アジア太平洋地域のタッチセンサー市場、タイプ別(抵抗型、静電容量型、表面弾性波(SAW)、赤外線、光学式)、柔軟性別(従来型、フレキシブル型、その他)、チャネル別(マルチチャネル、シングルチャネル)、アプリケーション別(民生用電子機器、家電製品、医療機器、生体認証システム、自動車、現金自動預け払い機(ATM)、生体認証システム、自動車、その他)業界動向および2029年までの予測。

市場分析と規模

タッチスクリーンディスプレイとデバイスの増加によるセンサーの統合の拡大は、アジア太平洋地域のタッチセンサー市場の成長を加速させる可能性があります。スマートテレビ、スピーカー、ホームオートメーションシステムなどの消費者向け電子機器の需要の高まりが、市場の成長を補完しています。

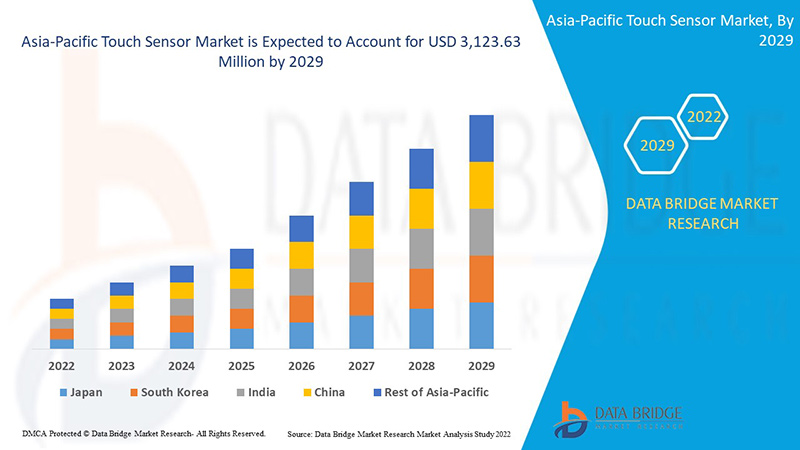

小売店やショッピングモールでのインタラクティブなデジタルサイネージの需要の高まりが、これらのタッチセンサーの需要を牽引しています。データブリッジマーケットリサーチは、アジア太平洋地域のタッチセンサー市場は、予測期間中に13.5%のCAGRで成長し、2029年までに31億2,363万米ドルに達すると予測しています。また、小売店やショッピングモールでのインタラクティブなデジタルサイネージの需要の高まりは、手作業を減らし、消費者のセルフヘルプとして機能するため、市場の成長をさらに加速させます。タッチセンサー技術の急速な進歩と、インタラクティブ性を高めるために教育および企業部門でタッチスクリーンの使用が増えていることが、市場の成長を後押ししています。自動車部門は、車両へのタッチパネルの急速な統合により、タッチセンサーの需要をリードする大きな可能性を秘めています。

アジア太平洋地域のタッチセンサー市場のプレーヤーは、アジア太平洋地域のタッチセンサー市場シェアを拡大するために、新製品の開発、パートナーシップ、およびその他の戦略に重点を置いています。

アジア太平洋地域のタッチセンサー市場の成長を促進すると予想される主な要因は、タッチベースのディスプレイの採用の増加、民生用電子機器の需要の増加、自動車業界でのタッチスクリーンの使用の増加、およびデジタル化に向けた政府の取り組みです。ただし、オールインワン PC の需要の減少により、市場の成長が抑制される可能性があります。

Data Bridge Market Research チームがまとめた市場レポートには、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、気候連鎖シナリオが含まれています。

|

レポートメトリック |

詳細 |

|

予測期間 |

2022年から2029年 |

|

基準年 |

2021 |

|

歴史的な年 |

2020 (2019 - 2014 にカスタマイズ可能) |

|

定量単位 |

売上高は百万米ドル、価格は米ドル |

|

対象セグメント |

タイプ別 (抵抗型、静電容量型、表面弾性波 (SAW)、赤外線型、光型)、柔軟性 (従来型、フレキシブル型、その他)、チャネル別 (マルチチャネル、シングルチャネル)、アプリケーション別 (民生用電子機器、家電製品、医療機器、生体認証システム、自動車、ATM (現金自動預け払い機)、生体認証システム、自動車、その他) |

|

対象国 |

中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋諸国 |

|

対象となる市場プレーヤー |

Neonode Inc.、ルネサス エレクトロニクス株式会社、SCHURTER、Semtech Corporation、Silicon Laboratories、Texas Instruments Incorporated、Zytronic PLC、Apex Material Technology Corporation、CIRQUE CORPORATION、Futaba Corporation、Synaptics Incorporated、Infineon Technologies AG、ジャパンディスプレイ株式会社、NISSHA株式会社、Azoteq (PTY) Ltd、CAPTRON、DMC CO., LTD.、Elo Touch Solutions, Inc.、Microchip Technology Inc. など |

市場の定義

タッチ センサーは、物理的なタッチを検出して記録するために使用される電子センサーとして定義されます。従来の機械式スイッチに代わる、経済的な小型の代替品と考えられています。センサーは通常、表面に接触または圧力が加えられ、回路に電流が流れると作動します。静電容量式、抵抗式、赤外線式、表面弾性波 (SAW) など、さまざまなタイプがあります。

これらは数多くの利点があるため、民生用電子機器、医療機器、自動車など、さまざまな用途で使用されています。民生用電子機器は、スピーカーなどのエンターテイメント システムから、携帯電話などの通信機器、スマート ホームやホーム オートメーションまで多岐にわたります。

アジア太平洋地域のタッチセンサー市場の市場動向は次のとおりです。

- タッチベースのディスプレイの採用増加

世界は、従来の機械式デバイスから最新のタッチ ベースのデバイスへと着実に移行しています。個人、企業、製造会社は、より優れた視覚化とエクスペリエンスを実現するために、タッチ ベースのディスプレイとインターフェイスを採用しています。推奨される主な理由の 1 つは、インタラクティブで魅力的であり、操作が非常に簡単であることです。したがって、レストランから製造会社、金融サービスに至るまでのさまざまな業界でタッチ ベース デバイスとタッチ スクリーン デバイスが急速に導入されていることが、市場の成長を促進する要因となる可能性があります。

- 家電製品の需要増加

より優れた機能を備えたデバイスに対する強い需要に支えられた民生用電子機器の需要の上昇傾向は、世界のタッチセンサー市場の成長を促進すると予想される主な要因です。

- 自動車業界でタッチセンサーの使用が増加

タッチ コントロールは長年使用されてきましたが、その用途は限られていました。しかし、さまざまな業界が機械式システムからタッチ ベースのシステムに移行するにつれて、タッチ デバイスは爆発的に増加しました。

- デジタル化に向けた政府の取り組み

デジタル化は私たちの生活を根本的に変えましたが、今回のパンデミックの出現はそれを一変させました。政府がイニシアチブと外国投資を通じてデジタル化を推進していることは、市場の成長を促進すると予測される大きな要因です。

- インタラクティブデジタルサイネージの需要増加

フレキシブルで曲面のあるディスプレイが登場し、機械と機械、人間と機械のインタラクションの道が開かれ、インタラクティブなデジタルサイネージが誕生しました。技術の進歩と高速接続により、新たな可能性の扉が開かれました。

アジア太平洋地域のタッチセンサー市場が直面する制約/課題

- オールインワンPCの需要減少

在宅勤務用にオールインワン PC ではなくラップトップを従業員に提供する企業が増えているため、市場の成長は抑制されると予想されます。

- チップ供給不足

アジア太平洋地域の多国籍企業のリーダーや幹部は、半導体の不足が多くの国で製造と販売に打撃を与えており、早期の解決策が見当たらない現状を懸念しており、市場の成長にとって大きな課題となっている。

このアジア太平洋タッチセンサー市場レポートでは、最近の新しい開発、貿易規制、輸出入分析、生産分析、バリューチェーンの最適化、市場シェア、国内および現地の市場プレーヤーの影響、新たな収益源の観点から見た機会の分析、市場規制の変更、戦略的市場成長分析、市場規模、カテゴリ市場の成長、アプリケーションのニッチと優位性、製品承認、製品発売、地理的拡大、市場における技術革新などの詳細が提供されます。タッチセンサー市場に関する詳細情報を取得するには、アナリスト概要について Data Bridge Market Research にお問い合わせください。当社のチームは、市場の成長を達成するための情報に基づいた市場決定を行うお手伝いをします。

最近の開発

- ルネサスエレクトロニクス株式会社は、2021年9月に、エントリーレベルのRX100シリーズの最新製品となる超低消費電力の32ビットRX140マイクロコントローラ(MCU)グループの発売を発表しました。RX140 MCUは最新の静電容量式タッチセンサーユニットを搭載しており、強化されたユーザーエクスペリエンス(UX)とユーザーインターフェース(UI)を顧客に提供します。これにより、市場での同社の製品が強化されました。

アジア太平洋地域のタッチセンサー市場の範囲

アジア太平洋地域のタッチセンサー市場は、タイプ、柔軟性、チャネル、アプリケーションに分かれています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供し、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

タイプ

- 抵抗性

- 静電容量式

- 表面弾性波(SAW)

- 赤外線

- 光学

タイプ別に見ると、アジア太平洋地域のタッチセンサー市場は、抵抗型、静電容量型、表面弾性波(SAW)、赤外線型、光学型に分類されます。

柔軟性

- 従来の

- フレキシブル

- その他

On the basis of flexibility, the Asia-Pacific touch sensor market is segmented into conventional, flexible, and others.

Channel

- Single Channel

- Multi-Channel

On the basis of channel, the Asia-Pacific touch sensor market is segmented into single channel and multi-channel.

Application

- Consumer Electronics

- Home Appliances

- Medical Devices

- Automated Teller Machines (ATM)

- Biometric Systems

- Automotive

- Others

On the basis of application, the Asia-Pacific touch sensor market has been segmented into consumer electronics, home appliances, medical devices, automated teller machines (ATM), biometric systems, automotive, and others.

Asia-Pacific Touch Sensor Market Regional Analysis/Insights

The Asia-Pacific touch sensor market is analyzed, and market size insights and trends are provided by country, type, flexibility, channel, and application as referenced above.

Some of the countries covered in the Asia-Pacific touch sensor market report are China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, and Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific touch sensor market because of the presence of a large number of manufacturers and fabrication foundries in the region. Moreover, the increasing pace of digitalization and changing lifestyle of the population in the region is fueling the demand for electronic components such as touch sensors.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends and porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Touch Sensor Market Share Analysis

The Asia-Pacific touch sensor market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points are only related to the companies' focus on the Asia-Pacific touch sensor market.

アジア太平洋地域のタッチセンサー市場で活動している主要企業としては、Neonode Inc.、ルネサス エレクトロニクス株式会社、SCHURTER、Semtech Corporation、Silicon Laboratories、Texas Instruments Incorporated、Zytronic PLC、Apex Material Technology Corporation、CIRQUE CORPORATION、Futaba Corporation、Synaptics Incorporated、Infineon Technologies AG、ジャパンディスプレイ株式会社、Nissha株式会社、Azoteq (PTY) Ltd、CAPTRON、DMC CO., LTD.、Elo Touch Solutions, Inc.、Microchip Technology Inc. などがあります。

調査方法: アジア太平洋地域のタッチセンサー市場

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。市場データは、市場統計モデルとコヒーレント モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせ内容をドロップダウンしてください。

DBMR 研究チームが使用する主要な研究手法は、データ マイニング、データ変数の市場への影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。これ以外にも、データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、専門家分析、輸入/輸出分析、価格分析、生産消費分析、気候チェーン シナリオ、企業ポジショニング グリッド、企業市場シェア分析、測定基準、世界対地域、ベンダー シェア分析が含まれます。研究手法について詳しくは、お問い合わせを送信して、当社の業界の専門家にご相談ください。

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

目次

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TOUCH SENSOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 PREMIUM INSIGHTS

5.1 TOUCH SENSOR PRICING ANALYSIS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING ADOPTION OF TOUCH-BASED DISPLAYS

6.1.2 RISING DEMAND FOR CONSUMER ELECTRONICS

6.1.3 INCREASING USE OF TOUCH SCREENS IN THE AUTOMOTIVE INDUSTRY

6.1.4 GOVERNMENT INITIATIVES FOR DIGITALIZATION

6.1.5 RISING DEMAND FOR INTERACTIVE DIGITAL SIGNAGE

6.2 RESTRAINTS

6.2.1 DECLINING DEMAND FOR ALL-IN-ONE PC

6.2.2 SHORTAGE OF SKILLED LABOUR

6.2.3 SHORT SUPPLY OF INDIUM

6.3 OPPORTUNITIES

6.3.1 SURGE IN INDUSTRIAL APPLICATIONS OF TOUCH-BASED PANELS AND EQUIPMENT

6.3.2 DEVELOPMENTS IN MULTI-TOUCH TECHNOLOGY

6.3.3 RISE IN INVESTMENTS FOR R&D OF TOUCH SENSORS

6.4 CHALLENGES

6.4.1 CHIP SUPPLY SHORTAGE

6.4.2 ACCIDENTAL TOUCHES DUE TO HIGH SENSITIVITY

7 COVID-19 IMPACT ON THE ASIA PACIFIC TOUCH SENSOR MARKET

7.1 ANALYSIS OF IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 IMPACT ON DEMAND

7.5 IMPACT ON PRICE

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 ASIA PACIFIC TOUCH SENSOR MARKET, BY TYPE

8.1 OVERVIEW

8.2 RESISTIVE

8.2.1 5 –WIRE

8.2.2 8 –WIRE

8.2.3 4 –WIRE

8.3 CAPACITIVE

8.3.1 BY TECHNOLOGY

8.3.1.1 PROJECTED CAPACITANCE

8.3.1.2 SURFACE CAPACITANCE

8.3.2 BY SURFACE TYPE

8.3.2.1 GLASS

8.3.2.2 NON-GLASS

8.3.2.2.1 PLASTIC/POLYMER

8.3.2.2.1.1 PET & PETG

8.3.2.2.1.2 POLYCARBONATES

8.3.2.2.1.3 PMMA

8.3.2.2.1.4 OTHERS

8.3.2.2.2 SAPPHIRE

8.4 SURFACE ACOUSTIC WAVE (SAW)

8.5 INFRARED

8.6 OPTICAL

9 ASIA PACIFIC TOUCH SENSOR MARKET, BY FLEXIBILITY

9.1 OVERVIEW

9.2 CONVENTIONAL

9.3 FLEXIBLE

9.4 OTHERS

10 ASIA PACIFIC TOUCH SENSOR MARKET, BY CHANNEL

10.1 OVERVIEW

10.2 MULTI-CHANNEL

10.3 SINGLE CHANNEL

11 ASIA PACIFIC TOUCH SENSOR MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 CONSUMER ELECTRONICS

11.2.1 LAPTOPS

11.2.2 MONITORS

11.2.3 WEARABLE

11.2.4 ALL-IN-ONE (AIO) PCS

11.2.5 OTHERS

11.3 HOME APPLIANCES

11.3.1 WASHING MACHINES

11.3.2 OVEN

11.3.3 REFRIGERATOR

11.3.4 OTHERS

11.4 MEDICAL DEVICES

11.5 BIOMETRIC SYSTEMS

11.6 AUTOMOTIVE

11.7 AUTOMATED TELLER MACHINES (ATM)

11.8 OTHERS

12 ASIA PACIFIC TOUCH SENSOR MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 JAPAN

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 INDONESIA

12.1.7 MALAYSIA

12.1.8 SINGAPORE

12.1.9 THAILAND

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA PACIFIC TOUCH SENSOR MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 MICROCHIP TECHNOLOGY INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 INFINEON TECHNOLOGIES AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 JAPAN DISPLAY INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 TEXAS INSTRUMENTS INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 NISSHA CO. LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 RENESAS ELECTRONICS CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 APEX MATERIAL TECHNOLOGY CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 AZOTEQ (PTY) LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 CAPTRON

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CIRQUE CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 DMC CO., LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 ELO TOUCH SOLUTIONS INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 FUTABA CORPORATION

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 NEONODE INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 SCHURTER

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 SEMTECH CORPORATION

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 SILICON LABORATORIES

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

15.18 SYNAPTICS INCORPORATED

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 TSITOUCH

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 XYMOX TECHNOLOGIES, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 ZYTRONIC PLC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

表のリスト

TABLE 1 ASIA PACIFIC TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC RESISTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC CAPACITIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SURFACE ACOUSTIC WAVE (SAW) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC INFRARED IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OPTICAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CONVENTIONAL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC FLEXIBLE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC MULTI-CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC SINGLE CHANNEL IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC CONSUMER ELECTRONICS IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC HOME APPLIANCES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC HOME APPLIANCES IN TOUCH SENSOR, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC MEDICAL DEVICES IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC BIOMETRIC SYSTEMS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC AUTOMOTIVE IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC AUTOMATED TELLER MACHINES (ATM) IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC OTHERS IN TOUCH SENSOR MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC TOUCH SENSOR MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 44 CHINA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 45 CHINA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 48 CHINA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 CHINA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 CHINA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 CHINA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 55 JAPAN CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 59 JAPAN TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 60 JAPAN TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 JAPAN CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 INDIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 INDIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 INDIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 66 INDIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 67 INDIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 INDIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 INDIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 70 INDIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 INDIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 72 INDIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 SOUTH KOREA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 SOUTH KOREA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 SOUTH KOREA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 77 SOUTH KOREA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 78 SOUTH KOREA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 SOUTH KOREA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 SOUTH KOREA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 81 SOUTH KOREA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 SOUTH KOREA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 83 SOUTH KOREA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 SOUTH KOREA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 89 AUSTRALIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 AUSTRALIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 AUSTRALIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 92 AUSTRALIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 93 AUSTRALIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 AUSTRALIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 95 AUSTRALIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDONESIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDONESIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDONESIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 99 INDONESIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 100 INDONESIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDONESIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDONESIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 103 INDONESIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 INDONESIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 105 INDONESIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDONESIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 MALAYSIA TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 MALAYSIA RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 MALAYSIA TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 115 MALAYSIA TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 SINGAPORE TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 SINGAPORE RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 SINGAPORE CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 SINGAPORE CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 122 SINGAPORE NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 123 SINGAPORE PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 124 SINGAPORE TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 125 SINGAPORE TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 SINGAPORE TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 SINGAPORE CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 SINGAPORE HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 129 THAILAND TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 THAILAND RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 THAILAND CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 THAILAND CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 133 THAILAND NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 THAILAND PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 THAILAND TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 136 THAILAND TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 137 THAILAND TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 THAILAND CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 THAILAND HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 PHILIPPINES TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 PHILIPPINES RESISTIVE IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 PHILIPPINES CAPACITIVE IN TOUCH SENSOR MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 PHILIPPINES CAPACITIVE IN TOUCH SENSOR MARKET, BY SURFACE TYPE, 2020-2029 (USD MILLION)

TABLE 144 PHILIPPINES NON-GLASS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 PHILIPPINES PLASTIC/POLYMER IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 PHILIPPINES TOUCH SENSOR MARKET, BY FLEXIBILITY, 2020-2029 (USD MILLION)

TABLE 147 PHILIPPINES TOUCH SENSOR MARKET, BY CHANNEL, 2020-2029 (USD MILLION)

TABLE 148 PHILIPPINES TOUCH SENSOR MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 149 PHILIPPINES CONSUMER ELECTRONICS IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 150 PHILIPPINES HOME APPLIANCES IN TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 151 REST OF ASIA-PACIFIC TOUCH SENSOR MARKET, BY TYPE, 2020-2029 (USD MILLION)

図表一覧

FIGURE 1 ASIA PACIFIC TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TOUCH SENSOR MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TOUCH SENSOR MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TOUCH SENSOR MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TOUCH SENSOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TOUCH SENSOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC TOUCH SENSOR MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC TOUCH SENSOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC TOUCH SENSOR MARKET: APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC TOUCH SENSOR MARKET: CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC TOUCH SENSOR MARKET: SEGMENTATION

FIGURE 12 GROWING INTEGRATION OF SENSORS IN TOUCH-ENABLED DEVICES IS EXPECTED TO DRIVE ASIA PACIFIC TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 13 RESISTIVE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF ASIA PACIFIC TOUCH SENSOR MARKET IN 2022 & 2029

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS THE FASTEST-GROWING REGION IN ASIA PACIFIC TOUCH SENSOR MARKET IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC TOUCH SENSOR MARKET

FIGURE 16 ASIA PACIFIC TOUCH SENSOR MARKET: BY TYPE, 2021

FIGURE 17 ASIA PACIFIC TOUCH SENSOR MARKET: BY FLEXIBILITY, 2021

FIGURE 18 ASIA PACIFIC TOUCH SENSOR MARKET: BY CHANNEL, 2021

FIGURE 19 ASIA PACIFIC TOUCH SENSOR MARKET: BY APPLICATION, 2021

FIGURE 20 ASIA-PACIFIC TOUCH SENSOR MARKET: SNAPSHOT (2021)

FIGURE 21 ASIA-PACIFIC TOUCH SENSOR MARKET: BY COUNTRY (2021)

FIGURE 22 ASIA-PACIFIC TOUCH SENSOR MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 ASIA-PACIFIC TOUCH SENSOR MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 ASIA-PACIFIC TOUCH SENSOR MARKET: BY TYPE (2022-2029)

FIGURE 25 ASIA PACIFIC TOUCH SENSOR MARKET: COMPANY SHARE 2021 (%)

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。