INDUSTRY INSIGHTS

6.1 KEY PRICING STRATEGIES

6.1.1 OVERVIEW

7 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, REGULATORY FRAMEWORK

7.1 OVERVIEW

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RAPID GROWTH IN THE E-COMMERCE SECTOR

8.1.2 HIGH BENEFITS OFFERED BY THIRD-PARTY LOGISTICS

8.1.3 RISING GROWTH IN CROSS BORDER TRADES AND GLOBALIZATION

8.1.4 INCREASE IN GROWTH OF LOGISTICS THROUGH AIRWAY AND DIFFERENT OTHER TRANSPORT MODES

8.2 RESTRAINTS

8.2.1 CONGESTION ASSOCIATED WITH TRADE ROUTES

8.2.2 HIGH COST ASSOCIATED WITH REVERSE LOGISTICS

8.2.3 CONCERNS RELATED TO INVENTORY MANAGEMENT IN HEALTHCARE LOGISTICS

8.3 OPPORTUNITIES

8.3.1 INCLINATION TOWARDS DIGITALIZATION OF THE SECTOR

8.3.2 ADOPTION OF CLOUD BASED LOGISTICS SOLUTIONS

8.3.3 INCREASING GROWTH INVESTMENTS AND EXPANSIONS MADE BY THE MARKET PLAYERS

8.3.4 EMERGENCE OF NEW ADVANCED TECHNOLOGIES

8.4 CHALLENGES

8.4.1 INADEQUATE LABOUR RESOURCES TO HANDLE RETURN

8.4.2 FREQUENT DELAYS IN THE DELIVERY OF PRODUCTS DUE TO VARIOUS TECHNICAL FACTORS

9 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICE

9.1 OVERVIEW

9.2 TRANSPORATATION

9.2.1 COLD CHAIN

9.2.1.1 PHARMACEUTICS

9.2.1.1.1 BOTTLES

9.2.1.1.2 VIALS AND AMPOULES

9.2.1.1.3 CARTRIDGES AND SYRINGES

9.2.1.1.4 POUCHES AND BAGS

9.2.1.1.5 BLISTER PACKS

9.2.1.1.6 TUBES

9.2.1.1.7 PAPER BOARD BOXES

9.2.1.1.8 CAPS AND CLOSURES

9.2.1.1.9 LABELS

9.2.1.1.10 OTHERS

9.2.1.2 INVESTIGATIONAL MEDICINES

9.2.1.3 HOSPITAL SUPPLIES

9.2.1.3.1 DIAGNOSTIC SUPPLIES

9.2.1.3.2 INJECTABLE SUPPLIES

9.2.1.3.3 MEDICAL EQUIPMENT AND DEVICES

9.2.1.3.4 PERSONAL PROTECTIVE EQUIPMENT

9.2.1.3.5 DISINFECTANTS

9.2.1.3.6 WOUND CARE CONSUMABLE

9.2.1.3.7 INFUSION & DIALYSIS CONSUMABLES

9.2.1.3.8 OTHERS

9.2.1.4 LABORATORY SPECIMENS

9.2.1.4.1 REAGENTS AND CONSUMABLES

9.2.1.4.2 TEST SPECIMENS

9.2.1.5 TISSUE AND ORGAN

9.2.1.5.1 HEART

9.2.1.5.2 LUNGS

9.2.1.5.3 KIDNEY

9.2.1.5.4 LIVER

9.2.1.5.5 OTHERS

9.2.1.6 OTHERS

9.2.2 NON-COLD CHAIN

9.2.2.1 PHARMACEUTICS

9.2.2.2 INVESTIGATIONAL MEDICINES

9.2.2.3 HOSPITAL SUPPLIES

9.2.2.4 LABORATORY SPECIMENS

9.2.2.5 TISSUE AND ORGAN

9.2.2.6 OTHERS

9.3 PACKAGING

9.3.1 PHARMACEUTICALS

9.3.2 MEDICAL DEVICES

9.3.3 LABORATORY SPECIMENS

9.4 STORAGE AND WAREHOUSING

9.4.1 RAW MATERIALS

9.4.2 MEDICINES

9.4.3 MEDICAL DEVICES

9.4.4 CONSUMABLES

9.4.5 BIOLOGICAL MATERIALS

9.4.6 CONTAINERS

9.4.7 OTHERS

9.5 MONITORING

9.6 OTHERS

10 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE

10.1 OVERVIEW

10.2 AMBIENTS

10.3 CHILLED/REFRIGERATED

10.4 FROZEN

10.5 CRYOGENIC

11 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE

11.1 OVERVIEW

11.2 OVERLAND LOGISTICS

11.3 SEA FREIGHT LOGISTICS

11.4 AIR FREIGHT LOGISTICS

12 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 MEDICINES

12.3 BULK DRUG HANDLERS

12.4 PATIENT LOGISTICS

12.5 VACCINE

12.6 BIOLOGICAL MATERIAL AND ORGANS

12.7 HAZARDOUS CARGO

12.8 OTHERS

13 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY END USER

13.1 OVERVIEW

13.2 BIOPHARMACEUTICAL COMPANIES

13.3 MEDICAL DEVICES COMPANIES

13.4 REFERENCE AND DIAGNOSTIC LABORATORIES

13.5 HOSPITAL & CLINICS

13.6 ACADEMIC AND RESEARCH INSTITUTES

13.7 EMERGENCY MEDICAL SERVICES COMPANIES

13.8 OTHERS

14 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 THIRD PARTY

14.3 CONVENTIONAL LOGISTICS

15 AUSTRALIA HEALTHCARE LOGISTICS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: AUSTRALIA

15.2 COMPANY SHARE ANALYSIS: NEW ZEALAND

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ACFS PORT LOGISTICS PTY LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 UNITED PARCEL SERVICE OF AMERICA, INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 LOGISTICS BUREAU PTY LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 LINFOX PTY LTD.

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT DEVELOPMENT

17.5 DSV

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 A.P. MOLLER - MAERSK

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 C.H. ROBINSON WORLDWIDE, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 SERVICE PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CEVA LOGISTICS

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 CRYOPDP

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 DB SCHENKER

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 DEUTSCHE POST AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 EBOS GROUP LIMITED

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 FEDEX

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SERVICE PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 KERRY LOGISTICS NETWORK LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 SERVICE PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 KUEHNE+NAGEL

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 MTF LOGISTICS PTY LTD

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 PIK PAK.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 RHENUS GROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 TOLL HOLDINGS LIMITED.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 YUSEN LOGISTICS CO., LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

表のリスト

TABLE 1 AUSTRALIA & NEW ZEALAND HEALTHCARE LOGISTICS MARKET, PATENT ANALYSIS

TABLE 2 GLOBAL HEALTHCARE LOGISTICS MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 4 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 5 AUSTRALIA TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 6 NEW ZEALAND TRANSPORTATION IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 7 AUSTRALIA COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 8 NEW ZEALAND COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 9 AUSTRALIA PHARMACEUTICS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 10 NEW ZEALAND PHARMACEUTICS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 11 AUSTRALIA HOSPITAL SUPPLIES IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 12 NEW ZEALAND HOSPITAL SUPPLIES IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 13 AUSTRALIA LABORATORY SPECIMENS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 14 NEW ZEALAND LABORATORY SPECIMENS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 15 AUSTRALIA TISSUES AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 16 NEW ZEALAND TISSUES AND ORGANS IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 17 AUSTRALIA NON- COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 18 NEW ZEALAND NON- COLD CHAIN IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 19 AUSTRALIA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 20 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY SERVICES, 2021-2030 (USD MILLION)

TABLE 21 AUSTRALIA PACKAGING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 22 NEW ZEALAND STORAGE AND WAREHOUSING IN HEALTHCARE LOGISTICS MARKET, BY SERVICE, 2021-2030 (USD MILLION)

TABLE 23 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2021-2030 (USD MILLION)

TABLE 24 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY TEMPERATURE TYPE, 2021-2030 (USD MILLION)

TABLE 25 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2021-2030 (USD MILLION)

TABLE 26 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY LOGISTICS TYPE, 2021-2030 (USD MILLION)

TABLE 27 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 28 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 29 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 30 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 AUSTRALIA HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 32 NEW ZEALAND HEALTHCARE LOGISTICS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

図表一覧

FIGURE 1 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 2 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DATA TRIANGULATION

FIGURE 3 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DROC ANALYSIS

FIGURE 4 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: GLOBAL VS. REGIONAL MARKET ANALYSIS

FIGURE 5 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 AUSTRALIA HEALTHCARE LOGISTICS MARKET: END USER COVERAGE GRID

FIGURE 10 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: END USER COVERAGE GRID

FIGURE 11 AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET: SEGMENTATION

FIGURE 12 INCREASING GROWTH IN GLOBALIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE AUSTRALIA HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 INCREASING GROWTH IN GLOBALIZATION LEADING TO HIGH FREIGHT TRANSPORTATION IS EXPECTED TO DRIVE NEW ZEALAND HEALTHCARE LOGISTICS MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 TRANSPORTATION MODE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF AUSTRALIA HEALTHCARE LOGISTICS MARKET FROM 2023 TO 2030

FIGURE 15 TRANSPORTATION MODE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NEW ZEALAND HEALTHCARE LOGISTICS MARKET FROM 2023 TO 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF AUSTRALIA AND NEW ZEALAND HEALTHCARE LOGISTICS MARKET

FIGURE 17 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 18 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2023-2030 (USD MILLION)

FIGURE 19 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, CAGR (2023-2030)

FIGURE 20 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 21 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2022

FIGURE 22 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, 2023-2030 (USD MILLION)

FIGURE 23 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, CAGR (2023-2030)

FIGURE 24 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 25 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2022

FIGURE 26 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2023-2030 (USD MILLION)

FIGURE 27 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, CAGR (2023-2030)

FIGURE 28 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, LIFELINE CURVE

FIGURE 29 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2022

FIGURE 30 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, 2023-2030 (USD MILLION)

FIGURE 31 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, CAGR (2023-2030)

FIGURE 32 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY TEMPERATURE TYPE, LIFELINE CURVE

FIGURE 33 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2022

FIGURE 34 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2023-2030 (USD MILLION)

FIGURE 35 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, CAGR (2023-2030)

FIGURE 36 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, LIFELINE CURVE

FIGURE 37 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2022

FIGURE 38 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, 2023-2030 (USD MILLION)

FIGURE 39 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, CAGR (2023-2030)

FIGURE 40 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY LOGISTICS TYPE, LIFELINE CURVE

FIGURE 41 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2022

FIGURE 42 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 43 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 44 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 45 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2022

FIGURE 46 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, 2023-2030 (USD MILLION)

FIGURE 47 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 48 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 49 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, 2022

FIGURE 50 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 51 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 52 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, 2022

FIGURE 54 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 55 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 56 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 57 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 58 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 59 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 60 AUSTRALIA HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 61 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 62 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 63 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 64 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 65 AUSTRALIA HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2022 (%)

FIGURE 66 NEW ZEALAND HEALTHCARE LOGISTICS MARKET: COMPANY SHARE 2022 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。